Modern Economy

Vol.5 No.3(2014), Article ID:43958,5 pages DOI:10.4236/me.2014.53023

Institutional Quality and Inflation

Raufhon Salahodjaev*, Sergey Chepel

Institute of Forecasting and Macroeconomic Research, Tashkent, Uzbekistan

Email: *rsalaho1@binghamton.edu, swchep@mail.ru

Copyright © 2014 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 3 February 2014; revised 3 March 2014; accepted 10 March 2014

Abstract

The purpose of this paper is to empirically analyze the effects of the quality of institutions on inflation. Using panel data from 1991 to 2007, we find that increase in institutional development which is measured by the ratio of domestic credit to private sector to GDP has significant and sizeable effect on inflation. This paper finds that in countries with high inflation rates, financial sectors cannot resist current levels of inflation and banking system does not decrease inflation in the environment where private banks and financial companies have adapted to existing monetary environment.

Keywords

Inflation; Credit; Institutions; Quality

1. Introduction

Economic institutions, such as private property, rule of law, political stability and investment protection, play a vital role in promoting economic growth and development. While research shows that institutions are important determinant economic growth [1] -[3] , there is evidence showing no link between institutions and economic growth [4] . A ubiquitous number of studies in the 1990’s have discovered a strong positive impact of institutional development on macroeconomic stability, such as growth and low level of inflation [5] -[7] .

Naturally, inflation has important implications for the society as it results in social and political complications of a serious nature [8] . Therefore understanding the drivers of inflation has always been in the center of interest to researchers, politicians and policymakers. Since the statement that “inflation is always and everywhere a monetary factor”, cross-country determinants of inflation have been subject to economic attention [9] . These include openness [10] , institutions [11] [12] and level of economic development [9] .

The purpose of the paper is twofold. First, we contribute to the empirical literature on the cross-country determinants of inflation [9] [12] . We extend the literature by incorporating the measure of financial development/ depth which is measured by domestic credit to private sector as a share of GDP. A number of studies used this variable to assess the allocation of financial assets and were as a proxy of institutional development in crosscountry studies [13] [14] .

Second, we extend the discussion of [15] and [16] that “inflation is everywhere and always a monetary phenomenon” with the hypothesis that size of that phenomenon is dependent on existing financial development of a country.

2. Related Literature and Hypothesis

Inflation has always been in the center of interest to researchers, politicians and policymakers. According to classical economic theory there is a direct interrelation between the amount of money supply and the price level holding aggregate income and speed of transaction constant [17] . With the statement that “inflation is always and everywhere a monetary factor” economists are in general consensus regarding the factors that affect inflation rate [9] [15] . A number of other studies recover the fact that inflation is purely monetary phenomena in a long run when structural policy challenges exist [15] [18] [19] .

Kemal [18] examined the long run relationship and short-run dynamics between the money supply and inflation rates. The study based on the quarterly data for a period of 1975-2003 showed that inflation is strongly associated with the short-run movements of money supply. According to results of the study money supply affects inflation in third quarter. A number of other studies focused on the impact of intuitional aspects like central bank independence, political stability on inflation [11] [12] . Using the system GMM estimator and data on economic, political and institutional variables from 1960 to 1999 for 160 economies [12] find that severe degrees of political instability and low level of democracy and institutional development contribute to volatility of inflation rates. Additionally, central bank independence decreases inflation volatility [11] . Findings show existence of negative relation between central bank independence and inflation in Western countries. However, in former socialist economies central bank independence contributes to the reduction on inflation only above determined threshold of achieved level of liberalization. A feasible argument for that conclusion is that in command economy, the freedom is significantly limited; hence law abidance, including in particular Central Bank laws, is not as important. Gelos and Ustyugova [20] provide assessment of the impact of international commodity price shocks on domestic inflation in 31 advanced and 61 emerging economies. According to their results better overall governance, central bank independence helps to anchor inflation expectations and reduce aftereffects of price shocks.

