Modern Economy

Vol.4 No.2(2013), Article ID:28186,10 pages DOI:10.4236/me.2013.42014

Accruals, Persistence of Profits and Stock Returns in Brazilian Public Companies

School of Economics, Business and Accountancy University of São Paulo, São Paulo, Brazil

Email: rettakamatsu@gmail.com, lpfavero@usp.br

Received December 8, 2012; revised January 9, 2013; accepted February 1, 2013

Keywords: Accounting Accruals; Persistence of Profits, Stock Returns, Brazil, Panel Data

ABSTRACT

The central aim in this research was to assess investors’ accounting information interpretation skills. Therefore, it was assessed how different profit components would affect the future profitability of publicly traded Brazilian companies. Through a sample of all Brazilian public companies listed in Bovespa from 1995 to 2010, the research results demonstrated that current accruals were incapable of explaining future abnormal return behavior in the firms analyzed. In addition, no significant abnormal returns were reached in an accruals-based investment strategy, indicating that investors would be capable of interpreting and pricing accounting data.

1. Introduction

Departing from the seminal work by [1], subsequent studies started to show the relation between the data and indicators extracted from financial statements and companies’ future performance, proving this association through empirical evidence ([2,3]). According to [4], however, even when used to assess business risks and estimate companies’ capital costs, accounting variables have not been sufficiently explored in contemporary academic research. Imperfect understanding about the nature of the financial statement can result in a reduction of capital market agents’ ability to: 1) manage resources efficiently, and 2) detect investment alternatives to enhance the possibility of gains. This possible interference between what Accounting informs and what its users understand results in accounting anomalies.

Among the data included in the financial statements, there is a trend for investors, analysts and creditors to recommend some information more recurrently like profit-related information for example. That is so because, despite possible social implications, businesses are primarily based on the owners’ conviction that company operations can result in profits. In profit analysis, [5] defend the idea that different profit components entail different implications for company value, frequently found in financial studies, and apparently supported by investment analysts. In general, profits contain cash flow components and accruals, distinguished by different degrees of subjectivity. While the cash flow components comprise revenues and expenses that represent effective inflows or outflows of financial resources during the period, accruals are temporary cash flow adjustments, transferring them to the period when they are recognized in the income statement [6]. In that sense, [7] affirms that accruals are based on deferrals, allocations and evaluations, all of which involve a high level of subjectivity.

According to [7], subjectivity and the transitory nature of accruals represent causes for their shorter persistence. Therefore, one may suppose that companies with higher accrual levels during the fiscal year tend to increase the probability of exhibiting a lower persistence level of this profit in the future. The empirical results the author found confirmed the persistence of lower profits associated with accruals, thus supporting traditional authors’ arguments that accruals and cash flow components should be considered separately in financial assessments [5].

Investors should consider the reduction in the future profitability level as a result of a shorter persistence of current accruals than cash flow items [8,7], on the other hand, detected negative associations between current accruals and abnormal future returns in the companies. In other words, although empirical evidence indicates that high accrual levels enhance the probability of reductions in future profitability, investors’ expectations—reflected in stock prices—demonstrated that they have not incurporated information about the persistence of accruals in their analyses.

Studies that investigated the effect of accruals on profit persistence and company value in general have focused on developed markets like the United States and the United Kingdom [9]. Hence, the number of investigations to study investors’ reaction to different profit components in emerging markets is still limited.

A series of distinguished characteristics marks the Brazilian market. Historically, in its institutional environment, fiscal rules have strongly influenced the financial statements. The State issued accounting standards in response to its fiscal and tax needs, what deviates the statements’ focus from the provision of useful information to investors and other users [10,11] defends that, in countries where the impact of accounting information is comparatively weaker, like in Brazil, the functional fixing in the final profit reported is less common or less important in stock pricing, which in turn interferes in accrual anomalies.

The above considerations and a transition period in the financial statements, which used to be based on standards, towards a more principle-based accounting, reveal a unique opportunity to analyze investors’ ability to interpret Accounting data, particularly the disclosure of profit information. Thus, the general aim of this study was to verify whether accounting anomalies in accruals are detected in the Brazilian capital market. To assess this objective, the research was developed to check whether different profit components influence profit persistence and the market’s reactions. The study was conducted based on the method by [7], which served as a reference for further similar studies ([5,12-14]).

The specific aims are to verify whether the current accrual level is related to the profit behavior and market value in future periods and to detect whether investment strategies based on accruals produce statistically significant abnormal returns.

After presenting the research objectives, it is interesting to express the research hypotheses in analytic terms. The first hypothesis, on the persistence of accruals, serves as a premise to evaluate the other hypothesis. Thus:

H1: The current profits resulting from adjustments to the accrual base of accounting are less persistent than the profits deriving from cash flow components.

The other tests refer to the accrual anomaly itself, that is, that investors would not understand the nature of profits, resulting in asset pricing evaluation errors. Therefore, the second research hypothesis is that:

H2: The expected profits embedded in current stock prices do not correctly reflect available information on accounting profit.

An extension of the second research hypothesis established refers to the formation of investment strategies. It can be formulated as follows:

H2,1: A negotiation strategy based on the profit accrual level produces positive abnormal returns.

Traditional financial literature is based on the semistrong form of the capital market efficiency hypothesis. The premise is that asset prices embed all publicly available information in a logical and instantaneous form, making it impossible for investors to systematically reach extraordinary gains. The empirical results on the anomaly of accruals challenge the market efficiency paradigm in its semi-strong form, suggesting that abnormal returns can be reached through investment strategies based on publicly available information [15].

