Journal of Service Science and Management, 2011, 4, 118-124 doi:10.4236/jssm.2011.42015 Published Online June 2011 (http://www.SciRP.org/journal/jssm) Copyright © 2011 SciRes. JSSM Comparative Study on the Impacts of Institutional and Individual Investor on Security Investment Risk Zunhuan Shen, Dong Cao School of Economics and Management, Xidian University, Xi’an, China. Email: zunsh03@126.com Received December 22nd, 2010; revised March 6th, 2011; accepted April 6th, 2011. ABSTRACT Institutional investor is supposed to be more powerful than individual investor from the perspectives of regularity au- thority and scholar, but the results are mixed. Using the data of listed company in China, the paper presents a com- parative study on the impacts of institu tional investor and individual investo r on investment risk. It shows that the scale and ownership of institu tional investor have negative impacts on investment risk significantly , but the scale and owner- ship of individual investor have positive impacts on investment risk, which implies institutional investor has the effects to reduce investment risk compar ing with individual investor. Therefore, developing institutional investor and reducing the scale of individual inventor is important for the stability of security market. Keywords: Corporate Governance, Institutional Investor, Individual Investor, Informati on Disclosure, Investment Risk 1. Introduction The separation of ownership and operation of corporation results in the conflict of its prin cipal and a gent, and th ere is lots of literature focusing on it [1]. However, with the development of institutional investor, the ownership of company both in USA and UK has the tendency of con- centration [2]. And therefore, the conflict between man- agers and shareholders is replaced by controlled share- holder and minority shareholders [3]. As the deputy and trustee of individual investor, insti- tutional investor has advantage of information. Scholars regard that institutional inv estor is full of experience, has the capacity of collecting information, analysis data, and has critical influence on investment company [4]. Based on the point, institutional investor has more information than individual investor [5]. However, in literature, the impacts of investor on investment risk are mixed. On one hand, scholar regards the information included in the price of stock could reduce the fluctuation of security return ratio, so the more share held by institutional in- vestor, the more information included in stock price [6], and which is called in stitution al soph isticatio n hypothesis [7]. On this point, it implies the ownership of institu- tional investor is positive related with the fluctu ation and investment risk. On the other hand, literature argues that institutional inv estor is prudent [8], and the ownership of institutional investors is negative related with the fluc- tuation of stock price and investment risk, which is called institutional preference hypothesis [7]. With the rapid development of institutional investor in China, it is im- portant to study the impacts of institutional investor on investment risk, not only for the decision of investors and security regularity commission, but also for the devel- opment of security market. The paper makes a comparative study on the impacts of institutional and ind ividual investor on investment risk based on the data of listed company in China during 2001-2008, and examines the institutional sophistication hypothesis and institutional preference hypothesis. There are three contributions of the paper in theory and practice. Firstly, it checks two hypothesis set up by west scholar using Chinese database. Secondly, it compares the im- pacts of institutional investor with that of individual in- vestor in China, which can help scholars to understand the influence of institution al investor further. The last but not the least, the paper also analysis the combined influ- ences of institutional investor on disclosure and invest- *Funds of Chinese Education Ministry (09XJA790008) and (72104888).  