Open Journal of Social Sciences 2013. Vol.1, No.6, 17-25 Published Online November 2013 in SciRes (http://www.scirp.org/journal/jss) http://dx.doi.org/10.4236/jss.2013.17004 Open Access 17 Performance of Mergers and Acquisitions under Corporate Governance Perspective —Based on the Analysis of Chinese Real Estate Listed Companies Yong Liu, Yongqing Wang School of Business Administration, South China Universit y of Technology , Guangzhou, China Email: bmdoer@163.com Received 2013 This paper investigates the impact of mergers and acquisitions (M&A) on corporate performance. This ar- ticle selects 36 M&A cases of China’s listed real estate companies in Shanghai and Shenzhen Stock Ex- changes from 2008 to 2009. Regarding the corporate value in 2011 as the measure of the long-term per- formance, we will explore the relationship among check-and-balance Ownership Structure, board size, and institutional investors impact the performance. This paper concludes a positive impact ownership structure on the M&A performance. In addition, the empirical analysis reveals that that the board size has a significant negative effect on the performance. Additionally, the results of the paper indicate that the CEO-Chairman duality has a significant impact on the long-term performance. Besides, institutional in- vestors have positive effect on M&A performance. Keywords: Corporate Governance; M&A; Long-Term Performance; Real Estate Introduction Mergers and acquisitions as growth strat egies have received attention from developed as well as emerging economies. In the 21st century, the global M&A transactions created a new record both in quantity and scale. Clearly, the M&A activity has be- come an important way to seek resources and development. M&A, however, can really make a profit for the enterprise, or increase the shareholder’s wealth? It has also been an academia controversial problem. Since the first M&A case of listed com- pany come out in China, the number of such cases have grown with each passing day. Increasing competitions in the Chinese market lead to constant take over activities and gradual expan- sion of acquisition scale, the cumulative volume of business transactions of M&A hit 910.9 billion Yuan in 2006-2009, which is 40 times as much as that in the period of 2002-2005. Under the environment of market economy, companies can achieve its goal by accumulating internal resource and the mergers and acquisitions. George Stigler noted that no compa- nies can grow without merge and acquisition to some extent. Large companies can hardly grow by organic business expan- sion, as a source of growth is particularly e vident in developing country. Therefore, M&A exerts an important influence on the development of the industry. In the American history, there were five waves of mergers and acquisitions. Facing with the offensive threat of the multi- national enterprises, the companies of China should enhance their comprehensive competitive power through the local merge and acquisition as to improve their inferior position in the area of resources and market after entering WTO. Affected by the global financial crisis, the number of M&A transactions in 2008 was only 1441, a sharp drop by 18.73% compared with that in 2007. But the total transaction turnover still hit 488.81 19 billion Yuan, increasing by 10.85%. These statistical data are well-explained the trend of M&A transactions. In addition, the trend of M &A has moved away from poorly-related acqui- sitions that diversify business to highly-related acquisitions that focus their advantage. M&A transactions are significantly different in number and volume of trade in different industries. Facing the financial and market pressures, many real estate companies, especially the leading ones, purchased some small firms. In 2008, the industry of manufacturing and real estate are the most active ones in merger and acquisition activity, much more than the rest. The world has experienced a few large tides of mergers and acquisitions, promoting the development of the country and boosting the modernization of the industrial structure. Real estate industry has an important impact on the whole national economy. Today, the impact of these merger and acquisition activities on the enterprise performance is worth of some aca- demic study. To understand the impact of M&A on perfor- mance, managers can make correct strategy. Small investors can reduce investment risks, and increase return on investment (Guo & Chen, 2013). Therefore, this paper is of practical and theoretical significance. Compared with related research, this paper has several contributions as follows: Firstly, this paper comprehensively analyzes the influences of Corporate Governance on acquiring companies’ M&A per- formance. While researching M&A transactions, many scholars have brought ownership structure into their study scope. But, they mostly focused on the influences of ownership concentra- tion and ownership nature, and rarely investigated the effect of check-and-balance relationships among big shareholders in ownership structure. What’s more, this paper take institutional investors and CEO duality into consideration .Therefore, this paper contributes to the extension and perfection of researches on influencing factors of M&A performance. Secondly, this paper also examines factors that may influ-  Y. LIU, Y. Q. WANG Open Access ence the M&A performance. Those factors were selected partly with the help of literature analyses and partly in virtue of model deductions. And the final empirical tests found that these fac- tors had indeed impacts on the performance. On one hand, it is the further validation of existing research results, and on the other hand it also provides new theoretical perspectives and empirical evidence, which makes the research on corporate governance and M&A performance more detailed and com- plete. The remainder of the paper is organized as follows. Section 1 presents the literature review. Section 2 introduces to the cur- rent situation of real estate in China. Section 3, the paper puts forward four hypothesizes. Section 4 presents data selection and the analysis model results. Section 5 discusses the conclu- sions and their implications. At last, we make several sugges- tions for further study. The Literature Review With acceleration of the economic globalization process, the worldwide market competition is becoming increasingly intense. Merger is widely considered to be a significant tool by the en- terprises looking for an unbeaten success in the fierce competi- tion. Since 