Low Carbon Economy, 2011, 2, 62-70 doi:10.4236/lce.2011.22010 Published Online June 2011 (http://www.SciRP.org/journal/lce) Copyright © 2011 SciRes. LCE Contribution of Finance to the Low Carbon Economy Constancio Zamora Ramírez, José María González González Department of Accounting and Finance, University of Seville, Seville, Spain. Email: constancio@us.es Received February 1st, 2011; revised March 5th, 2011; accepted March 30th, 2011. ABSTRACT Given the advent and spread of carbon assets, as well as the rapid development of financial markets and transactions related with them, this paper intends to achieve the objective of categorizing these phenomena and describing their main characteristics, in such a way that it can be used as a reference by those professionals and scholars who are in- terested in the fighting climate change through the world of fin ance. In this line, this paper will review and analyse the main carbon assets on regulated and voluntary markets, Emission Reduction Purchase Agreements (ERPAs) and the various structures they may acquire, the role of carbon funds, futures and options over carbon assets, as well as adap- tation in financial markets, particularly in relation to climate derivatives and disaster bonds. The paper ends with a proposal of a reference framework that gathers and categorizes different carbon assets, carbon markets and financial operations traded on these markets. Keywords: Carbon Markets, Carbon Assets, Carbon Finance 1. Introduction At the international level, various measures are being implemented to reduce greenhouse gases (GHGs). Th ese measures are oriented towards a transition from our cur- rent economic model to one known as the “low carbon economy,” thereby separating it from the consumption of fossil fuels [1]. The goal is to develop a system which is capable of including the deterioration caused to the en- vironment by GHG emissions throughout the production process as a cost of that activity. The two mechanisms available to achieve this are the creation of taxes on emissions and the development of a market of tradable emission rights, the latter of these two alternatives being the choice made at the international level at the end [2]. Decreasing GHGs and establishing carbon asset mar- kets has not taken place, in general, as a result solely of the development of a regulatory framework. For instance, the voluntary carbon asset market has arisen due to the specific needs of companies and other organizations to offset their emissions. The reasons which cause an or- ganization that does not do business in a regulated sector to offset its emissions are diverse and include [3]: the development of the organization’s own social corporate responsibility and sustainability policy, competitive dif- ferentiation before their customers, an improvement in its access to financial resources, and even having influence on a regulatory framework which is foreseen to become more burdensome in the future. Moreover, the use which companies may make of carbon assets that they obtain by offsetting their emis- sions may range from the offsetting of internal emissions while carrying out all or some of their activities, to the offsetting of external emissions so as to offer CO2-neutral products, which they believe may be more greatly valued and better paid by customers. Carbon assets are a mechanism for mitigation, because they have come about as a result of an attempt to reduce the level of GHGs in our atmosphere, with the lon g-term objective of returning to the levels at which these gases existed in the early twentieth century. Nevertheless, it must be highlighted that the climate has already under- gone changes which undoubtedly affect companies. In this sense, business profits may be affected as a result of the temperature variations which lead to greater or lesser energy consumption. Companies may also suffer signifi- cant losses of property and assets as a result of natural disasters, which have become more violent in recent times. These problems have also given rise to the crea- tion of financial markets which are generally referred to as adaptation in financial mark ets [4, 5]. Therefore, as can be concluded from the preceding  Contribution of Finance to the Low Carbon Economy63 paragraphs, becoming familiar with carbon markets en- tails special difficulty: first of all, because of the diverse origins of the carbon assets that one can encounter, and secondly, because of the wide range of transactions that can be performed in relation with these assets, which can become quite complex and occur within the environment of both regulated markets and Over-The-Counter (here- inafter OTC). Along these lines, the purpose of this paper is to propose a categorization and structure for carbon markets, as well as for the financial transactions involv- ing carbon assets which take place in those markets. It may serve as a framework of reference for both scholars and professionals in carrying out their research and pro- fessional activities, respectively. In order to achieve this objective, we have performed an analysis of the most important markets and financial transactions related with carbon emissions in business practice. In the upcoming sections, we will first analyze the different carbon assets referred to as “primary”, which arise directly from the contractual relations between companies, or in the case of certain regulatory systems, between companies and governments. We shall then structure the different markets in which these assets may be traded, then categorizing the various transactions that can be carried o ut within th is structure. We co mplete this analysis by examining adaptation in financial markets, then concluding the report with a section containing our final considerations, in which we provide a summary of the different market types and the main financial transac- tions involving carbon. 