Journal of Human Resource and Sustainability Studies

Vol.04 No.03(2016), Article ID:69639,7 pages

10.4236/jhrss.2016.43019

Product Market Competition, Competitive Position and Employee Wage

Li Yang

School of Management, Jinan University, Guangzhou, China

Copyright © 2016 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 14 July 2016; accepted 8 August 2016; published 11 August 2016

ABSTRACT

Although executives and workers all are the enterprise value creators, most research has focused on the study of executive compensation, and the wages of employees are less. Especially, there is little literature to study the salary problem of employees in product market competition environment. Using a sample of China’s listed firms from 2002 to 2014, we examine how product market competition influences firm worker’s pay. We find that market competition will strengthen employee wage, which results from market competition augment firm’s labor demand. At the same time we also find that the higher the competitive position of enterprises in the industry, the higher the wages. The evidence has an important implication for research on product market competition and corporate behavior and provides some useful suggestions for policy makers.

Keywords:

Product Market Competition, Competitive Position, Employee Wage

1. Introduction

Product market competition plays a significant role in influencing corporate strategies and internal governance mechanisms. Imperfect competitive market is an important reason for the low efficiency of enterprises and the slack of managers. Nickel (1996) [1] first analyzed the relationship between product market and labor market. They found that product market competition will increase the total social output and labor demand, enhance the bargaining power of wages, and ultimately improve the level of labor wages.

But the current research on product market competition and compensation, mainly focused on executives, there are few literature system to study the effect of competition for employee compensation. For example, in Hart’s (1983) [2] model, product market competition unambiguously reduces the managerial slack. In the competitive product market, managers cannot afford to slack off but must instead work hard to achieve their profit goals. Karuna’s (2007) [3] study found that enterprises in the strong competitive industries to provide a stronger incentive to executives, industry characteristics affect the incentive pay managers.

Following these studies, we hypothesize that product market competition is associated with employee wage. And when the competitive position of the enterprise is not at the same time, the salary of the staff is also different.

Our study contributes to the literature in the following ways. First, it adds to the literature on the effects of product market competition. Second, previous studies have mainly examined the effect of product market competition to executive compensation, ignoring the important influence of competition on ordinary employees’ wages. Our findings provide direct evidence of the impact of competition on the wages of ordinary employees.

The remainder of this paper is organized as follows. Section 2 develops the hypotheses and discusses the related empirical predictions. Section 3 describes the research design. Section 4 presents our empirical results and some sensitivity. Section 5 presents some robustness checks. Section 6 concludes.

2. Hypothesis Development

Prior studies have indicated that changes in the product market environment will directly affect the status of the labor market. We believe that the product market will affect the company’s staff salary from the following three aspects. First, fierce competition in the product market environment has increased the staff to obtain other enterprise staff salary treatment of information channels, reducing the cost of information acquisition. Once employees through peer comparison to recognize their own pay less than other employees, they may reduce the level of effort and even slack. Second, intense competition in the product market environment has increased the total demand for labor, thus increasing the employees’ outside employment opportunities and the mobility of the labor market. Thirdly, in the fierce competition of product market environment, enterprises tend to increase staff training expenses to improve production efficiency. Once these employees job hopping, the enterprise will have to bear a higher loss. This means that the fierce competition in the product market environment will force enterprises to optimize the salary system, thereby enhancing the relative advantages of other enterprises in the same industry. Therefore, we anticipate that product market competition is more intense, the higher the staff pay. Thus, we put forward the hypothesis1:

Hypothesis 1: In the control of other factors, the product market competition is more intense, the higher the employee compensation.

The impact of product market competition on the company will be different because of the company’s competitive position. High competitive position in the market the company can plunder more market share, and thus have better performance, by virtue of the good performance, it can continue to expand the scale of production, by reducing the production cost, enhance and consolidate its position in the market, enrich its economic strength. As a result, these companies can provide higher wages. Instead the company with a competitive position in a disadvantage in the market, it is able to plunder the market share is limited, and because of the strong competitive position of the company performance is getting better and better, encroach on its market share, make itself less market share, the company’s performance is worse. So, low competitive position of the company may pay less employee wages. Thus, we put forward the hypothesis 2:

Hypothesis 2: In the control of other factors, the higher the competitive position of the enterprise, the higher the employee compensation.

