Technology and Investment

Vol.5 No.1(2014), Article ID:42939,6 pages DOI:10.4236/ti.2014.51004

An Empirical Study on the Effects of Equity Incentive of the Listed Corporations in the SME Board of China

—An Empirical Analysis Based on the View of Earnings Management

School of Management, University of Science and Technology of China, Hefei, China

Email: cuiwenqin27@163.com

Copyright © 2014 Lixin Xu, Wenqin Cui. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. In accordance of the Creative Commons Attribution License all Copyrights © 2014 are reserved for SCIRP and the owner of the intellectual property Lixin Xu, Wenqin Cui. All Copyright © 2014 are guarded by law and by SCIRP as a guardian.

Received October 29, 2013; revised November 29, 2013; accepted December 6, 2013

KEYWORDS

Equity Incentive; SME Board; Company Performance; Earnings Management

ABSTRACT

Currently, most researches are focusing on Shanghai & Shenzhen exchange, and few researches have been done on the SME board. Besides, while studying the effect of equity incentive, most of the researchers have ignored the earnings management triggered by stock ownership incentive. This paper takes the SME board companies which have implemented stock ownership incentive as the research object. We have used earnings management to modify the company performance and carried out an empirical research to study the effect of stock ownership incentive. Our result shows that without earnings management to modify the company performance, stock ownership incentive is positively related to company performance. Taking the earnings management into account, the positive correlation relationship between stock ownership incentive and company performance will be weakened, and stock ownership incentive will stimulate earnings management.

1. Introduction

In 2005, the Measures for the Administration of Listed Companies Equity Incentive (Trial) issued by China Securities Regulatory Commission, marked the beginning of China’s equity incentive. Equity incentive mechanism is an important part of the corporate governance mechanism. Theoretically, it’s a long-term and encouraging system, and is able to restrict the behavior of executives through institutional arrangements so as to reduce agency cost and improve operation efficiency. However, in reality, whether the equity incentive can coordinate the conflicts of interests between shareholders and managers effectively and improve company performance is still a dispute in the academic circles.

American scholars, Jensen & Meckling (1976) [1] proposed to solve the principal-agent problems through equity incentive first and they proved that managers can not realize the maximal benefit of stockholders, because they have the motivation to pursue expense in-office. Listed companies implementing equity incentive plans can produce Alignment effect, which brings the interest accordance between the executive and external shareholders to effectively solve the principal-agent problems; Mehran (1995) [2] had found that CEO and managerial ownership have a positive effect on company performance. Through an empirical study on the randomly selected sample data of 153 companies, there is a positive correlation between management shareholding ratio and company performance. Some scholars e.g. Himmelberg, Hubbard & Palia (1999) [3] argued that the equity incentive cannot effectively improve the performance of the company. By the empirical study based on a panel data sample, they found that the correlation between managerial ownership and corporate performance does not exist or is weak.

The implementation of equity incentive mechanism of China’s listed companies is late and the development time is very short. Studies in this issue are not sufficient in China, but are the same with the foreign studies, there are two diametrically opposite conclusions too. Wei Gang (2000) [4] found that Managerial ownership and company performance are not remarkable related or not related to each other; Li Zengquan (2000) [5] proved that China’s listed Corporation manager shareholding is helpful to improve company performance, but since most of the managers shareholding ratio is very low, it can’t perform its functions; through empirical studies, Gu Bing and Zhou Liye (2007) [6] suggested that at present, long-term effect of executive equity incentive of China’s listed corporations is not obvious; the empirical research of Liu Guoliang and Wang Jiasheng (2000) [7] showed that the management equity incentive and firm performance have a positive correlation in statistics.

Throughout the previous researches, it is not hard to find that, at present, most of the researches are focused on Shanghai & Shenzhen exchange, and few researches have been done on the SME board. With more small and medium size companies listed on the SME board and the improvement of equity incentive mechanism, more and more listed SMEs began to implement equity incentive and became the most active part. Most of the companies of listed SMEs are private enterprises, which are different from the Main-Board Market mainly composed by state-owned enterprises. As managers in these companies are selected through the system of employment under contract, their appointment is usually closely related to their job performance. Theoretically, the effectiveness of equity incentive in listed SMEs is different from those of main board companies. The listed SMEs implement equity incentive can promote managers to work harder and achieve the interests of the clients. Our research takes the listed SMEs as the sample, and hopes to help improve the equity incentive theory.

