Open Journal of Statistics

Vol.06 No.05(2016), Article ID:71110,12 pages

10.4236/ojs.2016.65064

Properties of Time-Varying Causality Tests in the Presence of Multivariate Stochastic Volatility*

Daiki Maki

Faculty of Economics, Ryukoku University, Kyoto, Japan

Copyright © 2016 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY 4.0).

http://creativecommons.org/licenses/by/4.0/

Received: August 15, 2016; Accepted: October 5, 2016; Published: October 8, 2016

ABSTRACT

This paper compares the statistical properties of time-varying causality tests when errors of variables have multivariate stochastic volatility (SV). The time-varying causality tests in this paper are based on a logistic smooth transition autoregressive model. The compared time-varying causality tests include asymptotic tests, heteroskedasticity-robust tests, and tests using wild bootstrap. Our simulation results show that asymptotic tests and heteroskedasticity-robust counterparts have size distortions under multivariate SV, whereas tests using wild bootstrap have better size properties regardless of type of error. In particular, the time-varying causality test with first-order Taylor approximation using wild bootstrap has better statistical properties.

Keywords:

Time-Varying Causality Tests, Wild Bootstrap, Multivariate Stochastic Volatility

1. Introduction

Granger causality is one of most representative methods to analyze causality between economic variables. It is based on linear vector autoregressive (VAR) models and investigates whether past information is effective for prediction. Although Granger causality is used for various studies, it can be applied to examine only stable linear relationships in the long run. The relationship between economic variables is not necessarily stable in the long run and frequently has time-varying properties. This implies that a causality relationship can also be time-varying, and hence we should take into account the time-varying properties when analyzing a causality relationship.

One method to introduce time-varying properties to Granger causality is through the use of a logistic smooth transition (LST) function. By using an LST function with time as the transition variable, we can test for both smooth and abrupt causalities. When a causality has such nonlinearity, the usual Granger causality tests based on a linear VAR model have low power and tend to give the misleading result of having no causalities in the system. [1] [2] and [3] proposed nonlinear causality tests. Their analyses also showed significant nonlinear causality.

While time-varying causality is significant for the precise analysis of variables, heteroskedastic variances influence the tests for causality and nonlinearity such as time- varying properties. For example, [4] provided Monte Carlo evidence that causality tests have size distortions under heteroskedastic variances. In addition, [5] and [6] showed that heteroskedastic variances lead to spurious nonlinearity. Several economic variables investigated using Granger causality have heteroskedastic variances such as stochastic volatility (SV) (e.g., [7] and [8] ). Therefore, if we do not deal appropriately with heteroskedastic variances in the tests for causality, we would not be able to obtain reliable results when examining for time-varying causality. However, previous studies have not clarified the influences of heteroskedastic variances on time-varying causality tests.

This paper investigates the statistical properties of time-varying causality tests when the disturbance terms have SV. The investigated tests include asymptotic tests based on first-order and third-order Taylor approximation and their counterparts with the heteroskedasticity-consistent covariance matrix estimators (HCCME) as introduced by [9] . As pointed out by [10] , the order of Taylor approximation affects the performance of linearity tests. We reveal the impact of the order of Taylor approximation on time- varying causality tests in the presence of SV. We also examine the time-varying causality tests using wild bootstrap. Wild bootstrap was proposed by [11] and replicates a sampling that does not depend on the form of heteroskedastic variances. [12] and [13] examine the properties of tests using wild bootstrap. We show which tests perform well even under SV by analyzing the size and power of the tests.

Our simulation results provide evidence that asymptotic time-varying causality tests and their counterparts with HCCME over-reject the null hypothesis of no causality in the presence of SV. This implies that their tests tend to yield misleading and unreliable results. In particular, their tests based on third-order Taylor approximation have larger distortions than those based on first-order Taylor approximation. In contrast, we find that time-varying causality tests using wild bootstrap have reasonable empirical sizes and sufficient power. The results of this paper would enable appropriate and reliable time-varying causality tests.

The rest of this paper is organized as follows. Section 2 presents time-varying causality tests. Section 3 provides the size and power properties of tests. Finally, Section 4 concludes the paper.

