Journal of Mathematical Finance, 2013, 3, 476-486 Published Online November 2013 (http://www.scirp.org/journal/jmf) http://dx.doi.org/10.4236/jmf.2013.34050 Open Access JMF Optimal Variational Portfolios with Inflation Protection Strategy and Efficient Frontier of Expected Value of Wealth for a Defined Contributory Pension Scheme Joshua O. Okoro1, Charles I. Nkeki2 1Department of Physical Science, Faculty of Science and Engineering, Landmark University, Omu-Aran, Nigeria 2Department of Mathematics, Faculty of Physical Sciences, University of Benin, Benin City, Nigeria Email: joshuate@yahoo.com, nkekicharles2003@yahoo.com Received August 16, 2013; revised September 27, 2013; accepted October 26, 2013 Copyright © 2013 Joshua O. Okoro, Charles I. Nkeki. This is an open access article distributed under the Creative Commons Attri- bution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. ABSTRACT This paper examines optimal variational Merton portfolios (OVMP) with inflation protection strategy for a defined con- tribution (DC) Pension scheme. The mean and variance of the expected value of wealth for a pension plan member (PPM) are also considered in this paper. The financial market is composed of a cash account, inflation-linked bond and stock. The effective salary of the plan member is assumed to be stochastic. It was assumed that the growth rate of PPM’s salary depends on some macroeconomic factors over time. The present value of PPM’s future contribution was obtained. The sensitivity analysis of the present value of the contribution was established. The OVMP processes with inter-temporal hedging terms and inflation protection that offset any shocks to the stochastic salary of a PPM were es- tablished. The expected values of PPM’s terminal wealth, variance and efficient frontier of the three classes of assets are obtained. The efficient frontier was found to be nonlinear and parabolic in shape. In this paper, we allow the stock price to be correlated to inflation risk index, and the effective salary of the PPM is correlated to inflation and stock risks. This will enable PPMs to determine extents of the stock market returns and risks, which can influence their contribu- tions to the scheme. Keywords: Optimal Variational Merton Portfolios; Mean-Variance; Expected Wealth, Defined Contribution; Pension Scheme; Pension Plan Member; Inter-Temporal Hedging Terms; Stochastic Salary 1. Introduction This paper considers the OVMP strategy under inflation protection, expected wealth and its variance for a DC pension scheme. It was assumed that the salary and risky asset are driven by a standard geometric Brownian mo- tion. The growth rate of salary of PPM is assumed to be a linear function of time. In this paper, we focus on study- ing the OVMP strategy under inflation protection for a DC pension scheme. In related literature, [1] and [2], studied optimal portfolio strategy based on the non-Gaussian models. They constructed optimal portfolios of variance swaps based on a variance gamma correlated model. The portfolios of the variance swaps are optimized based on the maximization of the distorted expectation given in the index of acceptability. [3] examined the rationale, nature and financial consequences of two alternative ap- proaches to portfolio regulations for the long term insti- tutional investor sectors of life insurance and pension funds. [4] studied the deterministic life styling and grad- ual switch from equities to bonds in accordance to preset rules. This approach was a popular asset allocation strat- egy during the accumulation phase of a defined contribu- tion pension plan and was designed to protect the pen- sion funds from