A. DIOP ET AL.

Copyright © 2011 SciRes. AM

520

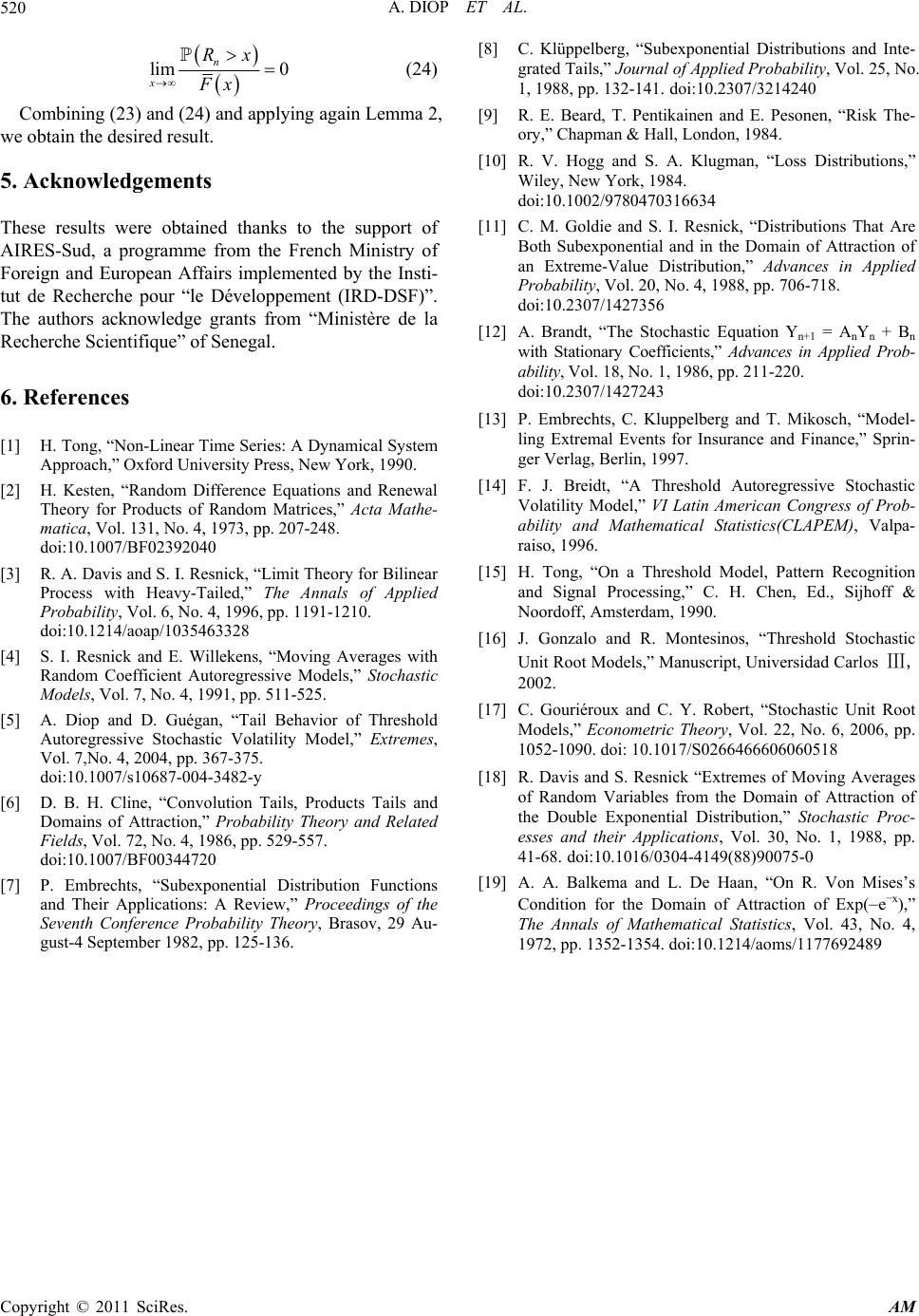

lim 0

n

x

Rx

Fx

(24)

[8] C. Klüppelberg, “Subexponential Distributions and Inte-

grated Tails,” Journal of Applied Probability, Vol. 25, No.

1, 1988, pp. 132-141. doi:10.2307/3214240

Combining (23) and (24) and applying again Lemma 2,

we obtain the desired result.