1980s, three major merger waves have swept China in several decades, while counterpart of which in western coun- tries takes more than one hundred years. Essentially, only suc- cessful merger could help enterprises to enhance its business performances, and it is the result of a game played by multiple sides to determine whether the merger effects are taken advan- tage of or not. Thus, clarifying the influences of merger on business performances of listed companies in China, studying the trend of changes of merger performances, and offering practical countermeasures and suggestions would be meaning - ful both from theoretical and practical perspectives to enhance merger performances, exploit cooperative merger effects, regu- late stock capital market and maintain stability of financial market. Why do companies choose merger? Broadly speaking, there are three main reasons: 1) economies of scale theory: mergers and acquisitions among enterprises will lead to lower marginal costs and the improvement of the competition; 2) synergistic effect: The synergies gained from the merger would lower the cost and increase the efficiency of resource allocation; 3) Di- versification Management Theory: the company can maintain financial stability, reduce asset and risk diversification. M&A are one of the mechanisms by which firms gain access to new resources; via resource redeployment, they increase revenues and reduce cost. Limited resources should be transferred from the inefficient enterprises to the high efficient ones, which is conducive to the optimization of resources and the formation of large companies. Mergers and acquisitions in this process play a vital role in industry consolidation. In the previous studies, scholars have come to inconsistent conclusions on the effect of acquisition. Some (Phalippou & Gottschalk, 2009; Jang & Liu, 2012) concluded that the acqui- ree usually gets higher returns although the acquirer has certain advantages. Yu (2011) found that M&A did not improve the performance of the entire enterprise through the sample of Chinese stock market listed companies i n 2007-2010. Rani et al. (2013) claimed that mergers and acquisitions have not resulted improvement in assets turnover ratios, as initially there might not be increase in sales and any consequently, further im- provement in combined capacity utilization may not be possi- ble. However, some studies indicate that M&A appear to have been beneficial for the acquiring companies in the long-run with regard to their operating performance. The findings sug- gest that profitability of acquiring firms have improved during post-M&A phase. Mergers and acquisitions have resulted to better and improved performance. Du & Guo (2012) found that the M&A is an important factor in promoting business growth, and the effect is more obvious after 2 or 3 years. According to the existing literature, the study appears to op- posite result, because they selected different performance indi- cators and control variables. Das et al. (2012) pointed out that the M&A performance measures are diverse owing to hetero- geneous views on what constitutes M&A performance and or- ganization performance. They are categorized under Account- ing Measures, Market Measures and Other Measures, including subjective assessments. Hagendorff & Keasey (2009) found that the long-term performance of M&A is measured by the third year company value. The transition is a characteristic of Chinese economy. In the current capital market system, mergers and acquisitions market are with distinct characteristics of the times. The market me- chanism is imperfect, so the company relies on non-market system. In the current stage, the state-owned enterprises have the advantages of the government relations and market position. The literature about corporate governance identifies three prominent parts: board, check-and-balance ownership structure and CEO duality. One other factor that may influence long-term performance was also analyzed in the paper—Institutional in- vestors. OECD (2004) defines corporate governance is one of the key elements that improves a firm’s performance, and the fluctuation of capital markets, stimulating the innovative activ- ity and development of enterprises. However, Manpreet Singh Gill (2009) found that there is no unanimity among the re- searchers about the relationship between corporate governance and M&A performance. One also finds that most of the work in this regard was done in the context of developed countries. The logic of the paper reflects the relationship between long-term performance of M&A and corporate performance (board of directors, institutional investors and equity balance). Hermalin et al. (2003) found that the board of directors’ fea- tures can cause significant effects on shareholder value. Perry and Shivdasani (2005) stated, “Charged with hiring, evaluating, compensating and ongoing monitoring of the management, the board of directors is the shareholder’s primary mechanism for oversight of managers”. Furthermore, Lei G. & Song S. (2008) aimed to examine the influences of board composition and ownership structures on the firm performance. Their paper in- dicated that a strong positive relation between the level of own- ership and performance .While no strong relation was found between the inside directors or level of managerial ownership and profitability in continental European companies. Hu (2012) contended that the board must oversee blind expansion and assertive behavior of the management. Based on a framework composed of structural, ownership, expertise, and prestige power of the board, Stephen V. Horner (2010) contributes to the role of agency theory in explaining corporate governance by extending upper echelons thinking to the study of boards. Zhou et al. (2013) believed that board of directors has different pro- fessional background, work experience and professional train- ing, so they have a broader perspective to solve problems. The  Y. LIU, Y. Q. WANG Open Access board can act as a strategic role in strategy formulation to check managerial opportunism. If corporate governance is in place, the management will make optimal strategic policies and end up making sub-optimal strategies, which can lead to sustainable competitive advantage (Luke H. Cashen, 2011). Large board size gives the firm a competitive edge in different fronts rang- ing from more expertise, experience, resource corporate strate- gy and provision of broad services. So, corporate governance structure can be a resource for the firm. Raheja