Applied Mathematics

Vol.07 No.08(2016), Article ID:66696,25 pages

10.4236/am.2016.78071

Minimization of the Expected Total Net Loss in a Stationary Multistate Flow Network System

Kristina Skutlaberg, Bent Natvig

Department of Mathematics, University of Oslo, Oslo, Norway

Copyright © 2016 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 15 March 2016; accepted 21 May 2016; published 24 May 2016

ABSTRACT

In the present paper, a three-component, stationary, multistate flow network system is studied. Detailed costs and incomes are specified. The aim is to minimize the expected total net loss with respect to the expected times the components spend in each state. This represents a novelty in that we connect the expected component times spent in each state to the minimal total net loss of the system, without first finding the component importance. This is of interest in the design phase where one may tune the components to minimize the expected total net loss. Due to the complex nature of the problem, we first study a simplified version. There the expected times spent in each state are assumed equal for each component. Then a modified version of the full model is presented. The optimization in this model is completed in two steps. First the optimization is carried out for a set of pre-chosen fixed expected life cycle lengths. Then the overall minimum is identified by varying these expectations. Both the simplified and the modified optimization problems are nonlinear. The setup used in this article is such that it can easily be modified to represent other flow network systems and cost functions. The challenge lies in the optimization of real life systems.

Keywords:

Reliability, Nonlinear Optimization, Multistate Flow Network

1. Introduction

A series of challenges concerning reliability engineering is presented in [1] . Some of these challenges are connected to the representation and modeling of complex systems, such as multistate systems, and their operational tasks, for instance maintenance optimization.

Over the past decades various measures of component importance have been studied. The use of such measures permits the reliability analyst to prioritize the system components in order to allocate resources efficiently. In [2] a new theory for measures of importance of system components is presented. Generalizations of the Birnbaum, Barlow-Proschan and Natvig measures (see [3] - [5] respectively) from the binary to the multistate case, both for unrepairable and repairable systems are covered. A numerical study of the above mentioned multistate measures of component importance is also covered in [2] . Loss of utility due to the system leaving the different sets of better states are introduced in that study. However, no detailed costs or incomes are specified. Recently, work has been done to also include costs in the determination of component importance for binary systems. In [6] and [7] the Birnbaum measure is extended to also include both failure induced and maintenance costs, while [8] and [9] introduce other cost-effective importance measures.

In maintenance optimization studies one is often interested in choosing a maintenance plan which minimizes life cycle costs, maximizes net present value or maximizes system reliability for a given system. See for instance [10] - [14] for some recent work on these subjects.

In this article we will look at one particular type of maintenance action, the complete repair. As the components reach the complete failure state, they are repaired to what we will denote the perfect functioning state. The aim is to include both costs and incomes in the study of a repairable multistate flow network system. To achieve this, we will define incomes and cost functions for the purpose of minimizing the expected total net loss over a time period with respect to the expected component times in the different states. This represents a novelty in that we connect the expected component times spent in each state to the minimal total net loss of the system, without first finding the component importances.

It would of course have been nice to optimize with respect to probability distributions instead of expectations, but this is not trivial even for a simple three-component system. However, the optimization problem considered in this article is particularly interesting in a design or re-design phase, where one may tune the components in such a way that the expected total net loss is minimized.

With the optimization problem considered in this article we are facing complex dependencies. We therefore study both a simplified version and a modified version of the optimization problem. In the simplified version we see that the optimal expected time spent in each state increases with increasing operational time for all three cost function types considered. However, the extent of the increase differs with the different basic cost function types. Due to basic investment costs this is not a trivial result. In the modified version of the optimization problem we only find approximate solutions. We observe that the different types of cost functions influence the end results significantly. For instance one of the functioning states is redundant for two of the three cost function types when the cost function parameter is increasing. For both problems we see that the minimum expected total net loss is increasing with increasing component cost per repair.

The rest of the article is organized as follows: Section 2 introduces the basic model, the three different types of cost functions and the three-component system of interest. The simplified version of the optimization problem with results is presented in Section 4. Section 5 presents the modified optimization problem with results, and concluding remarks are found in Section 6.