2 Time-Varying Causality Tests

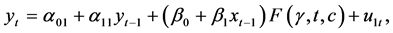

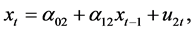

We consider the following bivariate vector autoregressive system to test for time-varying causality relationship.

(1)

(1)

(2)

(2)

where  and

and  are zero mean errors and

are zero mean errors and  is a logistic smooth transition function to model time-varying causality. The transition function

is a logistic smooth transition function to model time-varying causality. The transition function  can be given by

can be given by

(3)

(3)

where  is a parameter determining the function’s smoothness, t is a transition variable, and c is the point where a regime changes from one to another. We assume that

is a parameter determining the function’s smoothness, t is a transition variable, and c is the point where a regime changes from one to another. We assume that ,

,  , and

, and . The system has a causality from

. The system has a causality from  to

to  when

when  and

and .

.  means a time-varying constant. When

means a time-varying constant. When , the causality from

, the causality from

have

when

The null and alternative hypotheses to test for time-varying causality in the system are

If

The regression models for (1) using the first-order and third-order Taylor series approximation are given by

where

where

Testing for time-varying causality is expressed as

The Wald statistics to test for time-varying causality are derived as

where

where

Wild bootstrap is also used for regression models with heteroskedastic variances to obtain reliable results. The method can simply resample heteroskedastic variances like SV. This paper employs the recursive-design wild bootstrap. The testing procedure is as follows.

Step 1. Compute test statistics (11) and (12) by applying (7) and (8) to the data.

Step 2. Estimate the system using the restricted model with

Step 3. Obtain the estimates

Step 4. Generate the bootstrapped sample as

where

Step 5. Compute test statistics (11) and (12), denoted as WB1 and WB3, by applying (7) and (8) to the generated bootstrap sample.

Step 6. Repeat the bootstrap iterations M for steps 4 and 5. We obtain M statistics WB1 and WB3.

Step 7. Compute the bootstrap p-values as follows:

3. Size and Power Properties

This section conducts Monte Carlo simulations to compare the size and power properties of causality tests under multivariate SV. The nominal size of the tests is 0.05, and we consider sample sizes

We first investigate the size properties based on data generating process (DGP) given as

where

The correlation parameter

Table 1(a) presents the size properties of tests for normal error. We investigate two cases of

We next examine the empirical sizes of tests under multivariate SV. The property of SV is that volatility is influenced by an error and changes stochastically. Multivariate SV allows for the correlation between errors of volatilities.

where

Here,

where

The regression parameter

Table 1(b) presents the size performance of tests under symmetric multivariate SV with

Table 1. (a) Size properties under normal error; (b) Size properties under symmetric multivariate stochastic volatility; (c) Size properties under asymmetric multivariate stochastic volatility.

Asymmetric multivariate SV also results in size distortions for causality tests. We set

We next investigate the power properties based on DGP, given as

where c is the point at which a regime changes from one to another. We set c to

Table 2(a) reports the power performance of tests under normal errors

Table 2(b) presents the power properties under multivariate SV. SV is generated by (22) with

4. Conclusion

This paper investigated the statistical properties of time-varying causality tests when the errors of variables have multivariate SV. It is important to clarify the statistical properties of time-varying causality tests under SV, because economic variables often have SV and the relationship between them is time-varying. The tests we compared include the standard linear Granger causality and the time-varying causality tests, their tests with HCCME, and their tests using wild bootstrap. Simulation results indicate that time-varying causality tests and their counterparts with HCCME have size distortions

Table 2. (a) Power properties under normal error; (b) Power properties under multivariate stochastic volatility.

under highly persistent SV. Standard linear Granger causality tests perform relatively well under SV but has low power under time-varying causality. In contrast, time-varying causality tests using wild bootstrap have better size properties regardless of type of error. In particular, the time-varying causality test with first-order Taylor approximation and wild bootstrap has better statistical properties. These results indicate that the time-varying causality test with first-order Taylor approximation and wild bootstrap is reliable and useful to test for time-varying causality.

