Journal of Mathematical Finance

Vol.05 No.05(2015), Article ID:61674,20 pages

10.4236/jmf.2015.55041

Conditional Law of the Hitting Time for a Lévy Process in Incomplete Observation

Waly Ngom1,2

1IMT, University of Toulouse, France

2F.S.T, University Cheikh Anta Diop, Dakar, Sénégal

Copyright © 2015 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

Received 8 October 2015; accepted 27 November 2015; published 30 November 2015

ABSTRACT

We study the default risk in incomplete information. That means we model the value of a firm by a Lévy process which is the sum of a Brownian motion with drift and a compound Poisson process. This Lévy process cannot be completely observed, and another process represents the available information on the firm. We obtain a stochastic Volterra equation satisfied by the conditional density of the default time given the available information. The uniqueness of solution of this equation is proved. Numerical examples of (conditional) density are also given.

Keywords:

Conditional Density, Default Time, Lévy Processes, Filtering Theory, Stochastic Voltera Equations

1. Introduction

Here we consider a jump-diffusion process X which models the value of a firm. This is a Lévy process. Details on this class of processes can be found in [1] and [2] . Their use in financial modeling is well developed in [3] . We study the first passage time of process X at level  modeling the default time. We investigate the behavior of the default time under incomplete observation of assets. In the literature, there exists some papers in relation to this topic. Duffie and Lando [4] suppose that bond investors cannot observe the issuer’s assets directly; instead, they only receive periodic and imperfect reports. For a setting in which the assets of the firm are geometric Brownian motion until informed equity holders optimally liquidate, they derive the conditional distribution of the assets, and give the available information. In a similar model, but with complete information, Kou and Wang [5] study the first passage time of a jump-diffusion process whose jump sizes follow a double exponential distribution. They obtain explicit solutions of the Laplace transform of the distribution of the first passage time. Laplace transform of the joint distribution of jump-diffusion and its running maximum,

modeling the default time. We investigate the behavior of the default time under incomplete observation of assets. In the literature, there exists some papers in relation to this topic. Duffie and Lando [4] suppose that bond investors cannot observe the issuer’s assets directly; instead, they only receive periodic and imperfect reports. For a setting in which the assets of the firm are geometric Brownian motion until informed equity holders optimally liquidate, they derive the conditional distribution of the assets, and give the available information. In a similar model, but with complete information, Kou and Wang [5] study the first passage time of a jump-diffusion process whose jump sizes follow a double exponential distribution. They obtain explicit solutions of the Laplace transform of the distribution of the first passage time. Laplace transform of the joint distribution of jump-diffusion and its running maximum,  , is too obtained. To finish, they give numerical examples. Bernyk et al. [6] , for their part, consider stable Lévy process X of index

, is too obtained. To finish, they give numerical examples. Bernyk et al. [6] , for their part, consider stable Lévy process X of index  with non negative jumps and its running maximum. They characterize the density function of

with non negative jumps and its running maximum. They characterize the density function of  as the unique solution of a weakly singular Volterra integral equation of the first kind. This leads to an explicit representation of the density of the first passage time. To unify the noisy information in Duffie and Lando [4] , X. Guo, R. A. Jarrow and Y. Zang [7] define a filtration which models incomplete information. By simple examples, they give the importance of this notion. Similarly to Kou and Wang, without specifying the jumps size law, Dorobantu [8] provides the intensity function of the default time. That is very important for investors, but the information brought by this intensity is low. Furthermore, Roynette et al. [9] prove that the Laplace transform of the random triplet (first passage time, overshoot, undershoot) satisfies an integral equation. After normalization of the first passage time, they show under some convenient assumptions that the random triplet converges in distribution as level x goes to