a catastrophic fall in the stock market just prior to retirement. They showed that this strategy, although easy to understand and implement, can be highly suboptimal. [5] developed a model for analyzing the ex ante liquidity premium demanded by the holder of an illiquid annuity. The annuity is an insurance product that is similar to a pension savings account with both an accumulation and decumulation phase. They computed the yield needed to compensate for the utility welfare  J. O. OKORO, C. I. NKEKI 477 loss, which is induced by the inability to re-balance and maintain an optimal portfolio when holding an annuity. [6-8] considered the optimal design of the minimum guarantee in a defined contribution pension fund scheme. They studied the investment in the financial market by assuring that the pension fund optimizes its retribution which is a part of the surplus, which is the difference between the pension fund value and the guarantee. [9] studied optimal investment strategy for a defined con- tributory pension plan. They adopted dynamic optimiza- tion technique. [10] considered optimal portfolio strate- gies with minimum guarantee and inflation protection for a DC pension scheme. [11,12] studied the optimal port- folio and strategic lifecycle consumption process in a defined contributory pension plan. This work is an ex- tension of [13]. [13] studied the OVMP process of a PPM. In this paper, we introduce additional underlying asset, which is the inflation-linked bond that will protect the investment against inflation risks in the investment pro- file. [14] considered optimal investment strategy with discounted cash flows. In their work, the investment and the portfolios processes were protected from inflation risks by trading on the index bond asset that is linked to inflation risk over time. The remainder of this paper is organized as follows. In Section 2, we present the financial market models and wealth process of a PPM. Section 3 presents the expected value of PPM’s future contribution, the present value of the expected flow of future discounted contribution, sen- sitivity analysis of the present value of expected future discounted contribution and value of wealth process of a PPM. In Section 4, we present the optimization process and portfolio value of wealth of a PPM in pension scheme. Also, in this section, some numerical illustra- tions were made. Section 5 presents the expected wealth and variance of expected wealth for a PPM up to termi- nal period. Finally, Section 6 concludes the paper. 2. Problem Formulation Let ,, P be a probability space. Let :0, t, Ft T where : t Ws s t and the Brownian motion ,, QS WtWt Wt 0tT is a 2-dimensional process, defined on a com- plete probability space ,,, , FP T where is the real world probability measure and the terminal time. The vectors S and P t zt are the volatility vector for stock and inflation index with respect to changes in S Wt and Q Wt , respectively. t is the appreciation rate for stock. Moreover, St and zt are the volatilities for the stock and inflation in- dex, respectively, referred to as the coefficients of the market and are progressively measurable with respect to the filtration . We assume that the investor faces a market that is characterized by a risk-free asset (cash account), inflation-linked bond and stock, all of whom are tradeable. In this paper, we allow the stock price to be correlated to inflation risk index and the effective salary of the PPM to be correlated to inflation and stock. This will enables us to check how stock market risks can in- fluence contribution into the scheme. 