Journal of Service Science and Management, 2011, 4, 52-58 doi:10.4236/jssm.2011.41008 Published Online March 2011 (http://www.SciRP.org/journal/jssm) Copyright © 2011 SciRes. JSSM Inter-Group and Intra-Group Externalities of Two-Sided Markets in Electronic Commerce Lixiang Li, Yueting Chai, Yi Liu Department of Automation, Tsinghua University, Beijing, China. Email: {li-lx07, chaiy, yiliu}@mail.tsinghua.edu.cn Received November 11th, 2010; revised December 23rd, 2010, accepted December 24th, 2010. ABSTRACT The e-marketplaces, which play an important role in facilitating transa ction s and aggrega ting informatio n in electronic commerce, show positive inter-group externalities where one group’s benefit from receiving a service depends on the number of the intermediary services consumed by the other group, and negative intra-group externalities where the surplus is destroyed because members within the group compete with each other. In this paper, with a different ap- proach from the emerging two-sided markets theory and the traditional microeconomic theory, we analyze a monopo- listic e-marketplace owned by a third-party firm by substitu ting the size of consumers with the number of intermediary services. Moreover, we pay close attention to solving the following problems: 1) When these inter- and intra-group ex- ternalities exist, are both the demand curves and the pricing strategies of intermediary services different from those of traditional goods? 2) How to price intermediary services to maximize profit in the e-marketplaces? 3) How do these network externalities affect the management strategy of platforms? Finally, we exemplify such analytical results as pricing strategies of platforms with managerial practice of electronic commerce. Keywords: Electronic Commerce, E-Marketplace, Two-Sided Markets, Network Externalities 1. Introduction During the last decade, many business-to-business (B2B) and customer-to-customer (C2C) e-marketplaces, such as ALibaba, GlobalSources, BuyerZone, eBay, and Taobao, continue to flourish, and are generating enormous vol- umes of trades. However, some famous commercial websites like Commerce One had gone into bankruptcy. One common feature of these platforms is that, besides trade services, they also provide such information ser- vices as industry news and economic policies, consulting services for management decisions, and other services. In fact, these information services can fascinate sellers and buyers and help the platform form a virtual community to disseminate new message. Thereafter, this fascinates more sellers and buyers. Furthermore, most of these e-commerce platforms usually provide free service for sellers or buyers. A principle problem facing platform owners is how to price trade services to maximize their profit in electronic commerce? How do network exter- nalities affect the management strategy of platforms? Which economic theory explains these economic phe- nomena? In fact, many literatures in two-sided markets begin to speculate these problems, but there is few sys- tematic research results in electronic commerce. According to the emerging theory of two-sided mar- kets, e-marketplaces are a typical two-sided market. Rochet and Tirole [1] strictly defined two-sided markets as ones in which the price structure affects the economic outcome (volume, profits, and welfare). Some markets fit this description: B2B e-marketplaces, credit cards, media markets, real-estate agents and shopping malls. Evans [2] provided more cases and discussion of such two-sided markets. In these markets, intermediaries or “platforms” enable interactions among distinct groups of agents and attempt to gain the two sides with rational price to each side. This interaction exhibits inter- and intra-group ex- ternality: 1) inter-group externalities, or indirect network externalities, as far as the benefit