Besides, a lot of foreign studies show that although equity incentive can improve the corporate governance structure, reduce the agency cost, improve the company performance (Mehran, 1995), it may initiate earnings management effect. The correlation between equity incentive and company performance shows a significant change if we use earning management to modify the company performance (Cheng and Warfild, 2005) [8]. As equity incentive has some requirements for company performance index, the managers have the motive to manipulate earnings to satisfy vesting conditions, which may hurt ordinary investors’ interests. While studying on the effect of equity incentive, most of the Chinese scholars have ignored the earnings management triggered by stock ownership incentive. Further research shows that most of the data in Chinese scholars’ studies were before the year of 2005, but the true sense of equity incentive in our country started from the year of 2005 and the relevant laws and regulations were issued since 2006. We use the data from the year 2009 to 2011 as the sample and modify company performance based on earnings management, which effectively avoid the above problems. In conclusion, this paper has certain academic and practical significance.

2. Research Design

2.1. Hypotheses

Theoretical Model of Jensen and Meckling’s (1976) showed that equity incentive can reduce the agency conflict, increase the effort level of executive, strengthen the executives and shareholders benefit sharing and risksharing mechanism, and improve the company performance through synergistic effect. But equity incentive can also urge the executives to manipulate earning for their own benefits, which can dampen company performance. Research showed that the ratio of equity and options on total compensation are significantly and positively associated with discretionary accruals (Bergstresser and Philippon, 2006) [9] and their effects on company performance reduce significantly when the performance is modified by earning management (Cheng and Warfild, 2005), so we make the following assumptions.

Hypothesis 1: There is a positive correlation between company performance and incentive ratio.

Hypothesis 2: There is no positive correlation between company performance which is modified by earning management and incentive ratio.

Hypothesis 3: There is a positive correlation between discretionary accruals and incentive ratio.

2.2. Sample and Data

This paper choosed the companies those are listed in Shenzhen Stock Exchange before the year of 2009 and implemented equity incentive during 2009-2011, and removed the following companies: 1) ST companies; 2) financial industry companies; 3) those who aborted the equity incentive plan during 2009-2011; 4) those whose financial data is incomplete. Finally we had 21 listed companies left, then we choosed these companies’ report data from 2009 to 2011 as our sample. The index data and other related data in this paper comes from CSMAR and RESSET. Data analysis tool is Stata 11.0.

2.3. Variables Design

1) Explained Variables .

.

a) Company performance (ROAit), we use return on total assets to measure company performance.

b) Company performance is modified by earning management (ADJROAit). To obtain a performance measure which is relatively free of manipulation, we need to strip away the impact of potential strategic choices concerning to depreciation. Therefore, we use ADJROAit as the measure of unmanaged performance.

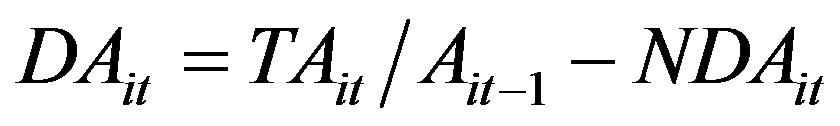

c) Discretionary accruals (|DAit|)The modified Jones model is used to estimate normal accruals as a fraction of lagged assets which is from the following equations:

Here we use tool stata11.0 to get the coefficient estimates a0, a1, a2, then we get the following equation:

Discretionary accruals as a fraction of assets, DAit is then defined as

TAit denotes total accruals for firm i in year t; Ait denotes total assets for firm i in year t; REVit denotes change in sales for firm i in year t; and PPEit denotes property, plan and equipment for firm j in year t; ΔREVit denotes the deference between main business income firm i in year t and year t − 1; ΔRECit denotes the deference between amount receivable for firm i in year t and year t − 1.

