Applied Mathematics

Vol.5 No.4(2014), Article ID:43567,13 pages DOI:10.4236/am.2014.54058

Transfer of Global Measures of Dependence into Cumulative Local

Boyan Dimitrov1, Sahib Esa2, Nikolai Kolev3, Georgios Pitselis4

1Kettering University, Flint, USA

2Salahaddin University, Erbil, Iraq

3University of Sao Paulo, Sao Paulo, Brazil

4University of Piraeus, Piraeus, Greece

Email: bdimitro@kettering.edu, sahib_esa@yahoo.com, nkolev@ime.usp.br, pitselis@unipi.gr

Copyright © 2014 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 27 September 2013; revised 27 October 2013; accepted 5 November 2013

ABSTRACT

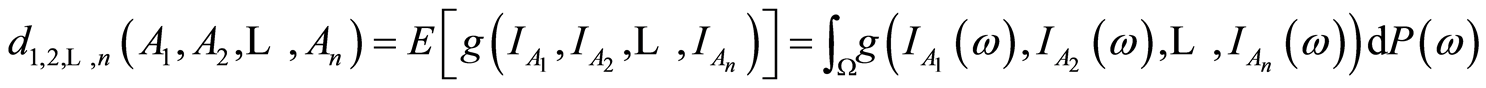

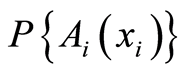

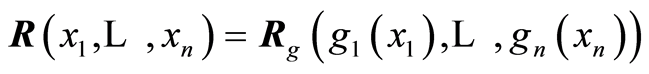

We explore an idea of transferring some classic measures of global dependence between random variables  into cumulative measures of dependence relative at any point

into cumulative measures of dependence relative at any point  in the sample space. It allows studying the behavior of these measures throughout the sample space, and better understanding and use of dependence. Some examples on popular copula distributions are also provided.

in the sample space. It allows studying the behavior of these measures throughout the sample space, and better understanding and use of dependence. Some examples on popular copula distributions are also provided.

Keywords: Analysis of Variance; Copula; Correlation; Covariance; Multivariate Analysis; Measures of Dependence; Probability Modeling

1. Introduction

The ideas of transferring integral measure of dependence into local measures are probably not new. We got the clue from the works of [1] -[3] . Cooke raised the idea of the use of the indicator random variables (r.v.’s) in regression models to consider the regression coefficients as measures of local dependence. Genest [4] gave some more motivations on the need of transfer of overall (integrated) measures to the cumulative local functions. Dimitrov [2] revived some old measures of dependence between random events proposed by Obreshkov [5] , and noticed their convenience in the use of the studies of local dependence between r.v.s. [6] is an attempt looking at the cumulative dependence from the point of view of the so called Sibuya function, which is also used in studies of dependence.

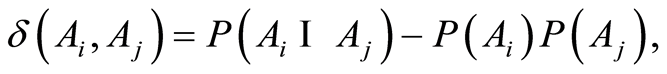

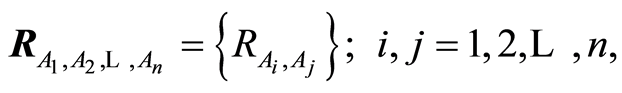

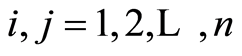

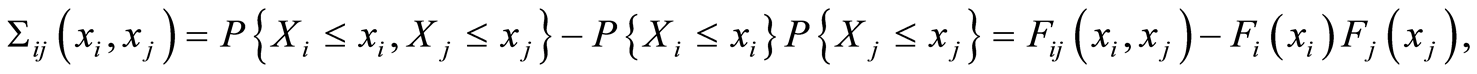

We propose here a review of the classic statistical analysis approach, where the procedures are more or less routine to be used in the analysis of local dependence. The manuscript is built in the following way: Section 2 introduces the idea of the transfer in detail. Section 3 considers the covariance and correlation matrices between indicator functions for a finite family of random events. At this point it is worth noticing that the expressions for the entries  of the covariance matrix for identificators of random events

of the covariance matrix for identificators of random events  coincide with the quantity

coincide with the quantity  introduced as connection between the events

introduced as connection between the events  and

and  Similarly, the entries

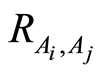

Similarly, the entries  of the correlation matrix coincide with the expression called in [5] as correlation coefficient between the events

of the correlation matrix coincide with the expression called in [5] as correlation coefficient between the events  and

and . Obreshkov approach is using different categories. Following these ideas, [2] exposes a relatively complete analysis of the two-dimensional dependence between random events, and establishes some more detailed properties of the Obreshkov measures of dependence. Similar expressions for the correlation between random events, are used in [4] . They call it correlation coefficient associated with pairs of dichotomous random variables. Long before [7] , p.311 uses correlation coefficient between indicator functions of two events, but does not elaborate any details.

. Obreshkov approach is using different categories. Following these ideas, [2] exposes a relatively complete analysis of the two-dimensional dependence between random events, and establishes some more detailed properties of the Obreshkov measures of dependence. Similar expressions for the correlation between random events, are used in [4] . They call it correlation coefficient associated with pairs of dichotomous random variables. Long before [7] , p.311 uses correlation coefficient between indicator functions of two events, but does not elaborate any details.

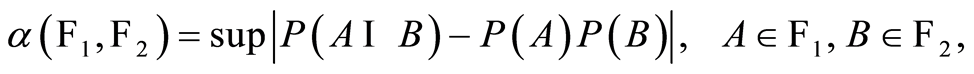

Let  and

and  be two

be two  -sub-algebras of

-sub-algebras of . The survey of [3] proposes the measure

. The survey of [3] proposes the measure

(1.1)

(1.1)

to be used as magnitude of dependence between  and

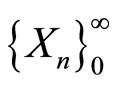

and . This measure is used for studying properties of a sequence

. This measure is used for studying properties of a sequence  of r.v.’s, when choosing

of r.v.’s, when choosing  and

and  generated by two remote members—

generated by two remote members— and

and  of the sequence. The

of the sequence. The  is called mixing. The similarity with the Obreshkov’s connection measure between events is obvious. However, this measure of dependence

is called mixing. The similarity with the Obreshkov’s connection measure between events is obvious. However, this measure of dependence  is a global measure limited within the interval

is a global measure limited within the interval , and does not have clear meaning of magnitude. Some of its properties are summarized in the statements of Section 3. Section 4 extends these results as integrated local measures of dependence between finite sequence of r.v.’s. Explicit presentations in terms of joint and marginal cumulative distribution functions (c.d.f.’s) are obtained. Some invariant properties are established in Section 5; Examples (explicit analytic and graphic) with popular copula distributions, and a bivariate Poisson distribution with dependent components illustrate these properties. 3-d surfaces with level curves consisting of points with constant cumulative magnitude of local dependence (covariance or correlation magnitude) in the sample space are drawn (Sections 5, 6, and 7).