Comparative Study on the Impacts of Institutional and Individual Investor on Security Investment Risk Copyright © 2011 SciRes. JSSM 119 ment risk . 2. Literature Review and Hypothesis Information about the invested company is asymmetric between mangers and shareholders. Information asym- metry may influence the information included in stock price, and therefore has impacts on the pricing function and investment risk. Comparing with individual investor, institutional in- vestor has two advantages in the respect of information. On one hand, institutional investor has large scale and professional knowledge, and has more power than indi- vidual investor to collect information, analysis informa- tion and make money [9,10]. Moreover, institutional in- vestor may transfer the related information to other shareholders and stakeholders, which influence invest- ment further. On the other hand, on the base of high ratio of share held, institutional investor has motives to take part in corporate governance and improve the quality of information disclosure. References [11,12] show that Chinese institutional investor has played an important role to improve the corporate governance and foreign large institutional investor could improv e the information disclosure and enhance the mobility of security market. References [4,13] also regard that institutional investor could monitor the information disclosure behavior effec- tively based on their large capital and powerful capacity to deal with information. Limited literature concluded that institutional inves- tor could improve information disclosure in China. Ref- erence [14] shows that the share held by institutional investor is positive related with the quality of informa- tion disclosure, and scholar also indicts that the ratio of share held and the scale of invested company of institu- tional investor are positive related with the quality of information disclosure [15]. According to literature, it is reasonable to regard that institutional investor has more power than individual investor to improve information disclosure. As a consequence, we have the hypotheses as follows: Hypothesis H1: Comparing with individual investor, institutional investor has more power to enhance infor- mation disclosure, embodied as the ratio of share held and the scale of institutional investor are positive related with the quality of informatio n disclosure, but that of the individual investor are not related with the quality of information disclosure significantly. Monitoring cost will exist if inve stors monitor manag- ers of listed company. In this point, individual investors have not strong incentive to care the behavior of manag- ers. Contrary to this view, institutional investors have large share of listed company, face serious press of their principles and investment risk. Therefore, institutional investors have strong incentive to monitor managers in order to enhance information disclosure, improve the performance and reduce the investment risk. However, there are different points about the relation between the ownership of institutional investor and the fluctuation of stock price. First, scholars regard that institutional investor en- hance the fluctuation of stock price. Reference [16] has the opinion for the west section. In Ch ina, literature sho w that the fluctuation of share held by institution al investor has significantly effects on the fluctuation of Shanghai stock index, but that of the individual investor has not these impacts [17]. Reference [18] also has the view. Second, other literature regard that institutional investor can not induce the fluctuation of stock price. Empirical study shows that the existence of institutional investor at least can not result in the instability of security market [19], and scholar also finds evidence to support this point that institutional investor has not play the function to stabilize the security