Journal of Mathematical Finance

Vol.05 No.03(2015), Article ID:58462,17 pages

10.4236/jmf.2015.53025

Pricing a European Option in a Black-Scholes Quanto Market When Stock Price Is a Semimartingale

E. R. Offen, E. M. Lungu

University of Botswana, Gaborone, Botswana

Email: offen@mopipi.ub.bw, lunguem@mopipi.ub.bw

Copyright © 2015 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 18 April 2015; accepted 26 July 2015; published 30 July 2015

ABSTRACT

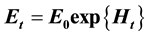

We look at the price of the European call option in a quanto market defined on a filtered probability space  when the exchange rate is being modeled by the process

when the exchange rate is being modeled by the process  where

where  is a semimartingale. Precisely we look at an investor in a Sterling market who intends to buy a European call option in a Dollar market. The market consists of a Dollar bond, Sterling bond and and Sterling risky asset. We first of all convert the Sterling assets by using the exchange rate

is a semimartingale. Precisely we look at an investor in a Sterling market who intends to buy a European call option in a Dollar market. The market consists of a Dollar bond, Sterling bond and and Sterling risky asset. We first of all convert the Sterling assets by using the exchange rate  and later on derive an integro-differential equation that can be used to calculate the price on the option.

and later on derive an integro-differential equation that can be used to calculate the price on the option.

Keywords:

Semimartingale, Hedging, Arbitrage, Contingent Claim

1. Introduction

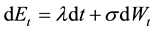

This paper considers the European call option in the Black-Scholes market when the exchange-rate is a semimar- tingale. Specifically, we consider a problem of a Dollar investor seeking to invest in a Sterling market. Theory of exchange rates has been widely discussed (see [1] -[4] ). Exchange rates change with time due to a number of factors, such as changes in fiscal and monetary policies, interest rate differentials between two countries usually resulting in revaluation or devaluation of currency. The main challenge is to construct a model which captures the dynamics of exchange rate and its effect when investments are made in different currencies. A number of models have been developed which are being modified to accommodate reality. Generally, exchange rate models fall into two major categories: Those that treat the dynamics of exchange rate as a continuous process and those treat exchange rates as processes with jumps. The Black-Scholes model is the most celebrated non- jump model whose dynamics are modelled by the stochastic differential equation  where

where  is the exchange rate, λ is the drift parameter, σ is the volatility parameter and Wt is a Wiener process. This model assumes the logarithmic exchange which follows Brownian motion with drift. Using this as a benchmark model,

is the exchange rate, λ is the drift parameter, σ is the volatility parameter and Wt is a Wiener process. This model assumes the logarithmic exchange which follows Brownian motion with drift. Using this as a benchmark model,

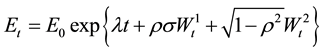

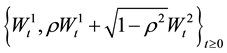

other models were developed, for example, a model given by the equation

where  is a pair of correlated Brownian motions with correlation co-efficient ρ and

is a pair of correlated Brownian motions with correlation co-efficient ρ and

is Brownian Motion driving the given asset prices [2] . It is known that jump-diffusion models are more realistic for studying the dynamics of exchange rates [3] . Dating back from the introduction of jump-diffusion process by [4] [5] as a tool for modelling the prices of options based on more general processes of underlying asset returns, jump-diffusion processes have also been widely used in modelling the dynamics of exchange rates. Empirical evidence based on simple jump-diffusion models suggests that jumps really form significant com- ponents of foreign exchange rate processes [1] [3] . As such, it is reasonable that both empirical and theoretical studies of exchange rates under uncertainty should allow for the presence of discontinuities explicitly. There has been a wide use of jump-diffusion processes to model financial time series to reflect discontinuities of asset returns. Some of the most well known jump-diffusion models for the dynamics of foreign exchange include: 1) Merton’s Jump Model, 2) Conditional Heteroscedasticity and Jump model and Mean-Reversion, Conditional Heteroscedasticity and Jump model. The Merton’s Jump Model is given by the stochastic differential equation