, and does not have clear meaning of magnitude. Some of its properties are summarized in the statements of Section 3. Section 4 extends these results as integrated local measures of dependence between finite sequence of r.v.’s. Explicit presentations in terms of joint and marginal cumulative distribution functions (c.d.f.’s) are obtained. Some invariant properties are established in Section 5; Examples (explicit analytic and graphic) with popular copula distributions, and a bivariate Poisson distribution with dependent components illustrate these properties. 3-d surfaces with level curves consisting of points with constant cumulative magnitude of local dependence (covariance or correlation magnitude) in the sample space are drawn (Sections 5, 6, and 7).

2. The Idea for Measure Transfer

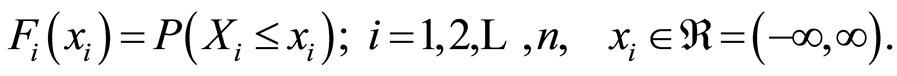

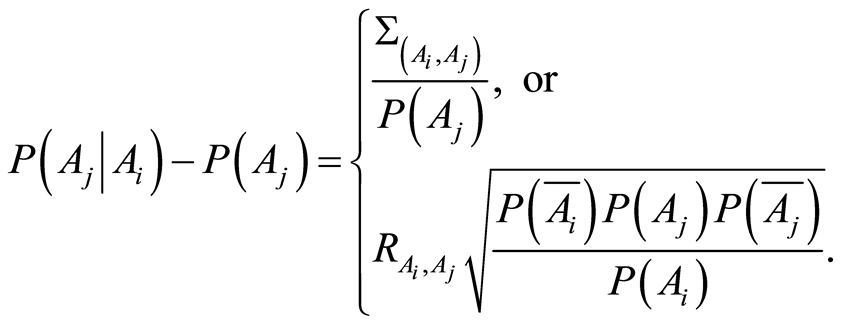

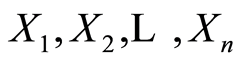

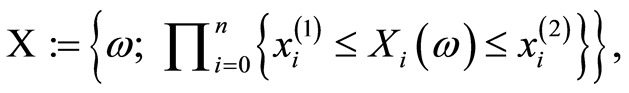

Let  be random variables (r.v.’s) defined on a probability space

be random variables (r.v.’s) defined on a probability space  with joint cumulative distribution function (c.d.f.)

with joint cumulative distribution function (c.d.f.)

and marginals

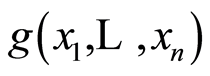

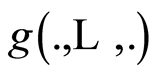

Most of the conventional measures of dependence between r.v.’s used in the practice are integral (global). Usually they have the form of expected values of some specifically selected function . Sometimes

. Sometimes  can be a real number, a vector, or a matrix. The dependence measure “of type

can be a real number, a vector, or a matrix. The dependence measure “of type ” is expressed by the equation

” is expressed by the equation

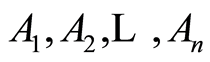

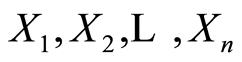

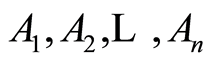

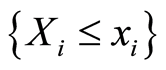

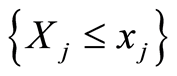

Let  be a finite set of random events in the sample space

be a finite set of random events in the sample space  of an experiment, where the r.v.’s

of an experiment, where the r.v.’s  are defined. Introduce the indicator r.v.’s

are defined. Introduce the indicator r.v.’s

Then the domain of the r.v.’s  is a subset of the sample space

is a subset of the sample space  of the r.v.’s

of the r.v.’s

Definition 1. The quantity

is called measure of dependence of the type  between the random events

between the random events .

.

Assume, the measure of dependence of type  is introduced, and its properties are well established and understood. For any choice of the point

is introduced, and its properties are well established and understood. For any choice of the point  define the random events

define the random events

(1.2)

(1.2)

Obviously,  define the marginal distribution functions of the r.v.’s

define the marginal distribution functions of the r.v.’s . Put these events in Definition 1, and get naturally the next:

. Put these events in Definition 1, and get naturally the next:

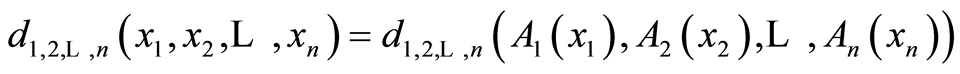

Definition 2. The quantities

are called cumulative local measure of dependence of type  between the r.v.’s

between the r.v.’s  at the point

at the point .

.

As an illustration of the above idea we consider the frequently used and well known integral measures within a finite sequence of r.v.’s, the covariance and correlation matrices.

3. Covariance and Correlation between Random Events

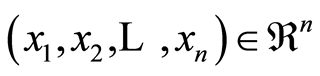

Introduce vector-matrices  and

and , and their transposed

, and their transposed  and

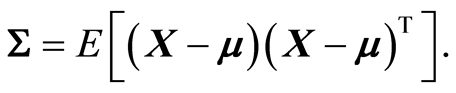

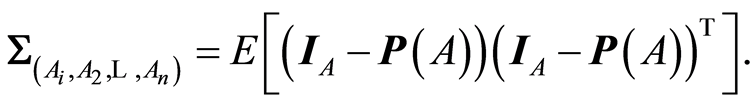

and . The covariance matrix between r.v.’s

. The covariance matrix between r.v.’s  is

is

(1.3)

(1.3)

By implementing the idea of the previous section, we introduce Covariance matrix between random events .

.

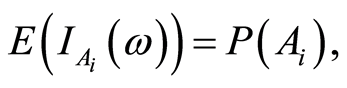

First, observe that  and

and

Introduce vectors

and

Formally, the covariance matrix  between the random events

between the random events  is defined by

is defined by

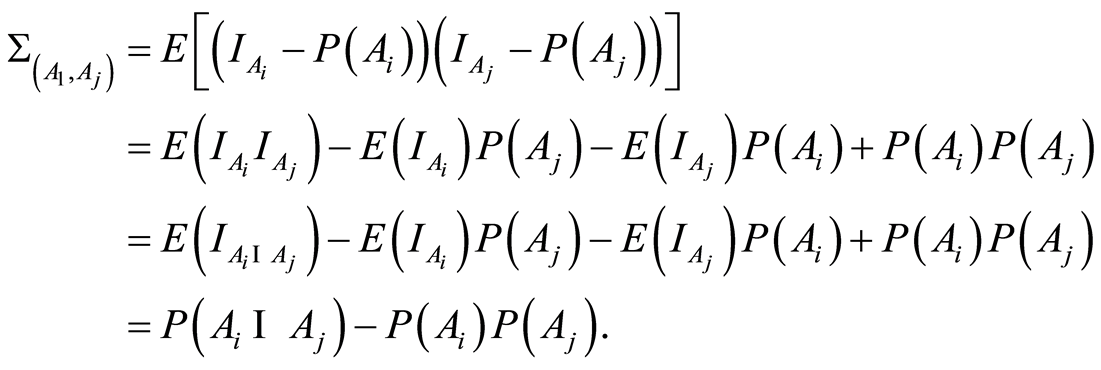

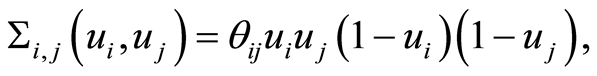

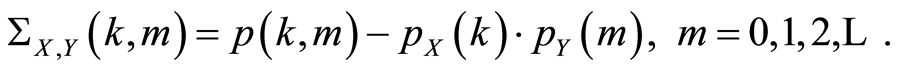

Its entries are

(1.4)

