Journal of Mathematical Finance

Vol.05 No.01(2015), Article ID:54072,8 pages

10.4236/jmf.2015.51005

A Regime Switching Model for the Term Structure of Credit Risk Spreads

Seungmook Choi1, Michael D. Marcozzi2

1Department of Finance, University of Nevada Las Vegas, Las Vegas, NV, USA

2Department of Mathematical Sciences, University of Nevada Las Vegas, Las Vegas, NV, USA

Email: seungmook.choi@unlv.edu, marcozzi@unlv.nevada.edu

Copyright © 2015 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 22 January 2015; accepted 10 February 2015; published 13 February 2015

ABSTRACT

We consider a rating-based model for the term structure of credit risk spreads wherein the credit- worthiness of the issuer is represented as a finite-state continuous time Markov process. This approach entails a progressive drift in credit quality towards default. A model of the economy is presented featuring stochastic transition probabilities; credit instruments are valued via an ultra parabolic Hamilton-Jacobi system of equations discretized utilizing the method-of-lines finite difference method. Computations for a callable bond are presented demonstrating the efficiency of the method.

Keywords:

Optimal Stopping, Failure Rate, Regime Switching, Credit Risk Spreads

1. Introduction

When pricing of credit instruments subject to default risk, market participants typically assume that default is unpredictable, using dynamics derived from rating information in order to take advantage of credit events (cf. [1] ). Generally, they fall into a loose hierarchy known as reduced-form models. The most ubiquitous approach involving hazard rate models wherein default risk via unexpected events is modeled by a jump process. In this framework, credit-risky securities are priced as discounted expectation under the risk neutral probability mea- sure with modified discount rate (cf. [2] , [3] ). Although conceptually simple and easy to implement, these models are limited by the appropriate calibration of the hazard rate process. More generally, spread modeling represents spreads directly and eliminates the need to make assumptions on recovery (cf. [4] , [5] ). Finally, rating based models consider the creditworthiness of the issuer to be a key state variable used to calibrate the risk-neutral hazard rate (cf. [6] - [8] ). A progressive drift in credit quality toward default (an absorbing state) is now allowed as opposed to a single jump to bankruptcy, as in many hazard rate models. Rating based models are particularly useful for the pricing of securities whose payoffs depend on the rating of the issuer.

In this paper, we consider a rating based regime switching model for the term-structure of credit risk spreads in continuous time (cf. [9] , [10] ). A unique feature of our model is the inclusion of stochastic transition pro- babilities. Credit instruments are then characterized as the solution to a ultraparabolic Hamilton-Jacobi system of equations for which we develop a methods-of-lines finite difference method. Computations are presented for a rating based callable bond which validates the applicability and efficiency of the method.

2. Model of the Economy

In this section, we introduce the dynamics of the risk-less and risky term structures of interest rates as well as the bankruptcy process. To this end, we assume the existence of a unique equivalent martingale measure such that all risk-less and risky zero-coupon bond prices are martingales after normalization by the money market account (cf. [11] , [12] ). Without loss of generality, we suppose a single risky zero-coupon bond price and continuous trading over a finite time interval . We let

. We let

denote a continuous time Markov process on the regime (or états) space

denote a continuous time Markov process on the regime (or états) space  with associated transition probabilities

with associated transition probabilities

, for all

, for all ; it follows that

; it follows that

(2.1)

(2.1)

for . Let

. Let  represent the

represent the  -state transition distribution.

-state transition distribution.

We define the transition probabilities as follows. The  -state we associate with default, in which case

-state we associate with default, in which case  . For

. For , we define the

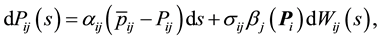

, we define the  -state transition dynamics consistent with the non- negativity constraint in (2.1) such that

-state transition dynamics consistent with the non- negativity constraint in (2.1) such that

(2.2a)

(2.2a)

for

and

We relate the transition matrix

such that

for

where

for

is known at inception such that

We suppose that the risky interest rate R follows a state specific Cox-Ingersall-Ross dynamic given by

for

where

We consider the risk-less interest rate

where in default

For a given contract

for

In particular, for a non-coupon paying bond

3. Characterization

Letting

we recover (2.6) succinctly as

for

where

Let

and

for all

for

4. Approximation Solvability

Towards obtaining a constructive approximation of (3.2), we consider an exhaustive sequence of bounded open domains

for all

for

where

We next place (4.1) into standard form by setting

Equation (4.1) becomes

for all

for

where

We consider the discretization of (4.2) by the backward Euler method temporally and central differencing in

space. To this end, we introduce the temporal step sizes

that

where

the difference quotients are then backward first order in time:

and central second-order in space:

and so forth, and

and so forth.