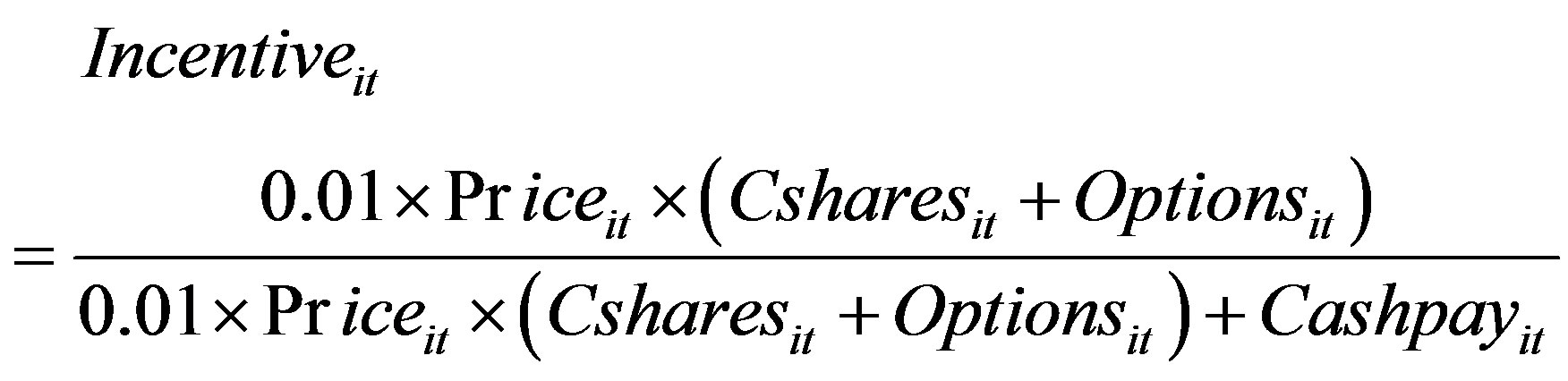

2) Explanatory Variable (Incentiveit)

The incentive ratio is selected as the explanatory variable, and the method developed by Bergstresser and Philippon (2006) is used, and it is defined as follows:

Incentiveit is incentive ratio. This ratio employs the total holding of stock and options rather than annual grants; Priceit is the stock price at the end of the year of company i. Csharesit and Optionit is the amount of stock and option of company i’s executive in year t; Cashpayit is the total pay of company i’s executive in year t.

3) Control variables In order to control the affection of different characteristic environments on company performance, we choose the following index as control variables.

a) D/A, asset-liability ratio. Asset-liability ratio partly reflects the company’s long-term solvency. When the assets liabilities ratio is high, the executive tends to manipulate earning for relieving the pressure of debt.

b) LnSIZE, asset scale, ledger asset in natural logarithm. The company with larger scale will have a complex management environment, which will lead to more Agency relationship and a high probability of the occurrence of earnings management.

c) GROW, company’s growth is EPSG. EPSG is an important measurement index of corporate profitability and can partly reflect company’s future prospects.

d) SH, ownership concentration, the shareholding ratio of the top ten major shareholders. It is common that our listed companies have high shareholding concentration. Part of the directors of the board are representatives of the large shareholders, while equity incentive plan should be preplanned by the board of directors, then shareholders’ meeting decides whether to implement the plan after examining it.

