Modern Economy, 2011, 2, 114-123 doi:10.4236/me.2011.22016 Published Online May 2011 (http://www.SciRP.org/journa l/ me ) Copyright © 2011 SciRes. ME The Interaction of Monetary and Fiscal Policy: The Brazilian Case Tito Belchior Silva Moreira1, Fernando Antônio Ribeiro Soares2, Adolfo Sachsida3, Paulo Roberto Amorim Loureiro4 1Department of Economics, Catholic University of Brasília, Brasília, Brazil 2Brazilian Ministry of Defense, Bra sília, Brazil 3Instituto de Pesquisa e Economia Aplicada, Brasília, Brazil 4Universidade de Br as ília, Brasília, Brazil E-mail: tito@pos.ucb.br, fernando.a.r.soares@gmail.com, sachsida@hotmail.com, loureiro77@hotmail.com Received December 6, 2011; revised March 18, 2011; accepted M ar ch 20, 2011 Abstract We tested, empiricall y , wheth er th e Brazilian fiscal po licy for the p erio d between 199 5: I to 2008: III was ac- tive or passive. To analyze fi scal policy transmissio n mechanis ms, we estimated funct ions by which t he pub- lic debt/GDP ratio affects investment, primary surplus, output gap and the demand for money. The ratio of public debt to GDP was found to be statistically significant, positively affecting the demand for money and the primary surplus, whereas it was found to negatively affect the level of investment and the output gap. We conclude that the Brazilian reg ime was non-Ricardian in the context of fiscal dominance. Keywords: Active and Passive Polici es, Non-Ricardian R egime, Public Debt and Fiscal Do mi nance Regime 1. Introduction Since 1999, Brazil has been under an inflation targeting regime in an environment of fiscal imbalance, illustrated by the successive nominal deficits generated in recent decades. Despite the successive primary surpluses generated in recent years and a relatively stable ratio of public debt to GDP, the trajectory and profile of the Brazilian public debt continue to constitute a cause for concern, especially if we consider the rise in the ratio of debt to GDP after the recent bank crisis/financial crisis (subprime crisis) that has gripped the world. The sharp reduction in the level of economic activities since the last quarter of 2008 due to subprime crisis and the strong retraction in the Brazilian output growth rates in 2009 contr i buted to reduce the publ ic revenues, whe re a s the level of government expenditure increased. The high interest rates imposed by the Brazilian Cen- tral Bank (BCB) in order to reach the inflation targets con- tribute to making the cost of servicing the debt higher than the primary surplus. Despite the recent reduction in the nominal interest rate in 2009, Brazil still has one of the highest real interest rates in the world. Continuous growth of the nominal deficit and, cones- quently, of the public debt, makes the fiscal imbalance particularly worrisome, due to the high public debt stock and the elevated short-term liabilities in a scenario of strong retr action of the wor ld economy and, the refore, of the national economy. The principal objective of this study was to test, em- pirically, whether fiscal policies have had, from 1995: I to 2008: III, an impact on real variables such as the real demand for money, the ratio of investment to GDP and the output gap. Hence, we aimed to investigate whether the Brazilian economy supports the Ricardian equiva- lence hypothesis. We also test, empirically, whether or not the monetary and fiscal policies are passive or active based on Leeper model [1]. To that end, we tested certain non-Ricardian models, such as those devised by [2-4]. In addition, we aimed to analyze the transmission mechanisms of fiscal policy by estimating the relationship between the primary surplus and public debt, as well as the “fiscal” investmen t -sav - ings (IS) curve. The use of the term “fiscal” IS was based on the fact that a fiscal variable was used in the estima- tion. For the present study, we used the ratio of the pri- mary surplus to GDP. We also determined whether the fiscal variable, public debt, was significant and to what extent it affected the investment rate, the output gap and  T. B. S. MOREIRA ET AL. Copyright © 2011 SciRes. ME the demand for money. In other words, we analyzed whether the fiscal policy was active in the period ana- lyzed. The basis of this discussion is the con cept of Ricardian equivalence, as proposed by [5]. The general principle of Ricardian equivalence is that the government debt is equivalent to future taxes and, if consumers are suffi- ciently prudent, future taxes will be equivalent to current taxes. Therefore, to finance the government by increase- ing the debt is equivalent to financing by raising taxes. The implication of Ricardian equivalence is that fiscal cuts financed by debt do not alter consumption. Families save the extra disposable income to pay for the future fiscal liability caused by the fiscal cuts. This increase in private savings compensates precisely for the reduction in public savings. National savings re- main unaltered. In the present study, we attempted to determine whether the public debt truly matters. 2. Monetary and Fiscal Policies: A Brief Discussion Since the 1970s, Brazil has systematically shown i nternal or external macroeconomic disequilibrium. This condition generated substantial inflation. To attenuate this effect, policymakers resorted to stabilization policies. These policies frequently result in internal or external debt dis- equilibrium. One of the possible explanations to the debt stock disequilibrium is the possible inconsistency be- tween fiscal and monetary policies. The debate between monetary and fiscal policies has been restricted to the discussion between rules versus discretionary behavior. Nowadays, this discussion has mainly emphasized the inflation targeting pro posals. The optimal monetary policy rule as sumes that the fiscal pol- icy is not relevant to the monetary policy. It is assumed implicitly that public debt is solvent. In other words, the fiscal authorities always adjust the taxes in order to guarantee debt solvency. In fact, in a fiduciary regime, the debt will always be solvent given that it is possible to use the seigniorage as source of revenue. With the fiscal policy neglected, the discussion about coordination be- tween monetary and fiscal policies is weakened. In this context, some researchers place emphasis on the discus- sion related to the coordination between monetary and fiscal policies to keep economic stability. Sargent and Wallace [6], for example, discuss this question in their seminal work related to the unpleasant monetarist arith- metic. Reference [6] show that if the monetary policy affects the extent to which the seigniorage is exploited as a source of revenue, then the monetary and fiscal policies should be coordinated. In this sense, the price stabiliza- tion policy depends on the following question: who acts first, the fiscal or the monetary authority? Or, who im- poses discipline on whom? The unpleasant monetarist arithmetic suggested by the authors appears in a process of policy coordination in which the fiscal policy domi- nates monetary policy and the monetary authority con- fronts itself with restrictions imposed by the demand of government bonds. This is a possible case of