is Brownian Motion driving the given asset prices [2] . It is known that jump-diffusion models are more realistic for studying the dynamics of exchange rates [3] . Dating back from the introduction of jump-diffusion process by [4] [5] as a tool for modelling the prices of options based on more general processes of underlying asset returns, jump-diffusion processes have also been widely used in modelling the dynamics of exchange rates. Empirical evidence based on simple jump-diffusion models suggests that jumps really form significant com- ponents of foreign exchange rate processes [1] [3] . As such, it is reasonable that both empirical and theoretical studies of exchange rates under uncertainty should allow for the presence of discontinuities explicitly. There has been a wide use of jump-diffusion processes to model financial time series to reflect discontinuities of asset returns. Some of the most well known jump-diffusion models for the dynamics of foreign exchange include: 1) Merton’s Jump Model, 2) Conditional Heteroscedasticity and Jump model and Mean-Reversion, Conditional Heteroscedasticity and Jump model. The Merton’s Jump Model is given by the stochastic differential equation  where Et is the exchange rate, λt is the instantaneous expected return, σ is the instantaneous volatility of the asset’s return subject to the Poisson jump not occurring, Wt is the Gauss- Wiener process,

where Et is the exchange rate, λt is the instantaneous expected return, σ is the instantaneous volatility of the asset’s return subject to the Poisson jump not occurring, Wt is the Gauss- Wiener process,  is a Poisson process which is independent and identically distributed over time, α is the intensity parameter of Poisson distribution,

is a Poisson process which is independent and identically distributed over time, α is the intensity parameter of Poisson distribution,  is the random jump size with

is the random jump size with  and

and ,

,  are statistically independent. This model explicitly allows for the presence of asymmetric lognormal jumps to the exchange rate. 3) The Conditional Heteroscedasticity and Jump model, is described by the stochastic dif- ferential equation

are statistically independent. This model explicitly allows for the presence of asymmetric lognormal jumps to the exchange rate. 3) The Conditional Heteroscedasticity and Jump model, is described by the stochastic dif- ferential equation , which is an extension of Merton’s model and allows for conditional heteroscedasticity in addition to jumps. 4) Lastly, the Mean-Reversion, Conditional Heteroscedasticity and Jump model, described by the differential equation

, which is an extension of Merton’s model and allows for conditional heteroscedasticity in addition to jumps. 4) Lastly, the Mean-Reversion, Conditional Heteroscedasticity and Jump model, described by the differential equation

2. The Model

We consider the quanto market model consisting of Dollar bond

space

tion generated by the stock price process while

Converting into Dollars

Since our asset is in Sterling, we need first of all to find the Dollar equivalent of this asset. For convenience sake we let

Define

where

Then, using Ito’s formula for semimartingales [6] [7] , the dynamics of the dollar value for the Sterling risky asset is

where

(see Appendix). Let

It is important to take note that superscript

Since

where

Now, using the bilinear property of sharp bracket process [9] , we obtain

We further note that

This is true because μt, and σWt are continuous processes. It then follows that

Substituting Xt and Equations (3), (10), (11) into Equation (5) we have

Similarly, let Zt be the dollar value of the Sterling bond given by

Let

It clearly follows that

Noting that

Note that Equation (15) follows because us is a continuous function so that

Hence

Zt can now be written as

Its differential form, the dynamics of the dollar value of the Sterling bond can be written as

Which can be written as

where

And

For our analysis, we need to express the decompositions

In our case, we have

And from Equation (10) we have

Hence, process of bounded variation

where A is as defined in Equation (6) and D is the process of bounded variation for the semimartingale Ht. We can express these results in canonical form by using the random measure of jumps (see [7] ). From Equation (5),

Now, if we assume that

where

Now if we substitute Equations (9) (10) and (19) into Equation (21) we obtain

where

i.e.

where

If we set

where

This means the dynamics in our market model are modeled by the equations can also be presented by the eququations

where

3. Arbitrage

A question we must ask before we proceed is whether the market (27) allows arbitrage opportunities or not. In this market, an investment strategy or portfolio is a predictable process

Such that

inequality (29) ensures that the integrals

Let

be the worth the worth process. We need to know if our portfolio

or in differential form, if

Equations (31) and (32) imply that the portfolio is self-financing if changes in the value of the portfolio on an infinitesimal interval are due entirely to the changes in value of assets and not to an injection (or removal) of wealth from outside.