2. Basic Model

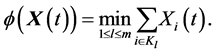

Let S be the set of possible system states, and , the set of possible component states. Throughout this article we will assume that

, the set of possible component states. Throughout this article we will assume that . Since we are regarding the system as a flow network, the system state is the amount of flow that can be transported through the network. In the same way, the component state is the amount of flow that can be transported through each component. Let

. Since we are regarding the system as a flow network, the system state is the amount of flow that can be transported through the network. In the same way, the component state is the amount of flow that can be transported through each component. Let  be the vector of component states at time t. That is

be the vector of component states at time t. That is  if component

if component  is in state

is in state  at time t.

at time t.

A binary minimal cut set is a minimal set of components which upon failure will break the connection between the endpoints of the network. Let ,

,  , be the binary minimal cut sets of the network. Then, by applying the max-flow-min-cut theorem (see [15] ), we get that the system state is given by

, be the binary minimal cut sets of the network. Then, by applying the max-flow-min-cut theorem (see [15] ), we get that the system state is given by

(1)

(1)

Thus, the system state equals the smallest total flow through the minimal cut sets of the system. Assume now that no components are in series with the rest of the system. Then there must be at least two components in every minimal cut set. If all components are in the perfect functioning state, M, the system state will be at least 2M, and therefore we must have that . Thus, the assumption of equality between the set of system states and the set of component states,

. Thus, the assumption of equality between the set of system states and the set of component states,  , implies that at least one component is in series with the rest of the system. For this reason, we will in Sections 4 and 5 focus on the three component system given in Figure 1.

, implies that at least one component is in series with the rest of the system. For this reason, we will in Sections 4 and 5 focus on the three component system given in Figure 1.

Assume that the components deteriorate by going through all states in , from the perfect functioning state M to the complete failure state 0, before being repaired back to M.

, from the perfect functioning state M to the complete failure state 0, before being repaired back to M.

Let  be the expected time component

be the expected time component  spends in state

spends in state , and let the vector of positive expected component times in each state be denoted

, and let the vector of positive expected component times in each state be denoted

Assume for

For any given functioning state

expensive it should be. Therefore, we assume that the cost function

Type 1:

Type 2:

Type 3:

where

In this article we only consider perfect repairs. Let

Let

This means that the income decreases, starting from the perfect functioning state, from one state to the next until the system reaches the complete failure state, where the income is non-positive. Thus, there is a loss per time unit that the system spends in the complete failure state. Such negative income might correspond to interest rate expenses connected to system building investments. The presence of such costs will increase the incentive for repairing the failed components.

Figure 1. A system with three components.

The contribution from the i-th component to the total cost connected to the operation of the system in the time interval

Let

To find the total income we integrate the income at time t over the time period

Note that a negative net loss equals a positive net gain. By taking the expectation we find that the corresponding objective function is

In the remaining parts of this article, we will focus on stationary multistate systems. Component availabilities are now given by

for

Let

The expected number of repairs of component i is now given by

which is determined explicitly by

Thus, the optimization problem that we will consider is to minimize (5) with respect to

3. The Three-Component System

For simplicity, the system we will focus on, is the multistate flow network system consisting of three com- ponents where component 1 is in series with the parallel structure of components 2 and 3 (see Figure 1). We will assume that all components and the system are in one of three states, that is we assume

The structure function of the module consisting of components 2 and 3 in parallel is

since

4. The Simplified Problem

Because of the complex nature of the problem presented in Section 2 we first study a simplified version of the problem. Assume the expected times spent in each state to be equal for each component. That is, we assume

As a consequence, the total income, given by the last term in the objective function (5), is constant. Let

and the corresponding optimization problem is

This is a box constrained nonlinear optimization problem. Note that the sum

4.1. Analysis of Convexity

Let

where

The objective function is convex if and only if the Hessian matrix is positive semidefinite (see for instance [16] ). In our case, the Hessian matrix is a diagonal matrix with

4.2. The Objective Functions

4.2.1. Type 1 Cost Functions

Let the cost functions be given by

and the diagonal elements of the Hessian matrix are, for

Thus, in this case, the objective function is convex.