(1.4)

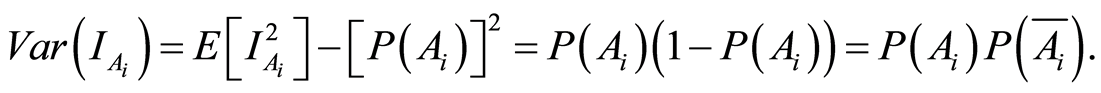

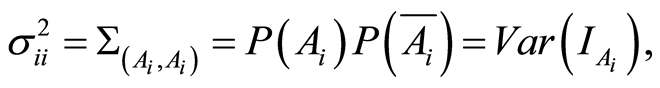

On the main diagonal of the covariance matrix  we recognize the entries

we recognize the entries

(1.5)

(1.5)

where  is the complement event to the event

is the complement event to the event . By making use of the standard approach we introduce the correlation matrix between random events

. By making use of the standard approach we introduce the correlation matrix between random events

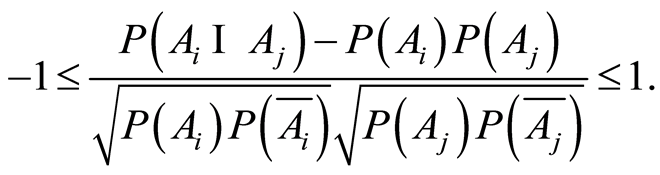

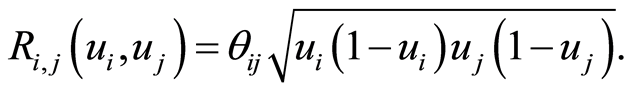

whose entries are the correlation coefficients between the indicators of respective events. Based on (1.4) and (1.5) for , they have the form

, they have the form

(1.6)

(1.6)

We call these entries correlation coefficients between random events  and

and . As one should expect, the entries on main diagonal are equal to 1. Each entry of the correlation matrix for

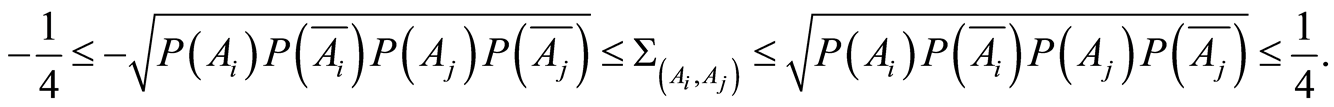

. As one should expect, the entries on main diagonal are equal to 1. Each entry of the correlation matrix for , satisfies the inequalities

, satisfies the inequalities

(1.7)

(1.7)

Let us focus on some basic properties of the entries of covariance and correlation matrices. They reveal also the information contained in terms of these matrices. Details can be seen in [2] .

Theorem 1. a) The covariance  and the correlation coefficient

and the correlation coefficient  between events

between events  and

and

equal 0 if and only if  and

and  are independent. The case includes the situation when one of the events

are independent. The case includes the situation when one of the events  or

or  is the sure, or the impossible event (then the two events also are independent);

is the sure, or the impossible event (then the two events also are independent);

b)  if and only if events

if and only if events  and

and  coincide;

coincide;

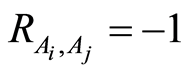

c)  if and only if events

if and only if events  and

and  coincide (or equivalently, if and only if the events

coincide (or equivalently, if and only if the events  and

and  coincide);

coincide);

d) The covariances between events  and

and  satisfy the inequalities

satisfy the inequalities

(1.8)

(1.8)

The equalities in the middle of (0.8) hold only if the two events  and

and  obey the hypotheses stated in parts a), b) and c);

obey the hypotheses stated in parts a), b) and c);

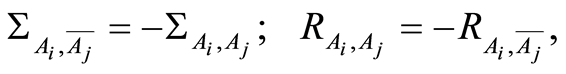

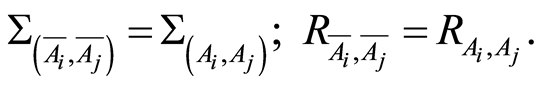

e) The covariance and the correlation coefficients between the events  and

and  and their complements

and their complements  and

and  are related by the equalities

are related by the equalities

and

The advantage of the considered measures is that they are completely determined by the individual (marginal) probabilities  of the random events, and by their joint probabilities

of the random events, and by their joint probabilities  An interesting fact is that we do not need the joint probability to calculate conditional probabilities between the events. If either of the measures of dependence

An interesting fact is that we do not need the joint probability to calculate conditional probabilities between the events. If either of the measures of dependence  or

or  is known then the the conditional probability

is known then the the conditional probability  can be found when marginal probabilities

can be found when marginal probabilities

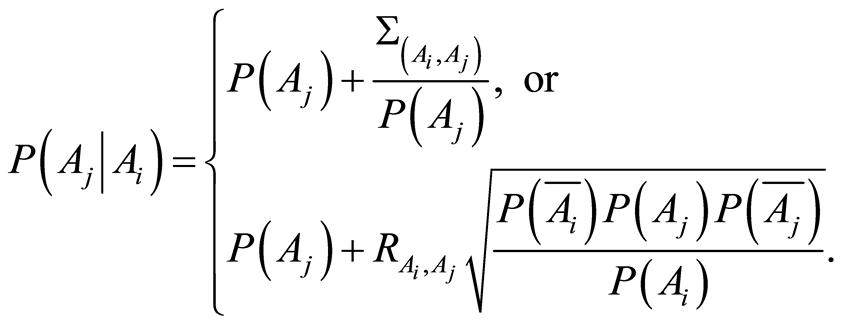

are known. It holds Theorem 2. Given the measures

are known. It holds Theorem 2. Given the measures  or

or  and marginal probabilities

and marginal probabilities

, the conditional probabilities of one event, given the other, can be calculated by the equations

, the conditional probabilities of one event, given the other, can be calculated by the equations

(1.9)

(1.9)

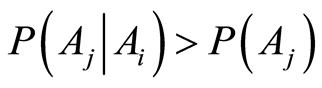

Remark 1. If the covariance, or the correlation between two events  and

and  is positive, the conditional probability of one event, given the other one, increases, compare to its unconditional probability, i.e.

is positive, the conditional probability of one event, given the other one, increases, compare to its unconditional probability, i.e.  and the exact quantity of increase equals to

and the exact quantity of increase equals to

(1.10)

(1.10)

Conversely, if the correlation coefficient is negative, the information that one of the events has occurred, the chances that the other one occurs decrease. The net amount of decrease in probability is also given by (1.10).