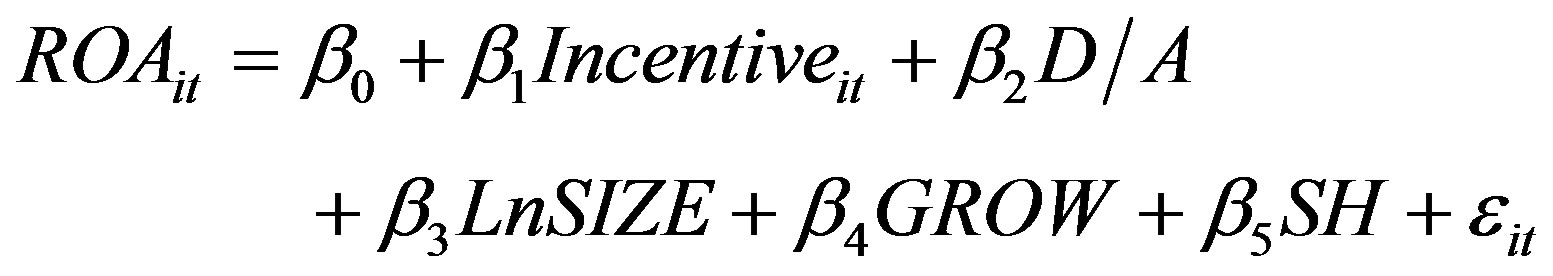

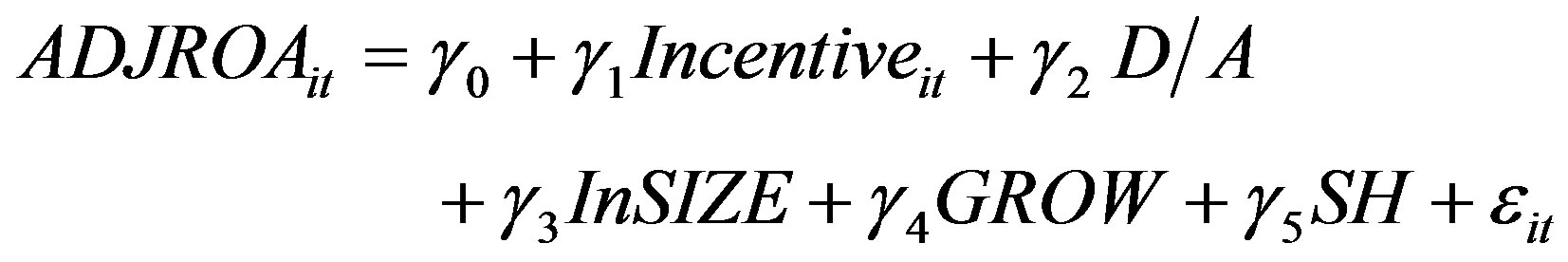

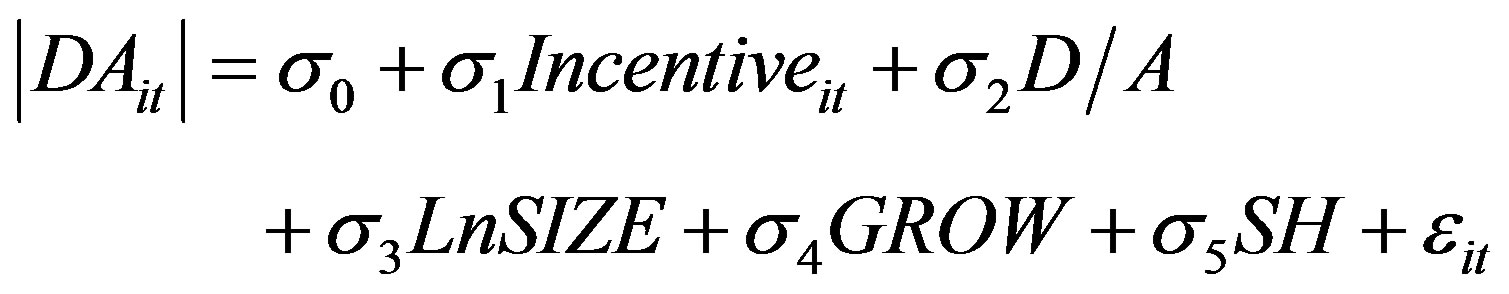

2.4. Model Design

To testify the hypotheses, we apply panel data and design following regression models on the base of relevant references:

(1)

(1)

(2)

(2)

(3)

(3)

ROAit is the return on total asset of company i in t year; ADJROAit is the return on total asset modified by earning management of company i in t year;  is the degree of earning management of company i in year t.

is the degree of earning management of company i in year t.

