Natural Science

Vol.6 No.13(2014), Article ID:49060,12 pages DOI:10.4236/ns.2014.613101

A Tree Formulation for Signaling Games with Noise

Xeni Dassiou, Dionysius Glycopantis

Department of Economics, City University London, London, UK

Email: x.dassiou@city.ac.uk

Copyright © 2014 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 26 June 2014; revised 29 July 2014; accepted 11 August 2014

ABSTRACT

The paper provides an analysis of a sender-receiver sequential signaling game. The private information of the sender is transmitted with noise by a Machine, i.e. does not always correctly reflect the state of nature. Hence, a truthful revelation by the sender of his information does not necessarily imply that the signal he sends is correct. Also, the receiver can take a correct action even if the sender transmits an incorrect signal. The payoffs of the two players depend on their combined actions. Perfect Bayesian Equilibria which can result from different degrees of noise is analysed. The Bayesian updating of probabilities is explained. The fixed point theorem which makes the connection with the idea of rational expectations in economics is calculated. Given a number of equilibria, we comment on the most credible one on the basis of the implied payoffs for both players. The equilibrium signals are an example of the formation of a language convention discussed by D. Lewis.

Keywords:Signals and Non-Cooperative Signaling Games, Noise, States of Nature, A Machine, Imperfect Information Sets, Actions, Language Convention, Nash Equilibrium, Beliefs Updating, Perfect Bayesian Equilibrium, Fixed Point, Self-Fulfilling Prophesies, Rational Expectations Equilibrium

1. Introduction

In this paper we use the Lewis [1] formulation of signaling and base our model on our earlier paper (Dassiou and Glycopantis [2] ), where we analysed a signaling game using a decision tree formation. The earlier paper presents a number of Bayesian equilibria and explains which one is likely to prevail using as a criterion the expected payoffs that they entail for the two players. A distinction between a true signal by a sender and a correct action by a receiver is established in terms of leading to different payoffs. A correct action by the receiver of a signal alone is not sufficient for leading to an equilibrium that involves maximum payoffs for both players. Moreover there are equilibria that do not involve maximum payoffs for either player.

Signaling games lead to the formation of language through combinations of signals

and actions. In this paper we use the same signaling game as in [2] . The helper, (H), referred to also as he, stands behind

a truck gesturing to the driver, (D), referred to also as she, to help her steer

the truck into a narrow parking space. We assume that Nature consists of the particular

position of the truck and of the parking space and that there are two such alternatives,

each with probability . Unlike the earlier paper,

the sender is no longer fully aware of the state of nature, but rather receives

a message with a noise regarding this. While both players are aware of the probabilities

attached to the choices of nature,

. Unlike the earlier paper,

the sender is no longer fully aware of the state of nature, but rather receives

a message with a noise regarding this. While both players are aware of the probabilities

attached to the choices of nature,

alone has private information (in the form

of this message) and he signals to

alone has private information (in the form

of this message) and he signals to

to direct her how to park her car.

to direct her how to park her car.

Lewis describes the signaling behaviour and the action that follows as a “conventional

regularity” of unwritten rules of parking gestures, based on experience to which

all parties conform. In terms of highest payoffs there is a common interest objective

of

and

and

to get the truck into the space. In this situation they both receive their optimal

payoffs.

to get the truck into the space. In this situation they both receive their optimal

payoffs.

This is not always the case. A deviation from this rule, perhaps based on lack of

trust, could lead to one or both of the two players getting inferior payoffs. In

[2] there is a distinction between

true or untrue signals sent by

and correct or incorrect actions by the driver. The issue is to investigate whether

a “correct” interpretation of the signals is possible, i.e. one which would lead

to an optimal payoffs equilibrium position. In such a situation no one would wish

to independently change his action if all the information was revealed and moreover

the payoffs would be optimal.

and correct or incorrect actions by the driver. The issue is to investigate whether

a “correct” interpretation of the signals is possible, i.e. one which would lead

to an optimal payoffs equilibrium position. In such a situation no one would wish

to independently change his action if all the information was revealed and moreover

the payoffs would be optimal.

In general, we can imagine that there are

alternative states of nature,

alternative states of nature,

, observed by the sender,

, observed by the sender,

, who will send a signal concerning the private

information (messages) he has received regarding the state of nature. The messages

received by

, who will send a signal concerning the private

information (messages) he has received regarding the state of nature. The messages

received by

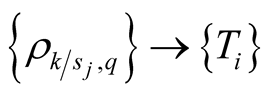

are not precise, but correct with a probability

are not precise, but correct with a probability

The sender compiles a set of alternative signals

The sender compiles a set of alternative signals

using a function

using a function

This is an encoding rule according to Blume [3]

. The function

This is an encoding rule according to Blume [3]

. The function

translates (truthfully or not) the messages regarding the states of nature into

translates (truthfully or not) the messages regarding the states of nature into

communicated signals.

communicated signals.

The receiver,

, then has to choose a response without knowing

the state of nature. However he is aware of the prior probabilities of these states

and the accuracy of the sender’s private information. In the sequential game,

, then has to choose a response without knowing

the state of nature. However he is aware of the prior probabilities of these states

and the accuracy of the sender’s private information. In the sequential game,

translates these signals (decodes according

to [3] ). He chooses a best response

translates these signals (decodes according

to [3] ). He chooses a best response , from alternative

actions

, from alternative

actions , to the signals.

He applies Bayes’ rule to form a posterior assessment that the signal comes from

each state of nature by setting a decoding function

, to the signals.

He applies Bayes’ rule to form a posterior assessment that the signal comes from

each state of nature by setting a decoding function :

: . Rubinstein

[4] , notes the difficulty of formulating communication

models into game theory models. Solutions in the latter are invariant to a change

in the names of the actions that lead to these outcomes, i.e. alternative conventions

leading to the same outcome.

. Rubinstein

[4] , notes the difficulty of formulating communication

models into game theory models. Solutions in the latter are invariant to a change

in the names of the actions that lead to these outcomes, i.e. alternative conventions

leading to the same outcome.

A characteristic of the sender-signal-receiver-action sequential game paradigm is

a plethora of equilibria. This raises the question of how to choose among such equilibria.

Cho and Kreps [5] propose to eliminate some of

these equilibria by branding them as “unintuitive”. They restrict the out-of-equilbrium

beliefs of the second party,

, i.e. interpretations that

, i.e. interpretations that

would have given to the signal that

would have given to the signal that

might have sent, but in equilibrium does not. Such beliefs might upset the given

equilibrium. Cho and Kreps posit an intuitive explanation according to which the

equilibrium introduces a self-reinforcing behaviour that is common knowledge among

the players. By giving an emphasis to the equilibrium (outcome) payoffs any deviation

from it is perceived as a conscious defection from the outcome. Therefore it needs

to be justified on the basis of how it compares to that outcome. This emphasis carries

on to our article in terms of choosing the most probable equilibrium outcome.

might have sent, but in equilibrium does not. Such beliefs might upset the given

equilibrium. Cho and Kreps posit an intuitive explanation according to which the

equilibrium introduces a self-reinforcing behaviour that is common knowledge among

the players. By giving an emphasis to the equilibrium (outcome) payoffs any deviation

from it is perceived as a conscious defection from the outcome. Therefore it needs

to be justified on the basis of how it compares to that outcome. This emphasis carries

on to our article in terms of choosing the most probable equilibrium outcome.

We assume that for each state of nature there is one action that has to be selected.

To the best of our knowledge, the prevailing assumption in the literature is that

if

takes the “correct” action then maximum payoffs will be received by both

takes the “correct” action then maximum payoffs will be received by both

and

and

irrespective of whatever signal

irrespective of whatever signal

has sent. See, for example, [1] , Pawlowitsch

[6] , Huttegger [7]

. This is a game of common interest in which a resolution leads to optimal payoffs

for both actors as noted by Skyrms [8] .

has sent. See, for example, [1] , Pawlowitsch

[6] , Huttegger [7]

. This is a game of common interest in which a resolution leads to optimal payoffs

for both actors as noted by Skyrms [8] .

This type of analysis is not complete on two counts. First, there is little discussion of the case where the action of the receiver may be appropriate (e.g. “correct”) to the state of nature even if the signal sent is not. Second, there is no discussion of what happens to the payoffs of the two agents when this is the case. Lewis, and most recently philosophers like Stokke [9] make an attempt to discuss what constitutes “true” and “untrue” signals by a sender and responses in a signaling system. However there is no discussion of “truthfulness” in relation to “correctness”.

Paper [2] departed from the assumption

of a correct decision by the receiver leading to an optimal payoff for both. It

distinguished between true signals (by ) and correct actions

(by

) and correct actions

(by ). Unlike [1]

and the majority of the subsequent literature, we noted that a correct action is

not always the result of a truthful signal.

