iBusiness, 2011, 3, 23-29 doi:10.4236/ib.2011.31004 Published Online March 2011 (http://www.SciRP.org/journal/ib) Copyright © 2011 SciRes. iB Coping with Imprecision in Strategic Planning: A Case Study Using Fuzzy SWOT Analysis Hasan Hosseini-Nasab1,2, Amin Hosseini-Nasab3, Abbas S. Milani2* 1Department of Industrial Engineering, Yazd University, Tehran, Iran; 2School of Engineering, University of British Columbia, Ke- lowna, Canada; 3Department of Industrial Engineering, Amirkabir University of Technology, Tehran, Iran Email: abbas.milani@ubc.ca Received December 9th, 2010; revised December 27th, 2010; accepted December 30th, 2010. ABSTRACT In this article, it is shown that using the co nventiona l SWOT analysis in the vicinity o f strategic regions in th e matrix of internal and external factors, ambiguity can exist in defin ing fin a l strateg ies. To cop e with th is difficu lty and to enh an ce the accuracy of the underplaying decision process, a straightforward fuzzy SWOT analysis is presented a nd exemplifie d by extracting and analyzing strengths, weaknesses, opportunities and threats in a company known as KPPP. The analy- sis is performed based on actual field data using 90 external and 85 internal factors and a group of 12 experts. Next to the identificatio n of the fuzzy SWOT matrix, it is shown that the external threats and intern al weaknesses of KPPP can have stronger effects compa red to its external opportunities and intern al strengths. Keywords: Fuzzy Applications, Internal and External Factors, Strategic Planning, SWOT Analysis 1. Introduction It is well known that a company’s success in today’s competitive business environment requires its ability to create and update strategic plans [1-6]. While various management analysis techniques such as the Total Qual- ity Management (TQM) [7-10] and Re-engineering [2,4] have proven to be beneficial for meeting organizational specific objectives, strategic planning remains the single most important element for companies’ overall success. Reported case studies indicate that organizations using the principles of strategic planning are by far in better condition in marketing, profitably and beneficiation [2,4,11,12]. Earlier studies have been performed on improving the classical strategic planning methods such as the strengths, weaknesses, opportunities, and threats (SWOT) analysis. Ghazinoory et al. [13] applied a fuzzy set approach to both the internal and external factors using conventional membership functions. The algorithm prioritizes and extracted the most significant strategies based on inten- sity of effects. Kuo-liang and Lin Shu-chen [14] pro- posed a fuzzy SWOT method to evaluate the competitive environment of different transshipment locations as in- ternational distribution centers (IDC) in the Pacific-Asian region. Their work suggested that the fuzzy method iden- tifies more competitive locations as compared to the conventional SWOT. Zhangjiajie [15] presented a new fuzzy decision-making tool for small and medium enter- prises (SMEs) under a set of ambiguous strategic policies. The model can assist SMEs to train their own core strengths and gradually explore their ideal strategies. Lee et al. [16] presented a mechanism for integrating a fuzzy cognitive map (FCM) within strategic planning simula- tions, where FCM helps decision makers understand complex dynamics between a certain strategic goal and related environmental factors. Wang and Chang [17] investigated the properties of fuzzy scenario analysis to cope with the issue of data