active fiscal policy and pass ive monet a ry behavior. Many papers show the equilibrium policy as the result of a game between fiscal and monetary authorities. Ref- erence [7], for example, makes the description of a Ri- cardian regime in which the monetary authority is the dominant player while the fiscal authority is the follower. In this sense, the fiscal authority increases the fiscal tax to satisfy the condition of budget equilibrium. This is an example of a passive fiscal policy and active monetary policy. According to [1], what distinguishes an active policy from a passive one is the fact that the active policy takes into account the expected future while the passive one relies on the behavior of current and past values of eco- nomic variables. Thus, an active policy is not restricted by current conditions and may well include a choice of a decision rule that depends on past, current or future val- ues of economic variables. A passive policy or passive authority (fiscal or mone- tary), on the one hand, is restricted by decisions of con- sumer optimization and by the actions of the active au- thority, on the other hand. If the fiscal policy is passive, for example, the decision rule of the fiscal authority will necessarily depend on the public debt, current or past. Reference [8] emphasizes that the discussion related to fiscal dominance is not new. It appeared in the literature in the works such as [6,9]. Reference [9] states that the price of bonds is analogous to the price level, and the nominal rate of interest is determined by the bond/money ratio and bears no close relationship to the rate of expan- sion of the price level. The recent developments were started with the Fiscal Th eory of the Price Level (FTPL) of [10]. The studies of [1,11-18] concentrate on the dis- cussion about coordination and interaction between the monetary and fiscal policies. The main point emphasized by the research on the FTPL is that the intertemporal government budget con- straint and the fiscal policy are the determining factors for the price level. This argument runs counter to the tra- ditional theory of price determination, in which the stock of money and the monetary authority are the only deter- minant of the price level. Moreover the fiscal policy, ex- plicitly or implicitly, passively adjusts the primary sur- plus to guarantee government solvency for any price level. Since the fiscal authority is free to choose the pri-  T. B. S. MOREIRA ET AL. Copyright © 2011 SciRes. ME mary surplus, independently of the government debt, then it is the price level th at has to adjust itself to satisfy the intertemporal government budget constraint in a way that there is only one price level compatible with the equilibri um. The FTPL can be understood, in a simplistic way, as an application of one of the aspects discussed by [6], where the fiscal policy imposes restrictions on the extent of results from the monetary policy. The main distinction between the classic theory and FTPL lies in the interpretation of the intertemporal gov- ernment budget. According to the monetarist tradition, the government intertemporal equation is a constraint that is assured for any price level. According to the FTPL, the government intertemporal equation is an equilibrium condition determining the equilibrium price lev e l. The distinction between Ricardian and non-Ricardian regimes brings important implications to economic poli- cies. Based on the Ricardian regime, a good monetary policy is a necessary and sufficient condition to guaran- tee low inflation. An independent central bank, with a strong institutional commitment towards price stability, should compel the fiscal authority to adopt a responsible and appropriate fiscal policy. For the non-Ricardian re- gime, a good monetary policy is not a sufficient condi- tion to ensure low inflation, unless additional measures are taken into consideration to restrict the freedom of the fiscal authority. 3. Methodological Aspects The principal source of the quarterly database regarding the period between 1995:I and 2008:III was the Instituto de Pesquisa Econômica Aplicada (IPEA)1. The variables collected from the IPEA database and adopted in the present study, as well as their respective abbreviations (in parentheses), were as follows: money supply (M) - end of p eriod - in millions of Br azilian Reals (R$); GDP (Y) - market prices - in millions of R$; nominal interest rate (R) - over/SELIC - in %; investment (I) or gross formation of fixed capital, in millions of R$; amplified consumer price index (P); nominal R$/US$ exchange rate (E), as official rate, purchase price and mean; real effective exchange rate (e); primary surplus (PS) in mil- lions of R$, and the direct tax ( ) in millions of R$ is given by the sum of income and land taxes. As a proxy for the public debt, we used the federal government bonds and open market operations (B), the source of which is the BCB. We also used a dummy variable to distinguish be- tween the period of the fixed exchange rate regime (1995: I to 1998: IV) and the subsequent period of the “flexible” exchange rate. The real GDP was calculated according to the implicit GDP deflator. The Hodrick-Prescott filter was used in order to calculate the output gap (y) defined as the difference between the real GDP and the potential GDP (trend). A positive value indicates excess demand. To calculate the real interest rate (r) the Amplified Con- sumer Price Index was used. The real interest rate was calculated in the tradition al mann er, in which 1t R+ = 1 1 *1π t tt rE + ++ , assuming that ππ tt t E =. The estimated time series models are described in item 4. We used the Johansen cointegration test and the unit root test, as well as models of simultaneous equations, such as the generalized method of moments (GMM) with instrumental variables. The long-term equations resultin g from the cointegration tests were analyzed, focusing es- pecially on whether the public debt was significant and presented the sign expected based on the theoretical model. Other standard techniques for time series, such as tests of weak exogeneity, were also used. The economet - ric techniques used in the present study have been widely applied and are described in various books on the subject ([19-22 ]). We used the GMM with instrumental variables to es- timate a system of equations. When the variables are not stationary, one can expect specific problems regarding the conventional inference procedures based on ordinary least squares regression. Reference [20] stating that it was necessary to know whether similar problems arose in the context of two-stage lea st squar es regression when facing such problems. This has been investigated by [23] and [24], who concluded that inferences with two-stage least squares estimators using instrumental variables were still valid, even in cases of non-stationary or non- cointegrated series. In this context, the conclusions drawn by [23,24] are also valid when the GMM is ap- plied. 4. The Non-Ricardian Models and Their Empirical Resu lts In the next four subsections we estimated functions by which the public debt/GDP ratio affects investment, de- mand for money, primary surplus and output gap to ana- lyze fiscal policy transmission mechanisms. 