Paper Menu >>

Journal Menu >>

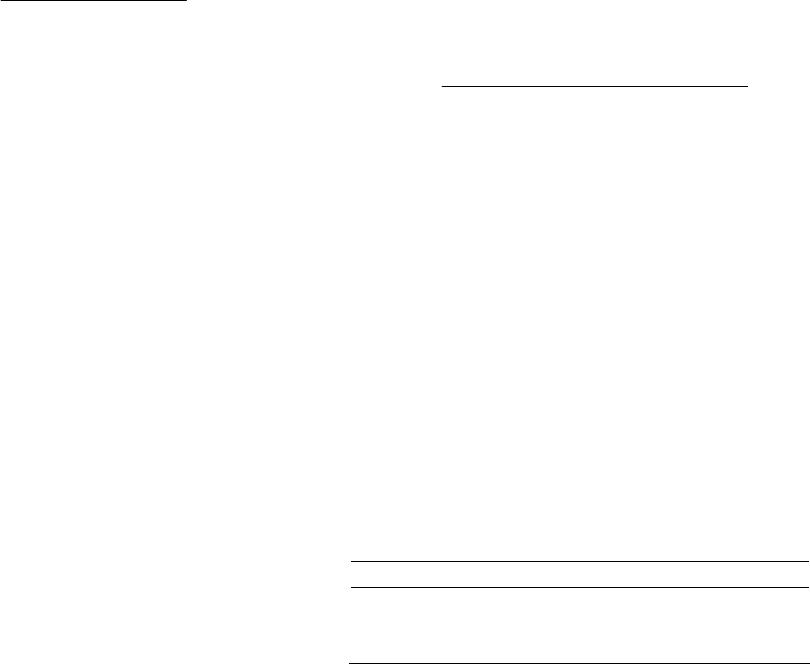

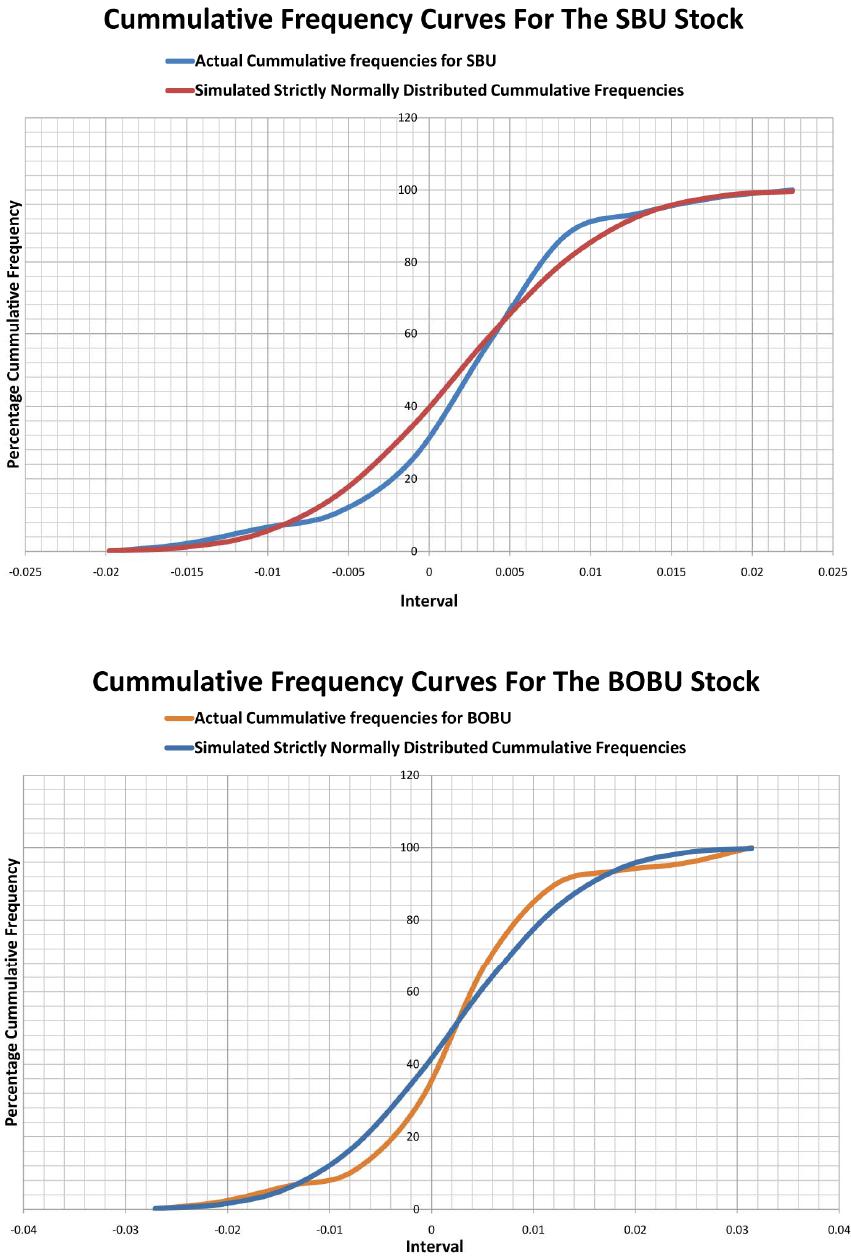

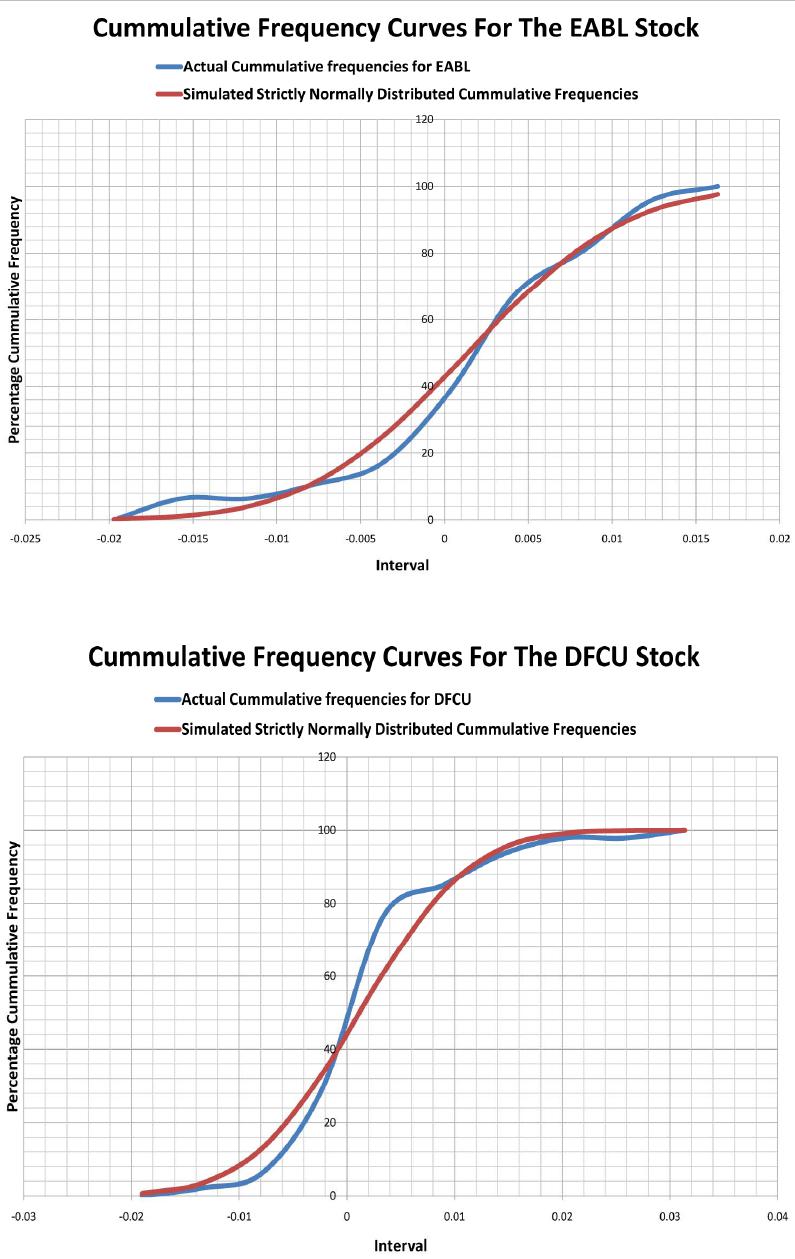

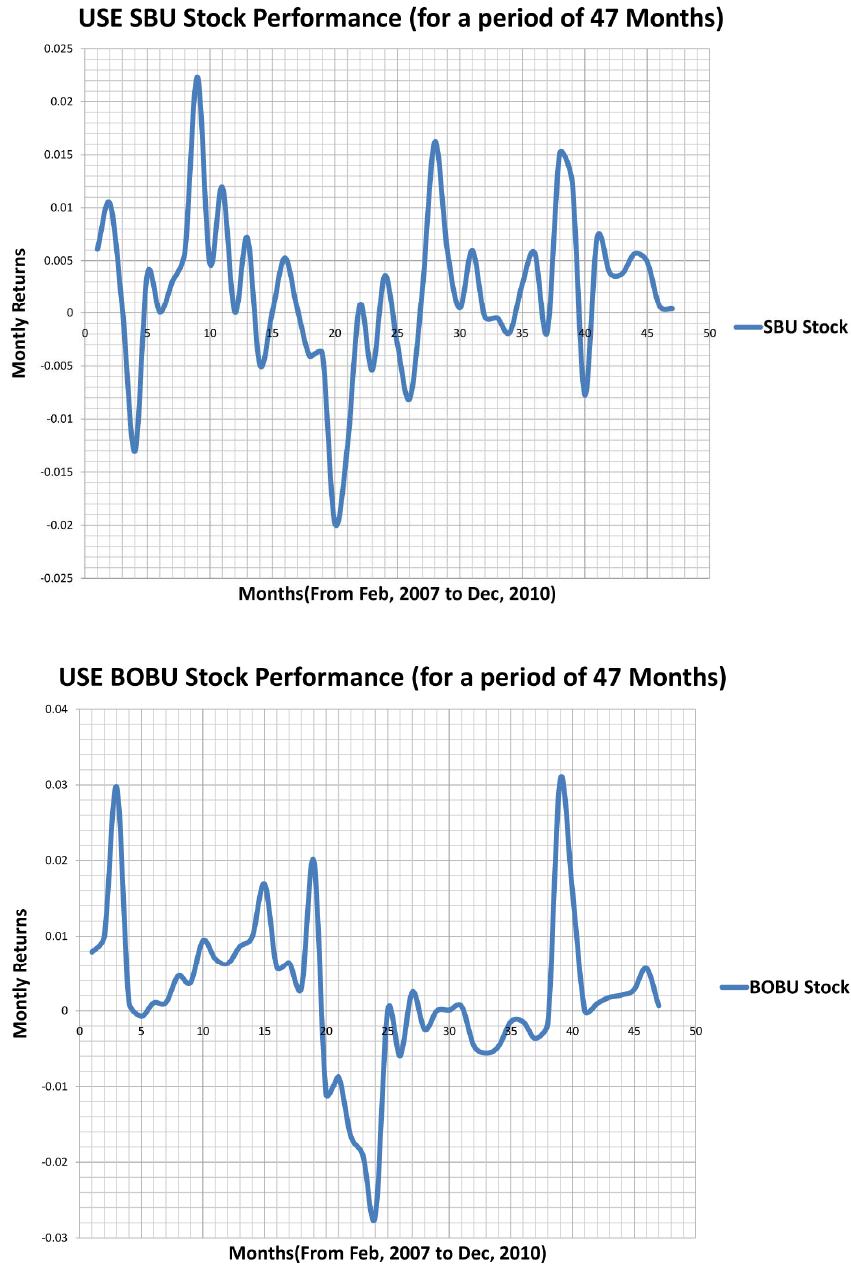

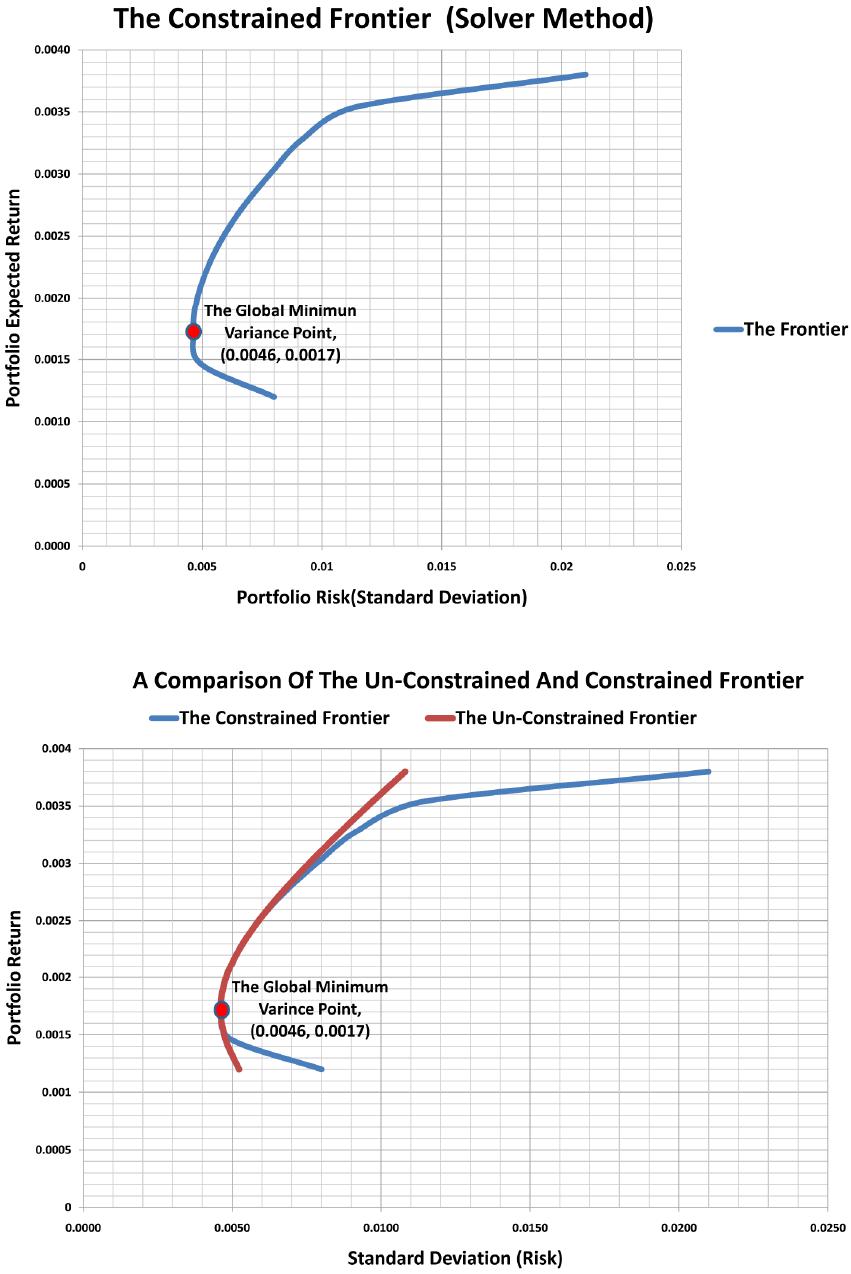

Journal of Mathematical Finance, 2013, 3, 487-501 Published Online November 2013 (http://www.scirp.org/journal/jmf) http://dx.doi.org/10.4236/jmf.2013.34051 Open Access JMF A Mathematical Approach to a Stocks Portfolio Selection: The Case of Uganda Securities Exchange (USE) Fredrick Mayanja1, Sure Mataramvura2, Wilson Mahera Charles3 1Department of Investments and Research, STANLIB, Kampala, Uganda 2Division of Actuarial Sciences, University of Cape Town, Rondebosch, South Africa 3Department of Mathematics, College of Natural and Applied Sciences, University of Dar es Salaam, Dar es Salaam, Tanzania Email: fredrickmay@gmail.com, mayanjaf@stanlib.com, sure.mataramvura@uct.ac.za, mahera@math.udsm.ac.tz Received August 23, 2013; revised October 23, 2013; accepted November 6, 2013 Copyright © 2013 Fredrick Mayanja et al. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. ABSTRACT In this paper, we present the problem of portfolio optimization under investment. This area of investment is traced with works of Professor Markowitz way back in 1952. First, we determine the probability distributio n of the Uganda Securi- ties Exchange (USE) stocks returns. Secondly, we develop unrestricted portfolio optimization model based on the clas- sical Modern Portfolio Optimization (MPT) model, and then we incorpo rate certain restrictions typ ical of the USE trad- ing or investment environ ment and hence, develop the modified restricted model. Thirdly, we explore the possibility of diversification under a portfolio of averagely correlated assets. Determination of the model parameters and model de- velopment is all done using Excel spreadsheets. We explicitly go through the mathematics of the solution methods for both models. Validation of the models is done using the USE stocks daily trading data, in which case we use a random sample of 6 stocks out of the 13 stocks listed at the USE. To start with, we prove that USE stocks log returns are nor- mally distributed. Data analysis results and the fro ntier curves show that our modified (restricted) model is valid as the solutions are all consistent with the theoretical foundations of the classical MPT-model but inferior to the unrestricted model. To make the model more useful, accurate and easy to apply and robust, we programme the model using Visual Basic for Applications (VBA). We therefore recommend that before applying investment models such as the MPT, model modifications must be made so as to adapt them to particular investment environments. Moreover, to make them useful so as to serve the intended purpose, the models should be programmed so as to make implementation less cum- bersome. Keywords: Portfolio Optimisation; Uganda Securities Exchange (USE); Stocks; Modern Portfolio Theory (MPT); Markowitz; Portfolio Diversification; Frontier; Efficient Frontier; Constraints 1. Introduction Portfolio Optimization also commonly referred to as Portfolio selection is the problem of allocating capital over a number of available assets in order to maximize the “return” on the investment while minimizing the “ri- sk” [1]. Research into the development of models for portfolio selection under uncertainty dates back to the fif t i e s with Markowitz’s (1959) pioneering work on mean- variance efficient (MV) portfolios [2]. Although the benefits of diversification in reducing risk have been appreciated since the inception of finan- cial markets, the first mathematical model for portfolio selection was formulated by Markowitz [3,4]. In the Markowitz portfolio selection model, the “return” on a portfolio is measured by the expected value of the ran- dom portfolio return, and the associated “risk” is quan- tified by the variance of the portfolio return. Markowitz showed that, giv en either an upper boun d on the risk that the investor is willing to take or a lower bound on the re- turn the investor is willing to accept, the optimal port- folio can be obtained by solving a convex quadratic pro- gramming problem. This mean-variance model has had a profound impact on the economic modeling of financial markets and the pricing of assets: The Capital Asset Pricing Model (CAPM) developed primarily by [5,6] was an immediate logical consequence of the Markowitz theory. Work on models for portfolio optimization con- tinued, with much of it concentrated on improving the mean-variance (Modern Portfolio Theory) model. Deve- lopments in portfolio optimization are stimulated by two F. MAYANJA ET AL. 488 basic requirements: 1) adequate modeling of u tility func- tions, risks, and constraints; 