2. Primary Carbon Assets A primary carbon asset can be defined as an agreement (be it legal or voluntary) between two parties, in which one party grants the other the right to offset an amount of GHGs emitted into the atmosphere, within the frame- work of that regulation or contract. 2.1. Regulated or Statutory Markets First of all, we must distinguish those assets which come into existence under the protection of required regulation with which the company must comply. Such regulation may be imposed by either local governments or by su- pranational institutions such as the United Nations. In this sense, the carbon asset does not come into existence due to a voluntary contractual relationship. The regulatory alternatives available are the creation of taxes or the development of a market of transferable emissions rights, though most legal systems have opted for the latter by establishing a cap-and-trade type system [6]. The way this system works is by setting certain emissions reduction targets, and therefore an absolute amount of emissions which are to be assigned amongst the companies subject to that regulation, in such a way that, when that level is surpassed, the organization will be fined. However, the organization can avoid being fined by accessing the flexibility alternatives created through the systems, or more specifically: the market itself, to which the company may turn to purchase emis- sions rights which other companies are selling. They may do this, for example, because they possess a surplus amount above and beyond the emissions they produce. A company may also increase its emissions by obtaining credits earned as a result of reducing emissions through projects carried out in other countries. A market which comes about due to regulation to limit emissions not only makes the system more flexible, but also allows companies with higher marginal emissions reduction costs to participate in the market and acquire emissions rights from other companies which have lower marginal costs. In this way, companies also have a fi- nancing source added to the technological change pro- vided by the resources obtained by selling surplus emis- sions rights or credits obtained through projects in third countries [2]. These assets, because they arise from regional, na- tional or supranational regulation, are also referred to as “statutory”. This system allows them to become fungible more easily, or in other words they can be traded more easily in an organized market. At the international level, the regulation of the Kyoto Protocol (1997) establish es the first period of co mpliance from 2008 to 2012, at the end of which the signatory countries must have reduced their emissions to a level compared with the emissions produced in some year of reference, which is generally 1990. The European Union, in particular, has undertaken to reach this goal under a system which has been called the “shared burden,” hav- ing established the overall objective of an 8% reduction as regards to the emissions produ c ed in 1996. Once the cap is set, each country has to distribute emissions rights amongst the companies with affected in- stallations, through National Allocation Plans. Neverthe- less, the possibility also exists that countries can in crease their emissions by acquiring rights from third countries. The companies which possess these rights can trade them through the European Union Emissions Trading Scheme (EU ETS) [7]. These assets, known as European Union Allowances (EUAs), confer upon the company the right to issue GHGs in amounts equivalent to 1 Tm of CO2 (CO2e)1. Therefore, a company may get rid of its EUA surpluses for the emissions produced in a specific period, or acquire these rights to offset some deficit that has been 1Not all GHGs have the same greenhouse effect. For instance, 1 Tm o methane is equivalent to 25 Tm of CO2, 1 Tm of N2O is equivalent to 298 Tm of CO2, 1 Tm of HFC-23 is equivalent to 14,800 Tm de CO2, 1 Tm of SF6 is equ i va l e nt t o 2 2 ,800 Tm of CO2, etc. In general, emissions rights and credits are specified i n CO2 equivalent units (CO2e). Copyright © 2011 SciRes. LCE  Contribution of Finance to the Low Carbon Economy 64 produced. Transactions involving EUAs (as with other carbon assets that we shall discuss below) may be performed amongst parties that do or do not have installations af- fected by emissions limitations, as well as through bro- kers or platforms where they are traded and generate market, the most notable of which are: - European Climate Exchange (ECX). - European Energy Exchange (EEX). - Nordpool Powernext. - Energy Exchange Austria (EXAA). - Sendeco2. In order to facilitate compliance with the Kyoto Pro- tocol commitments, the Protocol foresees various mecha- nisms to create flexibility, the first and foremost of which is the potential