as the unique solution of a weakly singular Volterra integral equation of the first kind. This leads to an explicit representation of the density of the first passage time. To unify the noisy information in Duffie and Lando [4] , X. Guo, R. A. Jarrow and Y. Zang [7] define a filtration which models incomplete information. By simple examples, they give the importance of this notion. Similarly to Kou and Wang, without specifying the jumps size law, Dorobantu [8] provides the intensity function of the default time. That is very important for investors, but the information brought by this intensity is low. Furthermore, Roynette et al. [9] prove that the Laplace transform of the random triplet (first passage time, overshoot, undershoot) satisfies an integral equation. After normalization of the first passage time, they show under some convenient assumptions that the random triplet converges in distribution as level x goes to . Gapeev and Jeanblanc [10] study a model of a financial market in which the dividend rates of two risky asset’s initial values change when certain unobservable external events occur. The asset price dynamics are described by a geometric Brownian motion, with random drift rates switching at independent exponential random times. These random times are independent of the constantly correlated driving Brownian motion. They obtain closed expressions for rational values of European contingent claims given the available information. Moreover, estimates of the switching times and their conditional probability density are provided. Coutin and Dorobantu [11] prove that the default time law has a density (defective when

. Gapeev and Jeanblanc [10] study a model of a financial market in which the dividend rates of two risky asset’s initial values change when certain unobservable external events occur. The asset price dynamics are described by a geometric Brownian motion, with random drift rates switching at independent exponential random times. These random times are independent of the constantly correlated driving Brownian motion. They obtain closed expressions for rational values of European contingent claims given the available information. Moreover, estimates of the switching times and their conditional probability density are provided. Coutin and Dorobantu [11] prove that the default time law has a density (defective when ) with respect to the Lebesgue measure in case of a stationary independent increment process built on a pair (compound Poisson process, Brownian motion).

) with respect to the Lebesgue measure in case of a stationary independent increment process built on a pair (compound Poisson process, Brownian motion).

We extend this approach studying the conditional law of the first passage time of Lévy process at level x given a partial information. We solve this problem using filtering theory inspired by Zakai [12] , Pardoux [13] , Coutin [14] , Bain and Crisan [15] , based on the so called “reference probability measure” method. The paper is organized as follows: Section 2 sets the model; Section 3 gives the results on the existence of the conditional density given the observed filtration and on the integro-differential equation satisfied by this conditional density; Section 4 gives the proofs of the results. To finish, we conclude and give some auxiliary results in Appendix.

2. Model and Motivations

This section defines the basic space in which we work and announces what we will do. Subsection 2.1 gives the model of the firm value and defines the default time. Subsection 2.2 recalls some important results in the complete information case. Subsection 2.3 defines the signal and observation process and the model for available information. Basically, it introduces the notion of filtering theory. Subsection 2.4 gives our motivation.

2.1. Construction of the Model

Let  be a filtered probability space satisfying the usual conditions on which we define a

be a filtered probability space satisfying the usual conditions on which we define a

standard Brownian motion W, a sequence of independent and identically distributed random variables

with distribution function , a Poisson process N with intensity

, a Poisson process N with intensity  and a stochastic process Q. We assume that all these elements are independent,

and a stochastic process Q. We assume that all these elements are independent,  is a Brownian motion and

is a Brownian motion and  is a compound

is a compound

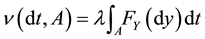

Poisson process with intensity ν under  defined for any Borel set A by

defined for any Borel set A by . On this

. On this

probability space, we define a process X as follows:

(1)

(1)

X models a firm value and the default is modeled by the first passage time of X at a level

We suppose that X is not perfectly observable and that observation is modeled by process Q.

2.2. Some Results When X Is Perfectly Observed

Let

By (5.12) page 197 of [16] ,

where

The function

to

as a default time the random variable

For a general Lévy process, Doney and Kiprianou [17] give the law of the quintuplet

Coutin and Dorobantu [11] consider (1) and (2) and show that

where

2.3. The Incomplete Information

Our work is inspired and is in the same spirit as D. Dorobantu [8] . In her thesis, Dorobantu assumes that investors wishing to detain a part of the firm do not have complete information. They don’t observe perfectly the process value X of the firm but a noisy value. She defined a process Q independent of

with h a Borel and bounded function and B a standard Brownian motion.