market [20]. Third, the existence of institutional investor can reduce the fluctuation of stock price. For instance, reference [21] finds that the higher the share held ratio of institutional investors, the more information included in stock price, which implies the share held ratio of institutional investor is negative re- lated with the fluctuation of stock price. Reference [10] indicates that institutional investor can transfer the in- formation related with the value of company to stake- holders, which has the function to reduce the value of information and investment risk. In China, some scholars find that the ownership of institutional investor is nega- tively related with the fluctuation of stock price [22]. Different from the three points above, the fourth view regards that the relationship between the ownership of institutional investor and the fluctuation of stock price is decided by the dividend policy, and there are evidence to support this consequence [7]. In general, the different points can be classified as two main views. The first view emphasizes the institutional preference hypothesis [7], which means the ownership of institutional investor is negative related with the fluctua- tion of stock price. The second view is the institutional transaction hypothesis [7], which means the ownership of institutional investor is positive related with the fluctua- tion of stock price or investment risk. Different from the west, the capital market in China is not maturity, and whether the two hypothesizes are correct needed to be test further. In addition, the more institutional investors invest a company, the stronger incentives of them to monitor the company’s managers, and therefore, the higher quality of the information disclosure, the lower fluctuation of stock price. According to these views, we  Comparative Study on the Impacts of Institutional and Individual Investor on Security Investment Risk Copyright © 2011 SciRes. JSSM 120 have the hypotheses as follows: Hypothesis H2: Comparing with individual investor, the ownership and the scale of institutional investor are negative with the fluctuation of stock price or investment risk, but that of the individual investor has not negative impacts on the fluctuation of stock price or investment risk significantly. 3. Methodology 3.1. Variables In order to test the hypotheses, three types of variables including explanatory variable, explained variable and controlling variable are introduced. In the hypothesis H1, the explained variable is DIS, the quality of information disclosure, and the data of it is co ming from the database of Shenzhen Stock Exchange, graded as high quality, medium quality, low quality and failed quality. Refer- ence [15] measures them as 1, 2, 3 and 4 respectively. However, this measure method is not in line with their meanings in general. In order to deal with the problem, we measure them as 95, 85, 70 and 30 respectively. In other words, we use their medium value to measure the different level of information disclosure quality. In the hypothesis H2, the explained variable is the fluctuation of stock BETA. According to Efficient Market Hypothe- sis, stock price not only includes public information, but also includes private information of investors, listed companies and government monitoring section. In this view, the fluctuation of stock price reflects the extent of information asymmetry between listed company and in- vestors. The greater the fluctuation of stock price, the higher the information asymmetry. Based on this point, we use the system risk - BETA to measure the fluctuation of stock price. In the hypothesizes H1 and H2, the explanatory vari- ables are the ownership of institutional investor IIS and the scale of institutional investor NII, which is the total share ratio held by institutional investors in the top 10 shareholders holding transactional share and the number of institutional investor repetitively. In order to compare its effects with individual investor, the