Journal of Mathematical Finance

Vol. 2 No. 4 (2012) , Article ID: 24644 , 6 pages DOI:10.4236/jmf.2012.24034

From Dynamic Linear Evaluation Rule to Dynamic CAPM in a Fractional Brownian Motion Environment*

School of Science, Beijing University of Posts and Telecommunications, Beijing, China

Email: zqleii@gmail.com, 907871377@qq.com

Received May 29, 2012; revised June 3, 2012; accepted June 17, 2012

Keywords: Fractional Brownian motion; Clark-Haussmann-Ocone theorem; fractional Girsanov theorem; Evaluation operator; Capital asset pricing model

ABSTRACT

In this paper, we present the fundamental framework of the evaluation problem under which the evaluation operator satisfying some axioms is linear. Based on the dynamic linear evaluation mechanism of contingent claims, studying this evaluation rule in the market driven by fractional Brownian motions has led to a dynamic capital asset pricing model. It is deduced here mainly with the fractional Girsanov theorem and the Clark-Haussmann-Ocone theorem.

1. Introduction

In the 1960s, Sharpe (1964), Lintner (1965) and Mossin (1966) established the famous Capital Asset Pricing Model (CAPM for short). The CAPM has been used and cited in the literature over the past several decades. Some efforts have been made to extend this model. Dybvig and Ingersoll [1] investigated the relationship between the linear evaluation rule and the CAPM. They proved that the standard mean-variance separation theorem obtained in a complete market only if all investors had quadratic utility. In addition, the familiar CAPM pricing relation could hold for all assets in a complete market only if arbitrage opportunities existed. A description of the relationship between the linear evaluation rule and the theory of Markowitz portfolio choice can be found in [2], which they derived a general representation for asset prices that displayed the role of conditioning information. This representation was then used to examine restrictions implied by asset pricing models on the unconditional moments of asset payoffs and prices. An exhaustive discussion of the equivalence of these three theories (the linear evaluation rule, the CAPM and the theory of Markowitz portfolio choice) was presented in [3]. Shi [4] gave a fundamental probability model in the two-period security market. Under some conditions, if the linear evaluation rule holds, then there would be a stochastic discount factor. If this is true, all three theories (CAPM, linear evaluation rule and Markowitz portfolio choice) are equivalent. They are mainly deduced by the method of Hilbert space and stochastic discount factor. Particularly, CAPM could be deduced from the linear evaluation rule in the intertemporal market.

Since nowadays the market fluctuates promptly and dealings in securities require extremely high speed, no discrete-time model could adapt to the market well. However, the continuous-time model is regarded as a good approximation to real scenarios. If we assume that the model is continuous, then it facilitates the use of stochastic differential equations, stochastic analysis, and so on, to obtain some profound and concise conclusions. The famous Black-Scholes option pricing model is a classic issue of continuous-time finance. The fundamental theorem of asset pricing, the portfolio choice of securities and the CAPM all have their continuous-time version. Zhou and Wu [5] deduced the dynamic CAPM from the dynamic linear evaluation rule in the market driven by the Levy processes. They mainly used the predictable representation property in weak form and the Girsanov theorem of the Levy processes to obtain the results.

Ever since the pioneering work of Hurst [6,7] and Mandelbrot [8], the fractional Brownian motion has played an increasingly important role in various fields such as hydrology, economics, and telecommunications [9-12]. In this paper, we study the dynamic CAPM in the fractional Brownian motion environment, which represents a new perspective.

The remaining sections of this article are organized as follows: Some preliminaries of fractional Brownian motion are presented in Section 2. Section 3 presents the fundamental framework of the evaluation problem under which the evaluation operator satisfying some axioms is linear. In Section 4, we investigate the relationship between the dynamic linear evaluation rule and the dynamic CAPM in the market driven by fractional Brownian motions. Section 5 provides the conclusions.

2. Preliminaries of Fractional Brownian Motion

As preparation, collecting some important results concerning fractional Brownian motion is essential in this section. Also, it is necessary to introduce notation for further use.