for trading carbon assets. Similarly, a company can increase the permitted emissions through other mechanisms like the following, all of which allow for the offsetting of 1 Tm of CO2e emitted into the at- mosphere: - The acquisition of Certified Emission Reduction Units (CERs), issued for projects resulting from the Clean Development Mechanism (CDM), which are mainly characterized by achieving an emissions reduction in a developing country (referred to as Non- Annex I Countries, or in oth er words countries th at have taken on no emission reduction commitments). CERs are issued by the United Nations. - Obtaining Emission Reduction Units (ERUs), which are the credits granted for the so-called Joint Imple- mentation (JI) projects for reducing emissions in a country included in Annex B of the Protocol. The project’s host country will have its emissions cap lowered in order to issue these credits. - Also foreseen in the Protocol and acknowledged by the European Union is the possibility of offsetting emissions through Removal Units (RMU) obtained through carbon sink activities. Among all these, CDM is the most common. The logic underlying this mechanism is that developing countries do not take on reduction commitments, because their future development involves a significant increase in their emissions. However, if a company in a developed country decides to implement a project which co ntributes to a decrease in emissions in a developing country, then that developed country could have an increase in its emissions allowance. CERs are obtained after a strict verification process in which not only the veracity of the emissions reduction is checked; the additional nature of the project is also measured, in terms of investment and technology. In other words, the attempt is made to verify that the fi- nancing obtained through the CERs makes the project feasible and that the technology is actually transferred to the country where the project is carried out. 2.2. Voluntary Markets The assets analyzed up to this point come about within the framework of regulation that requires compliance, allowing emissions on the basis of an agreement which establishes their amount and distributes that cap. How- ever, there are assets which come about within what are commonly referred to as voluntary carbon asset markets [8]. The value of these assets is not determined by the chance they offer the organization which possesses them to emit an amount of CO2e into the atmosphere without being fined, but rather by the added value which a spe- cific project generates due to the reduction in emissions which it entails. For instance, the holder of these assets may use them to offset the emissions produced in its ac- tivity and offer its customers a CO2-neutral product, in- creasing its price as a result of this “added value”. The carbon assets in voluntary markets are normally created within the framework of a project that contributes to reducing emissions. Similarly, because they possess many particular features, the trading of these assets is much more limited. An exception can be found in the Chicago Climate Exchange (CCX), where companies voluntarily commit to follow a system by which they undertake to respect certain maximum emissions levels, and these assets can be traded in the market. In voluntary markets, carbon assets are usually re- ferred to as Verified Emission Reduction units (VERs)2, because they usually undergo some sort of verification process, which verifies whether they are compliant with a specific standard, such as the Voluntary Carbon Stan- dard, the Voluntary Gold Standard, Gold Standard or VER+. Likewise, there are registries that to guarantee that the same amount of reduction produces one single emission credit. These registries are normally developed by the operators of the corresponding standard them- selves. However, voluntary markets entail significant added risks. First of all, the value of the assets is more greatly dependent upon factors such as the type of project which generates them, their verification standards, the country in which the project is carried out, etc. This makes them less fungible and, as a result, the potential for trading them is substantially lower. Secondly, they bear non- compliance risks, such as selling the same credit on sev- eral occasions, selling them in the initial phase of a pro- ject which never ends up producing the carbon asset at a later time. 2If no verification process is completed, they are referred to as Emis- sion Reduction units (ERs). C opyright © 2011 SciRes. LCE  Contribution of Finance to the Low Carbon Economy65 It can be highlighted that carbon markets have become the main instrument in the fight against climate change, as opposed to other instruments such as taxes on GEI emissions. Furthermore, regulated cap-and-trade ma r k e t s , such as that of the European Union, are the most popular due to the minimization of marginal costs in emission reduction and the additional financing contributed to- wards technological change aimed at a low-carbon eco- nomy. Specifically, in the European market, apart from EUAs, CERs have become the main mechanism foreseen by the Kyoto Protocol to grant flexibility to the emissions trade. In order to facilitate operations on carbon markets, over the last few years there has been a rapid develop- ment in carbon asset negotiation platforms. Finally, de- spite the existence of voluntary carbon markets, where the development of standards to verify carbon assets is highly relevant for the reduction of consequent risks, of significance is the fact that the level of negotiation of these risks is slight in comparison with regulated markets [9]. 