In other words, if anomalous accruals are detected, it is demonstrated that investment strategies based on accounting data support decision making, allowing capital market agents to detect investment alternatives with a greater possibility of gains. In that sense, investors and financial market portfolio managers will obtain additional empirical evidence and theoretical arguments for the financial statement information efficiency in companies whose stocks are traded on the primary and seconddary markets of the São Paulo Stock Exchange (BM&F Bovespa).

2. Theoretical Platform

The theoretical platform can be separated in four subsections. First, a short summary on profit, its elements and importance is presented. Then, financial anomalies are defined, explaining how they challenge the Market Efficiency Hypothesis by [15]. The third subsection discusses the literature on the anomaly of accruals, highlighting the empirical evidence found. Finally, anomalous accruals are treated specifically in the Brazilian environment.

2.1. Accounting Profit

According to [16], profits produced in the framework of accounting accruals represent a measure that summarizes company performance information. Hence, profit information is used in a range of situations, like in the establishment of executive compensation plans, in the prospects of firms that intend to go public, and also by any creditor or investor interested in assessing companies’ future performance.

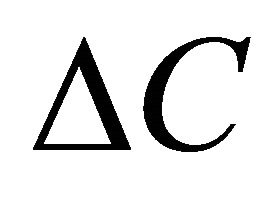

Basically, cash flows and accruals constitute profits. The cash flow components comprise revenues and expenses that corresponded to actual inflows or outflows of financial resources during the period. On the other hand, accruals are temporary cash flow adjustments [6]. The relationship between profits, accruals and cash flow is shown in Equation (1).

(1)

(1)

Accruals permit compliance with the main foundations of the accrual base of accounting: the revenue realization principle and the matching principles between revenues and expenses in the same period. Cash flows, on the other hand, cannot comply with these principles, as they join revenues and expenses accrued in different periods in the same statement. In that sense, [6] highlight that accruals inhibit potential timing and mismatching problems.

[17] underlines that accrual estimates are based on business administrators’ view/expectation of revenues and expenses related to the economic phenomena incurred in the current period. [18] defend that, when adding accruals to operating cash flows, Accounting produces a variable with less noise than operating cash flows alone, as accruals mitigate extreme and temporary variations deriving from modifications in working capital, anticipated payment, accounts receivable and accounts payable.

2.2. Financial Anomalies

In capital market studies, in general, the efficient market hypothesis is assumed in its semi-strong form. [15] generically established that, in efficient markets, the prices of the assets traded fully reflect available information, making it impossible for investors to systematically achieve abnormal returns.

Inquiries about support for the argument in favor of investors’ total rationality encouraged the creation of a group of behavioral fans, in which the principle of limited rationality replaced that of limited rationality [19]. Information efficiency constraints, like the concentration and information processing abilities inherent in human nature, imply economic effects called financial anomalies [14].

Financial anomaly can be considered a seemingly unexplained systematic event [20]. Similarly, [21] define financial anomalies as documented standards of price behavior that is inconsistent with the theory of market efficiency. According to [22], despite the strong focus on capital market anomalies, recent researches are almost exclusively focused on behavioral finance, without addressing accounting anomalies.

2.3. Anomaly of Accruals

The seminal research developed by [7] evaluated whether stock prices would reflect the different persistence of cash flow components and accruals. The results demonstrated that cash flow components are more capable of predicting profits for the subsequent period. In the author’s model, accruals were subdivided in ten groups (based on the calculated deciles) and the cash flow components and accruals showed persistence coefficients of approximately 0.8 and 0.5.

Based on the estimated regressions and constitution of theoretical portfolios, [7] found that companies in which the income contained a large share of accruals generally exhibited negative abnormal returns in the year after forming the portfolio, mainly during the period when financial statements are presented and accounting income is disseminated. These findings demonstrated that investtors did not understand the different persistence of profit components but focused on the final profit reported, instead of analyzing the different implications of its components in the formation of company income.

In view of the results those authors found, the conjecture was established that the market would be incapable of correctly pricing accrual information. These findings triggered subsequent studies that investigated the anomaly of accruals, which implied the development of new research methods and a considerable range of foci, samples and empirical evidence available on the theme.

The hypothesis established [7] about investors’ naïve focus on the final profit accounting reported, without an in-depth understanding about the different properties of its components, was tested by [12,14,23], among others.

[23] explored some cross-sectional characteristics of the accrual anomaly. Based on the premise that this anomaly would result from investors’ inability to correctly process the information in the financial statements, the authors investigated whether this inability could be related to investigators’ degree of sophistication. Against expectations, the results demonstrated that the association between accruals and subsequent returns was stronger in larger firms. For smaller companies, in which less interest by sophisticated investors was expected, this relation was weaker. These results collide with the hypothesis that the anomaly would derive from market participants’ inability to understand relevant information, as it seems improbable that more sophisticated investors, with a comprehensive understanding about the different natures of profit components, would only focus on the bottom line.

Using a method distinct from [12,23] evaluated the functional fixing hypothesis of the final accounting profit. The author demonstrated that the profitability of companies that exhibited extreme accrual levels continued across two consecutive years and that, despite this continuity, companies experienced abnormal returns, suggesting that these returns do not result from the reversal of accruals. Thus, using distinct methods, the findings by [12] and [23] led to the same conclusion, i.e. both studies found that the investors’ fixation could not be the reason for the accrual anomaly.