4.1. Effect of the Public Debt on Investment Reference [2] demonstrated that it is possible to have sustainable long-term growth in a model of a sector in which generations overlap. They assume the presence of a convex technology, without redistribution of income from the older to the younger generation, with taxation via income tax and without the pure altruism of [5]. 1Institute for Applied Economic Research.  T. B. S. MOREIRA ET AL. Copyright © 2011 SciRes. ME Working with the so-called “AK” production function and assuming the hypothesis that the utility function of the agent incorporates an absolute bequest motive, ref- erence [2] derives a clear implication of the model po licy, i.e., an increase in the government debt adversely affects the rate of growth of the capital stock, as exemplified in the following equation: ()( ) 1 1 1 11 t ttt t K KBK A δ − −− = − + ++ (1) where Kt is the capital stock at the beginning of period t; Bt is the stock of government debt bonds at the beginning of period t; A represents technology; and the coefficient indicates the preferences of the agents. This equation shows that the rate of growth of the cap- ital stock is endogenous. In this context, the public debt as a proportion of the capital stock in the previous period adversely affects the rate of capital accumulation. Considering that the difference between the capital stock in t and the capital stock in (t − 1) is the investment (1 KK I − ), and that , Equation (1) can be rewritten as follows: 1 011 * tt tt IYBY ββ = + (2 ) where and . The equation can then be esti- mated with log-transformed variables, as follows: 1 011 * tttt t IYBY u ββ (3 ) where the parameter 1 β shows the relationship b etween the ratios of debt (t) to GDP (t − 1) and of investmen t (t) to GDP (t − 1); 0 β is the intercept parameter; and t u is the error (stochastic term). We then determined whether the parameter 1 β was statistically significant, that is, whether it was different from zero, and its respective sign. If 1 β is negative and statistically significan t, we can infer that the ratio of debt to GDP negatively affected the ratio of investment (t) to GDP (t − 1). In other words, if 1 β = 0, the hypothesis of Ricardian equivalence can be established. We initially determined whether the aforementioned variables were stationary. In case the variables were not stationary, we attempted to determine whether they were cointegrated. The table presented in Appendix shows that both variables were non-stationary. Therefore, we needed to employ a cointegration test to determine whether the regression was validated, i.e., whether or not the regres- sion was spurio us. The Johansen cointegration test showed that there was a cointegration equation with a level of significance of 5%, as shown in the Tables A.2 and A.3 in Appendices . A dummy variable was used (as an exogenous variable in the VAR model used in the present study) to distin- guish between the period of the fixed exchange rate re- gime (1995: I to 1998: IV) and the subsequent period of the “flexible” exchange rate. The resulting long-term equation showed that the pa- rameter 1 β was statistically significant, as follows: ( ) () () 11 1.621 0.220 0.073 0.116 tt tt IYBY −− =−− (4 ) The values in parentheses represent the standard de- viations of the respective coefficients estimated. Ac- cording to the long-term equation, we observed that for each 1% increase in the ratio of debt (t) to GDP ( ) there was a 0.22% reduction in the ratio of investment (t) to GDP ( ). The negative correlation (Pearson) be- tween these two variables was of −27.3%, at a level of significance of 5%. In addition, based on the chi-square statistic (1.819), th e null hypothesis of weak endog eneity was not rejected (p = 0.177), i.e., the ratio of debt (t) to GDP ( ) was weakly exogenous. We observed that the public debt did affect the real variable in the economy, i.e., the ratio of investment to GDP. Such empirical evidence suggests the need for a clear public policy prescription: the government should aim to reduce the ratio of debt to GDP. A reduction in the ratio of debt to GDP translates to a higher invest- ment/GDP ratio. 4.2. Effect of the Public Debt on the Demand for Money Reference [3] defined the real demand for money as a function of a negative relationship with the nominal in- terest rate and a positive relatio nship with output and r eal wealth2. Real net wealth is defined using the following equation: W MPBP β = + (5) where W is the value of real net wealth of private agents; is the fraction of government bonds that private agents perceive as net wealth ( ); B is the nomi- nal stock of government debt bonds; Y/P is the real out- put; R is the nominal interest rate; P is the price level; and M is the no minal money supply. Therefore, the defi- nition of real demand for money is given by this equa- tion: ( )() 1 23 MPLYPLRL MPBP β = +++ (6) According to [3], after dividing Equation (6) by Y/P we would have the fol l owing equation: 12 3 mLLRL mb β =++ + (7) 2Reference [4] employed a similar app roach to the real demand for mo- ney in the context of non-Ricardian equivalen ce.  T. B. S. MOREIRA ET AL. Copyright © 2011 SciRes. ME where 10 >, 20 < and 30 >; =; and =. Equati on ( 7) can be rewritten as: () ()() 1323 33 11 1m LLLLRLLb β = −+− +− (8) On the bas is of Equation (8) , we can defin e a stochas- tic equation: 01 2tt tt m Rb βββ η (9 ) where 1 β =− , 1 β =− and . If was statistically equal to zero, the hypothesis of Ricardian equivalence was established. We estimated Equation (10) with log-transformed variables. The table in Appendix A.1 shows that m, b and R were not station- ary. The Johansen cointegration test showed that there were two cointegration equations at a level of signify- cance of 5%, as shown in the Tables A.4 and A.5 in Appendices. We again used the dummy variable as an ex- ogenous variable in the VAR model. The long-term equation showed the following: () ()() 1.924 0.2860.820 0.088 0.087 0.114 t tt m Rb=−− + (10) The values in parentheses represent the standard de- viations of the respective coefficients estimated. Ac- cording to the long-term equation, we noted that for each 1% increase in the ratio of debt to GDP there was a 0.82% increase in the demand for money. There was a positive correlation (Pearson) of 94.2% between these two variables at a level of significance of 1%. On the basis of the chi-square statistic (15.197), the null hypo- thesis of weak endogeneity of the ratio of debt to GDP was rejected (p < 0.001). As expected, there was a nega- tive correlation between the interest rate and the demand for money. We observed that for each 1% increase in nominal interest rate there was a 0.286% reduction in the demand for money. 