shortage and the linguistic expression of experts. Their study successfully incorpo- rated the fuzzy set theory into the scenario analysis such that uncertainties are accounted for. Kahraman1 et al. [18] proposed a method to evaluate different alternative strategies for an e-government application in Turkey. They used the SWOT approach in conjunction with the analytic hierarchy process (AHP) to prioritize their strategies. Shuliang et al. [19] proposed a hybrid ap- proach for integrating a group Delphi, fuzzy sets and expert systems in developing marketing strategies. The method was specifically employed to help groups of managers undertake SWOT analysis. It is worth adding that next to the strategic planning area, fuzzy sets have been widely used in a range of applications including  Coping with Imprecision in Strategic Planning: A Case Study Using Fuzzy SWOT Analysis 24 linear and nonlinear control, pattern recognition, financial systems, etc [13,18,20]. This article is intended to first indentify a potential imprecision problem in the use of conventional SWOT analysis for particular strategic planning problems, and then present an application of a fuzzy SWOT method to resolve the problem. The method has been exemplified via a case study on the strategic planning of the KPPP company. The case is based on actual field data, col- lected from 12 experts based on 90 external and 85 in- ternal decision factors. Section 2 reviews the basics of the conventional SWOT analysis. Section 3 identifies the potential problem with the conventional SWOT matrix and extends the analysis to the fuzzy method. Section 4 presents the KPPP’s case study and discusses the results using a quantitative measure for determining the total distance between the obtained fuzzy internal and external factors. Section 5 concludes the article. 2. Basic SWOT Analysis Strategic planning in an organization can involve making decisions on allocating resources such as capital and people. During strategic planning, main objectives are often presented as vision and mission statements and subsequently the company’s strengths, weaknesses, op- portunities, and threats (SWOT) are assessed [21-31]. The vision statement is an image or state to which the com- pany aspires. It emphasizes the desire of where the com- pany would be at a specific time. The nature of a business is often expressed in terms of its mission indicating the purpose of the business; for example, to design, develop, manufacture and market specific product lines for sales based on certain features to meet the identified needs of specific customer groups via certain distribution channels in particular geographic areas. Having built up a picture of the company’s past and current achievements, the SWOT analysis can commence. The following four steps are considered for analyzing the internal factors: 1) All internal factors are scored based on their exist- ing status in the company. The scores are crisp values and usually range from −2 to 2 as shown in Figure 1. 2) An overall importance coefficient/weight of 1 to 100 is assigned to each internal factor based on the viewpoints of experts. The weights are then normalized such that their sum is one. 3) The weighted score of each factor is calculated by multiplying the corresponding normalized importance Figure 1. Scoring of the internal (or external) factors based on their importance. coefficient by the score of the factor from Step 1. 