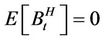

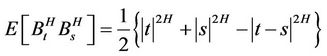

Recall that if 0 < H < 1, then the fractional Brownian motion with Hurst parameter H is a Gaussian process  with mean

with mean

and covariance

where  and

and  denotes the expectation with respect to the probability law for

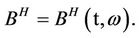

denotes the expectation with respect to the probability law for  Assume that

Assume that is defined on the

is defined on the  of subsets of

of subsets of  generated by the random variables

generated by the random variables . For simplicity we assume

. For simplicity we assume

If , then

, then  coincides with the standard Brownian motion

coincides with the standard Brownian motion , which has independent increments. If

, which has independent increments. If  then

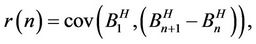

then  has a long-range dependence, in the sense that if we put:

has a long-range dependence, in the sense that if we put:

then

then .

.

For any  the process

the process  is self-similar in the sense that

is self-similar in the sense that  has the same law as

has the same law as  for any

for any  See [8,12] for more information about fractional Brownian motion.

See [8,12] for more information about fractional Brownian motion.

Due to these properties,  with Hurst parameter

with Hurst parameter  has been suggested as a useful tool in many applications [11], including finance.

has been suggested as a useful tool in many applications [11], including finance.

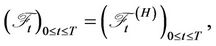

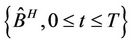

Fix a Hurst constant ,

,  Since H is fixedthe probability measure is denoted by P and the filtration is denoted by

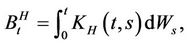

Since H is fixedthe probability measure is denoted by P and the filtration is denoted by . In this case we have the integral representation [13] and the references therein):

. In this case we have the integral representation [13] and the references therein):

where  is a standard Brownian motion (Wiener process) and

is a standard Brownian motion (Wiener process) and

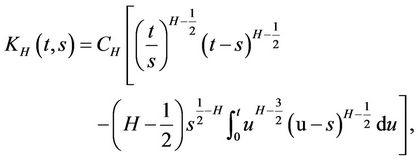

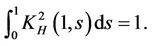

with  being a constant such that

being a constant such that

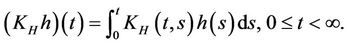

With this  we associate an operator

we associate an operator

Recently, stochastic calculus for fractional Brownian motion has been developed by many researchers [13,14].

2.1. Quasi-Conditional Expectation and Fractional Girsanov Theorem

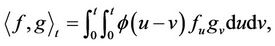

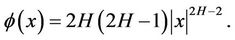

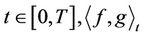

The quasi-conditional expectation is important to obtain the main results. It was initially introduced to find the hedging strategy in an application to finance [9]. Let f and g be two continuous functions on [0, T], where  is a fixed time horizon. Define

is a fixed time horizon. Define

where

when , denote:

, denote:

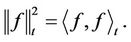

Apparently, for any  is a Hilbert scalar product. Let

is a Hilbert scalar product. Let  be the completion of the continuous functions under this Hilbert norm. The elements in

be the completion of the continuous functions under this Hilbert norm. The elements in  may be distributions [15].

may be distributions [15].

For any  let

let  denote the set of all real symmetric functions

denote the set of all real symmetric functions  variables on

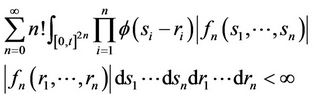

variables on  such that

such that

It is known [15] that  is a subspace of

is a subspace of  and they are not identical. Let

and they are not identical. Let  denote the set of

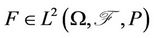

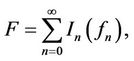

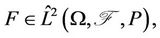

denote the set of  such that F has the following chaos expansion:

such that F has the following chaos expansion:

where  when restricted to

when restricted to  is in

is in  for all

for all and

and

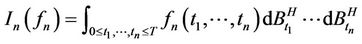

is the multiple stochastic integral (for the multiple integrals and the chaos expansion, [14,16].