). Unlike [1]

and the majority of the subsequent literature, we noted that a correct action is

not always the result of a truthful signal.

may still correctly guess the state of nature

although

may still correctly guess the state of nature

although

sends a “wrong” signal. A correct guess by

sends a “wrong” signal. A correct guess by

means that she will receive the maximum payoff.

means that she will receive the maximum payoff.

will not if she has not truthfully revealed

a signal that matches the true state of nature. Unlike [1] , in our model a true signal is mutually rewarding if it

leads to a correct decision by

will not if she has not truthfully revealed

a signal that matches the true state of nature. Unlike [1] , in our model a true signal is mutually rewarding if it

leads to a correct decision by

but a correctly guessed state of nature by

but a correctly guessed state of nature by

is not necessarily so. We bind truthfulness (in the report of a signal) to a maximum

payoff if accompanied by correctness, but the latter (in terms of the actions of

is not necessarily so. We bind truthfulness (in the report of a signal) to a maximum

payoff if accompanied by correctness, but the latter (in terms of the actions of ) is not solely the result of a truthful signal.

) is not solely the result of a truthful signal.

may still correctly guess the state of nature

although

may still correctly guess the state of nature

although

sends a “wrong” signal i.e. one that deviates from what he has seen. In this case

sends a “wrong” signal i.e. one that deviates from what he has seen. In this case

receives the reward alone but

receives the reward alone but

does not. If

does not. If

ends up doing the incorrect thing then both get zero payoffs.

ends up doing the incorrect thing then both get zero payoffs.

In our current paper of a signaling model with noise,

receives a message that does not necessarily

match with the actual true state of nature. Therefore, there is a de-coupling of

the truthful revelation of the received information in the form of a signal dispatched

by

receives a message that does not necessarily

match with the actual true state of nature. Therefore, there is a de-coupling of

the truthful revelation of the received information in the form of a signal dispatched

by

and whether this signal correctly reflects the state of nature. In other words,

the delivery by

and whether this signal correctly reflects the state of nature. In other words,

the delivery by

to

to

of a signal that does not match the true state of nature does not necessarily imply

that the sender has been untruthful in revealing his signal. However, a signal that

no longer reflects the true state of nature will imply a zero payoff for

of a signal that does not match the true state of nature does not necessarily imply

that the sender has been untruthful in revealing his signal. However, a signal that

no longer reflects the true state of nature will imply a zero payoff for . This is irrespective

of whether or not it truthfully reflects the private information held by

. This is irrespective

of whether or not it truthfully reflects the private information held by

and irrespective of whether

and irrespective of whether ’s actions are correct

or not.

’s actions are correct

or not.

2. On a Simple Signaling Model with Noise

We introduce the game theoretic analysis by considering a helper/driver example,

as in our previous paper [2] . As in the previous

model, there are two players, a helper , (he), who tries to direct

a driver

, (he), who tries to direct

a driver , (she), to park her car.

“Nature” selects with probability

, (she), to park her car.

“Nature” selects with probability

the state to be either “left” (L) or “right” (R). It is now assumed that player

the state to be either “left” (L) or “right” (R). It is now assumed that player

picks up the correct state of nature with a noise indicated by probability

picks up the correct state of nature with a noise indicated by probability

We have again an imperfect information, non-cooperative signaling game, but this

time it is rather more complicated, as the private information of

We have again an imperfect information, non-cooperative signaling game, but this

time it is rather more complicated, as the private information of

regarding the state of nature in not precise. We are using again a game theoretic

extensive form, dynamic decision tree formulation and the notation for pure and

mixed strategies is obvious and that of the previous paper. The vectors of payoffs

are given at the terminal nodes of the tree. The first element is the payoff of

regarding the state of nature in not precise. We are using again a game theoretic

extensive form, dynamic decision tree formulation and the notation for pure and

mixed strategies is obvious and that of the previous paper. The vectors of payoffs

are given at the terminal nodes of the tree. The first element is the payoff of

and the second that of

and the second that of .

.

The rules for calculated payoffs are as follows. When

ends up sending the “correct” signal and the correct action, i.e. the one corresponding

to the actual state of the world, follows by

ends up sending the “correct” signal and the correct action, i.e. the one corresponding

to the actual state of the world, follows by , then both players receive

a payoff of 1. If

, then both players receive

a payoff of 1. If

communicates an incorrect signal and this leads to an incorrect action by

communicates an incorrect signal and this leads to an incorrect action by , then both players get

0. If

, then both players get

0. If

sends an incorrect signal and

sends an incorrect signal and

reacts choosing to play in the opposite direction then

reacts choosing to play in the opposite direction then

gets 1 for performing the correct action but

gets 1 for performing the correct action but

ends up with zero.

ends up with zero.

In [2] we made the connection between the resolution of the signaling game without any noise and the ideas of rational expectations (self-fulfilling prophesies) from economic theory, which provide a formal interpretation of the results of our analysis. The expectations of the actors are self-fulfilling and they both receive their optimal payoffs. This connection between the concepts from the neighbouring disciplines of game theory and economics can also be established in the present case in which the existence of noise in the signals makes the game tree formulation more involved.

The structure of the game, the uncertainties introduced, the payoffs and the rationality

of the players are common knowledge. Both players,

and

and , make rational decisions

taking fully into account all the information which is common knowledge. The implications

of their various strategies are clearly laid out. The players make rational predictions,

(prophesies), of each others’ actions and on this basis they act themselves. In

the rational expectation equilibrium that results the predictions, that is the players’

beliefs, are confirmed. The prophesies of the players are self-fulfilling. We give

an explicit example of this below.

, make rational decisions

taking fully into account all the information which is common knowledge. The implications

of their various strategies are clearly laid out. The players make rational predictions,

(prophesies), of each others’ actions and on this basis they act themselves. In

the rational expectation equilibrium that results the predictions, that is the players’

beliefs, are confirmed. The prophesies of the players are self-fulfilling. We give

an explicit example of this below.

We are concerned with the analysis of the implications of the signals sent by

to

to . The signal of nature and how it is read by the

machine are both fixed with given probabilities and this is background information

in the analysis. A machine picks up the signal from nature and transmits it to

. The signal of nature and how it is read by the

machine are both fixed with given probabilities and this is background information

in the analysis. A machine picks up the signal from nature and transmits it to . However, like all machines, it is not a

. However, like all machines, it is not a

accurate. As the signal from nature goes to the machine it can be distorted. This

means that if the machine shows on the screen “left”

accurate. As the signal from nature goes to the machine it can be distorted. This

means that if the machine shows on the screen “left” , player

, player

will know that the real state is

will know that the real state is

with probability

with probability

and that with probability

and that with probability

the real state is

the real state is . The situation is analogous

if the machine shows on the screen “right”

. The situation is analogous

if the machine shows on the screen “right” . That is the machine could have

distorted the original signal as it is transmitted on the screen. Player

. That is the machine could have

distorted the original signal as it is transmitted on the screen. Player

will know that the real state is

will know that the real state is

with probability

with probability , and

, and

with probability

with probability . If the machine is only

a bit faulty, we say that

. If the machine is only

a bit faulty, we say that

is the noise, due to the “trembling” hand of the machine. The smaller

is the noise, due to the “trembling” hand of the machine. The smaller

is, the more accurate is the transmission. If the machine is very faulty then the

possibility of distortion,

is, the more accurate is the transmission. If the machine is very faulty then the

possibility of distortion,

, is large and we still call this “noise”, as a

technical term. Of course for

, is large and we still call this “noise”, as a

technical term. Of course for

we retrieve the previous model.1

we retrieve the previous model.1

The information sets

and

and

of

of

capture the fact that he does not know for sure that what he sees at the screen

is a true reflection of the state of nature.

capture the fact that he does not know for sure that what he sees at the screen

is a true reflection of the state of nature.

corresponds to seeing

corresponds to seeing

and

and

to observing

to observing . The information sets

. The information sets

and

and

belong to

belong to

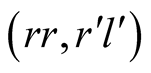

and capture the fact that she hears

and capture the fact that she hears

or

or , respectively, but does not know what

, respectively, but does not know what

saw on the screen (e.g.

saw on the screen (e.g.

or

or ). The two players

can also play “left” or “right”. In a pair of strategies for

). The two players

can also play “left” or “right”. In a pair of strategies for

the first refers to

the first refers to

and the second to

and the second to . In a pair of strategies

for

. In a pair of strategies

for

the first refers to

the first refers to

and the second to

and the second to . As there is no risk of

confusion, and in order to simplify matters, we use the same notation for the left

and right moves from the nodes of information sets which belong to the same player.

. As there is no risk of

confusion, and in order to simplify matters, we use the same notation for the left

and right moves from the nodes of information sets which belong to the same player.

can play

can play

or

or , and

, and

can play

can play

or

or .

.

In a pair of strategies for

the first refers to

the first refers to

and the second to

and the second to . In a pair of strategies

for

. In a pair of strategies

for

the first refers to

the first refers to

and the second to

and the second to .

