iBusiness, 2011, 3, 5-15 doi:10.4236/ib.2011.31002 Published Online March 2011 (http://www.SciRP.org/journal/ib) Copyright © 2011 SciRes. iB Strategic Analysis of Synergistic Effect on M&A of Volvo Car Corporation by Geely Automobile Xia Zhou, Xiuzhi Zhang School of Economic and Management, Jiangxi University of Science and Technology, Ganzhou, C hina. Email: wymemory@163.com,leos_zhang@163.com Received September 24th, 2010; revised October 25th, 2010; accepted November 7th, 2010. ABSTRACT Strategic M&A is focused on the development of enterprises within the same industry or related industries and has mul- tiple effects such as economies of scale, structural integration of upstream and downstream industry chain, powerful alliances and complementary advantages. A major motivation of strategic M&A is the synergistic effect. In the upsurge of M&A at home and abroad, failed to achieve the synergistic effect is one of the important reasons of a high failure rate of M&A. This paper probes into the example of Geely Automobile’s M&A of Swedish Volvo Car Corporation in March 2010 from a strategic angle by analyzing the strategic decision-making, the competitive environment, the me- chanism of action, the evaluation and the realization risks of the synergistic effect, thus to provide references for the M&A practice of Chinese enterprises. Keywords: St rategic Perspecti v e, M&A, Synergistic Effect 1. Introduction Strategic M&A is a complex business involving great risk. Huge losses are often due to the errors in strategic decision-making. Understanding and evaluating the syn- ergistic effect is very necessary for those companies which want to grow up through strategic M&A, because it is not only the basis to determine the feasibility of M&A, but also the basis for the set of transaction price, and to a extent, it determines the success or failure of strategic M&A. At present, domestic M&A activities are lack of the guidance of strategic thinking and the study of domestic scholars on synergistic effect from a strategic perspective are relatively less. In addition, M&A activi- ties of companies have high risks, according to the for- mula “M&A synergistic effect = acquisition premium + the net present value of M&A”, even in the case of ze- ro-premium, the companies still need to meet certain necessary competitive conditions as well as the basic requirements for synergistic effect, otherwise, the com- panies will be hard to avoid falling into the “synergy trap” [1,2]. Therefore, the main purpose of this paper is to make an analyze on strategic decision, competitive environment, mechanisms of action, the evaluation and realization risks of the synergistic effect from a strategic perspective, thus to provide references for Chinese com- panies to better achieve strategic M&A synergies [3]. In recent years, China’s automobile industry is very active in M&A, this paper take Zhejiang Geely Holding Group’s (hereinafter to be referred as Geely) M&A of Sweden’s Volvo Car Corporation(hereinafter to be re- ferred as Volvo) for example to analyze M&A synergies from a strategic perspective. Geely is a large-scale pri- vate enterprise of China which mainly produces motor vehicles and parts. Volvo was founded in 1927, which is one of the world’s 20 largest automobile companies and enjoys high prestige in ex cellent quality and p erformance in northern Europe, especially known for its safety and environmental protection. At present, Volvo has nine series of automobile brands, three new intellectual prop- erty platform and more than 2,000 sales outlets world- wide. If Geely’s M&A of Volvo is successful, it will have historic direct effect to promoting the growth of China’s automobile industry and change the pattern of future global automotive industry. Based on the above favorable considerations, Geely acquired 100% equity stake of Swedish Volvo in March 2010 successfully. This paper is appropriately amended as needed based on the original case. 2. Strategic Decision Analysis of Synergistic Effect M&A is a high-risk activity, great loss often springs from  Strategic Analysis of Synergistic Effect on M&A of Volvo Car Corporation by Geely Automobile 6 strategic decision mistakes, and therefore, the company’s management must first clearly define the enterprise’s development strategy and have to launch an investigation into the acquired enterprise’s business and resources [4-6]. In the development of M&A strategy, we can use some appropriate models to support M&A decision such as BCG Matrix, PIMS methods and Directional Policy Matrix. The BCG matrix analysis of Geely’s strategic M&A can be represented as shown in Figure 1. As Volvo is one of the world’s 20 largest automobile companies, it has a huge market capacity and a relatively higher market increase rate. However, because of the global financial crisis in 2008, Volvo had huge losses last year due to poor management. In 2009, the total sales of Volvo was only 218.4 billion SEK (1 U.S. dollar equals 7.5 SEK), compared with 2008, its total sales reduced by nearly 30%, which caused Volvo a huge loss of 14.7 bil- lion SEK. Thus for Geely, Volvo belongs to the “Ques- tion marks” and can be indicated with solid line box in Figure 1. At this time, there need to input a large number of fixed capital and working capital. Geely should use appropriate means of financing to obtain sufficient funds to meet the growth of its market share. With regard to the capital source of Geely’s M&A of Volvo and the subse- quent provision of huge working capital, the M&A pur- chase price of Volvo is 1.8 billion dollars, plus follow-up liquid capital, Geely has prepared to provide a total of 2.7 billion dollars. Half of these funds were funded through domestic financing, the rest of the funds were foreign capital mainly coming from the United States, Europe and Hong Kong. If the demand for Volvo’s automobile continues to grow, after Geely’s M&A, Geely’s production capacity will increase substantially and new Volvo production bases will be built at home. If Geely can be able to suc- cessfully solve the market digestive problems which caused by the excess production capacity, its relative market share will be greatly improved and the product will be gradually changed to the “Stars” and can be indi- cated with dotted box in Figure 1. At this time, the prod- Figure 1. BCG matrix analysis of Geely automobile’s stra- tegic M&A. uct may be advanced “absorber” or advanced “producer”, which primarily depends on the amount of money needed to invest to maintain the market share. If the product can achieve a certain economies of scale, it will eventually change to “Cash cows” and Geely must ensure that its market share do not suffer erosion. Such strategic analy- sis tools will be conducive to make a more reasonable M&A decision for Geely. 