2) efficiency, i.e., ability to handle large numbers of instruments and scenarios [7]. All models directly or indirectly emerged from the Mo- dern Portfolio Theory model, as most research tried to make the assumptions more realistic to real life; some have incorporated transaction costs in the model [8]. Others proposed alternative ways of measuring risk as opposed to use standard deviation of the stock returns. Many practitioners were not fully convinced of the validity of the standard deviation as a measure of risk [9]. They are certainly unhappy to have small or negative profit, but they usually feel happy to have larger profit. This means that the investors’ perception against risk is not symmetric around the mean [10]. Unfortunately, however, some studies of stock prices in Tokyo Stock Market [11] revealed that most of asset returns are not normally nor even symmetrically distributed. Also, much has been done in developing algorithms for portfolio optimization using various approaches. This is because to carry out portfolio optimization one needs some form of software, which must have in built algo- rithms. There are software companies dedicated to deve- loping software for portfolio optimization, and these software are either spreadsheets applications and/pro- grams. Most commonly used software is Solver or Opti- mizers; these are software tools that help users to find the “best” way to allocate resources. To carry out portfolio optimization there must be portfolios in existence, such that one seeks only to find the optimal set of weights for this portfolio. These portfolios are investment portfolios held and traded in Stock (Securities) Exchanges. Stock exchanges are markets where government and industry can raise long-term capital and investors can buy and sell securities [12]. It is an organized market where buyers and sellers of securities meet as dealers/brokers represent them and acquire or sell securities. The Uganda Se- curities Exchange (USE) is one such market; it was established in 1998 as a result of a Gov ernment Policy of transforming the economy of the country from a public sector to the private sector basis [13]. The USE represents a vital link between companies with capital needs and the public with savings to invest. The Uganda Clays was the first company to be listed in 1999, and by 2004 there were 5 companies trading. To- day USE has 13 companies listed and trading in the va- rious securities available [14 ]. Securities that are current- ly traded at the Exchange include Government Bonds, Corporate Bonds and Ordinary Shares. There are a num- ber of individual investors, financial institutions and companies that currently hold investment portfolios among these listed companies at USE. These investors, financial institutions and companies use brokers and investment managers to trade and manage their portfolios. These investment managers or brokers use the qualitative analysis approach of market surveillance intelligen ce and speculation. This is mainly because the models available for optimization of portfolios have not been customized to the Ugand a Securities Market and cannot b e applied in the market. The need to adapt the models arises fro m the fact that different assets behave differently in different investment environment [10]. However, the Uganda Securities Market has developed over time and is still growing as more companies become listed at the USE; this has made the market analysis more complex. There- fore, there is need for a mathematical approach of using optimization models to analyze and manage the invest- ment portfolios so as to complement the conservative methods currently used. To appreciate the importance of adaptation rather than adoption of investment models to various trading environments, let us briefly list down some of the characteristics of one of the developed se- curities exchanges-the New York Securities Exchange (NYSE) so as to have a clear comparison with the USE: The NYSE was started way back in 1792, with its first constitution adopted in 1817. NYSE is the world's largest cash equities market. It is the world's largest stock ex- change by market capitalization of its listed companies at US trillion, with an average trading value of approximately USbillion, as of August, 2008. It provides a mea ns for bu yers and s ellers to trad e shares of stock in companies registered for public trading. It opens for trading Monday - Friday between 9:30 am - 4:00 pm. All NYSE stocks can be traded via its electronic Hybrid Market, and customers do send orders for immed iate elec- tronic execution. In 2007, NYSE joined a merger with some other stock exchanges to form; NYSE Euronext, and as of March, 31, 2011, NYSE Euronext has approxi- mately 7950 listed issues, a total global market capitali- zation