Cite this paper

Maki, D. (2016) Properties of Time-Varying Causality Tests in the Presence of Multivariate Stochastic Volatility. Open Journal of Statistics, 6, 777- 788. http://dx.doi.org/10.4236/ojs.2016.65064

References

- 1. Christopoulos, D.K. and León-Ledesma, M.A. (2008) Testing for Granger (Non-)Causality in a Time-Varying Coefficient VAR Model. Journal of Forecasting, 27, 293-303.

http://dx.doi.org/10.1002/for.1060 - 2. Li, Y. and Shukur, G. (2011) Linear and Nonlinear Causality Tests in an LSTAR Model: Wavelet Decomposition in a Nonlinear Environment. Journal of Statistical Computation and Simulation, 81, 1913-1925.

http://dx.doi.org/10.1080/00949655.2010.508163 - 3. Hatemi-J, A. (2012) Asymmetric Causality Tests with an Application. Empirical Economics, 43, 447-456.

http://dx.doi.org/10.1007/s00181-011-0484-x - 4. Vilasuso, J. (2001) Causality Tests and Conditional Heteroskedasticity: Monte Carlo Evidence. Journal of Econometrics, 101, 25-35.

http://dx.doi.org/10.1016/S0304-4076(00)00072-5 - 5. Van Dijk, D., Franses, P.H. and Lucas, A. (1999) Testing for Smooth Transition Nonlinearity in the Presence of Outliers. Journal of Business and Economic Statistics, 17, 217-235.

- 6. Pavlidis, E., Paya, I. and Peel, D. (2010) Specifying Smooth Transition Regression Models in the Presence of Conditional Heteroskedasticity of Unknown Form. Studies in Nonlinear Dynamics and Econometrics, 14, Article 3.

- 7. Asai, M., McAleer, M. and Yu, J. (2006) Multivariate Stochastic Volatility: A Review. Econometric Reviews, 25, 145-175.

http://dx.doi.org/10.1080/07474930600713564 - 8. Vo, M. (2011) Oil and Stock Market Volatility: A Multivariate Stochastic Volatility Perspective. Energy Economics, 33, 956-965.

http://dx.doi.org/10.1016/j.eneco.2011.03.005 - 9. White, H. (1980) A Heteroskedasticity-Consistent Covariance Matrix Estimator and a Direct Test for Heteroskedasticity. Econometrica, 14, 1261-1295.

http://dx.doi.org/10.2307/1912934 - 10. Van Dijk, D., Terasvirta, T. and Franses, P.H. (2002) Smooth Transition Autoregressive Models—A Survey of Recent Developments. Econometric Reviews, 21, 1-47.

http://dx.doi.org/10.1081/ETC-120008723 - 11. Liu, R.Y. (1988) Bootstrap Procedure under Some Non-i.i.d. Models. Annals of Statistics, 16, 1696-1708.

http://dx.doi.org/10.1214/aos/1176351062 - 12. Davidson, R. and Flachaire, E. (2008) The Wild Bootstrap, Tamed at Last. Journal of Econometrics, 146, 162-169.

http://dx.doi.org/10.1016/j.jeconom.2008.08.003 - 13. Grobys, K. (2015) Size Distortions of the Wild Bootstrapped HCCME-Based LM Test for Serial Correlation in the Presence of Asymmetric Conditional Heteroscedasticity. Empirical Economics, 48, 1189-1202.

http://dx.doi.org/10.1007/s00181-014-0817-7 - 14. Davies, R.B. (1977) Hypothesis Testing When a Nuisance Parameter Is Present Only under the Alternative. Biometrika, 64, 247-254.

http://dx.doi.org/10.1093/biomet/64.2.247 - 15. Davies, R.B. (1987) Hypothesis Testing When a Nuisance Parameter Is Present Only under the Alternative. Biometrika, 74, 33-43.

- 16. Luukkonen, R., Saikkonen, P. and Terasvirta, T. (1988) Testing Linearity against Smooth Transition Autoregressive Models. Biometrika, 70, 491-499.

http://dx.doi.org/10.1093/biomet/75.3.491 - 17. Harvey, A., Ruiz, E. and Shephard, N. (1994) Multivariate Stochastic Variance Models. Review of Economic Studies, 61, 247-264.

http://dx.doi.org/10.2307/2297980 - 18. Asai, M. and McAleer, M. (2006) Asymmetric Multivariate Stochastic Volatility. Econometric Reviews, 25, 453-473.

http://dx.doi.org/10.1080/07474930600712913

*This research was supported by KAKENHI (Grant number: 15K03527).