[14], however, documented results that are consistent with the hypothesis of the investors’ focus on accounting profit, as opposed to the abovementioned evidence. The authors investigated whether investors neglect information on cash generation, assessing the extent to which reported profits arouse excessive optimism. These authors also demonstrated when companies’ net operating assets (NOA) are high, that the subsequent growth in profits tends to be low. A strong and negative association between NOA and long-term returns would demonstrate that investors did not analyze information on the amount of NOA adequately, but essentially based their evaluations on accounting profitability. Hence, it is only in later periods, when the large quantity of net operating assets affects company profitability that investors readjusted their evaluations, resulting in the negative return observed through empirical tests.

2.4. Empirical Results Found in the Brazilian Market

The deep review realized by [24] found that, despite the increasing number of international studies on the anomaly of accruals, in Brazil, research on this phenomenon is still incipient, to the extent that [25] are pioneers in their exploration of the theme.

[25] evaluated the first hypothesis [7] established, about the lower persistence of accrual-related profits than that of cash flow items. In a sample of 126 Brazilian companies, with data available for the period 1995-2007, the authors were unable to prove the established hypothesis. When expanding the sample to all assets traded on BM&FBovespa (except for financial companies) between 1990 and 2008, however, [24] obtained indices consistent with international literature. In this study, signs were found that the persistence of accruals is shorter than that of cash flows. No relation was found, though, between high levels of accruals and negative abnormal returns in companies on the Brazilian capital market. Hence, no evidence was detected that accruals would be badly priced by the market, nor even that accrual-based negotiation strategies would provide positive and consistent returns.

3. Research Methods

The methodological procedures adopted in the study are described in this chapter, in which the sample selection criterion is treated in the first subsection. Then, the procedures to detect outliers are explained, as well as the operational definitions of the study variables. Next, the estimated models to investigate the research hypotheses are presented.

3.1. Research Sample

The sample used in this study consisted of Brazilian publicly traded companies with stocks traded on BM&FBovespa between 1995 and 2010, excluding financial companies. As three-monthly observations tend to vary as a result of possible seasonal spreads and accounting principles, we decided to use the companies’ annual reports. The financial information used was taken from the Economática® database and variables were updated to December 31st 2010, using the Brazilian Institute of Geography and Statistics’ (IBGE) Extended Consumer Price Index—IPCA.

To compose the sample, only companies with complete data for all study variables across the study period were considered. In addition, corrective measures were adopted for the outliers. Using box plot graphs, the presence of outliers was evaluated in the dependent variable. Thus, any values beyond the inter-quartile interval were excluded from the sample. On the other hand, to detect outliers in the independent variables, the Mahalanobis distance was used [26]. Hence, the research sample for the first hypothesis included 465 companies, totaling 3166 observations.

Significantly fewer observations were available to assess the second study hypothesis. That was so because the stocks of a range of companies listed on BM&FBovespa are not frequently traded, which makes it impossible to calculate return in the period after the presentation of the financial statements. As a result, less data were available to assess the second hypothesis, resulting in a final sample of 243 companies and 1291 observations.

3.2. Operational Definitions of Variables

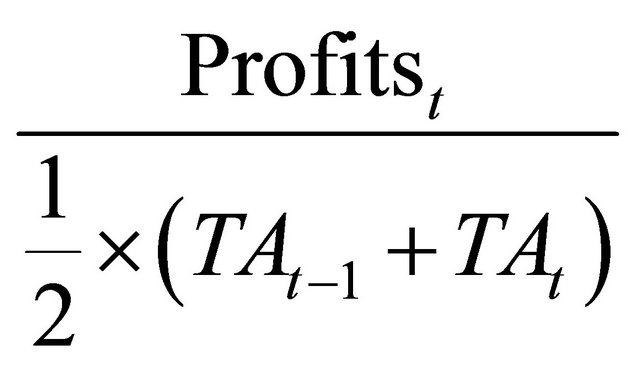

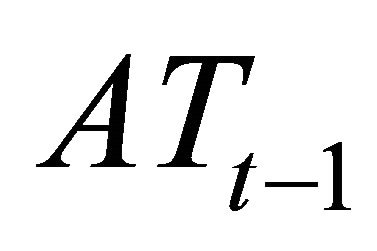

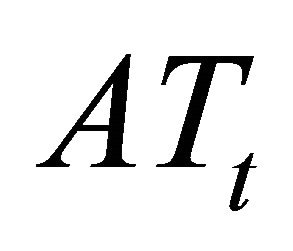

The measure used to represent company profits was Earnings before Interest and Taxes—EBIT). The used of the EBIT excludes non-recurrent items, such as extraordinary items, discount operations and special items, as well as non-operating profit (present in statements before law 11.638/2007). Non-recurrent items are problematic, as the information needed to decompose them between cash flows and accruals are not always available. The exclusion of these items permits more consistent access to the persistence of cash flow components and accruals. Profits were standardized in relation to mean total assets [27].