4) The summation of the weighted scores is considered as the overall score of internal factors. The external opportunities and threats to the company can fall in the areas such as customers, distribution channels, identities, substitute products, etc. The same procedure used for scoring the internal factors can be employed to evaluate the external factors; i.e., eventually an overall weighted score for the external factors is esti- mated. Next, the company’s overall internal and external scores are used to locate its position in a SWOT matrix as shown in Figure 2. The two overall internal and ex- ternal scores define the coordinates of a strategic point that fall in one of the matrix cells. The matrix cells nor- mally indicate known strategies for the managers. For example, if a company's position is located in cell #1, growth strategies for adding new products are proposed; for cell #9, divestiture strategies are considered and so on. 3. A Fuzzy SWOT Analysis Whilst a list of strategies should be suggested based on the final position of a company in the SWOT matrix, the crisp division of two adjacent cells may be a methodo- logical limitation. This can be especially problematic when most of the data collected during the scoring proc- ess are qualitative. For instance, assuming a company with a total external score of 1.5 and a total internal fac- tor of 1.001, the company’s position is then placed in cell #1 in Figure 2 and therefore, growth strategies for add- ing new products would be proposed. In a very similar case, assuming the same external score of 1.5 but with an internal score of 0.999, the company’s position would be placed in cell #2 and consequently, a different strategy such as keeping existing situation would be proposed. Hence, in such cases, two close internal or external scores can cause a major difference in the dictated 2 1 -1 -2 -2 1 2 Internal Score External Score -1 3 2 1 6 5 4 9 8 7 Figure 2. Matrix of internal and external scores. –2 –1 1 2 Very weak Weak Strong Very Strong 2 1 1 2 Copyright © 2011 SciRes. iB  Coping with Imprecision in Strategic Planning: A Case Study Using Fuzzy SWOT Analysis25 strategies, while practically there are no large differ- ences between the companies’ ability and status with respect to the internal and external factor values (in the presence example, 0.999 vs. 1.001). To overcome the above difficulty, a fuzzy scale (Fig- ure 3) for scoring the internal and external factors may be considered and consequently, the evaluation matrix can compass fuzzy regions as shown in Figure 4. Using this fuzzy approach, the likelihood of a company’s stra- tegic point falling in a weak/medium or medium/strong state in the vicinity of two adjacent cells varies gradually (with a reasonable slope of the membership function). As a result, a sudden change from the weak to medium or from the medium to strong state is avoided. For example, recalling Figure 4, internal scores of 0.999 or 1.001 would both be considered within the intersection of the weak and medium states. The following steps are proposed within the fuzzy SWOT framework: 1) Analyze the background data and define company’s vision. 2) List the company’s all external environment factors, including political, economical, social and technological factors. For each factor, its sub-factors/attributes can also be defined. 3) List the company’s all internal environment factors, including those related to the marketing, functional sources, employee, general management, information and quality management. For each internal factor, its attributes can also be defined. 