of US trillion and it’s equity exchanges transact an average daily trading value of approximately US billion 11.92 83.6 153 26.4 .ny se.org, 09.06.2011.thwww Clear- ly, when we compare the two securities exchanges it would be wrong to assume that since a model is app- licable to the NYSE then, it will also be applicable to the USE without any ch ang es. And th er efor e this ju stifies the focus of our study on examining and testing the appli- cability of the classical mean—variance model to the USE. 2. Testing Whether Log Returns Are Normally Distributed Six Stocks namely, British American Tobacco Uganda (BATU), Bank Of Baroda Uganda (BOBU), Develop- ment Finance Company of Uganda (DFCU), Stanbic Bank Uganda (SBU), East African Breweries Limited (EABL) and Uganda Clays Limited (UCL) were ran- domly selected from the 13 stocks available at the USE. Open Access JMF  F. MAYANJA ET AL. 489 Their daily trading data was down-loaded from the USE website; www.use.org as per the The data we down-loaded was for four years , The spreadsheets used were the excel spread- sheets, this is where the stocks returns were calculated using the data. When calculating the stocks returns we used the formula; .01.2011.18 h t 2007-20 2007 10 Closing Price, Previous Closing Price i R we determined the frequencies of the log returns using the “FREQUENCY” excel in built function. Using these frequencies we calculated the cumulative frequencies using the formula; And, this gave us the actual stocks i’s for the his- torical data. Then we simulated the cumulative frequen- cies for a normally distributed data set with the same mean and standard deviation as each of our stocks. Here we used the excel’s “NORMDIST” function which pro- duces cumulative frequencies that are normally distri- buted given the mean and standard deviation of any data set. We then plotted th e actual cumulative frequencies of the historical data and the simulated normal distribution frequencies on the same graph, for each stock. The re- sulting graphs are as shown in Figures 1-4. cf From the graphs, as analyzed for each stock we see that there are some small deviations from normal dis- tribution for the actual data but, the deviations are not significant enough for us to reject normal distribution of the log returns. These slight deviations could be because of skewness and kurtosis. However, to avoid making wrong conclusions about the distribution of our log re- turns we took a step further the deviations at the extreme ends are due to outliers. To accomplish this task we plotted the stocks log returns for each stock as shown in Figures 5-8. From the results we note that these stocks have some two to three “extreme months”. That is, for each stock there is a month or two where the monthly log returns are either extremely high or extremely low as compared to the average monthly returns, and this adequately explains the slight deviations between the cumulative curves. Since for real data outliers are certainly expected, we therefore comfortably concluded that the log returns of the stocks at USE are normally distributed, which con- firms to the general findings that log returns are normally distributed, [15,16]. Note that instead of analyzing the stocks log returns by plotting them, we could have used the method of calculating the kurtosis and skewness parameter values to determine whether they lie within the theoretical normal distribution values. But, this method was not preferred because the kurtosis and skewness values are not conclusive since they are highly dependent on the data size. In fact for the same data set, selecting different sample sizes results in to totally different para- meter values for both kurtosis and skewness, [17]. 3. Model Parameters and Model Development The correlation of the stocks and hence correlation ma- trix was determined using the excel’s function “CORREL” for determining the correlation, this function uses the for- mula; 111 22 22 11 11 nnn iii i iii nn nn ii ii ii ii nxyx y r nxx nyy For more details about the setup of the model para- meters in the excel spreadsheet and explicit results you may refer to page 45 of [1]. Note that this formula is based on a sample of historical returns of any two assets, this means that the formula provides sample correlation coefficient (r) of the two assets rather than the population or “true” correlation coefficient , That is, it might not be a true representation of the “true” correlation coe- fficient. Despite the problems of using a sample of histo- rical returns to estimate the correlation coefficient be- tween two assets [18]. It remains a very popular techni- que among investors and investment analysts because the formula for this approach has already been pro- grammed in most calculators and spreadsheet programs. However