3. Competitive Environment Analysis of Synergistic Effe ct According to Mark L Sirower’s (1997) theory, “Syner- gistic effect” must be taken into account in the competi- tive environment [7,8]. M&A must meet one of the fol- lowing two points to achieve synergistic effect and ob- tain M&A earnings. First, the acquirer must be able to restrict the competitive threat of the current and po tential competitors in the input market, the production process or the output market; second, the acquirer must be able to open up new markets or invade and occupy the market of its competitors who can’t react. Thus, before the an alysis of M&A synergies, we should first analyze the competi- tive environment of Geely. Competitive environment analysis of synergistic effect mainly includes two aspects: the analysis of industry barriers to entry and the analysis of competitive situation. 3.1. Analysis of the Industry Barriers to Entry The industry barriers to entry can be analyzed from the need for capital, operating scale, technological content and cost disadvantages independent of scale, as shown in Figure 2. 1) Fund demand. As for cost competitiveness, Geely’s capacity planning is unavoidable and its capital cost will be higher and higher. As the automobile industry is capital-intensive industry, its R&D and the construction of production lines will face a high financial barrier. At present, Geely expands its production capacity in a “great leap forward” way, it has established production bases in Linhai, Zhe- jiang, Ningbo, Shanghai, Lanzhou, Xiangtan, Jinan, etc. According to Geely’s current base construction devel- opment plan, by 2010, Geely’s production capacity Figure 2. Analysis of automobile industry barriers to entry. Copyright © 2011 SciRes. iB  Strategic Analysis of Synergistic Effect on M&A of Volvo Car Corporation by Geely Automobile7 will break 1 million vehicles and b y 2015 reach 2 million . Relevant data show that in addition to 1.8 billion dollars of M&A, Geely also need 1.5 billion dollars of liquid capital. The 1.8 billion dollars acquisition funds and the huge capital loans will certainly exert financial pressure on the operation of Geely. 2) Scale of operation. Whether Geely can produce in large scale is a key factor in the success of its production. Because the au- tomobile’s R&D costs are very high an d there are appr o- priate costs of management, procurement and sales, G eely must produce in large scale, otherwise, the costs will be difficult to be amortized. After Geely’s M&A of Volvo, Geely will face numerous difficulties in product plann ing, site selection, the split with Chang’an Ford’s products, whether the fund flow is smooth and the variables in the domestic market. These problems may lead to the failure of the M&A in all probability. Geely’s self-confidence seems to come from the infinite Chinese automobile mar- ket. Volvo has top 20 largest independent automobile parts suppliers, among them, 16 suppliers have set up factories in China. Through additional supporting facto- ries in China, Geely is expected to reduce procurement costs at least 1.2 billio n dollars within 5 years. However, to form a new plant, Geely need at least 1 and a half years, this should be the most difficult transition period after its M&A of Volvo. Shufu Li, the president of Geely, who claimed that Volvo would be profitable in 2011 seems to be unbelievable. 3) Technological cont ent . Volvo is “the most secure vehicles” in the eyes of consumers. Through M&A of Volvo, Geely can absorb Volvo’s patented technology and expertise to enhance its technical strength and development capabilities, and at the same time to obtain fat profits of brand premium [9,10]. But the problem is that Geely’s desire to acquire technology through M&A may not realize. First, in order to protect their own interests, the host government, the acquired companies and its trade unions representing the interests of the parties may establish harsh restricted conditions of technology transfer and will carry out strict surveillance in the future; second, even if Geely obtain Volvo’s technology at the best price successfully, this can not substitute its self-absorption and subsequent de- velopment. If Chinese companies can not form a suffi- ciently strong international competitiveness in technol- ogy development, Geely’s plan to improve R&D capac- ity through M&A will likely come to nothing even tually. In 2004, SAIC Group spend s 612 billion won (about 500 million dollars) in M&A of 51% equity stake of South Korea’s fifth-largest car maker Ssangyong Motor. Af- terwards, SAIC and Ssangyong union disputed many times, South Korean prosecu tors also conducted a search of Korean headquarters of SAIC in the name of “leak core technology”. In the financial crisis, the continued loss of Ssangyong finally dragged down SAIC, in Janu- ary 2009, SAIC filed for bankruptcy protection in Seoul District Court and give up the management of Ssangyong. Therefore, whether Geely can achieve bigger break- through on technology after M&A will be difficult to identify. 