Journal of Mathematical Finance

Vol.05 No.02(2015), Article ID:56116,10 pages

10.4236/jmf.2015.52013

Arbitrage-Free Gaussian Affine Term Structure Model with Observable Factors

Gang Wang1,2

1School of Finance, Shanghai University of Finance and Economics, Shanghai, China

2Shanghai Key Laboratory of Financial Information Technology, Shanghai, China

Email: delta9527@gmail.com

Copyright © 2015 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 10 March 2015; accepted 30 April 2015; published 5 May 2015

ABSTRACT

This paper analyzes a simple discrete-time affine multifactor model of the term structure of interest rates in which the pricing factors that follow a Gaussian first-order vector autoregression are observable and there are no possibilities for risk-free arbitrage. We present the theoretical results for the compatible risk-neutral dynamics of observable factors in a maximally flexible way consistent with no-arbitrage under the assumption that the factor loadings of some yields are specified exogenously.

Keywords:

GDTSMs, Observable Factors, No-Arbitrage

1. Introduction

This paper analyzes a simple discrete-time affine multifactor model of the term structure of interest rates in which the factors of the model that follow a Gaussian first-order vector autoregression are observable and there are no possibilities for risk-free arbitrage. Rather than defining latent states indirectly through normalization on parameters governing the dynamics of latent states, a number of recent literatures have instead prescribed observable risk factors. For instance, [1] simply identified the factors with the yields themselves; [2] used both the yields and macroeconomic observables; [3] [4] and [5] used the first three principal components of yield curve. Our work positions itself in this line of research.

In the history of dynamic term structure model, the pricing factors are treated as shocks of various kinds that are not necessarily designed to be observable. Recent studies show that modeling the factors as observable has enormous computational advantages in the parameter estimation (“calibration”) process (see, for example, [3] [6] ). For arbitrage-free affine term structure model, the risk-neutral (hereafter denoted by ) distribution parameters of pricing factors are directly related to the cross-section observations of the yield curve and we can use enough number of cross-section bond price observations at a given time (no less than that of

) distribution parameters of pricing factors are directly related to the cross-section observations of the yield curve and we can use enough number of cross-section bond price observations at a given time (no less than that of  parameters) to identify the

parameters) to identify the  parameters at that time (in reality, it is common to use time series data and to assume fewer bond price observations at a given time than parameters). However, in order to estimate the behavior of the state factors under the real-world probability measure (hereafter denoted by

parameters at that time (in reality, it is common to use time series data and to assume fewer bond price observations at a given time than parameters). However, in order to estimate the behavior of the state factors under the real-world probability measure (hereafter denoted by ), one generally must resort to time-series observations. In estimation, when the factors are observable, [3] showed that there is an inherent separation between the parameters of

), one generally must resort to time-series observations. In estimation, when the factors are observable, [3] showed that there is an inherent separation between the parameters of  and

and  distributions of risk factors, which greatly facilitate the estimation of

distributions of risk factors, which greatly facilitate the estimation of  parameters. In contrast, when the risk factors are latent, estimates of the parameters governing the

parameters. In contrast, when the risk factors are latent, estimates of the parameters governing the  distribution necessarily depend on those of the

distribution necessarily depend on those of the  distribution of the state, since the pricing model is required to either invert the model for the fitted states (when some bonds are priced perfectly) or filter for the unobserved states (when all bonds are measured with errors).

distribution of the state, since the pricing model is required to either invert the model for the fitted states (when some bonds are priced perfectly) or filter for the unobserved states (when all bonds are measured with errors).

In this paper, although one of our goals is to classify a family of models that is convenient for empirical work, we are not directly concerned with estimation issues. We refer readers to the empirical studies for such issues, such as [3] [5] [6] and so on. We will restrict our attention to behavior under one particular equivalent martingale measure .

.

Contrary to traditional affine latent factor approach in which some dynamics for factors are assumed firstly and then establishing the factor loadings of yields through arbitrage-free restriction, we take the loadings on specific yields as given firstly and then parametrize the  distribution of observable factors in a maximally flexible way consistent with no-arbitrage. That is, we specify the factor loadings exogenously, which is reasonable since the factors and yields are all observable.

distribution of observable factors in a maximally flexible way consistent with no-arbitrage. That is, we specify the factor loadings exogenously, which is reasonable since the factors and yields are all observable.

The remainder of this paper is structured as follows. In Section 2 we discuss the general Gaussian affine term structure models (GDTSM) and some assumptions imposed on yields and factors. In Section 3 we discuss the compatible dynamics of observable factors. In Section 4, we give an example. In Section 5, we conclude.

2. Gaussian Affine Term Structure Models

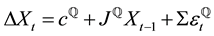

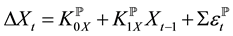

More precisely, for our purposes a useful starting point is the work by [3] , who show that every canonical GDTSM is observationally equivalent to the JSZ canonical GDTSM, and the discrete-time evolution of the risk factors (state vector)  is governed by the following equations,

is governed by the following equations,

(1)

(1)

(2)

(2)

(3)

(3)

where  is the one-period spot interest rate, l is a column vector of ones,

is the one-period spot interest rate, l is a column vector of ones,

Here, we specify the Jordan form with each eigenvalue associated with a single Jordan block. Thus, when the eigenvalues

and where the blocks are in order of the eigenvalues.

Under Equations (1)-(3), the price of an n-year zero-coupon bond is given by

where

subject to the initial conditions

where

In this setting, the factors are latent variables and the “loadings” (

In other settings, the factor loadings may be specified a priori, for example, the dynamic Nelson-Siegel model

(DNS) was first proposed by [8] with

responding Arbitrage-free model (AFNS) in which the absence of arbitrage and a priori specification of DNS loading actually restrict the coefficient of the process for the factors under

tors are the principal component of zero-coupon bond yields and the factor loadings for the corresponding bond yield are assigned a priori. They show in continuous-time frame that if the factors follow a mean-reverting dynamics, then the pre-specified factor loadings imposes some unexpected constraints on the reversion-speed ma- trix.