4. Covariance and Correlation Functions Describe Cumulative Local Dependence for Random Variables

Here we continue developing the idea of Section 2 to illustrate how the cumulative local measures of dependence between r.v.’s are obtained and expressed in terms of the conventional probability distribution functions. Let  be arbitrary finite sequence of r.v.’s. For any choice of the real numbers

be arbitrary finite sequence of r.v.’s. For any choice of the real numbers , let

, let  be the random events as defined in (1)

be the random events as defined in (1)  The covariance and correlation matrices for random events

The covariance and correlation matrices for random events  immediately turn into respective integrated measures of local dependence between the r.v.’s

immediately turn into respective integrated measures of local dependence between the r.v.’s  at the selected point

at the selected point . We discuss these matrices here, and focus on their specific forms in terms of the respective distribution functions. The covariance matrix function

. We discuss these matrices here, and focus on their specific forms in terms of the respective distribution functions. The covariance matrix function

whose entries are defined for any pair

by the equations

by the equations

(1.11)

(1.11)

represents the cumulative local covariance structure between r.v.’s  at the point

at the point . Analogously, we obtain the correlation matrix function

. Analogously, we obtain the correlation matrix function

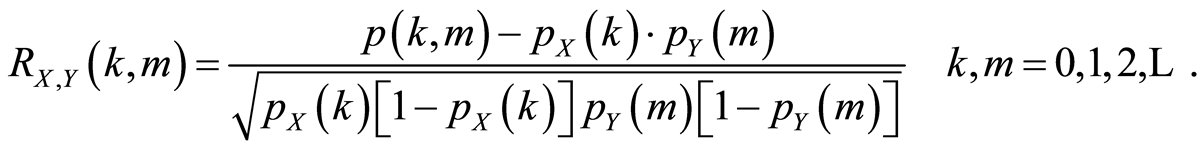

whose entries according to Equation (1.6), are

(1.12)

(1.12)

Obviously, these matrices are functions of the joint c.d.f.’s  and of the marginals

and of the marginals

of the participating r.v.’s. The properties of these entries are described by Theorem 1, and Theorem 2. We notice here the following particular and important facts.

of the participating r.v.’s. The properties of these entries are described by Theorem 1, and Theorem 2. We notice here the following particular and important facts.

Theorem 3. a) The equality

holds if and only if the two events , and

, and  are independent at the point

are independent at the point ;

;

b) The equality

holds if and only if the two events , and

, and  coincide at the point

coincide at the point ;

;

c) The equality

holds if and only if the two events , and the complement

, and the complement  coincide at the point

coincide at the point . Then also the events

. Then also the events , and

, and  coincide.

coincide.

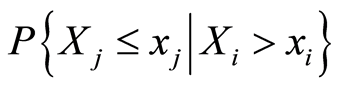

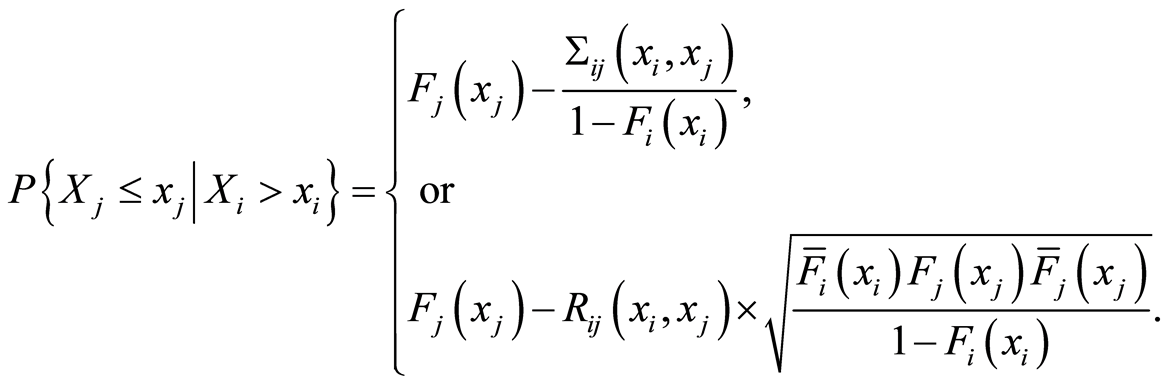

d) Given the dependence function measures  or

or  and marginal c.d.f.’s

and marginal c.d.f.’s

, the conditional probabilities

, the conditional probabilities  and

and  can be evaluated by the expressions

can be evaluated by the expressions

and

Proof. The statement is just an illustration of the transfer of the results of Theorems 1 and 2 from random events to the case of events depending on parameters. We omit details.

Theorem 3 d) provides the opportunity to make predictions for either of the events , or

, or , given that the other event occurs, or does not occur. The absolute values of the increase (or decrease) of the chances of the r.v.

, given that the other event occurs, or does not occur. The absolute values of the increase (or decrease) of the chances of the r.v.  to get values less than a number

to get values less than a number  under conditions of known values of the variable

under conditions of known values of the variable  compare to these chances without conditions, can be evaluated as shown in Remark 1. The evaluation is expressed in terms of the local measures of dependence and the marginal c.d.f.’d of participating r.v.’s.

compare to these chances without conditions, can be evaluated as shown in Remark 1. The evaluation is expressed in terms of the local measures of dependence and the marginal c.d.f.’d of participating r.v.’s.

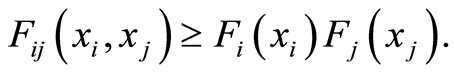

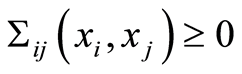

Remark 4. [8] introduces positive quadrant dependence between two r.v.’s by the requirement: for all  to be fulfilled

to be fulfilled  This is equivalent to the validity of

This is equivalent to the validity of  everywhere. The reverse inequality, when it remains true for all

everywhere. The reverse inequality, when it remains true for all  Nelsen calls as negative quadrant dependence. Also there ([8] p. 189) the author gives some discussion about Local Positive (and Local Negative) Quadrant Dependencies between r.v.’s

Nelsen calls as negative quadrant dependence. Also there ([8] p. 189) the author gives some discussion about Local Positive (and Local Negative) Quadrant Dependencies between r.v.’s  and

and  at a point

at a point , and does not go any further in its possible use. We are confident, that having local measure of dependence at a point, and especially, the measure of its magnitude given by the correlations functions

, and does not go any further in its possible use. We are confident, that having local measure of dependence at a point, and especially, the measure of its magnitude given by the correlations functions  offers the opportunity to use more. Namely, it is possible to classify the points in the plane according to their magnitude of dependence. For instance, there might be points of marginal independence, where the covariance equals zero. There can be areas of positive and negative dependence, depending on the sign of the covariance. There can be curves of constant cumulative correlations, e.g. curves given by the equations, like

offers the opportunity to use more. Namely, it is possible to classify the points in the plane according to their magnitude of dependence. For instance, there might be points of marginal independence, where the covariance equals zero. There can be areas of positive and negative dependence, depending on the sign of the covariance. There can be curves of constant cumulative correlations, e.g. curves given by the equations, like  or

or , etc. Our examples below provide effective proofs of such facts.

, etc. Our examples below provide effective proofs of such facts.