explanatory vari- ables also include individual investor’s ownership PIS and its number NPI, wh ich is the total sh are ratio held b y individual investors in the top 10 shareholders holding transactional share and the number of individual inves- tors repetitively. In this paper, the institutional investor includes investment fund, investment bank, commercial bank and trust company. According to Principal and Agent Theory, corporate governance not only influences the quality of information disclosure and performance, but also has impacts on the investment return of investors. In order to research the impacts of institutional investor on investment risk on a certain corporate governance level, the controlling vari- able in the paper includes the scales of director in board, independent director, board of monitoring, the ratio of debt-asset and the concentration of ownership. All the variables are listed in Table 1. 3.2. Samples Although the history of capital market in China is not more than 30 years, it develops fast. According to the monthly statistics d ata on January 2011 of Ch inese Secu- rity Regulatory Commission, there are 2063 listed com- panies and 704 security investment funds at the end of 2010, which are available data source for scholars. The sample in this paper is listed company in Shenzhen Stock Exchange during 2001-2008, but not including financial and special treated company. Finally, the sample includes 337, 293, 294, 309, 272, 278, 299 and 276 companies at the year of 2001 to 2008 re spectively. All the data comes from CCER DATABASE. Table 1 shows the da ta of the samples. Table 2 shows the characteristics of listed company in China. For instance, the average quality of information disclosure is 80.85, indicting that the information disclo- sure is high, and the security regulation is efficient. The average value of the system risk is 1.098, which implies the average system risk is nearly equal to the stock ex- change market as a whole. From the point of ownership, in the top 10 large shareholders who held the transac- tional share, there are 3.33 institutional investors on av- erage, but the total share ratio of institutional investor is only 3.9% for each company. Meanwhile, the average ratio of share held by the top 5 large shareholder is 54.8% and that of the top 10 is 57.6%, which implies that the ratio of share held by the sixth to tenth large share- holders is 2.8%, lower than that of the institutional in- vestor. According to this view, institutional investor should play an important role in corporate governance. 4. Research Model and Discussion 4.1. Research Model The hypotheses are tested by three steps. Firstly, we study the impacts of the number and share ratio of both the institutional and individual investor on the quality of information disclosure to check the hypothesis H1. Sec- ondly, we analysis the impacts of the quality o f informa- tion disclosure on the investment risk. Finally, we re- search the impacts of the numbered share ratio of both the institutional and individual investor on investment risk to test the hypothesis H2. In literature, the level of corporate governance not only influences the extent of the interest of investors, but also influences the information disclosure and investment  Comparative Study on the Impacts of Institutional and Individual Investor on Security Investment Risk Copyright © 2011 SciRes. JSSM 121 Table 1. Variables and definition. Items Name of variables Sign Definition of Variable Quality of information disclosure DIS High, medium, low and failed is measured by 95, 85, 70 and 30 repetitively Fluctuation of stock price BETA System risk of stock The scale of institutional investor NII The number of institutional investors in the top ten shareholders with transactional share The ownership of institutional investor IIS The ownership of institutional investors in the top ten shareholders with transactional share The scale of individual investor NPI The number of individual investors