enjoyed by a member of one group increases with the number of members of the other group; 2) intra-group externalities, or competi- tion externalities, as far as the benefit enjoyed by a member of a group decrease because members within the group compete with each other. For instance, industrial B2B e-marketplaces shares these characteristics: 1) the more services consumed by sellers in e-marketplaces, the  Inter-Group and Intra-Group Externalities of Two-Sided Markets in Electronic Commerce 53 higher the benefits for buyers connected with platforms, and vice versa; 2) sellers compete for the trade of buyers, and vice versa. Therefore, business strategies of interme- diaries are shaped by inter- and intra-group externalities. In the presence of inter-group externalities, Caillaud and Jullien [3] put ‘divide-and-conquer’ strategies subsidiz- ing the participation of one side (divide) and recovering the loss on the other side (conquer). Intra-group external- ities, however, blur the picture. This paper naturally relates to the very recent literature on two-sided markets, pioneered by Rochet and Tirole [1,4], Caillaud and Jullien [3], and Armstrong [5,6], based on the theories of network externalities initiated by Katz and Shapiro [7]. Rochet and Tirole [1,4] emphasize the importance of relative price elasticity of demand on the two sides of the platform in determining its pricing structures with general approaches. Besides, most analy- ses apply to specific industries: payment systems [8,9], Internet-related intermediation [3], software and video games [10,11], media markets [12]. Jullien [13] and Rochet and Tirole [1] propose useful road maps to this flourishing literature. The main emphasis of these papers is on the effects of inter-group externalities on the design of pricing structures, the competition between platforms, multi-homing vs. single-homing decisions, platform own- ership, exclusive contracts and so on. Intra-group exter- nalities are either abstracted away or not central to the analysis. The paper closest in spirit to mine is Yoo et al. [14] and Belleflamme and Toulemonde [15]: they study how the two types of network externalities jointly shape intermediary strategies in two-sided markets. However, all this papers essentially consume that the number of intermediary services consumed by an agent is either one or zero, but not directly affected by the consumer’s budget and platforms’ prices. That is to say, these papers don’t consider sellers’ and buyers’ decision problems to choose the consumption quantity of services, but simply focus on whether agents will connect with platforms. In our model the consumption choices with budget con- straints play an important role, because they affect the demand and prices of services consumed by sellers and buyers and therefore profits and social welfare. Contrib- uting to the recent two-sided market theory, we introduce a novel mechanism 1) that models an industrial e-mar- ketplaces with the theory of consumer behavior and the theory of the firm, 2) that illustrates the shape of the de- mand curves of intermediary services in platforms joined by two-sided network externalities, 3) that deduces the optimal pricing strategies of intermediary services when the impact of inter- and intra-group externalities is sig- nificant, 4) that shows the impact of such parameters as network externalities on optimal prices. The rest of this paper is arranged as follows. Firstly, we model e-marketplaces joined by inter- and intra-group externalities in Section II. Secondly, we analyze the im- pact of the parameters that define sellers and buyers on price levels in Section III. Finally, section IV concludes. 