4) List the effective internal and external factors based Figure 3. Triangular fuzzy numbers for scoring internal and external factors of the company. Figure 4. Fuzzy matrix of the internal and external factors. on the company’s main objectives and activities. 5) Considering a factor (e.g., the j-th factor), define a triangular fuzzy number ( k , k B, k C) for each of its attribute values (e.g., the k-th attribute) based on a scale of −2 to +2, where −2: complete threat/weakness, −1: weak threat/weakness, + 1: weak opportunity/strength, + 2: complete opportunity/strength. k B is the most probable (average) value, k is the minimum and k C is the maximum (note that kjkjk BC). If N experts (i1,, N ) are employed during data collection, each expert may define a fuzzy number such as (i k ,i k B,i k C). Averaging these fuzzy numbers for the j-th factor, k-th attribute gives [32] ( k , k B, k C) = 1 N ( 1 Ni k i , 1 Ni k i B , 1 Ni k i C ). The process can be repeated for all attributes of external and internal factors. 6) Define a weight, k, for each attribute based on its influence on the company’s activities and objectives by using a scale of 1 to 100 (subsequently the weights can be normalized to one). Weights may be found by brain storming among experts or by averaging individual weights from the experts. w 7) Calculate an average fuzzy numbers Cfor each factor based on its attribute values and weights: j A 1 j n kjk wA k ,j B 1 j n kjk wB k , j C 1 j n kjk wC k ; where n is the number of attributes for the j-th factor. 8) Calculate a total score of the internal factors (FIF) and a total score of the external factors (FEF) by sum- ming the corresponding fuzzy scores ( , B, C) from the previous step. Note that FIF and FEF will also be fuzzy numbers. Weak medium strong 9) Locate the company’s position in a fuzzy SWOT matrix based on the FIF and FEF values. The located coordinates should indicate a fuzzy triangular region, instead of a single point that would normally be obtained using the conventional SWOT. 4. Case Study Due to the confidentiality reasons, let us name the com- pany under study ‘KPPP’. KPPP carried out various na- tional and international activities. The IT department of KPPP has the role of facilitating the technology integra- tion and IT service development towards integrated solu- tions. This department manages KPPP’s electronic ser- vices and internal information systems. In the beginning of 2011, KPPP made the decision that it should revisit its strategic planning for a better performance. The company’s vision during strategic planning is de- fined, e.g., based on a better control over its future, the –2 –1 1 2 3 2 1 1 2 weak medi weak medium strong Fuzzy External Score 2 1 6 5 4 9 8 7 2 -1 1 2 0 1 Membership function 0 1 Copyright © 2011 SciRes. iB  Coping with Imprecision in Strategic Planning: A Case Study Using Fuzzy SWOT Analysis Copyright © 2011 SciRes. iB 26 need for better circulation, environmental alterations, opportunities and threats and also cultural modifications. Considering the opportunity for a strategic evaluation of the company’s production and service, the vision and objective of KPPP were defined as follows. ”The com- pany is capable of continuing the production and service with a high level of quality and quantity and with a stable progress, and it can aim at becoming the source of better services for other related industries. “ 1) All potential internal and external factors on KPPP’s activities and aims were listed. 