in the top ten shareholders with transactional share The ownership of individual investor PIS The ownership of individual investors in the top ten shareholders with transactional share The scale of listed company SCA The LOG10 of total asset Debt-asset ratio RDA Total debt / equity of shareholder The scale of board of director SBD The number of director in board The scale of independent board SBID The number of independent director The scale of monitoring board SBM The number of monitoring director Ownership concentration CR5 The total share held by the top 5 largest shareholders Table 2. Descriptive analysis of the sample. Variable Minimum MaximumMean Std. Deviation DIS 30.000 95.000 80.850 10.609 BETA 0.010 4.095 1.098 0.295 NII 0.000 10.000 3.330 3.615 IIS 0.000 0.648 0.039 0.062 NPI 0.000 10.000 4.880 3.676 PIS 0.000 0.000 0.010 0.014 SCA 8.085 11.000 9.28 0.428 RDA –16.515 273.718 1.376 5.963 SBD 0.000 17.000 6.850 2.169 SBID 0.000 8.000 2.820 1.305 SBM 0.000 6.000 1.150 0.790 CR5 0.129 1.277 0.548 0.143 CR10 0.145 1.339 0.576 0.138 risk. Therefore, in our model, we use the scales such as the number of director in board, independent director, monitoring board and the ownership concentration index to reflect the level of corporate governance. Meanwhile, in order to make out the impacts of investor of a certain scale listed company, we also take the scale of company as a variable in the models. In addition, in literature, scholars take the ownership of investor, leverage, stock return annual and information disclosure into account [7]. Therefore, we also use them as variables in the models. Furthermore, in or der to make out the im pact s of i nvest ors on information disclosure and investment risk under the same condition, the models we used are similar with each other. Under this consideration, in the paper, we use Model (1) and (3) to study the impacts of institutional investor, use the model (2) to check the impacts of infor- mation disclosure on the investment risk, and use the (4) and (5) to study t he impacts of individ ual i nv e st or. 012 345 6789 510 DISaa NIIaIISaSCAaRDAaSBD aSBIDaSBMaCRaCR (1) 01 234 5678 510 BETAc cDIScSCAcRDAcSBD cSBIDcSBMcCRcCR (2) 012 345 6789 510 BETAbbNIIbIISbSCAbRDAbSBD bSBID bSBMbCRbCR (3) 012 34 567 8 9 5 10 DISddNPIdPISdSCAdRDA dSBD dSBID dSBMdCR dCR (4) 012 34 567 8 9 5 10 BETAee NPIePISeSCAeRDA eSBD eSBID eSBMeCR eCR (5) 4.2. Outputs and Discussion Using the SPSS 16.0 to deal with the data, we present the results in Table 3 to Table5. We use the Enter Method, so there is not collinearity in the model. In Ta ble 3, the model (1) shows that the scale o f insti- tutional investor has positive impacts on the quality of information disclosure at the level of 1%, which supports the hypothesis H1. Contrary to the result, the share ratio held by institutional inv estor has negative impacts on the quality of information disclosure at the level of 5%, which does not support the hypothesis H1. As for the reasons, in our opinion, both of the ratios of share held by institutional investor and that of the sixth to the tenth large shareholder are low, they have the inventiv e to col- laborate with each other to protect their interest. The higher the ratio of share held by institu tional investor, the more probability they collaborate with each other, and as a result, the more likelihood they harm the interest of other small shareholders to benefit themselves. Conse- quently, the share ratio of institutional investor has the impacts to reduce the quality of information disclosure. In fact, although institutional investor has the advantages of information, it is only used for their own interest. For example, in China, institutional investors disclosure th eir portfolio at the end of each season, which implies the information belongs to themselves and listed company. From the data of Standard Coefficient at the table, the effects of the scale of institutional investor is triangular that of the ownership of institutional