C. G. (2005) re- searched optimal board size and composition under various conditions (the type of industry and industry characteristics). When the probability of passing bad projects is low, bad pro- jects could directly affect the performance of the firm. There- fore, board size and composition could affect the performance of the company. Bello Lawal (2012) found that It is logical to first identify if board size affects quality of corporate board decision before moving further to ascertain whether such board decision has impact on firm performance (Board Size → Quality Decision → Firm Performance). Some studies (Mak & Yuanto, 2003; Haniffa & Hudaib, 2006; Garg, 2007) favor smaller board sizes. However, (Abidin et al., 2009) and Sulong & Nor, 2010) favor large board sizes, (Dwivedi & Jain, 2005; Jackling & Johl, 2009) support large board size. Francoeur et al. (2012) asserted that large shareholders have strong incentives to manage earnings upward prior to stock- financed transactions to limit the dilution of their controlling position. Through mergers and acquisitions, Sarkar et al. (2000) found that the controlling shareholder improved the value of non-listed companies. In order to supervise managers, large shareholders involved in business management, so agency con- flicts between managers and shareholders can be alleviated. Goranova et al. (2012) found that the second and the third larg- est shareholder’s stake will constraint the largest shareholder, and improve corporate governance efficiency. Silveira & Dias (2010) analyze the impact on market value of news about con- flicts of interest between controlling and minority share-holders. They suggest that the actions of controlling shareholders that hurt minority shareholders are perceived as value destroying in a significant way. Minority shareholders may sell their stock with large losses and walk away. In firms with concentrated ownership, conflict of interest also exists between controlling owners (or block holders) and minority shareholders (Fan & Wong, 2005). Institutional investors are found to improve the quality of corporate governance in financial reporting in cases where other important governance factors exist. Ben-Amar, Walid, & Paul Andre (2006) found that maintaining harmo- nious corporate relationship with each stakeholder is of high strategic importance to the company and the delivery of success in the marketplace as well as the ability to add value for firms. Mehrdad Alipour & Hossein Amjadi (2011) investigated the effect of ownership structure on performance of listed compa- nies in Tehran Stock Exchange. Findings indicate that there is significant and negative relationship between “the amount of ownership of biggest shareholder” and firm performance, while “the amount of ownership of five greater share-holders” has positive effect. Besides, the relationship between “the amount of ownership of institutional shareholders” and “the amount of ownership of managerial shareholders” is significant and nega- tive. Chairman-CEO duality is defined in respect of one person heading both the Management and the Board. Masulis et al. (2007) concluded that Chairman-CEO duality in different in- dustries have different effect on the acquisition of wealth. The papers have been divergence about CEO duality and the effect of firm performance. The results ra nges from positive (Coles et al., 2001) to negative and mix findings (Heracleous, 2001; Adams et al., 2005). Raluca-Georgiana (2013) use data of list- ed Romanian firms from the Bucharest Stock Exchange, and analyze the relationship between CEO duality and performance (ROA or ROE). Empirical findings indicate that CEO duality is positively related with performance. He concluded that the integrity of information available to board is compromised with CEO duality due to asymmetric as CEO determines what kinds of information are brought to board attention. Saibaba, M. D. (2013) examines the impact of board independence and CEO duality on the valuation of companies listed in BSE 100 index. The paper results show that CEO duality do not have a signifi- cant impact on firm valuations measured by Tobin’s Q. The study also indicates that the firms with large board sizes have better valuation in the Indian context. Wang Kun and Xiao Xing (2005) showed that, in the listed companies with the institutional investors in China, the amount of funds used by related parties was significantly lower, and the correlation between the share proportion held by institutional investors was significant negative. Yingzhao Li & Jian Wei. (2011) classifie institutional investors into three types based on their investment behavior, and respectively research their in- fluences to major shareholders’ benefits transportation. Their paper indicates that, for their interests, active and passive insti- tutional investors can effectively inhibit the benefits transporta- tion behavior of large shareholders. And securities investment funds are the larger, higher shareholders in the company, which makes them not able to inhibit the benefits transportation beha- vior of large shareholders, even have “conspiracy” tendencies with the substantial shareholders. From the above literatures, we can conclude that there is no exact answer to the relationship between the corporate gover- nance and performance. Similarly, the relationship between M&A performance and ownership structure is still ambiguous. The relationship may be either positive or non-existent. The Real Estate Industry The real estate is such kind of industry which is engaged in various economic activities such as development, investment, intermediary services, property management, rental and sales along with the links of production, circulation and consumption. The real estate, under the title of “GDP barometer”, is sensi tive to business cycle. There are three categories of real estate no- wadays in China, the development, intermediary services and property management. The development of the real estate main- ly involves in property and land development. The intermediary services aim at providing intermediary services for property circulation, including real estate brooking and appraisal. The property management aims at providing support for building, equipment and landscaping and services for security a nd clean- ing. The real estate development is the head and front of real estate industry in China. The motive for merge and acquisition in China as follows: 1) The obtaining of land resources Land is essential and indispensable for the real estate. How- ever, the