3. Emissions Reduction Purchase Agreements (ERPAs) and the Financing of Projects Which Produce Carbon Assets Several of the aforementioned carbon assets come about through projects which lead to a decrease in emissions, with added financing obtained by transferring these as- sets. This financing is usually obtained through specific agreements known as ERPAs. These contracts basically consist of the commitment assumed by a carbon asset investor to acqu ire thos e produced th roughou t a period of time specific in the contract, in exchange for a specific amount. ERPAs do not have a pre-determined financial struc- ture. However, they normally invo lve the acquisition, for a specific term, of the carbon assets created through a specific project, generally one of clean development (CERs), establishing the number of assets to be delivered per year and the price to be paid for them. Therefore, ERPAs may take on very different financial structures, because it is the parties (project promoter and financier) who define what they consist of, an d therefore they depend upon their investment and financing needs. In some cases, third parties may even become involved [5]. As for CERs, the price which is paid for them is a fixed amount, though indexing or optional clauses may be established which limit or activate the variability in their price. In this sense, we offer a list of the most commonly used structures below, though this list is not necessarily complete, because one may find other new structures or combinations of structures, since the market is undergoi n g con st a nt development: - Fixed price, when the CERs (or whichever other car- bon assets) are to be acquired at a price per unit es- tablished in the ERPA. - Indexed price, when the price at which the assets are acquired will vary depending upon the changes in variables or prices, such as: The value of those assets on secondary markets. The price of a specific raw material, such as petro- leum, coal, natural gas, etc. Interest rates, inflation rates, etc. - Floor and/or cap clauses. Price indexing may lead to the introduction of other clauses which control varia- tion: Floor: this means a minimum payment for the car- bon assets, regardless of whether the reference variable involves a lesser amount. However, the price to be paid would potentially go on an increas- ing path. Cap: unlike the preceding, the variation in price would have a maximum in its amount. Collars: consists of a combination of the two pre- ceding elements, or in other words, the price to be paid will have a minimum but will never surpass an established maximum, with the advantage that, for the assets’ buyer, this structure is less expensive, since the buyer needs not assume the considerations for setting a minimum amount in the contract. At the same time, a project’s financing may be related with carbon assets that are generated in the future, in which case certain structures like the following may ap- pear: - Monetization: this involves obtaining a volume of funds in advance, before the project produces the CERs or other carbon assets. Through monetization, the financial entity, or market operator where appro- priate pays for the assets in advance, instead of awaiting their delivery to reimburse them, thereby becoming their future possessor. Nevertheless, the amount received must be covered, either in a corpo- rate manner or by any other asset. In the event that sufficient CERs are not generated to cover the amount received, the promoter will be forced to complete the coverage of that amount. - Collateralization: in these cases, the financing is actu- ally obtained from a third party unrelated to the ERPA, which will not become the future title-holder of the CERs (or other carbon assets). However, the financing received will be guaranteed precisely by the funds which are obtained with in the framework of the ERPA contract. In a certain way, therefore, one can say that the ERPA is “monetized.” The guarantee to return the financing received may be completed by others grant ed by the p romoter. Copyright © 2011 SciRes. LCE  Contribution of Finance to the Low Carbon Economy 66 - Leveraged carbon finance or the financing of projects: the financing received is guaranteed exclusively by the funds generated through the project, which is why this is also referred to as financing “without re- course.” Last of all, we must point out the role played by in- vestment funds in these types of projects. Social aware- ness about climate change has also come to determine the way in which certain funds invest. For instance, invest- ment funds which are known as “green” exclude or minimize their investments in projects and companies which are especially pollu ting, establish ing ratings on the sustainability of th e companies in which they inv est. One can also distinguish those hedge funds which specialize in acquiring future carbon credits at a very low price by taking part in projects to reduce emissions, which may obtain a significant bonus on th e sale of the cred its which