investor, which means the number of institutional investor is more im- portant than that of their ownership on information dis-  Comparative Study on the Impacts of Institutional and Individual Investor on Security Investment Risk Copyright © 2011 SciRes. JSSM 122 Table3 . The impacts of different investors on information disclosure. Institutional investor (Model (1)) Individual investor (Model (4)) Unstandard Coefficient Standard CoefficientUnstandard Coefficient Standard Coefficient B Std. Error Beta B Std. Error Beta (Constant) 70.24*** (14.8) 4.739 74.86*** (15.53) 4.813 NII 0.616*** (7.23) 0.085 0.210 IIS –10.65* (–2.16) 4.935 –0.062 NPI –0.18** (–2.57) 0.071 –0.062 PIS –92.54*** (–4.99)18.558 –0.122 SCA 0.263 (0.527) 0.500 0.011 0.176 (0.35) 0.504 0.007 RDA 0.009 (0.254) 0.036 0.005 0.006 (0.16) 0.036 0.003 SBD 0.042 (0.42) 0.102 0.009 0.045 (0.45) 0.102 0.009 SBID 1.18*** (6.95) 0.170 0.145 1.133*** (6.5) 0.173 0.139 SBM 0.100 (0.37) 0.274 0.007 0.093 (0.34) 0.276 0.007 CR5 –1.768 (–0.23) 7.863 –0.024 –5.217 (–0.67) 7.834 –0.070 CR10 6.576 (0.81) 8.166 0.085 9.824 (1.2) 8.109 0.128 R = 0.25 Adjusted R2 = 0.059 F = 17.316*** R = 0.24 Adjusted R2 = 0.056 F = 16.484*** Table 4. The impacts of information disclosure on investment risk (Model(2)). Unstandard Coefficient Standard Coefficient B Std. Error B t Sig. (Constant) 1.456 0.141 10.333 0.000 DIS –0.001 0.001 –0.045 –2.142 0.032 SCA –0.009 0.014 –0.014 –0.663 0.507 RDA 0.001 0.001 0.014 0.681 0.496 SBD –0.006 0.003 –0.046 –2.191 0.029 SBID 0.004 0.005 0.018 0.830 0.406 SBM –0.002 0.008 –0.006 –0.309 0.758 CR5 0.246 0.220 0.119 1.120 0.263 CR10 –0.469 0.228 –0.219 –2.055 0.040 R = 0.136 Adjusted R Square = 0.015 F = 5.554 (Significantly at the level of 1%) Table 5. The impacts of different investors on investment risk. Institutional investor (Model (3)) Individual investor (Model (5)) Unstandard Coefficient StandardCoefficient Unstandard Coefficient Standard Coefficient B Std. Error Beta B Std. Error Beta (Constant) 1.377*** (10.24) 0.134 1.374*** (10.01) 0.137 NII –0.008*** (–3.25) 0.002 –0.096 IIS –0.019** (–0.135) 0.140 –0.004 NPI 0.006*** (2.82) 0.002 0.070 PIS 0.214 (0.41) 0.526 0.010 SCA –0.012** (–0.83) 0.014 –0.017 –0.016 (–1.1) 0.014 –0.023 RDA 0.001*** (0.69) 0.001 0.014 0.001 (0.73) 0.001 0.015 SBD –0.006*** (–1.94) 0.003 –0.041 –0.006** (–2.1) 0.003 –0.045 SBID 0.005*** (0.95) 0.005 0.020 0.003 (0.61) 0.005 0.013 SBM 0.000*** (0.34) 0.008 0.000 0.000 (–0.12) 0.008 –0.003 CR5 0.077 (0.34) 0.225 0.037 0.159 (0.71) 0.224 0.077 CR10 –0.278 (–1.19) 0.233 –0.130 –0.372 (–1.61) 0.232 –0.174 R = 0.16 Adjusted R2 = 0.022 F = 6.89*** R = 0.15 Adjusted R2 = 0.019 F = 5.97*** closure. In Table 3, the model (4) also shows that both the number and the share ratio held by individual investor have negative impacts on the quality of information dis- closure at the level of 3% and 1% significantly respec- tively, which suppo rt the hypo thesis H1. Comparing with the outputs of model (1) and (4), the ownership of institutional and individual investor has negative impacts on the quality of information disclo sure. Different with the impacts of the ownership, the scale of institutional investor and individual investor have differ- ent effects, which implies the number of institutional investor has more important role to improve the quality of information disclosure than that of the individual in- vestor. Table 4 shows that the quality of information disclo- sure has negative impacts on investment risk at the level of 5% significantly, in line with the literature [23-25]. In other words, high quality information disclosure could reduce the conflict of company and external investors, agency cost and investment risk. From the output of Model (3), it shows that the num-  Comparative Study on the Impacts of Institutional and Individual Investor on Security Investment Risk Copyright © 2011 SciRes. JSSM 123 ber of institutional investor has negative impacts on in- vestment risk at the level of 1% significantly, and