H. de la FUENTE-MELLA ET AL.

Open Access

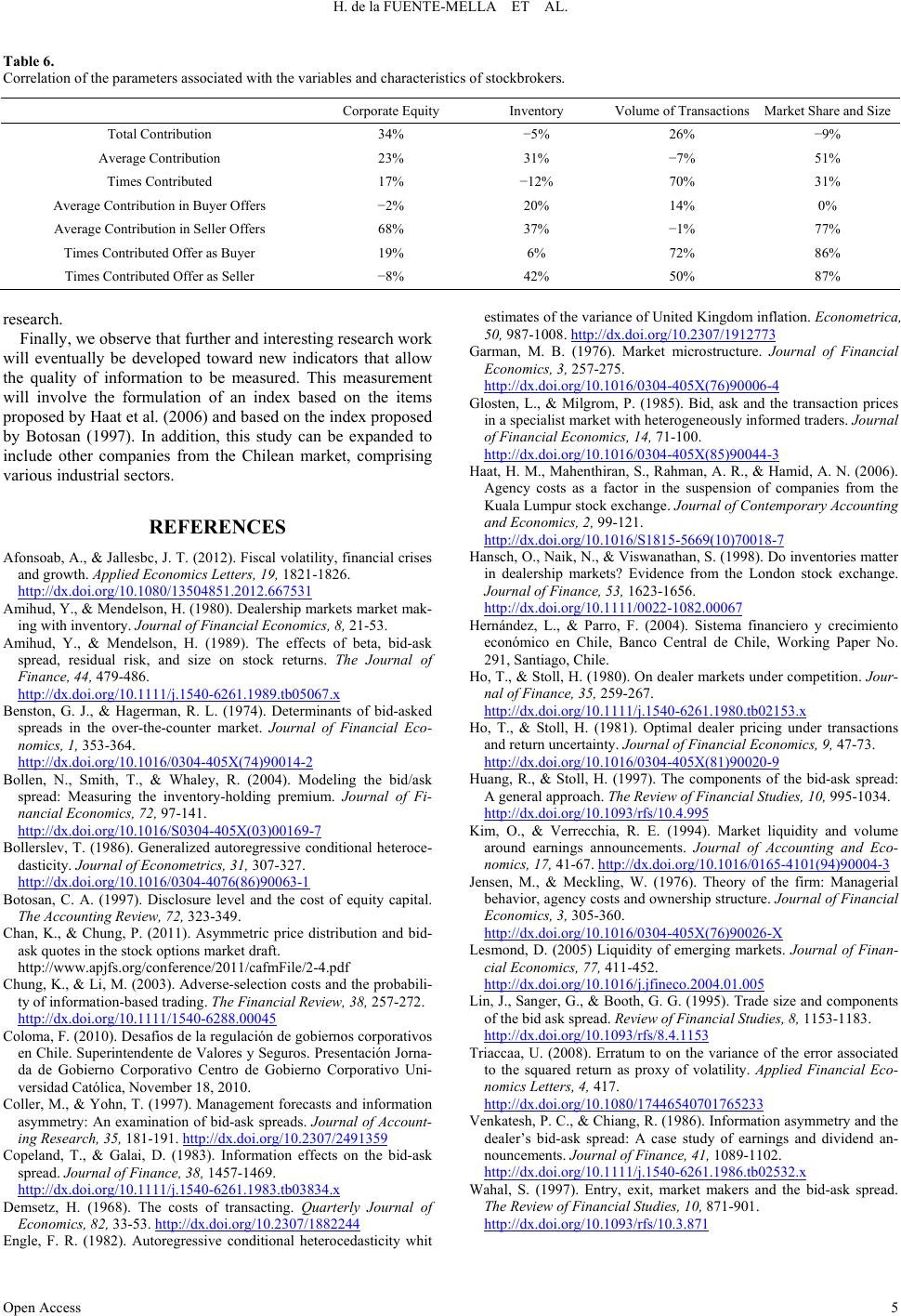

Table 6.

Correlation of the parameters associated with the variables and characteristics of stockbrokers.

Corporate Equity Inventor y Volume of Transactions Market Share and Size

Total Contribution 34% −5% 26% −9%

Average Contributi on 23% 31% −7% 51%

Times Contributed 17% −12% 70% 31%

Average Contributi on in Buyer O f fers −2% 20% 14% 0%

Average Contributi on in Seller Off ers 68% 37% −1% 77%

Times Contributed Offer as Buyer 19% 6% 72% 86%

Times Contributed Offer as Seller −8% 42% 50% 87%

research.

Finally, we observe that further and interesting research work

will eventually be developed toward new indicators that allow

the quality of information to be measured. This measurement

will involve the formulation of an index based on the items

proposed by Haat et al. (2006) and based on the index proposed

by Botosan (1997). In addition, this study can be expanded to

include other companies from the Chilean market, comprising

various industrial sectors.

REFERENCES

Afonsoab, A., & Jallesbc, J. T. (2012). Fiscal volatility, finan cial crises

and growth. Applied Economics Letters, 19, 1821-1826.

http://dx.doi.org/10.1080/13504851.2012.667531

Amihud, Y., & Mendelson, H. (1980). Dealership markets market mak-

ing with inventory. Journal of Financial Economics, 8, 21-53.