Definition 1. The process X is called the signal. The process Q is called the observation and is perfectly observed by investors.

This leads us to a filtering model and we introduce the filtering framework inspired of Zakai [12] , Coutin [14] or Pardoux [13] .

Since the function h is bounded, the Novikov condition,

define the following exponential martingale for the filtration

For a fixed maturity

Definition 2. For fixed

We also note that the law of X, so the one of

Then all the available information is represented by the filtration

where the s-algebra

2.4. Motivations

D. Dorobantu [8] obtains the

is a

approximated by

show that the conditional law of default time

This section presents our basic model of a firm with incomplete information about its assets. More generally, we treat a continuous time setting, staying with the work of D. Dorobantu [8] in her thesis second part. Next section gives our main results.

3. The Results

3.1. Existence of the Conditional Density

We recall that

Proposition 1. For all

where

And

Remark 1 Referring to [9] , for all

3.2. Mixed Filtering-Integro-Differential Equation for Conditional Density

In this subsection, we give our main results. Indeed, we first show that the conditional law of the hitting time

given the filtration

result. This type of equation is the same as the one studied in [18] with the only difference that here, we have more general Voltera random coefficients.

Theorem 1. Let

where

and G is defined in Proposition 1.

Proposition 2. If Equation (6) admits a solution, this one is unique.

3.3. Some Technical Results

Here, we give some technical and auxiliary results which are useful to prove Theorem 1 and Proposition 2.

Proposition 3. For any bounded function

By this proposition, we establish two corollaries which give a representation more accessible of the processes

Corollary 1. For all

1)

and equivalently

2)

Corollary 2. For

1)

and equivalently

2)

Proposition 4. For any

Remark 2. Equation (12) of Proposition 4 can be rewriten as:

Where

This equation is similar to the non normalized conditional distribution Equation (3.43) in A. Bain and D. Crisan [15] , called Zakai equation.

In the same way, Equation (6) which is derived from (12) is similar to the normalized conditional distribution Equation (3.57) in A. Bain and D. Crisan [15] , called Kushner-Stratonovich equation.

3.4. Numerical Examples

We simulate the density of the first passage time respectively in complete information and in incomplete information. We suppose that the jump size follows a double exponential distribution, i.e, the common density of Y

is given by

Here,

information and on another hand to the values taken by the parameters m and

These four first figures (Figue 1 and Figure 2) represent the densities of the first passage time for a jump

Figure 1. Densities for

Figure 2. Densities for

diffusion process (case of complete information). The variable

Figure 3, Figure 4 and Figure 6 are those of the conditional density

We observe that the maximum reached is greater if the drift m is positive, meaning the positive level x is more probably reached in a shorter time.

In incomplete information, the distance between the curve and axis is greater than in complete information case, this would mean that in case of incomplete information, the level x is more difficult to be reached in a short time.

The choice of the small value of

A large value of

In these last four figures (Figure 5 and Figure 6), the maximum reached is greater if the drift m is negative, meaning the positive level x is more probably reached in a shorter time. This is due to the very small value of

4. Proofs

Proposition 1

Proof. First note that, since X is a

The fact that

Secondly, for any

Figure 3. Conditional densities for

Figure 4. Conditional densities for

The

By hypothesis, we have

Then, we have for any

Figure 5. Densities for

Figure 6. Conditional densities for

Now, we show the equality almost surely for all

These processes are increasing, then they are sub-martingales with respect to the filtration