the ownership of them has negative impacts on investment risk at the level of 3% significantly, and both of them support the hypothesis H2. From the model (5) in Table 5, it shows the ownership of individual investor has posi- tive impacts on investment risk, which also supports the hypothesis H2. Combining the outputs of Table 3, Table 4 and Table 5, it shows that the number of institutional investor has positive impacts on the quality of information disclo sure, which has negative impacts on the investment risk fur- ther significantly. As a result, in the Tab le 5, the number of institutional investor has negative impacts on invest- ment risk, supporting the institutional preference hy- pothesis [7]. Different from the effects of institutional investor, both the number and ownership of individual investor has negative impacts on the quality of informa- tion disclosure, and the quality of information disclosure has negative impacts on investment risk. As a conse- quence, the number of individual investor has positive impacts on investment risk, which is in line with the output on model (5). The fact that the outputs in Table 3 and Tab le 4 are in harmony with the outputs in Table 5 shows that the large number of institutional investor has the impacts to reduce the investment risk, but the large number of individual investors has the effects to reduce the extent of monitor- ing and information disclosure, and finally increase the extent of investment risk. Hence, increasing the scale of institutiona l investor and reducing the scale of ind ividual inventor is important to minimize the investment risk and stabilize the security market in China. 5. Conclusions In order to steady the stock market and reduce the in- vestment risk, institutional investor is becoming more and more important around the world, especially in China. Although there is lots of literature concerning on the impacts of institutional investor, the results are mixed. It is important to make an empirical study on the influ- ence of institutional investor on the quality of informa- tion disclosure and investment risk. With the data of listed company in China, the paper shows that both of the number and ownership of institu- tional investor has negative impacts on investment risk, which support the institutional preference hypothesis [7 ]. From the point of the number of institutional investor, it has positive impacts on the quality of information dis- closure and negative impacts on investment risk, which implies institutional investor has the function to stabilize the stock market. Contrary to this view, both of the number and ownership of individual investor has nega- tive impacts on the quality of information disclosu re sig- nificantly, which implies that the individual investor has the effect to enhance the investment risk. Therefore, en- hancing the institutional investor and reducing the scale and ownership of individual investor may improve the information disclosure and reduce the investment risk in China. 6. Acknowledgements The paper is sponsored by Social Science and Humanity Program of Chinese Education Ministry (09XJA790008) and supported by the Fundamental Research Funds for the Central Universities (72104888). The author thanks them sincerely. At the same time, the author also thanks our colleagues at the School of Economics and Manage- ment, Xidian University, for their constructive sugges- tions. REFERENCES [1] E. F. Fama and M. C. Jensen, “Agency Problems and Residual Claims,” Journal of Law and Economics, Vol. 59, 1983, pp. 537-600. [2] R. L. Porta, F. Lopez-de -Silanes and A. Shleifer, “Corpo- rate Ownership around the World,” Journal of Finance, Vol. 54, No. 2, 1999, pp. 471-517. doi:10.1111/0022-1082.00115 [3] R. L. Porta, F. Lopez de Silanes and R. W. Vishny, “Le- gal Determinants of External Finance,” Journal of Fi- nance, Vol. 52, No. 3, 1997, pp. 1131-1150. doi:10.2307/2329518 [4] J. B. Kim, I. Krinsky and J. Lee, “Institutional Holdings and Trading Volume Reactions