2. Model There are a monopoly platform and two types of con- sumers: sellers and buyers (denoted 1 and 2 in turn). As can be seen in Figure 1, an agent of one group pays at- tention to the quantities of intermediation services con- sumed by agents of the other group and competition among members within the group. For simplicity, suppose the quasi-linear utility function of a member of sellers or buyers is determined as follows: when the platform admits m1 sellers and m2 buyers, the quantities of the intermediary services consumed by the ith (i = 1, 2, , m1) group-1 agent and the jth (j = 1, 2, , m2) group-2 agent are x1i and x2j separately, each consumer’s problem of choosing her most preferred con- sumption level given service prices p1 or p2 and wealth levels w1i or w2j can be stated as the following utility maximization problems: 1 21 111211111 1121111 1 11 11 111 2 2 ..1, , iiii i x nn ij ii ji ii i Maxuxb XrXxBy i bxr xxBy st pxywim (1) 2 12 2221122 22 22122 222 11 22 222 2 2 ..1, , jjjj j x nn ijj ij jj j Maxuxb XrXxBy j bxr xxBy stp xywjm (2) where X1 (X2) is the aggregate demand of services to sellers (buyers), y1i (y2j) is the budget surplus to a mem- ber of sellers (buyers). The parameter B1 (B2) describes the net fixed benefit, which equals information values minus usage costs to sellers (buyers) in the platform. The inter-group externality parameter b1 (b2) weighs the Figure 1. Inter- and intra-group externalities of e-market- places. Copyright © 2011 SciRes. JSSM  Inter-Group and Intra-Group Externalities of Two-Sided Markets in Electronic Commerce 54 benefit a member of sellers (buyers) enjoys from inter- acting with each member of sellers (buyers) because in- termediaries save the transaction cost in direct transac- tion, and the intra-group externality parameter r1 (r2) weighs the loss a member of sellers (buyers) suffers from competing among members within the group each other. Generally, there are b1, b2 > r1, r2 in e-marketplaces. Using the first-order conditions of (1) and (2), we get the inverse demand functions to the two groups 11211 pbXrXB 1 2 (3) 22122 pbXrX B (4) Equation (3) describes that the aggregate demand X1 decreases with the price p1 when X2 is fixed, and the same to (4). It is consistent with the demand-price char- acter of general goods or services. Simultaneous Equa- tions (3) and (4) have a unique solution characterizing the demand X1 and X2 as functions of (p1, p2): 21 12 21 12 1 12 12 21 1221 12 2 12 12 rpbprB bB Xbb rr bprpbB rB Xbb rr (5) Expression (5) shows that the aggregate demand X1 (X2) increases with the prices (p1, p2) of services in the pres- ence of inter-group and intra-group externalities. That is to say, the aggregate demand curve of services slopes upwards because network externalities make the two groups in the platform obtain more value from consump- tion of intermediary services when the network scale is more large. From the cost side, we assume the monopoly platform will incur the marginal costs C1 and C2 for serving sellers and buyers respectively. Consequently, the platform’s profit is equal to: 1112 2 pCX pCX 2 (6) where the sunk cost is not considered implicitly. Substituting (3) and (4) into (6), we obtain the first- order conditions of the profit maximization problem: 11221111 21212222 2 2 XbbXrXBC XbbXrXBC 0 0 (7) From (7), the optimal aggregate consumption levels to the two groups are where and when the following condi- tions hold: * 10X* 20X 2111222 1221 211 20 20 rCBb bCB rCBb bCB (9) with derived from b1 > r1 and b2 > r2. 