We conclude that, almost surely, for all

Taking

□

Proposition 2

Proof. Let

where

We recall the expression

and remark that

Markov property implies

We use Lemma 4 with

and Lemma 7 (22) with the pair

All computations are done on the set

submartingale. Then for all

Thanks to Jensen inequality and Lemma 8 with

Concerning the numerator,

is satisfied then

So finally

Let

It follows using (13) that

Taking

Then

By Gronwall’s lemma, we deduce that

Proposition 3

Proof. Let be a process

Conditioning by

Conversely compute the expectation of the product of

Since

Finally we could replace

Proposition 4

Proof. Applying Lemma 4, it follows that

But, since the condition

that

consider for

(17). But Lemma 7 of Appendix ensures that

We apply Ito formula to the ratio of processes

satisfying the stochastic equations respectively (9) and (11):

The Itô’s formula applied to

We achieve the proof letting

Theorem 1

Proof. Let us now find a mixed filtering-integro-differential equation satisfied by the conditional probability density process defined from the representation

We fix a and t such that

By definition of G, we have

Then

By Tonelli Theorem,

Similarly

In Equation (12) of Proposition 4,

are respectively replaced by

By hypothesis, we have

For

The numerators being bounded by

position 4, which can be written again as

To express this result with

under the integral is multiplied and divided by the same term

tion, we use the filtration

Therefore, using (20) in Lemma 4, on the set

which finishes the proof. □

5. Conclusion

This paper extends the study of the first passage time for a Lévy process in [5] from complete to incomplete information and D. Dorobantu’s work in [8] from intensity to conditional density. Here, we are proving the existence of the density of

Acknowledgements

We thank my PhD advisor Laure Coutin for her help and pointing out error. We thank too Monique Pontier for her careful reading. We thank the Editor and the referee for their comments. This work is supported by A.N.R. Masterie. This support is greatly appreciated.

Cite this paper

WalyNgom,11, (2015) Conditional Law of the Hitting Time for a Lévy Process in Incomplete Observation. Journal of Mathematical Finance,05,505-524. doi: 10.4236/jmf.2015.55041

References

- 1. Bertoin, J. (1998) Lévy Processes. Vol. 121, Cambridge University Press, Cambridge.

- 2. Sato, K. (1999) Lévy Processes and Infinitely Divisible Distribution. Vol. 68 of Cambridge Studies in Advanced Mathematics, Cambridge University Press, Cambridge, Translated from the 1990 Japanese Original, Revised by the Author, 1999.

- 3. Cont, R. and Tankov, P. (2004) Financial Modeling with Jump Processes. Chapman & Hall/CRC, Boca Raton, London, New York.

- 4. Duffie, D. and Lando, D. (2001) Term Structure of Credit Spreads with Incomplete Accounting Information. Econometrica, 69, 633-664.

http://dx.doi.org/10.1111/1468-0262.00208 - 5. Kou, S.G. and Wang, H. (2003) First Passage Time of a Jump Diffusion Process. Advances in Applied Probability, 35, 504-531.

http://dx.doi.org/10.1239/aap/1051201658 - 6. Bernyk, V., Dalang, R.C. and Peskir, G. (2008) The Law of the Supremum of a Stable Lévy Process with No Negative Jumps. The Annals of Probability, 36, 1777-1789.

http://dx.doi.org/10.1214/07-AOP376 - 7. Guo, X., Jarrow, R. and Zeng, Y. (2009) Credit Model with Incomplete Information (Earlier Version Information Reduction in Credit Risk Models). Mathematics of Operations Research, 34, 320-332.

http://dx.doi.org/10.1287/moor.1080.0361 - 8. Dorobantu, D. (2007) Modélisation de risque de défaut en enterprise. Thèse de l’Université de Toulouse 3.

- 9. Roynette, B., Vallois, P. and Volpi, A. (2008) Asymptotic Behavior of the Hitting Time, Overshoot and Undershoot for Some Lévy Processes. ESAIM: PS, 12, 58-93.