4.3. Effect of the Public Debt on the Primary Surplus Reference [25] evaluated the sustainability of the fiscal policy based on the response of the primary surplus (ex- cept fo r interest rates)/GDP ratio to changes in the public debt/GDP ratio. We simplified this relatio nship through a regression with log-transformed varia bles as follows: () () 0.004 0.031* 0.0020.003 PSYB Y= + (11) The Tables (A.6) and (A.7) in the appendices show that both variables were I(1), and that they cointegrated at a level of significance of 5%. The values in parenthe- ses represent the standard deviations of the respective coefficients estimated. According to the long-term equation, we noted that for each 1% increase in the ratio of debt to GDP there was a 0.031% increase in the ratio of the primary surplus to GDP. The positive correlation (Pearson) between the two variables was 74.7%, at a level of significance of 5%. We also observed that, based on the chi-square statistic (1.168), the null hypothesis of weak endogeneity was not rejected (p = 0.279), i.e., the ratio of debt to GDP was weakly exogenous. 4.4. Effect of the Public Debt on the Primary Surplus and on the Output Gap In this section, we estimated the equations of the fiscal IS and of the relationship between the primary surplus and public debt. The most appropriate method of estimating these two equations as a system was using the GMM, with appro pr iat e instr u ment al var iable s. All v ariables were log-transformed. The estimation of the equation to mea- sure the response of the primary surplus/GDP (PS/Y) ratio to the levels of the government debt/GDP (B/Y) ratio was defined as follows: 01 2 1 1t t tt PS YaaPSYaBYu+ + (12) where ut is the stochastic term. The fiscal IS was defined as: ( ) 1345 671tt ttt t yaayaraPSYa e η ++ =+ ++++ (13) where yt is the output gap; rt is the real interest rate; (PS/Y)t is the fiscal variable of interest (primary sur- plus/GDP); et is the real exchange rate; and 1t + is the stochastic term. The use of the denomination fiscal IS was due to the fact that we considered a fiscal variable in the IS curve. We assumed that the stochastic terms of Equations (12) and (13) were not serially correlated. On the basis of this model, we identified the direct ef- fects of the public debt on the primary surplus and the indirect effects of the public debt on the output gap. If the ratio of public debt to GDP was statistically signify- cant in Equation (1 2) and the ratio of the pr imary surplus to GDP was also statistically sign if icant in Equation (13), we would have an indication that the fisc al policy was ac - tive. That meant that the government debt indirectly af- fected a real variable (output gap) via the primary surplus. The results presented in Table 1 show that all vari- ables were statistically significant to a level of 1% and that each 1% increase in the ratio of debt to GDP trans- lated to a 0.023% increase in the ratio of the primary surplu s to GDP.  T. B. S. MOREIRA ET AL. Copyright © 2011 SciRes. ME The GMM applied in combination for the two equa- tions in the form of a system, yielded the results pre- sented in Tables 1 and 2. The model specification was tested using the J statistic associated with overide ntifica- tion restrictions. The value of the J statistic was 0 .28 (p = 0.50), and there was therefore no basis for rejecting the model specification. The results presented in Table 2 also showed that all variables were statistically sign ificant to the level of 5%. In short run, an increase of 1% in the ratio of the primary surplus to GDP caused a reduction of 2.963% in the output gap, so that the final effect of the 1% increase in the ratio of debt to GDP was a 0.07% reduction in the current output gap. In the long term, considering the ef- fect of the coefficient for the lagged output gap, the fin al effect would be a reduction of 0.31% in the output gap. This result provided empirical evidence that the fiscal policy was active. The remaining coefficients showed the expected signs, so that each 1% increase in the real interest rate ca used a 0.048% reduction in the output gap and each 1% increase in the real exchange rate caused a 0.006% increase in the output gap. Table 1. GMM estimate using t he Bartlett kernel and a fixed bandwidth: ( )( )( ) =+ ++ 1 01 2 1 t t tt PS YaaPSYaBYu + + . Variable Coefficient Standard deviation t statistics p-value Intercept 0.004 < 0.001 18.045 < 0.001 PS/Y 0.221 0.026 8.411 < 0.001 B/Y 0.023 < 0.001 27.670 < 0.001 R2 0.612 Note: instruments: y(–3, –4, –5, –6), r(–3, –4, –5, –6), PS/Y(–3, –4, –5, –6), e(–3, –4, –5, –6), B/Y(–3, –4, –5, –6), c. Table 2. GMM estimate using the Bartlett kernel and a fix- ed bandwidth: 345 67tt t t =+ +++ 1t yaaya raPSYae . Variable Coefficient Standard deviation t statistics p-value Intercept 0.431 0.029 15.047 <0.001 Y 0.771 0.013 59.371 <0.001 R −0.048 0.009 −5.316 <0.001 PS/Y −2.963 0.250 −11.836 <0.001 E 0.006 0.003 2.091 0.039 R2 0.722 Note: instruments: y(–3, –4, –5, –6), r(–3, –4, –5, –6), PS/Y(–3, –4, –5, –6), e(–3, –4, –5, –6), B/Y(–3, –4, –5, –6), c. 5. The Leeper’s Model and the Empirical Results The model developed by [1] defines the conditions ac- cording to which the monetary and fiscal policies may be classified as passives and/or active, where is the gov- ernment nominal debt, on which a nominal interest rate t is paid, is the direct lump-sum tax, is the price level, 1 πt tt − = and . The author describes government policies based on simple rules where the fiscal policy is: (14 ) where t Ψ is the exogenous shock, occurring at the be- ginning of t and following the AR(1) process: 1 Ψ=Ψ+ (15) with and 10 tt E ε Ψ+ =. We believe that it makes more sense to consider direct taxes and the nominal government debt relative to GDP. Equati on ( 14 ) be c omes: 1 01 t Bu GDP GDP τγγ − − (16) where is the stationary AR(1). The monetary policy also obeys a simple rule for the interest rate, that is, (17) where t Θ is an exogenous shock, occurring at the be- ginning of t and following the AR(1) process: 01 θ − Θ=Θ + (18) with 01 ρ < and 10 tt ε Θ+ =. Leeper’s approach reduces the equilibrium solution of his model to a dynamic system in π, b and finds the roots and . The stability condition requires one root less than or equal to one in absolute value and another greater than or equal to one. It follows that the equilibrium generates four regions of i nt e rest. 1) Region 1: 1 αβ ≥ and 11 − . This is the case of a unique equilibrium. In this region, the Ricardian equivalency holds. In this context, the monetary policy is active and the fiscal policy is passive. This is the ideal region for the policy- maker to instate a target of inflationary regime con- trolling the interest rate; 2) Region 2: 1 αβ < and 11 − . This region also generates a unique equilibrium. The region II represents the fiscal theory of price level (FTPL) or the regime of fiscal do minancy. In this case, on e has a passive moneta ry policy and an acti ve fiscal policy; 3) Region 3: 1 αβ < and 11 − . In this re- gion, the fiscal and monetary authorities act pas-  T. B. S. MOREIRA ET AL. Copyright © 2011 SciRes. ME sively, subject to the budget constraint. In this case, there are an infinite number of equilibrium points, which means that the equilibrium is undetermined; and 4) Region 4: 1 αβ ≥ and 11 − . There is no equilibrium in this region unless the exogenous shocks, and , are perfectly correlated. In this case, the monetary and fiscal policies are active. The discussion above implies important consequences for the policy-making decisions. The optimal monetary policy rules, in the context of inflation targeting regime, assume, explicit or