care has to be taken when interpreting the meaning of sample correlation coefficient: Sample Correlation CoefficientInterpretation 0.3 1.0r Positive relationship 0.3 0.3r Random relationship 1.0 0.3r Negative relationship Referring to our correlation matrix on page 45 [1], our sample correlation coefficient is r; which according to the interpretation by [18] means that our stocks returns have a random relationship. It is there- fore for this very reason that we did not use Markowitz's principle of adding negatively correlated assets to the portfolio to improve it through diversification, simply because not any one of our portfolio stocks have a strong negative correlatio n. So we formulated a condition for an additional stock to improve the frontier of the portfolio as we shall show in the next section. For now we try to formulate and solve the MPT-model using USE data. 0.15 0.3r 4. Mathematical Formulation of the Model Recall that the MPT model is a theory of investment which tries to minimize risk (standard deviation of the returns) for a given level of expected return, by carefully Open Access JMF  F. MAYANJA ET AL. Open Access JMF 490 Figure 1. SBU stock. Figure 2. BOBU stock.  F. MAYANJA ET AL. 491 Figure 3. EABL stock. Figure 4. DFCU stock. Open Access JMF  F. MAYANJA ET AL. 492 Figure 5. SBU stock performance. Figure 6. BOBU stock performance. Open Access JMF  F. MAYANJA ET AL. 493 Figure 7. EABl stock performance. Figure 8. DFCU stock performance. Open Access JMF  F. MAYANJA ET AL. Open Access JMF 494 choosing the proportions (weights) of various assets available. Therefore the model can be written as: 11 1 Minimize 2 nn ij ij ij X X 1 Subject to n ii p i X 1 and 1 n i i X That is, given the target expected rate of return of the portfolio p , find the portfolio strategy that minimizes the portfolio variance in returns 2 p . 5. The Solution Method for the n-Asset Model First, we note that it is more convenient and easier to use vector and matrix notation , so we formulate this model in matrix notation; 1 Minimize , . 2 , =1 T nT T p zXVXst SXRX Xe (5.1) where , is column vector of port- folio weights for each security. T 12 ,,, n XXXX R V is the covariance matrix of the returns. T 1,1,,1 ,n ee p is the desired level of expected return for the port- folio. Note that in this model formulation; 1) The admissible set includes short selling, i.e. portfolio positions with negative weights are allowed. <0 i X 2) The parameter p is exogenously given. 3) The model (5.1) is a convex quadratic programming problem (i.e., the objective function is quadratic, with linear constraints and the feasibility set S is convex). 4) The solution(s) of the program depend(s) on the parameter p . To avoid degeneracies we impose the following tech- nical conditions: .i All first and second moments of the random variables exist. .ii The vectors ,e are linearly independent. That is, no two securities can have the same expected return . We note that this is typically the case when u sing real data. , ij ij .iii The covariance matrix is strictly positive definite. The positivity of the covariance matrix means that all the assets are indeed risky, and this is the case of our portfolio since we considering stocks only. n To illustrate why we require to be strictly positive definite, suppose; V T 0 . 0 00,0,,0 T XstXVX Then there exists a portfolio whose return T p X has zero variance. This implies that 0p , essentially, that this portfolio is risk less. But, this contradicts the idea that our portfolio consists of only risky assets. At this stage, before we attempt to solve our formulated problem there is need to see whether the problem has been well formulated. That is whether a unique solution exists. Proposition 1. Model problem (5.1) is a convex quadratic problem with a unique convex solution. Proof. The function T X VX defines a quadratic form. The matrix is symmetric and positive definite (from condition V iii ), this means that is strictly convex. The constraints are linear, which guarantees that is a convex solution space. Moreover condition implies that the gradients of the constraints are linearly indepen- dent, which guarantees a unique solution. Therefore, if conditions zS ii and iiiiii hold, the model problem (5.1) has a unique solution and hence well formulated. 6. Solution to the Formulated Model We therefore can proceed to determine the solution, first we note that model problem (5.1) is a constrained classical optimization problem, with equality constraints. It can therefore be solved by the Lagrangian method. The La- grangean function1 for the model is 12 1 ,1 2 TT T p LXXVX XeX 2 nPropositio ( If conditions hold, the solution to the above problem is2; )( ))(iiiandiii *1 12 12 22 , with and , p XV e cba b ac bac b p (6.1) where 11 , , . TT T aeVebeV cV 1 Note that 1 and 2 depend on p , which is the target portfolio mean prescribed in the variance minimi- zation problem. The variables can be deter- mined since and , aab nd c V are known. 