[9] R. E. Beard, T. Pentikainen and E. Pesonen, “Risk The-

ory,” Chapman & Hall, London, 1984.

[10] R. V. Hogg and S. A. Klugman, “Loss Distributions,”

Wiley, New York, 1984.

doi:10.1002/9780470316634

5. Acknowledgements

These results were obtained thanks to the support of

AIRES-Sud, a programme from the French Ministry of

Foreign and European Affairs implemented by the Insti-

tut de Recherche pour “le Développement (IRD-DSF)”.

The authors acknowledge grants from “Ministère de la

Recherche Scientifique” of Senegal.

[11] C. M. Goldie and S. I. Resnick, “Distributions That Are

Both Subexponential and in the Domain of Attraction of

an Extreme-Value Distribution,” Advances in Applied

Probability, Vol. 20, No. 4, 1988, pp. 706-718.

doi:10.2307/1427356

[12] A. Brandt, “The Stochastic Equation Yn+1 = AnYn + Bn

with Stationary Coefficients,” Advances in Applied Prob-

ability, Vol. 18, No. 1, 1986, pp. 211-220.

doi:10.2307/1427243

6. References

[13] P. Embrechts, C. Kluppelberg and T. Mikosch, “Model-

ling Extremal Events for Insurance and Finance,” Sprin-

ger Verlag, Berlin, 1997.

[1] H. Tong, “Non-Linear Time Series: A Dynamical System

Approach,” Oxford University Press, New York, 1990.

[14] F. J. Breidt, “A Threshold Autoregressive Stochastic

Volatility Model,” VI Latin American Congress of Prob-

ability and Mathematical Statistics(CLAPEM), Valpa-

raiso, 1996.

[2] H. Kesten, “Random Difference Equations and Renewal

Theory for Products of Random Matrices,” Acta Mathe-

matica, Vol. 131, No. 4, 1973, pp. 207-248.

doi:10.1007/BF02392040

[15] H. Tong, “On a Threshold Model, Pattern Recognition

and Signal Processing,” C. H. Chen, Ed., Sijhoff &

Noordoff, Amsterdam, 1990.

[3] R. A. Davis and S. I. Resnick, “Limit Theory for Bilinear

Process with Heavy-Tailed,” The Annals of Applied

Probability, Vol. 6, No. 4, 1996, pp. 1191-1210.

doi:10.1214/aoap/1035463328 [16] J. Gonzalo and R. Montesinos, “Threshold Stochastic

Unit Root Models,” Manuscript, Universidad Carlos Ⅲ,

2002.

[4] S. I. Resnick and E. Willekens, “Moving Averages with

Random Coefficient Autoregressive Models,” Stochastic

Models, Vol. 7, No. 4, 1991, pp. 511-525.

[17] C. Gouriéroux and C. Y. Robert, “Stochastic Unit Root

Models,” Econometric Theory, Vol. 22, No. 6, 2006, pp.

1052-1090. doi: 10.1017/S0266466606060518

[5] A. Diop and D. Guégan, “Tail Behavior of Threshold

Autoregressive Stochastic Volatility Model,” Extremes,

Vol. 7,No. 4, 2004, pp. 367-375.

doi:10.1007/s10687-004-3482-y [18] R. Davis and S. Resnick “Extremes of Moving Averages

of Random Variables from the Domain of Attraction of

the Double Exponential Distribution,” Stochastic Proc-

esses and their Applications, Vol. 30, No. 1, 1988, pp.

41-68. doi:10.1016/0304-4149(88)90075-0

[6] D. B. H. Cline, “Convolution Tails, Products Tails and

Domains of Attraction,” Probability Theory and Related

Fields, Vol. 72, No. 4, 1986, pp. 529-557.

doi:10.1007/BF00344720

[19] A. A. Balkema and L. De Haan, “On R. Von Mises’s

Condition for the Domain of Attraction of Exp(–e–x),”

The Annals of Mathematical Statistics, Vol. 43, No. 4,

1972, pp. 1352-1354. doi:10.1214/aoms/1177692489

[7] P. Embrechts, “Subexponential Distribution Functions

and Their Applications: A Review,” Proceedings of the

Seventh Conference Probability Theory, Brasov, 29 Au-

gust-4 September 1982, pp. 125-136.