(2)

(2)

where:

= Current profits before interests and taxes

= Current profits before interests and taxes

= Lagged Total Assets

= Lagged Total Assets

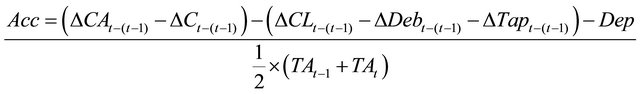

= Current Total Assets Total accruals were calculated through the balance sheet focus ([28]), as demonstrated in Equation (3):

= Current Total Assets Total accruals were calculated through the balance sheet focus ([28]), as demonstrated in Equation (3):

(3)

(3)

where:

= Variation in Current Assets

= Variation in Current Assets

= Variation in Cash and cash equivalents

= Variation in Cash and cash equivalents

= Variation in Current Liabilities

= Variation in Current Liabilities

= Variation in Short-term debts

= Variation in Short-term debts

= Variation in taxes payable

= Variation in taxes payable

= Variation in depreciation and amortization expenses

= Variation in depreciation and amortization expenses

= Lagged Total Assets

= Lagged Total Assets

= Current Total Assets The cash flows, on the other hand, were estimated by the difference between profits and accounting accruals, as shown in Equation (4).

= Current Total Assets The cash flows, on the other hand, were estimated by the difference between profits and accounting accruals, as shown in Equation (4).

(4)

(4)

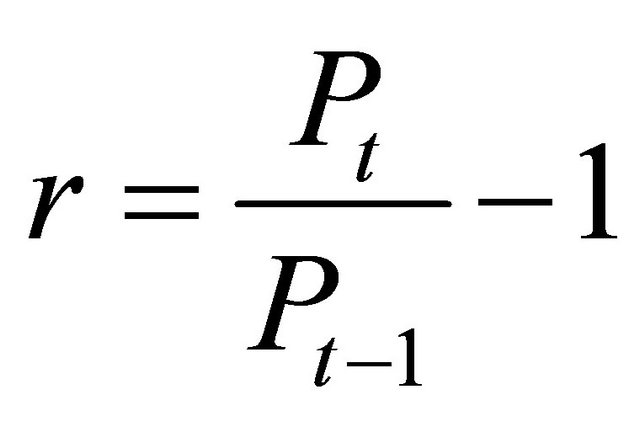

Returns were calculated for an annual period. The start of the estimation window was established at the end of the fourth months after closing off the previous year. This procedure assumes a lag between the end of the year and the date on which the financial statements are disseminated [24]. To calculate the returns, the expression described in Equation (5) was used:

(5)

(5)

With  and

and  indicating stock prices on t and t–1, respectively.

indicating stock prices on t and t–1, respectively.

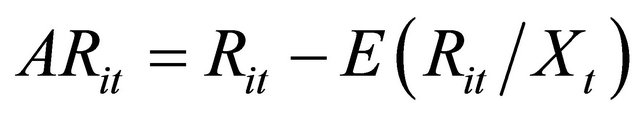

The abnormal return was given by the actual return obtained by security  minus the expected normal return

minus the expected normal return , given

, given , which is the conditioning information for the normal performance model. For a stock i and event date t, the abnormal return

, which is the conditioning information for the normal performance model. For a stock i and event date t, the abnormal return  was defined as shown in Equation (6):

was defined as shown in Equation (6):

(6)

(6)

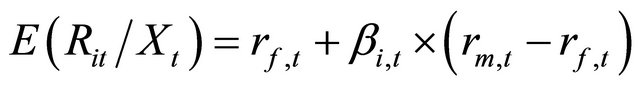

The expected return was calculated through the financial asset pricing model CAPM. The Beta of each stock was obtained using the Economática database. The riskfree return rate of the economy was represented by the Selic (basic interest rate in Brazilian economy). The proxy of the market return was the Ibovespa index return. The CAPM is expressed in Equation (7):

(7)

(7)

To assess the risk, the Beta of the sample companies’ stock was estimated. As an alternative, the Ibovespa return was included as a dependent variable. In addition, two additional measures were used: Book-to-Market and return on assets (ROA). Traditional authors like [29] detected that value-related measures like the Book-toMarket ratio were reliable to forecast expected returns on assets. The results were extended and confirmed by [30-32], which included this indicator in their three factor model. To control for company size, a proxy was used, calculated based on the natural logarithm of total company assets, a variable that was also considered significant to explain stock returns.

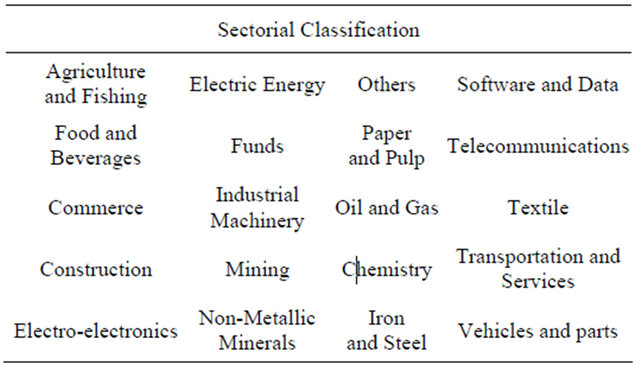

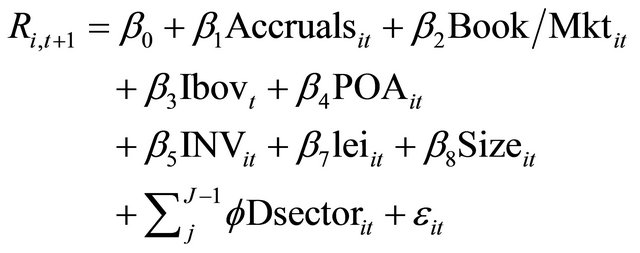

To test the influence of the activity sector on the relation between current accruals and future returns, dichotomous dummy variables were inserted to identify the sector each company belongs to (dsector). In this case, 20 sectors were considered, following the Economática classification, as displayed in Figure 1.

