Journal of Mathematical Finance

Vol.2 No.1(2012), Article ID:17590,2 pages DOI:10.4236/jmf.2012.21005

Optimal Portfolio Control with Unknown Horizon

University of the West Indies, St. Augustine, Trinidad-and-Tobago

Email: malghalith@gmail.com

Received November 10, 2011; revised December 20, 2011; accepted December 28, 2011

Keywords: portfolio; investment; random horizon; stochastic

ABSTRACT

In this paper, we relax the assumption of a known time horizon in optimal control models.

1. Introduction

The literature on control and optimization mainly considered a known predetermined time horizon or infinite horizon. However, the previous studies did not examine the possibility of unknown (random) time horizon. Examples include Alghalith (2009) [1], Fleming (2004) [2], and Focardi and Fabozzi (2004) [3], among many others. In some cases, it is more realistic to assume that the horizon depends on some of the stochastic factors of the model and therefore it is random. Hence, it cannot be predetermined at the initial time. For example, the horizon of the investor might depend on the stochastic asset price or any other economic factor. Therefore the investor adjusts the horizon accordingly. Consequently, the assumption of a non-random horizon is somewhat restrictive.

In this paper, we relax the assumption of a known time horizon without significantly complicating the optimal solutions. As an example, we apply our methods to a stochastic factor incomplete markets investment model. In so doing, we provide solutions for the optimal portfolio under the assumption that the investor does not have a predetermined time horizon.

2. The Model

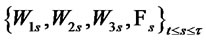

We consider an investment model, which includes a risky asset, a risk-free asset and a random external economic factor. We use a three-dimensional standard Brownian motion  based on the probability space

based on the probability space  where

where  is the augmentation of filtration. The risk-free asset price process is

is the augmentation of filtration. The risk-free asset price process is

where

where  is the rate of return and

is the rate of return and  is the stochastic economic factor.

is the stochastic economic factor.

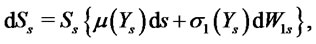

The dynamics of the risky asset price are given by

(1)

(1)

where  and

and  are the rate of return and the volatility, respectively. The economic factor process dynamics are given by

are the rate of return and the volatility, respectively. The economic factor process dynamics are given by

(2)

(2)

and .

.

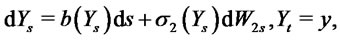

The stochastic terminal time is denoted by  and its dynamics are given by

and its dynamics are given by

We define

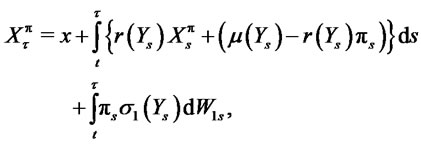

The wealth process is given by

(3)

(3)

where ![]() is the initial wealth,

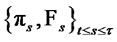

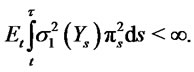

is the initial wealth,  is the portfolio process with

is the portfolio process with  The trading strategy

The trading strategy  is admissible.

is admissible.

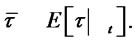

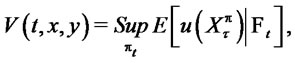

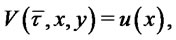

The investor’s objective is to maximize the expected utility of the terminal wealth

(4)

(4)

where  is the value function,

is the value function,  is a continuous, bounded and strictly concave utility function.

is a continuous, bounded and strictly concave utility function.

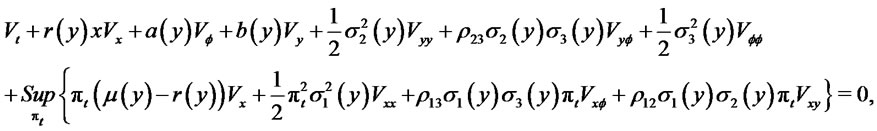

The value function satisfies the Hamilton-JacobiBellman PDE

(5)

(5)

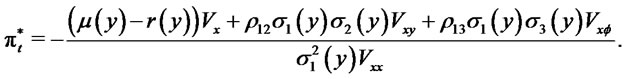

where  is the correlation coefficient between the Brownian motions. Hence, the optimal solution is

is the correlation coefficient between the Brownian motions. Hence, the optimal solution is

(6)

(6)

Clearly, following previous studies, we can obtain an explicit solution for specific functional forms of the utility such as an exponential utility function.

REFERENCES

- M. Alghalith, “A New Stochastic Factor Model: General Explicit Solutions,” Applied Mathematics Letters, Vol. 22, No. 12, 2009, pp. 1852-1854. doi:10.1016/j.aml.2009.07.011

- W. Fleming, “Some Optimal Investment, Production and Consumption Models,” Contemporary Mathematics, Vol. 351, 2004, pp. 115-124.

- F. Focardi and F. Fabozzi, “The Mathematics of Financial Modeling and Investment Management,” Wiley, New York, 2004.