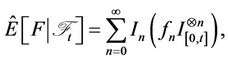

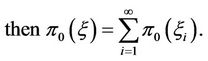

Definition 2.1 If  then the quasiconditional expectation [7] is defined as

then the quasiconditional expectation [7] is defined as

where

The following Lemma 2.1 (resp. Lemma 2.2) is from [17] Theorem 3.9 (resp. Theorem 3.11).

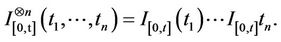

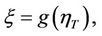

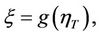

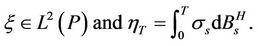

Lemma 2.1 Let  be continuous such that

be continuous such that  is an increasing function. Denote

is an increasing function. Denote  where g is a measurable real valued function of polynomial growth and

where g is a measurable real valued function of polynomial growth and  Then

Then

The following lemma is an analogue of the StriebelKallianpur formula. It is called a form of fractional Girsanov theorem.

Lemma 2.2 Let  and

and  be continuous functions of s in [0, T] and

be continuous functions of s in [0, T] and

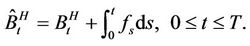

Consider the translation of

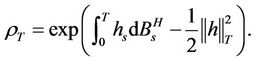

Let Q denote the probability measure given by

Then  is a fractional Brownian motion under Q. If

is a fractional Brownian motion under Q. If  satisfies the integral equation

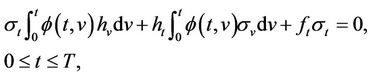

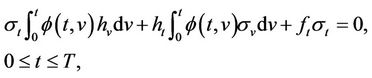

satisfies the integral equation

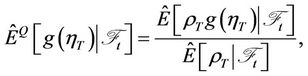

then for any measurable function g of exponential growth,

where

The above two lemmas are indispensable to the main results.

2.2. A fractional Clark-Haussmann-Ocone (CHO) Theorem

Finally let us review a fractional version of the ClarkHaussmann-Ocone (CHO) representation obtained in Theorem 4.5 in [9].

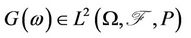

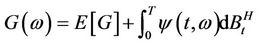

Lemma 2.3 Let  be

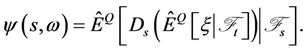

be  -measurable, then

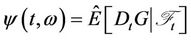

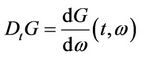

-measurable, then  exists. Define

exists. Define

Here  is the stochastic gradient (Malliavin derivative) of G at t. Then,

is the stochastic gradient (Malliavin derivative) of G at t. Then,

Refer to Section 4 in [9] for details.

3. Mechanism of Evaluation of Contingent Claims

The mathematical formulation to the evaluation problem is provided below.

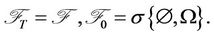

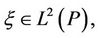

Let  be a complete probability space defined in Section 2, and

be a complete probability space defined in Section 2, and  a filtration satisfying the usual conditions,

a filtration satisfying the usual conditions,  Fix a time interval

Fix a time interval  and set

and set

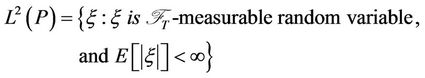

For all  define the inner product of these two random variables

define the inner product of these two random variables  Then

Then  is a Hilbert space, which denotes the subspace of all contingent claims.

is a Hilbert space, which denotes the subspace of all contingent claims.  is the space of

is the space of  -measurable and square-integrable random variables.

-measurable and square-integrable random variables.

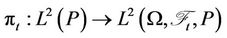

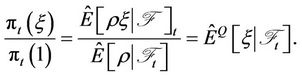

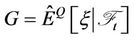

For all contingent claims , denote the evaluated value by

, denote the evaluated value by

At each time t,

is an evaluation operator. We will present the following axiomatic hypotheses of the evaluation operator:

(H1)

(H2)

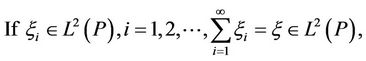

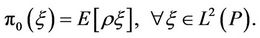

The following lemma is from [5] Lemma 2.1.