- 10. Gapeev, P.V. and Jeanblanc, M. (2010) Pricing and Filtering in Two-Dimensional Dividend Switching Model. International Journal of Theoretical and Applied Finance, 13, 1001-1017. http://dx.doi.org/10.1142/S021902491000608X

- 11. Coutin, L. and Dorobantu, D. (2011) First Passage Time Law for Some Lévy Process with Compound Poisson: Existence of a Density. Bernoulli, 17, 1127-1135. http://dx.doi.org/10.3150/10-BEJ323

- 12. Zakai, M. (1969) On the Optimal Filtering Diffusion Process. Zeitschrift für Wahrscheinlichkeitstheorie und Verwandte Gebiete, 11, 230-249.

http://dx.doi.org/10.1007/BF00536382 - 13. Pardoux, E. (1991) Filtrage non linéaire et équations aux dérivées partielles stochastiques associées. Ecole d’Eté de Probabilités de Saint-Flour-1989, Lecture Notes in Mathematics 1464, Springer-Verlag, Heidelberg, New York.

- 14. Coutin, L. (1996) Filtrage d’un système càd-làg: Application du calcul des variations stochastiques à l'existence d'une densité. Stochastics and Stochastics Reports, 58, 209-243.

http://dx.doi.org/10.1080/17442509608834075 - 15. Bain, A. and Crisan, D. (2009) Fundamentals of Stochastic Filtering. Springer-Verlag, New York.

http://dx.doi.org/10.1007/978-0-387-76896-0 - 16. Karatzas, I. and Shreve, S.E. (1991) Brownian Motion and Stochastic Calculus. Second Edition, Springer-Verlag, New York.

- 17. Doney, R.A. and Kiprianou, A. (2005) Overshoot and Undershoot of Lévy Process. The Annals of Applied Probability, 16, 91-106.

http://dx.doi.org/10.1214/105051605000000647 - 18. Protter, P. (1985) Volterra equations driven by semi martingale. Annals of Probability, 13, 518-530.

http://dx.doi.org/10.1214/aop/1176993006 - 19. Revuz, D. and Yor, M. (1999) Continuous Martingales and Brownian Motion. Third Edition, Springer-Verlag, Berlin, Heldelberg, New York.

http://dx.doi.org/10.1007/978-3-662-06400-9 - 20. Protter, P. (2003) Stochastic Integration and Differential Equation. Second Edition, Springer, Berlin.

- 21. Jeanblanc, M. and Rutkowski, M. (2000) Modeling of Default Risk: Mathematical Tools, Mathematical Finance; Theory and Practice. Modern Mathematics Series, High Education Press.

Appendix

Lemma 1. Let be

Proof. Indeed using the law of G, we have

Since

By change of variable

□

Lemma 2. If

Proof. We have

where

□

Lemma 3. There exists some constants

Proof. The function f defined in (4) satisfies

Using the fact that if

Replacing

Let

Remark that conditionally to process N and the

Gaussian law with mean

Applying Lemma 1 we get the conditional expectation

Using the fact that

The proof is completed with Lemma 2. □

The next lemma is inspired of Jeanblanc and Rutkovski [21] and Dorobantu [8] .

Lemma 4. For all

For instance with

Proof. Assume that there exists

Then,

Thus

what is not possible. Indeed,

That means for all

Thus for any t, t,

On the set

Taking the conditional expectation with respect to

This implies that

Using Kallianpur-Striebel formula (see Pardoux [13] ) and

□

The following is in [14] .

Lemma 5. The family of

is total in the set of processes taking their values in

Let us denote by

Lemma 6. Let

Then

Proof. As in Lemma 5, the family of processes

is total in the set of processes taking their values in

Therefore, since

The equality is obtained from the fact that under

Lemma 7. Let be a process

and

For instance

Proof. Let be

The integration by parts Itô formula applied to the product

and remark that

Since X and Q are independent under

Similarly, using first

and the independence between X and Q under

Equations (23) and (24) imply that

Now let be

so

which concludes the proof. □

Lemma 8. For all

Proof. The process

From Corollary 2 (i), the process

position

Let

taking the expectation we derive

Using Gronwall’s Lemma

The proof of Lemma 8 is achieved by letting n going to infinity. □