Amihud, Y., & Mendelson, H. (1989). The effects of beta, bid-ask

spread, residual risk, and size on stock returns. The Journal of

Finance, 44, 479-486.

http://dx.doi.org/10.1111/j.1540-6261.1989.tb05067.x

Benston, G. J., & Hagerman, R. L. (1974). Determinants of bid-asked

spreads in the over-the-counter market. Journal of Financial Eco-

nomics, 1, 353-364.

http://dx.doi.org/10.1016/0304-405X(74)90014-2

Bollen, N., Smith, T., & Whaley, R. (2004). Modeling the bid/ask

spread: Measuring the inventory-holding premium. Journal of Fi-

nancial Economics, 72, 97-141.

http://dx.doi.org/10.1016/S0304-405X(03)00169-7

Bollerslev, T. (1986). Generalized autoregressive conditional heteroce-

dasticity. Journal of Econometrics, 31, 307-327.

http://dx.doi.org/10.1016/0304-4076(86)90063-1

Botosan, C. A. (1997). Disclosure level and the cost of equity capital.

The Accounting Review, 72, 323-349.

Chan, K., & Chung, P. (2011). Asymmetric price distribution and bid-

ask quotes in the stock options market draft.

http://www.apjfs.org/conference/2011/cafmFile/2-4.pdf

Chung, K., & Li, M. (2003). Adv erse-selection costs and th e probabili-

ty of information-based trading. The Financial Review, 38, 257-272.

http://dx.doi.org/10.1111/1540-6288.00045

Coloma, F. (2010). Desafíos de la regulación de gobiernos corporativos

en Chile. Superintend ente de Valores y Seguros. P resentación Jorna-

da de Gobierno Corporativo Centro de Gobierno Corporativo Uni-

versidad Católica, Novem ber 18, 2010.

Coller, M., & Yohn, T. (1997). Management forecasts and information

asymmetry: An examination of bid-ask spreads. Journal of Account-

ing Research, 35, 181-191. http://dx.doi.org/10.2307/2491359

Copeland, T., & Galai, D. (1983). Information effects on the bid-ask

spread. Journal of Finance, 38, 1457-1469.

http://dx.doi.org/10.1111/j.1540-6261.1983.tb03834.x

Demsetz, H. (1968). The costs of transacting. Quarterly Journal of

Economics, 82, 33-53. http://dx.doi.org/10.2307/1882244

Engle, F. R. (1982). Autoregressive conditional heterocedasticity whit

estimates of the variance of United Kingdom inflation. Econometrica,

50, 987-1008. http://dx.doi.org/10.2307/1912773

Garman, M. B. (1976). Market microstructure. Journal of Financial

Economics, 3, 257-275.

http://dx.doi.org/10.1016/0304-405X(76)90006-4

Glosten, L., & Milgrom, P. (1985). Bid, ask and the transaction prices

in a specialist mark et with h eterog eneously informed traders. Journal

of Financial Economics, 14, 71-100.

http://dx.doi.org/10.1016/0304-405X(85)90044-3

Haat, H. M., Mahenthiran, S., Rah man, A. R., & Hamid, A. N. (200 6).

Agency costs as a factor in the suspension of companies from the

Kuala Lumpur stock exchange. Journal of Contemporary Accounting

and Economics, 2, 99-121.

http://dx.doi.org/10.1016/S1815-5669(10)70018-7

Hansch, O., Naik, N., & Viswanathan , S. (1998). Do inven tories matter

in dealership markets? Evidence from the London stock exchange.

Journal of Finance, 53, 1623-1656.

http://dx.doi.org/10.1111/0022-1082.00067

Hernández, L., & Parro, F. (2004). Sistema financiero y crecimiento

económico en Chile, Banco Central de Chile, Working Paper No.

291, Santiago, Chile.

Ho, T., & Stoll, H. (1980). On dealer markets under competition . Jour-

nal of Finance, 35, 259-267.

http://dx.doi.org/10.1111/j.1540-6261.1980.tb02153.x

Ho, T., & Stoll, H. (1981). Optimal dealer pricing under transactions

and return uncertainty. Journal of Financial Economics, 9, 47-73.

http://dx.doi.org/10.1016/0304-405X(81)90020-9

Huang, R., & Stoll, H. (1997). The components of the bid-ask spread:

A general approach. The Review of Financial Studies, 10, 995-1034.

http://dx.doi.org/10.1093/rfs/10.4.995

Kim, O., & Verrecchia, R. E. (1994). Market liquidity and volume

around earnings announcements. Journal of Accounting and Eco-

nomics, 17, 41-67. http://dx.doi.org/10.1016/0165-4101(94)90004-3

Jensen, M., & Meckling, W. (1976). Theory of the firm: Managerial

behavior, agency costs and ownership structure. Journal of Financial

Economics, 3, 305-360.

http://dx.doi.org/10.1016/0304-405X(76)90026-X

Lesmond, D. (2005) Liquidity of emerging markets. Journal of Finan-

cial Economics, 77, 411-452.

http://dx.doi.org/10.1016/j.jfineco.2004.01.005

Lin, J., Sanger , G., & Booth, G. G. (1995). Trade size and components

of the bid ask sprea d. Review of Financial Studies, 8, 1153-1183.

http://dx.doi.org/10.1093/rfs/8.4.1153

Triaccaa, U. (2008). Erratum to on the variance of the error associated

to the squared return as proxy of volatility. Applied Financial Eco-

nomics Letters, 4, 417.

http://dx.doi.org/10.1080/17446540701765233

Venkatesh, P. C., & Chiang, R. (1986). Information asymmetry and the

dealer’s bid-ask spread: A case study of earnings and dividend an-

nouncements. Journal of Finance, 41, 1089-1102.

http://dx.doi.org/10.1111/j.1540-6261.1986.tb02532.x

Wahal, S. (1997). Entry, exit, market makers and the bid-ask spread.

The Review of Financial Studies, 10, 871-901.

http://dx.doi.org/10.1093/rfs/10.3.871