Technology and Investment

Vol.1 No.4(2010), Article ID:3211,5 pages DOI:10.4236/ti.2010.14031

Innovation and Investment: Nasdaq-Listed Companies of Israel

Department of Economics, Fatih University, Istanbul, Turkey

E-mail: msakin2000@yahoo.com, msakin@fatih.edu.tr

Received July 9, 2010; revised July 8, 2010; accepted August 5, 2010

Keywords: Israel, Middle East, Technology, Nasdaq, venture capital, startups

Abstract

Abstract: Using a cross-section of Nasdaq-listed Israeli companies, we examine the impact of R & D spending on their market values and the ecosystem for start-ups in Israel. We find a very strong positive association between the two, learning that $1 million of spending in R & D associated with an increase of $5 million of market value. Among all countries outside the U.S., Israel is third after Canada and China in terms of the number of stocks registered on Nasdaq. Since 1981, sixty-one companies have registered, and their total R & D spending in 2009 reached $3.750 billion, which is approximately equal to the total R & D expenditure of Turkey. In the region, Middle Eastern and North African (MENA) countries cannot accomplish to register in Nasdaq. Israel's great success comes from the strong dedication and cooperation between private and public sectors in research and venture capital. Israel spends 4.7% of its GDP for R & D, which is equal to the total expenditure of MENA.

1. Introduction

Israel is a success story as a small, developing country because it has homegrown technologies. Among all countries outside the U.S., Israel is third after Canada and China in terms of the number of stocks registered on Nasdaq. In this paper, using a cross-section of Nasdaqlisted Israeli companies, we examine the impact of the companies’ R & D spending on their market values and the ecosystem for start-ups in Israel.

A large body of research examines how financial development influences economic growth and development. Levine [1] provides a survey of much of this literature, including both cross-sectional, time series, and panel data analyses. Minier [2] finds that opening a stock exchange, which one could argue is a nascent financial innovation, also increases economic growth. Greenwood and Jovanovic [3] sees causality going in both directions.1 Not only does financial development cause growth, but economic growth makes more sophisticated and costly financial services possible. Handa and Khan [5] find mixed results across countries via Granger-causality tests. For some countries in their sample, causality is bidirectional, whereas for others, causality goes only from economic growth to financial development. For no country in their sample do they find causality only going from financial development to economic growth. Marci and Sinha [6] also find differences across countries, although some of the countries they consider do exhibit one-way causality from finance to growth2. These findings support arguments

Source: Nasdaq (number of firms) [11]

Figure 1. Regional distribution of Nasdaq (North America excluded).

by Demetriades and Hussien [10] that economic growth could precede financial development in some countries but follow it in others.