2) The effective factors were short-listed, regardless of their form of influence (positive or negative effect). It was recognized that an exact analysis of internal envi- ronment is essential in confronting weaknesses by utiliz- ing strengths. Internal factors were classified into mar- keting, money, employees, general management, etc. The main external factors were grouped into political, social, economical, technological, etc. In total, 5 external and 7 internal factors were used (to be discussed for Tables 3 & 4). To apply the fuzzy SWOT method of Section III, data for both internal and external environmental factors were collected from a committee of 12 experts in the area. In doing so, the company's general background and its condi- tion relative to the nation’s activities were accounted for; e.g., the company's share in job security and employment. 3) The attributes of each factor in Step 2 were identi- fied. For instance, for the ‘Economical’ factor (Table 1), attributes were chosen as: more predictable cash flow, Table 1. Fuzzy external factors (sample data for the “Economical” factor). fuzzy number Priorities (weights) 1 m 1 m 1 m C on scale of [1-100] Normalized value Factor and its Attributes 1 1.2 1.5 65 0.030 More predictable cash flow –1.6 –1.3 –1 80 0.035 Breakability to natural disaster 0.1 0.2 0.4 77 0.034 Gaining financial knowledge 0.2 0.5 1.1 80 0.035 Minimum salary –0.8 –0.4 –0.1 49 0.023 Rate of bank interest ... .... ..... .... .... ....(total of 28 attributes) Economical Table 2. Fuzzy internal factors (sample data for the “Employee” factor). Factor conditions Priorities Minimum amount Most possible amount Maximum amount 0-1 1-100Factor and its Attributes 0.2 0.3 0.6 0.06781 Happy employees –1.5 –1 –0.5 0.05370 Employee union –1 –0.6 –0.2 0.06883 Employee shortage 1.1 1.2 1.5 0.06680 Employee with high perform- ance 0 0.5 1 0.06984 Low level of employee pay- ment 0 1 1.9 0.05370 Skilled employee .... .... .... .... .... (total of 15 attributes) Employee Table 3. Fuzzy external environmental factor analysis of KPPP. Final Score (fuzzy average) Minimum amount Most possible amount Maximum amount Number of factors External Group Title # –0.0072 0.005 0.0213 24 Political 1 –0.0133 –0.0065 0.0075 28 Economical 2 –0.045 –0.027 0.0091 20 Social 3 –0.062 –0.025 0.002 12 Technological 4 0.103 –0.041 0.018 6 Others 5 –0.23 –0.11 0.034 90 FEF  Coping with Imprecision in Strategic Planning: A Case Study Using Fuzzy SWOT Analysis27 Table 4. Fuzzy internal environmental factor analysis of KPPP. Final Score (fuzzy average) Minimum amount Most possible amount Maximum amount Number of Attributes Factor Group Title # –0.0745 –0.0451 –0.011 8 Marketing 1 –0.0638 –0.023 –0.0214 5 Money 2 –0.0061 0.02 0.063 11 Activities 3 –0.044 –0.0243 –0.0183 15 Employee 4 –0.0167 –0.0149 –0.0008 21 General management 5 –0.0362 –0.0173 –0.0016 10 Information 6 –0.0251 –0.0002 –0.0043 15 Quality management 7 –0.27 –0.11 –0.018 85 FIF breakability to natural disaster, gaining financial knowl- edge, minimum salary, and rate of bank interest. 4) Fuzzy numbers using the linguistic scale of Figure 3 were assigned by each expert and an average score was found for each attribute of a factor as ( k , k,B k). Sample results are included in Tables 1 and 2 for the external ‘Economical’ and internal ‘Employee’ factors, respectively. The weight of each attribute within each factor category (e.g., political) was also determined con- tingent to its influence on the KPPP activities. A scale of 1 to 100 was used and the final weights were normalized. C 1) The attribute scores within each factor group were averaged and a total score for the factor was calculated as ( , B, C); . Complete results are shown in Tables 3 and 4. For instance, the weighted average of attribute scores in Table 1 for the ‘Economical’ factor resulted in (−0.0133, −0.0065, 0.0075) as indicated in Table 3. 