.

We refer very briefly to two relevant equilibrium concepts in game theory. A Nash Equilibrium (NE) is a pair of strategies (actions) of the two players which are in terms of payoffs best replies to each other’s.

A behavioural strategy assigns to the information sets of a player independent probability distributions to the actions available from those sets. The equilibrium concept of Perfect Bayesian Equilibrium (PBE) consists of a set of players’ optimal behavioural strategies and consistent with these, a set of beliefs which attach a probability distribution to the nodes of each information set. Consistency requires that the decision from an information set is optimal given the particular player’s beliefs about the nodes of this set and the strategies from all other sets, and that beliefs are formed from updating, using the available information. If the optimal play of the game enters an information set then updating of beliefs must be Bayesian. Otherwise appropriate beliefs are assigned arbitrarily to the nodes of the set. The PBE offers a dynamic interpretation of the solution noncooperative extensive form game. It makes use of the agents beliefs and it is a subset of NE.

The behavioural assumption is that every agent chooses his best strategy given the strategy of the other. That is, in effect, a reaction function is formed. If each player optimizes believing, (prophesyzing), a particular strategy for the other, and the outcome is that there is no reason for anybody to feel they have predicted wrongly, then we have an equilibrium which has been obtained rationally. The confirmation of the predictions takes places where the reaction functions intersect.

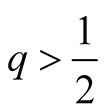

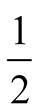

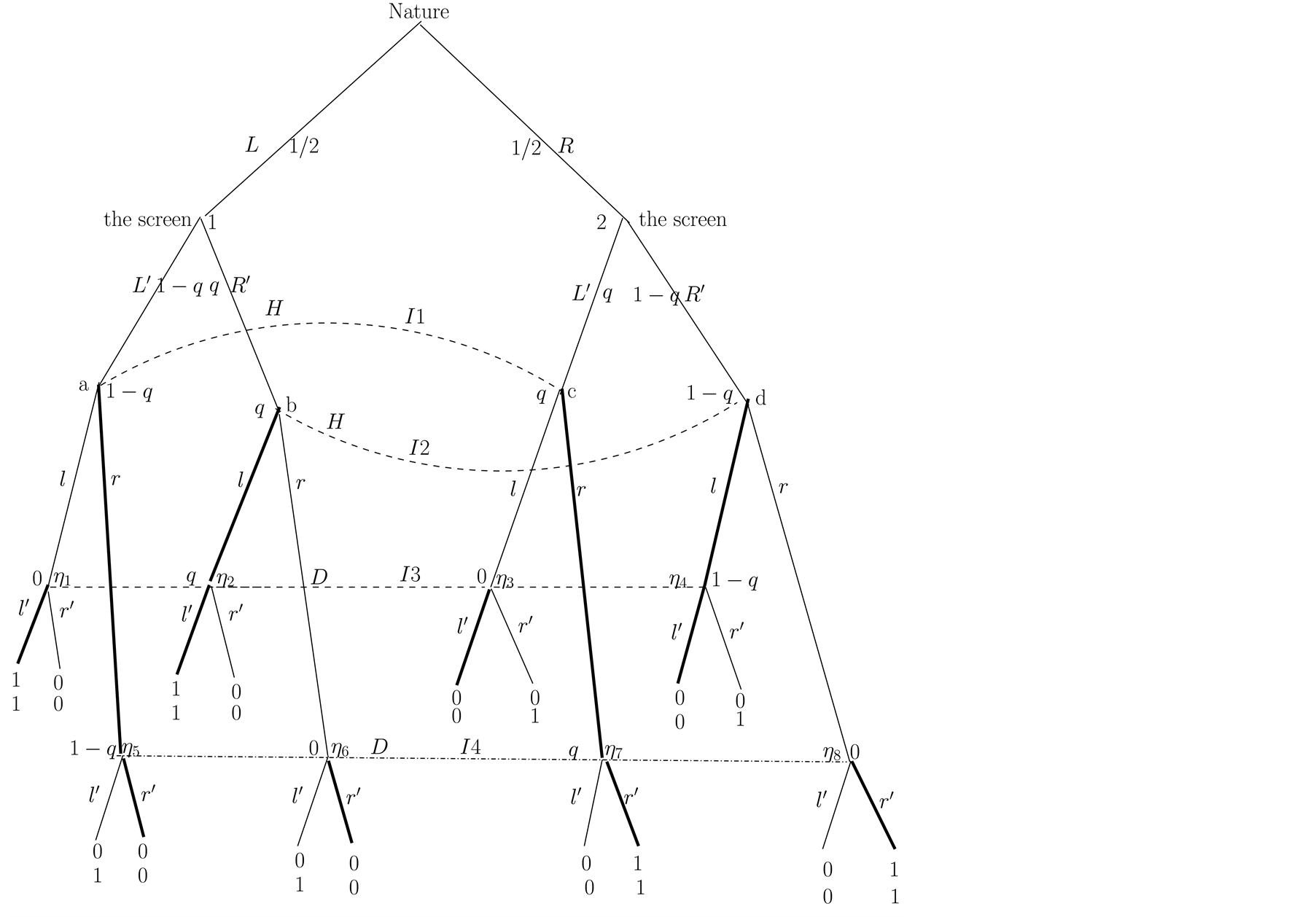

In terms of equilibria the distinction is between small , and large

, and large . In Figures 1-5, we have shown the optimal strategies of

. In Figures 1-5, we have shown the optimal strategies of

and

and

with heavy lines.2 The calculations correspond to examples with

with heavy lines.2 The calculations correspond to examples with

small Figure 1

and Figure 2), large, (Figure

3 and Figure 4) and equal to

small Figure 1

and Figure 2), large, (Figure

3 and Figure 4) and equal to

(Figure 5). The expected payoffs,

(Figure 5). The expected payoffs,

and

and , of the two players

are also given. It is straightforward to check that the strategies form a Nash Equilibrium

(NE).

, of the two players

are also given. It is straightforward to check that the strategies form a Nash Equilibrium

(NE).

The calculations, through Bayesian updating, of the conditional probabilities, (beliefs),

attached to the nodes of the information sets are based on the strategies and thus

we obtain a PBE. The beliefs are shown on the nodes of the information sets. With

