Paper Menu >>

Journal Menu >>

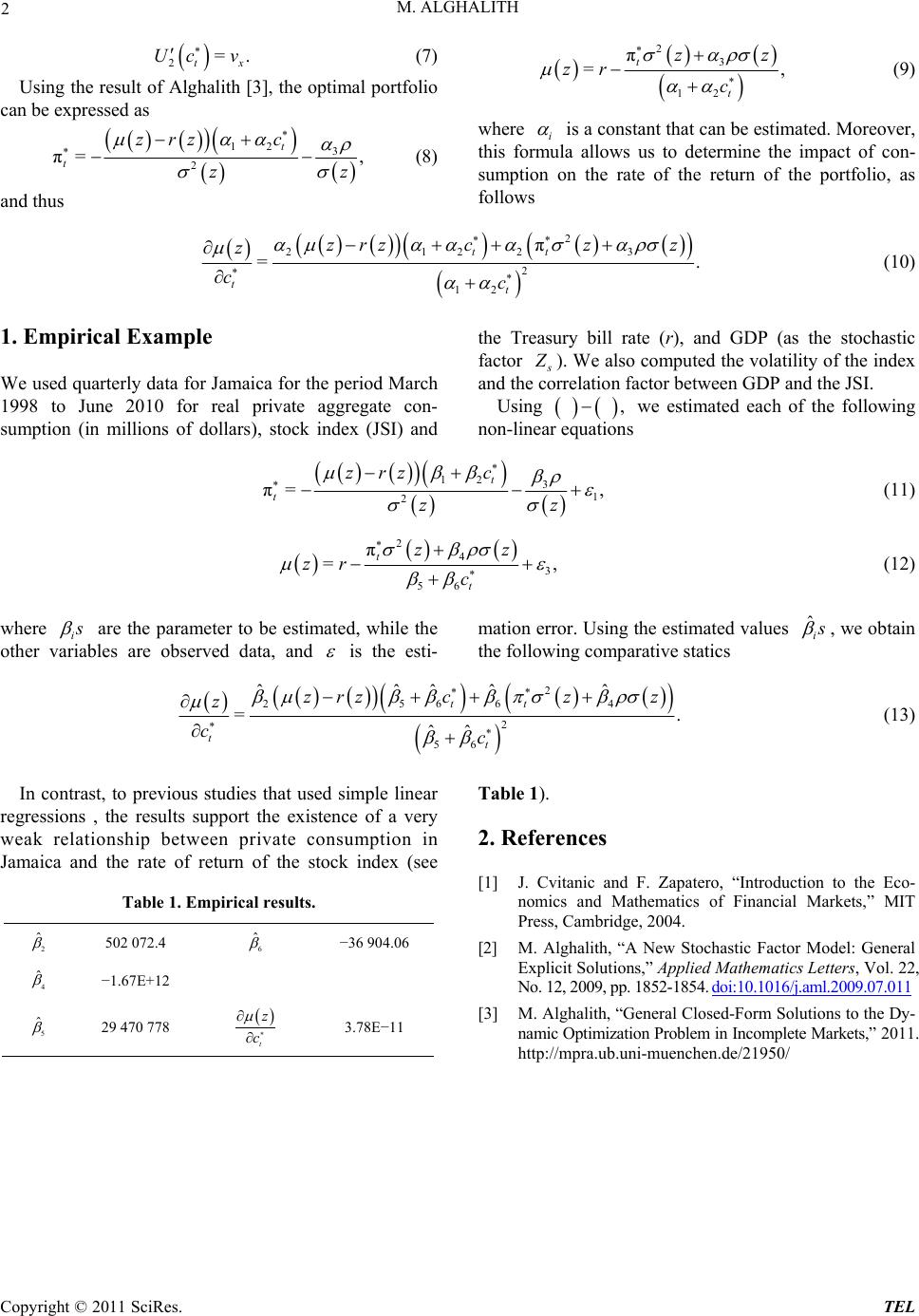

Theoretical Economics Letters, 2011, 1, 1-2 doi:10.4236/tel.2011.11001 Published Online May 2011 (http://www.SciRP.org/journal/tel) Copyright © 2011 SciRes. TEL A New Method of Estimating the Asset Rate of Return Moawia Alghalith, Tracy Polius Economics, University of the West Indies, St Augustine, USA E-mail: malghalith@gmail.com, tracy.polius@sta.uwi.edu Received April 19, 2011; revised April 21, 2011; accepted April 25, 2011 Abstract We present a new consumption-based method of estimating the asset rate of return. Keywords: Return, Investment, Portfolio, Asset, Stochastic, Consumption CAPM In this note, we present a new model that links the stock/portfolio rate of return to consumption. Our app- roach is more general than the existing models such as the consumption-CAPM models, that are based on very restrictive assumptions [1]. In so doing, we utilize a more advanced and appropriate theoretical and empirical framework than the ones used by previous literature. It is worth noting that previous literature mainly used simple linear regressions without a rigorous theoretical basis. We use a stochastic factor model, which includes a risky asset (portfolio, a risk-free asset and a stochastic external economic factor [2,3]. Thus, we have a two- dimensional standard Brownian motion 12 ,, sss tsT WW on the probability space ,, sP, where stsT is the augmentation of filtration. The risk-free asset price process is d 0=e , T rZs s t S where 2 sb rZC R, is the rate of return and s Z is the sto- chastic economic factor. The dynamics of the risky asset price is given by 1 d=dd , stss s SS ZtZW (1) where t Z and t Z are the rate of return and the volatility, respectively. The stochastic economic factor process is defined as 2 12 d=dd1d ,=, ss sst Z aztWW Zz (2) where <1 is the correlation factor between the two Brownian motions, is a parameter, and 1 s aZC R has a bounded derivative. The wealth process is given by π,, 1 =πd πd, T cc Tssssss t T ss s t X xrYXYrY cs YW (3) where x is the initial wealth, π, ts tsT is the portfolio process and , ts tsT c is the consumption process, with 2 πd< T s t s , d< T s t cs and 0c. The trading strategy π,, ss cAxy is admissible. The investor’s objective is to maximize the expected utility of terminal