1Definition 6.1 . Let , F LXf XgX The function L is called the Lagrangian function and the parameters are the L agrange multipliers, where the functions and f XgX are twice continuously differentiable. 2For a thorough and detailed proof refer to pages 26-28 [1].  F. MAYANJA ET AL. 495 Hence *1 12 XV e can be solved. Where T **** 12 ,,, n XXXX is the optimal portfolio weights. For , Equation (6.1) bec omes; 6n *1112131415161 1 *21 2223 2425262 2 *31 3233343536 31 *41 4243 444546 4 *51 5253545556 5 *61 6263 646566 6 1 1 1 1 1 1 aaa aaa X aaaaaa X aaaaaa X aaaaaa X aaaaaa X aaa aaa X 32 4 5 6 The variance3 for the optimal portfolio 2 * p * X is given by 2 2 *2 pp p ab d c . The resulting frontiers of the un constrained problem above for the Lagrange method is as shown in Figure 9 with the global minimum variance portfolio marked red on the frontier4. However this is ideal as there are restrictions in the USE market for example no short selling, and there is a specified sum to be invested in a particular stock there- fore we incorporate restrictions 7. Effect of Incorporating Restrictions to the Model Imposing the restriction; ,,n aXbabXR , where in general we assume that 11 1, 1 nn ij ij ab hold. Note that 11 n i ia is necessary for the portfolio optimization problem to have a solution and 1 assures us that total wealth available will be invested. 1 n j jb Our optimization problem (5.1) would therefore be: 1 Minimize ,. , 1, ,, 2 TnTT rr pn Z XVXstSXRXXea X babXR To be specific we require that the weights are non- negative, therefore, we shall restrict 0X0a , So we have 0 X b . Our problem therefore is: 1 Minimize ,. ,1, 0, , 0, , 2 TnTT rr pn Z XVXstSX RXXeXXbbX R (7.1) Next, we now seek to write our model as a quadratic programming problem. First we recall that a quadratic programming problem has the general form: Minimize Maximize T Z CXX DX Subject to , 0AXb X T 12 ,,, n X xx x T 12 ,,, n Cccc T 12 ,,, m bbb b 11 1 1 n mm aa A aa n 11 1 1 n nn dd D dd The function T X VX defines a quadratic form, the matrix is symmetric and positive, the constraints are linear which guarantees a convex solution space. The solution to this problem is based on the Karush-Kuhn- Tucker (KKT) conditions5. Applying the KKT conditions to the model problem above for we which we seek a solution becomes6; V 12 0 TT ab XV eI T I XSb 1 T XeT p X n 5Historically, w. Karush was the first to develop the KKT conditions in 1939 as part of his M.S. thesis at the University of Chicago. The same conditions were developed independently in 1951 by W Kuhn and A. Tucker. The KKT conditions provide the most unifying theory for all non linear programming problems [19]. 6For the explicit mathematical gymnastics please refer to pages 40-42 o f [1]. 3A reader is advised to refer to pages 29-30 of [1] for the proof. 4For a detailed proof of how the global minimum variance portfolio is determined plea s e refer to pages 30-32 o f [1]. Open Access JMF  F. MAYANJA ET AL. 496 Figure 9. The unconstrained frontier (lagrange method). 0 3,4, ,22, 3,4, ,2,1,2, , kj ai bj XS kn nn jni n , , , 0 ab XS And according to the theorem we must con- sider at most different cases to find the optimal solu- tion. It is therefore very evident at this stage, what impact the weight restrictions have had on the solution proce- dure. This system unlike the unrestricted model we had before, cannot be solved analytically for assets. Therefore we have to seek numerical algorithms to deter- mine the optimal solution. However, the good news is that with the current computer advancements we do not have to struggle with the algorithms. Powerful algori- thms for numerical methods have been developed in va- rious softwares. For this particular problem we shall use the excel solver , which uses the Newton Raph- son algorithm to find the optimal solutions numerically. These optimal portfolio returns were plotted against the optimal standard deviation and the resulting frontier is as shown in Figure 10. KKT 3n 2n 2007 In an attempt to make a comparative analysis of the effect of restriction on the level of returns we plotted both frontiers on the same graph as shown in Figure 11. From the graph notice that the unconstrained frontier is superior to the constrained frontier. That is, for every risk level, the unconstrained frontier gives a higher or equal return as compared to the constrained frontier. Which is as expected, since constraints or restrictions on investment have a negative affect on the level of returns. This is in line with the theoretical findings [20]. 