However, a study by [9] concludes that there is little evidence that institutional development (central bank independence) favors low inflation. Their results are in line with [21] . He argues that in countries with high inflation rates financial sectors cannot resist current levels of inflation and central bank independence does not decrease inflation in the environment where banking system and financial companies have adapted to existing monetary environment. Hyperinflation impairs financial system and destroys financial intermediation [22] .

Based on the previous theoretical background we derive the following hypothesizes:

Hypothesis 1. Increase in the quality of institutional development is associated with decrease in inflation rates.

Hypothesis 2. Institutional development does not decrease decrease inflation in countries experiencing high inflation rates.

3. Data and Methodology

The key methodological challenge in our approach is to use a good measure of quality of institutional development. Economic literature does not offer one precise definition of economic, social and political institutions and means of institutional impact on economic activity [23] . According to [2] institutions are a class of rules, compliance procedures and moral and ethical behavioral norms intended to constrain the behavioral of individuals in the interest of maximizing the wealth or utility of the principals. To measure quality of institutions existing studies has focused on a set of variables and indices such as the enforcement of property rights, level of corruption, global competitiveness index, governance indicators and others. Economists frequently rely on a number of indicators collectively to account for various channels of institutional impact on economic outcomes. Samimi [24] explored the effect of economic freedom on inflation rate for 17 Middle East and North African countries (MENA). As a proxy for “economic freedom” the study used index computed by Heritage Foundation. The index of Heritage Foundation is a mean of ten sub-indexes which focuses on monetary freedom, trading freedom, fiscal freedom, investment freedom, property rights and etc. A number of studies used Worldwide Governance Indicators (WGI) as a measure of governance and institutional development [20] [25] . Provided by [26] WGI covers 215 countries in following dimensions: voice and accountability, political stability, government effectiveness, regulatory quality, rule of law and control of corruption. These indicators range from −2.5 to +2.5 where higher value indicates better governance.

However, [23] argues that this leads to substantial errors in research for developing countries and diminishes the interpretation of the place of institutional development in economic outcomes. Most of the institutional variables integrated into economic models are based on the survey responses or measured as indices. The interpretation of economic content of such variables in empirical results is rather limited and subjective [27] .

In this paper as a measure of institutional development we use domestic credit to private sector as % of GDP which measures quality and the quantity of the banking system [28] [29] . Jonas and Mishkin [30] report that in transition economies the government is directly involved in the central bank’s monetary policy limiting the independence of banking system and personalizing conducted monetary policy. All these facts favor in choice of this variable.

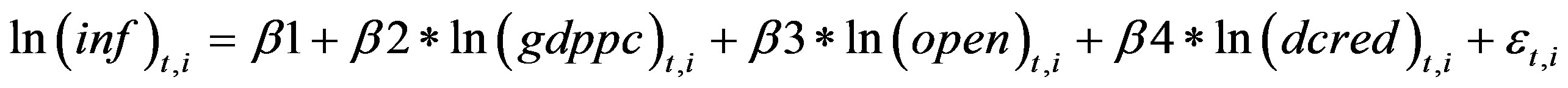

Our preferred methodology is based on [10] and can be summarized as follows:

where inf stands for GDP deflator (annual), gdppc—GDP per capita, PPP (constant 2005 international $), open—imports as a share of GDP, and dcred—domestic credit to private sector as a % of GDP, ε—is a normally distributed random error capturing unobserved effects on inflation. Summary statistics are shown in Table 1.

4. Results

We use panel data to test the prediction that inflation is higher in the countries with underdeveloped banking sector. Our sample covers all the available countries for period of 1991-2007. Table 2 contains the results obtained from OLS estimation. We perform a Hausman test to choose between a fixed and random effects specification. Based on the test results, we have chosen a fixed effect rather than a random effects model.

All of the coefficients have the expected signs, and statistically significant. We find that institutional characteristics of a monetary policy (quality of banking system and the level of financial development) are important determinant of inflation in developing countries. Our results are consistent with the findings of [31] [32] . These studies demonstrate that growth in domestic credit to private sector is inversely related to inflation.