2.1. The Financial Model The dynamics of the underlying assets are given by (1) and (2) t tC d,tCdCt r01 (1) d 0 0 St S Ss dd S tt ,ttWt (2) , 0 Qz d, d, z d , tQ tQt Z t Z tWt t rt z t t (3) where, rt is the nominal interest rate, Ct is the price of the riskless asset at time , t , tQt is the price of the inflation-linked bond at time , t Qt is the inflation index at time , and satisfies the dynamics t dddqt tQ Q QtEt W Qtt , Eqt is the expected rate of inflation which the dif- ference between the nominal interest rate and the real interest rate and Q t is the volatility of inflation in- dex, St is the stock price process at time , t zt is the inflation price of risk, is the correlation coefficient and 2 ,1 S SS tt t , ,0 .t zQ The volatility matrice now become 2 0 1 Q SS t ttt The market is complete since 2 10 QS , tt therefore there exists a unique market price of risk vctor, t 2 satisfying 2 1 z z S t t Sz t S tr t t t t t Open Access JMF  J. O. OKORO, C. I. NKEKI 478 The effective salary of the PPM is assume to follow the dynamics 0 ddd 00, Y YtYtt tt Wt Yy , (4) where, 12 , , YYY tt t 1Yt is the volati- lity caused by the source of inflation, Q Wt and 2Yt is the volatility caused by the source of uncer- tainty arises from the stock market, S Wt . We assume that the growth rate of the salary of PPM is linear and satisfies , 0, 0.tata a is seen as expected yearly growth of PPM’s salary and economic growth effect or welfare of the PPM. (4) define the buying power of PPM’s salary at time .t Suppose that (4) becomes 0, 0, Yt 0 dd,0YttYt tYy 0, (5) define the deterministic salary process of the PPM at time In this paper, we assume that the salary process of the PPM is stochastic. In the case of deterministic sal- ary, we shall state it. .t Therefore, the flow of contributions of the PPM is given by ,cY t where is a proportion of PPM’s salary that he/she is contributing into the scheme. We assume in this paper that , 0c rt t , t , , , Yt St Qt , 1Y, t 2Yt , t , Zt , S We now define the following exponential process which we assume to be Martingale in t are constants in time. :P 2 1 exp , 2 tWt t which will be useful in the next section. 2.2. The Wealth Process of a PPM Let t be the wealth process and , QS ttt . The portfolio process, Qt represents the proportion of wealth invested in infla- tion-linked bond and the proportion of wealth invested in stock at time . Then, t t S 01QS tt t is the proportion wealth invested in the riskless asset at time . We now have the following definition: t Definition 1: The portfolio process is said to be self-financing if the corresponding wealth process , 0,, tt T satisfies 0 dd d, 0 , zz r . , tXtrtcYtt XttWtXx (6) where 3. The Expected Value of PPM’s Future Contribution section, we considr the value of PPM’s expected future contribution over the planning horizon. We now scounted value of expected future In this e make the following definitions. Definition 2: The di contribution process is defined as d T tt s tE cYss t where , (7) t EEFt is the conditional expectation with respect to the Brownian filtration and 0t Ft exptZtrt is the s factor which adjusts for nomi- nal interest rate and market price of risk. Definition 3: A portfolio process is e admis- tochastic discount s said to b sible if the corresponding wealth process t satisfies 01, t s T PXt EcYsds tt 0, .tT Theorem 1: Let )(t be the discounted value of expected future contrin (PVFC) process of PPM, then butio a 0 1 ,0 0exp1,0 tTt cY T exp cY t (8) 2 0 2 2 2 πexp , 422 0 02 2 πexp , 422 0. cY t t Tt Erfi Erfi cy T Erfi Erfi (9) 0,T where, . z ar See Nkeki and Nwozo (2012). Remark 1: The present value of expected future con tribution of a PPM is given by In this paper, we consider te case of Proof: - 0 . h0. For the Open Access JMF  J. O. OKORO, C. I. NKEKI 479 0, see [4case of ,7,10,11,12]. 