8. Diversification under a Portfolio with Averagely Correlated Assets In consideration of diversification constraint 4., we try to explore Mathematically the effect of increasing or reduc- ing the number of stocks held in a portfolio on the fron- tier. That is, we shall examine the necessary and su- ffi- cient conditions for a security to improve the Marko- witz hyperbola (frontier). Let 012 ,,, n PSS S be a set of n securities among which we may choose for our portfolio. Addi- tionally, let 101211 \,,,,,, iii PPS SS SSS n . Also, let p and q be the Markowitz hyperbolas for security sets and respectively. 0 P1 P Proposition 3. Unique portfolio weights can be determined for secu- rities that lie on the hyperbola as a linear function of the portfolio expected return, p . That is, * p X gh , where g and h are known constants for a particular portfolio. Proof. Recall that we have *1 12 XV e Open Access JMF  F. MAYANJA ET AL. 497 Figure 10. The constrained frontier. Figure 11. The unconstrained and constrained frontiers. Open Access JMF  F. MAYANJA ET AL. 498 for the un-restricted model problem. Where; Proof of (iii). If , the linear function * p X gh 1 p cb d , and 2p ab d Substituting for 12 , gives; *1 pp cbab XV e dd *1 pp ce be ab XV d 11 11 *pp cV e bVeaVbV Xd 11 11 *pp cV ebVaVbVe Xdd 111 1 * p cV ebVaVbV e Xdd Therefore, 11 ha VbVe d * 11 , 1 where , 1 p Xgh gcVebV d (8.1) T heorem 8.1 Consider equationthe above * p X gh , then; , then1) If 0 ii gh p q . 0, the2) Id nf 0h an i i g p q and any point on p has a fixe the security. 3) If, then non-zerod weight ofth i 0 i h p q , so p and q are tangent at e one Proof of (i). Assume . Then p xactlypoint. 0 ii gh 0, iiip Xgh . Hence, the security has a zero weight for every point on th i p , an s ut, up ft wi d so it may be disregarded from portfolio cideration as it does not improve the hyperbola.on removing the security from , we are leth . That is, the set of securities that ize on B q th i 0 P optim 1 P . Ther, efore p q . Proof of nd , the expression p (ii). If 0 i h a 0 i giii X gh 0 i h will have exactly one root at * p g h . Therefore, *i pi g h such that will be the only p 0 iiip Xgh ; that is, * p 0 i h if will be the only value of p at whe Markyperbolas ich thowitz h p and q intrsect. use e That is beca *i pi g h , 0 iiip Xgh . Therefore, 0 i X , so thesecurity is not invol- ved. But, th i and q cannot cross each other so p p is inside o r onq . bo Therefore, the intersection ofo Marklas must be a tangent po since the tw int. Also, owitz hyper p and q only intersect at one point, it is clear that p q . Corollary 1. 0 ii p gh iffq . Proof. Suppose 0 ii gh does not hold. That is, .0 i ah and 0 i g , or , (in part .0 i bh .b i g is not conditioned because if 0 i h whether 0 i g or equals gip and thus, any point on p has a fixed security. Recall that points non-ht o on zero weigf the th i p have fer to Prop os uniolios asso (re d that each que po ition 1) artf nciated with them point on p has conclude that a nsecurityon-zero weight of the th i , we p q . 0 i g the effect of the th i security car Mathematical implication on pries the same ). From )( iiart 0 , if and ptheorem i h0 i g , then p q contra.a. Also .)( iiiptheorem if 0 i h which art dicts , from , then p q which contradicts .b. Therefore, we conclude that p q implies 0 ii gh . But, from . partithe, if 0 ii gh orem , then p q . He, 0 enc ii p gh iffq . 8.2 Theorem 11 0 0 ii gh iffVeV ii Proof. Assume 0 ii gh , then from Equation (8.1) we have; 111 1 and ii ii cV ebVaVbV e From 11 e bV ii cV we have: Open Access JMF  F. MAYANJA ET AL. 499 Proof. From Corollary 1 have; if 11 ii Ve V c b (8.2) and from 11 ii aVbVe we have: 1 Ve 1 ii aV b (8.3) Combining Equations (8.2) and (8.3) we get; 2 1 ab 11 1 iii i b VVaV V bc c (8.4) In Equation (8.4) above we see that if 10 i V , then we conclude 2 b ac which implies 2 ac b, and that 20acb , which is impossible!(ref , the proore we proved that ). So Since d f of 1claim , whe 10 i V . er to2 dacb e b >0 11 cV V ii , b which im ut 10V i plies that also, 1 i cV e 0 . But >0c 11 therefore, , V 10 i e . Hence 0 if 0ghVe V ii ii . Conversely Assume 11 0e V . ii V Then clearly 11 10 ii cV ebV d . But recall 11 10 iii gcVebV d . So, 0 i g . Also, 11 10 aVb e . But recall ii V d 1V bVe . S 11 iii ha d o,. wh plies y 2 0 i h Thus, 11 0 ii Ve V ich im Corolla 0 ii gh. r 11 0 pq ii VV eiff 0 ii gh p q . Aorem we havlso, from the2e; 11 0 0 ii ii ghiff VeV . re, Corollary 1 and Theorem together im- ply; Therefo 2 11 0 pq ii VV eiff . And, Corollary 2 s the final result t we have been seeking to prove. Corollary 2 provides a necessary and n for some security, , to improve a Markowitz hyperbola. This will be so provided the add hat sufficient conditio1n S ition of the 1n S to 12 n PS S ich ,,,S h the existing security set (portfolio) is includes such that