they generate. However, those which have taken on the most impor- tance in developing CDM projects are the so-called car- bon funds [10]. These funds attract resources from both the private and public sectors, investing them in projects which generate carbon credits through the flexibility mechanisms in the Kyoto Protocol, so that their partici- pants can use them to offset their emissions and they can live up to their commitments. Therefore, their investors do not earn cash returns on them (though there is a po- tential for this), but instead they receive CERs, for in- stance as the return on their investment. As stated in this section, ERPAs have become a rele- vant instrument for carbon market operations and may adopt different structures, particularly in relation to CERs. Furthermore, different structures have been de- veloped in order to relate a project’s financing to the carbon assets it will generate in the future. Also, we can highlight the significant role played by “green” invest- ment funds and, particularly, carbon funds, to finance investments based on a low-carbon economy. 4. Carbon Asset-Based Derivatives Primary carbon assets may give rise to a wide range of transactions which in many cases become other assets in and of themselves. For this reason, one can also point to the existence of secondary carbon assets, or in other words, those which are created on the basis of an invest- ment in other carbon assets [4]. In general, the price of primary carbon assets is deter- mined by the trading values in organized markets. In the case of EUAs, for example, prices of more than 30 Euros have been reached, with floors under 0.50 Euros having been reached, as well. As a result, the market risks for companies are significant, and assets with more or less complex derivative structures have been developed. Nevertheless, these structures may also be contracted amongst private parties (OTC), especially by banking institutions which already have very sophisticated prod- ucts. Likewise, most of the carbon asset financial mar- kets offer derivatives on them. The following structure may be considered the most common: - Futures: this consists of setting a price at which a specific carbon asset will be traded (EUAs, CERs, etc.) at the end of a specific time period (3, 6, 9, 12 months, etc.). Contracting futures is inherent to or- ganized markets such as the ECX, in which futures are traded on both EUAs and on CERs. These con- tracts are structured into lots of 1,000 Tm, with deliv- eries in the months of March, June, September and December of each year. The buyer and seller view- points of the market are very different. Whereas the buyer is looking out for increases, because they want to secure the price of the carbon asset that they will be acquiring at some future time, sellers look out for decreases, intending to secure the price at which they will sell the asset through the contract. These con- tracts, for instance, make it possible to secure the margin that will be obtained from the sale of the CERs produced by a certain project. Another market in our surrounding environment which markets this product is the EEX. - Options: in this case, the buyer of the option acquires the right to purchase (these options are known as calls) or sell (known as puts) the carbon assets at a fixed price in the contract, in exchange for payment of a premium to the seller or issuer of the option. The ECX is a platform in which one can find products with this structure, on both EUAs and CERs. Likewi se, an EUA-CER swap is al so possible, like th e one offered by Sendeco 2, in which two parties exchange one set of assets for another. This transaction is justified by the difference existing between the two assets, given that CERs are traded at a somewhat lower price than EUAs, but their value for the purposes of offsetting emissions is practically the same. This strategy wo uld be advisable for a company, for instance, that possesses EUAs, but whose emissions may be offset in the same way with CERs, while receiving compensation in cash by way of the swap. The Repo-Swaps structur e, with bo th EUAs an d CERs, normally occurs in response to an OTC transaction be- tween a GHG issuer and a financial institution. The is- suer may be the possessor of a series of rights which it does not foresee it will use until a certain time period elapses, and therefore it assigns them to a bank. As for the bank, it will deliver to the issuer of the GHG the dif- ference between the cash price and the trading price at the time of maturity. C opyright © 2011 SciRes. LCE  Contribution of Finance to the Low Carbon Economy67 Transactions have been executed on carbon markets under basic financial structures, primary and derivative, as well as other more specific carbon asset structures. The performance of regulated markets after 2012, the final date foreseen in the Kyoto Protocol, together with that of voluntary and regional markets, will entail greater complexity in these contractual structures, requiring the international unification of their legal implications. 