Differentiating

For

We see from (12) that the optimal

4.2.2. Type 2 Cost Functions

Let for

Table 1. Cost functions of type 1.

Figure 2. Optimal

The diagonal elements, (10), in the Hessian matrix are in this case given by

for

This is a 5-th order polynomial in

Differentiating (13) with respect to

The solutions to

which can be solved numerically. Every third degree polynomial has at least one real root, and since

4.2.3. Type 3 Cost Functions

The cost functions are in this section given by

The diagonal elements of the Hessian matrix are, for all

Hence, (15) is convex and therefore it has a global minimum value.

4.3. Results

In this section the incomes per time unit are chosen to be

The assumption,

4.3.1. Effect of T

Figure 2 shows the development of the optimal expected times spent in each state (the optimal

In Figure 2 we see that

For cost functions of type 1 we see some increase in the optimal expected

From Figure 3 we see that the minimum expected net loss as function of the operational time T behaves differently with different types of cost functions. For cost functions of type 1 and 2, the minimum expected net loss is decreasing with increasing operational time T. For type 3 the minimum expected net loss is increasing at first before it starts to decrease. The minimum expected net loss is positive for

4.3.2. Effect of C1

For cost functions of type 1, we see from Table 1 that the theoretical results given by (12) are equal to the computational results. For constant

in the minimum expected net loss. The minimum expected net loss is dependent on the values of

For cost functions of type 2 we found in Section 2.2.2 that the optimal

Figure 3. Minimum expected net loss as function of the operational time T for cost functions of type

polynomial given in (14). For the parameter values in Table 2 this polynomial has one positive root, which equals the results obtained from the optimization routine. We see an increase in the optimal

Figure 4 shows the development of the minimum expected net loss as the repair costs,

From Figure 5 we see that for cost functions of type 2 it is optimal to spend longer time in each state than it is for the other two cost functions. The optimal expected time spent in each state for component 1 is increasing with increasing repair costs

4.3.3. Effect of c1

Figure 6 shows the minimum expected net loss as a function of the cost function parameter

The corresponding optimal

Figure 4. Minimum expected net loss as function of

Figure 5. Optimal

Figure 6. Minimum expected net loss as function of

Figure 7. Optimal

Table 2. Cost functions of type 2.

5. Modifications of the Full Model Optimization Problem

The original problem, represented by the objective function (5), turned out to be quite complex even though we only considered a simple three-component system with three possible system and component states. Thus, the optimization of this problem was not straightforward. In order to overcome difficulties with starting value sensitive optimization results, we reformulated the original optimization problem in order to find an approximate solution.

Let

where

Step 1: Choose values for

Step 2: Identify the overall minimum from the optimization results from step 1. The corresponding

Optimization problems as the ones in step 1 may be solved using the augmented Lagrange multiplier method, for instance using the SOLNP algorithm as described in [17] . This algorithm is implemented in the Rsolnp package, see [18] , in R.

Note that minimizing the expected total net loss is equivalent to maximizing the expected total net gain, and that a negative expected total net loss is a positive expected net gain. Since we are using minimization algorithms instead of maximization algorithms, the focus has been on minimizing the total net loss rather than maximizing the total net gain.

5.1. Results

In this section lower bounds on

As in the previous section, the incomes per time unit when the system is in state

Component 2 and component 3 are in parallel. Their roles in the system are therefore interchangeable. Since we assume that the components’ cost functions are of the same type and that we are varying one parameter at a time, we are in the following only varying the parameters connected to component 1 and component 2. When the parameters of component 1 are varied the results for components 2 and 3 are identical. Hence, results for component 3 are then omitted.