To show that our portfolio is self-financing, we use Lemma (5.1.3) in [2] . According to [2] ,

where

This means

Satisfying Equation (33). Hence

as defined in Equation (34) above is lower bounded, then

If

Similarly, the dynamic

From Equation (30)

Since the portfolio

Then

This means the differential form of of the dynamics of the discounted wealth process is

Hence the discounted wealth process will be

From the above equations,

Definition 1 A portfolio

Since the portfolio

3.1. Converting Yt into a Martingale

Our stock price process as described in Equation (27) is a semimartingale. To use the martingale approach, we need to convert the price process into a martingale by finding another probability space

(see Equation (27)).

This means our price process is a local martingale iff

Suppose we have the triplet

Using the Gisanov’s Theorem for semimartingales,

where

And

where

where

definition, the

For all non-negative

where

And

We start by finding the values β and

It is easy to see that the continuous part of the semimartingale

Hint: in our calculations, we have made use of Equation (2) and the canonical decomposition of the semi- martingale hence the differential form of

From Equation (47) and using properties of conditional quadratic variation process for stochastic integrals with respect to semimartingales

Now

We can deduce from equating Equations (49) and (50), that Equation (40) can only hold if

And the Equation (42) which simplifies below

We arrive at a choice of

Hence from Equation (46)

Now under

(see [8] )

From Equation (44),

But in our case, to really achieve the case

It is also important to take note that from the assumption we have made and lemma (2.13) in [11] above,

(see [12] ) and from Equation (55)

From Equation (38)

This means that under

Which is a martingale process.

This means that since our market has an equivalent local martingale measure

3.2. Equivalent Local Martingale Measures (ELMM)

In our previous section (section 3.1), we have proved the existence of ELMM

Minimal Relative Entropy Martingale Measure (MEMM)

Let

Definition 2

where

(see [14] [15] ).

The relative entropy measures the minmal departure from a given measure

The minimal martingale measure

Let

where

Now solving (61) above gives

where

Now

And

(see Equation (10)). Hence

(for

Hence

The process

which is the continuous and most familiar case, while if

3.3. The Price of European Call Option

We now come to the question fundamental of this study.

How much should the investor be willing to pay for a European call option at t = 0 in the case where Yt is a semimartingale process as defined in Equation (65)?. We extend the theorem which was given in [16] .

Theorem 1 Let

Proof. Before we proceed, we take note of the following:

This means that

The theory of pricing of the European call option (see [17] ) and the Markovian property of

where

□

But how do we evaluate the value

Now using the fact that a predictable local martingale with finite variation starting at zero is zero (theorem leads us to the equation i.e.

4. Examples

4.1. Example 1: Continuous Case

Suppose

From Equation (3),

where

Note that U, as it is defined in Equation (69), is an element of Borel sets which do not have a 0 element. Since

It follows that

Similarly

From Equations (39) and (51)), under measure

And

Hence

And hence (from the same theorem)

4.2. Example 2: Process with Jump

Suppose in our model, the exchange rate is not continuous and is modeled by the stochastic differential equation

where

To find out what our Xt and

Using Itó’s formula for processes with jumps, we let

From which we obtain

And

Hence from Equation (77), we obtain

Clearly,

From (78) we obtain the process of the form

Equation (79) yields the sharp bracket process for

And hence under measure

Clearly

And

From Equation (80),

And

Hence from theorem (1),

And

4.3. Example 3: Ht a Cumulative Process

We consider a situation where the exchange rate is

In this case

This means that

Hence Equation (80) becomes

This means

With

5. Discussion

Equation (73) compares well with Equation (82) in the sense that (82) without the term

Gives Equation (73). This means that Equation (85) is the contribution of the jump to the price of the option. The effects of the jumps on the price of the the option can be easily observed from this Equation (82) through the role

Hence Equation (82) is reduced to Equation (73) which is a continuous case. This can be further justified from the definition of our

In Equation (82), the increase in

We also take note that expression (85) is also equal to zero if either

A case which can be handled numerically.