the new covariance matrix new V, w 1n S , is invertible and the condition ; 11 11 0 new new nn VVe do when es not hold. If one wonders how this is so; 11 11 0 new new nn Ve V does not hold, Corollary 2 imies that thenpl p q . saw that But, from proo when f of we 1 .theorempart iii p q , these two have onlyngent point and therefore one of the two hyperbogreater than the other. Andol one las i ta s in this case it is the hyperba of th poo which an extra seas been add iginal one. Howevere stocks in our portfolio have a random relationship, we preferred to use the condition we proved in Corollary 2 of chapter , which is in the correlation of the assets; the condition on us to compute the new covaance matrix , that includes the additional stock anden check if e rtfolio tcurity hed that is greater than the or , since th 3 ri th dependent of ly required new V 11 0 new new VVe does not hold, if and when this condition does not hold then the new stock added will improve thfrontier. We started with a portfolio of three stocks namely; DFCU, BU with covariance matrix, then we added a new stock UCL and computed t cova- riance matrix and , checcondition and found that e OBU and SB V he new he 4new V ; 14new Vked t 11 44 0 new new VVe , we further added a fifth stock EABL and an computed the new covariance matrix and which inw EABL stock, gai 5new V we got 15new V cluded the ne 11 55new new VVe 0 and otting the three frontiers together on the same grobserved that the frontier for the portfolio of upon pl aph, we Open Access JMF  F. MAYANJA ET AL. Open Access JMF 500 stocks was above that of the stockhich in turn was above that of stocks, as show Figure 12. r conditionor diversification as derived in Corollary 2 is valid and applicable for the USE (restricted) model. Hence, an invesr can still reduce portfolio risk even when his/her portfolio is made upks only. Therefore, even for investors who are lele for tto reduc eaer of stock in a port- folio. 9. study, we have identified that the USE stock market as a whole is stochastic, as there are no particular months where all stocks returns are low or high, and each st s ha r all correlation coefficient 5 4 n ins w 3 Therefore ou f in chapter 3, to of stoc ss risk averse, it is still possibhem e portfolio risk by incrsing the nu mb Conclusions In this ock behaves randomly. This is seen from the graphs showing individual stocks performance—Figures 5-8, in which case we concluded that the stockve a random relationship as their ove ; 0.15 0.3 We have also noted that the "BATU volatile stock among them all but, still thest profi- table amo sample of the 6 stocks. " stock is the mo ng a We have proved that the log returns ofe USE stocks are normally distributed, which implies their returns We have also discussed in detail the Mthematics and theoretical advancements behind the classical MPT-mo- agai USE the data analysis results agree with the theory. First, we ve showed that the plot of stocks returns against their sdard deviation hg magreement wd Finally, we found out that the solution of the unres- m is superior (for every level of risk, ot newor va del and tested these argumentsnst the stocks data for which we have found out that ha tan (risk) is a hyperbola for both the unrestricted and the restricted optimization model problem. Secondly, we ave also noted that increasinthe number of stocks in the portfolio iproves th e frontier, which is in ith the MPT-model theory. However, since our port- folio assets ha a random relationship we could not rely on Markowitz’s idea. So we have provided a condition that each extra additional stock should satisfy so as to improve the frontier. In other words, it is not necessarily true that every additional stock improves a frontier. It will only do so as long as Corollary 2 condition is satis- fied. tricted model proble the unrestricted frontier gives an equal or higher level of returns as compared to the restricted frontier of the same portfolio) to that of the restricted model problem, this as seen from Figure 11, in which the two frontiers were plotted together. Though the Mathematics involved is tedious and at times complex in general, the users of these models do ned to ry because with th e current computer ad- most th at th have a log normal distribution. ncements a number of softwares have been developed ready to use with out bothering about the Mathematics. a . Figure 12. Diversification based on corollary 2  F. MAYANJA ET AL. 501 10. Recommendations We recommend the use of computer programmes as they help to enhance the performance of the optimization soft- ware and also automate the various calculations that ould other wise be performed manually in spreadsheets. w We also, recommend financial institutions and any other investors who use investment models to always