5.1.1. Effect of T

Figure 8 shows the minimum expected net loss as a function of T. We see that with cost functions of type 1 and 2, the minimum expected net loss is negative and decreasing for the chosen values of T. This means that for these cost functions we have an increasing maximum expected net gain. The loss is smaller for cost functions of type 2 than it is for the other two types of cost functions. For cost functions of type 3 the minimum expected net loss is positive for small T.

The corresponding optimal

5.1.2. Effect of an Increasing Cost Per Repair Ci, i = 1, 2

For this, and the following sections, the operational time is set to

The corresponding optimal

Figure 8. Minimum expected net loss as function of T for cost functions of type

Figure 9. Optimal

Figure 10. Minimum expected net loss as function of

Figure 11. Minimum expected net loss as function of

Figure 12. Optimal

Figure 13. Optimal

component 1 in the perfect functioning state for as long as possible. Hence, we see a large

As the repair costs of component 2,

Since component 1 is critical to the functioning of the system we see from Figure 12 an increase in

5.1.3. Effect of an Increasing

As the cost function parameter

Figure 14. Minimum expected net loss as function of

Figure 15. Minimum expected net loss as function of

functions. In state

The effect of an increasing

An increasing

As

increasing, it becomes less desiring to maintain this level, and we see a decrease. The decrease is faster in

Figure 16. Minimum expected net loss as function of

Figure 17. Optimal

Figure 18. Optimal

Figure 19. Optimal

5.1.4. Effect of an Increasing

An increasing

Figures 23-25 show the optimal expected times spent in each state for each component as the cost function parameter,

For every cost function type we see from Figure 23, for component 2, an increase in

repair times of component 2 low increases, it is optimal to spend more expected time repairing this component. At the same time, it will be more important to keep the expected repair times of component 3 low.

We see from Figure 24 that the optimal

high (approximately 15) for

The optimal

Figure 20. Minimum expected net loss as function of

Figure 21. Minimum expected net loss as function of

Figure 22. Minimum expected net loss as function of

Figure 23. Optimal

Figure 24. Optimal

Figure 25. Optimal

has increasing

6. Concluding Remarks

In the present paper we have been minimizing the expected total net loss over a time period

optimization was done in two steps (see Section 5). This method found an approximate solution. The indication of lack of constructive conclusions is mainly due to that we are facing complex dependencies.

The variables

For the simplified problem we were able to find expressions for the optimal

In both the simplified problem and the modified full model, the minimum expected net loss was increasing with increasing

As the operational time T increased we saw a decrease in the minimum expected net loss in the modified full model for all three cost functions (as seen in Figure 8). This is in contrast to the results with the simplified model when the exponential cost functions were used. Then, the minimum expected net loss increased at first, before it started to decrease (as seen in Figure 3).

For every cost function parameter,

zero. Hence, it was, for cost functions of type 2, optimal to spend as little time as possible in state 1 independent

of the values of the parameters. With cost functions of type 1 we observed the same, except from when

stayed constant and close to 0. Thus, it seems like the functioning component state 1 is in a way redundant for cost functions of type 1 and 2. This was not the case with cost functions of type 3.

The general objective function (5) can quite easily be modified to represent the expected net loss of other network flow systems, and to include other types of cost functions. However, with larger systems, with more components and possibly more component states, the optimization problem quickly becomes large. Hence, the real challenge lies in the optimization of real life systems.

Acknowledgements

The authors thank Professor Geir Dahl for the idea on how to modify the full optimization problem and Ph.D Olav Skutlaberg for valuable feedback throughout the process.

Cite this paper

Kristina Skutlaberg,Bent Natvig, (2016) Minimization of the Expected Total Net Loss in a Stationary Multistate Flow Network System. Applied Mathematics,07,793-817. doi: 10.4236/am.2016.78071

References

- 1. Zio, E. (2009) Reliability Engineering: Old Problems and New Challenges. Reliability Engineering and System Safety, 94, 125-141.

http://dx.doi.org/10.1016/j.ress.2008.06.002 - 2. Natvig, B. (2011) Multistate Systems Reliability Theory with Applications. Wiley, New York.

http://dx.doi.org/10.1002/9780470977088 - 3. Birnbaum, Z.W. (1969) On the Importance of Different Components in a Multicomponent System. In: Krishnaiah, P.R., Ed., Multivariate Analysis—II, Academic Press, Waltham, 581-592.