implicitly, that the economy is oper- ating in Region 1. On the other hand, if we assume that the economy is operating in Region 2, where FTPL dominates, an op- timal monetary policy rule defined by the control of the interest rate via Taylor rule does not make sense. In Re- gion 2, the price level is determined by the fiscal policy, and the monetary policy is ineffective given that it is passive. In a context of a non-Ricardian regime, refer- ence [8] suggests an optimal fiscal rule to control infla- tion. In Regions 3 and 4, coordination between the mone- tary and fiscal authorities is necessary to force the eco- nomy to migrate to Region 1. In this section, we estimated two systems of equation to obtain the parameters and of the Equation (16) and (17) via GMM. The first system shows the equation used by [26] to analyzing the solvency of public debt such as: ( )( ) 01 23 1t tt B YaaTrendaB Yadummyu − =+++ + (19) and the Equation (16 ) . The results presented in Table 3 show that all vari- ables were statistically sign ifican t to a level of 5% except the intercept and that each 1% increase in the lagged ratio of the debt to GDP translated to a 0.717% increase in the ratio of the current debt to GDP. In this case, eventual insolvency will occur if 10a≠, that is there is a deterministic trend ([26]). Table 3. GMM estimate using t he Bartlett kernel and a fixed bandwidth: ( )( ) 1 =++ 01 2 t t- BYaaTrenda BY . Variable Coefficient Standard deviation t statistics p-value Intercept 0.001 0.021 0.057 0.955 Tend 0.001 < 0.001 2.064 0.042 (B/Y)(-1) 0.717 0.043 16.847 < 0.001 Dummy 0.146 0.031 4.636 < 0.001 R2 0.968 R2 adjusted 0.966 Note: Instruments: B/Y(–3, –4, –5, –6), /Y (–3, –4, –5, –6), c. The GMM applied in combination for the two equa- tions in the form of a system, yielded the results pre- sented in Tables 3 and 4. The model specification was tested using the J statistic associated with overide ntifica- tion restrictions. The value of the J statistic was 0 .20 (p = 0.97), and there was therefore no basis for rejecting the model specification. The results presented in Table 4 show that all vari- ables were statistically significant to a level of 1% and that each 1% increase in the ratio of the lagged debt to GDP translated to a 0.005% increase in the ratio of the direct taxes to GDP. This implies that . The second system shows two equations: the IS curve and the Taylor rule. The IS equation is: 12131 415ttttt η −− − =+++ ++ (20) and the Taylor rul e is defined a s follow: ( ) 6 71891 π tttttt RaaEay aR η +− =+++ + (21) where is the expected inflation rate. The results presented in Table 5 show that all vari- ables were statistically significant to a level of 1% and all the coefficients showed the expected signs. The GMM applied in combination for the two equa- tions in the form of a system, yielded the results presented in Tables 5 and 6. The model specification was tested using the J statistic associated with overidentification Table 4. GMM estimate using the Bartlett kernel and a fixed bandw i dt h: ( )( ) *=++ 34 -1 t tt Ya aBY τη . Variable Coefficient Standard deviation t statistics p-value Intercept 0.006 < 0.001 27.282 < 0.001 (B/Y)(-1) 0.005 < 0.001 10.035 < 0.001 R2 0.386 R2 adjusted 0.373 Note: Instruments: B/Y(–3, –4, –5, –6), /Y(–3, –4, –5, –6), c Table 5. GMM estimate using t he Bartlett kernel and a fixed bandwidth: 12131415 * tt t−−− =+++ ++ tt yaay arae aDummy η . Variable Coefficient Standard deviation t statistics p-value Intercept 0.8555 0.096 8.947 < 0.001 1t y− 0.331 0.077 4.312 < 0.001 1t r− –0.236 0.031 –7.612 < 0.001 0.111 0.028 3.971 < 0.001 Dummy 0.274 0.036 7.659 < 0.001 R2 0.505 R2 adjusted 0.460 Note: Instruments: R(–2, –3, –4, –5, –6), (–2, –3, –4, –5, –6), B/Y(–2, –3, –4, –5, –6), c.  T. B. S. MOREIRA ET AL. Copyright © 2011 SciRes. ME Table 6. GMM estimate using t he Bartlett kernel and a fixed bandwidth: ( ) -1 * **=++++ 67189 π ttttt t RaaE ayaR + η . Variable Coefficient Standard deviation t statistics p-value Intercept –0.315 0.054 –5.835 < 0.001 0.149 0.038 3.940 < 0.001 0.177 0.033 5.398 < 0.001 1t R− 0.872 0.026 34.070 < 0.001 R2 0.789 R2 adjusted 0.775 Note: Instruments: R(–2, –3, –4, –5, –6), (–2, –3, –4, –5, –6), B/Y(–2, –3, –4, –5, –6), c restrictions. The value of the J statistic was 0.25 (p = 0.90), and there was therefore no basis for rejecting the model specification. The results presented in Table 6 show that all vari- ables were statistically significant to a level of 1% and all the coefficients showed the expected signs. We as- sume that ππ tt t E =. Noticing that an increase of 1% in the expected inflation rate generate an increase of 0.149% in the nominal interest rate. This implies that . The value of , the rate of time preference, was taken from [27]. With , and , the Brazilian economy, in the analyzed period, was in Region 2, where 1 αβ < and 11 − . What can be concluded is that, in the analyzed period, Brazil was operating in a situation of fiscal dominance. We estimated the Taylor rule without the output gap, in according to Equation (17), and we also obtain the same result, i.e., 1 αβ <. 6. Conclusions The results show that public debt plays a key role in de- termining variables such as the real demand for money, the ratio of investment to GDP and the output gap. In the period between 1995: I and 2008: III, we observed a pos- itive correlation b etween the ratio of p ublic debt to GDP and the demand for money normalized to the GDP. We also observed that there was a negative correlation be- tween the ratio of public debt to GDP and the ratio of investment to GDP, and a negative correlation between the ratio of public debt to GDP and the output gap. In this context, we found empirical evidence that the Bra- zilian economy in the period considered did not corro- borate the hypothesis of Ricardian equivalence. In addition, it was observed that the ratio of the pri- mary surplus to GDP during this same period reacted positively and directly to an increase in the ratio of pub- lic debt to GDP, and that the ratio of debt to GDP nega- tively and indirectly affected the output gap via the pri- mary surplus. Such results once again provide empirical evidence that the Brazilian economy did not conform to the regime of Ricardian equivalence. On the basis of our findings, we can also infer that there are strong empirical evidences that the fiscal policy was active and the monetary policy was passive based on Leeper model. Reference [28] found similar results. When there is a Ricardian regime, which implies that the monetary policy is active and the fiscal policy is pa s- sive, it is reasonable to only analyze the transmission mechanisms of the monetary policy. However, in the case of a non-Ricardian regime, in which the fiscal poli- cy was active and the monetary policy was passive, we can and must analyze the transmission mechanisms of the fiscal policy. Therefore, we can infer that if the pub- lic debt positively affects the demand for money, it might also affect the interest rate. Given the money supply, if there is an increase in the demand for money caused by an increase in the public debt, a rise or a pressure in the interest rate is expected. Higher interest rates tr anslate to reduce levels of investment and, in turn, reduced levels of output or an output gap. We observed that the public debt negatively affected the level of investment and the output gap. These links show how the effects of the fiscal policy are expanded or transmitted within the economy. 