respect to

and

and

they express the fixed probabilities with respect to which

they express the fixed probabilities with respect to which

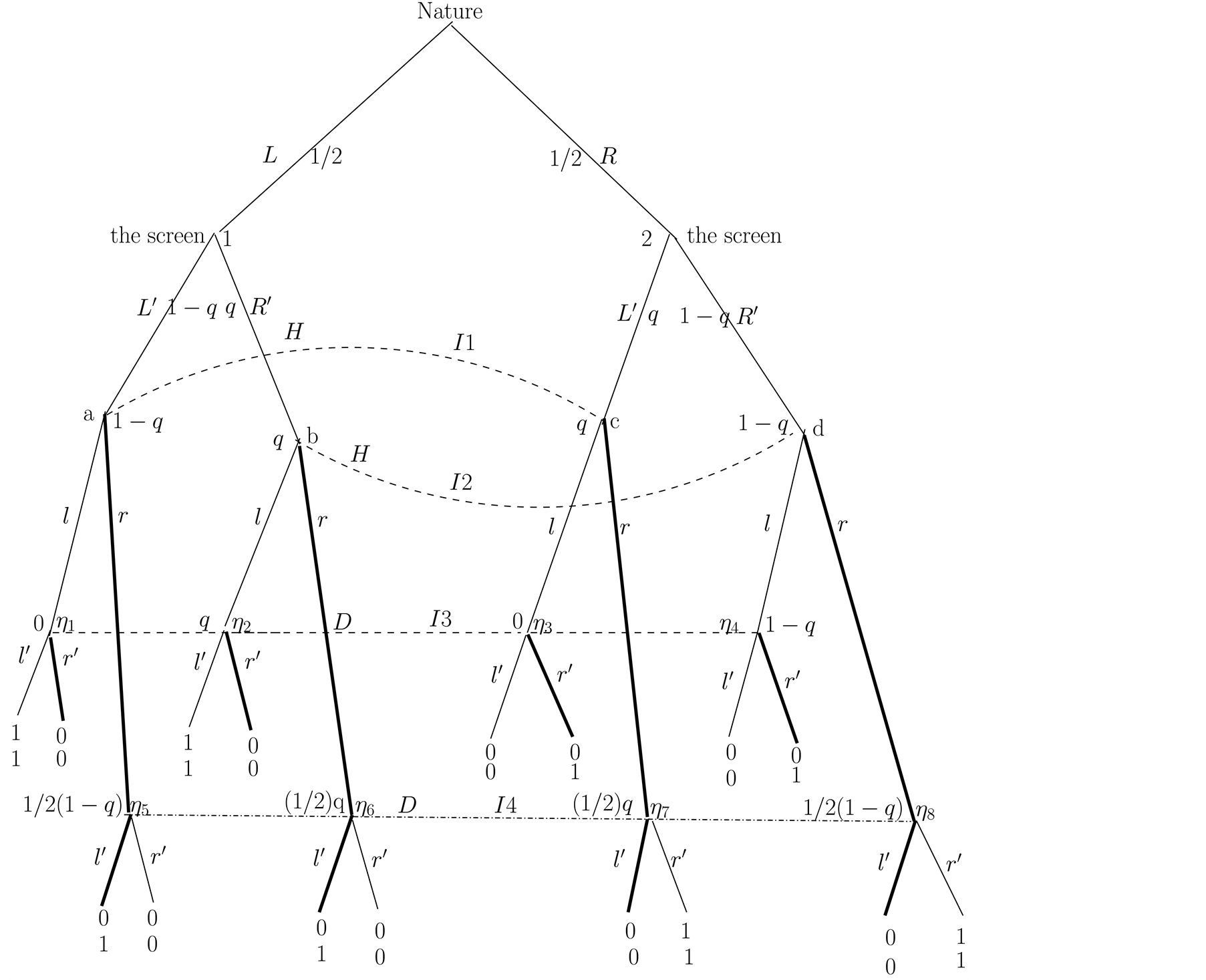

Figure 1. q small; E1 = 1 − q, E2 = 1 − q..

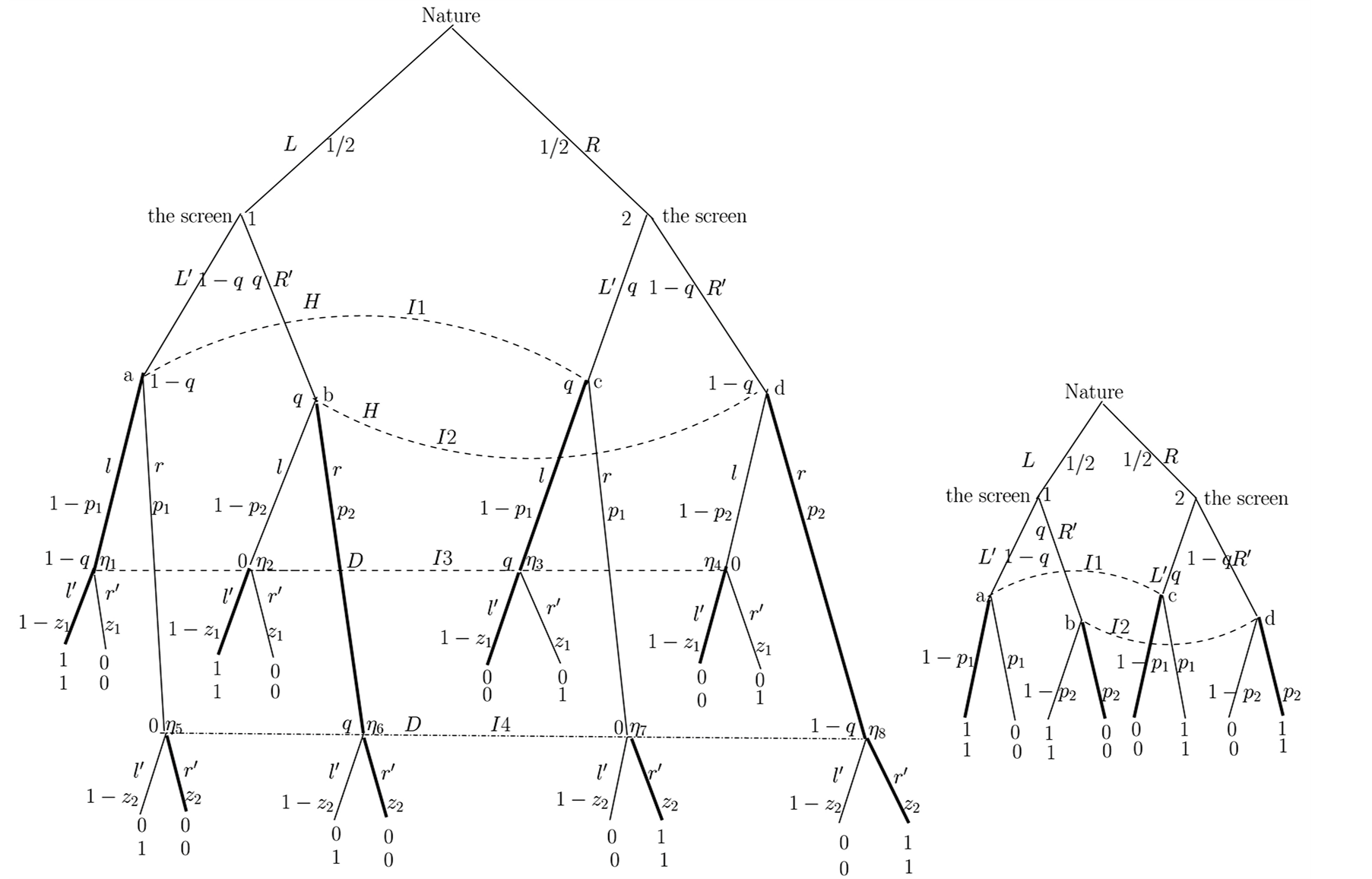

Figure 2. An alternative equilibrium with q small; E1 = 0, E2 = 1 − q.

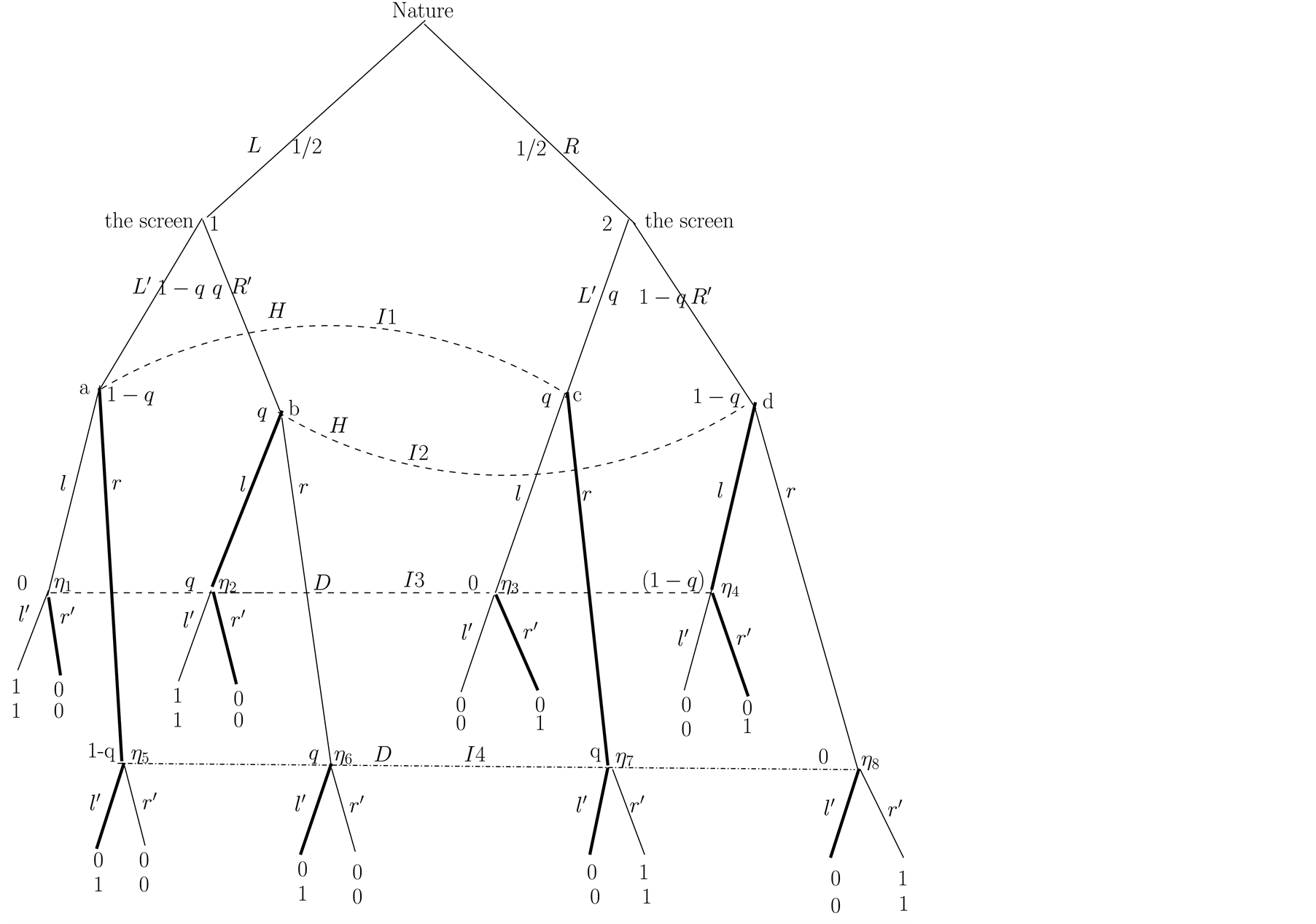

Figure 3. An equilibrium with q large; E1 = 0, E2 = q.