In view of the argument that the investment anomaly would cover the effect of the anomaly of accruals [33], a proxy was included for the Investment activity: Growth in Fixed Assets. Finally, it should be highlighted that the arrival of Law 11.638/2007 changed Corporation Law 6.404/1976. This law and the approval of Accounting Pronouncement 03 obliged publicly traded companies in Brazil to publish the Cash Flow Statement (CFS) as from 2008. This obligation could interfere in investors’ ability to separate profit components into accruals and cash flow components.

3.3. Estimated Models

To evaluate whether accruals and cash flow components affect predicted future profits differently, regressions were estimated, considering the sample companies’ behavior during the years covered in the analysis. Separating the two main profit components, a possible variation in their persistence was investigated, according to Equation (8):

(8)

(8)

If the regression demonstrates significant differences between  and

and , the hypothesis of different prediction powers between the two profit components will be confirmed. In order to actually test the anomaly of accrual, however, a relation needs to be established between stock returns and past accruals. A negative and statistically significant relation between accruals and stock returns during the immediately subsequent period

, the hypothesis of different prediction powers between the two profit components will be confirmed. In order to actually test the anomaly of accrual, however, a relation needs to be established between stock returns and past accruals. A negative and statistically significant relation between accruals and stock returns during the immediately subsequent period

Figure 1. Sectorial classification according to economática database.

demonstrates investors’ inability to understand the reversible property of accruals. To be able to test this relation, control variables were included in the model (Equation (9)), based on [7,23].

(9)

(9)

In this regression model,  measures the ability of accruals to predict future returns. When

measures the ability of accruals to predict future returns. When  is not statistically equal to zero, there are signs that an abnormal return can be reached in a strategy that involves the selection of firms based on the exhibit accruals level.

is not statistically equal to zero, there are signs that an abnormal return can be reached in a strategy that involves the selection of firms based on the exhibit accruals level.

3.4. Exploring the Anomaly of Accruals

Portfolios were constituted according to the level of accruals the firms exhibited. To evaluate whether companies with a higher level of accruals exhibited significantly lower abnormal returns that companies with low accrual levels, the following was done:

1) Classification of firms according to the level of accruals reported over the years for each year analyzed;

2) Segregation of firms into five portfolios of equal weight, based on the quintiles calculated for each firm;

3) Measurement of abnormal returns for portfolios with low as well as with high levels of accruals;

4) Comparison among returns reached through a test of differences of means.

4. Results and Discussion

This chapter presents the analyses and discussion of results. The first hypothesis established, about less persistent profits related to accruals than to cash flow components, represents a premise for the assessment of the other hypotheses. The other tests refer to the anomaly of accruals itself.

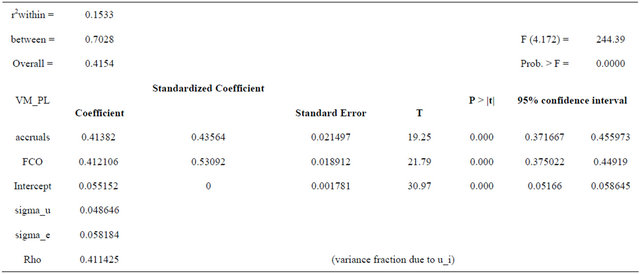

4.1. First Hypothesis—Persistence of Profits

Regression analysis with panel data was used to evaluate the first study hypothesis. First, Chow’s test was applied to compare available models for panel data. F-statistics (482, 2, 872) reached 2.26 (Prob > F = 0.000), which permits the rejection of the null hypothesis that the model that would best adapt to the data would be the estimation of the model through the Pooled Ordinary Least Squares —POLS), demonstrating the superiority of the fixed effects model, at a confidence level of 95% (Table 1).

The Hausman test offered an objective criterion for the decision between the fixed effect model and the random effect model. Hausman test statistics reached 455.44 (Prob >  = 0.000), which permitted the rejection of the null hypothesis, again leading to the conclusion that the most adequate model for the sample under analysis is the fixed effect model.

= 0.000), which permitted the rejection of the null hypothesis, again leading to the conclusion that the most adequate model for the sample under analysis is the fixed effect model.

The regression results demonstrated that the accruals are less persistent than the cash flow components. These differences are perceived in a more transparent way based on the standardized coefficients, in which accruals and cash flows presented standardized coefficients of 0.43 and 0.53, respectively. To evaluate whether the coefficients were statistically different, the hypothesis of equality between the coefficients through the F-test is appropriate. The results of that test proved, at a confidence level of 95%, that the coefficient of the accruals related to profit persistence was significantly different from the coefficient related to the cash flow components, with F-statistics (1, 2699) = 35.73 (Prob > F = 0.000).

The obtained results regarding profit persistence differed from Sloan’s findings (1996). In that author’s study, the cash flow components and accruals presented persistence coefficients bordering on 0.8 and 0.5, respectively, when calculating regressions in deciles. The coefficients detected in this study, however, are similar to [24]’s findings for the Brazilian reality, showing a persistence coefficient of 0.3945 for the cash flows and 0.3759 for the accruals.

4.2. Second Hypothesis—Effects of Current Accruals on Future Returns

Chow’s test was again applied, which permitted the conclusion that the fixed effect model was superior to the minimum least squares models for the study sample with regard to the second model under evaluation. F-test statistics (482, 2, 872) reached 2.26 (Prob > F = 0.000). At a 95% confidence level, this result induces the rejection of the null hypothesis that the model that would best adapt to the data would be the POLS model.