7. References [1] E. M. Leeper, “Equilibria under ‘Active’ and ‘Passive’ Monetary and Fiscal Policies,” Journal of Monetary Eco- nomics, Vol. 27, No. 1, February 1991, pp. 129-147. [2] J. T. Araújo and M. A. C. Martins, “Economic Growth with Finite Lifetimes,” Economics Letters, Vol. 62, No. 3, March 1999, pp. 377-381. doi:10.1016/S0165-1765(99)00013-0 [3] R. D. Kneebone, “On Macro-Economic Instability under a Monetarist Policy Rule in a Federal Economy,” The Ca- nadian Journal of Economics, Vol. 22, 1989, pp. 673- 685. [4] W. M. Scarth, “Macroeconomics: An Introduction to Ad- vanced Methods,” Harcourt Brace & Company, Toronto and Orlando, 1996. [5] R. J. Barro, “Are Government Bonds Net Wealth?” The Journal of Political Economy, Vol. 82, No. 6, Novem- ber-December1974, pp. 1095-1117. doi:10.1086/260266 [6] T. J. Sargent and N. Wallace, “Some Unpleasant Mone- tarist Arithmetic,” Quarterly Review, Federal Reserve Bank of Minneapolis 5, 1981, pp. 1-17. [7] T. J. Sargent, “Reaganomics and Credibility, Rational Expectations and Inflation,” Harper and Row, New York, 1986. [8] O. Blanchard, “Fiscal Dominance and Inflation Targeting: Lessons from Brazil,” Working Paper No. 10.389, NBER, March 2004.  T. B. S. MOREIRA ET AL. Copyright © 2011 SciRes. ME [9] M. C. A. Martins, “A Nominal Theory of the Nominal Rate of Interest and the Price Level,” The Journal of Po- litical Economy, Vol. 88, No. 1, February 1980, pp. 174- 185. doi:10.1086/260853 [10] M. Woodford, “Interest and Prices,” Princeton University Press, Princeton, 2003. [11] C. A. Sims, “A Simple Model for Study of the Price Lev- el and the Interaction of Monetary and Fiscal Policy,” Economic Theory, Vol. 4, No. 3, 1994, pp. 381-399. doi:10.1007/BF01215378 [12] M. Woodford, “Monetary Policy and Price-level Deter- minacy i n a Cash-in-Advance Economy,” Economic The- ory, Vol. 4, No. 3, 1994, pp. 345-380. doi:10.1007/BF01215377 [13] M. Woodford, “Price level Determinacy without Control of a Monetary Aggregate,” Working Paper No. 5.204, NBER, 1995. [14] M. Woodford, “Control of the Public Debt: a Require- ment for Price Stability?” In: G. Calvo and M. King, Eds, The Debt Burden and Monetary Policy, Macmillian, London, 1997. [15] M. Woodford, “Fiscal Requirements for Price Stability,” Journal of Money, Credit and Banking, Vol. 33, August 2001, pp. 669-728. doi:10.2307/2673890 [16] J. H. Cochrane, “A Frictionless View of the US Infla- tion,” Working Paper No. 6.646, NBER, 1998. [17] J. H. Cochrane, “Long Term Debt and Optimal Policy in the Fiscal Theory of the Price Level,” Econometrica, Vol. 69, No. 1, January 2001, pp. 69-116. doi:10.1111/1468-0262.00179 [18] J. H. Cochrane, “Money and Stock ,” 2001 (Unpublished). [19] D. Hamilton, “Time Series Analysis,” Princeton Univer- sity Press, Princeton, 1994. [20] J. Johnston and J. DiNardo, “Econometric Methods,” MacGraw-Hill, New York, 1997. [21] W. Greene, “Econometric Analysis,” Prentice Hall, Up- per Saddle River, 2000. [22] G. S. Maddala, and I. K im , “Unit Roots: Cointegration, and Structural Change,” Cambridge University Press, Cam- bridge, 2000. [23] C. Hsiao, “Statistical Properties of the Two-Stage Least Squares Estimator under Cointegration,” The Review of Economic Studies, Vol. 64, No. 3, 1997, pp. 385-398. doi:10.2307/2971719 [24] C. Hsiao, “Cointegration and Dynamic Simultaneous Equations Models,” Econometrics, Vol. 65, No. 3, May 1997, pp. 647-670. doi:10.2307/2171757 [25] H. Bohn, “The Behavior of U.S. Public Debt and Defi- cits,” The Quarterly Journal of Economics, Vol. 113, No. 3, 1998, pp. 949-963. doi:10.1162/003355398555793 [26] W. Buiter and R. Patel, “Debt, Deficits and Inflation: An Application to the Public Finances of India,” Journal of Public Economics, Vol. 47, No. 2, March 1992, pp. 171- 205. doi:10.1016/0047-2727(92)90047-J [27] A. M. C. Lima and J. V. Issler, “A Hipótese das Expectativas na Estrutura a Termo de Juros no Brasil: uma Aplicação de Modelos de Valor Presente,” Revista Brasileira de Economia, Vol. 57, No. 4, October-Decem- ber 2003, pp. 873-898. doi:10.1590/S0034-71402003000400010 [28] T. B. S. Moreira, G. S. Souza and C. L. Almeida, “The Fiscal Theory of the Price Level and the Interaction of Monetary and Fiscal Policy: The Brazilian Case,” Review of Econometrics, Vol. 27, 2007, pp. 85-106.  T. B. S. MOREIRA ET AL. Copyright © 2011 SciRes. ME Appendix Table A.1. Unit root tests. Variables ADF – Modified AIC ADF – Modified SIC Critical value 5% t-Statistic p-value Critical value 5% t-Statistic p-value L(m) –2.927 –1.701 0.424 –2.921 –2.196 0.210 L(R) –2.919 –2.506 0.120 –2.919 –2.506 0.120 L(b) –3.502 –2.145 0.509 –3.495 –2.518 0.319 L(I/Y-1) –2.924 –0.723 0.831 –2.924 –0.723 0.831 L(B/Y-1) –1.949 –0.916 0.314 –1.947 –0.506 0.821 L(PS/Y) –2.919 –0.929 0.771 –2.919 –0.929 0.771 Note: L = Log. Table A.2. Johansen cointegration test: L(I/Y-1) = f [L(B/Y-1)]. Hypothesized N° C.E. (s) Eigenvalue Trace Statistic 0.05 Critical Value p-value None* 0.333 29.388 20.262 0.002 At most 1 0.157 8.726 9.164 0.060 Note: Trace test indicates 1 cointegrating equation at the 0.05 level. (*) = denotes rejection of the hypothesis at the 0.05 level. Table A.3. Johansen cointegration test: L(I/Y-1) = f [L(B/Y-1)]. Hypothe- sized N° C.E. (s) Eigenvalue Ma x-Eigen Statistic 0.05 Critical Value p-valu e None* 0.333 20.662 15.892 0.008 At most 1 0.157 8.726 9.164 0.060 Note: Max-Eigenvalue test indicates 1 cointegrating equation at the 0.05 level. (*) = denotes rejection of the hypothesis a t t he 0.05 level. Table A.4. Johansen cointegration test: L(M/Y) = f [L(R), L(B/Y)]. Hypothesized N° C.E. (s) Eigenvalue Trace Statistic 0.05 Critical Value p-value None* 0.520 62.742 35.193 <0.001 At most 1* 0.262 23.825 20.262 0.016 At most 2 0.136 7.744 9.164 0.092 Note: Trace test indicates 2 cointegrating equation at the 0.05 level. (*) = denotes rejection of the hypothesis at the 0.05 level. Table A.5. Johansen cointegration test: L(M/Y) = f [L(R), L(B/Y)]. Hypothesized N° C.E. (s) Eigenvalue Max-Eige n Statistic 0.05 Critical Value p-value None* 0.520 38.917 22.299 <0.001 At most 1* 0.262 16.081 15.892 0.047 At most 2 0.136 7.744 9.164 0.092 Note: Max-Eigenvalue test indicates 2 cointegrating equation at the 0.05 level. (*) = denotes rejection of the hypothesis at the 0.05 level. Table A.6. Johansen cointegration test: L(PS/Y) = f [L(B/Y)] Hypothesized N° C.E. (s) Eigenvalue Trace Statistic 0.05 Critical Value p-value None* 0.532 47.908 20.262 <0.001 At most 1 0.150 8.434 9.164 0.070 Note: Trace test indicates 1 cointegrating equation at the 0.05 level. (*) = Denotes rejection of the hypothesis at the 0.05 level. Table A.7. Johansen cointegration test: L(PS/Y) = f [L(B/Y)]. Hypothesized N° C.E. (s) Eigenvalue Max-Eigen Statistic 0.05 Critical Value p-value None* 0.532 39.474 15.892 <0.001 At most 1 0.150 8.435 9.164 0.070 Note: Max-Eigenvalue test indicates 1 cointegrating equation at the 0.05 level. (*) = Denotes reje ction of the hy pot hesis at the 0.05 level .