3. uti(PVPPMFC) bution for 1. Sensitivity Analysis of Present Value of PPM’s Future Contribon In this subsection, we consider the sensitivity analysis of PPM’s p value future contriresent 0 it and y of a- rame for stochastic salary. We intend to find the elastic PVPPMFC with respect to change in its dependent p ters. In a sequel, we set 0. 0 First, we fi the partial derivative of 0 with respect to . nd 2 2 2 00 5 2 3 e 4π cy 2 2 2 4 2 2 eπ2e πe2 2 π() ; 2 T T Erfi T Erfi (10) The partial derivative of with respect to 0 :c 2 00 22 πe; 22 Erfi Erfi 2 y c T (11) The partial derivative of with respect to 0 0:y 2 0 0 22 πe; 22 Erfi Erfi 2 c y T (12) The partial derivative of with respect to 0 :a 2 2 00 3 2 44 e 2π 2 eπeπ; 2 cy a T Erfi (13) The partial derivative of with respect to 2 22 3T 0 :T 22 4 0 0e TT cy T (14) The partial derivative of with respect to 0 12 ,,,, SY Y r are respectively given as; 2 22 23 4 eπ T Erfi 00 2 32 2 24 1 1 2 2 ee π2 Y S cy r T (15) 2 22 00 2 1 32 2 23 24 4 1 2 2 eee π π2 Y Y z T cy T Erfi (16) 2 2 2 2 00 3 12 2 32 3 244 e 2π1 2 1eπeπ 2 z YS T S cy T Erfi (17) 2 22 2 00 3 22 23 44 e 2 2 eeπ. π2 S Y T cy T Erfi (18) 2 2 2 2 002 3 22 2 2 3 244 e 21π 2 1e πeπ. 2 Y S T S cy T Erfi 2 22 2 00 2 2 2 2 2 424 2 1 21 ee πe2 . π2 SY Yz T cy T Erfi We set (to obtain the values in Table 1 by vary- ing each of the parameters) , 0.0292a0.04,r 10.18 Y , 20.20 Y , 0.09 z , 0.30 S , 0.40 , 0.09 , 0.01 , 20T, 0.25 Q , Open Access JMF  J. O. OKORO, C. I. NKEKI Open Access JMF 480 the values of the parameters and the in PVPPMFC. It is observed that sitively sensitive to all the parame- that is constant overtime (or we astic in and ). But, nsitive in 00.8y, Table 1 the PVPPMFC ters exce say that PVPPMFC is ne 0.15.c gives corresponding change is po pt c and PVPPMFC is inel 0 y gatively se c 0 y . We observe that as increases by 0.1, the PVPcreases by ve the otr. Fo P han MFC de about 15.192. We also observed that among the sensitive parameters, some are more sensititsr instance, a small change in he PPM will lead to a veh inFCf ry hig PV, , an se oproportionate changei.e. increa by PV 0.001 unit will av bt an ave if rinease og aboueragncr PPMFC by 251 units. It is further observed that an increase of T by one unit will lead to a very small change in PVPPMFC. Increasing a by 0.001 will lead to about anerage of 2.19 increases in PCPPMFC. Similarly, an increase in r by 0.01 will lead to a pro- portionate increase in PVPPMFC by 1.65. Similarly, an increase in by 0.01 will bring about 0.20 propor- tionate increases in PVPPMFC. Again, an increase in 1Y by 0.05 will lead to about 0.75 proportionate in- creases in PVPPMFC. Finall , an increase in 2Y y by 0.05 will lead to about 1.52 proportionate increases in PPPMFC. When increase by 0.01, the PVPPMFC in- creases alongside with 15.2. We therefore conclude that PVPPMFC isastic with respect to change in the pa- rameters. The elasticity of PVPPMFC with respect to change in the above parameters will enable fund manag- ers and investors to value assets, flow of contributions, and investment flow that are to be receive some time in future. From (14), we obtain the critical time horizon for the present value of PPM’s future discounted contribu- ti as follows: V on el 22 * e0 2 14log . 2 Tcy (19) Lemma 1: The dynamics of the discounted value of future contribution process is given by dd d, z ttttWt cY tt d (20) where, π 2, 22 At Tt Erfi Erfi ,, atAtHt tT At t 22 2 exp2 exp. 44 Tt Ht Proof: See Nkeki and Nwozo (2012). 