1, ,12j To locate the strategic position of KPPP in a SWOT matrix, the FEF and FIF values were calculated by summing the fuzzy number in Tables 3 and 4, respec- tively. It was found that FEF= (−0.23, −0.11, 0.034) and FIF= (−0.27, −0.11, 0.018). Consequently, the locations of the best, most probable, and worst strategic points were shown in Figure 5. 4.1. Determining a Distance between the Internal and External Factors - a Decision-Making Case: Managers often intend to know which factors (external or internal) are more influential in their strategic decision making. The distance between the two fuzzy numbers of FIF and FEF can be calculated as: 123 ,,aaa 123 ,,bbb ,dFIFFEF = 123 123 22 4 aaa bbb In the KPPP case this gives: , 0.272( 0.11)0.0180.232( 0.11)0.0340.014 4 dFIFFEF Considering a negative distance (FIF-FEF<0), it could be recommended that the total effect of the internal (strengths/ weaknesses) factors is greater than the total effect of the external (opportunities/threats) factors and therefore, more focus should be made on reducing the company’s weaknesses and strengthening its strengths. Finally, of the three strategic points in the Fuzzy SWOT matrix in Figure 5, two points have been located in the threatening area; i.e., emphasizing sizable external threats and internal weaknesses of KPPP. Therefore, close attention should be paid to the external threats and internal weaknesses in making strategies for this com- pany. The only point located in the desirable area with positive factor values is point 1 (with the least possible external threats and internal weaknesses). Nevertheless, considering the minimum likelihood of this point, no strategy would be taken up on point 1. In fact, only a small area portion (< 25%) of the overall triangle has fallen in the positive region. Both points 2 and 3 belong to a strategic cell with a score between 0 and −1 (me- dium-to-week). 5. Conclusions Internal strengths and weaknesses are vital for strategic planning of companies to cope with the external threats and benefit from the external opportunities. One of the potential shortcomings of the conventional SWOT matrix was shown and a simple fuzzy SWOT approach was suggested to overcome the problem. The method was exemplified using a case study in the KPPP company. It was shown that the current strategic position of the KPPP company is identifiable as a three-point region by means Copyright © 2011 SciRes. iB  Coping with Imprecision in Strategic Planning: A Case Study Using Fuzzy SWOT Analysis 28 Internal fuzzy factors Point 3: The worst condition fo internal and external factors Figure 5. Strategic position of KPPP in the fuzzy SWOT matrix. of the coordinates of FIF and FEF fuzzy numbers. In particular, the position of the ideal point with the least possible external threats and the least possible internal weaknesses, or the most external opportunities and the most internal strengths was revealed. Similarly, strategic points corresponding to the most probable (mean) and the worst condition were located. Eventually, based on the general position of the strategic triangle (relative po- sition of the three points), a realistic strategy can be cho- sen. In the conventional SWOT analysis, only one point is identifiable and it may cause a decision ambiguity, specially in the vicinity of