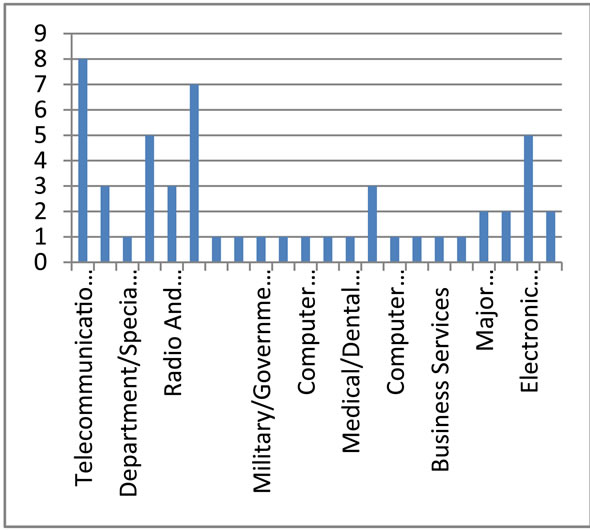

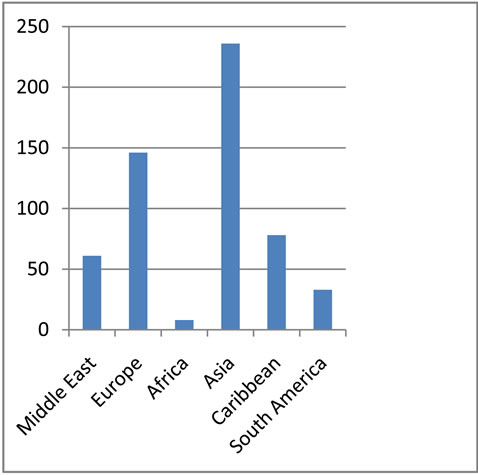

Nasdaq is the world’s leading stock market for hightech start-ups. There are several mega-companies (market value above $200 billion) registered, including Apple Inc., Bank of America Corporation, Exxon Mobil Corporation, Microsoft Corporation, and Procter & Gamble Company. Graph 1 demonstrates the distribution of firms in Nasdaq [11] in 2010 at the regional base. It is consistent with the wealth distribution on the planet and new emerging markets. With the rising power of China, that nation has become the leading region in the technologybased stock market. Europe follows Asia.

The rest of the regions are indeed supported by very few countries. The dominant countries are Israel in the Middle East, South Africa in Africa, Bermuda in the Caribbean, and Brazil in South America (Table 1). We conclude that there is greatly unequal technology distribution in the world.

Table 1. Number of companies registered in Nasdaq.

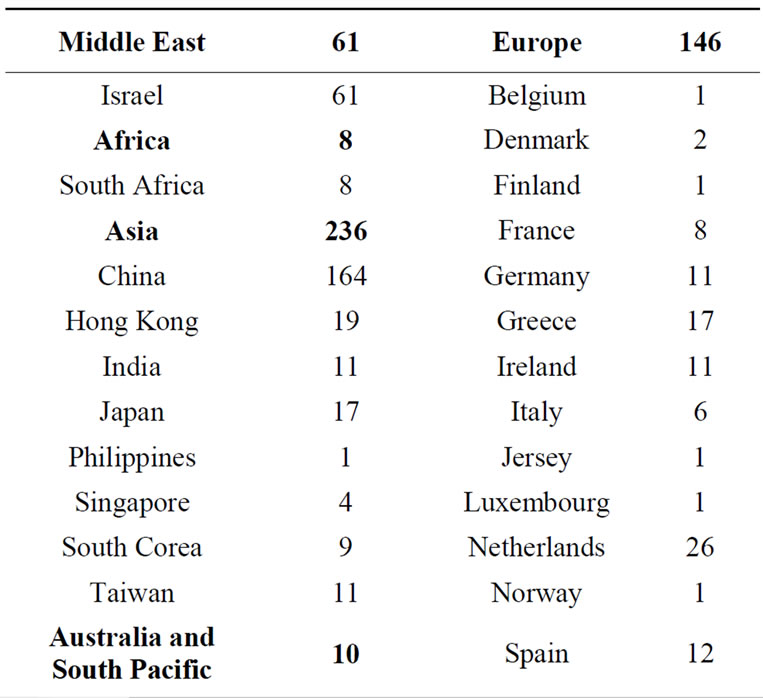

The sectoral base distribution of Israeli firms fits into the mainstream of Nasdaq; telecommunications equipment, computer communications equipment, computer software, and radio and television broadcasting and communications equipment are leading sectors (Figure 2).

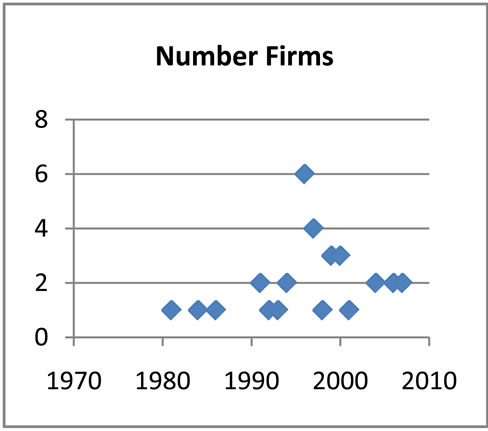

Since 1981, the registration of Israeli firms has increased. Every year, on average, two new Israeli firms register on Nasdaq (Figure 3).