- 4. Barlow, R.E. and Proschan. F. (1975) Importance of System Components and Fault Tree Events. Stochastic Processes and their Applications, 3, 153-173.

http://dx.doi.org/10.1016/0304-4149(75)90013-7 - 5. Natvig, B. (1979) A Suggestion of a New Measure of Importance of System Components. Stochastic Processes and their Applications, 9, 319-330.

http://dx.doi.org/10.1016/0304-4149(79)90053-x - 6. Gao, X., Barabady, J. and Markeset, T. (2010) Criticality Analysis of a Production Facility Using Cost Importance Measures. International Journal of Systems Assurance Engineering and Management, 1, 17-23.

http://dx.doi.org/10.1007/s13198-010-0002-0 - 7. Wu, S. and Coolen, F. (2013) A Cost-Based Importance Measure for System Components: An Extension of the Birnbaum Importance. European Journal of Operational Research, 225, 189-195.

http://dx.doi.org/10.1016/j.ejor.2012.09.034 - 8. Xu, M., Zhao, W. and Yang, X. (2011) Cost-Related Importance Measure. Proceedings IEEE International Conference on Information and Automation (ICIA), Shenzhen, 6-8 June 2011, 644-649.

- 9. Gupta, S., Bhattacharya, J., Barabady, J. and Kumar, U. (2013) Cost-Effective Importance Measure: A New Approach for Resource Prioritization in a Production Plant. International Journal of Quality and Reliability Management, 30, 379-386.

http://dx.doi.org/10.1108/02656711311308376 - 10. Nourelfath, M., Chatelet, E. and Nahas, N. (2012) Joint Redundancy and Imperfect Preventive Maintenance Optimization For Series—Parallel Multi-State Degraded Systems. Reliability Engineering and System Safety, 103, 51-60.

http://dx.doi.org/10.1016/j.ress.2012.03.004 - 11. Gomes, W.J.S., Beck, A.T. and Haukaas, T. (2013) Optimal Inspection Planning for Onshore Pipelines Subject to External Corrosion. Reliability Engineering and System Safety, 118, 18-27.

http://dx.doi.org/10.1016/j.ress.2013.04.011 - 12. Marais, K.B. (2013) Value Maximizing Maintenance Policies Under General Repair. Reliability Engineering and System Safety, 119, 76-87.

http://dx.doi.org/10.1016/j.ress.2013.05.015 - 13. Doostparast, M., Kolahan, F. and Doostparast, M. (2014) A Reliability-Based Approach to Optimize Preventive Maintenance Scheduling for Coherent Systems. Reliability Engineering and System Safety, 126, 98-106.

http://dx.doi.org/10.1016/j.ress.2014.01.010 - 14. Mendes, A.A., Coit, D.W. and Ribeiro, J.L.D. (2014) Establishment of the Optimal Time Interval between Periodic Inspections for Redundant Systems. Establishment of the Optimal Time Interval between Periodic Inspections for Redundant Systems, 131, 148-165.

- 15. Ford, L.R. and Fulkerson, D.R. (1956) Maximal Flow through a Network. Canadian Journal of Mathematics, 8, 399-404.

http://dx.doi.org/10.4153/cjm-1956-045-5 - 16. Magnus, J.R. and Neudecker, N. (1999) Matrix Differential Calculus with Applications in Statistics and Economics. Wiley, New York.

- 17. Ye, Y. (1987) Interior Algorithms for Linear, Quadratic, and Linearly Constrained Non-Linear Programming. PhD Thesis, Department of ESS, Stanford University, Stanford.

- 18. Ghalanos, A. and Theussl, S. (2012) Rsolnp: General Non-linear Optimization Using Augmented Lagrange Multiplier Method. R Package Version 1.12.