adjacent cells in the SOWT matrix. Further research is worthwhile to extend the fuzzy approach to more complex strategic planning mod- els (e.g., TOWS [33]) where interactions among decision factors may also be included. REFERENCES [1] L. C. Harris and E. Ogbonna, “Initiating Strategic Plan- ning,” Journal of Business Research, Vol. 56, 2006, pp. 100-121. doi:10.1016/j.jbusres.2005.02.003 [2] D. Kellogg and W. A. Nie, “A Framework for Strategic Service Management,” Journal of Operation Manage- ment, Vol. 3, 1995, pp. 323-337. doi:10.1016/0272-6963(95)00036-4 [3] K. E. Papke-Shields, M. K. Malhotra and V. Grover, “Evolution in the Strategic Manufacturing Planning Process of Organizations,” Journal of Operation Man- agement, Vol. 24, 2006, pp. 421-439. doi:10.1016/j.jom.2005.11.012 [4] M. Rhee and S. Mehra, “Aligning Operation, Marketing and Competitive Strategies to Enhance Performance,” In- ternational Journal of Management Science, Vol. 34, 2006, pp. 505-515. [5] Y. Sarason and F. Tegarden, “The Erosion of the Com- petitive Advantage of Strategic Planning,” Journal of Business and Management, Vol. 9, No. 1, 2003, pp. 1-21. [6] M. Tanabe, C. F. D. Angelo and N. Alexander, “The Ef- fectiveness of Strategic Planning: Competitiveness in the Brazilian supermarket sector,” Journal of Retailing and Consumer Services, Vol. 11, 2004, pp. 51-59. doi:10.1016/S0969-6989(02)00064-4 [7] J. Carlos Bou-Llusar, A. B. Escrig-Tena, V. Roca-Puig and I. Beltrán-Martín, “An Empirical Assessment of the EFQM Excellence Model: Evaluation as a TQM Frame- work Relative to the MBNQA Model,” Journal of Opera- tions Management, In Press. [8] M. Martínez-Costa and A. R. Martínez Lorente, “ISO 9000 & TQM: Substitutive or Complementary? An Em- pirical Study in Industrial Companies,” International Journal of Quality and Reliability Management, Vol. 21, No. 3, 2004, pp. 260-276. doi:10.1108/02656710410522711 [9] M. Rodney, L. Denis, J. Henderson and S. A. Hazlett, “Grounded Theory Research Approach to Building and Testing TQM Theory in Operations Management,” Omega, Vol. 36, No. 5, 2008, pp. 825-837. doi:10.1016/j.omega.2006.04.005 [10] M. S. Saremi, F. Mousavi and A. Sanayei, “TQM Con- sultant Selection in SMEs with TOPSIS under Fuzzy En- vironment,” Expert Systems with Applications, In Press, (2008). [11] T. C. Powell, “Strategic Planning as Competitive Advan- tage,” Strategic Management Journal, Vol. 13, No. 7, 1992, pp. 551-558. doi:10.1002/smj.4250130707 [12] M. Terziovski, P. Fitzpatrick and P. O. Neill, “Successful Predictors of Business Process Reengineering (BPR) in Financial Services,” International Journal of Production Economics, Vol. 84, No. 1, 2003, pp. 35-50. doi:10.1016/S0925-5273(02)00378-X [13] S. Ghazinoory, A. Esmail Zadeh and A. Memariani, “Fuzzy SWOT Analysis,” Journal of Intelligent & Fuzzy Systems, Vol. 18, 2007, pp. 99-108. Point 1: The ideal condi- tion for internal and exter- nal factors Point 2: The most proba le (mean) condition for internal and external factors External fuzzy factors 1 1 –1 1 2 2 –2 –2 Copyright © 2011 SciRes. iB  Coping with Imprecision in Strategic Planning: A Case Study Using Fuzzy SWOT Analysis29 [14] L. Kuo-liang and L. Shu-chen, “A Fuzzy Quantified SWOT Procedure for Environmental Evaluation of an In- ternational Distribution Center,” Information Sciences, Vol. 178, 2008, pp. 531-549. doi:10.1016/j.ins.2007.09.002 [15] H. Zhangjiajie, “The Application of Fuzzy Control in Strategic Decision-Making of Small and Medium Enter- prises,” The International Conference on Measuring Technology and Mechatronics Automation, China, 2009. [16] K. C. Lee, W. J. Lee, O. B. Kwon, J. H. Han and P. I. Yu, “Strategic Planning Simulation Based on Fuzzy Cognitive Map Knowledge And Deferential Game,” Simulation, Vol. 71, No. 5, 1998, pp. 316-327. doi:10.1177/003754979807100503 [17] H.