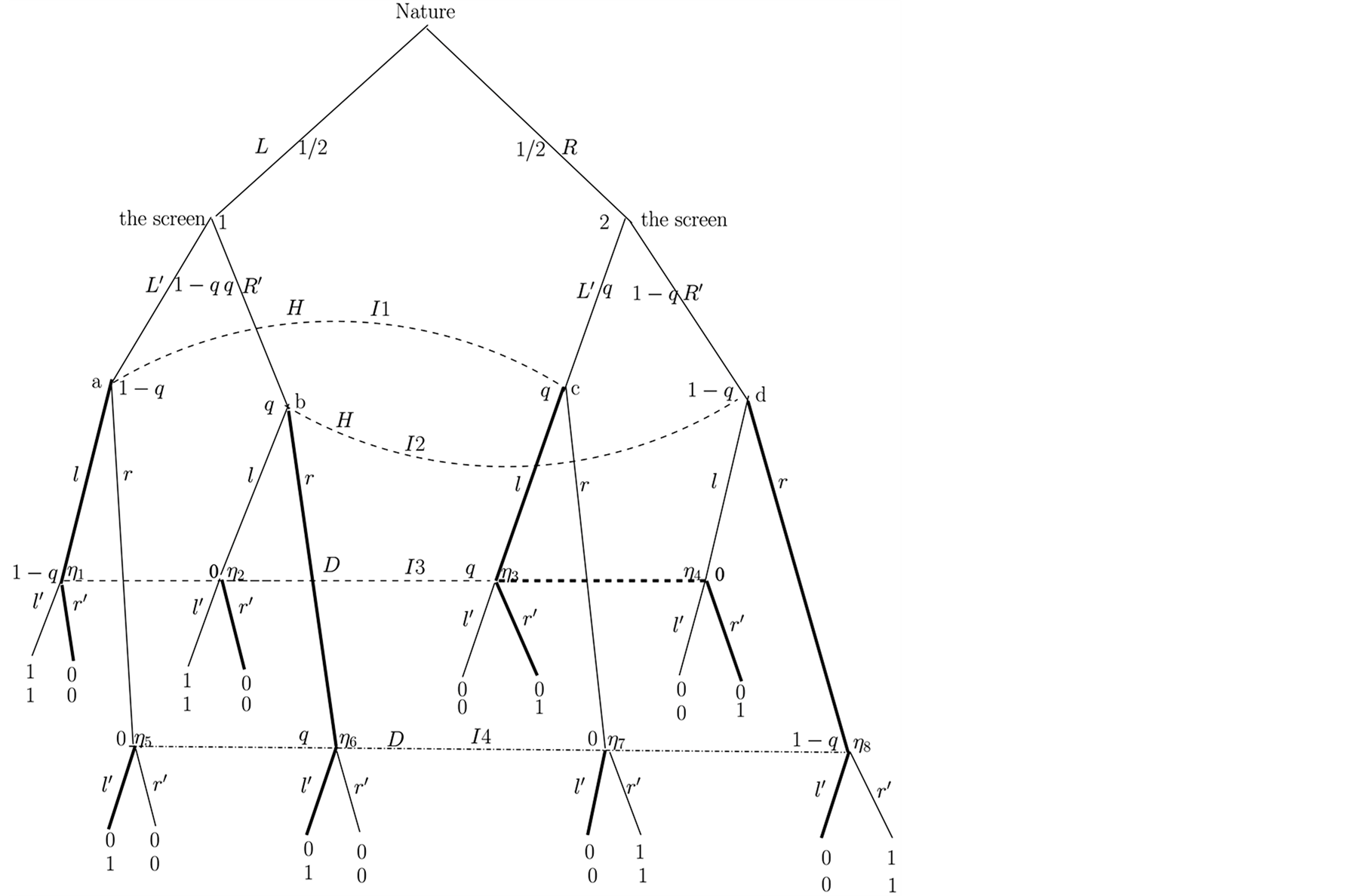

Figure 4. An alternative equilibrium with q large; E1 = q, E2 = q.

Figure 5. An equilibrium with q =1/2; E1 = 0, E2 =1/2.

believes that a signal is true of false.3

believes that a signal is true of false.3

In the end, we are interested in the players taking, from their information sets,

decisions with probability one. In particular we want to analyse the case when

will instruct

will instruct , with probability 1, to

turn “left” or “right” and

, with probability 1, to

turn “left” or “right” and

will also play a pure strategy. Eventually we want to know which combination of

pure strategies is most likely to prevail, i.e. whether the signal of

will also play a pure strategy. Eventually we want to know which combination of

pure strategies is most likely to prevail, i.e. whether the signal of

will be truthful and if

will be truthful and if

will believe it.

will believe it.

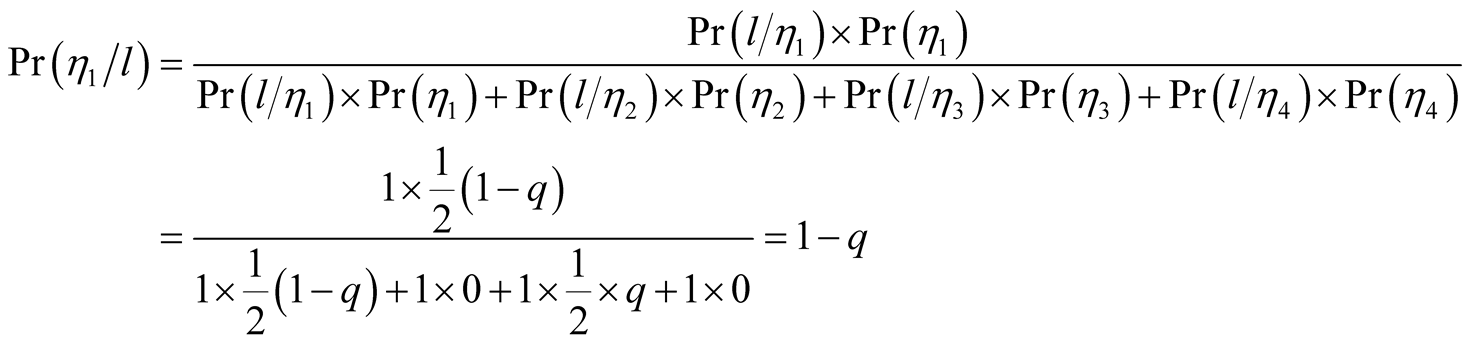

Case 1.

is small. The optimal paths are shown in Figure 1. The information set

is small. The optimal paths are shown in Figure 1. The information set

contains the nodes, from left to right,

contains the nodes, from left to right,

, and we wish to calculate the beliefs attached

to these by

, and we wish to calculate the beliefs attached

to these by

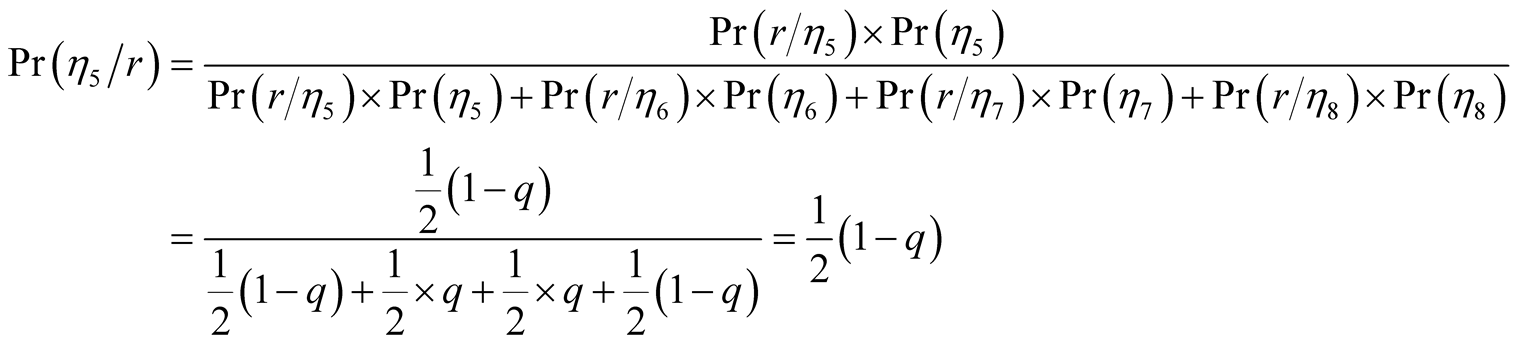

Using the Bayesian formula for updating beliefs, (see for example Glycopantis, Muir

and Yannelis [10] ), we can calculate these conditional

probabilities. We know that

Using the Bayesian formula for updating beliefs, (see for example Glycopantis, Muir

and Yannelis [10] ), we can calculate these conditional

probabilities. We know that

is entered only if

is entered only if

plays

plays . Hence

. Hence

Similarly we obtain the conditional probabilities

and

and .