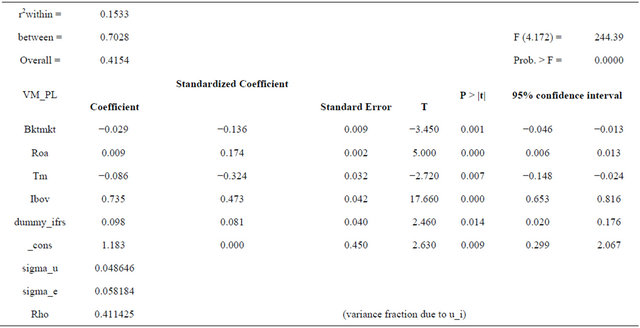

Like in the first model, to identify which of the fixed and random effects models would be the most adequate for the sample data, Hausman’s test was performed. As a result of a test statistics equal to 16.75, the null hypothesis was rejected. Thus, the result analysis concentrated on the fixed effects models presented in Table 2.

The first variable to be excluded from the model, the least significant in the regression, was exactly the study variable, i.e. accruals standardized by total assets. This exclusion leads to the rejection of the second study hypothesis. That is, a negative association between the current accruals and future abnormal returns of the companies under analysis cannot be proven. Thus, as opposed to what was detected in international literature, no empirical evidence was found that, after the arrival of new profit information, investors would revise their expectations, raising stock prices with low accrual levels and generating significant abnormal returns.

Table 1. Panel regression (fixed effects) for future profits.

Table 2. Panel regression for future returns (fixed effects).

The growth variable was the second variable excluded from the model, resulting in the final model presented. The Book-to-Market and ROA variables were significant and their signs were in line with international literature. The results signaled that, the greater the company’s valuation in the market (exhibiting a lower Book-toMarket indicator) and the higher its profitability (with a higher ROA rate), the higher the company’s future returns. In addition, the regression results demonstrate that larger companies would present a lower risk of insolvency, which would entail a lower risk and, therefore, a lower risk premium (return).

Investment Strategies Based on Information about Accruals

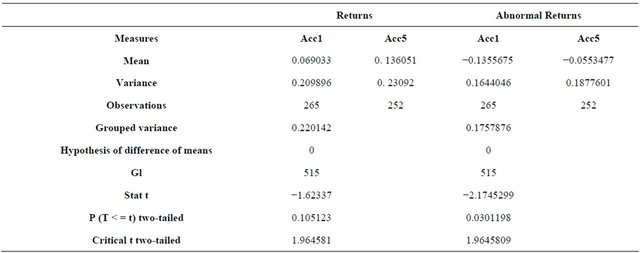

As an additional way to evaluate the effects of adjustments in the accrual base of accounting in period t on future returns, asset portfolios were constituted based on the accrual levels the companies exhibited [7]. After dividing the companies into five groups, it was evaluated whether firms with a higher level of accruals exhibited significantly lower abnormal returns that companies with a low level. In the assembly of the portfolios, it was considered that each stock portfolio was purchased and maintained for a year, i.e. a one-year return was considered for each stock.

The returns of the specific companies and the market index (Ibovespa) were calculated on the stock prices obtained from Economática. The portfolios were reached by adding up the returns of their individual stocks. To compare the mean returns, the t-test for two samples was used, always preceded by the variance analysis between the samples, a premise inherent in the application of the t-test.

According to the t-test, it is observed that the mean returns of portfolios with low accrual levels did not significantly differ from companies with high accrual levels. To reach definitive results on the effect of accruals on returns, however, the expected return part should be removed from the assets, permitting the analysis of the unexpected part only. To estimate the expected return part, the asset pricing model CAPM was used, which incorporates the variability of the security in view of market returns in its analyses.

To compare the abnormal return between the two stock portfolios, in which the first included observations with low accrual levels in the profits, and the second behaviors at the other end, the t-test for two samples was again processed, as indicated in Table 3.

Evidence for the purpose of arbitrage and for the development of investment strategies based on accrual information goes against expectations. In the year after the portfolio was established, no positive abnormal returns were identified for the portfolio with low accrual levels, differently from [7]’s findings. On the opposite, the mean return found was negative and statistically lower than the mean returns of companies with high accrual levels. Therefore, based on the analysis of nominal returns, no significant differences were detected between previously constituted portfolios. When the same returns were adjusted to the risk, however, the portfolio of assets with low accrual levels showed a statistically lower abnormal return.

5. Final Considerations

This study investigated the relation between companies’ accrual level and the market’s perception of publicly available profit information. Literature about accounting users’ perception on the different profit components is still incipient, a factor that demands further research to enhance knowledge about the understanding of accounting information in the Brazilian capital market.

The first research hypothesis established was that accruals were less persistent than cash flows. The estimated regression demonstrated that the persistence of the accrual components was significantly lower than the cash flow component, with coefficients of 0.43 and 0.53, respectively. Statistically different coefficients between the cash flow items and the profit components resulting from adjustments in the accrual bases, besides the shorter persistence of the second item, led to the acceptance of the first hypothesis.