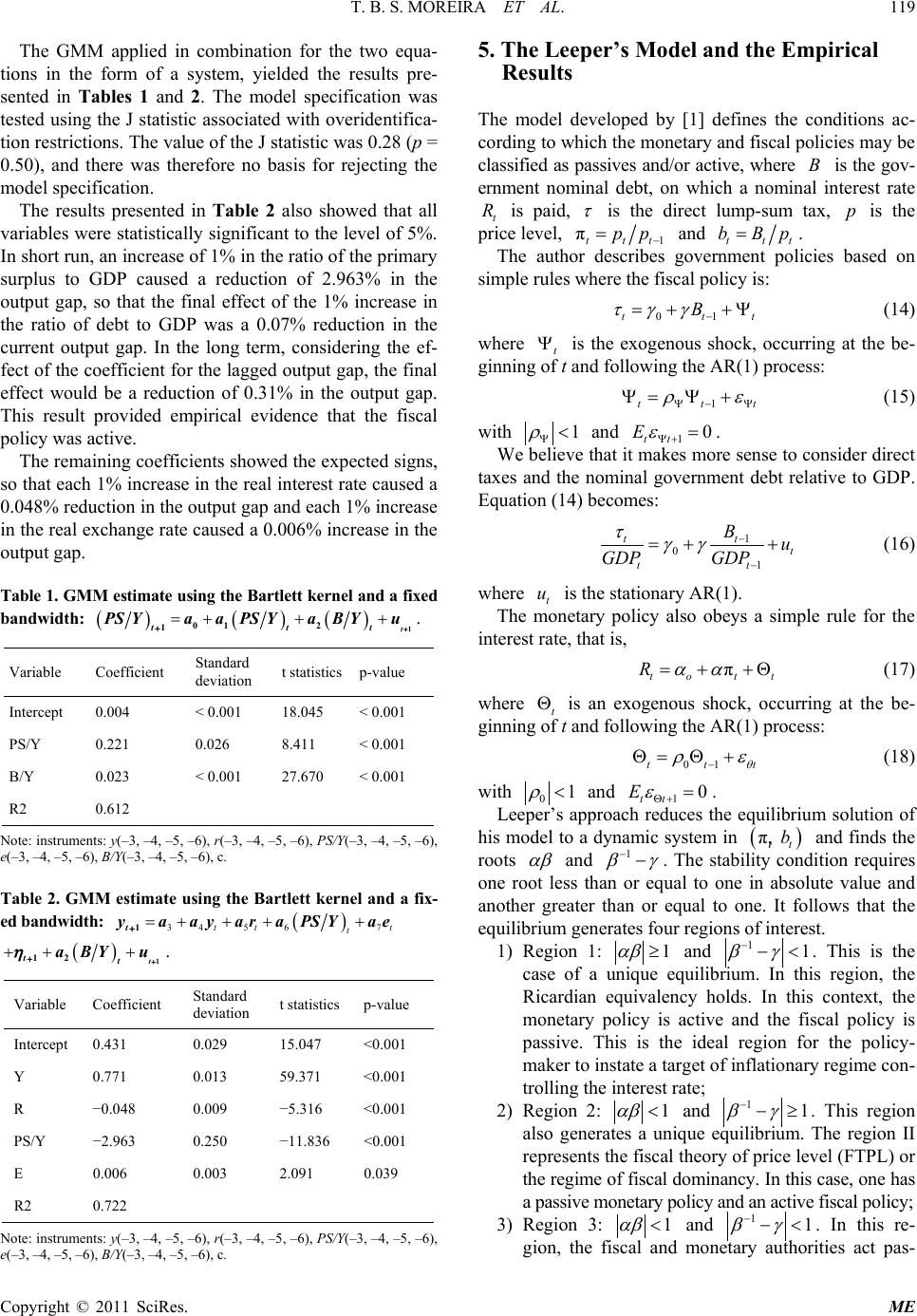

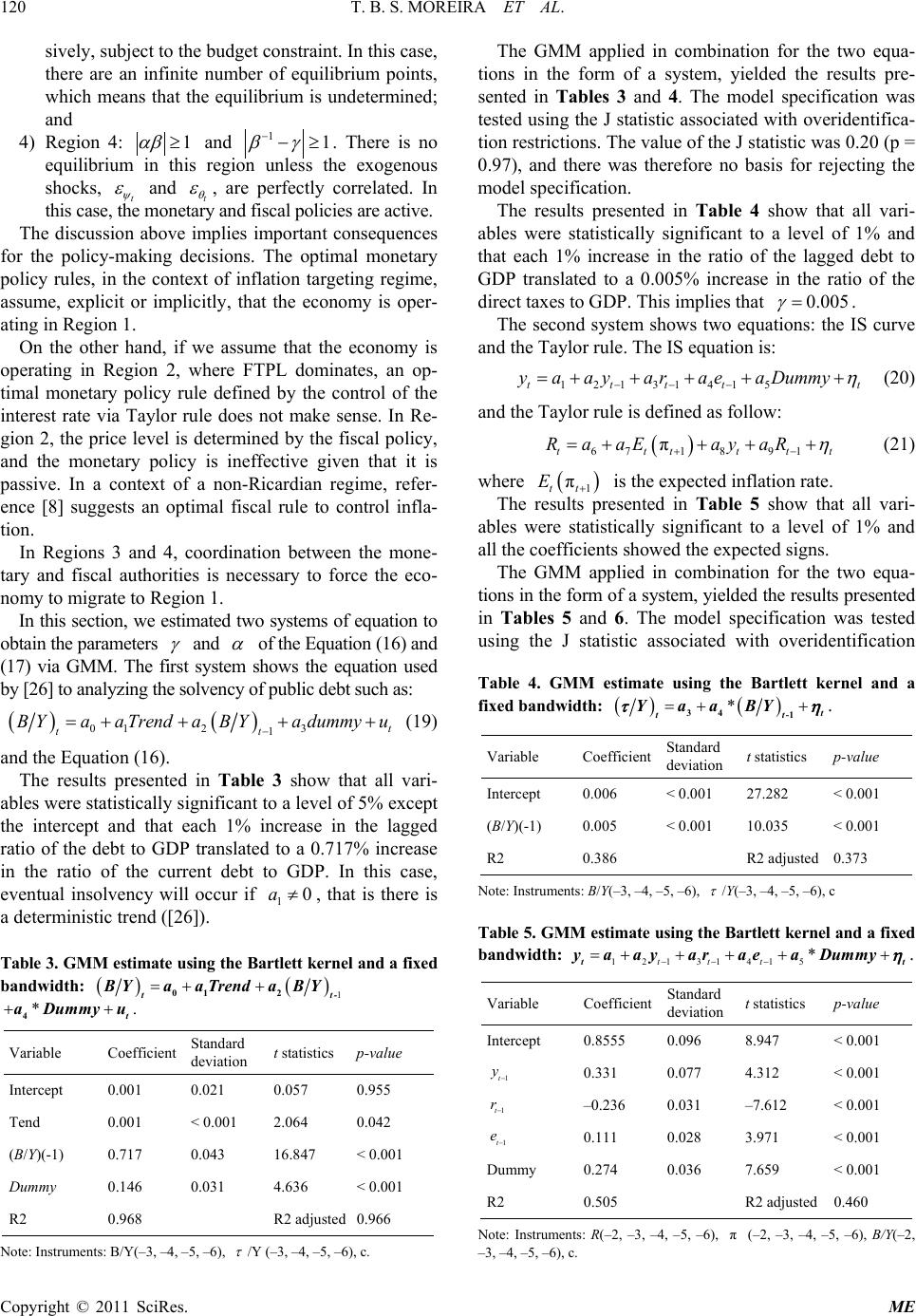