Section 2 of this paper outlines the empirical methodology and data. Section 3 presents results and discussion of the ecosystem. Section 4 offers a concluding discussion.

2. Empirical Methodology

We consider a cross-section of sixty-one Israeli firms registered on Nasdaq [11] from 1981 to 2010. Our dependent variable is the measure of 2010 market value from Nasdaq. Our independent variables are total sales, gross profit, and R & D expenditure. Our independent

variable is taken from the companies’ 2009 income statements.

When we consider the Israeli companies, the total market value exceeds $67 billion, total sales are $27 billion, total gross profit is $12 billion, and total R & D is $3.75 billion. Among the Israeli firms, the market capital ranges from $46 billion to $1.9 million (Table 2). The average value is $1.1 billion, but the standard deviation is very high, $6 billion. This indicates that the size of the companies varies greatly.

In terms of total revenue, four companies brought in more than $1 billion in sales. Several companies had no sales. In terms of gross profit and especially in net profit, many companies are taking large losses. In our sample data, half of the firms have negative net profits. However, sales and profit are secondary issues at this moment, and the success of R & D plays the key role.

Firms are under pressure to meet short-term objectives when profits are the primary goal [12]. Innovation is incredibly difficult to translate into value in the marketplace [13]. The success of technology is not predictable. Therefore, focusing on short-term goals and aiming at long-term innovation is the innovator’s dilemma.

3. Results and the Ecosystem

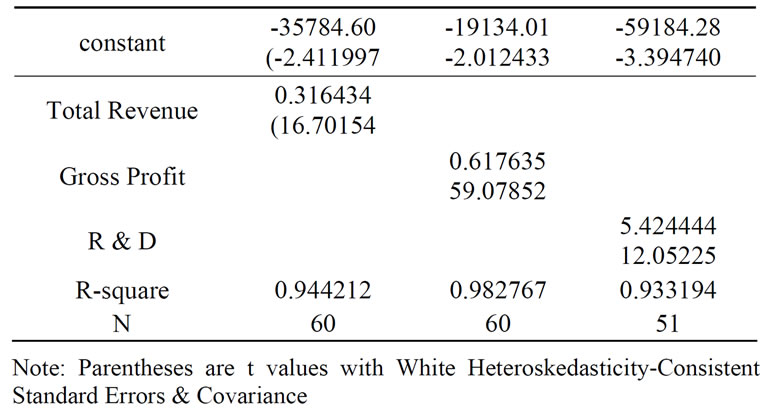

Table 3 presents our findings for the full sample of firms. Since total revenue, gross profit, and R & D are highly correlated with each other, we ran the regression separately. Ten firms on Nasdaq have not reported their R & D budget, so we omitted them from the third column. We did not regress net profit on the market value since it is negative at most of the start-up companies.

Table 2. Descriptive Statistics.

Table 3. Regression (dependent variable: market value-2010).

The coefficients on total revenue, gross profit, and R & D are positive, as we would expect. Their coefficients respectively are 0.31, 0.61 and 5.42. R & D is much more prominent in the valuation of stock on Nasdaq. An approximate $1 million increase in R & D results an increase in a $5 million market value, but the total sales increase by $310 thousand and gross profit by $617 thousand.