4) Cost disadv antages independent of scal e. According to the strategy theory of Michael Baud, the acquired enterprises have cost advantages which were formed by means of experience accumulation and learn- ing curve. But Chinese automo tive industry operates by a way of high-cost, and there are still some barriers in get- ting the advanced experience. The factors of cost disad- vantages independent of scale also include patent right, government subsidies and price inflation of equipment purchase which is caused by the changes in exchange rates. Geely have had overseas experience in restructur- ing and M&A of British Manganese Bronze company and Australian DSI automatic transmission company, however, this time Geely mergered 100% equity stake of Volvo is a very huge project, including Volvo’s R&D team, manufacture base, distribution channels, corporate debt and the reallocating of nearly 20,000 employees, this can not be compared with the previously M&A of Manganese Bronze and DSI to Geely, who hasn’t any experiences in manufacture and management of luxury vehicles, the cost disadvantages independent of scale is obvious. From the above analysis we can see that there are high barriers to entry in automobile industry. Whether Geely can resist the pressure of competition and open up new markets depends on the strength of the industry’s major competitors. This indicator can be measured by market share. From January to May in 2010, the sales of Volvo in China surged by 108% and led the luxury vehicles market. China has become the world’s fourth largest market for Volvo. Globally, from January to April in 2010, the sales of Volvo increased by 26.5%, which in- dicates that after M&A, the growth of Volvo is not only weakened, but also obtains considerable progress. How- ever, the current market in Europe has entered the drop period after spur growth, such situation will not condu- cive to Volvo’s rapidly reduce losses and increase profits, and long-term depression may made Volvo more depre- ciatory, thus go against Geely’s capital gain. With the recovery of the euro zone economy and the strength of U.S. dollar gradually winding down, the drop of the competitiveness of traditional industries in the euro area will exert a tremendous influence on Volvo’s exports. The shrinking market is still the biggest problem to Gee- ly’s changing the fate of Volvo. Copyright © 2011 SciRes. iB  Strategic Analysis of Synergistic Effect on M&A of Volvo Car Corporation by Geely Automobile 8 3.2. Analysis on the Competitive Situation within the Industry Although Geely is the industry leader in the domestic market, comparing with Japan, Germany and the United States, there is a considerable gap in its production tech- nology, market capacity and innovation ability. Whether Geely can achieve synergistic effect through M&A de- pends on its ability to get core competitiv eness. Therefore, we need to analyze what factors constitute the company’s core competencies and whether the companies can get core competitiveness through M&A activities [11]. Factors of core competencies include the following aspects. 1) Determining the scope of business. Experience in the industry shows that most of the ma- jor markets in the automotive industry are in a state of over-competition, the time that only rely on market growth to survive has passed. The first core competitiveness is how to determine the scope of business clearly and accu- rately. 2) Mastering the core technology. The important features of the automotive industry are the ever-changing technology and its rapid upgrade. En- terprises which can not be unable to master core tech- nology will be eliminated from the stage of international development. 3) The ability to attract and retain high-tech talents. Automotive industry competition for talent is very in- tense and to attract and retain talent is the key success factor in the industry. If Geely can acquire a company or business unit which has technical advantages and can attract highly qualified technical personn el, it will be able to form core competitiveness. The synergistic effect of strategic M&A is the result of the formation and spread of core competitiveness. As the sharehold er owning 100 percent of the sto ck of Volvo, Geely can obtain Volvo’s key technolog y, the use rights of its intellectual property and at the same time stay abreast of Ford’s developments. These favorable conditions have a great significance to personn el training and technological upgrading of Geely. Although Volvo’s core technology can not be easily obtained, the technical exchange and operation such as production base transfer and adaptive improvement will certainly improve Gee- ly’s manufacturing level and design conception remarka- bly. Taking the advantage of Volvo’s automotive safety technique is the key element of Geely’s M&A strategy. In the future, safety performance will be made as one of the core competitiveness of Geely’s products. 4. Analysis of the Mechanism of Synergistic Effect 4.1. Management Synergy Management synergy refers that the companies use its extensive and efficient management resources through new permutations and combinations after M&A to im- prove the existing management and finally increase the revenue. Geely’s M&A of Volvo belongs to horizontal M&A and its main purpose is to obtain scale effect, ba- sically reflect the management synergy. The mechanism of management synergy can be manifested mainly in the following aspects. First, Geely can make greater use of production capacity and improve production efficiency. Second, through the M&A of Volvo, Geely can expand scale, thereby increasing the production equipment and the labor force, thus improve the production efficiency. Third, M&A activities will enable Geely to get part of Volvo’s excellent management resources to achieve its learning effect. 4.2. Operating Synergy Operating synergy refers to the improvement of produc- tion and operation efficiency of enterprises which caused by economies of scale and economy of scope after M&A. Through M&A, Geely’s operating synergy can be mani- fested mainly in the following aspects. First, ge t some of the market of Volvo, provide special production service to different customer or market, use uniform distribution channels to sell products and save marketing expenses. Second, the fund of Geely will focus on R&D which can help to further promote the formation of Geely’s core competitiveness, launch new product rapidly and form the root causes of synergies. 