Lemma 3.1 For  hypotheses (H1) and (H2) hold if and only if it is a continuous linear function defined on

hypotheses (H1) and (H2) hold if and only if it is a continuous linear function defined on

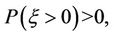

(H3) For each  if

if

, then

, then  , if in addition

, if in addition

then

then .

.

Remark 3.1 The financial meaning of hypothesis (H1) is self evident. Hypothesis (H3) is similar to that there is no arbitrage in the market. Hypotheses (H1)-(H3) are the static properties of the linear evaluation operator.

Remark 3.2 From Lemma 3.1, we know that  is a continuous linear function defined on the Hilbert space

is a continuous linear function defined on the Hilbert space . It then follows from (H3) and the Riesz representative theorem that: there exists

. It then follows from (H3) and the Riesz representative theorem that: there exists

, such that

, such that

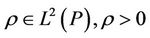

Since , by [16] Theorem 3.1 and 3.2, without loss of generality, we may assume that there exists a Borel measurable (deterministic) function

, by [16] Theorem 3.1 and 3.2, without loss of generality, we may assume that there exists a Borel measurable (deterministic) function  such that

such that

(H4) For each ,

,

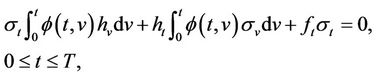

(3.1)

(3.1)

Remark 3.3 Hypothesis (H4) is the dynamic characteristic of the linear evaluation rules, which is shown uniquely in this paper. For the financial meaning of equation 3.1, you may see [5] Remark 2.2.

Now comes the explicit form of this evaluation operator in the market driven by fractional Brownian motion.

4. Deduce the Dynamic CAPM from the Dynamic Linear Evaluation Rule

4.1. The Explicit Form of the Evaluation Operator

Theorem 4.1 Let  be continuous such that

be continuous such that  is an increasing function. Denote

is an increasing function. Denote  where g is measurable real valued function of polynomial growth such that

where g is measurable real valued function of polynomial growth such that  If there exists a continuous function

If there exists a continuous function  satisfying the integral equation

satisfying the integral equation

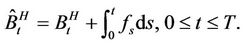

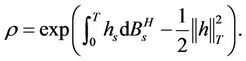

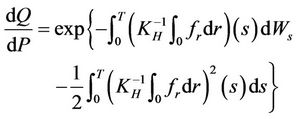

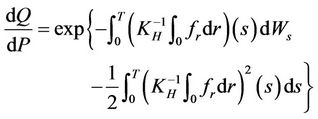

then let Q denote the probability measure given by

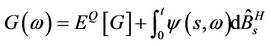

We have

(4.1)

(4.1)

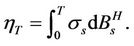

where

Here  is the stochastic gradient (Malliavin derivative) of G at s.

is the stochastic gradient (Malliavin derivative) of G at s.

Proof. Let  be continuous function such that

be continuous function such that  is an increasing function. Denote

is an increasing function. Denote  where g is measurable real valued function of polynomial growth such that

where g is measurable real valued function of polynomial growth such that  By Lemma 2.2, we know that if there exists a continuous function

By Lemma 2.2, we know that if there exists a continuous function  satisfying the integral equation

satisfying the integral equation

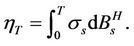

then consider the translation of

Let Q denote the probability measure given by

Then  is a fractional Brownian motion under Q. It follows from (3.1) and Lemma 2.2 that

is a fractional Brownian motion under Q. It follows from (3.1) and Lemma 2.2 that

Let . Define

. Define

where  is the stochastic gradient (Malliavin derivative) of G at s. By Lemma 2.1 and 2.3, we obtain that

is the stochastic gradient (Malliavin derivative) of G at s. By Lemma 2.1 and 2.3, we obtain that

Thus,

The theorem is proved.