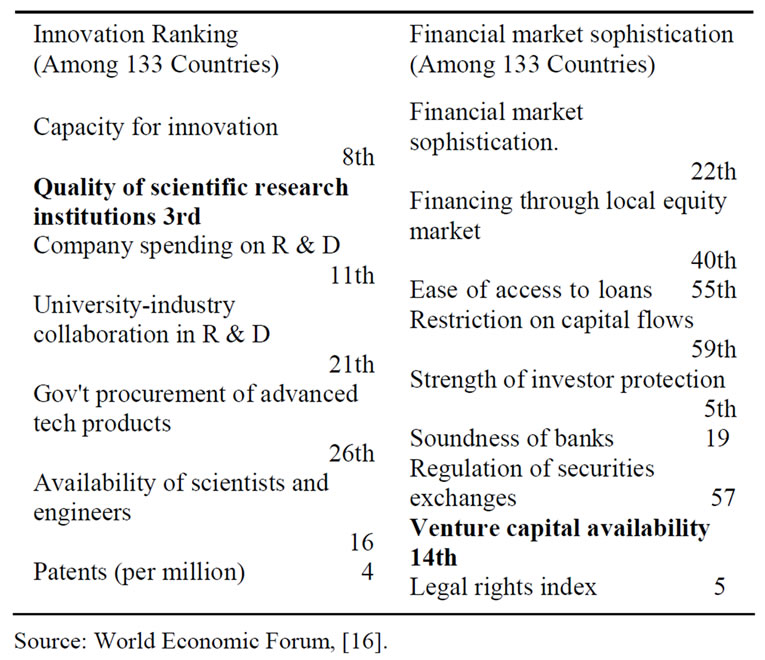

How did Israel succeed in listing so many companies on Nasdaq? How is the ecosystem in Israel able to promote investments in technology? Israel is a small, developing country, and the success of its firms is not coincidental. The ecosystem is supportive of the creation of high-tech start-up companies. This strong R & D comes from two main resources: innovation (especially strong research institutions) and finance (especially the availability of venture capital) (Figure 4 and Table 4).

Figure 4. The ecosystem in Israel.

Table 4. Innovation and financial ranking of Israel (133 countries) in 2009.

In terms of the quality of scientific research institutions, Israel is third in the world. In terms of availability of venture capital, it is fourteenth. In the old model, the developmental state was portrayed as having a strong relationship with the leading big firms, but in the new approach, growth lies with innovative firms [14]. The Grameen bank approach makes the level of lowest-low income countries into low income countries, but it will not be making countries competitive and adding high value. Opening a small business is not part of entrepreneurial capitalism. Higher income levels can be reached through a knowledge-based economy that deals with ideas, dreams and imaginations [15].

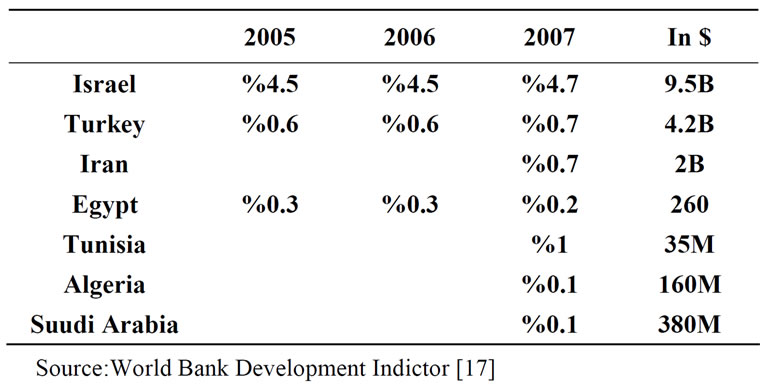

When we look the R & D expenditure in Middle Eastern Countries, Israel devotes 4.7% of its GDP to R & D activities. The other leading countries, Turkey and Iran, spend only 0.7% of their GDP on R & D. In terms of total expenditure, the sum of expenditure of R & D of Middle Eastern and North African countries is equal to that of Israel (table 5).