4.3. Financial Synergy Financial synergy refers to the financial benefits gener- ated by M&A transaction. It is a net cash flow on bene- fits which are caused by tax laws, accounting standards and other provisions of the securities and exchange. Since there are differences in the capital structure be- tween Geely and Volvo, this situation may produce the following financial synergy effect. First, according to the tax law, different tax rate should be applied to different types of assets. Geely may achieve a reasonable tax avoidance synergy through M&A. Second, M&A may produce the expected effects such as the increase of the stock price and the price-earning ratio [12]. The expected effects have a great influence on M&A. As the scale of M&A side are often large, when the acquirement is car- ried out through share tran saction, its price-earnings ratio is often used as the price-earnings ratio of the combined companies after M&A, which may lead to the increase of stock prices and make the market worth more than the sum of the worth of two companies before M&A. But in the weak form efficient market, this effect may not occur [13]. The above analysis belon gs to the synergistic effect of Copyright © 2011 SciRes. iB  Strategic Analysis of Synergistic Effect on M&A of Volvo Car Corporation by Geely Automobile9 tangible assets. In addition, Geely is also possible to achieve some synerg istic effects of intangible assets su ch as technology synergy, brand synergy and cultural syn- ergy. According to “dynamic synergy” theory, if a com- pany achieves synergistic effect of intangible assets through M&A, it can get inexhaustible source of com- petitive advantage. 5. Evaluation on Synergistic Effect Volvo is one of the world’s major automobile manufac- turers. Currently, as losses year by year, Ford which has a controlling stake in Volvo intends to carry out indus- trial restructuring and sell the stake of Volvo. In Sep- tember 2009, Geely participated in the bid for Volvo, and in March 2010, Geely successfully mergered 100% eq- uity stake of Volvo. For convenience of the calculation of synergistic effect evaluation, the information assumptions of relevant pa- rameters in the market of Geely and Volvo are as follows: the risk free rate , the expected rate of market 6% f R 11% m ER , each company’s debt interest rate, B , the income tax rate 10% 40%T , the expected super- normal growth period 10n , risk coefficient 1.2, Geely 1.4 Volvo . We select 2009 financial reports published by Geely and Volvo and made analysis on the data which were important and relatively easier to obtain. The following are relevant financial quantitative data of the two compa- nies (see Table 1), for ease of calculation, the data are modified moderately according to the raw data [14,15]. For synergistic effect evaluation, it is necessary to predict the important variables influencing the company value after M&A. This requires in-depth analysis of each M&A program according to the evaluation factors. Be- cause there is a strong correlation between the business of Geely and Volvo, considering complementation and promoti on o f management ability, production technology and marketing channels, Geely’s M&A of Volvo will Table 1. Relevant financial quantitative data of Geely and Volvo in 2009. (Monetary unit: millions of dollars). Company Financial index Geely Volvo Debt 1800 24000 Equity capital 900 9000 Total assets 2700 33000 Operating income 1800 12800 Net profit 1180 –653 )Total market value of capital ( S3300 1800 Source: financial report s p u b l ished by Geely and Volvo in 2009 help to develop Geely’s new products and improve its profitability. The following estimate values are predicted from the financial data of Geely and Volvo after M&A, it reflects the results of the above qualitative analysis (see Table 2). Then we can use the internal model approach to evalu- ate the M&A synergistic effect (namely the added value of the combined company after M&A). The steps of syn- ergistic effect evaluation are as follows. 1) Calculating new value of the combined company. To simplify the calculation, we assume that the new value (GV ) of the combined company is the weighted average value of each component corporate, then put the new value into capital asset pricing model (CAPM) to obtain the cost of equity capital of the com- bined company (GV S). + ++ Geely Volvo GV GeelyVolvo Geely VolvoGeely Volvo SS SS SS (1) GV fmfGV KSRE RR (2) According to the known conditions, Table 1, Formulas (1) and (2), we can obtain the result: 3300 1800 1.2 +1.4=1.27 3300+1800 3300+1800 GV 6%11% 6%1.2712.35% GV KS 2) Calculating WACC of the combi ned comp any. According to the known debt interest rate 10%KB , assume that the rate is unchanging after M&A, according to the above calculation result of the cost of equity capi- tal, we can obtain the weighted average cost of capital (WA ). We first give the CC simple balance sheet of the combined company after M&A (see Table 3). Then we can calculate the weighted average cost of capital (WA ): C C 1 GV EB WACC KSKBT VV (3) According to Formula (2), we can obtain the result: WACC 9900 25800 =12.35%+10%1 50%=7.04% 35700 35700 Table 2. Forecast of the key parameters of the combined company of Geely and Volvo. Financial index Net operating income (millions of dollars) 0 Net investment rate b Growth rate Combined Company ) GV( 240 0.9 0.4 Copyright © 2011 SciRes. iB  Strategic Analysis of Synergistic Effect on M&A of Volvo Car Corporation by Geely Automobile 10 Table 3. Simple balance sheet of the combined company after M&A. (Monetary unit: millions of dollars). Financial index combined company after M&A(GW) ) Debt ( 25800 )E Equity capital ( 9900 ) EVBTotal assets ( 35700 Source: financial reports published by Geely and Volvo in 2009 3) Calculating the value of the combined company. According to Waston model, we can use the evaluation model of zero growth after supernormal growth period to evaluate the value of the combined co mpany af ter M&A, according to the known conditions, the expected super- normal growth period is 10 years. The formula is as fol- lows: 1 0 01 111 11 11 i n GV i i gs xTgs VxTb rrr n n (4) According to Formula (3), we can obtain the result: 10 1 11 10 10.4 240 140%10.910.0704 500 150%10.431493 0.0704 10.0704 i GV i i V According to the above calculation results, we can make simple evaluation on the synergistic effect of the combined company after M&A (GW) (see Table 4). From the calculation results we can see that Geely’s M&A of Volvo may generate the value-added (synergis- tic effect) of 593 million dollars. The M&A synergistic effect is positive number and meet the basic conditions of M&A (GVGeely Volvo VV ). At the same time, we should consider the realization cost of M&A, which include the M&A integration costs and pre-acquisition costs. The maximum payment of Geely’s M&A of Volvo is the value-added of