3.2 Value of PPM’s Wealth Process Let the value of PPM’s wealth be Vt at timeis gi t ven by ,0,VtXtt tT . (21) s of Finding the differential of both side(21) and sub- stituting in (6) and (20), we obtain ddVtXtrtttt d. Ytt XtWt (22) 4. The Optimization Process and Portfolio Value of a PPM In this section, we consider the optimal portfolio process. sit Table 1. Simulation of the sen T ivity analysis of PVPPMFC. 0 T 0 a 0 a r 0 r z 0 z 1Y 0 1Y 2Y 0 2Y 0 0 1 0.1062 0.001 −2838.87 0.020 116.76 0.01 −42.830.05 −13.519 0.15 −12.903 0.20−19.52 0.01 −244.9 0.11.93 2 0.1035 0.002 −60.0597 0.021 118.84 0.02 −40.930.06 −13.310 0.20 −11.952 0.25−17.26 0.02 −220.9 0.21.60 3 0.1030 0.003 249.936 0.022 21 0.03 −198.8 0.31.25 4 0.1044 0.004 370.722 0.023 36 0.04 −178.4 0.40.83 5 0.1081 0.005 483.543 0.024 125.23 0.05 −35.630.09 −12.697 0.35 −09.425 0.40−11.69 0.05 −159.7 0.50.28 6 0.1141 0.006 627.520.025 127.42 0.06 −33.990.10 −12.497 0.40 −08.684 0.45−10.18 0.06 −142.0.6 −0.54 − 10 0.1733 0.010 2002.66 0.029 136.48 0.10 −28.010.14 −11.7240.60−06.1570.65−05.55 0.10 −87.9 0.99−134.8 120.94 0.03 −39.100.07 −13.103 0.25 −11.057 0.30−15. 123.07 0.04 −37.330.08 −12.899 0.30 −10.216 0.35−13. 1 5 7 0.1230 0.007 824.141 0.026 129.64 0.07 −32.410.11 −12.300 0.45 −07.989 0.50−08.82 0.07 −126.8 0.7−1.99 8 0.1351 0.008 1096.40 0.027 131.89 0.08 −30.890.12 −12.106 0.50 −07.337 0.55−07.60 0.08 −112.6 0.8−5.22 9 0.1515 0.009 1474.95 0.028 134.17 0.09 −29.420.13 −11.914 0.55 −06.727 0.60−06.52 0.09 −99.6 0.916.45  J. O. OKORO, C. I. NKEKI 481 Wdee efine the genral objective function ,t x t,JtV,EuV T X where uV t is the path of Vt gih strategy ne issi- bp e ven te portfolio ortfolio . Defi V gy that to b are e the set of all adm le stratV - progressively me u lv n as- rabe, and let u V t be a concave alue functio in Vt such that sup , , VJt V Then UVtfies the HJB equation sup , . VEuVT Xtxt satis UVt sup,,0 VHtv t U (23) subject to: ,, v UTv 0, where, 2 2 ,, 1 2 1. 2 x xx Yx YY tv xt tU xtU U rx xtUU Finding the partial derivative of ,,Htv with re- e optimal control spect to th t and setting it to zero, we obtain 1 *. xYx xx UU txU (24) Substituting (24) into (23), we obtain the HJB equation (25), we have 2 x tx MU UrxU U 22 1 2 2 xx Yx xYY x xx xx U MU UU UU 2 10. 2YY U where Prop (25) 1 M . osition: Let ,, vR t Utv Rt v Rt 11 0; 1Rt 1M 2 1 Y R trxv M vR t (26) 0, be the solution to the HJB Equation (25), then, *t *Y * Xt * X. 1 MX ttM tt Proof: We commence by obtaining the following par- tial derivatives: (27) 1 t UvRt Rt 1 x UvRt 2 1 xx UvRt 2 1 x UvRt 1 UvRt 2 1UvRt Substituting the partial derivatives abovto (25), we e in obtain 1 11 1 21 0. Y M Rt rxvRtRt vRt MvRt Again, substituting the partial derivatives into (24), we obtain * Y MXtttM * ** . 1 tXt Xt ortfolio value in the riskless asset is obtain as Therefore, the p * * 0** 1. 1 Y Xt t tM tXt Xt (28) The portfolio value (27) is made up of two parts. The first part is the OVMP value and the second part is the intertemporal hedging term that offset any shocks to the stochastic salary of the PPM at time . It is observe in (28) that the flow of intertemporal term is a gradual transfer fund from the risky assets to the riskless one ov the effective salary process of a PPM. It is also a ratio of the PPM discounted value of expected future contributions of a PPM to the optimal wealth process. This strategy is strongly recommended for PPMs of whom contributions are made compulsory. This will en- su ar er time. The intertemporal hedging term, interestingly is a function of financial market behaviour and volatility vector of re that the inflation risks in the portfolio of members e hedged. We therefore say that (27) is a portfolio with Open Access JMF  J. O. OKORO, C. I. NKEKI 482 inflation