Israel has observed the importance of innovative economic activities regardless of their direct benefit to its military force [14]. If a new product or service were not invented, the military would not benefit anyway. The investment amount is not relevant to growth [18], nor does the long-run investment amount for entrepreneurial activities matter. Therefore, the normal banking sector will not finance such long-term and risky investments because it is under the constraint of short-term goals. Successful innovative firms in developing countries such as Israel, Ireland, and Taiwan are supported by the state. Israel created a government VC fund (Yozma) of $100 million that had two functions in the 1970s. The first was to invest $8 million in ten private limited-partnership venture funds, which would be 40% or less of the total capital, the rest to be provided by other private limited partners. Second, a separate fund of $20 million started operating at the same time. To get this financing, the funds’ managers had to secure investments and partnerships from at least one established foreign financial institution [14].

Table 5. The R & D expenditure in GDP in Middle East and North Africa in 2005-2006-2007.

One specific area of finance is venture capital. Kortum and Lerner [19] define venture capital as “equity or equity-linked investments in young, privately held companies, where the investor is a financial intermediary who is typically active as a director, an advisor, or even a manager of the firm.” These companies often take new innovations to market and could be important conduits to exploit and disseminate benefits from technological breakthroughs. Given this potential, the presence of venture capital could spur innovation because it could increase profitable opportunities from new discoveries. Kortum and Lerner [19] report that venture capital could have contributed to 8% of industrial innovation in the late 1980s, even though it measured less than 3% of R & D during this period. Tang and Chyi [20] find that venture capital contributed to productivity growth in Taiwan.

The mission of venture capital is unique. Risk-sharing has an important role in developing new ideas. Financing is a serious obstacle bound in economics. Many students graduate with new ideas, but the ecosystem does not allow them to try innovative ideas. If innovation were not risky, big firms would try it, and they would use their great advantages in finance, marketing, and distribution channels. This market failure occurs because the significant uncertainties of R & D lead private investors to allocate suboptimal amounts of finance to research [14]. Therefore, big companies rely on external R & D. Another important issue with VC is scaling. The choice behind VC is to choose a self-growth business model that depends on the customer’s payment versus scaling with VC cash injections. Thanks to VC, a business can grow very fast. Without VC, it may take generations for a company to grow.

Implementing brain power into the market requests a trial and error approach. If the risk is only on the shoulders of entrepreneurs, they will avoid risk. Our view is that the main investment strategies for developed and developing countries those that create an ecosystem that thrives on innovative start-up companies. The main success (superiority) of Israel is not due to its military power or its natural resources, but to the existence of venture capitalism, which allows for trial and error.

However, too many good ideas fade away before coming to market since there are no opportunities for trial and error in developing countries. This is why entrepreneurial capitalism does not work in developing countries, and why we end up with severe income inequality. Poor people cannot find the opportunities to test their ideas, and rich people preserve their wealth. If failure is not tolerable, nobody will ever try anything.

4. Conclusions

In this research paper, we consider investment and technology in Israel. In the regional category, as a part of the Middle East and Northern Africa, no single country has ever managed to register companies on Nasdaq except Israel.

There are 61 Israeli stocks registered on Nasdaq. When we examine these companies, the total market value exceeds $67 billion, total sales are $27 billion, total gross profit is $12 billion, and total R & D is $3.75 billion. Half of the companies have a negative net profit due to their large R & D expenditures.

Both total revenue and gross profit are strongly correlated with market value. However, the coefficient of R & D and t-value are far stronger than the two other values. An approximate $1 million increase in R & D results in a $5 million market value.

Companies are succeeding in registering on Nasdaq thanks to the ecosystem of Israel. The economic and technology environment in Israel is very pleasant for start-ups. We find that high-tech start-ups are associated with subsequent venture capital and research opportunities. To the extent that venture capital promotes economic growth, several strong implications arise. For one, initial shocks to growth can have persistent effects. The initial effect is then augmented through the development of better capital markets. On the other hand, failure to raise growth rates could retard the very financial tools that promote further growth. In such cases, perhaps external assistance is necessary to develop venture capital markets in poorer countries, and thus questions would arise as to how such assistance could best be tailored. In Israel, the state has founded the first venture capital company (Yozma). Currently, Israel is third in the world in terms of the quality of its scientific research institutions and fourteenth in the world in terms of the availablity of venture capital.