.

On the other hand

is entered only if

is entered only if

plays

plays

The information set

The information set

contains the nodes, from left to right,

contains the nodes, from left to right, . We now have

. We now have

Similarly we obtain the conditional probabilities

and

and .

.

Given

small, player

small, player

will follow in his action the state that he observes almost surely, expecting that

will follow in his action the state that he observes almost surely, expecting that

will realize this, and thus turn herself in the same direction. Essentially,

will realize this, and thus turn herself in the same direction. Essentially,

is punished if he fails to report the signal that

he has seen on the screen. The noise it contains, means that despite the truthful

revelation, it is not always a correct reflection of the true state of nature and

hence the expected payoffs reflect this by being less than 1.

is punished if he fails to report the signal that

he has seen on the screen. The noise it contains, means that despite the truthful

revelation, it is not always a correct reflection of the true state of nature and

hence the expected payoffs reflect this by being less than 1.

In terms of Figure 1, the prophesies which form

a rational expectations equilibrium take the following form.

prophesizes that when

prophesizes that when

hears

hears

she will believe that

she will believe that

has observed

has observed

and therefore she will play

and therefore she will play

because she knows that if she takes the correct decision she will get an optimum

payoff.

because she knows that if she takes the correct decision she will get an optimum

payoff.

prophezises that when

prophezises that when

sees

sees , given that the noise is small, he will repeat

the message sent by the machine and play

, given that the noise is small, he will repeat

the message sent by the machine and play

since if he transmits a correct signal he may get an optimum payoff, whereas if

he transmits a signal that does not reflect the state of nature he will not irrespective

of what

since if he transmits a correct signal he may get an optimum payoff, whereas if

he transmits a signal that does not reflect the state of nature he will not irrespective

of what

plays.

plays.

We shall now discuss how these rational decisions of the agents are locked in a fixed point. As optimal reactions to each other’s actions they confirm themselves.

The fixed point equilibrium is characterized as follows.

plays from

plays from

the choices

the choices

and

and

with probabilities

with probabilities

and

and

respectively, and from

respectively, and from

the choices

the choices

and

and

with probabilities

with probabilities

and

and

respectively.

respectively.

plays from

plays from

the choices

the choices

and

and

with probabilities

with probabilities

and

and

respectively, and

respectively, and

the choices

the choices

and

and

with probabilities

with probabilities

and

and

respectively.

respectively.

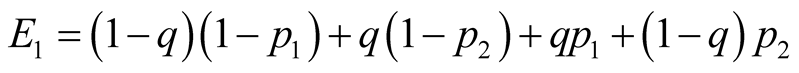

If

chooses

chooses

and

and

then the resulting expected payoff for

then the resulting expected payoff for , ignoring

, ignoring , is

, is

which is maximized at

and

and . On the other hand for

. On the other hand for

and

and , we obtain

, we obtain

which, given that q is small, is maximized at

and

and

Hence the the pairs

Hence the the pairs

and

and

confirm each other as a fixed pair. Starting from one pair of rational decisions

we go back and confirm it.

confirm each other as a fixed pair. Starting from one pair of rational decisions

we go back and confirm it.

In terms of reaction functions the Kakutani fixed point theorem is seen as follows.

Let ,

,

be the two vectors and

be the two vectors and ,

,

the reaction functions (correspondences) of the

helper and the driver respectively. The fixed point satisfies

the reaction functions (correspondences) of the

helper and the driver respectively. The fixed point satisfies .

.

We have analyzed the equilibrium . Inserting back in our

calculations the fraction

. Inserting back in our

calculations the fraction , the resulting payoffs are

, the resulting payoffs are

and

and .

.

The pair

and

and

are the best possible payoffs and hence the best candidates for optimality because

each time

are the best possible payoffs and hence the best candidates for optimality because

each time

follows the message of the machine, i.e. he reports correctly, he is right with

a high probability and

follows the message of the machine, i.e. he reports correctly, he is right with

a high probability and

follows his suggestion. So with a high probability,

follows his suggestion. So with a high probability,

, both players get each time payoff 1. In expectation

they get each time

, both players get each time payoff 1. In expectation

they get each time

and there are two such times. We discuss this further below.

and there are two such times. We discuss this further below.

We can provide some further explanation with respect to the expected payoffs. A

folded up tree can be obtained through backward induction. We are using the optimal

strategies of

given that

given that . In the folded up tree

of Figure 1 it is clear the

. In the folded up tree

of Figure 1 it is clear the

must use

must use

from point

from point

and

and

from 2.

from 2.

Now, the PBE is a technical definition and as such it allows for other such equilibria

as well. For example the following pairs of behavioural strategies ,

,

, and

, and

form a PBE.

form a PBE.

In Figure 2 we consider, in particular, the strategies

which also form a PBE, but with payoff lower for

which also form a PBE, but with payoff lower for

than that corresponding to the pair

than that corresponding to the pair .

.

We shall now discuss also for the pair

how these rational decisions of the agents form a fixed point and thus confirm themselves.

how these rational decisions of the agents form a fixed point and thus confirm themselves.

The fixed point equilibrium is found as follows. Again

plays from

plays from

the choices

the choices

and

and

with probabilities

with probabilities

and

and

respectively, and from

respectively, and from

the choices

the choices

and

and

with probabilities

with probabilities

and

and

respectively.

respectively.

plays from

plays from

the choices

the choices

and

and

with probabilities

with probabilities

and

and

respectively, and

respectively, and

the choices

the choices

and

and

with probabilities

with probabilities

and

and

respectively.

respectively.

The mathematical analysis is supported by optimal decisions obtained by analyzing

the graph. From Figure 2 we obtain the optimal

decisions ,

,

,

,

and

and

If

If

chooses

chooses

and

and

then the resulting expected payoff for

then the resulting expected payoff for

is seen to be

is seen to be

irrespective of

irrespective of

and

and . Therefore this value is also obtained

. Therefore this value is also obtained ,

, . On the other

hand for

. On the other

hand for ,

,

, we obtain, ignoring

, we obtain, ignoring ,

,

which is maximized at

and

and

Hence the the pairs

Hence the the pairs

and

and

confirm each other as a fixed pair. Starting from one pair of rational decisions

we go back and confirm it.

confirm each other as a fixed pair. Starting from one pair of rational decisions

we go back and confirm it.

We have analyzed the equilibrium . Inserting back in our

calculations the fraction

. Inserting back in our

calculations the fraction , the resulting payoffs are

, the resulting payoffs are

and

and . In Figure 2 the

beliefs of player

. In Figure 2 the

beliefs of player

are given for both the points in the information set

are given for both the points in the information set

and those in

and those in . These are consistent

with the moves up to these points and guarantee the optimality of the moves which

follow.

. These are consistent

with the moves up to these points and guarantee the optimality of the moves which

follow.

We return now to the issue of the most likely equilibrium to prevail. From the four

pure NE referred to above, it is easy to see that in the case of

and

and

the signal of

the signal of

has zero informational content. Hence the “updated” beliefs of

has zero informational content. Hence the “updated” beliefs of

in

in

and

and

are identical to the priors of the alternative states of nature.

are identical to the priors of the alternative states of nature.

This leads to equilibrium expected payoffs of . Regarding

. Regarding , we see that the expected

payoff for

, we see that the expected

payoff for

is zero. In other words, the sender will be punished for being untruthful in terms

of revealing his private information regarding the state of nature as seen on the

machine, as the probability that this is wrong is small. Hence if

is zero. In other words, the sender will be punished for being untruthful in terms

of revealing his private information regarding the state of nature as seen on the

machine, as the probability that this is wrong is small. Hence if

misreports what he has seen on the machine, then he is likely to have send an incorrect

signal regarding the state of nature. He will be punished for this with a zero payoff.

Given this, player

misreports what he has seen on the machine, then he is likely to have send an incorrect

signal regarding the state of nature. He will be punished for this with a zero payoff.

Given this, player

can reasonably expect that

can reasonably expect that

has an interest to report truthfully what he has seen on the machine.

has an interest to report truthfully what he has seen on the machine.

In cheap talk games speech serves the purpose of reinforcing a particular action

and provides the evolutionary process rationale for choosing a particular equilibrium.