5. Adaptation in Financial Markets Up to now, we have been discussing primary assets, de- rivatives and transactions of a fin ancial nature which can be used by companies to mitigate climate change. How- ever, an emissions level has already been reached which will not be reduced in the short term, and it is assumed that this change will have effects on temperatures, pre- cipitation, storms and other weather phenomena that may affect businesses both adversely and advantageously. In this respect, financial mechanisms have already been created, as well, to be able to convey or exchange these risks. This conveyance of risks may be extended to in- clude catastrophes, such as a hurricane, or other phe- nomena, regardless of whether their origin lies in climate change, and regardless of whether they are of a meteoro- logical nature, as may be the case with earthquakes or the eruption of a volcano. Therefore, while the markets described above are ori- ented towards reducing GHG, therefore having been given the name of “mitigating” the markets we will be describing in this section are referred to as “adaptation” because they make it possible to lessen the adverse ef- fects which the climate and other natural phenomena have on companies. Basically, two types of financial alternatives can be distinguished for managing these risks [4,5]: climate derivatives and disaster bonds. 5.1. Climate Derivatives Climate derivatives come about because a certain weather phenomenon may affect different companies in different ways. For example, high temperatures may benefit energy companies due to the increase in demand by companies and private individuals when they turn on their air conditioning devices. Similarly, coastal hotel businesses would benefit. On the other hand, high tem- peratures may harm, for instance, companies with agri- cultural interests, tho se that own office buildings or even shopping malls, because their electricity costs skyrocket. Other industries sensitive to weather and climate are construction, entertainment, clothing and drinks. The most sensitive sector of all is that of energy, for obvious reasons. In general, a company’s profits will be sensitive to these phenomena if its sales or some of its cost com- ponents vary i n response thereto. Companies have managed to develop mechanisms to manage these risks. The most common and traditional is insurance, but insurance only covers risks like frost, hail and wind, of an extreme nature, and damage must be caused to the company’s property. It would be quite dif- ficult to cover, for example, a decrease in sales during a snow season that sees low levels of precipitation . Climate derivatives can cover such risks, though. For instance, in the event that one single climate risk affects two compa- nies in different ways, these companies can swap the risk through a futu re, to provide one example3. In that way, if the temperature rises above a certain level, the buyer of the future may receive a payment from the counterpart selling the future. The underlying factors, in addition to references to temperature, may include other variables, such as snow- fall, hurricanes, frost or wind. In such contracts, a period must be established for observing the variable, as well as the weather station of reference whose measurements will determine the payments made pursuant to the con- tract. The most common structures are futures and options. In futures, the parties swap the amounts in one direction or the other depending upon whether the climate index rises above or falls below the strike. With options, these are usually referred to as calls or puts. In the case of calls, the buyer, after payment of a premium, receives an amount for each point in which the index of the cli- mate-related underlying factor rises above a certain ref- erence level (strike). On the contrary, in puts, the buyer of the option receives an amount based on whether the index of the climate-related underlying factor falls below the strike. The beginning of the climate derivatives market was OTC, though it has been on the rise, with the develop- ment of organized markets, the epitome of which is cur- rently the Chicago Mercantile Exchange (CME). Even greater growth is expected for these markets in the future, given the sensitivity which economic activity in general is undergoin g wi t h respect to changes in climate. 3In the specific case of temperature, the technical reference is not de- grees centigrade, but rather HDDs (Heating Degree Days) and CDDs (Cooling Degree Days). HDD is the number of days in which the tem- erature falls below a pre-established level. This measurewas created to determine efficiency in the energy use of a building. As for CDD, it refers to the days in which th e temperature rises above a pre- e st a bl is h ed level. These two indices may have values even greater than 1 point pe day, because each degree-day in which the temperature distances itsel from the reference, the indicator goes up by one point. Therefore, in the case of HDD, if the reference level is 18˚C and the average temperature of one day is 16˚C, the index would go up by 2 points that day (greater heating use is needed). As for CDD, it is used to determine energy use in the event of excessive heat, or in other words, by the need to use air conditioning. The reference temperature is normally 18˚C /65˚F, below which a building requires heating. In many cases, these indices are calculated cumulatively for time periods, normally by months or sea- sons. Copyright © 2011 SciRes. LCE  Contribution of Finance to the Low Carbon Economy Copyright © 2011 SciRes. LCE 68 5.2. Disaster Bonds The