protection strategy. The solution to (26) can be obtained numerically. Numerical Example Let 0.0292a, 0.04r, 10.18 Y , 20.20 Y , 0.09 z , S0.30 , 0.40 , 0.09 , 0.01 , 0.80 ,20T, 0.2 Q5 figures: , 00.8y, 0.15c, we Figures 1-3 are obtained for have the following 0 ock that ns for me lio va and for determi- ni in st inflation-linked bond to ensure maximum returmbers at retire- e portfolue in stock when stic salary process. Figure 1 shows the portfolio value of a PPM invested in inflation-linked bond for a period of 20 years given that the wealth is between 1 to 6 mil- lion. Similarly, Figure 2 shows the portfolio value of a PPM invested in stock for the same period and the same wealth. Figure 3 shows the portfolio value of a PPM in cash account. It is observed that the portfolio values in stock and inflation-linked bond are nonnegative, while in cash account is negative over time. We therefore recom- mend (based on these numerical examples) that the port- folio value in cash account should be shorten by the negative value to finance the risky assets (i.e., more money should be borrowed from cash account to finance the investment in stock and inflation-linked bond). It is also observed that the wealth generated by stock is higher than that of inflation-linked bond. This suggest that more fund should be invested ment. Figure 4 shows th 0 o , and for thse salary stocFigure 5 shows rtfolio val in Stock wh e ca the pue hastic. en 0 xe Fi when , gure for salar- d lad.6 s the portfolio value in cash account, y sto anrandomness is re showchastic 0 alary stochastic. Figure 7 shows t , and s he lio value in cash account, when 0 portfo , salary stochastic and randomness is relaxed. Figure 8 shows the portfolio value in infla- tion-linked bond, when 0 , and salary is stochastic. Figure 9 shows portfolio value in inflation-linked bond for 0 , salary stochastic and randomness is relaxed. Figures 4, 6, 8 are established for 0 and for sto- chastic salary process. These figures are made up of sev- eral shocks and paths. These shock paths made it difficult to make useful decisions, hence the need for us to relax the randomness associated with the portfolios for ef- fective decision making. We now have that the following Figures 5, 7, 9 are special cases of Figures 4, 6, 8, re- spectively. Similar behaviors exhibited by Figures 1-3 were also exhibited by Figures 5, 7, 9. The major differ- ence is that the portfolio value under stochastic salary yields higher returns that the deterministic salary. This makes sense, since it is expected that, the higher the risk taken, the higher the expected wealth. Interestingly, from the numerical examples, the amount that was gradually transferred from the risky assets to cash account seems to een re-invested back to the risky assets overtime. Figures 10-12 show the portfoliues for determi- nistic salary and for 0 have b o val in inflation-linked bond, stock and cash account, respectively. bserved that under this strategy, the entire fund should be invested in stock for maximealth for the PPM at retirement. Figures 13-15 show the portfolio values for stochastic salary and 0 We o um w in in-linked bond, stock and cash account overtime. It should be noted that the shocks associated with the portfolios arise from the salary risks flation of the PPM overtime. 5. Expected Wealth and Variance of the Expected Wealth In other to determine the expected wealth of the PPM at time t, we find the mathematical expectation of (22) as follows: 123456 0 10 20 30 0 10 20 30 40 Wealth For Beta= 0 for Determ i n ist i c S alary Time,t (in year) Figure 1. The portfolio value in inflation-linked bond for 0 Portfolio Value and salary deterministic. 