synergistic effect V subtract the realization costs of M&A. The above analysis shows that when Geely make a strategic decision on M&A, the synergistic effect evalua- tion on value-added can help decision makers determine the feasibility of different M&A schemes, thus provide basis for setting price ceiling of M&A. During the proc- ess of evaluation, it is usually required to give reasonable evaluation on the expected return and risk of the com- bined company in different M&A schemes. Although we can use historical data as the basis for variable values, we still must predict the earnings, growth and the risk of the combin ed co mp an y ac co rding to diff er e n t M&A cir cu m- Table 4. Simple evaluation on synergistic effect. (Monetary unit: millions of dollars). Financial index combined company after M&A(GW) Value of combined company31493 ) Less: Debt (25800 ) Equity capital after M&A (5693 Less: Total mar ke t val ue of ca pi ta l of G ee ly 3300 Less: Total market value of capital of Volvo1800 Incremental Value(Synergistic effect)593 stances. In order to make the prediction more close to reality, it is necessary to give in-depth study of relevant product market and the consequences of organizational merger. But even so, the error of predictive results usu- ally occurs unavoidably and sometimes the margin of error is very large, thus lead to less accurate of the pre- dictive results. Therefore, we should combine with other evaluation met hods to predict reasonable synergistic ef- fect gains, so as to provide the scientific basis for infor- mation users to make proper strategic M&A decision. 6. Risks Analysis of the Realization of Synergistic Effe ct The risks of the realization of synergistic effect refers to the uncertainty of the increment of corporation value and the performance of strategic M&A. Such risks always exist throughout the whole process of synergistic effect realization. From the view of the root causes of the risks, such risks can be divided into internal risks and external risks, as shown in Figure 3. Figure 3. Risks of the realization of synergistic effect. Copyright © 2011 SciRes. iB  Strategic Analysis of Synergistic Effect on M&A of Volvo Car Corporation by Geely Automobile11 6.1. Internal Risks Internal risks mainly refer to the synergistic effect of risks which is caused by M&A transactions and integra- tion. Synergistic effect of internal risks mainly includes financial risk, integration risk, anti-M&A risk, princi- pal-agent risk and asymmetric information risk. 1) Financial risk. M&A often requires large amounts of capital, how to raise funds in short term is very important. In this case, Geely can use cash, stock or debt financing for the M&A. Either way, there are great risks. If Geely use cash to complete the M&A, there will have the following short- comings: first of all, a one-time large amount of cash outflow for M&A will cause intense pressure on the production and management of the enterprise. Second, the trade size will be restricted by the ability to obtain cash and lead to the failure of a large-scale M&A. Moreover, the merged side may not like cash payment, because they can not get the new company’s equity, this situation will also lead to M&A risks. However, lever- aged acquisition is to bear greater risks. Although ini- tially leveraged acquisition can achieve desired economic benefits by paying a small price, but the repayment of debt will give the enterprises serious pressure after M&A. According to the mid-year report of Geely in 2009, its total liabilities were 7.0 billion yuan RMB, and the total assets were 13.67 billion yuan RMB, the debt ratio was 51.2%, the liquid capital was 1.88 billion yuan RMB. After financing from Goldman Sachs in the United States, the debt ratio of Geely was as high as 69%, more than the international alert level of 65%. The key to success of Geely’s M&A of Volvo is debt financing. Otherwise, Geely will be heavily in debt and near trouble itself. There are many examples of the bankruptcy of the “ad- vantage” enterprises which could not pay the principal and interest after heavy borrowing. In order to avoid financial risk, Geely should establish a financial early-warning index system, which include short-term liquidity financial ratios such as liquidity ratio < 2, quick ratio < 1, cash ratio < 30% and long-term li- quidity financial ratios such as asset-liability ratio > 60%, time interest earned ratio < 1.5. In addition, the acquiring company should have plenty of cash flow, make sure that investment can be matched with financing and avoid short-term financing for long-term investment. 2) Integration risk. According to a survey on the failure of M&A of Bain & Company, about 80% of M&A failures are caused by enterprise integ ration failur es and only about 2 0% appear in the pre-transaction phase of M&A [16-18]. In this case, the M&A integration risk of Geely manifested mainly in the following three aspects: first, production and tech- nology can not achieve the expected synergy after M&A. For example, the M&A side usually wants to implement diversification through M&A so as to enter new areas, when the growth of the new areas are faced with obsta- cles, it often makes M&A activities in trouble. Second, the integration of personnel, institution and culture after M&A. If the enterprise can not make effective integra- tion according to the designed M&A plan, this will lead to the conflict of personnel, institution and cultural be- tween new and old enterprises and resulting in internal friction. Third, the impact of M&A on business relation- ships, such as the impact on customers and suppliers. M&A might cause deterioration in external business re- lationship and lose some customers and suppliers, thus lead to the increase of enterprise’s operating costs and reduction its profitability. There are great differences in ideology, cultural and social background, thinking mode between China and western countries. Volvo has a series of problems of pen- sion gap and liabilities, apart from these technical prob- lems, cultural conflicts also can not be evaded. Volvo is a luxury automobile brand in Sweden. Swedish trade un- ions are known as “the world’s toughest workers” and “the Northern Europe’s most powerful trade unions”, whether Geely can lay down reasonable rules and