fundamental characteristic of these bonds is that certain payments thereof (normally the principal) do not take place if a certain event of a catastrophic nature de- fined in the bond issue takes place. Normally, the issuers of these bonds belong to the insurance industry, with interests in areas which would have to face the payment of claims resulting from huge losses, if a hurricane, earthquake, etc. were to take place. The appeal of these bonds is that they reward the in- vestor with much higher interest rates than the market commands in similar risk issues (normally the three- month LIBOR rate plus a differential, fluctuating be- tween 3% and 20%). Thus, adaptation in financial markets have comple- mented mitigating markets by covering the impact ex- pected from climate change due to the emission levels already reached. Within adaptation, of interest are both climate derivatives, which allow companies to establish futures and options to offset the risks derived from the impact of climate change on their economic activity, and disaster bonds, linked to catastrophic events. In the future, these financial structures are expected to develop further as the effects of climate change gradually worsen and become more apparent. 6. Final Considerations This paper has reviewed and analysed the main carbon assets that are traded both on regulated and voluntary carbon markets, as well as the financial structures and transactions carried out therein. Given the diversity and complexity inherent to this field, also involved in the fight against climate change, Table 1 is hereby intro- duced as a reference for the categorization of the various assets, markets and financial operations referred to. Regulated carbon markets have become a basic instru- Table 1. Carbon markets, carbon assets and financial transactions. According to action on climate change System Market in which the transaction is performed Type of operations - structuresExamples of markets and transac- tions Cash transactions ECX, EEX, SENDECO2 Futures ECX, EEX Organized markets Options ECX Cash transactions Sale/purchase of EUAs or CERs directly between private parties and later registration. Acquisition of a shareholding in a carbon fund. Term forwards ERPAs Options Certain clauses in ERPAs. Contracts between private parties (e.g., an investor and a financial institution) involving puts (or calls) on emission rights. Regulated (In this study, the Kyoto Protocol and the EU ETS) OTC Others Monetization of ERPAs Collateralization of ERPAs Leverage Carbon Finance EUA-CER Swaps Repo-Swap Transactions Cash transactions Futures Voluntary Organized markets Options CCX Mitigation OTC Transactions in voluntary markets are usually with OTC, though they are o p en t o a n y structure. ERPAs on VERs Cash Issue of disaster bonds Futures Organized markets Options Climate derivatives contracted at CME Adaptation Voluntary Futures OTC Options Traded climate derivatives, suc h as those between a company and an insurer or bank.  Contribution of Finance to the Low Carbon Economy69 ment in the fight against climate change, and the cap- and-trade markets are the most developed [2]. None- theless, this expansion has been of a qualitative nature, because fundamentally the types of carbon assets and financial trading transactions have been increased [4]. The main difficulty lies in getting these markets to achieve an acceptable depth and breadth. This fact would truly indicate that the cost of climate change as an exter- nality is being integrated into the eco nomy. Furthermore, of interest is the creation and development of voluntary carbon markets, although their trading volume is cur- rently well below that of regulated markets. In this line, the distribution and consolidation of standards for the verification of carbon assets traded on voluntary markets is the key to growth. As well as the emission rights traded on carbon mar- kets, CERs have become a very important mechanism to endow the emissions trade with flexibility, as foreseen in the Kyoto Protocol. In this regard, ERPAs on CERs have become very important in carbon market operations, and various structures have been developed. Along these structures, also of interest is the distribution of futures and options over emission rights and CERs as the main secondary carbon assets. Likewise, climate derivatives and disaster bonds are becoming a useful instrument to enable organizations to manage the economic and financial risks derived from the effects of climate change, although these instruments are expected to be more widely distributed as these ef- fects gradually become broader and more apparent. Given the diversity and complexity of carbon markets and the financial transactions they invo lve, a key issue is the development of regulations to endow the emissions trade system with warranties, stability and security. In this regard, a priority is progress towards a global agreement to succeed the Kyoto Protocol, which will only apply until the year 2012. To this effect, the next Conference of the Parties scheduled for late 2011 in Durban (South Africa) will be crucial. Furthermore, pol- icy-makers should make an effort to develop those issues of the regulatory framework that guarantee and encour- age transparency in the financial transactions that in- volved several types of carbon assets. This paper is mainly restricted