123456 0 10 20 30 0 10 20 30 40 Fo r Be ta=0 for D eterm in i st ic S a lary Wealth Tim e,t (i n year) Portfolio Va Figure 2. The portfolio value of a PPM in stock for lue 0 and salary deterministic. Open Access JMF  J. O. OKORO, C. I. NKEKI 483 123456 0 10 20 30 -50 -40 -30 -20 -10 0 Wealth For Bet a=0 for Det ermi n i stic S alary Time,t (in year) Portfolio Value Figure 3. The portfolio value of a PPM in cash account for and salary deterministic. 0 Figure 4. The portfolio value in stock. When 0 , and salary stochastic. 123456 0 10 20 30 0 5 10 15 20 25 30 Wealth For Beta = 0 for S tochas tic Salary but normal i zed Time,t (in year) Portfolio Value Figure 5. The portfolio value in stock. When 0 , and Figure 6. The portfolio value in cash account. When 0 , and salary stochastic. 123456 0 10 20 30 -30 -25 -20 -15 -10 -5 0 Wealth For Beta=0 for Stochastic Salary but normalized Time,t (in year) Portfolio Value Figure 7. The portfolio value in cash account. When 0 , and salary stochastic randomness is relaxed. Figure 8. The portfolio value in inflation-linked bond. 0 when , and salary stochastic. salary stochastic and randomness is relaxe d. Open Access JMF  J. O. OKORO, C. I. NKEKI 484 123456 0 10 20 30 0.05 0.06 0.07 0.08 0.09 Wealth For Beta=0 for Stochastic Salary but normalized Time,t (in year) Portfolio Value Figure 9. Portfolio value in inflation-linked bond. When and salary stochastic and randomness is relaxed. 0 , Figure 10. The portfolio value in inflation-linked bond for and deterministic salary. 0 Figure 11. The portfolio value in stock for and de terministic salary. 0 - Figure 12. The portfolio value in cash account for 0 and deterministic salary. Figure 13. The portfolio value in inflation-linked bond for 0 and for stochastic salary. Figure 14. The portfolio value in stock for 0 and sa- lary stochastic. Open Access JMF  J. O. OKORO, C. I. NKEKI 485 Figure 15. The portfolio value in cash account for 0 and salary stochastic. * * * * d 1 d d. 1 Y Vt MV t rV t rMttt MVt Wt (29) Taking the mathematical expectation (29), we have * * d 1 d Y EV t M rEVt rMtE tt (30) Solving (30), we have *ee tts t EV tvf (31) 00ds s where, *2 *2 * 2 *2 , 1 d 22d 1 2d 1 Y fsrMs Es M r Vt MM VtftVt t MVt Wt (32) Taking the mathematical expectation of (32), we have *2 dEV t *2 * 2 22 d 1 MMEVtftEVtt (33) Integrating (33), we have *2 2 00 0 00 eee eedd, ts tt ts ts T EVtvvfs fsf s ds where, 2 2. 1 MM Efficient Frontier In this subsection, we presents the efficient frontier of the three classes of assets. At ,tT we have 01 *2 2 02 e e T T T vT EV TvT * EV ss dd (34) where 10ed TTs Tf , 20 0 00 ee d ee Ts T Ts Ts T Tv fss sf s Therefore, the variance of the portfolio is obtained as (35) (34) is the expected terminal wealth of the PPM and (35) . The efficient frontier of the three classes of assets is obtain as 2 **2 * 2 2* 02 e. T Var VTE VTE VT vTEVT is variance of the expected terminal wealth of the PPM 2 *2* 02 2 1 * 2 02 2 1 *2 2 00 2 1 *2 2 02 2 1 *2 0 e e 2e 2e e2 e, T T TT TT T VarVTvTEVT vEVTT vEVT v vEVT Tv FTEVTv 0 e Open Access JMF  J. O. OKORO, C. I. NKEKI Open Access JMF 486 where, 2 02 2e T TvT . Therefore, the efficient frontier (that is nonlinear and of the portfolio process is have parabolic shape) * iVT w, 1 *2 2 0 1 eT EV TvFT . here i1. If * 20 VT FT , it implies that 1 *2 0eT EV Tv . This shows that fund can be borrowed from the optimal wealth at time for year. 6. Conclusion In portfolios with inflation protection strategy for a defined contribution Pension scheme. The present values of PP future contribution and sensitivity analysis of the presen value of the contribution were established. The optimal e, expected