6. Conclusion

The method gives the general method of calculating the price of the option in the sense that it accommodates both continuous and processes with jumps. When

Cite this paper

E. R.Offen,E. M.Lungu, (2015) Pricing a European Option in a Black-Scholes Quanto Market When Stock Price is a Semimartingale. Journal of Mathematical Finance,05,286-303. doi: 10.4236/jmf.2015.53025

References

- 1. Akigirayi, V. and Booth, G. (1988) Mixed Diffusion-Jump Process Modeling of Exchange Rate Movements. Review of Economics and Statistics, 70, 631-637.

http://www.jstor.org/stable/1935826 - 2. Etheridge, A. (2002) A Course in Financial Calculus. Cambridge Press, Cambridge.

http://dx.doi.org/10.1017/CBO9780511810107 - 3. Jorion, P. (1988) On Jump Processes in Foreign Exchange and Stock Markets. Review of Financial Studies, 1, 427-445.

http://dx.doi.org/10.1093/rfs/1.4.427 - 4. Merton, R. (1976) Option Pricing When Underlying Stock Returns Are Discontinuous. Journal of Financial Economics, 3, 125-144.

http://dx.doi.org/10.1016/0304-405X(76)90022-2 - 5. Press, J.A. (1967) A Compound Events Model of Security Prices. Journal of Business, 40, 317-335.

http://dx.doi.org/10.1086/294980 - 6. Protter, P. (1992) Stochastic Integration and Differential Equations: A New Approach. Springer-Verlag, Berlin.

- 7. Shiryaev, A.N. (1999) Essentials of Stochastic Finance, Facts, Models, Theory. World Scientific Pub Co Inc., Hackensack.

- 8. Jacod, J. and Shiryaev A.N. (1987) Limit Theorems for Stochastic Processes. Springer, Berlin.

http://dx.doi.org/10.1007/978-3-662-02514-7 - 9. Klebanner, F. (2005) Introduction to Stochastic Calculus with Applications. Imperial College Press, Berlin.

http://dx.doi.org/10.1142/p386 - 10. Papapantoleoen, A. (2006) Application for Semimartingales and Lèvy Processes in Finance: Duality and Valuation. Dissertation zur Erlangung des Doktorgrades der Fakultät für Mathematik und Physik der Albert-Ludwigs-Universitat, Freiburg im Breisgau.

- 11. Kallesen, J. and Shiryaev, A. (2002) The Cummlant Process and Esscher’s Change of Measure. Finance and Stochastics, 6, 397-428.

http://dx.doi.org/10.1007/s007800200069 - 12. Bulhman, H., Delbaen, F., Embrechts, P. and Shiryaev, A.N. (1996) No-Arbitrage, Change of Measure and Conditional Esscher’s Transforms. CW Quartery, 9, 291-317.

- 13. Harrison, J. and Pliska, S. (1981) Martingales and Stochastic Integrals in Theory of Continuous Trading. Stochastic Processes and Their Applications, 11, 215-260.

http://dx.doi.org/10.1016/0304-4149(81)90026-0 - 14. Follmer, H. and Schwaizer, M. (1991) Hedging Contingent Claims under Incomplete Information. In: Davis, M.A. and Elliot, R.J., Eds., Applied Stochastic Analysis Monographs, 4th Edition, Vol. 5, Gordon and Breach, London, 389-414.

- 15. Miyahara, Y. (1999) Minimal Entropy Martingale Measures Jump Type Price Process in Incomplete Asset Markets. Asian-Pacific Financial Markets, 6, 97-113.

- 16. Vecer, J. (2003) Pricing Asian Options in Semimartingale Model. Columbia University, New York.

- 17. Baxter, M. and Rennie, A. (1996) Financial Calculus: An Introduction to Derivative Pricing. Cambridge University Press, Cambridge, England.

http://dx.doi.org/10.1017/CBO9780511806636

Appendix

Then, using Ito’s formula for semimartingales (Protter [6] ), we have

And in differential form, this can be expressed as