Theoretical Economics Letters

Vol.04 No.09(2014), Article ID:52003,9 pages

10.4236/tel.2014.49098

The Strategic Entry Behavior Choices of Firms under Minimum Quality Standard*

Huishuang He

Management and Economic College, North China University of Water Resources and Electric Power, Zhengzhou, China

Email: 346952523@qq.com

Copyright © 2014 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 30 September 2014; revised 1 November 2014; accepted 20 November 2014

ABSTRACT

In order to analyze the strategic entry behavior choices of firms under minimum quality standard, a basic model is made under the endogenous minimum quality standard. An industry’s competitiveness and the level of performance tend to be subject to the entry conditions and the ease of entry. For entrants, the basic entry technological constraint is the minimum quality standard. In differentiated products markets, when there is no minimum quality standard and the entry cost is small, the entrant’ profit is the same, whether they choose the high quality or low quality to enter the product market. While in the case of endogenous minimum quality standard, the incumbent may choose to produce low quality products, and the entrant may choose to produce high quality products, which lead to the lack of competition in product markets. Therefore, government should create an open and competitive market environment and efficient policy guidance for firms.

Keywords:

Minimum Quality Standard, Entry Deterrence, Product Differentiation

1. Introduction

The industry’s competitiveness and performance level tend to be affected by entry condition and the degree of ease. Whether a firm can enter the market freely is a main factor to estimate the competitiveness of an industry. The absolute cost advantage of incumbent and product differentiation, economies of scale as well as the government regulations are considered to be the main reasons causing the barrier to entry. In addition to this natural entry barrier, these incumbents’ strategic behaviors towards to entrants are another barrier to enter a company or industry. As to the entrant, a fundamental technical factor barrier to entering a company is minimum quality standard (MQS). The potential and factual entry will affect the behavior of incumbent and optimize the market behavior. The introduction of minimum quality is also a policy to protect the consumers’ interests, the consumers’ externality and social welfare. Why do we set the minimum quality standards? What are the differences between these entry strategic choices the companies would choose in the free access (no minimum quality standards) and those under the regulation of government (under the minimum quality standards)? Which are all the basic questions that can not be avoided when discuss the quality standards regulations. In this study, we are to solve this problem, in the free entry and under the government’s quality regulation, in order to maintain the market power and to ensure higher ability of profits, what impacts would the incumbents have on the decisions’ of these potential entrants and market performances. This analysis has significant reference and value of application when we solve the disorderly competition of firms in reality and the minimum quality standards regulation of the government. A general description on related reference is displayed in part 2, and a basic model and its equilibrium analysis about price, quality, profit and welfare are displayed in part 3, and the basic occlusions and the relevant policy implications are showed in part 4.

2. General Description on Related Reference

The existing studies about firms’ entry strategic behaviors mainly focus on the entry deterrence theory. The stra- tegies of firms’ entry-deterrence can be divided into three parts: strike (Bonnisseau & Lahmandi-Ayed (2006)), signaling (Donnenfeld & Weber (1995)) and predatory behavior (Dixit (1979)) [1] -[3] . This kind of Game theory study is about an important issue: when do incumbents prevent entrants through credible strategies in the market. Under this perspective, Equilibrium only exists in the incredible threats which exclude the terrible consequences. The initial literature mainly focused on firms of the same quality, but after the introduction of the conception of differentiation, the entry-deterrence theory made a great improvement. In the industry of differentiated products, firms can prevent entry by pricing strategy but also can compete by product differentiation. In many industries, owing to inseparability of the fixed cost, firms choose effective measures to prevent entry, such as investing in building the most efficient plants, choosing products centrally in limited products sets, selecting the sites in a collective of bounded geographic locations and so on, then if the companies can take the first action in limited space, they can get the first-move advantage in competition, leading to potential entrants have no profit (Schmalensee (1978)) [4] . No matter which kind of analysis and conclusion, which is often extend from the competition of an incumbent and an entrant, considering more about the game behavior between the incumbent and the entrant. No matter which kind of entry deterrence strategy it is, the analysis of conclusions always are based on some basic assumption: firstly, for any incumbent, one way to get profit is to get and maintain monopolistic power, which needs the incumbent preventing entry or acquisition, threatening, repulsion of competitor or maintaining profits by Cartel behavior; Next, the monopolistic power always has backwards effects on efficiency and distribution, which proves the reasonableness and the necessity of antitrust or other legal measures of government intervention from another point of view.