examine, test and adapt these models to their investment en- vironment before applying or using them to make in- vestment decisions, since most of these models have underlying assumptions which have diverse implications mathematically, financially and economically for diffe- rent investment environment. In the study of the effect of imposing certain restric- tions we focused mainly on the mathematical implica- tions. We therefore, recommend that further research should be done on the economic and financial im- plications of the modifications or restrictions like re- stricting the weights with in particular bounds, number of stocks held in a portfolio, cost constraints, ad ministrative and policy restrictions on the MPT-model in the context of the USE investment environment. A more realistic model that incorporates such factors as: brokerage costs (commissions), the Uganda Capital Markets Authority (CMA) regulatory constraints, taxes, inflationary rates, central depository costs and foreign exchange move- ments (as there are cross listings in the USE market) needs to be developed so as to reflect the true picture of the USE trading env ironment. Finally, there is need to revisit the lassical MPT- environment. Such modi- CAPM (which was model), so as a direct consequence of the c to modify it to suite the USE fications can start from the most obvious issues like co- rrecting the beta )( estimations of the various com- panies in the USE (as there is a common mistake of assuming 1= ) for most companies, to more in depth mathematical analysis b ehind the CAPM so as to adapt it to the USE environ ment. This is very important since the CAPM is used in the valuation of capital assets in the investment sector in Uganda to date. REFERENCES [1] M. Fredrick, M. Sure and M. Charles, “Portfolio Optimi- Budgets,” The Review of Economics and Statistics, Vol. 47, No. 1, 1965, pp. 13-39. [6] W. F. Sharpe, “Capital Asset Prices: A Theory of Market Equilibrium under Conditions of Risk,” Journal of Fi- nance, Vol. 19, No. 3, 1964, pp. 425-442. [7] P. Krokhmal and S. Uryasev, “Portfolio Optimization with Conditional Value-at-Risk Objective and Constraints Center for Applied Optimization,” University of Florida, Gainesville, 2001, pp. 32611-6595. [8] S. Uryasev, “Portfolio Optimization with Conditional Value-at-Risk Objective and Constraints Center for Ap- plied Optimization,” University of Florida, Gainesville, 1999, p. 32611. [9] Y. Kroll, H. Levy and H. M. Markowitz, “Mean-Variance versus Direct Utility Maximization,” The Journal of Fi- nance, Vol. 39, No. 1, 1984, pp. 47-62. [10] H. Konno and H. Yamazaki, “Mean-Absolute Deviation Portfolio Optimization Model and Its Applications to Toky o Stoc k Mark et Mana geme nt, ” Science, Vol. 37, No. 5, 1991, pp. 519-531. [11] T. Kariya, “Distribution of Stock Prices in the Stock Market of Japan,” Toyo Keizai Publishing Co., Tokyo, 1989. [12] G. Arnold, “Corporate Financial Management,” 3rd Edi- tion, Pearson Education Limited, 2008. [13] Uganda Securities Exchange, “Frequently Asked Ques- s about USE,” 2010. www.use.or.ug No. 4, 1974, pp. 1265-1274. zation Model: The Case of Uganda Securities Exchange,” LAP LAMBERT Academic Publishing GmbH & Co. KG, Ltd., Saarbrücken, 2012. [2] A. V. Puelz, “A Stochastic Convergence Model for Port- folio Selection,” Operations Research, Vol. 50, No. 3, 2002, pp. 462-476. [3] H. M. Markowitz, “Portfolio Selection,” The Journal of Finance, Vol. 7, No. 1, 1952, pp. 77-91. [14] A. B. Mayanja and K. Legesi, “Cost of Equity Capital and Risk on USE: Equity Finance; Bank Finance, Which One Is Cheaper?” MPRA Paper No. 6407, Economic Policy Research Centre, First Brokerage House, Wash- ington DC, 2007. [15] E. J. Elton and M. J. Gruber, “Portfolio Theory When Investment Relatives Are Log normally Distributed,” Journal of Finance, Vol. 29, [4] H. M. Markowitz, “Portfolio Selection: Efficient Diversi- fication of Investments,” John Wiley & Sons, New York, 1959. [5] J. Lintner, “The Valuation of Risk Assets and the Selec- tion of Risky Investments in Stock Portfolios and Capital tions and Answer http://dx.doi.org/10.1111/j.1540-6261.1974.tb03103.x [16] H.-S. Lau, “On Estimating Skewness in Stock Returns Management,” Science, Vol. 35, No. 9, 1989, pp. 1139- 1142. http://dx.doi.org/10.1287/mnsc.35.9.1139 [17] D. J. Wheeler and D. S. Chambers, “Introduction to Skew- ness and Kurtosis,” SPC Press, Inc., Knoxville, 1992. [18] S.-P. Wan, “Modern Portfolio Theory Bussiness 442: Investments,” Chapter 5, 2000. [19] A. T. Hamdy, “Newblock Operations Research an Intro- duction,” 8th Edition, Pearson Education, Inc., University of Arkansas, Fayetteville, 2007. [20] M. Jackson and M. Staunton, “Advanced Modelling in Finance Using Excel and & Sons, Ltd., Chichester, 20 VBA,” John Wiley 01. Open Access JMF |