5. Monotone Transformations of the Random Variables and Related Dependence Functions. Copula

Here we study how the dependence functions behave under increasing or decreasing transformations. Before we move on, we introduce the following notations in order to make exposition clearer. We will use the notations  and

and  for the covariance and correlation matrices of the random variables

for the covariance and correlation matrices of the random variables  where

where  are arbitrary functions defined on the range of the arguments

are arbitrary functions defined on the range of the arguments . Also we introduce notations

. Also we introduce notations  and

and  to mark the variables for which the respective dependence functions are pertained.

to mark the variables for which the respective dependence functions are pertained.

Now we present the results with the following statement:

Theorem 4. Given arbitrary continuous functions  on the supports of the continuous r.v.’s

on the supports of the continuous r.v.’s  and

and  respectively, such that

respectively, such that  and

and  do exist, we have:

do exist, we have:

If  and

and  are all increasing functions, or if

are all increasing functions, or if  are all decreasing functions, then the values of the respective covariance and correlation functions at the respective points are related by the equations

are all decreasing functions, then the values of the respective covariance and correlation functions at the respective points are related by the equations

and

Also the relations

and

are valid.

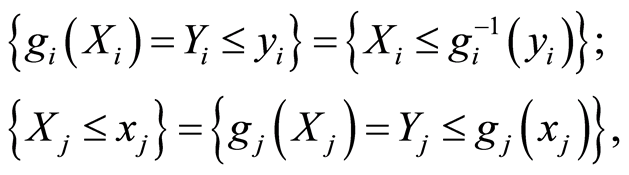

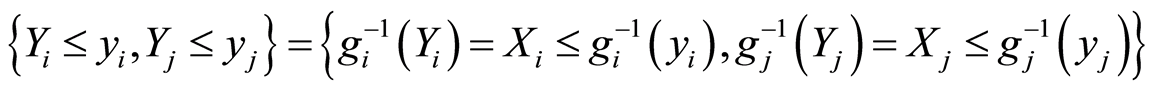

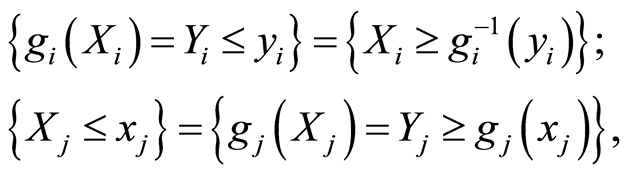

Proof. The statement follows from the fact that the following equivalence between the random events at any point  are valid:

are valid:

If  and

and  are both increasing functions, then the following random events are equivalent

are both increasing functions, then the following random events are equivalent

and equivalent are also the events

for all .

.

If  and

and  are both decreasing functions, then the following random events are equivalent

are both decreasing functions, then the following random events are equivalent

and also equivalent are

for all .

.

Next, we use the facts that the covariance and correlation matrix functions introduced in (1.11) and (1.12) for pairs of random events  and

and  are the same for any pairs of equivalent events

are the same for any pairs of equivalent events

, as well as for the pair of their complements

, as well as for the pair of their complements , according to Lemma 2 part b) are equal. The reason is that the respective probabilities used in the definition of the matrix entries of equivalent events also are equal.

, according to Lemma 2 part b) are equal. The reason is that the respective probabilities used in the definition of the matrix entries of equivalent events also are equal.

Assume now, that  are continuous r.v.’s, and

are continuous r.v.’s, and  is their continuous distribution function, as well as its all marginals are. According to [8] , there exists unique n-dimensional copula

is their continuous distribution function, as well as its all marginals are. According to [8] , there exists unique n-dimensional copula  (a n-dimensional distribution on the n-dimensional hyper-cube

(a n-dimensional distribution on the n-dimensional hyper-cube  with uniform 1-dimensional marginals and any 2- and higher-dimensional marginals also being copulas) associated with

with uniform 1-dimensional marginals and any 2- and higher-dimensional marginals also being copulas) associated with , such that it is true

, such that it is true

(1.13)

(1.13)

Then it is true also

(1.14)

(1.14)

Denote by  and by

and by  the covariance and the correlation matrix functions corresponding to the uniformly distributed on

the covariance and the correlation matrix functions corresponding to the uniformly distributed on  r.v.’s

r.v.’s  whose joint distribution function is the copula

whose joint distribution function is the copula . We introduce the notations

. We introduce the notations  and

and  for the covariance and correlation matrix functions corresponding to the original r.v.’s

for the covariance and correlation matrix functions corresponding to the original r.v.’s .

.

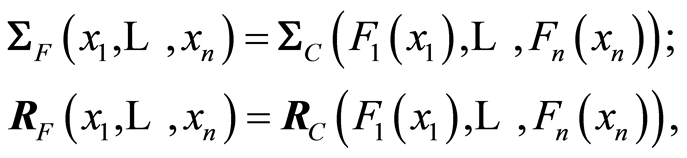

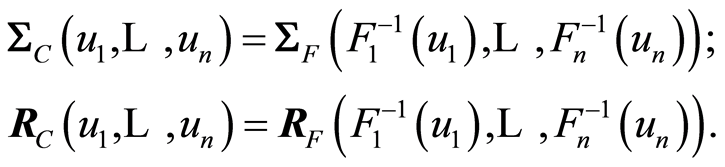

The following statement holds:

Theorem 5. If  is a continuous

is a continuous  -dimensional distribution function and

-dimensional distribution function and  is its associated copula, then the following relationships are true

is its associated copula, then the following relationships are true

and also

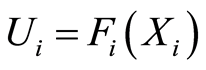

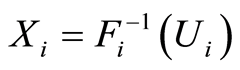

Proof. The proof of these relationships is a simple consequence from Theorem 4, when we notice that the copula is just the distribution of a set of random variables, obtained after a monotonically increasing transformation  or

or  is applied to each component of the original random vector

is applied to each component of the original random vector , or to the vector

, or to the vector

Both theorems explain how after transformation the local cumulative dependence structure for the new variables is transfered to the points related with the same transformations at each coordinate of the other set of random variables. The fact of curiosity is that the relationships in Theorem 5 completely repeats the relationships (1.13) and (1.14) which define the copula.

The next examples illustrate the covariance and correlation functions for two popular multivariate copula, which we borrow from [8] .

Examples

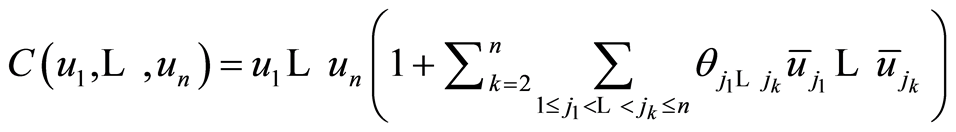

1) Farlie-Gumbel-Morgenstern (FGM) n-copula

The FGM n-copula is given by the equation

where the coefficients  and

and

The entries of the covariance and the correlation matrices are respectively

and

We observe here, that the covariance and correlation functions keep constantly the sign of the parameter .

.