regula- tions according to the legal and cultural differences be- tween the two countries will be the key to success after the M&A In early years, some M&As such as TCL ac- quired French Thomson in 2004 and BAIC’s acquisi- tion of Saab and Opel owned by AM General in 2009 have all been considered to be viable acquisitions, but eventually failed in “integration”. Also similar to Lenovo’s acquisition of IBM, is still in a difficult cultural integration at present. In order to avoid integration risk, Geely should first develop comprehensive integration plan to determine how to integrate strategic resources, business processes and core competencies of both sides so as to achieve the strategic objectives of M&A. Second, in the establish- ment of new business framework and organizational sys- tem, Geely should be committed to the formation of core competitiveness, peel off unrelated or risky businesses. Third, the acquiring company should choose positive, effective communication methods and channels such as communication between the management of both sides, communication between management and employees, communication between the company and other external stakeholders. Four, Geely should pay attention to cross- culture management, fully understand cultural backg r o un d and folkways of the target company, thus to form a new corporate culture through effective integration based on mutual respect and trust. 3) Anti-M&A risk. Copyright © 2011 SciRes. iB  Strategic Analysis of Synergistic Effect on M&A of Volvo Car Corporation by Geely Automobile 12 Under normal circumstances, the merged enterprise’s attitude of M&A is uncooperative. Because the merged enterprises are usually inferior enterprises, they will find ways to stop M&A. Such practices will greatly increase the M&A risks [19-22]. In addition, under the modern corporate governance structure, a successful M&A must first be accepted by enterprise management, then adopted by the board of directors in the enterprise, at last obtain the consent of the large, small and medium-sized inves- tors. In this case, the original Volvo’s manager and techni- cian will probably reject Geely’s M&A, because they might lose the original management position and their vested interests. They might try to prevent the integration after M&A, thus reduce the synergistic effect and lead to anti-M&A risk. In addition, if Geely’s acquisition offer is accepted by the majority shareholder of Volvo, for in- stance, there are 40% of the circulated stockholders who agree on the offer, but some small shareholders are str- ongly opposed to it and require Geely to raise its offer, such situation may also lead to anti-M&A risks and re- duce the M&A synergies. Another anti-M&A case such as Aluminum Corp of China’s investment in Australia’s third-largest mining company Rio Tinto in 2009. In June 2010, Rio Tinto suddenly renounced the plan of capital injection of 19.5 billion dollars in Aluminum Corp of China and determined to pay rationed shares of 15.2 bil- lion dollars to set up iron ore joint venture with BHP Billiton. In order to avoid anti-M&A risk, Geely can adopt the measures of competing for shareholder vote, launching media offensive, placate the trade unions and customers to reduce the resistance of anti-M&A action of the target company. Furthermore, for possible conflicts of interest, United States, Britain, Hong Kong, Germany, the Euro- pean Community and other countries and regions place strict limits on anti-takeover measures of the target com- pany. For example, the “Business Judgment Rule” of United States, the “City Code” of Britain and Hong Kong, the “Merger and Acquisition Regulations” of Germany and the 13th Directive of EU Company Law are all in- clude restrictions on the anti-takeover measures of the target company. These restrictions relatively reduce the difficulty of M&A. 4) Principal-a gent risk. Currently, the property right of many China’s state- owned enterprises is not clear, the appointment and re- moval of the key management personnel are mainly based on China’s administrative structure. For pursuing business expansion, the senior executives with informa- tion superiority might ignore the interests of shareholders to meet the needs of their individual fame and fortune. The “out of control” risk of principal-agent relationship in M&A decision is very dangerous. As Geely is a listed company, the relationship between its manager and corporate owners is principal-agent rela- tionship. The company management might pursuit com- pany expansion for their own interests to show their per- formance. They have information superiority and might agreed on the unreasonable terms of the target company without considering its own financial and operating con- ditions. This conduct will increase the realization cost of synergy and reduce d syner gy benefits. In order to avoid principal-agent risk, Geely should first conduct rigorous project selection and establish a scientific feasibility research system. Second, Geely should set up a more complete corporate governance structure and control mechanism, the operators should report accurate and abundant information of M&A to the board of directors timely and the board of directors should provide effective supervision on the M&A man- agement layer. Third, the board of directors should offer incentives to the managers and other stakeholders of M&A, such as linking their income with M&A effective, presenting them stock options, such measures will en- courage them to make a favorable M&A decision and focus on integrated management of the company after M&A [23,24]. 