3. The Empirical Results and Analysis

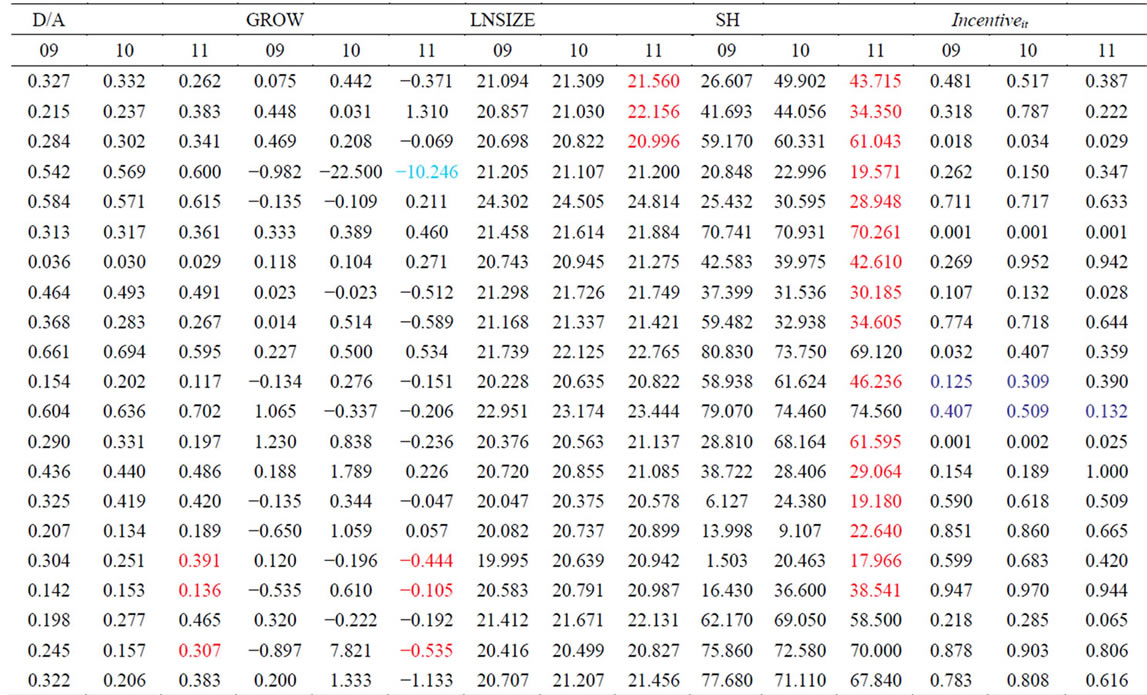

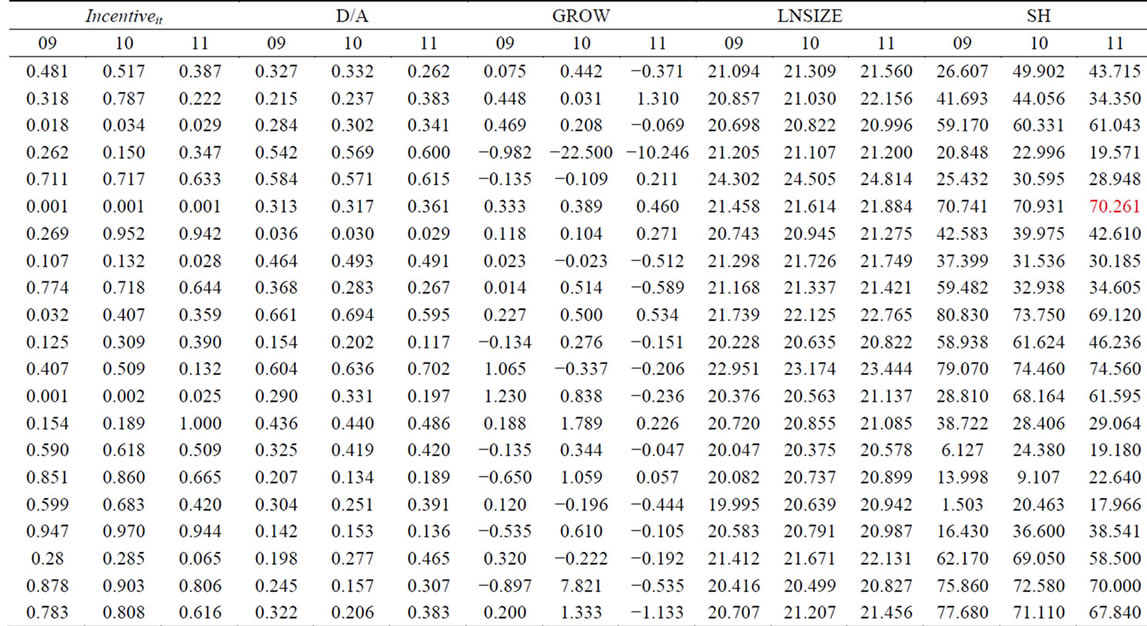

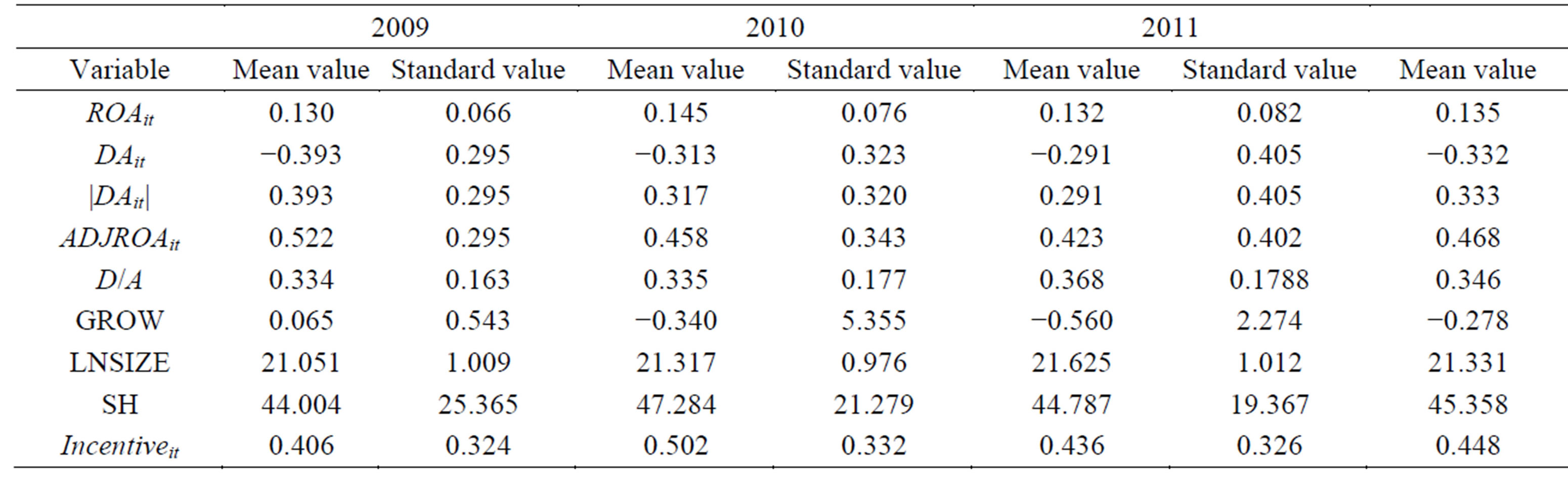

3.1. Descriptive Statistics

The descriptive statistics of the sample are showed at Table 1, from 2009 to 2011, the average of ROA of the 21 listed companies are 0.130, 0.145, 0.132. In general, the ROA has increased, but ADJROA has apparently declined. The average of Earning management (discretionary accruals) from 2009 to 2011 is 0.33, which shows that small and medium size companies listed on the SME board may have negative or positive earnings management behavior due to different needs. The top ten shareholders in proportion to the average is 45.3583, indicating that small and medium size companies listed on the SME board have a high degree of ownership concentration.