A strategy that developing countries follow is to support the R & D of companies through fiscal policy (i.e. tax holidays) but often they neglect to support private funding ventures. The source of growth is not the reserach, but putting the research into practice. The majority of company failures does not come from technology impotency, but from marketing operations. Therefore, in developing countries, advanced technological innovations created by top national engineering school do not bring any economic benefits. Finding the right niche needs a trial anbd error approach rather than scientific prescription.

5. References

[1] R. Levine, “Finance and Growth: Theory and Evidence,” In: P. Aghion, S. N. Durlauf, Ed., Handbook of Economic Growth, Elsevier, Amersterdam, Vol. 1A, 2006, pp. 865-934.

[2] J. Minier, “Opening a Stock Exchange,” Journal of Development Economics,Vol. 90, No. 1, 2009, pp. 135- 143.

[3] J. Greenwood and B. Jovanovic, “Financial Development, Growth, and the Distribution of Income,”The Journal of Political Economy, Vol. 98, No. 5, 1990, pp. 1076-1107.

[4] J. Handa, “Monetary Economics,” Routledge, London, 2000.

[5] J. Handa and R. Khan, “Financial Development and Economic Growth: A Symbiotic Relationship,” Applied Financial Economics, Vol. 18, 2008, pp. 1033-1049.

[6] M. Joseph and D. Sinha, “Financial Development and Economic Growth: the Case for Eight Asian Countries,” Economia Internazionale, Vol. 55, 2001, pp. 219-237.

[7] K. Neusser and M. Kugler, “Manufacturing Growth and Financial Development: Evidence from OECD Countries,” Review of Economics and Statistics, Vol. 80, 1998, pp. 636-646.

[8] P. Rousseau and P. Wachtel, “Financial Intermediation and Economic Performance: Historical Evidence from Five Industrial Countries,” Journal of Money, Credit, and Banking, Vol. 30, No. 4, 1998, pp. 657-678.

[9] Zhenhui Xu, “Financial Development, Investment, and Growth,” Economic Inquiry, Vol. 38, No. 4, 2000, pp. 331-344.

[10] P. O. Demetriades and K. Hussein “Does Financial Development Cause Economic Growth: Time Series Evidence from 16 Countries,” Journal of Development Economics, Vol. 51, No. 2, 1996, pp. 387-411.

[11] “Nasdaq Statistics,” 2010. http://www.nasdaq.com

[12] C. Christensen. “Innovator’s Dilemma,” Harper Business, New York, 1997.

[13] M. Desai, P. Gompers and J. Lerner, “Institutions, Capital Constraintsand Entrepreneurial Firm Dynamics: Evidence from Europe,”NBER Working Paper, No. 10165, 2003.

[14] D. Berlitz, “Political Choice and Strategies for Growth in Israel, Taiwan, and Ireland,” Yale Press, June 2009.

[15] T. Alvine and T. Heidi, “Revolutionary Wealth: How It will Be Created and How It will Change Our Lives,” Broadway Business, 2007.

[16] World Economic Forum, “Competitiveness Report,” 2010. http://www.wef.org

[17] C. D. Rom, “World Bank Development Index,” World Bank, 2010.

[18] W. Easterly, “The Elusive Quest for Growth: Economists’ Adventures and Misadventures in the Tropics,” MIT Press, Cambridge, 2002.

[19] S. S. Kortum and J. Lerner, “Assessing the Contribution of Venture Capital to Innovation,” RAND Journal of Economics, Vol. 31, No. 4, 2000, pp. 674-692.

NOTES

1Handa [4] also claims two-way causality.

2However, Neusser and Kugler [7], Rousseau and Wachtel [8], and Xu [9] find stronger evidence that causality runs from financial development to economic growth.