5) Asymmetric information risk. In the market mechanism of incomplete competition, the problem of information asymmetry is quite general. During the course of strong company’s acquisition of target company, the target company’s executives might conceal the facts such as enterprise’s hidden losses of contingent liability and the true value of patents to achieve their private intentions. They might also collude with the agency or the insider of the strong enterprise to make false information so that the policy makers of the merging side might make wrong decisions [25]. In this case, due to the global financial crisis, part of the Vol- vo’s clients in the market has been badly hit, the man- agement of Volvo might conceal their hidden losses of liabilities and the true value of intangible assets, thus lead Geely to make wrong decisions. In order to avoid asymmetric information risk, Geely should forecast synergy reasonably and avoid over- payment. To prevent over-payment, Geely should first optimize company’s governance structure and implement a performance management system linked to the reward system, thus to reduce the losses caused by information asymmetry. Second, Geely should invest in stages to reduce the risk, on the one hand, to test the tacit coopera- tion of the two sides, on the other hand, to disperse risks effectively. Third, the government should play a positive role in M&A. The government may grant the acquiring company a favorable financial environment and reason- Copyright © 2011 SciRes. iB  Strategic Analysis of Synergistic Effect on M&A of Volvo Car Corporation by Geely Automobile13 able “rules of the game”, thus to ensure the standard be- havior in investment and interests of the parties [26]. 6.2. External Risks As synergistic effect is based on certain of development strategy and the formulation of such a development strategy is based on external environment, therefore, the changes in external environment not only affects the en- terprise’s development strategy, but also cause the devia- tion from the expected synergies. The external risks of synergistic effect mainly include policy risk, legal risk and industrial risk. 1) Policy risk. Policy risk refers to the synergy risk which caused by the adjustment of national economic policies. In particu- lar, during the course of the state-owned enterprises’ re- form, in some places, there exist the phenomena of regional protectionism which caused by rent-seeking activities of the local governments. Namely, the govern- ment develops special policies to protect the vested in- terests of government and “special groups” or uses ad- ministrative means to arbitrarily change its policy to de- stroy the normal order of market competition, such beha- vior would increase the risk of synergy. In this case, when Geely makes decision, it should take into account the effect of national economic policy on synergistic ef- fect. At the same time, Geely might set up corresponding subsidiary in Sweden after M&A, therefore, the Swedish government’s policies in the industry can not be ignored. In order to av oid policy risk, Geely should first under- stand that which local interest groups have associated with its M&A. If Geely can rely on the local interest groups to establish lasting relationships, foster the rela- tionship network between different interest groups, it will be able to avoid or reduce the M&A risk, such as obtain the information on policy changes in advance. Second, strengthening cooperation between the acquiring com- pany and the development banks and other financial in- stitutions of the host country will also help determine the risk of the local situation in the process of M&A. Third, it’s better to sign a M&A agreement on the rights and obligations with the host government thus to regulate the behaviors of both sides. 2) Legal risk. Legal risk mainly lies in the following three aspects. The first is the provisions of anti-monopoly law. Most of western countries developed a series of anti-monopoly laws to safeguard fair competition. At present, although there are no corresponding laws promulgated in our country, but when the concentration of the industry in- creased to a certain level, the relevant legislation is in- dispensable; the second is the specific provisions of M&A in the law. For instance, according to the corre- lated laws, if the acquirer holds 5% of a listed company’s shares, it must notice and suspend trading, for each 2% subsequent increment, it is necessary to repeat the proc- ess, if holding 30% of the shares, it must launch a com- prehensive tender offer. This provision leads to great increase of the acquisition costs and M&A risk. Thirdly, during the course of M&A, as laws and regulations are incomplete, the conduct of company can not be guided correctly, thus result in the increase of M&A risk. In this case, Geely’s board of directors may face resource inte- gration issues after M&A such as rehiring new employ- ees and dismissing older employees. In the aspect of dismissal legal system, there are many differences be- tween Swedish and Chinese labor law. From the view of Swedish Labor Court’s judicial practice of 70 years, in practice, judges are often biased in favor of the workers in weak position. Therefore, after M&A, Geely should lay stress on the dismissal of “legitimate reasons” in the legal relationship between employers and employee. In addition, as China’s current legal system of M&A is not perfect, if Geely’s legitimate rights and interests are in- fringed but lack of corresponding legal protection, the synergy risk will increase. In order to avoid legal risk, Geely should first study the domestic and international laws and policies related to M&A thoroughly. Second, Geely should engage lawyers, accountants and other professional advisers to participate in the M&A and formulate the terms of the agreement. Third, use different methods of payment according to the laws of different countries. There are many kinds of M&A payment, such as cash payment, stock payment, debt payment and comprehensive security payment. In transnational M&A, stock paym ent often encounters some legal obstacles. This measure may not minimize the cost of M&A, but it makes the M&A feasible. 3) Industrial risk. Industry risk refers to the uncertainty of the industry prospects caused by the changes of country’s economic situation and industrial policy, which might influence the enterprise development strategy. In the process of M&A decision-making, many enterprises sink into woeful situ- ation because they are not familiar with the new industry they wish to enter or without a accurate grasp of the in- dustry prospects. The “big diving” of e-commerce enter- prises in the last two years are good examples. In order to avoid industrial risk, Geely should consider the development law of industrial life cycle. Currently, China’s high-end luxury car is still in the introduction period, Geely may encounter less domestic competitors in this industry. But as the product gradually entering the growth stage of product life cycle, more and more com- petitors will be attracted to the market and the market position of Geely will be threatened. In addition, in the Copyright © 2011 SciRes. iB  Strategic Analysis of Synergistic Effect on M&A of Volvo Car Corporation by Geely Automobile 14 domestic market, automobile is still a luxury, the price elasticity of demand is relatively high, once the macro- economic situation shows a decline trend, and the profits of Geely in the industry will be greatly reduced. This will definitely increase the M&A synergy risk . 