3.2. Regression Results and Analysis

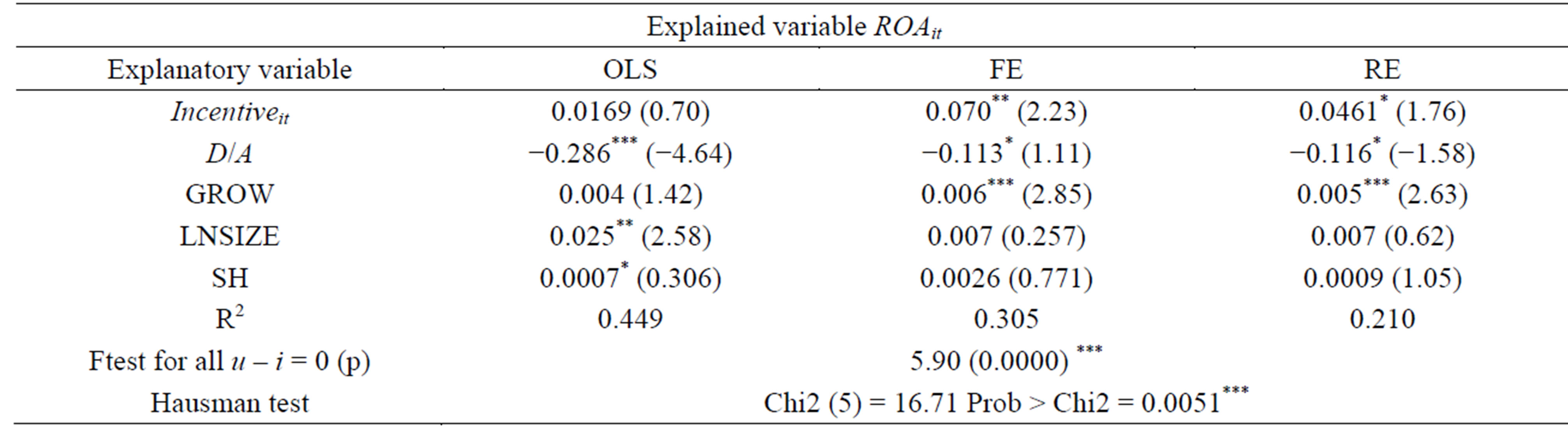

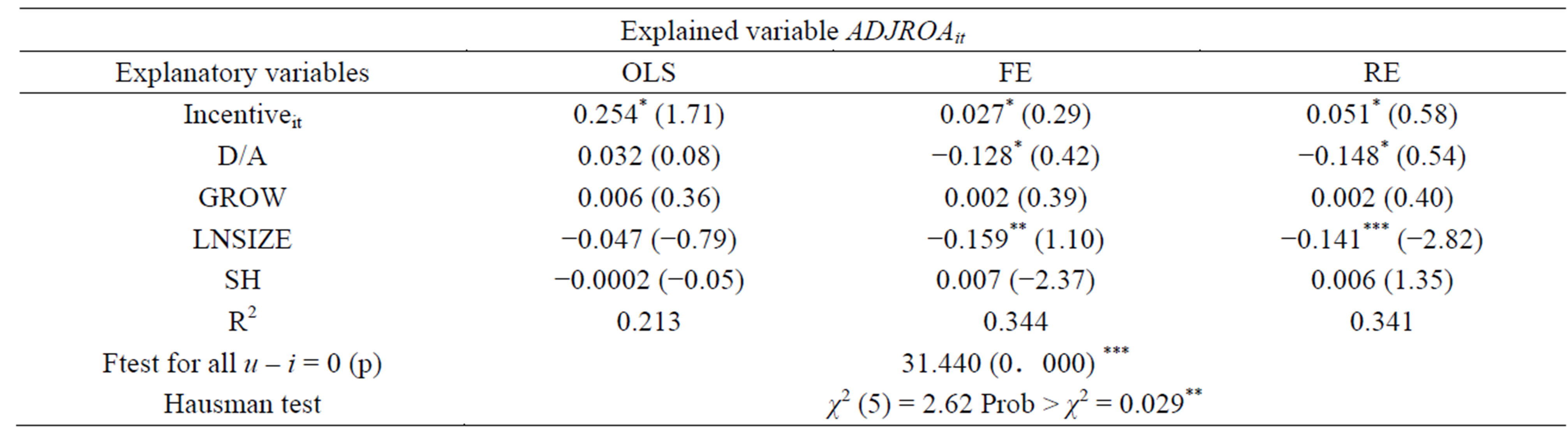

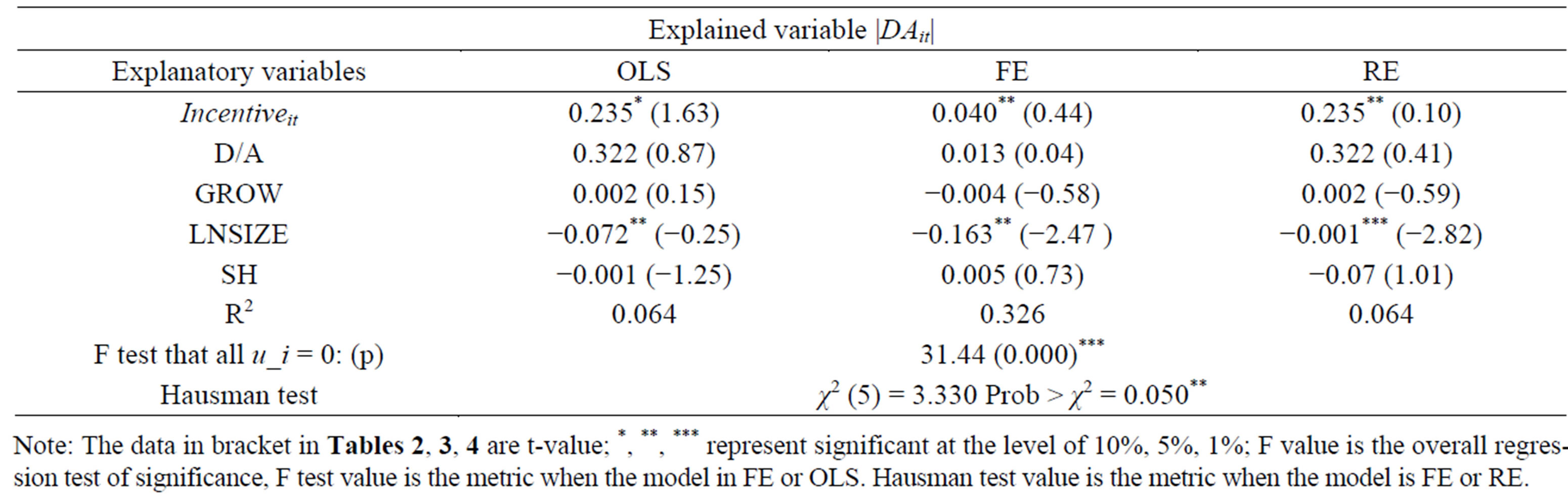

Table 2 shows the result of OLS regression model. Table 3 shows the result of FE regression model and Table 4 shows the result of RE model. We need to judge the setting form of the model, as we use panel data in this article. Compared OLS model and FE model, we choose FE model, as the F-test values are both significant at the 1% level. Compared FE model and RE model, we choose

Table 1. Descriptive statistic.

Table 2. The empirical result of the relation of ROAit and Incentiveit.

Table 3. The empirical result of relation of ADJROAit and Incentiveit.

Table 4. The empirical result of |DAit| and Incentiveit.

FE model, as the Hasman test values are both significant at the level of 1% and 5% level. Consolidated the result of F test and H test, we selected FE model in this paper.