In order to test hypothesis 2 we investigate the results for a variety of sub-samples (Table 3). Column 1 excludes all the countries with annual inflation above 50%. Exclusion of the countries with high inflation shows that well banking system plays important role in reducing inflation. Column 2 and 3 excludes observations with average inflation rates less than 50% and 100% from the sample. Results show that dcred coefficient has expected sign but is not statistically significant.

5. Conclusion

This paper examined impact of quality of institutions on inflation in cross-country estimations. Using panel data from 1991 to 2007, our paper finds that increase in the quality of institutions, which is measured by the ratio of domestic credit to private sector to GDP has significant and sizeable effect on inflation. Using alternative measure of institutional development of banking sector, we achieved results which are consistent with the findings of other papers [12] . Consequently, institutions play a role in reducing inflation and the estimated relations are robust overall. We clearly demonstrate that level of institutional development of banking system is an important determinant of anti-inflation policy in developing countries. The estimated results can be used by policymakers of

Table 1. Summary statistics.

Table 2. Dependent variable: logarithm of average annual GDP deflator (1991-2007).

Standard errors in parentheses. *p < 0.1, **p < 0.05, ***p < 0.01. Robust standard errors are in parenthesis.

Table 3. Dependent variable: logarithm of average annual GDP deflator (1991-2007).

Standard errors in parentheses. *p < 0.1, **p < 0.05, ***p < 0.01. Robust standard errors are in parenthesis.

transition countries such as CIS countries where inflation is an important factor of macroeconomic instability and domestic credit to private sector is much lower than the world averages. By enhancing monetary freedom and reforming banking system, these economies can create feasible tool conducive to long-run inflations stability. Our results reveal that in countries experience, hyperinflationary financial sectors cannot resist current levels of inflation and banking system does not decrease inflation in the environment where private banks and financial companies have adapted to existing monetary environment.

References

- Alchian, A. (1965) Some Economics of Property Rights. Il Polit, 30, 816-829.

- North, D. (1981) Structure and Change in Economic History. W.W. Norton, New York.

- Acemoglu, D., Johnson, S. and Robinson, J. (2005) Institutions as the Fundamental Cause of Long-Run Growth. In: Aghion, P. and Durlauf, S., Eds., Handbook of Economic Growth, Vol. 1A, North Holland, Amsterdam, 385-472. http://dx.doi.org/10.1016/S1574-0684(05)01006-3

- Durham, J.B. (1999) Economic Growth and Political Regimes. Journal of Economic Growth, 4, 81-111. http://dx.doi.org/10.1023/A:1009830709488

- Barro, R.J. (1991) Economic Growth in a Cross-Section of Countries. Quarterly Journal of Economics, 106, 407-443. http://dx.doi.org/10.2307/2937943

- Barro, R.J. and Sala-i-Martin, X. (2004) Economic Growth. 2nd Edition, MIT, Cambridge.

- Torstensson, J. (1994) Property Rights and Economic Growth: An Empirical Study. Kyklos, 47, 231-427. http://dx.doi.org/10.1111/j.1467-6435.1994.tb02257.x

- Zijlstra, J. (1975) Inflation and Its Impact on Society. De Economist, 123, 495-506. http://dx.doi.org/10.1111/j.1467-6435.1994.tb02257.x

- Campillo M. and Miron, J. (1997) Why Does Inflation Differ across Countries? In: Reducing Inflation: Motivation and Strategy, University of Chicago Press, Chicago, 335-362.

- Romer, D. (1993) Openness and Inflation: Theory and Evidence. The Quarterly Journal of Economics, 108, 869-903. http://dx.doi.org/10.2307/2118453

- Cukierman, A. (1992) Central Bank Strategy, Credibility, and Independence. MIT Press, Cambridge.