values of PPM’s terminal wealth and variance as well as the efficient frontier were tained. REFERENCES [1] L. Cao and Z. F. Guo, “Optimal Variance Swaps Invest- ments,” IAENG International Journal of Applied Mathe- matics, Vol. 41, No. 4, 2011, 5 Pages. [2] L. Cao and Z. F. Guo, “Delta hedging through Deltas from a Geometric Brownian Motion Process,” Proceed- ings of International Conference on Applied Financial Economics, London, 30 June-2 July 2011. [3] P. E. Davis, “Portfolio Regulation of Life Insurance Companies and Pension Funds,” Oxford University Press, ford, 2000. .org/dataoecd/30/39/2401884.pdf [4] A. J. G. Cairns, D. Blake and K. Dow ntrol, Vol. 30, No. 6, 2006, pp. 843-877. http://dx.doi.org/10.1016/j.jedc.2005.03.009 namics & Co [5] S. Brawne, A. M. Milevsky and T. S. Salisbury, “Asset Allocation and the Liquidity Premium for Illiquid Annui- 975.t01-1-00062 ties,” The Journal of Risk and Insurance, Vol. 70, No. 3, 2003, pp. 509-526. http://dx.doi.org/10.1111/1539-6 . Grasselli and P. Koehl, “Optimal design ined Contribution Funds,” 2002. [6] G. Deelstra, M of the Guarantee for Def http://www.amazon.com/Optimal-design-guarantee-defin ed-contribution/dp/B000RQY19I [7] G. Deelstra, M. Grasselli and P. Koehl, “Optimal Invest- ment Strategies in the Presence of a Minimum Guaran- tee,” Insurance: Mathematics and Economics, Vol. 33, No. 1, 2003, pp. 189-207. http://dx.doi.org/10.1016/S0167-6687(03)00153-7 [8] G. Deelstra, M. Grasselli and P. Koehl, “Optimal Design of the Guarantee for Defined Contribution Funds,” Jour- nal of Economics Dynamics and Control, Vol. 28, No. 11, 2004, pp. 2239-226. http:/ 0tT /dx.doi.org/10.1016/j.jedc.2003.10.003 [9] C. R. Nwozo and C. I. Nkeki, “Optimal Investment Stra- tegy for a Defon Plan in Nigeria Using Dynamue,” Studies in Ma- rantee and Infla- Portfolio and International Journal of Applied Mathe- al Form of 236/jmf.2012.21015 this paper, we studied the optimal variational Merton ined Contributory Pensi ic Optimization Techniq M’s t thematical Sciences, Vol. 2, No. 2, 2011, pp. 43-60. [10] C. R. Nwozo and C. I. Nkeki, “Optimal Investment and Portfolio Strategies with Minimum Gua variational Merton portfolio processes with inter-tem- poral hedging terms and inflation protection that offset any shocks to the stochastic salary of a PPM are obtained. Furthermor tion Protection for a Defined Contribution Pension Scheme,” Studies in Mathematical Sciences, Vol. 2, No. 2, 2011, pp. 78-89. [11] C. R. Nwozo and C. I. Nkeki, “Optimal ob- Strategic Consumption Planning in a Life-Cycle of a Pen- sion Plan Member in A Defined Contributory Pension Scheme,” IAENG matics, Vol. 41, No. 4, 2011, p. 299. [12] C. I. Nkeki, “On Optimal Portfolio Management of the Accumulation Phase of a Defined Contributory Pension Scheme,” Ph.D. Thesis, University of Ibadan, Ibadan, 2011. [13] C. I. Nkeki and C. R. Nwozo, “Variation Classical Portfolio Strategy and Expected Wealth for a Defined Contributory Pension Scheme,” Journal of Mathe- matical Finance, Vol. 2, No. 1, 2012, 132-139. http://dx.doi.org/10.4 t under [14] C. I. Nkeki and C. R. Nwozo, “Optimal Investmen Inflation Protection and Optimal Portfolios with Stocha- stic Cash Flows Strategy,” To appear in IAENG Journal of Applied Mathematics, Vol. 43, No. 2, 2013, p. 54. Ox http.//www.oecd d, “Stochastic Life- styling: Optimal Dynamic Asset Allocation for Defined Contribution Pension Plans,” Journal of Economic Dy-

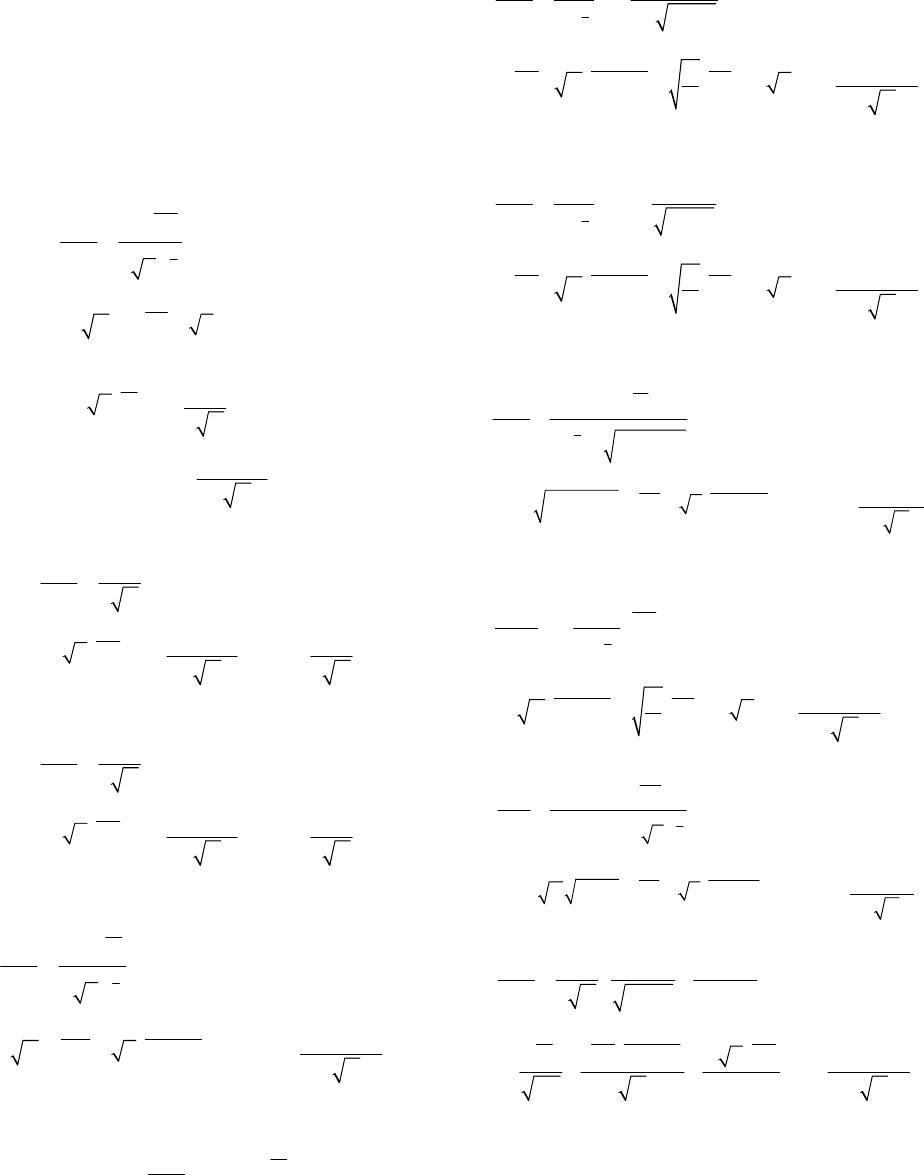

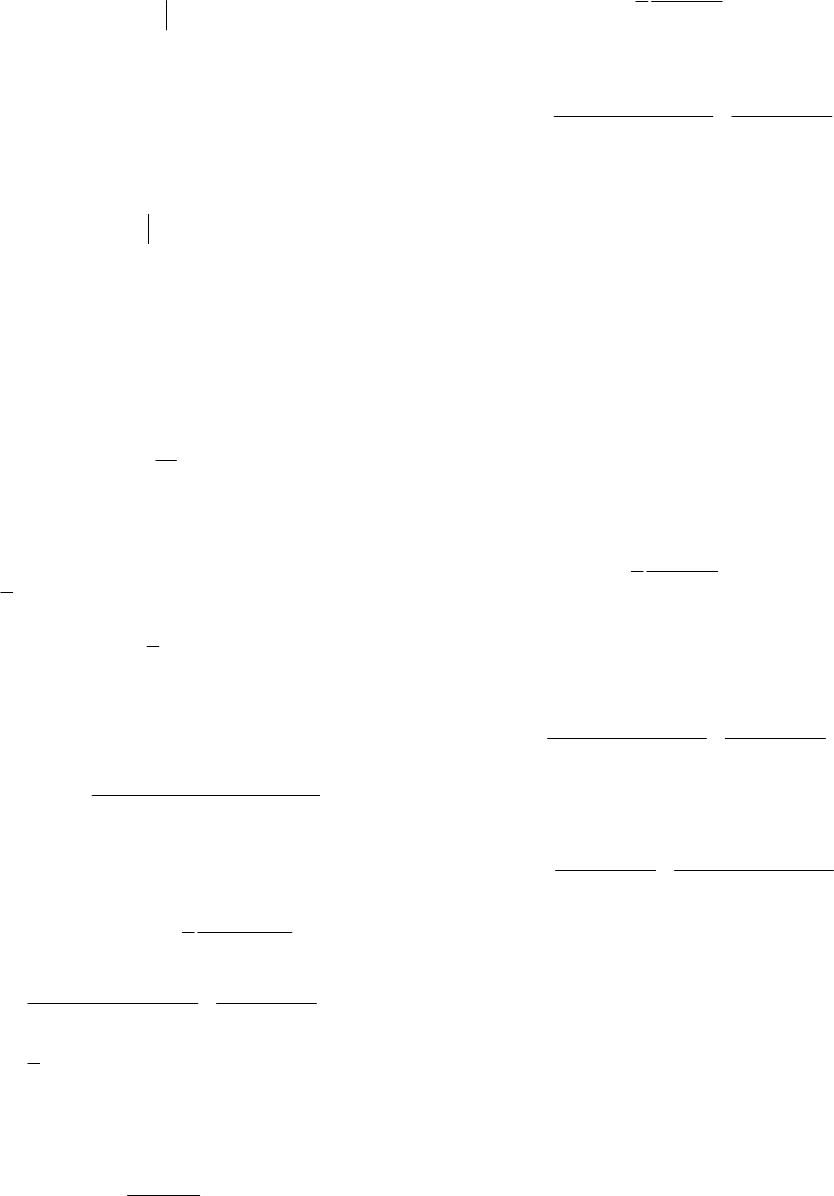

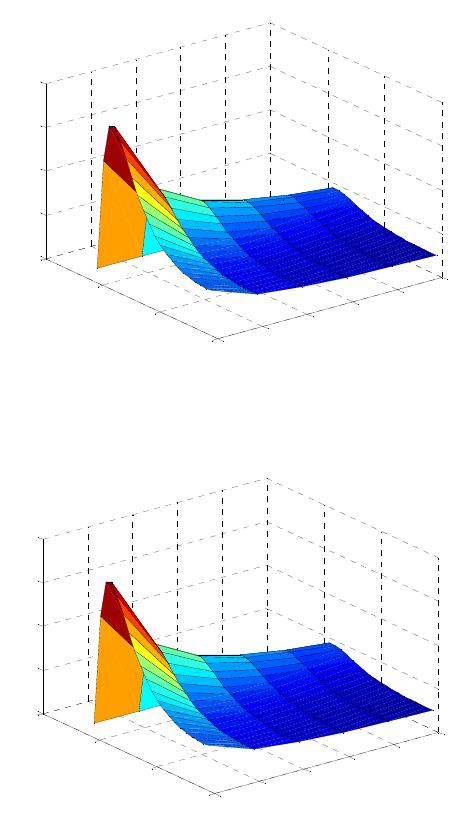

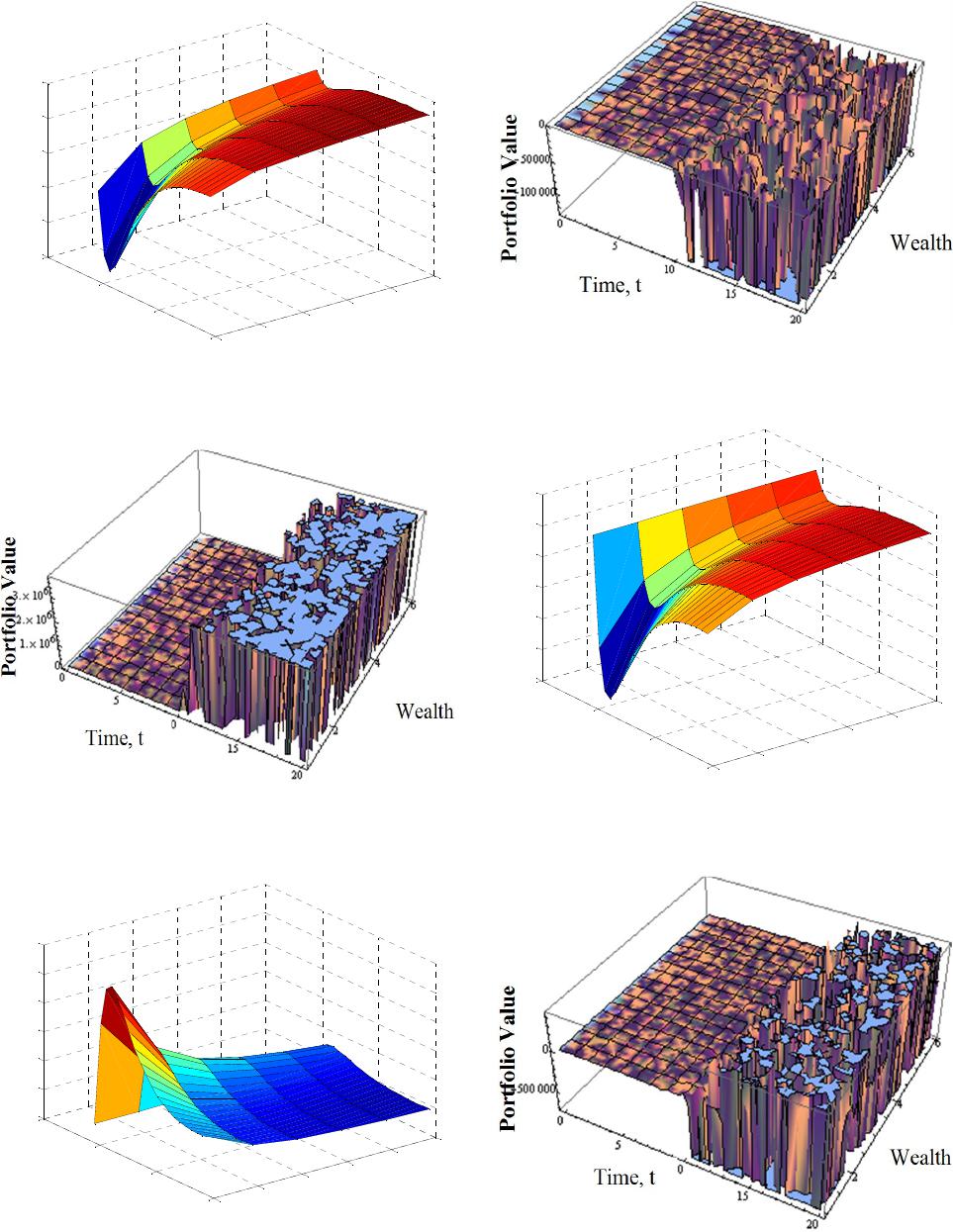

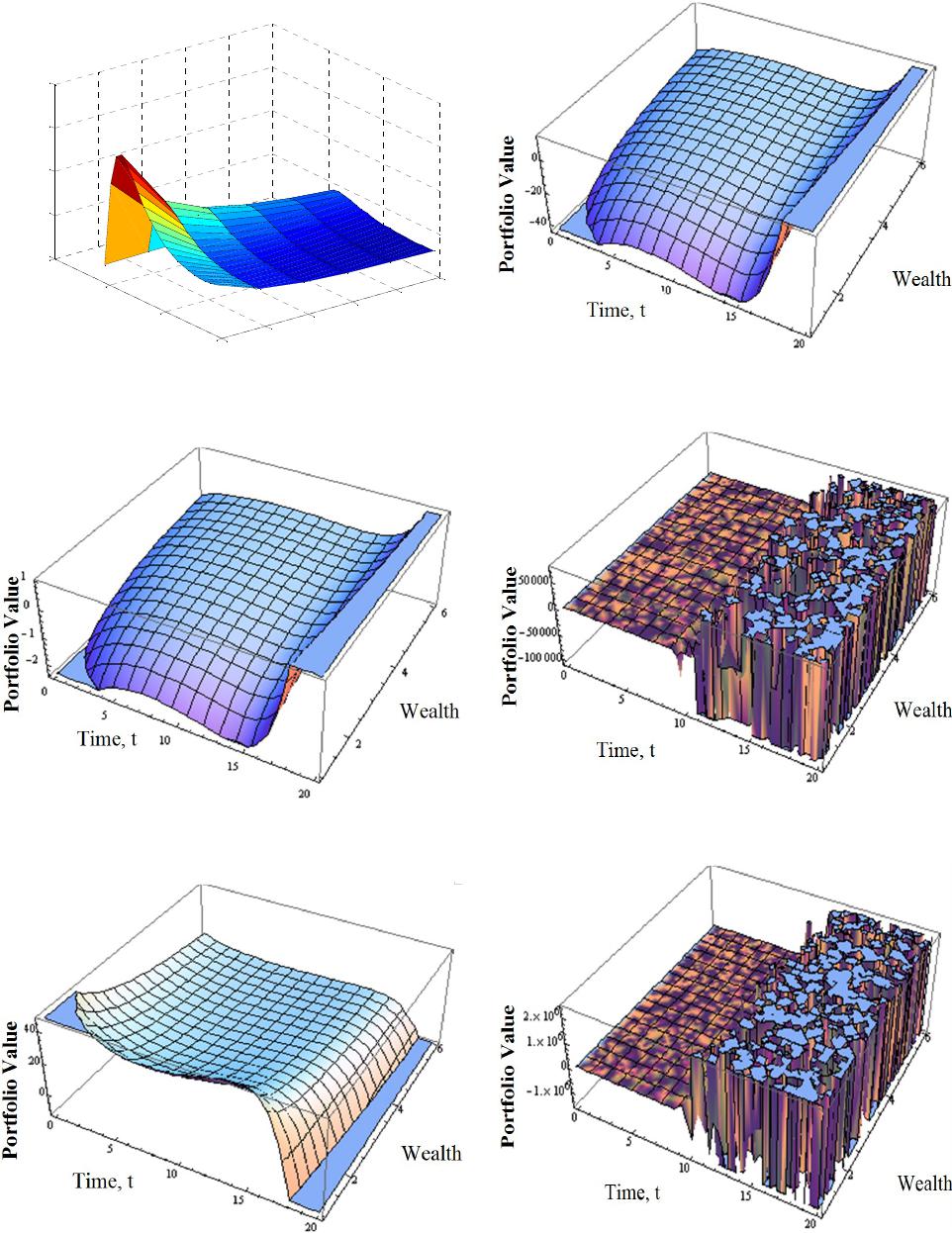

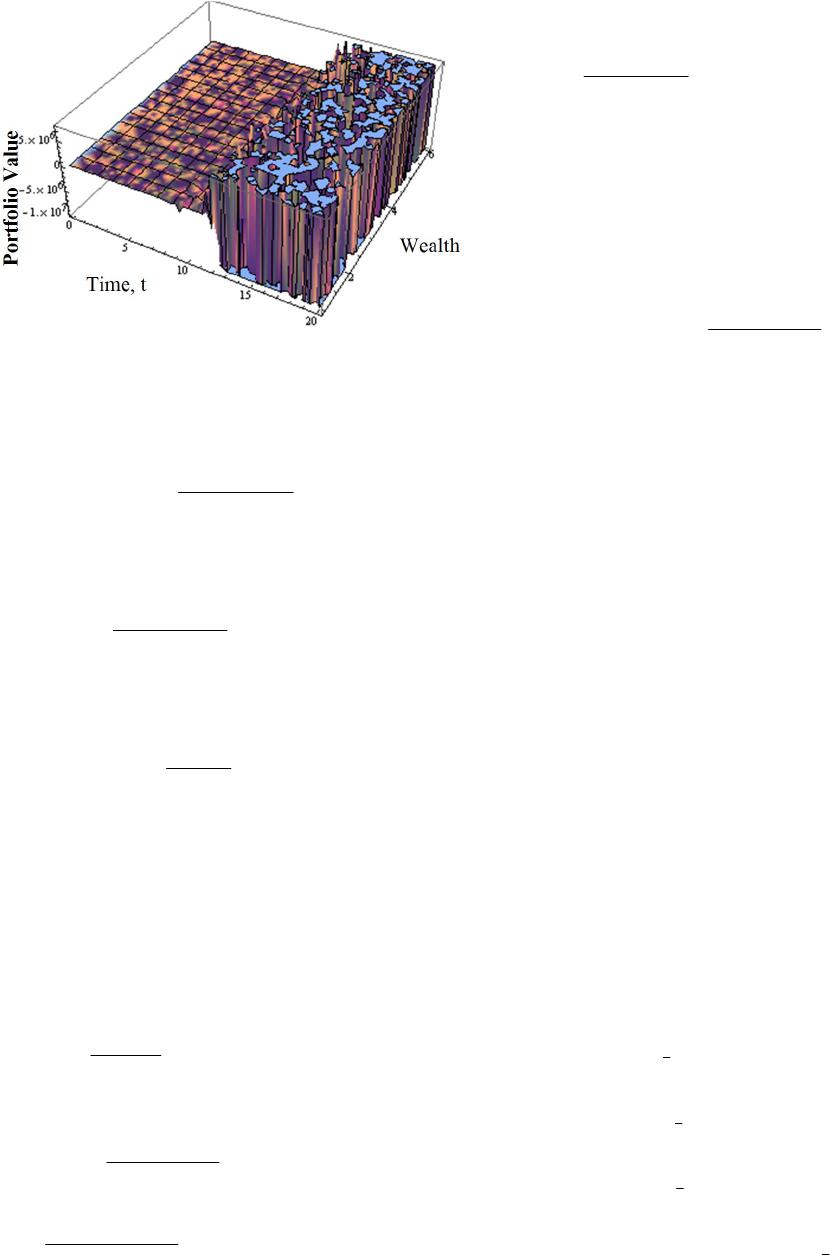

|