The second hypothesis was established to detect whether Brazilian investors understand the relation demonstrated in the first study hypothesis, i.e. that the persistence of accrual-related profits was shorter than that of profits related to cash flow items. Thus, it was evaluated whether they attribute different weights to the accrual components and cash flow components of profits. Among the variables included in the estimated model to explain future stock returns, the accrual variable showed the most limited explanatory capacity, as the statistical tests demonstrated. The lack of statistical significance led to the rejection of the hypothesis, showing that there was no evidence to conclude that the investors did not understand the profit components. In addition, a lack of significant differences among economic sectors was demonstrated, as all coefficients of the dichotomous variables that served to identify the effect of companies’ activity sectors were not statistically significant.

Expanding the second hypothesis, it was verified whether negotiation strategies based on the accrual level would produce positive abnormal returns. Through the establishment of portfolios based on accrual information and inter group comparison, additional evidence was obtained, which demonstrated that investment strategies based on accrual information were unable to produce statistically significant abnormal returns.

In summary, in line with [24]’s findings, the results indicate that future stock returns cannot be estimated based on accrual information for Brazilian publicly traded companies, leading to the rejection of the second research hypothesis. That is so because no consistent and statistically significant positive abnormal returns were identified, a necessary condition for an efficient negotiation strategy. This fact reinforces the perception that accruals have little explanatory power and, hence, demonstrates that the anomaly of accruals does not exist for the Brazilian stock market.

In view of evidence on the occurrence of the anomaly of accruals, following [34], this study contributed to current accounting literature by offering additional evidence on market behavior towards accounting information in an emergent country. The incorporation of variables like the proxies for the investment level and for the adoption of IFRS, omitted in other studies, can also be appointed as an additional contribution.

Nevertheless, gaps remain, including the role of investors’ level of sophistication and financial asset pricing errors. Departing from the premise that investors do not process relevant information on profit components and overestimate the accrual effect on future profits, it seems probable that this behavior is less recurrent in company Table 3. Test of mean returns and abnormal returns between different accrual levels.

stocks traded by less sophisticated investors. That is so because this type of investor tends to understand accounting information in a less detailed way, mainly profit information, thus revealing a lesser ability to adjust their future profit estimates in function of changes between profit proportions [23].

Another opportunity for research on the effect of accounting information in the Brazilian capital market would be the segregation of accruals into broad categories, according to equity elements, i.e. between elements deriving from assets and from liabilities, leveling accruals according to their reliability level [35]. Thus, a link could be established between this reliability and profit persistence, besides permitting assessments of investors’ ability to capture and anticipate persistence differences between groups of accruals.

Finally, research that provides results on the presence of the anomaly of accruals in emerging markets is highly relevant. In those markets, weak investor protection reduces the efficacy of accounting information for decision-making purposes. Thus, a general model to evaluate the anomaly of accruals in different countries could capture the effect of institutional differences and the legal regimen (code law/common law), indicating how these factors influence investors’ ability to interpret Accounting information.

REFERENCES

- R. Ball and P. Brown, “An Empirical Evaluation of Accounting Income Numbers,” Journal of Accounting Research, Vol. 6, No. 2, 1968, pp. 159-178. doi:10.2307/2490232

- J. A. Ou, “Financial Statement Analysis and the Prediction of Stock Returns,” Journal of Accounting and Economics, Vol. 11, No. 4, 1989, pp. 295-329. doi:10.1016/0165-4101(89)90017-7

- J. S. Abarbanell and B. J. Bushee, “Fundamental Analysis, Future Earnings, and Stock Prices,” Journal of Accounting Research, Vol. 35, No. 1, 1997, pp. 1-24. doi:10.2307/2491464

- J. Y. Campbell, C. Polk and T. Vuolteenaho, “Growth or Glamour? Fundamentals and Systematic Risk in Stock Returns,” Review of Financial Studies, Vol. 23, No. 1, 2005, pp. 305-344.

- A. Ali, L.-S. Hwang and M. A. Trombley, “Accruals and Future Stock Returns: Tests of the Naive Investor Hypothesis,” Working Paper, Social Science Research Network Electronic Paper Collection, 1999.

- P. M. Dechow and I. D. Dichev, “The Quality of Accruals and Earnings: The Role of Accrual Estimation Errors,” The Accounting Review, Vol. 77, 2001, pp. 35-59.

- R. G. Sloan, “Do Stock Prices Fully Reflect Information in Accruals and Cash Flows about Future Earnings?” The Accounting Review, Vol. 71, No. 3, 1996, pp. 289-315.

- M. T. Bradshaw, S. A. Richardson and R. G. Sloan, “Do Analysts and Auditors Use Information in Accruals?” Journal of Accounting Research, Vol. 39, No. 1, 2001, pp. 45-74. doi:10.1111/1475-679X.00003

- M. Pincus, S. Rajgopal and M. Venkatachalam, “The Accrual Anomaly: International Evidence,” The Accounting Review, Vol. 82, No. 1, 2007, pp. 169-203. doi:10.2308/accr.2007.82.1.169

- A. B. Lopes and E. M. Martins, “Teoria da Contabilidade: Uma Nova Abordagem,” São Paulo, Atlas, 2005.

- I. K. el Mehdi, “An Examination of the Naive-Investor Hypothesis in Accruals Mispricing in Tunisian Firms,” Journal of International Financial Management and Accounting, Vol. 22, No. 2, 2011, pp. 131-164. doi:10.1111/j.1467-646X.2011.01048.x

- T. Zach, “Evaluating the Accrual-Fixation’ Hypothesis as an Explanation for the Accrual Anomaly,” Working Paper, Washington University, 2006.