- Aisen, A. and Veiga, F. (2008) Political Instability and Inflation Volatility. Public Choice, 135, 207-223. http://dx.doi.org/10.1007/s11127-007-9254-x

- King, R.G. and Levine, R. (1993) Finance and Growth: Schumpeter Might Be Right. Quarterly Journal of Economics, 108, 717-737. http://dx.doi.org/10.2307/2118406

- Levine, R. and Zervos, S.J. (1993) What Have We Learned about Policy and Growth from Cross Country Regressions? American Economic Review, 83, 426-430.

- Friedman, M. (1956) The Quantity Theory of Money—A Restatement. In: Friedman, M., Ed., Studies in the Quantity Theory of Money, University of Chicago Press, Chicago, 1-21.

- Alan, G. (2004) Risk and Uncertainty in Monetary Policy. The American Economic Review, 94; Proceedings of the One Hundred Sixteenth Annual Meeting of the American Economic Association, San Diego, 3-5 January 2004, 33-40.

- Lothian, J.R. (2009) Milton Friedman’s Monetary Economics and the Quantity-Theory Tradition. Journal of International Money and Finance, 23, 1086-1096. http://dx.doi.org/10.1016/j.jimonfin.2009.06.002

- Kemal, M.A. (2006) Is Inflation in Pakistan a Monetary Phenomenon? The Pakistan Development Review, 45, 213- 220.

- Khan, M.S. (1980) The Dynamics of Money and Price and the Role of Monetary Policy in SEACAN Countries. SEACEN Occasional Paper.

- Gelos, G. and Ustyugova, Y. (2012) Inflation Responses to Commodity Price Shocks—How and Why Do Countries Differ? IMF Working Paper.

- Posen, A.S. (1995) Declarations Are Not Enough: Financial Sector Sources of Central Bank Independence. NBER Macroeconomics Annual, 10, 251-274.

- Reinhart, C.M. and Savastano, M.A. (2003) Las realidades de las hiperinflaciones modernas: Pese a que las tasas de inflación han bajado en el mundo entero, la hiperinflación no ha sido erradicada. Finanzas y desarrollo: Publicación trimestral del Fondo Monetario Internacional y del Banco Mundial, 40, 20.

- Aron, J. (2000) Growth and Institutions: A Review of the Evidence. World Bank Research Observer, 15, 99-135. http://dx.doi.org/10.1093/wbro/15.1.99

- Samimi, A., Mahmoodzadeh, M. and Shadabi, L. (2011) Inflation & Economic Freedom: Evidence from MENA Region. Journal of Economics and Behavioral Studies, 2, 125-130.

- De Grauwe, P., Houssa, R. and Piccillo, G. (2012) African Trade Dynamics: Is China a Different Trading Partner? Journal of Chinese Economic and Business Studies, 10, 15-45. http://dx.doi.org/10.1080/14765284.2012.638460

- Kaufmann, D., Kraay, A. and Mastruzzi, M. (2010) Governance Matters viii: Aggregate and Individual Governance Indicators 1996-2009. Policy Research Working Paper Series 4978, The World Bank.

- Grogan, L. and Moers, L. (2001) Growth Empirics with Institutional Measures for Transition Countries. Economic Systems, 25, 323-344. http://dx.doi.org/10.1016/S0939-3625(01)00030-9

- Beck, T., Demirgüç-Kunt, A. and Levine, R. (2000) A New Database on Financial Development and Structure. World Bank Economic Review, 14, 597-605. http://dx.doi.org/10.1093/wber/14.3.597

- Shan, J. (2005) Does Financial Development “Lead” Economic Growth?: A Vector Auto-Regression Appraisal. Applied Economics, 37, 1353-1367. http://dx.doi.org/10.1080/00036840500118762

- Jonas, J. and Mishkin, F. (2004) Inflation Targeting in Transition Economies. The Inflation-Targeting Debate. University of Chicago Press, Chicago.

- Antzoulatos, A. (1996) Consumer Credit and Consumption Forecasts. International Journal of Forecasting, 12, 439- 453. http://dx.doi.org/10.1016/S0169-2070(96)00687-5

NOTES

*Corresponding author.