Based on the above research hypothesis and conclusions and combined with the government regulations, this article introduces the strategic entry behavior choices under the minimum quality standard. There are many literatures about the exogenous minimum quality standards (Pezzino (2006), Garella (2006), Ecchia & Lambertini (2013), Nagurney & Li (2014)) [5] - [8] . In order to distinct with them, we assume the existence of minimum quality standard which is internalized (social planers belong to the members of the largest social welfare, the minimum quality standard are the internalized quality choice behavior. Seeing Cesi (2010) [9] , we analyze game behavior choices of the incumbent and entrant and provide reference for the government making the regulations of the minimum quality standard.

3. The Basic Model

Assuming that there is a group of consumers in market, with 1 representing it and

representing the consumers’ tastes, in which,

representing the consumers’ tastes, in which,

and

and . The distribution function is

. The distribution function is , the density function is

, the density function is , the consumers

, the consumers

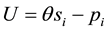

only have the unit demand for products. Same with Mussa & Rosen (1978) [10] , we define consumers’ utility function as

only have the unit demand for products. Same with Mussa & Rosen (1978) [10] , we define consumers’ utility function as ,

,

is the quality of products, and

is the quality of products, and , 1 is the highest quality, 0 is the lowest quality.

, 1 is the highest quality, 0 is the lowest quality.

is the price of the products, the consumers’ reservation utility is 0, that is to say, they choose not to buy in the case of the obtained effect is less than zero when buying products. There are two enterprises, firm 1 and firm 2

is the price of the products, the consumers’ reservation utility is 0, that is to say, they choose not to buy in the case of the obtained effect is less than zero when buying products. There are two enterprises, firm 1 and firm 2 , and provided that 1 is the incumbent and 2 is the potential entrant. The quality-improved cost is changeable cost,

, and provided that 1 is the incumbent and 2 is the potential entrant. The quality-improved cost is changeable cost,

(here,

(here,

is the need of products when the quality is

is the need of products when the quality is ). The game can be divided into three stages, the firm 1 choose

). The game can be divided into three stages, the firm 1 choose

on the first stage, the firm 2 will make the decision whether choose to enter after observing the choice of firm 1 on the second stage. If the firm 2 make the entry decision, entry cost

on the first stage, the firm 2 will make the decision whether choose to enter after observing the choice of firm 1 on the second stage. If the firm 2 make the entry decision, entry cost

will be produced because of the entry, Bertrand competition will arise if the entrants enter the market at the same quality, leading to no profit. Therefore, in the equilibrium, the differentiated quality the firm 2 choose is

will be produced because of the entry, Bertrand competition will arise if the entrants enter the market at the same quality, leading to no profit. Therefore, in the equilibrium, the differentiated quality the firm 2 choose is

3.1. Strategic Behavior under Free Entry

In the case of entry, owing to the entrant taking the same quality as that the incumbent had taken, the Bertrand competition would be aroused, leading to that the profit is 0. If the entrant chooses to produce product of different quality, thus there are two kinds of quality in market.

Now assuming that

On a given product quality level, firms choose their own price, we figure out the Nash equilibrium prices:

The corresponding equilibrium profits are:

To ensure that this market is completely covered, the needs of both firms’ products are positive and we can calculate the reaction function of the corresponding high quality firm and the low quality firm. The high quality

firm’s reaction function to the low quality firm is

3.1.1. The Analysis about Game Behavior of the Incumbent and the Entrant

1) The incumbent is a high-quality firm

When the incumbent is a high-quality firm, firm 2 can only choose to enter the market at low price as an entrant. High-quality incumbent would face the choice question on the first stage:

Therefore we can figure out the quality equilibrium is

In addition, the profit function of firm 2 is

so as long as

2) The incumbent is a low-quality firm

When the incumbent firm 1 is a low-quality firm, firm 2 choose to enter at low quality. firm 1 would face the choice question on the first stage

The quality equilibrium is

Thus when

When firm 2 enter the market, the profit function is

3) The entry-deterrence strategy of firm 1

To ensure the market is completely covered and simplify the analysis, we consider the condition of

I) Low fixed cost and accommodation of the entry. When entry cost is low enough,

II) High fixed cost and the entry deterrence. If

range of the incumbent’s free choice is

III) Moderate fixed cost and entry deterrence. When

tering, there would be two options for the incumbent: to accommodate entry or block entry with the quality

choice of

When

When

3.1.2. The Analysis about Consumers’ Surplus and Social Welfare

1) Analysis about consumers’ surplus

I) Under the high entry cost

II) Under accommodation of entry when

III) When

2) Analysis on social welfare

I) Under the high entry cost

II) Under accommodation of entry when

III) When

IV) Under entry deterrence when

3.2. The Strategic Entry Behavior of the Entrant and the Incumbent under Minimum Quality Standard

3.2.1. The Incumbent Is a High-Quality Firm

Government choose the minimum quality standard to maximize social welfare and the incumbent is constrained by the minimum quality standard. That is to say, government sets the minimum quality standard considering incumbent’s optimal response. Incumbent’s profit maximizing problem is

We calculate (2-9) and get

Note

Thus we draw these conclusions that the incumbent’ entry deterrence choices are as follows.

1) Low fixed cost and accommodation of entry. Under minimum quality standard, when firm 1 is a high-quality firm and f < 0.135004, firm 1 will accommodate the entry of firm 2 and get the profit of

2) High fixed cost and entry deterrence. Firstly, when

under the minimum quality standard, the incumbent can take quality choice,

make it get the maximum profit

of zero and the incumbent would monopolize the market and get the profit

3.2.2. The Incumbent Is a Low-Quality Firm

If the incumbent is a low-quality firm, this equal to that the regulator is a leaders on the stage of quality choice, the leader aims at

The solution of (2-10) is

The condition of covered market is

Therefore, in the case that the incumbent is a low-quality firm, the setting of social welfare standard is invalid, which does not affect the quality choices of the incumbent and the entrant. But if the incumbent and the entrant reduce quality level, it will be an improvement of social welfare. So in the case that the incumbent is a firm of low-quality product, the analysis is same to that under the entry behavior without quality regulation, the quality standard does not affect the behavior choice of the incumbent and the entrant.

4. Basic Conclusions and Associated Policy Implications

4.1. Basic Conclusions

1) When there is the minimum quality standard and it is endogenously determined, the equilibrium profit is rather different because the different quality choice of the incumbent and the entrant. When the incumbent is a high-quality firm, the entrant’s profit is increased due to that the minimum quality standard limits the range of the entrant’s quality choice and the entry’s fixed cost is high. Meanwhile, under the minimum quality standard, the range of the incumbent’s free quality entry is limited even if the entrant’ entry cost is rather high.

2) When the incumbent is a high-quality firm, the minimum quality standard aroused from maximizing social welfare improves consumers’ utility and increases social welfare. When the incumbent is a low-quality firm, minimum quality standard does not change the quality choice of the entrant and the incumbent, and their entry behavior are the same to those without the minimum quality standard. But if the incumbent and the entrant reduce the quality level, it would increase social welfare. Therefore, when the incumbent is a high-quality firm, government should set the minimum quality standard to increase social welfare. The government set the minimum quality standard hasn’t so much impact on social welfare when the incumbent is low-quality firm.

3) After comparison, without the constraint of the minimum quality standard, and the entry cost is relatively low, the profit of the entrant is the same whether the entrant is low-quality firm or high-quality firm. When the quality standard is internalized, the available quality choices for the incumbent and entrant are limited, the high- quality incumbent gets less profit than the low-quality incumbent, and the entrant is the same. Therefore, in the case that entry cost is relative low, the incumbent will choose to produce low-quality product when the incumbent can choose freely.