wealth and consumption π, 12 π, ,, =Supd, T c Tst ct tt vtxyEU XUcs (4) where .v is the (smooth) value function, .U, bounded and strictly concave utility function. The value function satisfies the Hamiltonian-Jacobi- Bellman PDE 22 π, 2 1 2 1 Sup ππ 2 0, txyyy txxt tx c t txyt vryxvazv v zvzrzcv zv uc ,, =,vTxzU x (5) Hence, the optimal solutions are 2 π=, xxy t x x xx zrzv v zv zv (6)  M. ALGHALITH Copyright © 2011 SciRes. TEL 2 2=. tx Uc v (7) Using the result of Alghalith [3], the optimal portfolio can be expressed as 12 3 2 π=, t t zrz c z z (8) and thus 2 3 12 π =, t t zz zr c (9) where i is a constant that can be estimated. Moreover, this formula allows us to determine the impact of con- sumption on the rate of the return of the portfolio, as follows 2 21223 2 12 π =. tt tt zrz czz z cc (10) 1. Empirical Example We used quarterly data for Jamaica for the period March 1998 to June 2010 for real private aggregate con- sumption (in millions of dollars), stock index (JSI) and the Treasury bill rate (r), and GDP (as the stochastic factor s Z ). We also computed the volatility of the index and the correlation factor between GDP and the JSI. Using , we estimated each of the following non-linear equations 12 3 1 2 π=, t t zrz c z z (11) 2 4 3 56 π =, t t zz zr c (12) where i s are the parameter to be estimated, while the other variables are observed data, and is the esti- mation error. Using the estimated values ˆi s , we obtain the following comparative statics 2 25664 2 56 ˆˆˆˆˆ =. ˆˆ tt tt zrz cz z z cc (13) In contrast, to previous studies that used simple linear regressions , the results support the existence of a very weak relationship between private consumption in Jamaica and the rate of return of the stock index (see Table 1. Empirical results. 2 ˆ 502 072.4 6 ˆ −36 904.06 4 ˆ −1.67E+12 5 ˆ 29 470 778 t z c 3.78E−11 Table 1). 2. References [1] J. Cvitanic and F. Zapatero, “Introduction to the Eco- nomics and Mathematics of Financial Markets,” MIT Press, Cambridge, 2004. [2] M. Alghalith, “A New Stochastic Factor Model: General Explicit Solutions,” Applied Mathematics Letters, Vol. 22, No. 12, 2009, pp. 1852-1854. doi:10.1016/j. aml.2009 .07.011 [3] M. Alghalith, “General Closed-Form Solutions to the Dy- namic Optimization Problem in Incomplete Markets,” 2011. http://mpra.ub.uni-muenchen.de/21950/ |