land resource is limited, with the increasing growth of population and the sustainable economic development, the scarcity of land resources becomes more apparent. The contra-  Y. LIU, Y. Q. WANG Open Access dictions among population, economy and land resources are inevitable, which result in the rise of land price. In the mean- while, the Chinese government monopolizes the supply of land resources, the price, quantity, structure and direction of land supply will have influence on the development of real estate. In recent years, the policies of credit, land and taxation car- ried out by government that meant to keeping down the housing price, also has effect on the cost for the real estate enterprises to hold land. Driven by these policies, the gap between the small and medium size real estate enterprises and the big one would widen, and some of those SME are doomed to be swallowed. The merge and acquisition of among the real estate business is imperative. The improvements made by the government in the land market also worsen the problem of the scarcity of the land resources. The land prices continue to rise, which imposes greater burden on the real estate companies. The large real es- tate enterprises could seize more land resources, lower the ac- quisition cost, expand their business and increase market share through the merge and acquisition of the small and medium size companies. 2) Expand new financing channels The debt-to-assets ratio of real estate companies is generally high in China. Under the mode of operation on borrowings, the ability of fund procurement determines the maintenance of fund chain and influences the overall development of the real estate enterprises. And the back loan would be the most significant source of the industry fund. Now, there are still some rough edges in the real estate financial market system, the financing channel, especially the small and medium size companies re- stricted by their own conditions, is simple. Therefore, it’s diffi- cult for those kinds of companies to finance through IPO as they are more dependent on the back loan. However, by means of selling enterprises land and projects, seeking the opportuni- ties to cooperate with others, the small and medium size com- panies could find the “short cut” to expand financing channels and free themselves from the constraints of capital. 3) Macroscopic regulation of government As macroscopic regulation of government, the real estate business capital chain is day by day tight. Industry competition and potential operational risk lead to M&A of real estate com- panies, besides, and M&A achieves multiple business areas. Mergers and acquisitions have become an approach of risk diversification, and steady income. Real estate enterprises de- sire to expand non-residential business, such as commercial real estate, tourism projects and the traditional projects, which be- come an important means to resist risks. 4) Horizontal competition Horizontal competition means the controlling shareholder or actual controller of listed companies engaged in the same or similar business, which may l ead to compete with own business. Chinese law prohibits horizontal competition in the real estate industry, in fact there is still horizontal competition, and from now on we should solve it. M&A is the most effective method to eliminate competition. So, M&A reaches the aim of resource integration. Mergers and acquisitions can achieve economies of scale and further enhance its core competitiveness of the real estate business, which is in line with the long-term corporate strategic planning and protect the interests of minority share- holders and the long-term development of enterprises. 5) Corporate real estate A feature of China’s real estate enterprises about the number and scale: many small and medium real estate companies, but large real estate companies are relatively small. On the one hand, the acquired company can retain high-quality resources, loyal customers, good reputation, and other valuable advan- tages through the acquisition, which lay the foundation of new market areas. On the other hand, M&A helps the acquirer to help enterprises enter new markets and avoid problems, so that enterprises can adapt to the new market environment with the fastest speed. Through mergers and acquisitions, the entire industry will integrate resources and improve the efficiency of resource use. What’s more, M&A improves the degree of mar- ket concentration and expand business scale, which improve the overall competitiveness of the real estate. The above characteristics affect corporate governance. The current situation of corporate governance in real estate listed Companies. With economic development; investors began to concern the corporate governance of listed companies. They wanted to the board to make more accurate investment deci- sions. In the current circumstances of real estate listed compa- nies, the characteristic of corporate governance as follows: First, the board size: The board size of listed real estate companies have reduced from the initial board size 16 - 28 people to 10 - 17 people, but there is still a gap compared with the optimal board size 7 - 9 people. The stakeholder theory and enterprise value maximization theory are familiar to us, so the number of Chairman-CEO duality is small. Second, the ownership struc- ture: ownership structure can be subdivided into ownership attributes and ownership concentration. In ownership concentration, the shareholding ratio of large shareholders is still at a high level. The average proportion of the largest shareholder is 40%, while the top ten shareholders are less than the largest shareholder’s stake, so the dominance of the large shareholder is quite serious. In addition to the largest shareholder, the second largest shareholder and the second to the tenth largest shareholders cannot form an effective check and balances, that is to say, the first major shareholders have absolute power. Hypothesis As aforementioned, the analysis of existing literatures im- plies that: 1) Check-and-balance Ownership Structure helps resolve the agency problems and improve the firm’s performance. 2) If board size increases, board become less effective and increases decision-making time. 3) There is influence CEO duality On the M&A performance. 