Moreover, the correlation functions  do not exceed the numbers

do not exceed the numbers  for all

for all .

.

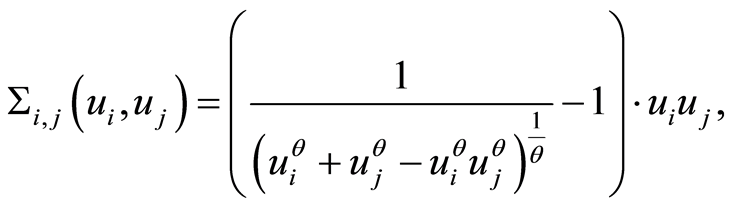

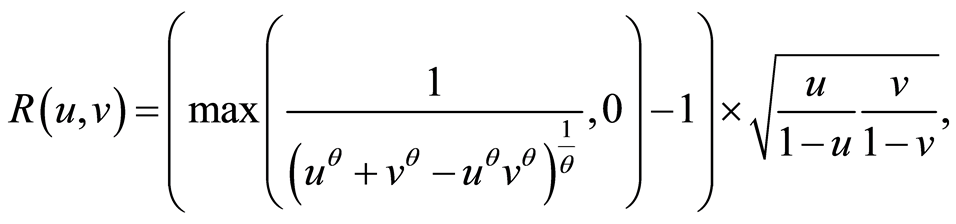

2) Clayton Multivariate Archimedean copula

The copula is given for any , by the equation

, by the equation

where  and the parameter

and the parameter  For negative values of

For negative values of  the maximum of the expression in the brackets and 0 must be taken, and

the maximum of the expression in the brackets and 0 must be taken, and  must be fulfilled. For instance, if

must be fulfilled. For instance, if  we should have

we should have .

.

The entries of the covariance and the correlation matrices in case of positive , are respectively

, are respectively

and

6. Maps for Dependence Structures on the Sample Space

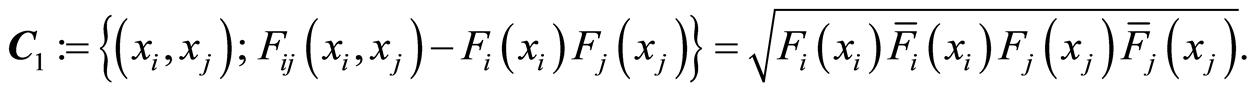

A thorough analysis of the results in previous sections leads to an interesting opportunity to divide the sample space for any pair of r.v.’s  into areas of positive, or negative dependence between the events

into areas of positive, or negative dependence between the events  and

and . For this purpose, one can use the following curves:

. For this purpose, one can use the following curves:

Curve of Independence,  the set of all points

the set of all points  in

in  where the correlation function

where the correlation function . In other words,

. In other words,

Here the events  and

and  are independent for all points

are independent for all points  .

.

Curve of Positive Complete Dependence,  the set of all points

the set of all points , where the correlation function

, where the correlation function . In other words,

. In other words,

Here the events  and

and  coincide for all points

coincide for all points  .

.

Curve of Negative Complete Dependence,  the set of all points

the set of all points , where the correlation function

, where the correlation function . In other words,

. In other words,

Here either of the events  and

and  is equivalent to the complement of the other one for all points

is equivalent to the complement of the other one for all points .

.

Additional mapping can be drown by making use of the Correlation Level Curves at level

At each point of such a curve , the correlation function

, the correlation function  between the events

between the events  and

and  equals to

equals to . and

. and .

.

When  is positive, the random variables

is positive, the random variables  are positively associated at the points

are positively associated at the points . When

. When  is negative, the random variables

is negative, the random variables  are negatively associated ate the points

are negatively associated ate the points .

.

In particular applications such curves may have important impact on understanding the dependence structure between the random variables . By the way, some of these curves may happen to be empty sets.

. By the way, some of these curves may happen to be empty sets.

One can ilustrate these curves in the next examples, using 3-d plots of the surfaces  and

and  with the level curves. In our plots we have used the program system Maple, and graph just the correlation function.

with the level curves. In our plots we have used the program system Maple, and graph just the correlation function.

Examples

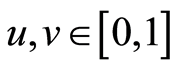

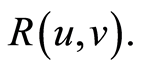

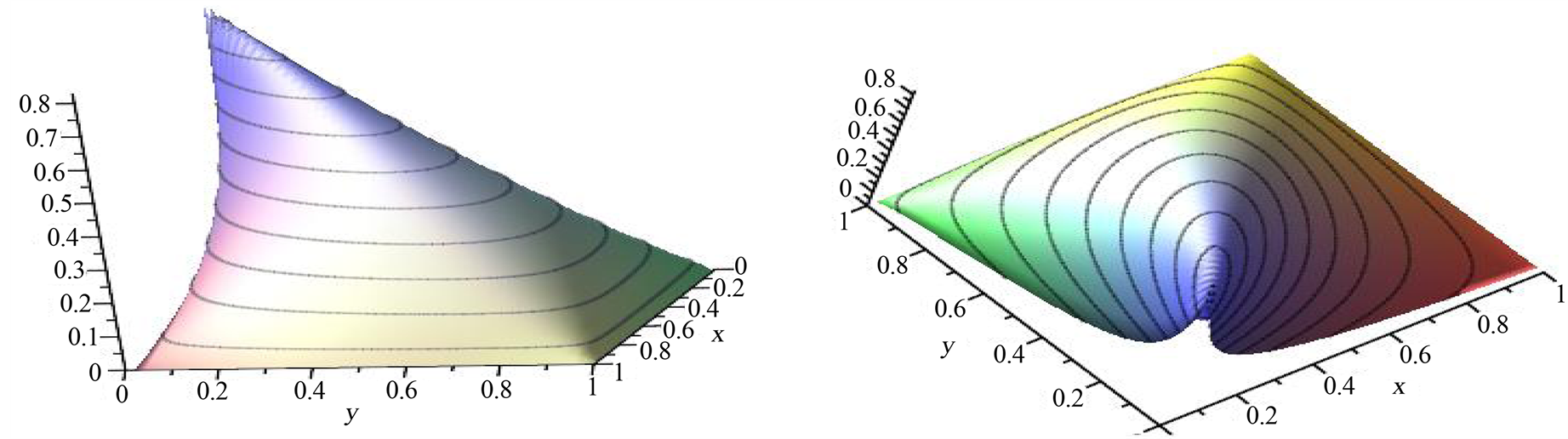

Here we illustrate the information one may visually get from the mapping of the 3-d graphs for the considered above copula. We plot their correlation function  with

with . Since the pictures are the same for any pair of indices

. Since the pictures are the same for any pair of indices , we use notations without any indices.

, we use notations without any indices.