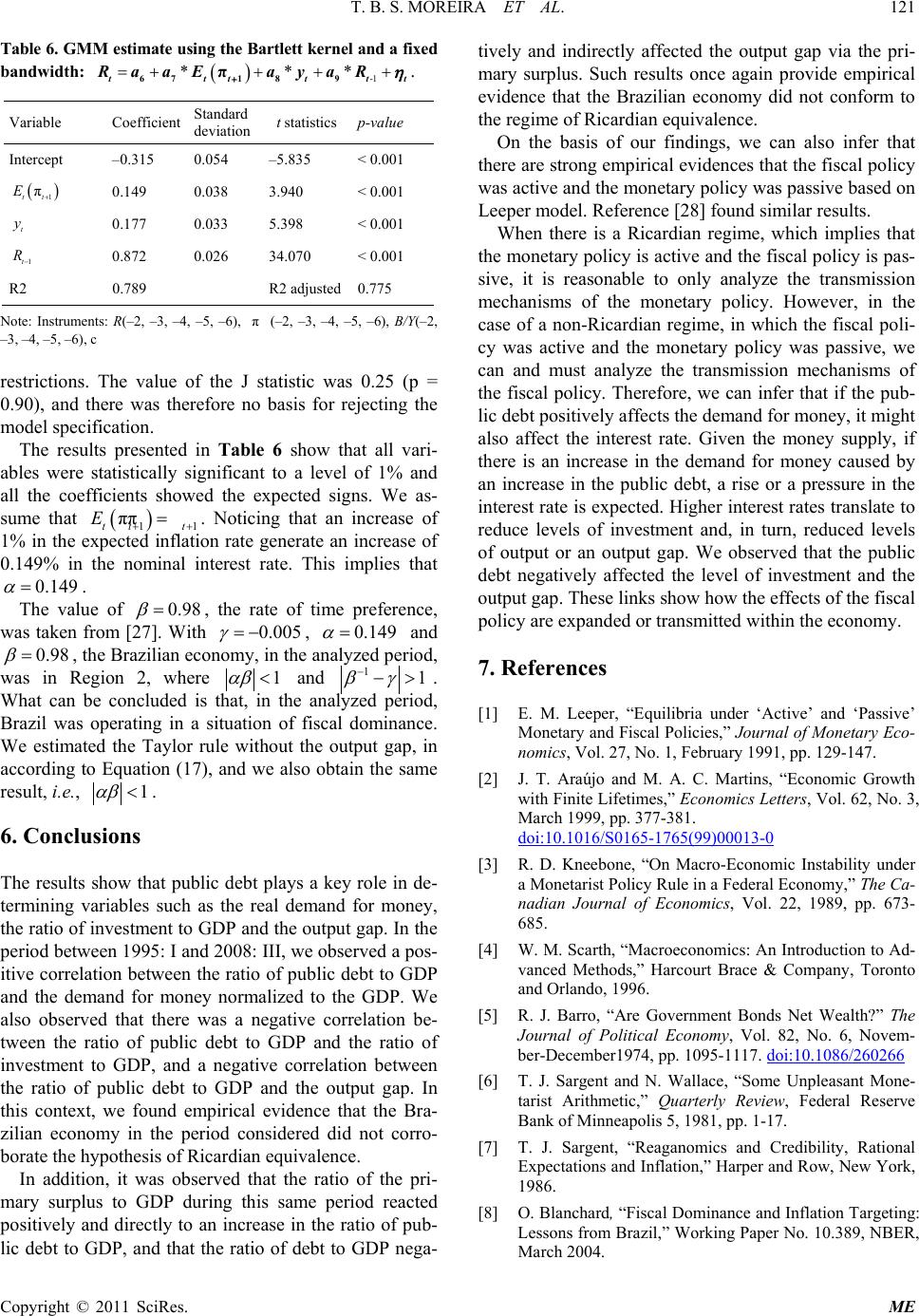

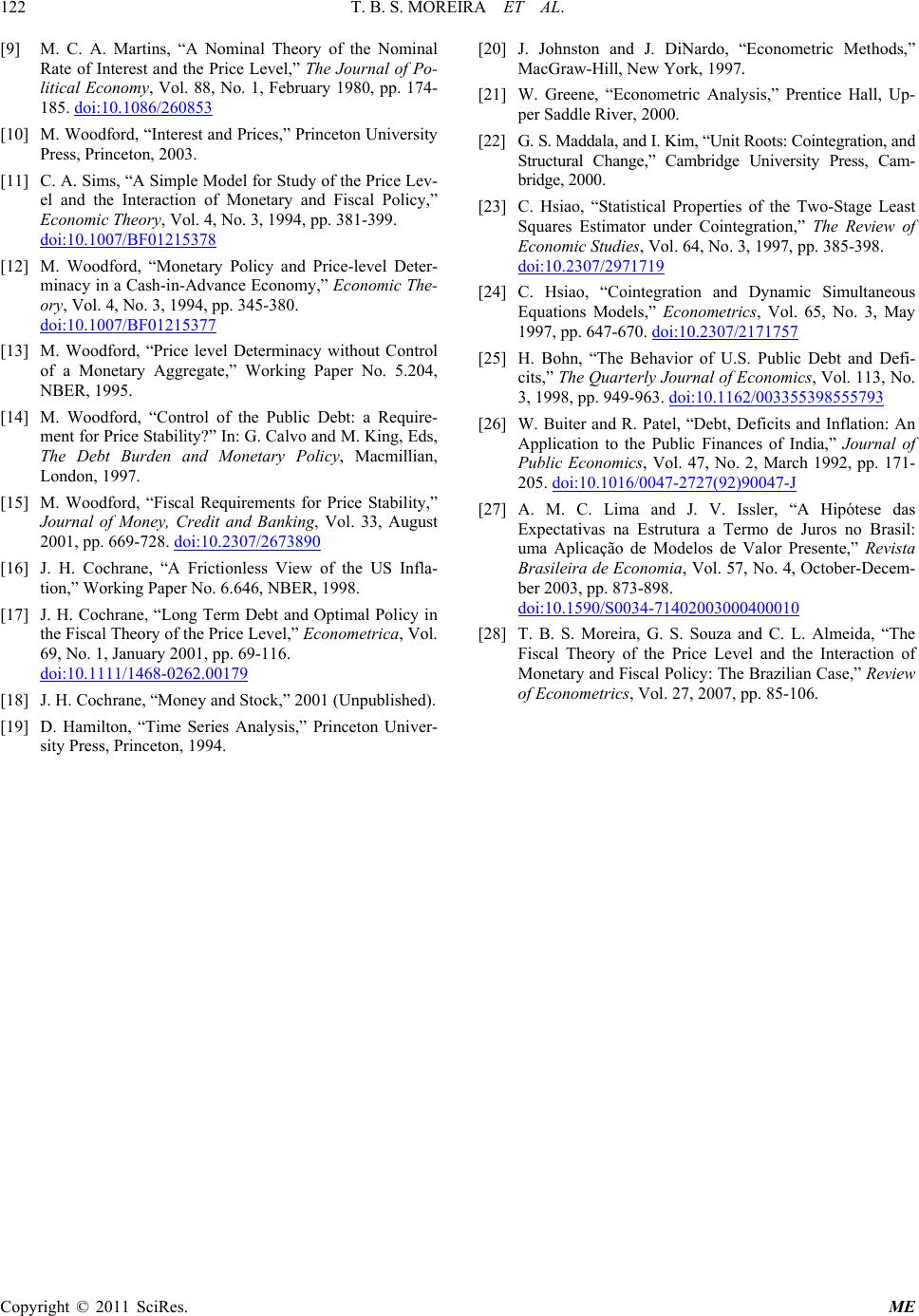

|