4) Institutional investors may affect the decision of board and long-term performance. Different aspects of board structure, comprising board size and CEO duality, have become influential factors in the imple- mentation of effective corporate governance of firms. However, the previous literatures have been showed mixed evidence about the factors. Therefore, the paper comes into sight to an- swer the above questions and put forward four hypothesizes. Ownership Control and Enterprise Performance Controlling shareholders have the incentives and power, with a large proportion of voting rights, to pursue their personal interests at the expense of minority shareholders (Wang Lijun, 2008; Fu Qiang, 2012). In fact, minority shareholders are diffi- cult to fully understand the internal operation, because Chinese  Y. LIU, Y. Q. WANG Open Access market rules and regulations are imperfect. The alignment ef- fect dominates the entrenchment motives and acts as a deterrent mechanism to prevent controlling shareholders from managing earnings in M&A. In state-owned enterprises, government will intervene in the company’s decision. But the corporate internal governance structure will affect the realization of government. When the controlling shareholder’s stake is higher, the ability of obtaining private benefits of control is higher, but they must bear the most of the losses and make its motivation of obtaining private benefits diminished. Therefore, the controlling share- holder in a lower shareholding, the motivation of merger and acquisition further deviate from the goal of profit, while con- trolling shareholder has a higher motivation of profit when at a higher stake. Therefore, the paper puts forward the first hypo- thesis: xinlunwen68. Hypothesis 1: Under the lower shareholding, mergers and acquisitions’ performance is negatively related to the control- ling shareholder’s ownership; under the higher stake, mergers and acquisitions’ performance is positively related to the con- trolling shareholder’s stake. Board of Di r ectors an d Corpor ate Performance The performance affected by the company’s characteristics and the board micro decision-making mechanisms. The role of directors in corporate governance is strategic, monitor and con- trol. The larger board members lead to communicate weak, allowing limited control of the management. Bedsides, trust and understanding between directors will be reduced. In China, the state-controlled real estate company has strong political overtones, so leaders’ decision is important. For private listed companies, board members have close personal relationship with controlling shareholder, so board members will not cast opposing votes. Board size affects the quality of deliberation among members and ability of board to arrive at optimal cor- porate decisions. The board size represents the total head counts of directors seating on the corporate board. Majority of docu- mented evidences have demonstrated that small boards are more efficient and effective. Taking into account the above equivocal findings, therefore, the paper puts forward the second hypothesis: Hypothesis 2: the Board size is negatively related to Perfor- mance of M&A. Institutional I nvestors and Corporate Performance Institutional investors mean that professional and indepen- dent investment as a corporate shareholder. One branch of the literature is consistent with institutional investors being better monitors than investors in general, which found that there is a positive correlation between the number and the percentage ownership of institutional investors and operating performance of large firms. In the mature capital markets, institutional in- vestors have a strong impact on the enterprise. The minority shareholders have certain options to dig enough information and analyze the trend of company. But, due to legal constraints, institutional investors in the company’s business decisions cannot play a direct role, who cannot act as the big shareholder in firms, so institutional investors have no strong motivation to care about the development of enterprises. Moreover, institu- tional investors tend to adopt a diversified investment strategy in order to avoid investment risks. Investment diversification reduces the enthusiasm of institutional investor to supervise the board. Now in China, the financial market is the lack of inde- pendence, and participants of the stock market are not mature. Besides, the insider trading is often exposed to the public. The relevant legal and rule is imperfect and incomplete, which leads to institutional investors conspire with the management for their own interests. Therefore, the paper puts forward the third hypothesis: Hypothesis 3: Institutional investors are negatively asso- ciated with the long-term performance of M&A. Chairman-CEO Duality and Enterprise Performance To our knowledge, in China’s national conditions, the gener- al manager has a good personal relationship with the president in private enterprises, especially the family company. While in the state-owned enterprises, the chairman and general manager are appointed by the relevant government departments. In the state-owned enterprises, Chairman-CE0 duality avoids replac- ing good CEO for some abnormal causes. CEO duality pro- vides the company with a leadership core, and brings clear cor- porate strategy and mission. When companies are in fierce competition, decisive decision-making and clear strategic orien- tation help companies make acquisitions decisions in time. Accordingly, CEO duality would make the firm more stable and sustainable, which will lead to improve corporate perfor- mance. Therefore, the paper puts forward the fourth hypothesis: Hypothesis 4: Chairman-CEO duality has significant impact on the on the M&A performance. Data Selection and the Analysis Model Sample and Variable Selection Selecting significant events of M&A which happened in the real estate companies listed on the Shanghai and Shenzhen stock exchanges from 2008 to 2009, we obtain the resulting 36 samples of enterprise merger and acquisition. Excluding condi- tions as follows: 1) excluding acquisitions failed samples; 2) Excluding ST, * ST listed companies; 3) exclude the delisting of the company in 2008-2012; 4) the payment is less than 5% of acquirer company total assets. In order to further scientific suitable empirical analysis, we use the following specific indicators to measure performance and some variables. The data of Table 1 come from CSMAR database. CSMAR means database of financial data and mar- keting data of China capital market. CSMAR database includes all financial data and marketing data of A-share listing compa- nies in Shanghai Stock Exchange and Shenzhen Stock Ex- change since 1990. In the regressions, purchase costs and em- ployee value are