Table 2 presents regression result with the use of Model (1). According to the statistic result of FE model, there is a positive correlation between incentive ratio and company performance. The correlation coefficient is 0.007 and is significant at the level 5%, which verifies hypotheses 1. Table 3 presents regression result with the use of Model (2). According to the statistic result of FE model, company performance modified by earning management has a positive correlation with earning management (DA), and is significant at the level of 5%, which means that equity is an important cause of earning management. During control variable, whether modified by earning management or not, the coefficient of debtto-assets ratio is negative and significant at the level 5%, which means that there is an obvious negative correlation between debt-to-assets and company performance; there is a positive correlation between company size and company performance, which shows that the larger the company is, the greater the probability of occurrence of earnings management is. In conclusion, there is a positive correlation between incentive ratio and company performance when the performance is modified. Equity incentive plays a role in improving the performance. The positive correlation between incentive ratio and company performance which strips away DA has decreased significantly. There is a positive correlation between DA and incentive ratio.

4. Conclusion and Suggestions

In order to test the real effect of equity incentive implemented in the small and medium-sized listed corporations, the research object of this paper was focused on Shenzhen Small & Medium Enterprise Board listed companies instead of Shanghai and Shenzhen stock listed corporations, and the effect of earning management produced by equity incentive was considered during the study of corporate performance. The analysis of regression results showed that:

1) In general, the equity incentive played a role in improving the performance of small and medium-sized listed corporations.

2) Equity incentive can lead the managers to practice earnings management for their own interests.

3) Earning management can partly weaken the effect of equity incentive.

We agree that equity incentive improves the performance of the small and medium-sized listed corporations. But at the same time, we must also be aware that equity incentive will lead to the phenomenon of earnings management in the implementation process and weaken the incentive effects of equity. In order to perfect the equity incentive mechanism in small and medium-sized board listed companies and let it play a positive role, this paper gives some advice:

1) Strengthen the index setting; establish an effective performance evaluation system. For index setting, the items that cannot be adjusted easily should be chosen for the sake of earning management. We can combine marketability index with non-traditional financial index (stock price, market value and so on) to assess the firm performance comprehensively.

2) Improve the board of supervisors system. Good and sound system of Board of Supervisors is the foundation of implementing equity incentive. Listed SMEs should set supervision to prevent the operators from the pursuit of shareholder value and their own interests which can have adverse impact on shareholders.

3) Perfect related rules and regulations of the equity incentive, and strengthen the supervision. On the one hand, competent authorities should strengthen the supervision of the disclosure of the listed companies and require the company to fully disclose the equity incentive information; on the other hand, strengthen the inspection of executive’s market manipulation behavior in the equity incentive plan, and enhance the intensity of civil damages and criminal penalties.

4) Improve the corporate governance structure, for example the system of company’s compensation committee.

REFERENCES

- M. Jensen and L. Senbet, “Resolving the Agency Problems of External Capital through Options,” Journal of Finance, Vol. 36, No. 3, 1981, pp. 629-691.

- H. Mehran, “Executive Compensation Structure, Ownership and Firm Performance,” Journal of Financial Economics, Vol. 38, No. 2, 1995, pp. 163-184. http://dx.doi.org/10.1016/0304-405X(94)00809-F

- C. P. Himmelberg, R. G. Hubbard and D. Palia, “Understanding the Determinants of Managerial Ownership and the Link between Ownership and Performance,” Journal of Financial Economics, Vol. 53, No. 2, 1999, pp. 353- 384.

- G. Wei, “Incentive for Management and Performance of Listed Companies,” Economic Research Journal, No. 3, 2000, pp. 32-40.

- Z. Q. Li, “Incentive Mechanism and Corporate Performance,” Accounting Research, No. 1, 2000, pp. 24-31.

- B. Gu and L. Y. Zhou, “Study on the Effect of the Implementation of Stock Incentives by Chinese Listed Companies,” Accounting Research, No. 2, 2007,pp. 2-12.

- G. L. Liu and J. S. Wang, “Positive Analysis Listed Companies: Equity Structures, Incentive Systems, and Preformances,” Economic Theory and Business Management, No. 5, 2000, pp. 40-45.

- Q. Cheng and T. D. Warfield, “Equity Incentives and Earnings Management,” Accounting Review, Vol. 80, No. 2, 2004, pp. 441-476. http://dx.doi.org/10.2308/accr.2005.80.2.441

- D. Bergstresser and T. Philippon, “CEO Incentives and Earnings Management,” Journal of Financial Economics, Vol. 80, No. 3, 2006, pp. 511-529. http://dx.doi.org/10.1016/j.jfineco.2004.10.011

Appendix: The Data from 2009 to 2011 in SME board.