Similarly, in a signaling game,

will believe that the sender will send him true

information unless he has a reason to deceive him. Using the idea of rational expectations

it is obvious that

will believe that the sender will send him true

information unless he has a reason to deceive him. Using the idea of rational expectations

it is obvious that

has an interest to report the truth regarding his private information because failing

to do so hurts him. Hence

has an interest to report the truth regarding his private information because failing

to do so hurts him. Hence

can reasonably expect and correctly guess that he will signal truthfully. This leads

to the formation of a language (signaling) convention between the players.

can reasonably expect and correctly guess that he will signal truthfully. This leads

to the formation of a language (signaling) convention between the players.

Therefore, given

small, the equilibrium

small, the equilibrium

in Figure 1 is the most likely to prevail, as it

involves the maximum possible payoff for both

in Figure 1 is the most likely to prevail, as it

involves the maximum possible payoff for both

and

and

and hence is the best candidate for optimality in a repeated game of trial and error

until a signaling convention is achieved.

and hence is the best candidate for optimality in a repeated game of trial and error

until a signaling convention is achieved.

Finally, we also consider a case of a pair of strategies which do not form a NE.

As it is easy to see this is the case if in Figure 1

where all decisions are kept the same apart from changing for the driver

to

to

in

in

i.e. the pair of strategies are

i.e. the pair of strategies are . In this case

. In this case

can change from

can change from

in

in

to

to

and improve her payoff.

and improve her payoff.

Case 2.

is large. The optimal paths are shown in Figure 3 and Figure 4.

It is easy to check that the heavy lines strategies form a NE. In Figure 3 only the strategies of

is large. The optimal paths are shown in Figure 3 and Figure 4.

It is easy to check that the heavy lines strategies form a NE. In Figure 3 only the strategies of

are different. On the other hand, since the optimal actions of

are different. On the other hand, since the optimal actions of

are the same for both small and large

are the same for both small and large

we shall be obtaining, through the Bayesian updating of conditional probabilities,

the same beliefs for the nodes of

we shall be obtaining, through the Bayesian updating of conditional probabilities,

the same beliefs for the nodes of

and

and

as in Figure 1. In the case of the equilibrium

in Figure 3,

as in Figure 1. In the case of the equilibrium

in Figure 3,

does not take into account the fact that the machine

is so faulty that it is more often wrong than right and he gets punished for truthfully

sending what is likely to be an incorrect signal. Player

does not take into account the fact that the machine

is so faulty that it is more often wrong than right and he gets punished for truthfully

sending what is likely to be an incorrect signal. Player

does not believe the signal she received, turns in the correct direction and she

is rewarded. As a result

does not believe the signal she received, turns in the correct direction and she

is rewarded. As a result

and

and .

.

In Figure 4 we show an alternative NE for large

and corresponding beliefs at the nodes of the information sets

and corresponding beliefs at the nodes of the information sets

and

and

and hence an alternative PBE to that in Figure 3.

In this case both players make the correct move and they are both rewarded. Specifically,

and hence an alternative PBE to that in Figure 3.

In this case both players make the correct move and they are both rewarded. Specifically,

reports the opposite of what he sees, and both him

and

reports the opposite of what he sees, and both him

and

end up with payoffs

end up with payoffs

The pair

and

and

are the best possible payoffs and hence the best candidates for optimality. The

machine is now very faulty and each time

are the best possible payoffs and hence the best candidates for optimality. The

machine is now very faulty and each time

makes a guess he does not follow its message, i.e. he misreports, and he is right

with a high probability and

makes a guess he does not follow its message, i.e. he misreports, and he is right

with a high probability and

follows his suggestion. So with a high probability, q, both players get each time

payoff 1. In expectation they get each time

follows his suggestion. So with a high probability, q, both players get each time

payoff 1. In expectation they get each time

and there are two such times.

and there are two such times.

Again for completeness, we also consider a case of a pair of strategies which do

not form a NE. This is the case, as it is easy to see, if in Figure 3 all decisions are kept the same apart from changing for the driver

to

to

in

in .

.

Finally we note that it is easy to see that in both Figure 3 and Figure 4 the actions of the optimal paths satisfy Kakutani’s fixed point theorem and form a rational expectation equilibrium.

Case 3.

We can now have an equilibrium such that only information

set

We can now have an equilibrium such that only information

set

or only

or only , as shown in

, as shown in

Figure 5, is visited. Suppose that the latter is

the case. With respect to the arbitrary beliefs for

which is not visited by the optimal strategies, we can adopt beliefs such that the

optimal choice is

which is not visited by the optimal strategies, we can adopt beliefs such that the

optimal choice is .

.

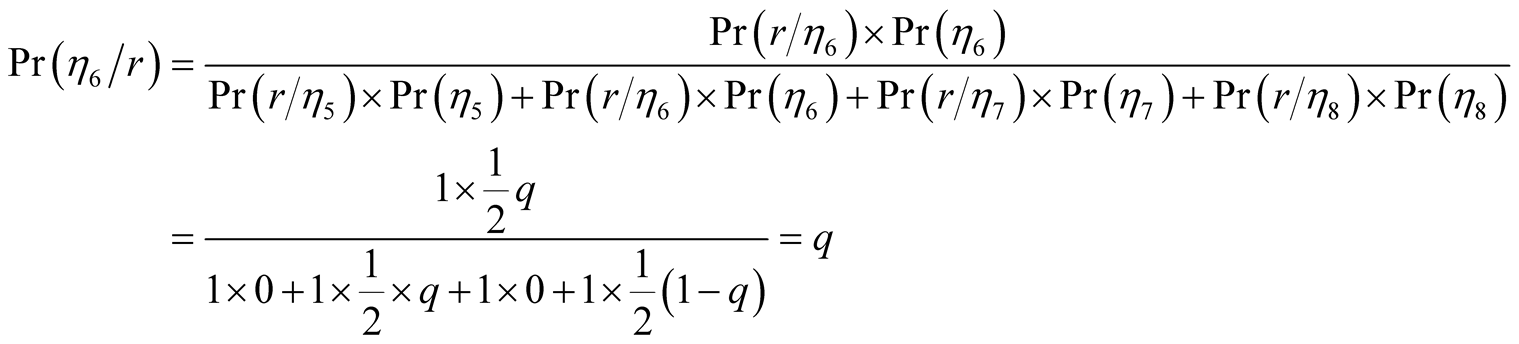

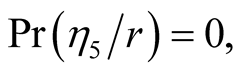

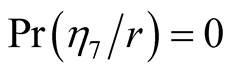

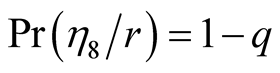

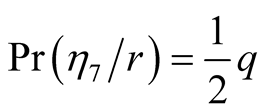

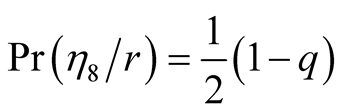

Coming now to , all its nodes are visited

as player

, all its nodes are visited

as player

plays constantly

plays constantly . The beliefs through Bayesian

updating are as follows.

. The beliefs through Bayesian

updating are as follows.

Similarly we obtain the conditional probabilities

and

and

.

.

We now have that

plays

plays

from

from

and

and

from

from , while

, while

always plays

always plays

We want to check that

We want to check that

is a NE. Given the strategies of one player we have to consider the alternative

actions of the other. Given constant

is a NE. Given the strategies of one player we have to consider the alternative

actions of the other. Given constant , player

, player

has made an optimal choice. For the response of

has made an optimal choice. For the response of

to

to

of

of , it is straightforward, inspecting the graph, that

, it is straightforward, inspecting the graph, that

cannot change a strategy and improve his payoff. Hence

cannot change a strategy and improve his payoff. Hence

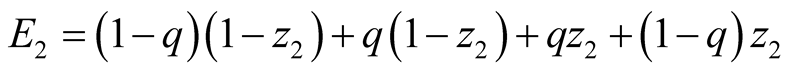

forms a NE. The payoffs are

forms a NE. The payoffs are

and

and

Player

Player

is punished if D decides to play

is punished if D decides to play

in .

.

We shall now discuss how these rational decisions of the agents are locked in a fixed point. As optimal reactions to each other’s actions they confirm themselves and the form a rational expectations equilibrium.

Suppose we consider

and

and . These values mean that

. These values mean that

irrespective of

irrespective of

and

and , and therefore we can choose

, and therefore we can choose

and

and

which

which

takes as given and calculates, ignoring

takes as given and calculates, ignoring ,

,

which means that

irrespective of

irrespective of

and

and

and therefore we can choose

and therefore we can choose , and

, and

In fact, we have a multiplicity of equilibria as D could play instead . The pairs of strategies

. The pairs of strategies

and

and

form also equilibria. In each of these case the beliefs at the nodes of the information

sets of

form also equilibria. In each of these case the beliefs at the nodes of the information

sets of

are properly adjusted, but the payoffs of

are properly adjusted, but the payoffs of

and

and

are the same. That is

are the same. That is

and

and . A general argument can be advanced that the pair

. A general argument can be advanced that the pair

are the best possible payoffs and hence the best candidates for equilibrium.

are the best possible payoffs and hence the best candidates for equilibrium.