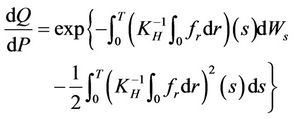

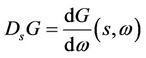

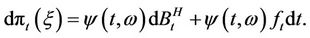

Suppose that  Remark Equation (4.1) can be formally expressed as

Remark Equation (4.1) can be formally expressed as

(4.2)

(4.2)

4.2. Deduce the Dynamic CAPM from the Dynamic Linear Evaluation Rule

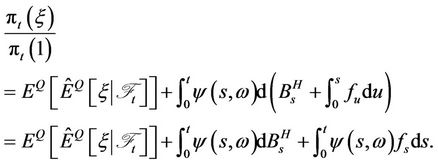

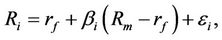

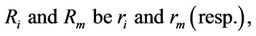

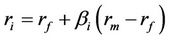

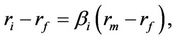

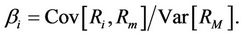

In fact, the CAPM attempts to relate  the one-period rate of return of a specified security i, to

the one-period rate of return of a specified security i, to  the oneperiod rate of return of the entire market (as measured, say, by the Standard and Poor’s index of 500 stocks). If

the oneperiod rate of return of the entire market (as measured, say, by the Standard and Poor’s index of 500 stocks). If  is the risk-free interest rate (usually taken to be the current rate of a US Treasury bill) then the model assumes that, for some constant

is the risk-free interest rate (usually taken to be the current rate of a US Treasury bill) then the model assumes that, for some constant

where  is a normal random variable with mean 0 that s values of

is a normal random variable with mean 0 that s values of

the CAPM model (which treats

the CAPM model (which treats  as a constant) implies that

as a constant) implies that

or, equivalently, that

or, equivalently, that  where

where

That is, the difference between the expected rate of return of the security and the risk-free interest rate is assumed to equal  times the difference between the expected rate of return of the market and the risk-free interest rate.

times the difference between the expected rate of return of the market and the risk-free interest rate.

From the above formula, we know that the rate of return of a single security is determined by the relationship between this single security and the market portfolio.

Assume that the non-risk interest rate is 0. Equation (4.2) indicates that the instantaneous return of the contingent claim can be decomposed into two parts. Containing fractional Brownian motion, the first term to the right side denotes the stochastic volatility and  denotes the volatility rate. The volatility rate changes in compliance with the change of the contingent claim

denotes the volatility rate. The volatility rate changes in compliance with the change of the contingent claim . In the other term, f is determined by the evaluation operator

. In the other term, f is determined by the evaluation operator  itself and it reflects the mechanism of the market.

itself and it reflects the mechanism of the market.  reflects the extent to which the instantaneous return of the contingent claim and the return of the market portfolio are related. Therefore, the instantaneous return of the contingent claim is mainly determined by this dependence. Equation (4.2) can be regarded as another version of CAPM. Accordingly, Equation (4.2) indicates that the instantaneous return of the contingent claim is mainly determined by the extent to which the instantaneous return of the contingent claim and the return of the market portfolio are related.

reflects the extent to which the instantaneous return of the contingent claim and the return of the market portfolio are related. Therefore, the instantaneous return of the contingent claim is mainly determined by this dependence. Equation (4.2) can be regarded as another version of CAPM. Accordingly, Equation (4.2) indicates that the instantaneous return of the contingent claim is mainly determined by the extent to which the instantaneous return of the contingent claim and the return of the market portfolio are related.

From the discussion above, we deduce the dynamic CAPM from the dynamic linear evaluation rule in the market driven by fractional Brownian motion.

5. Conclusion

In this paper, we first give some preliminaries of fractional Brownian motion. Then, we present the fundamental framework of the evaluation problem under which the evaluation operator satisfying some axioms is linear. Based on the dynamic linear evaluation mechanism of contingent claims, studying this evaluation rule in the market driven by fractional Brownian motions has led to a dynamic capital asset pricing model. It is deduced here mainly with the fractional Girsanov theorem and the Clark-Haussmann-Ocone theorem.