7. Conclusions With the constant development of market economy, the number and scale of assets reorganization, M&A and cross-regional joint of Chinese enterprises has been on a rapid rise in recent years. At present, the trend of Chinese enterprises’ M&A has shifted from financial-based M&A to strategy-based M&A and shown the following new features: the scale of M&A has enlarged gradually; strong enterprises are starting to consider M&A as a business development strategy; share acquisition of listed companies has become an important form of M&A; M&A has shown a trend of diversification, securitization and internationalization; M&A motive has transformed from prevenient simple M&A based on single motive to strategic M&A based on industrial integration and ex- pansion [27,28]. International M&A trends suggest that the main moti- vation for M&A is no longer just the pursuit of econo- mies of scale and market price-earnings ratio, but to consolidate the future global economic situation and the strategic position of market competition, namely so- called strategic M&A. As a developing country in the rising phase, China must size up the situation and achieve synergistic effect through the implementation of strategic M&A according to her own development needs and thereby enhance the international competitiveness of Chinese enterprises. REFERENCES [1] J. Kitching, “Acquisition in Europe: Causes of Corporate Success and Failure,” Business International, Vol. 2, 1973, pp. 20-35. [2] S. W. Salant, S. Switzer and R. J. Rey nolds, “Losses from Horizontal Mergers: The Effects of an Exogenous Change in Industry Structure on Cournot-Nash Equilibrium,” Quarterly Journal of Economecs, Vol. 98, No. 2, 1983, pp. 185-199. [3] B. J. Cui, “The Characteristics and Thinkings of China’s M&A,” Enterprise Economy, Vol. 7, 2007, pp. 154-157 (In Chinese). [4] T. Belcher and L. Nail, “Integration Problems and Turn around Strategies in a Cross Border Merger,” International Review of Financial Analysis, Vol. 2, 2000, pp. 219-234. [5] H. I. Ansoff, “Corporate Strategy,” revised Ed., Penguin Books, London, 1987. [6] J. H. Dunning, “The Geographical Sources of Compe- titivenss of Firms: Some Results of a New Survey,” Transnational corporation, 1996. [7] M. L. Sirower, “The Synergy Trap: How Compa ni es Lo se the Acquisition Game,” Free Press, Mankato, 1997. [8] Y. M. Du, “The Payment Method of Funds and Risk Prevention of Enterprise,” Commercial Accounting, Vol. 7, 2009, pp. 53-54 (In Chinese). [9] A. A. Aslani and S. Negassi, “Is Technology Integration the Solution to Biotechnology’s Low Research and Development Productivity,” Technovation, Vol. 26, 2006, pp. 573-582. [10] W. G. Liu, H. P. Hou and C. C. Liu, “Analysis of Technology Transference in Transnational Corporate M &As,” Science of Science and Management of S.&T., Vol. 8, 2009, pp. 19-23 (In Chinese). [11] G. Hamel and C. K. Prahalad, “The Core Competence of the Corporation,” Harvard Business Review, No. 5-6, 1990, pp. 79-91. [12] J. X. Li, Y. G. Wang, “Stock Price Effects of M&A of Listed Companies: Evidence from the Shanghai and Shenzhen Stock Markets of A-Share in China,” The Theory and Practice of Finance and Economics, No. 9, 2009, pp. 47-51. [13] Office of Fair Trading, “Merger Appraisal in Oligopolistic Markets,” Economic Research Paper, 1999. http:// www. oft.gov.uk/business/economic+research/completed.htm [14] Financial Report of Geely Auto in 2009 [EB/OL]. http:// q.stock.sohu.com/hk. [15] Financial Report of Volvo in 2009 [EB/OL].volvo group.com/group/china. [16] L. M. Lucas, “The Role of Culture on Knowledge Transfer: The Case of the Multinational Corporation,” Learn i ng Organization, Vol. 13, No. 3, 2006, pp. 257-275. [17] L. Pepall, D. Richards, G. Normal, “Industrial Organization: Contemporary Theory and Practice,” Cincinnati South- Western College Publishing, Cininnati, 1999. [18] P. H. Mirvis, M. L. Marks, “Managing the Merger,Making IT work,” Prentice-Hall, New York, 1992 . [19] E. Eckbo, “Horizontal Mergers, Collusion, And Equilibrium Analysis,” Journal of Financial Economics, No. 11, 1983, pp. 241-273. [20] R. Stillman, “Examining Antitrust Policy Toward Horizontal Mergers,” Journal of Financial Economics, No. 11, 1983, pp. 225-240. [21] A. Banerjee and E. W. Eckard, “Are Mega-Mergers Anti -Cmpetitive? Evidence from the First Great Merger Wave,” Radn Journal of Economics, Vol. 29, No. 4, 1998, pp. 803-827. [22] M. K. Perry and R. H. Porter, “Oligopoly and the Incentive for Horizontal Merger,” American Economic Review, Vol. 75, No. 1, 1985, pp. 219-227. [23] R. Deneckere and C. Davidson, “Incentives on Form Coalitions with Bertrand Competition,” Rand Journal of Economics, Vol. 16, No. 4, 1985, pp. 473-486. [24] W. B. Su, X. H. Li and Y. Li, “Corporate Control, Information Asymmetry and the Method of Payment for Copyright © 2011 SciRes. iB  Strategic Analysis of Synergistic Effect on M&A of Volvo Car Corporation by Geely Automobile Copyright © 2011 SciRes. iB 15 Mergers and Acquisitions,” Collected Essays on Finance and Economics, No. 9, 2009, pp. 67-73 (In Chinese). [25] S. Huck, K. Konrad and W. Mueller, “Big Fish Eat Small Fish: On Merger in Stankelberg Markets,” Economics Letters, Vol. 73, No. 2, 2001, pp. 213-217. [26] A. Creane and C. Davidson, “Multidivisional Firms, Internal Competition and the Merger Paradox,” Canadian Journal of Economics, Vol. 37, No. 4, 2004, http:// economics.ca /cje /en /forthcoming. php. [27] T. Nilssen and L. Sorgard, “Sequential Horizontal Mergers,” European Economic Review, Vol. 42, No. 9, 1998, pp. 1683-1702. [28] G. J. Stigler, “Monopoly and Oligopoly by Merger,” The American Economic Review, Vol. 40, No. 2, 1950, pp. 23-34.

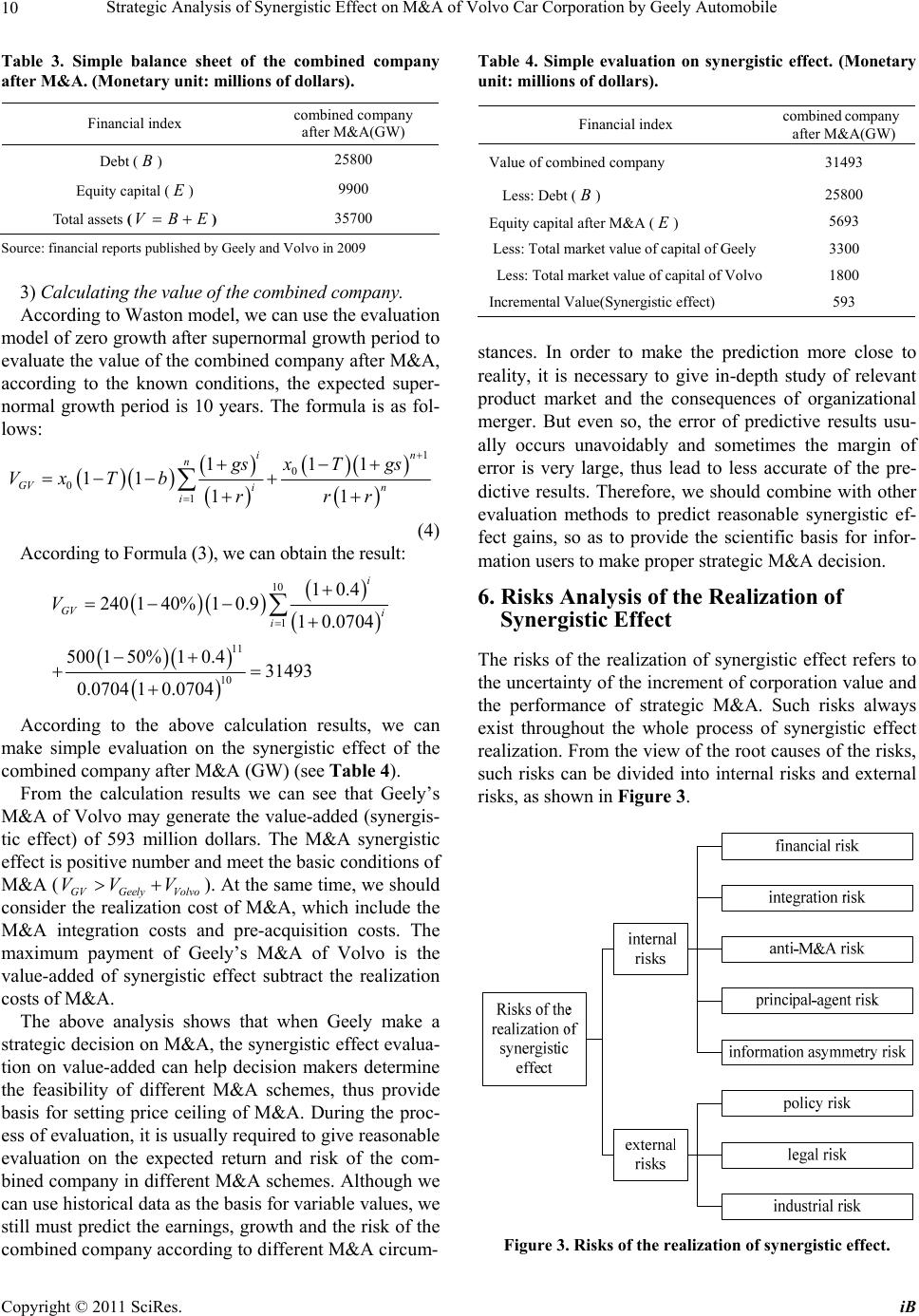

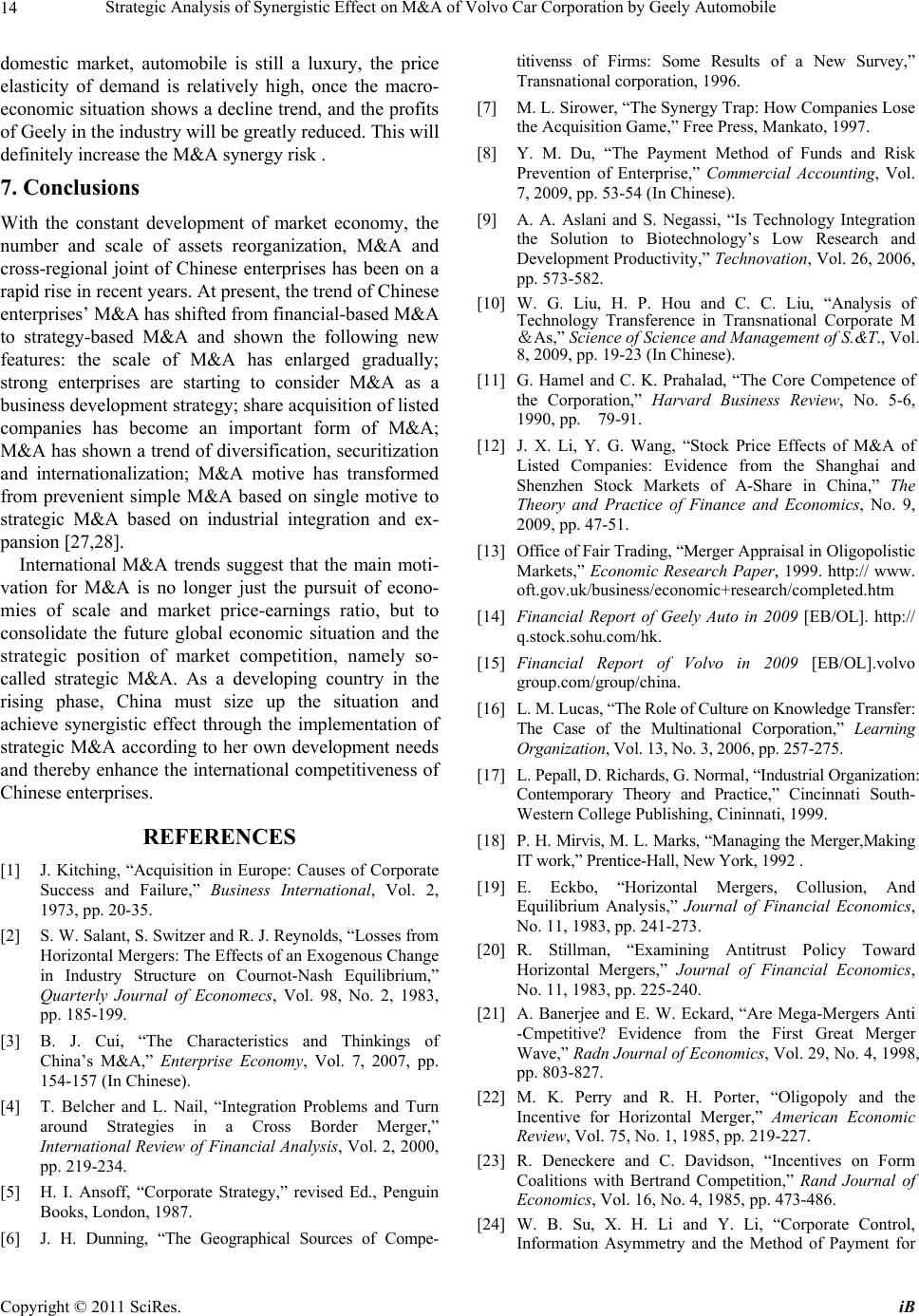

|