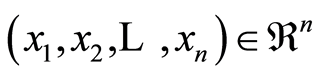

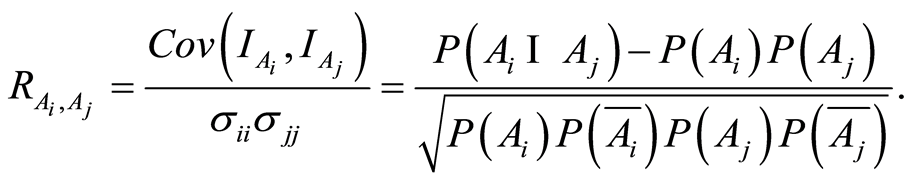

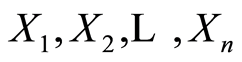

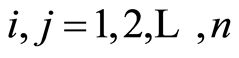

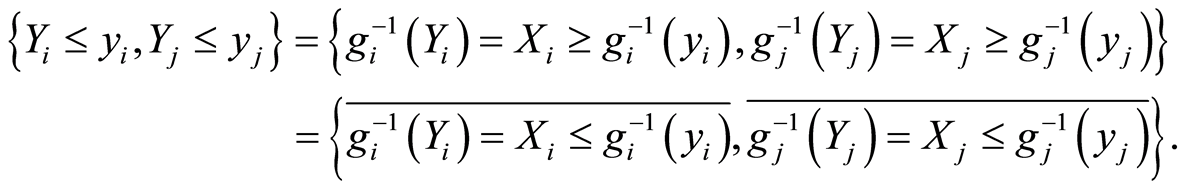

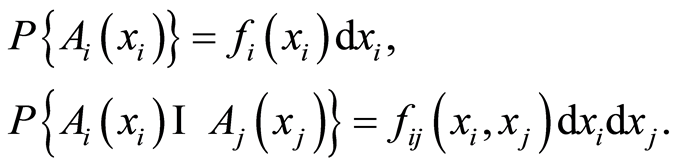

1) The correlation functions for FGM copula (continued)

The two-dimensional marginal distributions of the multivariate FGM copula are given by one and the same equation, and we drop the subscripts:

where

The correlation function is respectively

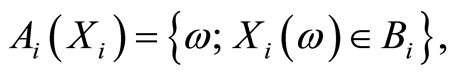

and satisfies the inequalities  On Figure 1 we see the 3-dimensional graph of the surface

On Figure 1 we see the 3-dimensional graph of the surface

, for the cases

, for the cases  and

and .

.

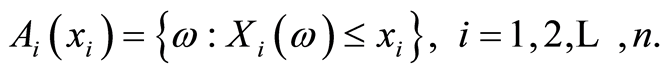

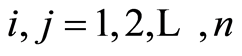

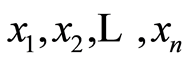

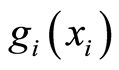

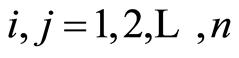

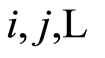

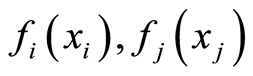

2) Clayton Archimedean copula (continued)

The two-dimensional marginal distributions of the multivariate Clayton copula also are given by the same equations, and we drop the subscripts:

The copula is given by the equation

and in the multivariate case it is required that  However the Clayton copula in the two-dimensional case is defined for all

However the Clayton copula in the two-dimensional case is defined for all  and

and

The respective correlation function is

and this relation is valid for all .

.

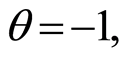

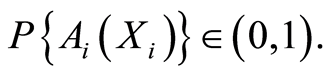

To have a base for comparison (with the pictures in [8] p. 120, Figure 4.2), we consider the case , and present several level curves on the 3-d graph of

, and present several level curves on the 3-d graph of  Actually, the level curves

Actually, the level curves  are visible on the surface from which we see that

are visible on the surface from which we see that  is between 0 and 1.0. Results are pictured of Figure 2.

is between 0 and 1.0. Results are pictured of Figure 2.

The 3-d graphs for this particular measure shown on Figure 2(b) of dependence between the two components of the copula closely imitate the situations given in the scatter-plots in the reference book [8] , but are more impressive and information giving.

Together with the surface plots, the correlation function and its level curves are quite more informative than the simulated scatter-plots used in copula.

(a) (b)

(a) (b)

Figure 1. Correlation function for the Farlie-Gumbel-Morgenstern copula with level curves, θ = ±1. (a) FGM-copula correlation function surface, θ = −1; (b) FGM copula correlation function surface, θ = 1.

(a) (b)

(a) (b)

Figure 2. Correlation function for the Clayton copula, θ = 4. (a) Clayton copula correlation function surface-a look from (1,1) corner; (b) Clayton copula correlation function surface-a look from (9,0) corner.

7. On the Use of the New Measures

At this point we believe that the introduced local measures of dependence can be used in similar ways as the covariance and correlation matrices are used in the multivariate analysis. However, because we think that the ideas developed here are so natural and simple, there will be no wonder if what we propose here is already in use. But, with the best of our knowledge, we have never seen anything similar, and we dare to say it under the risk we are not the first who offers such approach.

The results of Section 3 for random events may suit analysis of non-numerical, categorical, and finite discrete cases of random data similar to the ways as the numeric data are treated.

The results of Section 4 show that we are getting an opportunity to treat mixed discrete and continuous variables equally, using the cumulative distribution functions (marginal, and the two-dimensional).

If one treats the induces  of the events

of the events  as time variables (time is

as time variables (time is ), the above approach may offer interesting applications in the areas of Time Series Analysis, as well as in the studies of sequences of random variables.

), the above approach may offer interesting applications in the areas of Time Series Analysis, as well as in the studies of sequences of random variables.

Obtained results may have impact on various side effect questions, and we leave it for other’s comments. We insist on main practical orientation of our results-same and similar as everything else build on the use of the covariance and correlation matrices in the multivariate analysis.

8. Further Expansion of the Idea of Transforming Measures

In addition, the new measures may be used in studying the local structures of dependence within rectangular areas of the sample spaces when the sets of random events are defined as type of Cartesian products

and by making use of the main idea of the transfer from the Introduction.

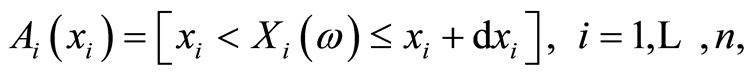

Another extension that may allow the involvement of the probability density functions (p.d.f.) could be obtained as in Section 4, by considering the elementary events

whose probabilities are

Here  and

and  are the marginal and the joint probability densities of the r.v.’s

are the marginal and the joint probability densities of the r.v.’s

and of the pair  Since the densities do not have meaning of probabilities, for now we cannot use them in similar constructions. However, the picture changes in case of discrete variables.

Since the densities do not have meaning of probabilities, for now we cannot use them in similar constructions. However, the picture changes in case of discrete variables.