2 12 1 4bb rr 2 We assume that expression (9) is satisfied for the fol- lowing sections and the second-order conditions of the profit function for (X1, X2) are also satisfied as follows: 22 22 11 22 2 222 2 12 12 22 12 12 20,2 0 40 Xr Xr bb rr XX XX (10) Substituting (8) into (3) and (4), we get the optimal prices to maximize the platform owner’s profit: 22 112 121212121 * 12 12 12 1212 2 2 12 12 22 212 122 112 122 * 22 12 12 2121 1 2 12 12 22 4 4 22 4 4 bbbrrC bbbrrB pbb rr bbrC B bb rr bbbrrC bbbrrB pbb rr bbrCB bb rr (11) These outcomes can be recorded as follows: Proposition 1: The optimal prices and the optimal aggregate demands of intermediary services ** 12 ,pp ** 12 ,nn , which maximize the platform owner’s profit, are characterized by (11) and (8). From (11), we can get that the optimal prices ** 12 ,pp vary with different marginal service costs (C1, C2). Intui- tively, when the marginal cost for serving a group is higher, the price of intermediary services is expected to be higher in order to recover the loss of the platform. But, in e-marketplaces joined by inter- and intra-group net- work externalities, we deduce some unusual results about the relation between optimal prices and marginal costs for serving the two groups. Proposition 2: In e-marketplaces connected with two- sided network externalities, the price level to a group is lower than the marginal cost for serving it, whereas the price level to the other group is higher than the marginal cost for serving it. 2111222 * 12 12 12 1211122 * 22 12 12 2 4 2 4 rCBb bCB Xbb rr bbCBrC B Xbb rr (8) Proof. With total optimal price level 2 , minus the total marginal cost for serving the two groups C1 + C2, we obtain * 1 pp* *** * 1212 111222 0ppCC rbX rbX (12) Copyright © 2011 SciRes. JSSM  Inter-Group and Intra-Group Externalities of Two-Sided Markets in Electronic Commerce 55 Expression (12) shows that not every price level to a group is greater than the marginal cost for serving it. Moreover, the maximal profit of the platform is not nega- tive, namely ** *** 111 222 0pCXpCX (13) Expression (13) shows that not every price level to a group is smaller than the marginal cost for serving it. Therefore, there is either (2 ) or ( 2 ) within the monopoly platform joined by inter- and intra-group network externalities. * 11 pC, * 2 pC* 11 pC, * 2 pC (Q.E.D.) According to Proposition 2, the monopoly platform can recoup a loss or make a profit not by charging both higher prices, which exceed marginal costs to the two groups, but by charging a higher price to a group whereas providing price subsidy for the other group in e-market- places. 3. Comparative Static Analysis From (11), we can find the relation between optimal prices and these parameters defined in this paper. 3.1. Impact of Inter-Group Externalities on Service Prices Optimal prices of trade services vary with the magni- tudes of inter-group network externalities to the two groups. The impact of positive inter-group externalities of both sellers and buyers on optimal service prices are stated as follows: Proposition 3: When the magnitude of the inter-group network externalities to group 2 is not smaller than that to group 1 (b2 ≥ b1), the service price to group 1 becomes higher, but the service price to group 2 becomes lower with the rise in the benefit of the in- ter-group externalities to group 1 b1. Oppositely, if the magnitude of the inter-group network externalities to group 2 is not bigger than that to group 1 (b2 ≤ b1), the service price to group 2 becomes higher, but the service price to group 1 is lower with the rise in the benefit of the inter-group externalities to group 2 b2. * 1 p * 2 p * 2 p * 1 p Proof. Many composite effects exist in e-marketplaces owing to several parameters, so the relation between the change of the optimal service price to each group and the relative change of inter-group network externalities (b1, b2) is obscure. However, while the relative value between the inter-group externality parameters to the two groups is known, the changes of and become distinct. The first-order derivatives of optimal prices to the two groups, and , on inter-group externality parame- ters (b1, b2) in expression (11) are stated in expression (14). Since all * 1 p* 2 p * 1 p* 2 p * 11 pb terms are positive when b2 ≥ b1 and all * 12 pb terms are negative when b2 ≤ b 1, * 11 pb is positive when b2 ≥ b1 and * 1 pb 2 is nega- tive when b2 ≤ b1. 