measured as ln(fees paid to acquire) and ln(total Assets in 2007/employee number in 2007), respectively. Tobin’s Q: Tobin’s Q = (Market value of the firm + Book value of the debt)/Book value of total assets. Market value of the acquiring firm’s assets divided by book value of its assets for the fiscal year prior to the acquisition. The market value of assets is equal to book value of assets plus market value of common stock minus book value of common stock minus bal- ance sheet deferred taxes. Tobin Q is used as indicators of per- formance, which takes goodwill, patents and other intangible assets into account. Tobin Q measures company’s future cash flows and discounted value. CEO duality: Chairman-CEO duality has been considered as  Y. LIU, Y. Q. WANG Open Access Table 1. Variable definition table. Variable Index Symbol Definition Dependent variable Market Value TBQ Tobin’s Q Explanatory variables Board size BS Directors number in 2007 annual report Shareholders’ degree SD 2007 annual report, the three major shareholding/ the largest shareholder proportion Institutional investors II 2007 annual report disclosure of the fund’s holdings and/ Fun d number Chairman-CEO duality CC Chairman and general manager are the same person, dummy varia bl e Control variables Time to market TM Companies listed on the relative value of time to 2008 Purchase shares PS the shares of the Target Company Purchase costs PC ln(Fees paid to acquire shares) Cost per CP Purchase price/purchase shares Employee value EV ln(2007 Assets/2007 number of employees) a dummy variable in the regressions. “1” has been given to firms having CEO non-duality and “0” Otherwise. Firms’ ability: As a measure of firm size, we used the num- ber of employees and total assets, taken at before one year of the M&A. The number of employees and total assets are always expressed in logarithm terms. Firm’s age: We measured the age of the firms, from being a listed company, at the year of the M&A. Target size: The acquisition of a company with a large vo- lume of assets or number of employees is characterized with high levels of complexity and more diverse product portfolio, so integration procedures and routines will differ from those for small targets, increasing risks and uncertainties. Besides, the value of target firms in large M&A can be more difficult to capture than in small one (Ellis et al., 2011). Statistical Description and Correlation Analysis In this paper, the date is analysis by statistical software (SPSS20.0 and EVIEWS6.0). First, we analyze the data with descriptive statistics. Second, we analyze the correlation of variables. In the end, assumptions are tested by the multiple regression models. Table 2 shows statistical description of each variable, in- cluding mean, median, minimum, maximum and standard devi- ation. The Chairman-CEO duality is a dummy variable. CC = 1, if the chairman and the CEO are the same one; CC = 0, other- wise. From Table 2. Table 3 shows the correlation between each variable and all the variables. It is easy to see that the value of the company in 2011 with 2007 employees get the highest correlation coeffi- cient reach to 0.474. The low correlation coefficient among Table 2. Descriptive statistics. Variable Mean Median Maximum Min SD TM 14.830 15.500 19.000 4.000 2.920 II 0.5300 0.390 1.760 0.000 0.719 PS 56.34 55.00 100.00 5.080 35.86 PC 7.960 7.930 8.960 6.690 0.650 EV 4.068 4.013 6.107 2.505 0.911 CC 0.110 0.000 1.000 0.000 0.320 BS 8.440 9.000 11.000 5.000 1.560 SD 1.511 1.386 2.562 1.022 0.436 TBQ 1.250 0.980 3.100 0.680 0.620 Table 3. Correlation coefficients. Variable TBQ II TM EV PS CC SD BS TBQ 1 II −0.42 1 TM 0.286 0.037 1 EV 0.474 −0.018 −0.108 1 PS 0.11 −0.404 −0.398 0.292 1 CC 0.339 0.127 −0.144 0.358 0.16 1 SD 0.12 −0.078 −0.098 0.078 0.127 0.13 1 BS −0.828 0.191 0.054 −0.976 −0.382 −0.55 −0.158 1 independent and control variables and acceptable variance in- flation factor statistics suggest that multicollinearity of va- riables is not a problem in our model. Model Results To test four hypotheses, this paper uses the OLS model as follows: Model A: check-balance ownership structure and Tobin’s Q 123 45 67 =+ SD TMEVC TBQ P PS CC PC +β ×+β×+β ×+β × + β×+β ∂ × β× +ε Model B: board size and Tobin’s Q 123 45 678 + TBQ S TMEVCP PS CC PC B PBS =+β ×+β×+β ×+β × +β×+β×+β× ∂ β× +ε Model C: Institutional Investors and Tobin’s Q 234 67 1 5 + TBQ II TMEVCP PS CC PS =+β ×+β×+β ×+β × +β×+β ∂ × β× +ε where: : Constant. βi: the coefficient of each variable. ε: residu al. The results are shown in Table 4.  Y. LIU, Y. Q. WANG Open Access Table 4. The model of multiple linear regression results1. Variable Model A Model B Model C C 1.257 10.423 0.984 (−1.027) (−4.207) (−0.812) SD 0.287 (−1.461) BS −0.585 (−4.168) PBS −3.087 (−3.903) II −0.197 (−1.709) TM 0.091 0.076 0.086 (−3.145) (−3.173) (−3.047) EV 0.230 0.123 0.245 (−2.309) (−1.370) (−2.503) CP −0.832 −1.032 −0.803 (−1.984) (−2.972) (−1.964) PS −0.010 −0.010 −0.009 (−2.566) (−3.333) (−2.375) PC −0.250 −0.179 −0.157 (−1.877) (−1.633) (−1.225) CC 0.605 0.471 0.671 (−2.163) (−2.010) (−2.414) R-squared 0.528 0.691 0.540 F-statistic 4.474 7.544 4.695 DW 1.861 1.987 2.231 As can be seen from Table 4, in these three variables, T-sta- tistic is statistically significant at a 95% confidence level. What’s more, goodness of fit well reflected the reality. Mean- while DW test value is around 2.0, avoiding multicollinearity and autocorrelation. Model A shows insignificant coefficient for ownership struc- ture, and the hypothesis 1 is supported. The check-balance ownership structure has a significantly positive correlation. The cooperation between the second and the third largest share- holder will limit the largest shareholder. The result in Model B shows that board size has significant effects. BS negatively related to the long-term M&A perfor- mance, which verifies the hypothesis 1 of this study. This means that if the enterprises have larger board members, the performance of mergers and acquisitions will be decreased. Besides, majority interests are often easy to be captured by a few people, so individual rationality succumb to the overall irrationality, making compromise decisions. One would realize that the size of board in terms of quantity is materially insigni- ficant compared to the quality which deter mi ne s effectiveness of corporate deliberations and decision making. The outcome of Model C shows that Institutional investors have positive and significant effects on M&A performance, so Hypotheses 3 is supported. Institutional investors have negative relationship with the long-term performance of M&A. Institu- tional investors are tend to accomplice with the company’s managers for their own interests. Hypothesis 4 proposes that Chairman-CEO duality is posi- tive related to M&A. In China’s national conditions, we can consider that Chairman-CEO duality bring long-term perfor- mance improvements. Empirical evidence has shown negative correlation between the paid for the acquisition and the acquisi- tion of long-term performance. Robustness Test In order to prove the reliability of the above conclusions, the following tests as follows: 1) Refer to Shao & Yu (2012) research method about the calculation of non-tradable shares, Tobin’s Q is calculated by the market value in circulation 25% discount. 