The machine is now faulty with probability . Each time

. Each time

makes a guess he has an equal chance to report or misreport the correct state of

nature and when

makes a guess he has an equal chance to report or misreport the correct state of

nature and when

responds she has an equal chance of discovering the true state of nature.

responds she has an equal chance of discovering the true state of nature.

Now, with respect to , since she is rewarded

for guessing correctly, she will always get expected payoff

, since she is rewarded

for guessing correctly, she will always get expected payoff

However the reward of

However the reward of

is calculated, as explained above, in a more complicated manner. He will only get

a payoff of 1 if his signal coincides with the correct choice of

is calculated, as explained above, in a more complicated manner. He will only get

a payoff of 1 if his signal coincides with the correct choice of ; otherwise he gets

; otherwise he gets

It is therefore possible that

It is therefore possible that

gets payoff 0 because he has signaled the opposite of the action taken by

gets payoff 0 because he has signaled the opposite of the action taken by . On the other hand the

latter by making a constant choice secures for himself payoff

. On the other hand the

latter by making a constant choice secures for himself payoff

Finally, we state a pair of strategies which do not form a NE. This is the case,

as it is straightforward to see, of the pair . If

. If

chooses

chooses

then

then

can improve his payoff by switching to

can improve his payoff by switching to .

.

3. Further Discussion and Conclusions

We have analysed a sequential game concerning instructions and decisions to and

by players, where nature selects a state and a machine transmits a noisy signal

which is received by a helper, . The latter decides

whether to truthfully report this signal to a driver,

. The latter decides

whether to truthfully report this signal to a driver, . For a small noise

the equilibrium outcome, not the payoffs, is the same as in the case

. For a small noise

the equilibrium outcome, not the payoffs, is the same as in the case

discussed in the earlier paper, but for a large noise

discussed in the earlier paper, but for a large noise

will be punished for truthfully sending to

will be punished for truthfully sending to

a false message.

a false message.

With respect to payoffs, both players know that if the noise in the signal is small,

announcements by

which are not reflective of the state of nature will lead to outcomes that will

hurt them. The incentives of

which are not reflective of the state of nature will lead to outcomes that will

hurt them. The incentives of

and

and

are compatible in the sense that

are compatible in the sense that

can reasonably expect and correctly guesses that

can reasonably expect and correctly guesses that

has an incentive to truthfully report a signal, when that signal is likely to be

a correct reflection of the state of nature.

has an incentive to truthfully report a signal, when that signal is likely to be

a correct reflection of the state of nature.

In the case of a noisy signal

may receive an incorrect signal from the machine which he reports truthfully. Even

if the final choice is correct, his expected payoff will in this case be zero. So

truthfulness no longer automatically implies that a correct signal is sent.

may receive an incorrect signal from the machine which he reports truthfully. Even

if the final choice is correct, his expected payoff will in this case be zero. So

truthfulness no longer automatically implies that a correct signal is sent.

As argued in [2] , the assumption of an aligned

interest between the helper, as the sender of a signal, and the driver as the receiver

is found in much of the existing literature. The incentive of

to choose

to choose

rather than

rather than

no longer applies if

no longer applies if ’s payoff is no longer

dependent on being correct. This would make the helper careless in terms of his

reporting. He knows that his payoff is dependent on the final outcome which is determined

by the actions of the driver irrespective of whether his signal reflects the true

state of nature. The result of this assumption is that the formation of a convention

is made less likely. This will still hold true in the case of a noisy signal, as

long as

’s payoff is no longer

dependent on being correct. This would make the helper careless in terms of his

reporting. He knows that his payoff is dependent on the final outcome which is determined

by the actions of the driver irrespective of whether his signal reflects the true

state of nature. The result of this assumption is that the formation of a convention

is made less likely. This will still hold true in the case of a noisy signal, as

long as .

.

In contrast, in our model,

knows that the probability of his signal to

knows that the probability of his signal to

correctly reflecting the state of nature is more likely if he truthfully reports

to

correctly reflecting the state of nature is more likely if he truthfully reports

to

the signal he has received from the machine. Since being correct is a necessary

condition for his getting a strictly positive payoff, the case is identical to the

one discussed in [2] where

the signal he has received from the machine. Since being correct is a necessary

condition for his getting a strictly positive payoff, the case is identical to the

one discussed in [2] where .

.

In the case of a large , the incentive of

, the incentive of

to report a signal that correctly reflects the state of nature still applies. But

in this case, it means that

to report a signal that correctly reflects the state of nature still applies. But

in this case, it means that

has an incentive to report the opposite of what has been transmitted to him by the

machine. In other words, it is not in the interests of

has an incentive to report the opposite of what has been transmitted to him by the

machine. In other words, it is not in the interests of

to truthfully report the message he has received by the machine (private information).

By reporting exactly the opposite of what he sees,

to truthfully report the message he has received by the machine (private information).

By reporting exactly the opposite of what he sees,

is more often correct than not. Hence in this

case there is an inverse relationship between correctness and truthfulness.

is more often correct than not. Hence in this

case there is an inverse relationship between correctness and truthfulness.

In both Case 1 and Case 2 we get a number of different PBE. Only one of these seems to be justified in providing an equilibrium which introduces a self enforcing behaviour and also provides an optimum outcome for both players.

In Case 3 there is also a number of equilibria. However from these only two PBE

secure an optimum payoff for both players. These are the ones where both

and

and

make constant choices from both of their corresponding information sets. However

unlike the PBE in Cases 1 and 2, these optimal payoffs do not exceed the default

payoff of

make constant choices from both of their corresponding information sets. However

unlike the PBE in Cases 1 and 2, these optimal payoffs do not exceed the default

payoff of

choosing an action randomly (i.e.

choosing an action randomly (i.e. ) as the informational value

of the signals by

) as the informational value

of the signals by

is zero.

Acknowledgements

We wish to thank Professor Dimitrios Tsomokos of Oxford University for his suggestions and penetrating comments which led to a substantial improvement of the final draft. Of course responsibility for all short comings stays with the authors.

References

- Lewis, D. (1969) Convention. Harvard University Press, Cambridge, MA.

- Dassiou, X. and Glycopantis, D. (2013) A Tree Formulation for Signaling Games. Game Theory, 2013, Article ID: 754398, 12p.

- Blume, A. (2012) A Class of Strategy-Correlated Equilibria in Sender-Receiver Games. Games and Economic Behavior, 75, 510-517. http://dx.doi.org/10.1016/j.geb.2012.03.008

- Rubinstein, A. (2000) Economics and Language. Cambridge University Press, Cambridge, UK. http://dx.doi.org/10.1017/CBO9780511492358

- Cho, I. and Kreps, D.M. (1987) Signaling Games and Stable Equilibria. The Quarterly Journal of Economics, 102, 179-221. http://dx.doi.org/10.2307/1885060

- Pawlowitsch, C. (2008) Why Evolution Does Not Always Lead to an Optimal Signaling System. Games and Economic Behavior, 63, 203-226. http://dx.doi.org/10.1016/j.geb.2007.08.009

- Huttegger, S.M. (2007) Evolutionary Explanations of Indicatives and Imperatives. Erkenntnis, 66, 409-436. http://dx.doi.org/10.1007/s10670-006-9022-1

- Skyrms, B. (2010) The Flow of Information in Signaling Games. Philosophical Studies, 147, 155-165. http://dx.doi.org/10.1007/s11098-009-9452-0

- Stokke, A. (2014) Truth and Context Change. Journal of Philosophical Logic, 43, 33-51. http://dx.doi.org/10.1007/s10992-012-9250-6

- Glycopantis, D., Muir, A. and Yannelis, N. (2003) On Extensive form Implementation of Contracts in Differential Information Economies. Economic Theory, 21, 495-526. (Reprinted in Aliprantis, C.D., Arrow, K.J., et al., Eds., Assets, Beliefs, and Equilibria in Economic Dynamics, Springer-Verlag, 2004, 323-354.)

NOTES

1The beginning of the idea of H receiving a false message from the machine regarding the state of nature was very briefly mentioned in , p. 5.

2We could interpret “Nature” and the “Machine” as two (passive) players, receiving, each, payoff zero, and playing the indicated mixed strategies.

3In order to simplify the graphs, only in Figure 1

we have inserted explicitly that the actions of the players from the information

sets can be mixed with probabilities as follows:

from

from ,

,

from

from ,

,

from

from

and

and

from

from . Exactly the same notation is assumed in all the graphs. Also,

only in Figure 1

we insert the folded up tree following the optimal decisions of

. Exactly the same notation is assumed in all the graphs. Also,

only in Figure 1

we insert the folded up tree following the optimal decisions of . Corresponding folded

up trees can be obtained for all other figures displayed.

. Corresponding folded

up trees can be obtained for all other figures displayed.