2 *21 211211 1 2 2 112 12 222 * 1121221222 2 22 12 12 2 *2121 1211 1 2 2 212 12 222 112121222 12 4 4 42 0, 0 4 4 4 42 bb bbrrCB p bbb rr rbbrrb bC Bp b bb rr brrb bbCB p bbb rr rrr bbbbCB bb * 2 2 21 12 0, 0 4 p b rr (14) (Q.E.D.) * 22 pb is the same to * 11 , whereas pb * 21 pb is the same to * 12 pb ; thus we only provide scenarios for * 11 pb and * 12 pb . If the benefit of inter-group network externalities to a group is bigger, the utility of intermediary services to that group is bigger. Moreover, the service price to that group can be higher (* 11 pb > 0, * 22 pb > 0). However, inconceivably, the optimal service price to a group is lower while the benefit of in- ter-group network externalities to the other group is big- ger (* 1 pb 2 < 0, * 21 pb < 0). 3.2. Impact of Intra-Group Externalities on Service Prices The relations between changes in optimal service prices and changes in different sizes of negative intra-group network externalities are showed as follows: Proposition 4: If the benefit of the inter-group net- work externalities to group 2 is bigger than that to group 1 (b2 > b1), the price to group 1 (group 2) will be lower (higher) along with a rise in the benefits of the in- tra-group externalities (r1, r2). Conversely, if the size of the inter-group network externalities to group 2 is less than that to group 1 (b2 < b1), the price to group 1 (group 2) will be higher (lower) along with a rise in the benefits of the intra-group externalities (r1, r2). Proof. The first derivatives of intra-group externality parameters (r1, r2) on optimal prices of each group, and in expression (11) are provided in expression (15). If b2 > b1 and (9) is satisfied, both * 1 p * 2 p * 11 pr and * 1 r 2 p are negative, but both * 22 and pr * 21 pr are positive. Oppositely, if b2 < b1 and (9) is satisfied, both * 11 pr and * 12 pr are positive, but both Copyright © 2011 SciRes. JSSM  Inter-Group and Intra-Group Externalities of Two-Sided Markets in Electronic Commerce 56 * 22 pr and * 21 prare negative. 22 *12 2111222 1 2 2 112 12 22 *211221211 2 2 2 212 12 * 1121 221211 1 2 2 212 12 *221211122 2 1 2 4 2 4 22 4 22 bb rCBbbCB p rbb rr bb rCBbbCB p rbb rr rb brCBbbCB p rbb rr rbbrCBb bCB p r 2 2 2 12 12 4bb rr (15) (Q.E.D.) We maybe hope that due to the bigger negative exter- nalities among members within each group and the ulti- mate negative impact on the benefits of group 1 and group 2, the service prices to the two groups will at all time be lower. However, if b2 > b1 (the attachment of group 1 is more worthy to group 2 than the attachment of group 2 to group 1), the service price to group 1 will be lower and the service price to group 2 will be higher when r1 or r2 becomes bigger. Similarly, if b2 < b1 (the attachment of group 1 is less worthy to group 2 than the attachment of group 2 to group 1), the service price to group 1 will be higher and the service price to group 2 will be lower when r1 or r2 becomes bigger. 3.3. Impact of Information Benefits on Service Prices The optimal price to each group is different with varia- tion of the information benefits (B1, B2). Instinctively, when the benefit of information services is greater, the expectation utility of the platform and the resulting price will also be higher. However, in some circumstances, we can find that the lower prices vary with the higher infor- mation benefits. The influence of information benefits to each group over the optimal prices is showed as follows. Proposition 5: 1) If information benefit to group 1, B1 (group 2, B2) becomes bigger, the service price charged to group 1 (group 2, ), will be higher. * 1 p* 2 p 2) If the size of network externalities to group 2 (group 1) is bigger than that to group 1 (group 2), b2 > b1 (b1 > b2), the service price charged to group 1, (group 2, ), will be higher when the information benefit