by its focus on carbon assets and markets based on the Kyoto Protocol, such as the EU ETS. In this regard, we should acknowledge the significant progress being made in other national and regional markets, in different countries, such as the US, Japan or New Zealand. The reason why the main refer- ence used herein is the EU ETS is mainly because it was the first international emissions trade market to be cre- ated, having become since then a worldwide reference in the global performance of carbon markets. Furthermore, right now, the EU ETS is by far the most relevant market by carbon asset trading volume [9]. Finally, this paper may be potentially improved with further research on the following issues: - The behaviour of carbon markets that are being estab- lished in leading Eastern powers, such as China, as their economic growth becomes an important deter- mining factor in world economic gr owth. - The variables that explain the price of carbon assets, particularly any interactions with other commodities to which they are linked [1 1, 12]. - The end purpose of carbon markets is an effective transition towards a more sustainable energy model. In order to reach this objective, in policy-making it will be necessary to have more complex tools to se- lect techniques, processes or more adequate price structures, instead of other more traditional analytical models, such as discounted cash flow method [13]. - As regards legal considerations, research should help develop an international standardization process to record carbon assets in financial statements. From an accounting perspective, there is a great deal of debate about the way these assets should be considered [14, 15]. More specifically, there are questions about whether they should be treated as intangible assets, inventory, or financial instruments. As for the value which they are assigned, there is also debate over whether these elements must appear at their cost or at their fair value, and depending on which is the case, how any changes in valu e should be dealt with [16]. - Another significant legal issue is the taxation of car- bon asset transactions [2]. Including the profits on these transactions in the accounting results of the fi- nancial year may lead to differen t taxations. Similarly, none of indirect taxes created by these transactions have been harmonized yet. Further research on these issues would provide greater transparency and uni- formity to the tax effects of different carbon asset transactions. REFERENCES [1] N. Stern, “The Economics of Climate Change: The Stern Review,” Cambridge University Press, Cambridge, 2006. [2] A. Brohé, N. Eyre and N. Howarth, “Carbon Markets,” Earthscan, Oxford, 2009. [3] J. Pinkse and A. Kolk, “Multinational Corporations and Emissions Trading: Strategic Responses to New Institu- tional Constraints,” European Management Journal, Vol. 25, No. 6, 2007, pp. 441-452. doi:10.1016/j.emj.2007.07.003 [4] S. Labatt and R. White, “Carbon Finance: The Financial Implications of Climate Change,” John Wiley & Sons, Chichester, 2007. Copyright © 2011 SciRes. LCE  Contribution of Finance to the Low Carbon Economy 70 [5] K. Tang, “A Guide to Carbon Finance: Carbonomics for A Credit Constrained World,” Risk Books, London, 2009. [6] D. MacKenzie, “Making Things the Same: Gases, Emis- sion Rights and the Politics of Carbon Markets,” Ac- counting, Organizations and Society, Vol. 34, No. 3-4, 2009, pp. 440-455. doi:10.1016/j.aos.2008.02.004 [7] P. Yeoh, “Is Carbon Finance the Answer to Climate Con- trol?” International Journal of Law and Management, Vol. 50, No. 4, 2008, pp. 189-206. doi:10.1108/17542430810890369 [8] R. Bayon, A. Hawn and K. Hamilton, “Voluntary Carbon Markets,” 2nd Edition, Earthscan, Oxford, 2009. [9] K. Hamilton, M. Sjardin, M. P. Stanley and T. Marcello, “Building Bridges: State of the Voluntary Carbon Markets 2010,” Bloomberg – New Energy Finance, New York, 2010. [10] K. E. Davis and S. Dadush, “Getting Climate-Related Conditionality Right,” In: R. B. Stewart, B. Kingsbury and B. Rudyk, Ed., Climate finance: Regulatory and Funding Strategies for Climate Change and Global De- velopment, New York University Press, New York, 2009, pp. 197-205. [11] G. Daskalakis, D. Psychoyios and R. N. Markellos, “Modeling CO2 Emission Allowance Prices and Deriva- tives: Evidence from the European Trading Scheme,” Journal of Banking & Finance, Vol. 33, No. 7, 2009, pp. 1230-1241. doi:10.1016/j.jbankfin.2009.01.001 [12] D. M. Johnston, S. E. Sefcik and N. S. Soderstrom, “The Value Relevance of Greenhouse Gas Emissions Allow- ances: An Exploratory Study in the Related United States SO2 Market,” European Accounting Review, Vol. 17, No. 4, 2008, pp. 747-764. doi:10.1080/09638180802481615 [13] S. C. Lee and L. H. Shih, “Renewable Energy Policy Evaluation Using Real Option Model – The Case of Tai- wan,” Energy Economics, Vol. 32, 2010, pp. S67-S68. doi:10.1016/j.eneco.2010.04.010 [14] M. McGready, “Accounting for Carbon,” Accountancy, Vol. 142, No. 1379, 2008, pp. 84-85. [15] J. Ratnatunga, “An Inconvenient Truth about Account- ing,” Journal of Applied Management Accounting Re- search, Vol. 5, No. 1, 2007, pp. 1-22. [16] J. Fornaro, K. Winkelman and D. Glodstein, “Accounting for Emissions,” Journal of Accountancy, Vol. 208, No. 1, 2009, p. 40. C opyright © 2011 SciRes. LCE

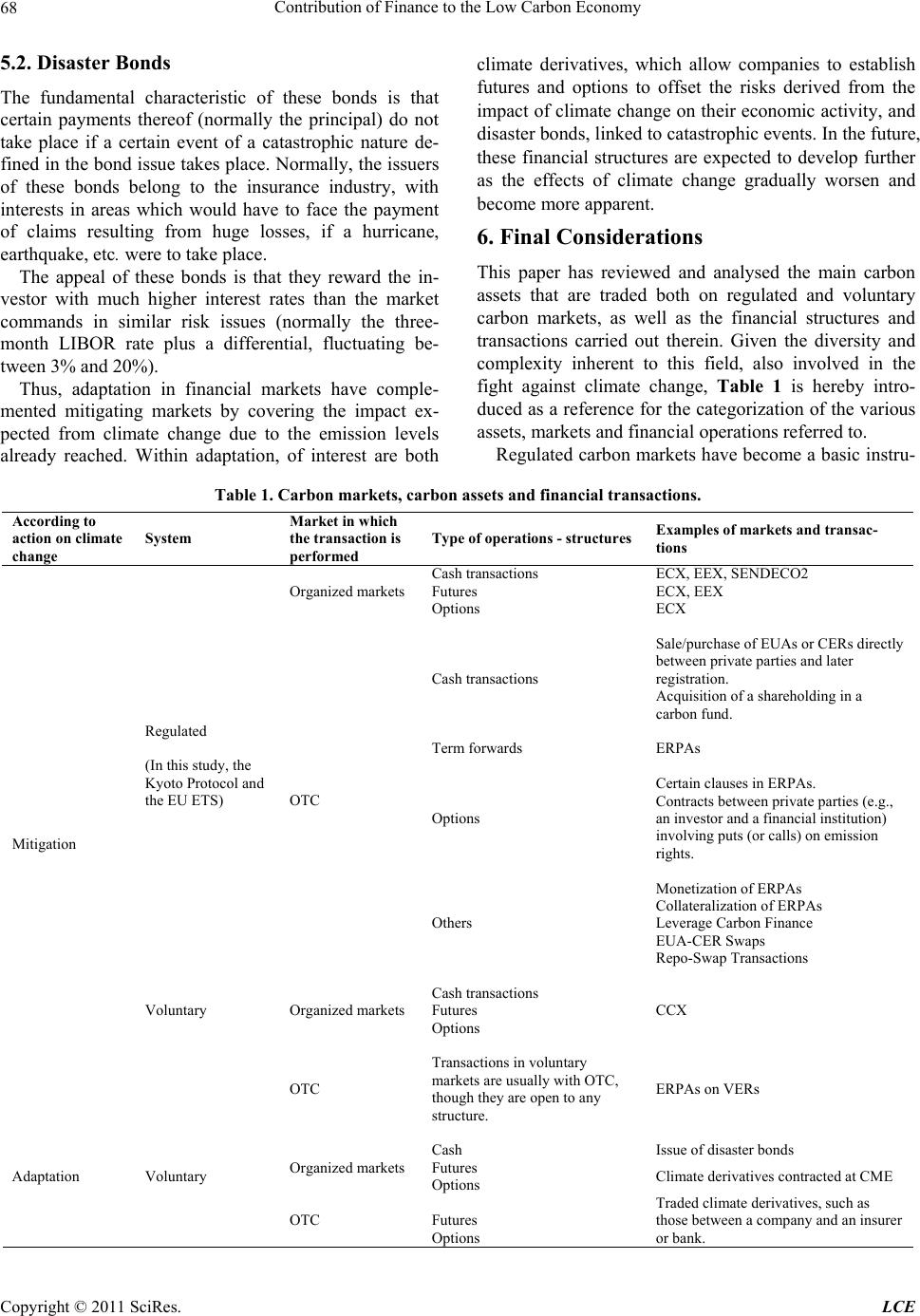

|