As an illustration of this approach in the study of local dependence structure we consider the discrete case. The r.v.’s  and

and  have joint distribution

have joint distribution  and marginals

and marginals  and

and

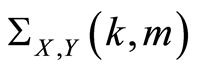

Then the covariance function

Then the covariance function  is defined by the equalities

is defined by the equalities

The respective correlation function will be defined by

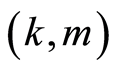

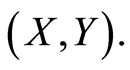

Graphing these functions, one can see the local dependence structure between the two variables at any point  and to evaluate its magnitude, and in addition will see the entire picture of this mutual dependence in the field-the range of the pair

and to evaluate its magnitude, and in addition will see the entire picture of this mutual dependence in the field-the range of the pair

As an illustration of this suggestion we consider the simplest Bivariate Poisson distribution constructed in the following way, borrowed from [9] . There are three Poisson distributed r.v.’s  of parameters

of parameters

Then it is supposed

Then it is supposed

The dependence between

The dependence between  and

and  comes from the involvement of

comes from the involvement of  in both components. Their marginal distributions are Poisson with parameters

in both components. Their marginal distributions are Poisson with parameters  and

and  correspondingly. The joint distribution is given by

correspondingly. The joint distribution is given by

After substitution of this form of the joint distribution and the marginal Poisson distributions in the above expressions, we get the covariance and correlation functions and the study of the local dependence can start. We omit detailed analytical expressions for these functions which is not a problem to get but are too cumbersome to write here.

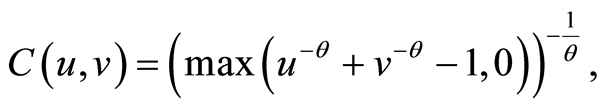

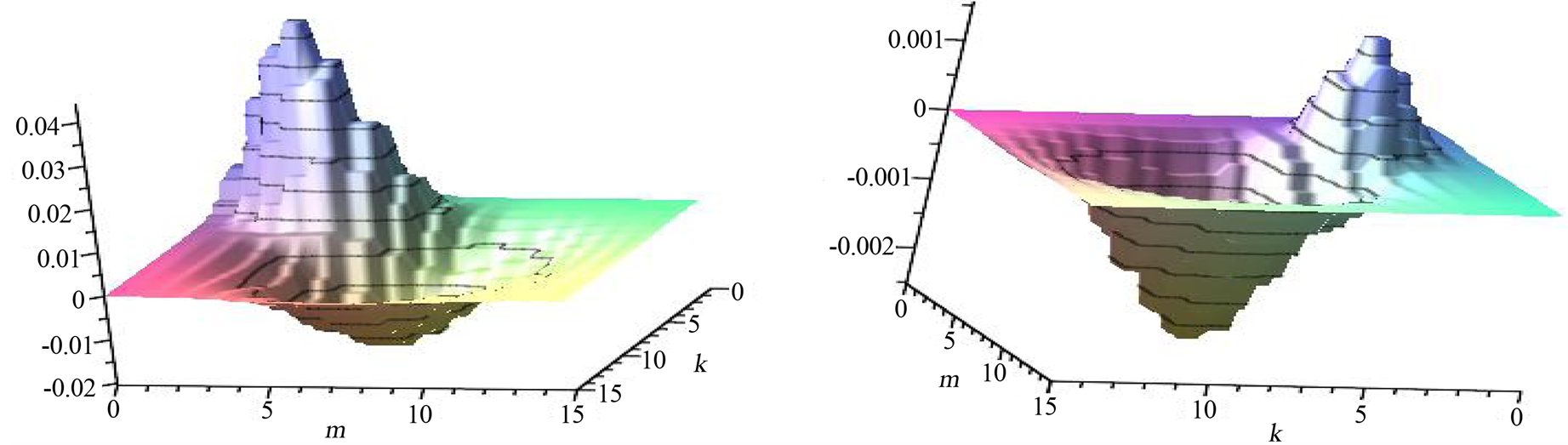

On Figure 3 we give an illustration of these functions by their 3-d graphs in the case when

and

and  The magnitude of dependence is not strong (the local correlation coefficient is too small). However, we observe that on the square

The magnitude of dependence is not strong (the local correlation coefficient is too small). However, we observe that on the square  the association is positive, when on the rectangle

the association is positive, when on the rectangle  this dependence is negative and also is a bit stronger. Outside these areas the two variables are almost independent.

this dependence is negative and also is a bit stronger. Outside these areas the two variables are almost independent.

More exotic spots of dependences can be obtained when in Definition 2 the events  are chosen as

are chosen as

where  are any Borel sets on the real line, with

are any Borel sets on the real line, with

In our opinion, there is a number of follow up questions in the multivariate dependence analysis, and more illustrations on real statistical data will trace the utility of the offered approach.

9. Conclusions

In this paper we discuss the possibility to transfer conventional global measures of dependence onto measures of

(a) (b)

(a) (b)

Figure 3. Surfaces explain local dependence structure in the Bivariate Poisson distribution. (a) Dependent PoissonCovariance function; (b) Dependent Poisson-Correlation function.

dependence between random events, and then using another transfer to turn them into cumulative local measures of dependence between random variables.

We illustrate the method on the example of covariance and correlation matrices between random variables. Important results can be found in the discussion on some specific properties of the new measures, and in the qualitative information that may be derived from the meaning of these measures.

The behavior of these measures under monotonic transformations is established. It shows full coincidence between the pictures in the sample space of the original random variables and their respective copulas.

We found that locally the random variables may have areas of positive dependence and areas of negative dependence, as well as areas of local independence. This seems something interesting from informational point of view compared to the global measures of dependence.

Our suggestion is that the local measures of dependence offer important topological pictures to study. Our examples illustrate the new opportunities in this field.

Acknowledgements

The authors acknowledge FAPESP (Grant 06/60952-1, and Grant 03/10105-2), which gathered us for several days, where we had the opportunity to start the work on this exciting topic. We are thankful to Professor Roger Cook for his then unexpected spontaneous support during the Third Brazilian Conference on Statistical Modeling in Insurance and Finance, Maresias, Brazil.

References

- Cooke, R.M., Morales, O. and Kurowitcka, D. (2007) Vine in Overview. Proceedings of 3rd Brazilian Conference on Statist. Modeling in Insurance and Finance, 26-30 March 2007, 2-20.

- Dimitrovm B. (2010) Some Obreshkov Measures of Dependence and Their Use. Compte Rendus de l’Academie Bulgare des Sciences, 63, 15-18.

- Bradley, R.C. (2005) Basic Properties of Strong Mixing Conditions. A Survey and Some Open Questions. Probability Surveys, 2, 107-104.

- Genest, C. and Boies, J. (2003) Testing Dependence with Kendall Plots. The American Statistician, 44, 275-284. http://dx.doi.org/10.1198/0003130032431

- Obreshkov, N. (1963) Probability Theory. Nauka i Izkustvo, Sofia (in Bulgarian).

- Dimitrov, B., Kolev, N. and Goncalves, M. (2007) Some Measures of Dependence between Two Random Variables. Work Paper.

- Renyi, A. (1969) Foundations of Probability Theory. Holden-Day, San Francisco.

- Nelsen, R. (1999) An Introduction to Copulas. Springer, New York. http://dx.doi.org/10.1007/978-1-4757-3076-0

- Kocherlakota, S. (1988) On the Compounded Bivariate Poisson Distribution: A Unified Treatment. Annals of the Institute of Statistical Mathematics, 49, 61-70. http://dx.doi.org/10.1007/BF00053955