to group 2, B2 (group 1, B1), becomes bigger,. Conversely, if the size of network externalities to group 2 (group 1) is smaller than that to group 1 (group 2), b2 < b1 (b1 < b2), the service price charged to group 1, (group 2, ), will be lower when the information benefit to group 2, B2 (group 1, B1), becomes bigger in the same way. * 1 p * 2 p * 1 p* 2 p Through the first derivatives of the information bene- fits (b1, b2) on optimal service prices and in expression (11), we can easily prove the above proposi- tion. If the information benefit to group 2 becomes big- ger, the utility of the platform to group 2 will become bigger, and the service price to group 2 will also become higher ( * 1 p* 2 p * 22 pB > 0). Therefore, we hope that the ser- vice price to group 1 will also become higher simply because the bigger value of intermediary services to group 2 increases the benefit for group 1 with the indirect externality. However, inconceivably, the information benefits for group 2 is higher, the optimal price for group 1 is lower when b2 < b1. All results in the above propositions are summarized in Table 1. 4. Managerial Applications In this paper, we have explored a general model of neu- tral e-marketplaces where the benefit to one group from inter-group externalities based upon the amount of ser- vices consumed by the other group and the loss to each group from negative intra-group externalities based upon competition among members within it. We conclude some useful results stated in the above propositions, which can help managers to determine the optimal pric- ing strategies of platforms connected with two-sided network externalities. Moreover, the significance of the relative size between the positive inter-group external- ities to the two groups is emphasized in these proposi- tions. In practice, information about the perceptual char- acter of these platforms may provide managers some Table 1. Summary of propositions. Parameter (Increase) * 1 * 2 Assumptions b1 + – when b1 ≤ b2 b2 – + when b1 ≥ b2 – + when b1 < b2 r1 + – when b1 > b2 – + when b1 < b2 r2 + – when b1 > b2 + – when b1 < b2 B1 + + when b1 > b2 + + when b1 < b2 B2 – + when b1 > b2 Copyright © 2011 SciRes. JSSM  Inter-Group and Intra-Group Externalities of Two-Sided Markets in Electronic Commerce 57 useful clues in recognizing which inter-group externality is bigger. Generally, a forward-auction e-commerce platform, i.e. seller’s market, may have higher inter-group network externalities to sellers compared to a reverse-auction e-commerce platform, i.e. buyer’s market. According to the above results, the service price to buyers may be very lower or zero in supplier-favored marketplaces con- trasted with that in buyer-favored marketplaces. For ex- ample, such neutral platforms as alibaba.com, made-in- china.com, globalsources.com and taobao.com run buyer’s market using posted prices or forward auctions. In com- parison, the price charged to sellers will be lower in re- verse-auction compared to that in forward-auction. For instance, FreeMarkets runs a buyer-favored B2B e-mar- ketplace using reverse-auctions, most of the market- making costs are charged to buyers [16]. Most of plat- form’s benefits come from sellers with charging mem- bership fees or commissions, whereas these trade ser- vices are free for buyers. However, 315.com, which is a neutral B2B block trading e-marketplace in the oil indus- try, chemical industry, steel industry, plastics industry, and rubber industry, charges commissions according to the trading volume between buyers and sellers in the platforms. 