2) When it comes to SD, I use the total shares of top ten shareholders replace the top three shareholders. Taken together, the conclusions of this paper have not been materially affected, except that an indicator (TM) is a slight change in the significance level, so the conclusions are reliable. Conclusions and Implications The conclusions of the real estate industry mergers and ac- quisitions under economic crisis give us some inspiration. Ed- die Hui C. M. et al. (2011) found that there are positive correla- tion between real estate market and stock market in the United Kingdom and in Hong Kong, from 1993 to 2007. The paper explains the similarities by two transmission mechanisms: wealth effect and credit-price effect. To analyze the influence of corporate governance on long-term performance of M&A transactions, this paper uses an empirical model. With the de- velopment of the security market and the growing power of the enterprises, the M&A is becoming increasingly popular. There is a misunderstanding in the mergers and acquisitions of listed companies in China which is in order to mergers and acquisi- tions and to mergers and acquisitions, and there is very little detailed analysis to the predicted results after mergers and ac- quisitions, which led to a doubt of creating value to mergers and acquisitions as theoretically speaking. Many scholars own different opinions to the thing that whether it can create value for our listed companies in mergers and acquisitions. So basi ng on the previous studies, this article researches the performance of the mergers and acquisitions of listed companies, which will own an important practical significance. Through practical studies and analysis, following conclu- sions could be summarized from this thesis: These results sug- gest that the concentrated ownership alignment effect domi- nates the entrenchment motives and acts as a deterrent mechan- ism to prevent controlling shareholders from managing earn- ings in stock-financed M&A. Besides, State-owned enterprises should take full advantage of social market economy, improv- ing their own internal checks and balances and the equity vot- ing sys tem. The Board inefficient results in the failure of bringing bene- fits to the company, taking the limitation of the rights and in- terest of independent directors into account who fail to play their roles. In China’s financial markets, institutional investors 1Unstandardized coefficients are shown, with standard errors next to them.  Y. LIU, Y. Q. WANG Open Access who engage in speculative activities will spare no effort in pushing stock prices up for their own interest. The paper has several implications for managerial practice. Notably, it suggests that the company that intends to perform acquisition with the aim of company value must take care of the decisions. Moreover, investors can predict or prevent some risks by valuing firm’s some characteristics such as board and CEO duality. Linda M. Cohen (2010) pointed that better under- standing how physical asset decisions can affect M&A out- comes, and how these assets can be used as a powerful tactical and strategic resource, will help managers achieve desired out- comes when faced with M&A. There are some limitations in this paper: 1) the lack of con- trast to the company that did not merger other firms; 2) the failure of giving a full consideration of the all the factors that may influence the performance, such as organizational structure, marketing. It would be much better for me to improve this pa- per with the help of questionnaire survey. REFERENCES Abidin, Z. Z., Kamal, N .M., & Jusoff, K. (2009). Board structure and corporate performance in Malaysia. International Journal of Eco- nomics and Finance, 1, 150-164. Adams, R. B., Al meida, H., & Ferr eira, D. (2005). Powerful CEOs and their impact on corpo rate performance. Review of Financial Studies, 18, 1403-1432. http://dx.doi.org/10.1093/rfs/hhi030 Bello, L. (2012). Board dynamics and corporate performance: Review of literature, and empirical challenges. International Journal of Eco- nomics and Finance, 4, 22-35. Ben-Amar, W., & André, P. (2006). Separation of ownership from con- trol and acquiring firm performance: The case of f a mily own ership in Canada. Journal of Busine s s Finance & Accounting, 4, 517-543. http://dx.doi.org/10.1111/j.1468-5957.2006.00613.x Coles, J., McWilliams, V., & Sen, N. (2001). An examination of the relationship of governance mechanisms to performance. Journal of Management, 27, 23-50. http://dx.doi.org/10.1177/014920630102700102 Das, A., & Kapil, S. (2012 ). Ex p lainin g M&A perfomance: A review of empirical research. Journal of Strategy and Management, 5, 284- 330. http://dx.doi.org/10.1108/17554251211247580 Zhong, D. C., & Long, G. S. (2012). Mergers and acquisitions for busi- ness growth and its mechanism analysis. Financial and Economic Issues, 12, 102-109. Dwivedi, N., & Jain, A. K. (2005). Corporate governance and perfor- mance of Indian firms: The effect of board size and ownership. Em- ployee Responsibilities and Rights Journal, 17, 161-172. http://dx.doi.org/10.1007/s10672-005-6939-5 Ellis, K. M., Reu s, T. H., La mont, B. T., & Ranft, A. L. (2011). Trans- fer effects in large acquisition s: How s ize-specific experi ence matters. The Academy of Management Journal, 54, 1261-1276. http://dx.doi.org/10.5465/amj.2009.0122 Fan, J. P. H., & Wong, T. J. (2005). Do external auditors perform a corporate governance role in emerging markets? Eviden ce from East Asia. Journal of Accounting Research, 43, 35-72. http://dx.doi.org/10.1111/j.1475-679x.2004.00162.x Francoeur, C., Amar, W. B., & Rakoto, P. (2012). Ownership stru cture, earnings management and acquiring firm post-merger market per- formance. International Journal of Managerial Finance, 8, 