6. Acknowledgements

The authors would like to thank the referees for the careful reading of the paper and helpful suggestions. Part of this work was completed when author Zhou was visiting the University of Kansas. We would like to thank Professor Yaozhong Hu and David Nualart, and Dr. Alexander Uhl for their help.

REFERENCES

- P. H. Dybvig and J. E. Ingersoll, “Mean-Variance Theory in Complete Markets,” Journal of Business, Vol. 55, No. 2, 1982, pp. 233-251. doi:10.1086/296162

- L. P. Hansen and S. F. Richard, “The Role of Conditioning Information in Deducing Testable Restrictions Implied by Dynamic Asset Pricing Models,” Econometrica, Vol. 55, No. 3, 1987, pp. 587-614. doi:10.2307/1913601

- J. H. Cochrane, “Asset Pricing,” Princeton University Press, Princeton, 2001.

- S. Z. Shi, “Ten Presentations of Financial Econometrics,” Shanghai Dometic Publishing, Shanghai, 2004.

- Q. Zhou and W. X. Wu, “From Dynamic Linear Evaluation Rule to Dynamic Capital Asset Pricing Model,” System EngineeringTheory and Practice, Vol. 27, No. 5, 2007, pp. 48-54. doi:10.1016/S1874-8651(08)60033-2

- H. E. Hurst, “Long-Term Storage Capacity in Reservoirs,” Transactions of the American Society of Civil Engineers, Vol. 55, 1951, pp. 400-410.

- H. E. Hurst, “Methods of Using Long-Term Storage in Reservoirs,” Proceedings of the Institution of Civil Engineers Part 1, Vol. 5, 1956, pp. 519-590.

- B. B. Mandelbrot and J. W. Van Ness, “Fractional Brownian Motions, Fractional Noises and Applications,” SIAM Review, Vol. 10, No. 4, 1968, pp. 422-437. doi:10.1137/1010093

- Y. Hu and B. Øksendal, “Fractional White Noise Calculus and Applications to Finance, Infinite Dimensional Analysis,” Quantum Probability and Related Topics, Vol. 6, No. 1, 2003, pp. 1-32.

- Y. Hu, B. Øksendal and A. Sulem, “Optimal Consumption and Portfolio in a Black-Scholes Market Driven by Fractional Brownian Motion,” Infinite Dimensional Analysis, Quantum Probability and Related Topics, Vol. 6, No. 4, 2003, pp. 519-536. doi:10.1142/S0219025703001432

- B. B. Mandelbrot, “Fractals and Scaling in Finance: Discontinuity, Concentration, Risk,” Springer & Verlag, Berlin, 1997.

- A. Shiryaev, “On Arbitrage and Replication for Fractal Models,” In: A. Shiryaev and A. Sulem, Eds., Workshop on Mathematical Finance, INRIA, Paris, 1998.

- Y. Hu, “Integral Transformations and Anticipative Calculus for Fractional Brownian Motions,” American Mathematical Society, Providence, 2005.

- F. Biagini, Y. Hu, B. Øksendal and T. S. Zhang, “Stochastic Calculus for Fractional Brownian Motion and Applications,” Springer, London, 2008. doi:10.1007/978-1-84628-797-8

- V. Pipiras and M. S. Taqqu, “Integration Questions Related to Fractional Brownian Motion,” Probability Theory and Related Fields, Vol. 118, 2000, pp. 251-291. doi:10.1007/s440-000-8016-7

- T. E. Duncan, Y. Hu and B. Pasik-Duncan, “Stochastic Calculus for Fractional Brownian Motion,” SIAM Journal on Control and Optimization, Vol. 38, No. 2, 2000, pp. 582-612. doi:10.1137/S036301299834171X

- Y. Hu and S. Peng, “Backward Stochastic Differential Equations Driven by Fractional Brownian Motion,” SIAM Journal on Control and Optimization, Vol. 48, No. 3, 2009, pp. 1675-1700. doi:10.1137/070709451

NOTES

*This research is supported by the Natural Science Foundation of China under grants 11001029 and 10971220, the Fundamental Research Funds for the Central Universities (BUPT2012RC0709).