Given the above, we define the method-of-lines finite difference discretization of (4.2) such that

for all

for

where

and

do

do

solve for

5. Numerical Experiment

In this section, we present a representative computation for the valuation of a callable bond relative to three credit ratings:

and rating’s dependent pay-off contract

with expiry

in which only the default probability

For

where

and

Letting

for all

for all

for

and

for all

Figure 1. v1 (0, b, 0.05, pdef).

Figure 2. v2 (0, b, 0.05, pdef).

for

Figure 1 and Figure 2 show the value function components

Cite this paper

SeungmookChoi,Michael D.Marcozzi, (2015) A Regime Switching Model for the Term Structure of Credit Risk Spreads. Journal of Mathematical Finance,05,49-57. doi: 10.4236/jmf.2015.51005

References

- 1. Bielicki, T. and Rutkowski, M. (2002) Credit Risk: Modeling, Valuation and Hedging. Springer-Verlag, Berlin.

- 2. Lando, D. (1998) On Cox Processes and Credit Risky Securities. Review of Derivative Research, 2, 99-120.

http://dx.doi.org/10.1007/BF01531332 - 3. Duffie, D. and Singleton, K. (1999) Modeling Term Structures of Defaultable Bonds. Review of Financial Studies, 12, 687-720.

http://dx.doi.org/10.1007/BF01531332 - 4. Longstaff, F. and Schwartz, E. (1995) Valuing Credit Derivatives. The Journal of Fixed Income, 5, 6-12.

http://dx.doi.org/10.3905/jfi.1995.408138 - 5. Jobst, N. and Zenios, S.A. (2005) On the Simulation of Interest Rate and Credit Risk Sensitive Securities. European Journal of Operational Research, 161, 298-324.

http://dx.doi.org/10.1016/j.ejor.2003.08.044 - 6. Jarrow, R., Lando, D. and Turnbull, S. (1997) A Markov Model for the Term Structure of Credit Risk Spreads. Review of Financial Studies, 10, 481-523.

http://dx.doi.org/10.1093/rfs/10.2.481 - 7. Das, S. and Tufano, P. (1996) Pricing Credit Sensitive Debt When Interest Rates, Credit Ratings and Credit Spreads Are Stochastic. Journal of Financial Engineering, 5, 161-198.

- 8. Arvantis, A., Gregory, J. and Laurent, J.-P. (1999) Building Models for Credit Spreads. The Journal of Derivatives, 6, 27-43.

- 9. Elliott, R.J. and Mamon R.S. (2002) An Interest Rate Model with a Markovian Mean Reverting Level. Quantitative Finance, 2, 454-458.

http://dx.doi.org/10.1080/14697688.2002.0000012 - 10. Wu, S. and Zeng, Y. (2005) A General Equilibrium Model of the Term Structure of Interest Rates under Regime-Switching Risk. International Journal of Theoretical and Applied Finance, 8, 1-31.

- 11. Harrison, J.M. and Pliska, S. (1981) Martingales and Stochastic Integrals in the Theory of Continuous Trading. Stochastic Processes and Their Applications, 11, 215-260.

http://dx.doi.org/10.1016/0304-4149(81)90026-0 - 12. Jarrow, R. and Turnbull, S. (1995) Pricing Derivatives on Financial Securities Subject to Credit Risk. Journal of Finance, 50, 53-85.

http://dx.doi.org/10.1111/j.1540-6261.1995.tb05167.x - 13. Karlin, S. and Taylor, H. (1975) A First Course in Stochastic Processes. Academic Press, New York.

- 14. Elliott, R.J., Aggoun, L. and Moore, J.B. (1994) Hidden Markov Models: Estimation and Control. Springer-Verlag, New York.

- 15. Brémaud, P. (1998) Markov Chains: Gibbs Fields, Monte Carlo Simulation, and Queues. Springer-Verlag, New York.

- 16. Marcozzi, M.D. (2001) On the Approximation of Optimal Stopping Problems with Application to Financial Mathematics. SIAM Journal on Scientific Computing, 22, 1865-1884.

http://dx.doi.org/10.1137/S1064827599364647 - 17. Marcozzi, M.D. (2015) Optimal Control of Ultradiffusion Processes with Application to Mathematical Finance. International Journal of Computer Mathematics, 92, 296-318.

http://dx.doi.org/10.1080/00207160.2014.890714