to Quarterly Earnings Announcements,” Journal of Accounting, Auditing and Finance, Vol. 12, 1997, pp. 1-14. [5] J. Lin, Y. Lee and Y. Liu, “IPO Auctions and Private Information,” Journal of Banking and Finance, Vol. 31, No. 5, 2007, pp. 1483-1500. doi:10.1016/j.jbankfin.2006.09.004 [6] K. D. West, “Dividend Innovations and Stock Price Vola- tility,” Economics, Vol. 56, No. 1, 1988, pp. 37-61. [7] A. Rubin and D. R. Smith, “Institutional Ownership, Volatility and Dividends,” Journal of Banking & Finance, Vol. 33, No. 4, 2009, pp. 627-639. doi:10.1016/j.jbankfin.2008.11.008 [8] D. D. Guercio, “The Distorting Effect of the Prudent-man Laws on Institutional Equity Investments,” Journal of Financial Economics, Vol. 40, No. 1, 1996, pp. 31-62. doi:10.1016/0304-405X(95)00841-2 [9] A. Chen and B. Hong, “Institutional Ownership Changes and Returns around Analysis’ Earnings Forecast Release Events: Evidence from Taiwan,” Journal of Banking and Finance, Vol. 30, No. 9, 2006, pp. 2471-2488. doi:10.1016/j.jbankfin.2005.07.016 [10] S. Chakravarty, “Stealth Trading: Which Traders’ trades Move Stock Prices?” Journal of Financial Economics, Vol. 61, No. 2, 2001, pp. 289-307.  Comparative Study on the Impacts of Institutional and Individual Investor on Security Investment Risk Copyright © 2011 SciRes. JSSM 124 doi:10.1016/S0304-405X(01)00063-0 [11] W. A. Li and B. Li, “An Empirical Study on the Impacts of Institutional Investor on Corporate Governance— Based on the CCGI,” Nankai Management Review, Vol. 1, 2008, pp. 4-14. (In Chinese) [12] R. Stulz, “Globalization of Equity Markets and the Cost of Capital,” Journal of Applied Corporate Finance, Vol. 12, No. 3, 1999, pp. 8-25. doi:10.1111/j.1745-6622.1999.tb00027.x [13] J. R. M. Hand, “A Test of the Extended Functional Fixa- tion Hypothesis,” Accounting Review, Vol. 65, No. 4, 1990, pp. 740-763. [14] X. C. Jiang, “Corporate Governance and the Ownership of Institutional Investor,” in Chinese, Nankai Manage- ment Review, 2004, pp. 17-25. [15] F. F. Ding and F. Li, “The Ownership of Institutional Investor and Information Disclosure—Evidence Coming from Listed Company at Shenzhen Exchange,” in Chinese, Soft Science, Vol. 23, 2009, pp. 18-23. [16] E. Maug and N. Naik, “Herding and Delegated Portfolio Management: The Impact of Relative Performance Evaluation on Asset Allocation,” IFA Working Paper, 1996. [17] Y. D. Yue and K. F. Zhou, “The Impacts of Institutional Investor on the Fluctuation of Stock Price—Based on the Topview,” in Chinese, China Industry Economics, 2009, pp. 140-148. [18] S. L. Li, “The Style and Investment Behavior of Institu- tional Investor and the Fluctuation of Stock Market,” in Chinese, Securities Market Herald, No. 5, 2007, pp. 63-67. [19] J. Lakonishok, A. Shleifer and R. Vishny, “The Impact of Institutional Trading on Stock Price,” Journal of Finan- cial Economics, Vol. 32, No. 1, 1992, pp. 24-43. doi:10.1016/0304-405X(92)90023-Q [20] J. L. Yang, “The Development of Institutional Investor and the Completion of Chinese Stock Market,” in Chinese, Research on Economics Problems, 2004, pp. 4-8. [21] S. Rajgopal, “Early Evidence on the Informativeness of the SEC’s Market Risk Disclosures: The Case of Com- modity,” Accounting Review, Vol. 74, No. 3, 1999, pp. 251-271. doi:10.2308/accr.1999.74.3.251 [22] B. Qi, M. Huang and S. Z. Cheng, “Institutional Investor and the Fluctuation of Stock Market,” in Chinese, Fi- nance Research, 2006, pp. 54-64. [23] C. A. Botosan, “Disclosure Level and the Cost of Equity Capital,” Accounting Review, Vol. 72, No. 3, 1997, pp. 323-341. [24] C. A. Botosan and A. Plumleem, “A Re-examination of Disclosure Level and the Expected Cost of Equity Capi- tal,” Journal of Accounting Research, Vol. 40, No. 1, 2002, pp. 21-40. [25] W. Wang and G. F. Jiang, “Information Disclosure, Transparency and Capital Cost,” in Chinese, Economics Research, 2004, pp. 107-114.

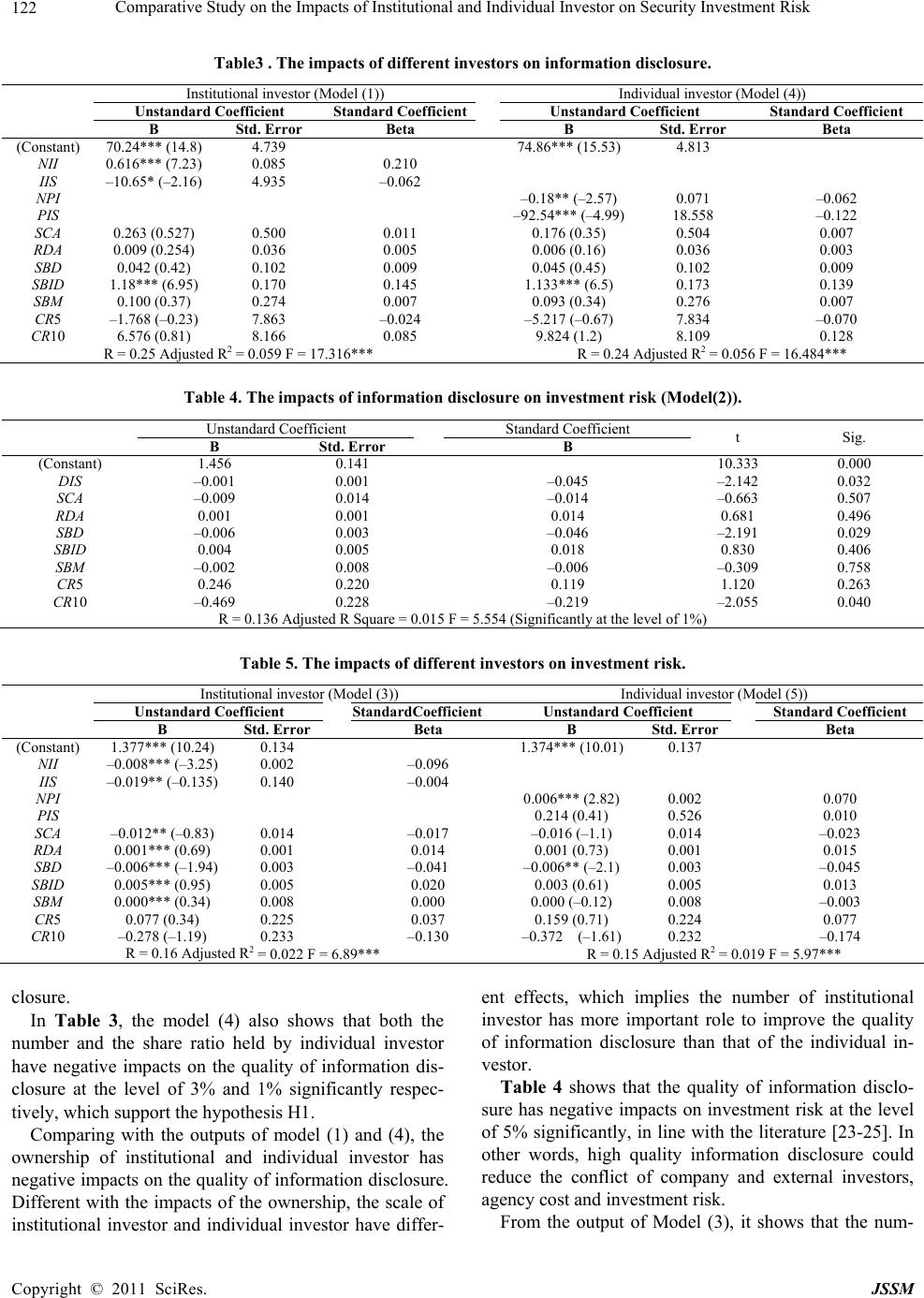

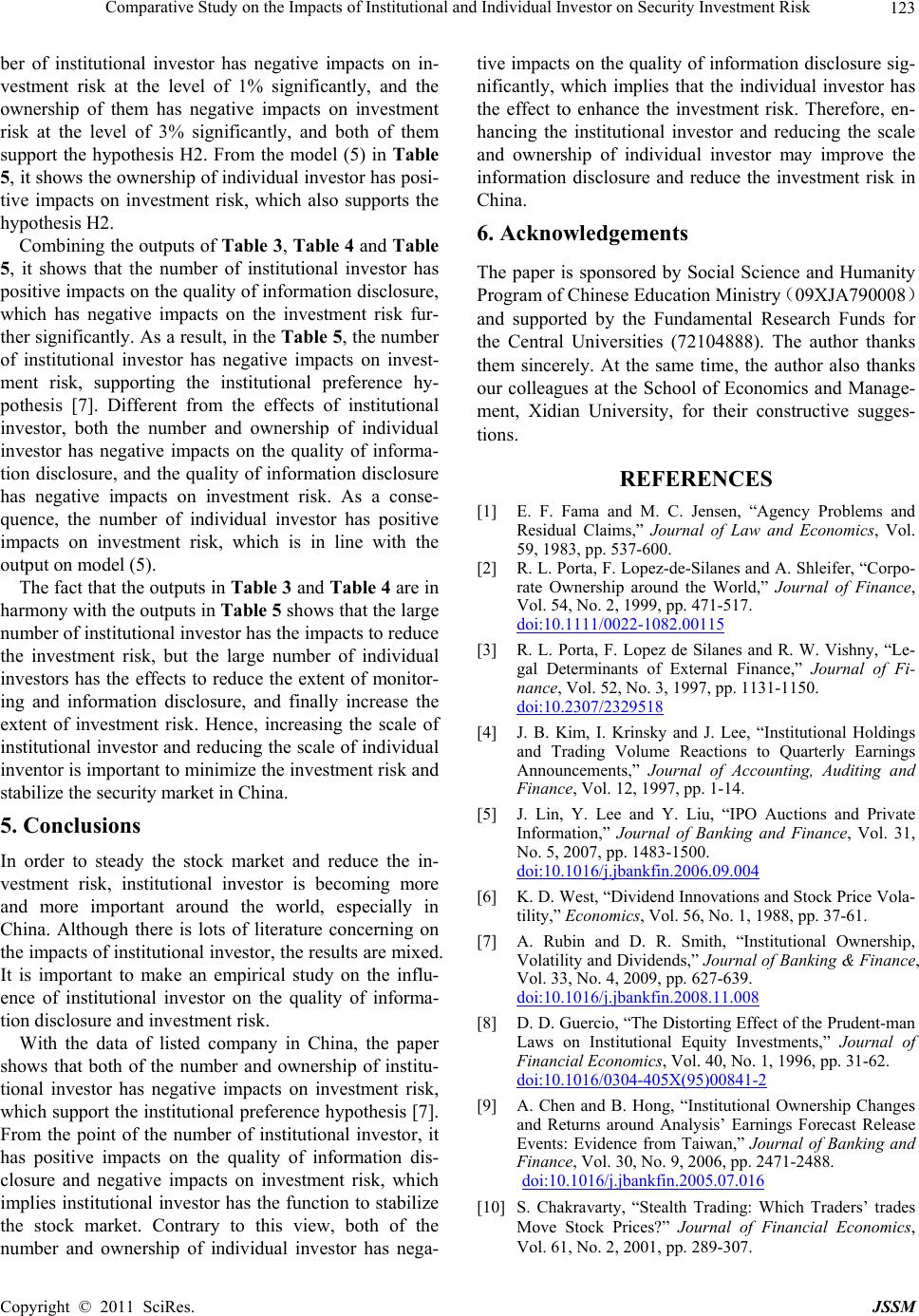

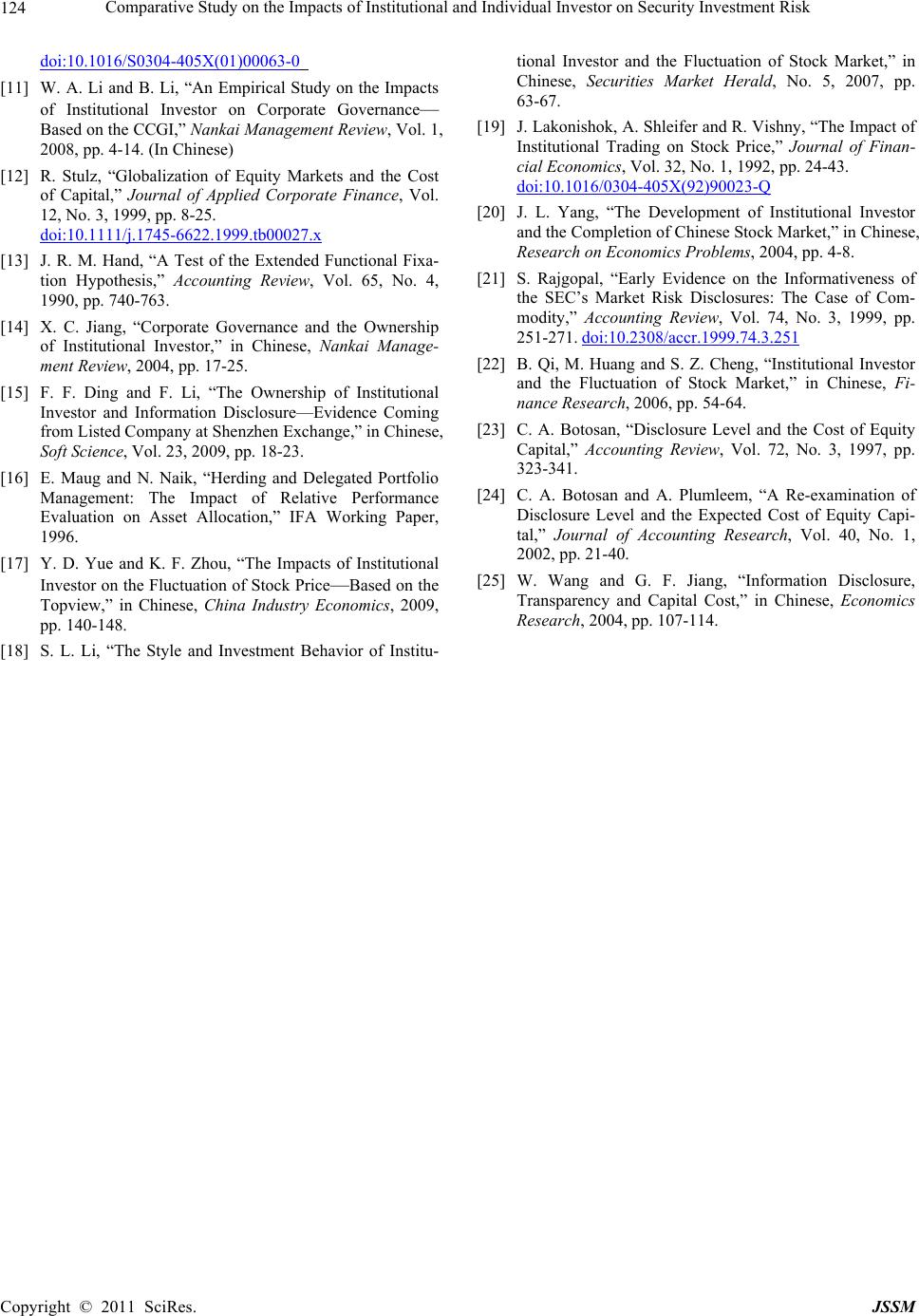

|