When quality standards is internalized, because the optimal minimum quality standard that meets social welfare narrows the available quality difference between the incumbent and the entrant, so the incumbent gets less profits when it is a low-quality firm than it is a high-quality firm, while the entrant is the opposite. Therefore, in the case that entry cost is relative low, the entrant will choose to produce low-quality products when it can choose freely.

4.2. The Relevant Policy Implications

The motivation of the set of the minimum quality standard is to improve consumers’ social welfare by strengthening market competition, thus improve whole social welfare. In the specific social practice, it mainly reflects on quality certification, administrative examination and approval etc. In economic practice, Quality certification mainly plays a role in practicing quality standards, reducing personal injury and property damage, guiding consumers to buy safe and reliable products, improving the competitiveness of products in international market, and as the effective means of eliminating technical barrier to trade, improving the manage level of quality and so on. The minimum quality standard is beneficial to both consumers and firms.

In addition, under perfect competition, firms’ entry to some industry will continue until firms get the normal investment profits without any other profits. When there is minimum quality standard and it is internalized, the incumbent may choose to produce low-quality products and the entrant may choose to produce high-quality pro- ducts to enter the market, which leads to the lack of competition in market. So under sufficient market demand, we should encourage competition in order to create an open and competitive market environment and policy guidance.

The above analysis focused on the minimum quality standard which is internalized. In practical economy, there is also the case of minimum quality standard that is externalized. It is easier to analyze the exogenous quality standard. Because the set of exogenous quality standards provide direct quality choices reference to these incumbents. The former literature has detailed analysis, it is not repeated here.

Note

This paper’s earlier Chinese edition was first published in Technoeconomics & Management Research, No. 2, 2013, pp. 7-11.

References

- Bonnisseau, J.-M. and Lahmandi-Ayed, R. (2006) Vertical Differentiation: Multiproduct Strategy to Face Entry? Topics in Theoretical Economics, 6, 1282.

- Donnenfeld, S. and Weber, S. (1995) Limit Qualities and Entry Deterrence. The RAND Journal of Economics, 26, 113- 130. http://dx.doi.org/10.2307/2556038

- Dixit, A. (1979) A Model of Duopoly Suggesting a Theory of Entry Barriers. The Bell Journal of Economics, 10, 20-32. http://dx.doi.org/10.2307/3003317

- Schmalensee, R. (1978) Entry Deterrence in the Ready-to-Eat Breakfast Cereal Industry. The Bell Journal of Economics, 9, 305-327. http://dx.doi.org/10.2307/3003584

- Pezzino, M. (2006) Minimum Quality Standards with More than Two Firms under Cournot Competition. Economics Discussion Paper EDP-0613, The University of Manchester, Manchester.

- Garella, P.G. (2006) “Innocuous” Minimum Quality Standards. Economic Letters, 92, 368-374. http://dx.doi.org/10.1016/j.econlet.2006.03.022

- Ecchia, G., Lambertini, L. and Tampieri, A. (2013) Minimum Quality Standards in Hedonic Markets with Environmental Externalities. Environmental Modeling & Assessment, 18, 319-323. http://dx.doi.org/10.1007/s10666-012-9345-z

- Nagurney, A. and Li, D. (2014) Equilibria and Dynamics of Supply Chain Network Competition with Information Asymmetry in Quality and Minimum Quality Standards. Computational Management Science, 11, 285-315. http://dx.doi.org/10.1007/s10287-014-0216-8

- Cesi, B. (2010) Mergers under Endogenous Minimum Quality Standard: A Note. Economics Bulletin, 30, 3260-3266.

- Mussa, M. and Rosen, S. (1978) Monopoly and Product Quality. Journal of Economic Theory, 18, 301-317. http://dx.doi.org/10.1016/0022-0531(78)90085-6

NOTES

*This paper is a stage result of Henan Philosophy and Social Science Planning Project (No. 2014CJJ054).