-F. Wang and W.-Y. Chang, “Fuzzy Scenario Analysis in Strategic Planning,” International Journal of General Systems, Vol. 30, No. 2, 2001, pp. 193-201. doi:10.1080/03081070108960705 [18] C. Kahraman, N. Ç. Demirel, T. Demirel and N. Y. Ateş, “A SWOT-AHP Application Using Fuzzy Concept: E-Government in Turkey,” Fuzzy Multi-Criteria Decision Making, Vol. 16, 2008, pp. 85-117. doi:10.1007/978-0-387-76813-7_4 [19] S. Li, B. Davies, J. Edwards, R. Kinman and Y. Duan, “Integrating Group Delphi, Fuzzy Logic and Expert Sys- tems for Marketing Strategy Development: The Hybridi- sation and Its Effectiveness,” Marketing Intelligence & Planning, Vol. 20, No. 5, 2002, pp. 273 -284. doi:10.1108/02634500210441521 [20] S. J. Chen, C. L. Huang and F. P. Huang, “Fuzzy Multiple Attribute Decision Making Method and Application,” Springer, Berlin, 1992. [21] H. H. Chang and W. C. Huang, “Application of a Quanti- fication SWOT Analytical Method,” Journal of Mathe- matical and Computer Modelling, Vol. 43, 2006, pp. 158- 169. doi:10.1016/j.mcm.2005.08.016 [22] F. R. David, “Strategic Management,” Prentice-Hall, New Jersey, 1998. [23] R. G. Dayson, “Strategic Development and SWOT Analysis at University of Warwick,” European Journal of Operation Research, Vol. 152, 2004, pp. 631-640. doi:10.1016/S0377-2217(03)00062-6 [24] L. kue, L. Liang and L. S. Chen, “A Fuzzy Quantified SWOT Procedure for Environment Evaluation of an In- ternational Distribution Centre,” Information Science, Vol. 178, 2008, pp. 531-549. [25] I. Yuksel and M. Dagdevirn, “Using the Analytic Net- work Process (ANP) in a SWOT Analysis–A Case Study for a Textile Firm,” Information Sciences, Vol. 177, No. 16, 15 August 2007, pp. 3364-3382. doi:10.1016/j.ins.2007.01.001 [26] K. Altinkemer, A. Chaturvedi and S. Kondareddy, “Busi- ness Process Reengineering and Organizational Perform- ance,” International Journal of Information Management, Vol. 18, No. 6, 1998, pp. 381-392. doi:10.1016/S0268-4012(98)00030-9 [27] C. V. Altrock and B. Krause, “Multi-Criteria Decision Making in German Automotive Industry Using Fuzzy Logic,” Fuzzy Sets and Systems, Vol. 63, No. 3, 1994, pp. 375-380. doi:10.1016/0165-0114(94)90223-2 [28] A. Attaran, “Exploring the Relationship between Infor- mation Technology and business process reengineering,” Information & Management, Vol. 41, No. 5, 2004, pp. 585-596. doi:10.1016/S0378-7206(03)00098-3 [29] S. A. Drew and R. Kaye, “Engaging Boards in Corporate Direction Setting: Strategic Scorecards,” European Man- agement Journal, Vol. 25, No. 5, 2007, pp. 359-367. doi:10.1016/j.emj.2007.07.006 [30] M. V. Severin and A. Grabski, “Complementary Controls and ERP Implementation Success,” International Journal of Accounting Information Systems, Vol. 8, No. 1, 2007, pp. 17-39. doi:10.1016/j.accinf.2006.12.002 [31] J. Yang, C. Wu and C. Tsai, “Selection of an ERP System for a Construction Firm in Taiwan,” Automation in Con- struction, Vol. 16, No. 6, 2007, pp. 787-796. doi:10.1016/j.autcon.2007.02.001 [32] K. Abraham, “Fuzzy Expert Systems,” CRC Press, Inc. 1992. [33] H. Weihrich, “The TOWS Matrix a Tool for Situational Analysis,” Long Range Planning, Vol. 15, No. 2, 1982, pp. 54-66. doi:10.1016/0024-6301(82)90120-0 Copyright © 2011 SciRes. iB

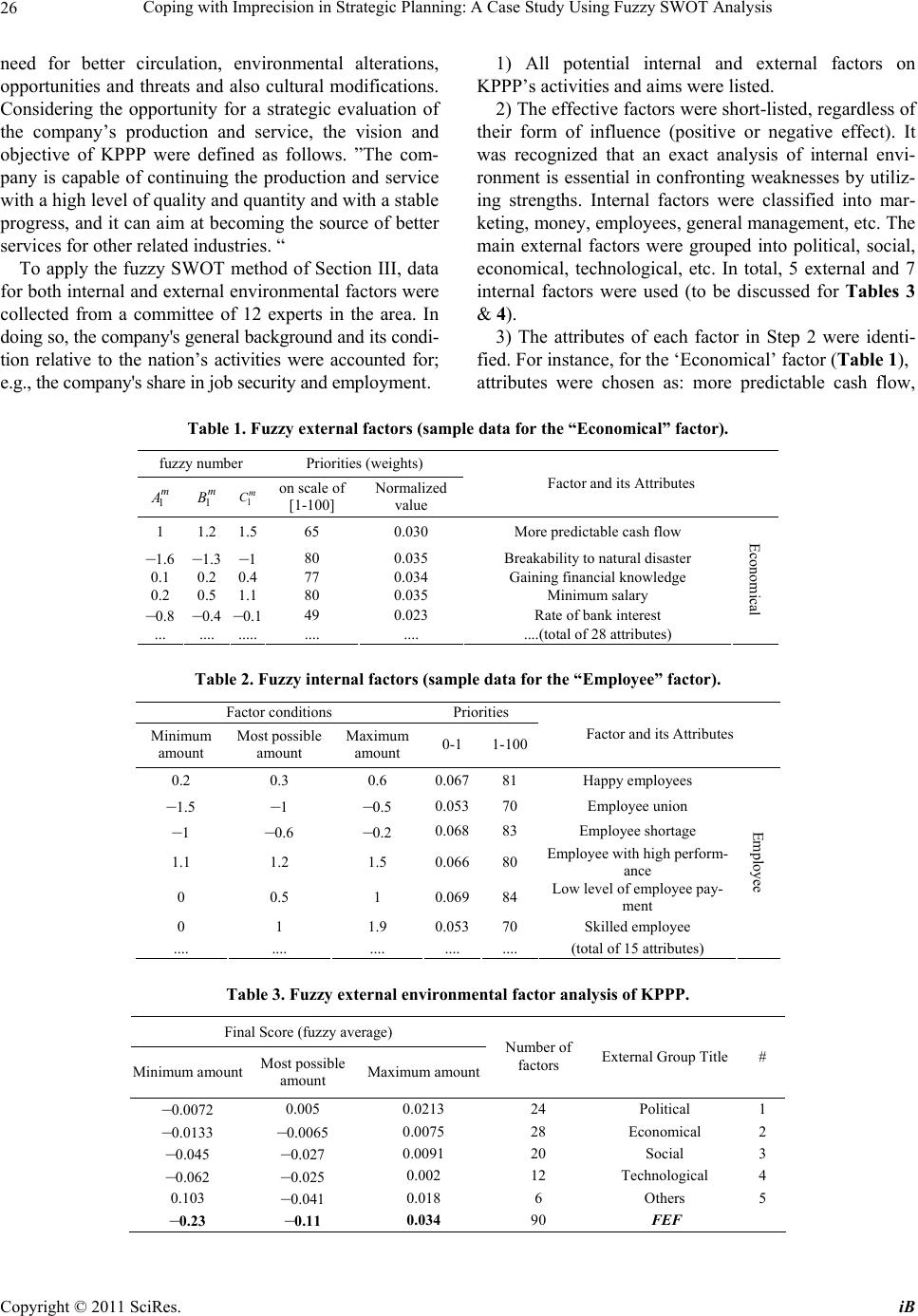

|