In the economy, we observe numerous zero-coupon bond yields with different maturities. We will take out from these yields a set of N yields,

where A an

In this paper, we derive a discrete-time arbitrage-free Gaussian affine term structure model under the following assumptions:

Assumption 1: There are N observable factors Ft in real economy which can linearly span the latent factors Xt.

Assumption 2: The factors Ft loadings for our key maturity yields yt are known as a priori. The assumption 1 imply that we can express yt as the affine combinations of Ft.

Assumption 2 means that u and U are given exogenously.

In the following, we define the process of

where

And the risk-free rate can be expressed as the affine functions of the vector of observable factors Ft. Without loss of generality we can define

where

3. The Compatible Dynamics of Observable Factors

In the following, we will take u and U as given exogenously and find compatible dynamics of observable factors. We first derive restrictions on parameters of the process of observable factors Ft under risk-neutral measure

3.1. Restrictions on Risk-Neutral Parameters of Factor Process-

Theorem 1. Given key maturities

where

where

with

Proof:

Combining Equations (8) and (7), we have,

Substituting Equation (13) into Equation (1), we have,

We will call Equation (14) the model consistency condition.

From Equations (4) and (6), we observe that

According to [4] , for any Jordan canonical form

defined as

Applying this formula to Equation (15), we have

where,

Defining

where

Let us define a block diagonal matrix

where

Now let

where

That is

Substituting Equations (17), (18) and (19) into Equation (16), we have

From Equation (14), we have

In deriving Equation (21), we use

We can check the relation

n

Thus by construction we have shown that with U given,

Since we assume the factors Ft are observable and the covariance matrix

Theorem 2. Given the choice of key maturities

where

Proof:

From Equations (14), (20) and (21), we have

In addition,

where

which is the first column of matrix G, and then we have

From Equations (5) and (6), we have

where

Then,

Calculating the summation in the above equation, we get

We define

where

n

3.2. Restrictions on Parameters of Risk-Free Rate Equation-

Theorem 3. Vector

where G is defined by Equation (12) and

Proof:

Substituting Equation (13) into Equation (3), we have,

From Equation (20), we have

For

As before, let

Since

Substituting Equation (28) into Equation (27), we get

n

Theorem 4. Let parameters of the model,

where G and

Proof:

From Equations (26) and (28), we have

Substituting Equation (24) into Equation (30), we get

n

4. Example

Consider a 3-dimensional observable affine factor model, and let the eigenvalues of the coefficient matrix

where

From Equations (15) and (15*), we have the close form for

5. Conclusions

A number of previous researchers have discussed the affine term structure with the pricing factors being observable. A distinctive feature of the models with observable factors is its computational advantage over that with latent factors. However, these researches just focus on the computational convenience but do not study such model in depth.

In this paper, our results show that if we treat the pricing factors observable and thus the factors loadings of some key maturity yields are given a priori, the no-arbitrage condition will impose strict restrictions on the risk-neutral dynamics of the observable factors and on the parameters of risk-free rate equation.

We discuss how to impose some important constraints on the

Acknowledgements

This work is supported by Research Innovation Foundation of Shanghai University of Finance and Economics under Grant No. CXJJ-2013-321. And I am grateful for helpful comments from the anonymous referee and especially to Professor Hong Li for his support and encouragement. All errors are my own.

References

- Duffie, D. and Kan, R. (1996) A Yield-Factor Model of Interest Rates. Mathematical Finance, 6, 379-406. http://dx.doi.org/10.1111/j.1467-9965.1996.tb00123.x

- Ang, A. and Piazzesi, M. (2003) A No-Arbitrage Vector Autoregression of Term Structure Dynamics with Macroeconomic and Latent Variables. Journal of Monetary Economics, 50, 745-787. http://dx.doi.org/10.1016/S0304-3932(03)00032-1

- Joslin, S., Singleton, K.J. and Zhu, H. (2011) A New Perspective on Gaussian Dynamic Term Structure Models. Review of Financial Studies, 24, 926-970. http://dx.doi.org/10.1093/rfs/hhq128

- Saroka, I. (2014) Affine Principal-Component-Based Term Structure Model. Http://Ssrn.Com/Abstract=2438623 http://dx.doi.org/10.2139/ssrn.2438623

- Rebonato, R., Saroka, I. and Putyatin, V. (2014) A Principal-Component-Based Affine Term Structure Model. Http://Ssrn.Com/Abstract=2451130

- Hamilton, J.D. and Wu, J.C. (2012) Identification and Estimation of Gaussian Affine Term Structure Models. Journal of Econometrics, 168, 315-331. http://dx.doi.org/10.1016/j.jeconom.2012.01.035

- Dai, Q. and Singleton, K. (2003) Term Structure Dynamics in Theory and Reality. Review of Financial Studies, 16, 631-678. http://dx.doi.org/10.1093/rfs/hhg010

- Diebold, F.X. and Li, C. (2006) Forecasting the Term Structure of Government Bond Yields. Journal of Econometrics, 130, 337-364. http://dx.doi.org/10.1016/j.jeconom.2005.03.005

- Christensen, J.H., Diebold, F.X. and Rudebusch, G.D. (2011) The Affine Arbitrage-Free Class of Nelson-Siegel Term Structure Models. Journal of Econometrics, 164, 4-20. http://dx.doi.org/10.1016/j.jeconom.2011.02.011