100-119. http://dx.doi.org/10.1108/17439131211216594 Fu, Q., & Hao, Y. (2012). Ultimate controller, control is transferred to investment efficiency. Economics and Management, 11, 5-16. Garg, A. K. (2007). Influence of board size and independence on firm performance: A study of Indian companies. Vikalpa, 32, 39-60. Guo, L. J., & Chen, H. M. (2013). Macro listed real estat e companies in China under the performance evaluation. Accounting, 3, 72-75. Goranova, M., Dharwadkar, R., & Brandes, P. (2010). Owners on both sides of the deal: Merger and acquisitions and overlapping institu- tional ownership. Strategic Management Journal, 31, 1114-1135. http://dx.doi.org/10.1002/smj.849 Hagendorff, J., & Keasey, K. (2009). Post-merger strategy and perfor- mance: Evid ence from the US and E uropean banking industries. Ac- counting & F inance, 49, 725-751. http://dx.doi.org/10.1111/j.1467-629X.2009.00306.x Haniffa, R., & Hudaib, M. (2006). Corporate governance structure and performance of malaysian listed companies. Journal of Business Finance and Acc ounting, 33, 1034-1062. http://dx.doi.org/10.1111/j.1468-5957.2006.00594.x Hermalin, B. E., & Weisbach, M. S. (2003). Boards of directors as an endogenously determined institution: A survey of the economic lite- rature. FRBNY Economic Policy Review, 4, 7-26. Heracleous, L. (2001). What is the impact of corporate governance on organizational perfor mance? Corporate governance. An International Review, 9, 165-173. Hu, Z. H. (2012). Mergers and acquisitions board characteristics and shareholder wealth research. Economic Issues, 11, 141-146. Jackling, B., & Johl, S. (2009). Board structure and firm performance: Evidence from India’s top companies. Corporate Governance: An International Review, 17, 492-505. http://dx.doi.org/10.1111/j.1467-8683.2009.00760.x Jiang, H., & Liu, X. (2012). Blockholders major shareholders of listed companies M&A performance. Southern Econom y, 9, 32-46. Lei, G., & Song, S. (2008). Management ownership and firm perfor- mance: Empirical evidence from the panel data of Chinese listed firms between 2000 and 2004. Frontiers of Business Research in China, 2, 372-384. http://dx.doi.org/10.1007/s11782-008-0022-7 Cohen, L. M. (2010). Physical assets in the M&A mix: A strategic option. Journal of Business Strategy, 31, 28-36. http://dx.doi.org/10.1108/02756661011089053 Cashen, L. H. (2011). Board leadership structure under fire: CEO dual- ity in the post-restructuring period. Academy of Strategic Manage- ment Journal, 10, 1-16. Raluca-Georgiana (2013). Does CEO duality really affect corporate performance? International Journal of Academic Research in Eco- nomics and Management Sciences, 2, 156-165. Masulis, R. W., Wang, C., & Xie, F. (2007). Corporate governance and acquirer returns. Journal of Finance, 62, 1851-1889. Gill, M. S., Vijay, T. S., & Jha, S. (2009). Corporate governance me- chanisms and firm performance: A survey of literature. The IUP Journal of Corporate Governance, 8, 7-22. Mehrdad, A., & Hossein, A. (2011). The effect of ownership structure on corporate performance of listed companies in Tehran stock ex- change: An empirical evidence of Iran . International Journal of Bus- iness and Social Science, 2, 49-55. Mak, Y. T., & Yuanto, K. (2003). Size really matters: Further evidence on the negative relationship between board size and firm value. Pa- cific-Basin Finance Journal, 13, 301-318. http://dx.doi.org/10.1016/j.pacfin.2004.09.002 Saibaba, M. D. (201 3). Do board independence and CEO duality matter in firm valuation?—An empirical study of Indian companies. The IUP Journal of Co r por ate Governance, 12, 50-67. OECD (2004). OECD principle of corporate governance. Paris: OECD. Perry, T., & Shivdasani, A. (2005) Do boards affect performance evi- dence from corporate restructuring. Journal of Business, 78, 1403- 1431. http://dx.doi.org/10.1086/430864 Phalippou, L., & Gottschalk, T. (2009). The performance of private equity funds. The Review of Financial Studies, 22, 1747-1776. Rani, N., Yadav, S. S., & J ain, P. K. (2013). Post-M&A op erating per- formance of indian acquiring firms: A Du Pont analysis. Internation- al Journal of Economics and Finance, 5, 65-73. http://dx.doi.org/10.5539/ijef.v5n8p65 Raheja, C. G. (2005). Determinants of board size and composition: A theory of corporate boards. Journal of Financial and Quantitative Analysis, 40, 1-38. http://dx.doi.org/10.1017/S0022109000002313 Sarkar, J., & Sarkar, S. (2000). Large sh areholder activis m in corporate governance in developing countries: Evidence from India. Interna- tional Review of Finance, 1, 161-194.  Y. LIU, Y. Q. WANG Open Access http://dx.doi.org/10.1111/1468-2443.00010 Silveira, A. M., & Dias Jr., A. L. (2010). What is the impact of bad governance practices in a concen-trated ownership environment? In- ternational Journal of Disclosure and Governance, 7, 70-91. http://dx.doi.org/10.1057/jdg.2009.21 Shao, Y. P., & Yu, F. F. (2012). Internal capital markets related trans- actions and corporate value. China Industrial Economy, 4, 102-114. Sulong, Z., & Nor, F. M. (2010). Dividends, ownership structure and board governance on firm value: Empirical evidence from Malaysian listed firms. Malaysian Accounting Review, 7, 55-94. Horner, S. V. (2010). Board power, ceo appointments And CEO duality. Academy of Strategic Management Journal, 9, 43-58. Wang, L.J., & Tong, X.W. (2008). Private listed companies control type, diversification and firm performance. Nankai Bu siness Review, 11, 31-39. Wang, K., & Xiao, X. (20 05). Empirical study: Institu tional ownership and related parties’ occupation. Nankai Management Review, 2, 27- 33. Wenjuan Zuo., & Lun Hu. (2011). Examining the relationsh ip between real estate and stock markets in Hong Kong and the United King do m through data mining. International Journal of Strategic Property Management, 15, 26-34. http://dx.doi.org/10.3846/1648715X.2011.565867 Li, Y. Z., & Wei, J. (2011). An empirical study: Heterogen eity of insti- tutional investors and large shareholders’ benefits transportation. Management & Engineering, 2, 1838-5745. Qu, Y. (2011). Mergers and acquisition s, executives and corporate per- formance characteristics. Zhejiang Finance, 12, 62-65. Daraghma, Z. M. A., & Alsinawi, A.-A. (2011). Board of directors, management ownership, and capital structure and its effect on per- formance: The case of palestine securities exchange. International Journal of Business and Management, 5, 118-127.

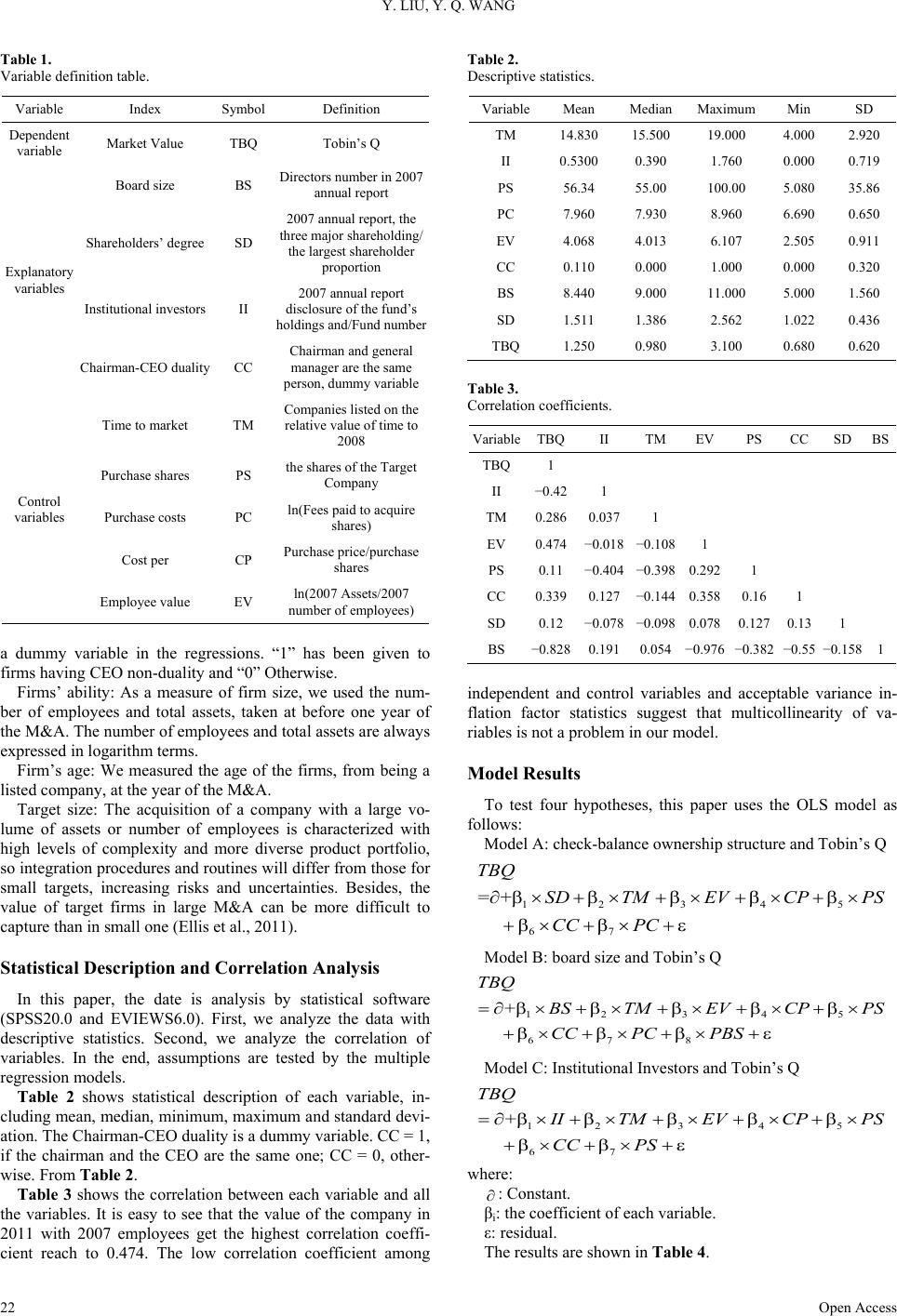

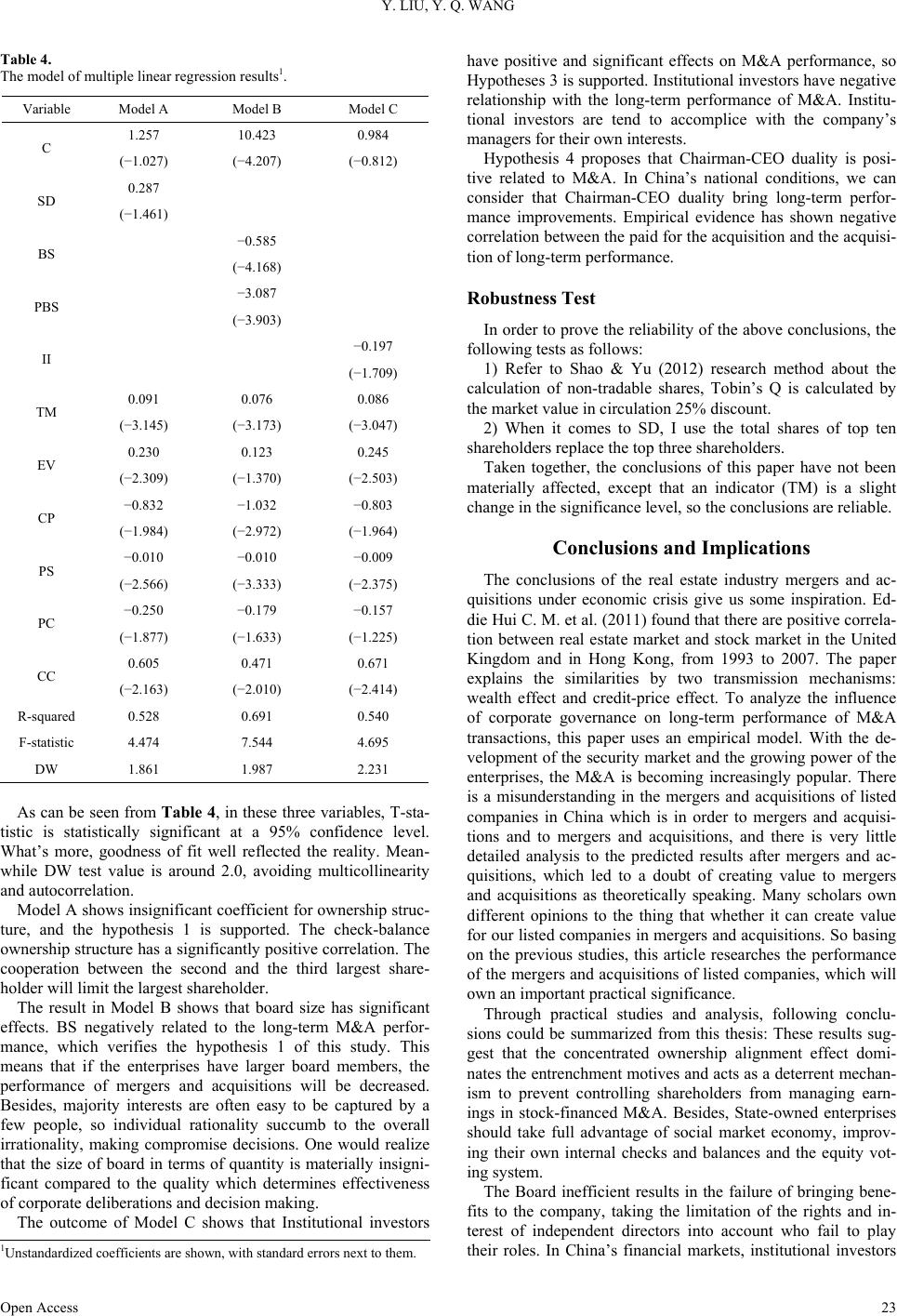

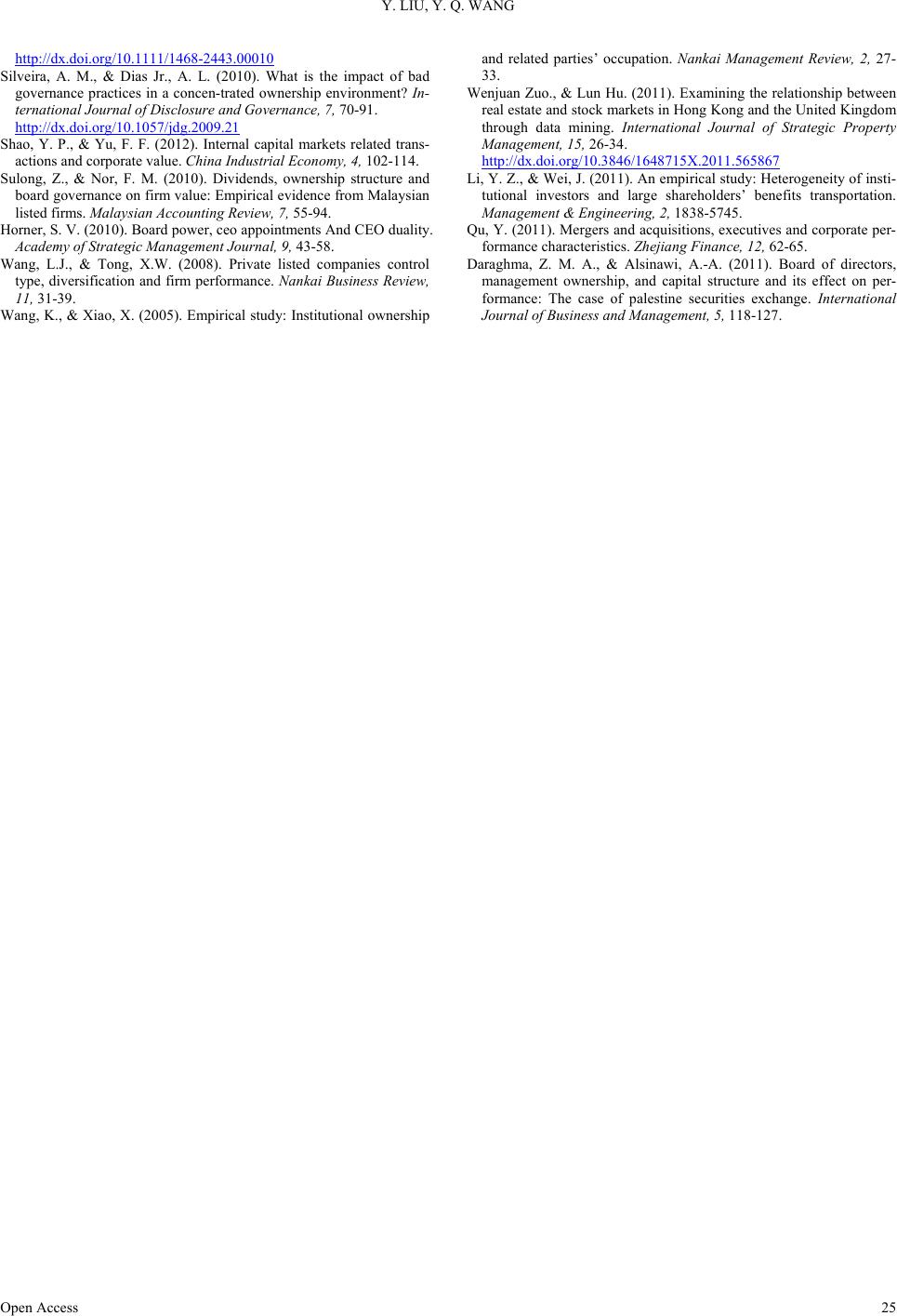

|