5. Conclusions In summary, our theoretical analyses enrich the emerging theory of two-sided markets with the introduction of negative intra-group externalities within members of the two groups. Based on our model, we derive the pricing strategy that an independent intermediary can use to maximize its profit. Based on our assumptions, the ag- gregation demand levels of participants in electronic markets as well as the prices charged from sellers and buyers in the electronic marketplace are dependent on the defined parameters of this paper. For simplicity, we assume that equal prices are charged from all sellers and all buyers, whereas the cost of information services are all fixed costs that do not affect the pricing decisions of e-marketplaces as long as the total profit is positive. Also, we consider a monopo- listic e-marketplace with a single-period model. Next, we hope to extend this analysis to a dynamic model with multiple periods. In future research, we will also analyze a duopoly model, which incorporates platform competi- tion between intermediaries in electronic commerce. 6. Acknowledgements This research is supported by the Key Projects in the National Science & Technology Pillar Program in the Eleventh Five-year Plan Period (Project Numbers: # 2009BAH48B03). REFERENCES [1] J. Rochet and J. Tirole, “Two-Sided Markets: A Progress Report,” Rand Journal of Economics, Vol. 37, No. 3, 2006, pp. 645-667. doi:10.1111/j.1756-2171.2006.tb00036.x [2] D. S. Evans, “The Antitrust Economics of Multi-Sided Platform Markets,” Yale Journal on Regulation, Vol. 20, No. 2, 2003, pp. 325-381. [3] B. Caillaud and B. Jullien, “Chicken & Egg: Competition among Intermediation Service Providers,” Rand Journal of Economics, Vol. 34, No. 2, 2003, pp. 309-328. doi:10.2307/1593720 [4] J. Rochet and J. Tirole, “Platform Competition in Two-Sided Market,” Journal of the European Economic Association, Vol. 1, No. 4, 2003, pp. 990-1009. doi:10.1162/154247603322493212 [5] M. Armstrong, “Competition in Two-Sided Markets,” Rand Journal of Economics, Vol. 37, No. 3, 2006, pp. 668-691. doi:10.1111/j.1756-2171.2006.tb00037.x [6] M. Armstrong and J. Wrigh, “Two-Sided Markets, Com- petitive Bottlenecks and Exclusive Contracts,” Economic Theory, Vol. 32, 2007, pp. 353-380. doi:10.1007/s00199-006-0114-6 [7] M. L. Katz and C. Shapiro, “Network Externalities, Com- petition, and Compatibility,” American Economic Review, Vol. 75, No. 3, 1985, pp. 424-440. [8] J. Wrigh, “Optimal Card Payment Systems,” European Economic Review, Vol. 47, 2003, pp. 587-612. doi:10.1016/S0014-2921(02)00305-7 [9] J. Wrigh, “The Determinants of Optimal Interchange Fees in Payment Systems,” Journal of Industrial Economics, Vol. 55, 2004, pp. 1-26. doi:10.1111/j.0022-1821.2004.00214.x [10] G. G. Parker and M. W. V. Alstyne, “Two-Sided Network Effects: A Theory of Information Product Design,” Man- agement Science, Vol. 51, No. 10, October 2005, pp. 1494-1504. doi:10.1287/mnsc.1050.0400 [11] A. Hagiu, “Pricing and Commitment by Two-Sided Plat- forms,” Rand Journal of Economics, Vol. 37, No. 3, 2006, pp. 720-737. doi:10.1111/j.1756-2171.2006.tb00039.x [12] M. Reisinger, L. Ressner and R. Schmidtke, “Two-Sided Markets with Pecuniary and Participation Externalities,” Journal of Industrial Economics, Vol. LVII, No. 1, March 2009, pp. 1-26. [13] B. Jullien, “Two-Sided Markets and Electronic Interme- diaries,” CESifo Economic Studies, Vol. 51, No. 2-3, 2005, pp. 233-260. doi:10.1093/cesifo/51.2-3.233 [14] B. Yoo, V. Choudhary and T. Mukhopadhyay, “A Model of Neutral B2B Intermediaries,” Journal of Management Information Systems, Vol. 19, No. 3, 2002, pp. 1-12. Copyright © 2011 SciRes. JSSM  Inter-Group and Intra-Group Externalities of Two-Sided Markets in Electronic Commerce Copyright © 2011 SciRes. JSSM 58 [15] P. Belleflamme and E. Toulemonde. “Negative Intra- Group Externalities in Two-Sided Markets,” Interna- tional Economic Review, Vol. 50, No. 1, February 2009, pp. 245-272. doi:10.1111/j.1468-2354.2008.00529.x [16] V. K. Rangan, “Free Markets Online,” Harvard Case Study 9-598-109, Harvard University, Cambridge, Feb- ruary 1999.

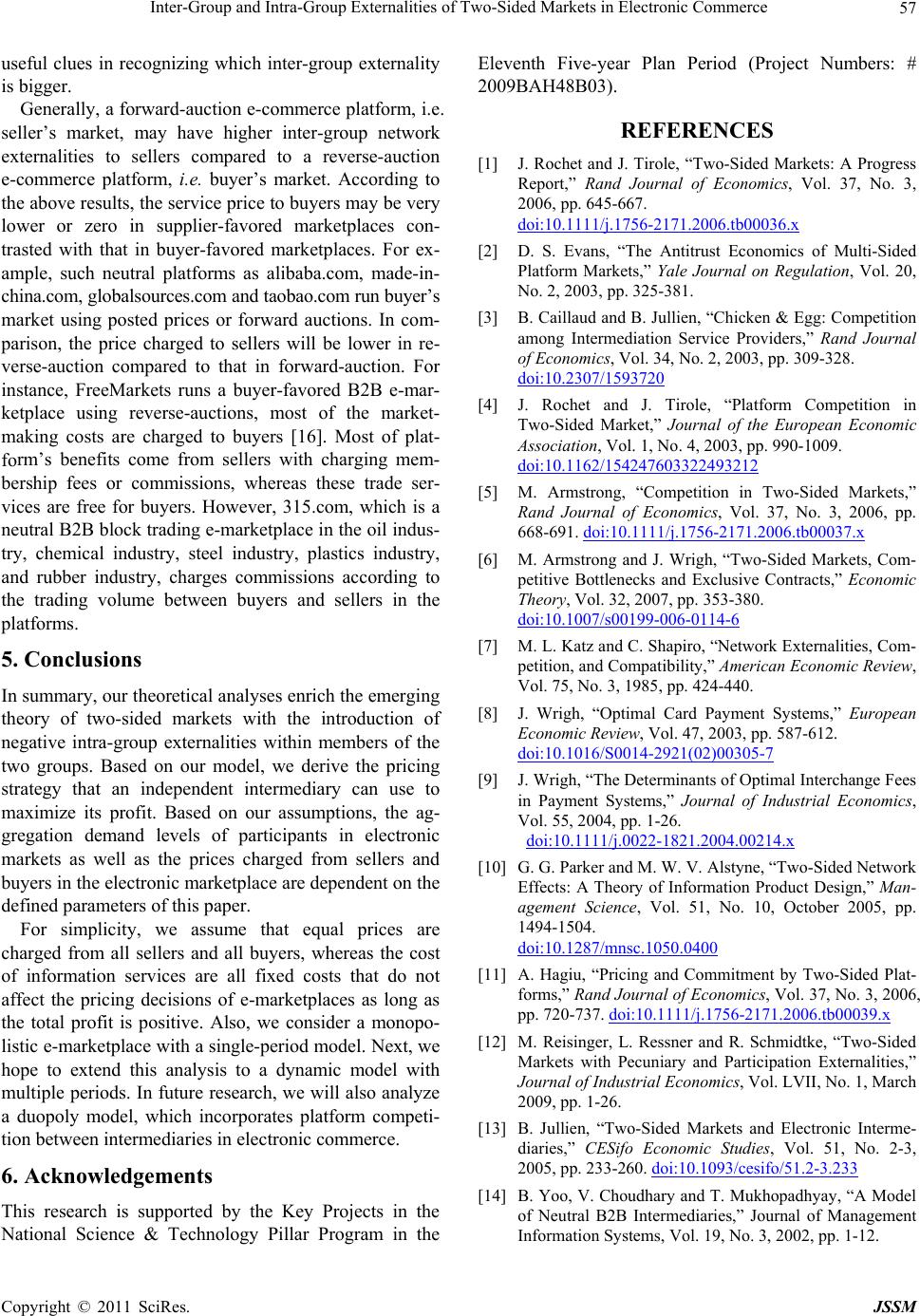

|