- S. P. Kothari, E. Loutskina and V. Nikolaev, “Agency Theory of Overvalued Equity as an Explanation for the Accrual Anomaly,” Working Paper, MIT Sloan School of Management, 2006.

- D. A. Hirshleifer, K. Hou, S. H. Teoh and Y. L. Zhang, “Do Investors Overvalue Firms with Bloated Balance Sheets?” Journal of Financial Economics, Vol. 38, No. 1, 2004, pp. 297-331.

- E. F. Fama, “Efficient Capital Markets: A Review of Theory and Empirical Work,” The Journal of Finance, Vol. 25, No. 2, 1970, pp. 383-417.

- P. M. Dechow, “Accounting Earnings and Cash Flows as Measures of Firm Performance: The Role of Accounting Accruals,” Journal of Accounting and Economics, Vol. 18, No. 1, 1994, pp. 3-42. doi:10.1016/0165-4101(94)90016-7

- E. Paulo, “Manipulação das Informações Contábeis: Uma Análise Teórica e Empírica Sobre os Modelos Operacionais de Detecção de Gerenciamento de Resultados,” Faculdade de Economia, Administração e Contabilidade da Universidade de São Paulo, São Paulo, 2007.

- R. Ball and L. Shivakumar, “The Role of Accruals in Asymmetrically Timely Gain and Loss Recognition,” Journal of Accounting Research, Vol. 44, No. 2, 2006, pp. 243-255. doi:10.1111/j.1475-679X.2006.00199.x

- A. Mussa, E. Yang, R. Trovao and R. Fama, “Hipótese de Mercados Eficientes e Finanças Comportamentais: As Discussões Persistem,” FACEF Pesquisa, Vol. 11, No. 1, 2008, pp. 5-17.

- R. Lafond, “Is the Accrual Anomaly a Global Anomaly?” Working Paper, Sloan School of Management, 2005.

- A. Brav and J. B. Heaton, “Competing Theories of Financial Anomalies,” The Review of Financial Studies, Vol. 15, No. 2, 2002, pp. 575-606.

- S. A. Richardson, P. D. Wysocki and I. Tuna, “Accounting Anomalies and Fundamental Analysis: A Review of Recent Research Advances,” Working Paper, Social Science Research Network Electronic Paper Collection, 2009.

- A. Ali, L.-S. Hwang and M. A. Trombley, “Accruals and Future Stock Returns: Tests of the Naïve Investor Hypothesis,” Journal of Accounting, Auditing & Finance, Vol. 15, No. 2, 2000, pp. 45-63.

- C. M. Cupertino, “Anomalia dos Accruals no Mercado Brasileiro de Capitais,” Universidade Federal de Santa Catarina, Florianópolis, 2010.

- C. M. Cupertino, J. K. Galimberti, J. R. Costa and C. A. Newton, “Explaining Earnings Persistence: A Threshold Autoregressive Panel Unit Root Approach,” X Encontro Brasileiro de Finanças, Anais, São Leopoldo, 2009.

- L. P. Fávero, P. Belfiore, F. L. da Silva and B. L. Chan, “Análise de Dados: Modelagem Multivariada Para Tomada de Decisões,” Campus Elsevier, Rio de Janeiro, 2009.

- T. Gabrielsson and H. Giaever, “The Accruals Anomaly in Sweden,” Master Thesis in Finance, Lund School of Economics and Management, 2007.

- P. Hribar and D. W. Collins, “Errors in Estimating Accruals: Implications for Empirical Research,” Journal of Accounting Research, Vol. 40, No. 1, 2002, pp. 105-134. doi:10.1111/1475-679X.00041

- S. Basu, “Investment Performance of Common Stocks in Relation to Their Price-Earnings Ratios: A Test of the Efficient Market Hypothesis,” Journal of Finance, Vol. 32, No. 3, 1977, pp. 663-682. doi:10.1111/j.1540-6261.1977.tb01979.x

- E. F. Fama and K. R. French, “The Cross-Section of Expected Stock Returns,” The Journal of Finance, Vol. 47, No. 2, 1992, pp. 427-465. doi:10.1111/j.1540-6261.1992.tb04398.x

- E. F. Fama and K. R. French, “Common Risk Factors in the Returns on Stocks and Bonds,” Journal of Financial Economics, Vol. 33, No. 1, 1993, pp. 3-56. doi:10.1016/0304-405X(93)90023-5

- E. F. Fama and K. R. French, “Multifactor Explanation of Asset Pricing Anomalies,” The Journal of Finance, Vol. 51, No. 1, 1996, pp. 55-84. doi:10.1111/j.1540-6261.1996.tb05202.x

- J. Zhang, “Two Essays on Empirical Asset Pricing: 1. Forecasted Earnings per Share and the Cross Section of Expected Returns and 2. The Limits to Arbitrage and the Fundamental Value-to-Price Trading Strategies,” Doctoral Dissertation in Finance, Hong Kong University of Science and Technology, 2006.

- P. M. Dechow and W. L. Ge, “The Persistence of Earnings and Cash Flows and the Role of Special Items: Implications for the Accrual Anomaly,” Review of Accounting Studies, Vol. 11, No. 2-3, 2006, pp. 253-296. doi:10.1007/s11142-006-9004-1

- S. A. Richardson, R. G. Sloan, M. T. Soliman and I. Tuna, “Information in Accruals about the Quality of Earnings,” Working Paper, University of Michigan, 2001.