3. Research Design

3.1. Sample and Data

The China Securities Regulatory Commission required listed companies to disclose executive compensation from 2001. To ensure the integrity of the sample and to effectively investigate the relationship between competition and employee wage, we examine listed companies in the 2002-2014 period, using all types of listed companies in our initial study sample except financial and insurance companies. As the financial and insurance company’s accounting statements require different from the general company, the major accounting items are also different from the general industry. So we removed the financial and insurance companies. After eliminating incomplete observations, we obtain a sample of 20,220 observations. In order to mitigate the influence of outliers, we winsorize all continuous variables at the 1% and 99% levels by year at the firm-year level. The data from the China Stock Market and Accounting Research (CSMAR) database. We use STATA software to process the data.

3.2. Definition of Variables

3.2.1. Product Market Competition

Following the literature, we measure product market competition using tow variables: the number of market participants in an industry (Num) and the Herfindahl-Hirschman Index (HHI) (Giroud and Mueller, 2011) [4] . “Num” is defined as the natural logarithm of total number of companies in an industry. The greater the value of Num, the more the number of competitors in the industry, the more intense the competition. The HHI is computed as the sum of squared market shares, market shares are computed from CSMAR using company’s sales. We exclude firms for which main-income are either missing or negative. A higher value of HHI indicates weaker product market competition.

We use Lerner Index (PCM) to measure the firms’ competitive position. Higher PCM values imply stronger competitive position, greater pricing power. Following Peress (2010) [5] , we use the following equation to calculate the firms’ competitive position.

3.2.2. Employee Wage

We use two methods to measure employee wage. The first measure (LNwage), is derived from prior study and has been used extensively in the prior literature. LNwage is defined as the cash paid to employees minus executive compensation, and then divided by the number of employees. The second measure (LNwage2), is equal to the cash paid to the employees plus the change in the salary payable to the employees minus the executive compensation, and then divided by the number of employees. Both LNwage and LNwage2 are to take the natural logarithm of the value. We use LNwage2 variables in robustness checks.

3.2.3. Control Variables

Following recommendations made in the literature, we include the following control variables (Berk et al, 2010; Zeng and Chen, 2006; Chen et al., 2010) [6] - [8] : 1) company size (Size), which is equal to the natural logarithm of the company’s total assets in that year; 2) the firm’s leverage (Lev), which is equal to the ratio of the company’s year-end long-term liabilities to its year-end total assets; 3) Chairman and CEO duality (POWER), which is equal to 1 if the chairman also holds the position of CEO, otherwise 0; 4) the firm’s capital intensity (PPE), which is equal to the ratio of the firm’s fixed assets to its year-end total assets; 5) company growth (GROWTH), which is equal to the increase rate of operating revenue.

3.3. Research Model

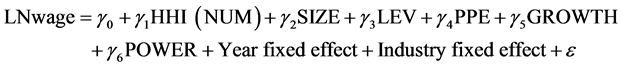

We use the following regression model to examine the relationship between product market competition and the employee wage.

To explore the effect of competitive position and employee wage, the following model is used.

4. Main Empirical Results

4.1. Descriptive Statistic

All of the variables in the regressions are winsorized at the top and bottom 1 percentile across years to control for the potential influence of outliers. Table 1 presents descriptive statistics for the variables described above. The mean (median) value of HHI is 0.064. The mean (median) firm in the sample has an NUM of 5.95. Similarly, the mean (median) values for PCM, LNwage and LNwage2 are 0.088, 10.97, 10.98. These values are consistent

Table 1. Sample description.

with prior study (Xing and Chen, 2013, Xia and Dong, 2014) [9] [10] .

4.2. Main Results

Table 2 reports the regression results for our conditional tests of hypotheses H1 and H2. As expected, we find evidence that product market competition has a statistically significant positive effect on employee wage. The results in columns 1 and 2 show that the coefficients (t-values) of HHI and NUM are −0.28 (−2.24) and 0.114 (3.25). When we add PCM to the model, the coefficients (t-values) of HHI and NUM are −0.278 (−2.23) and 0.121 (3.46), the HHI and NUM sign and significance are still unchanged. That is, in the same conditions, the product market competition is more intense, the higher the staff wage. These findings provide consistent support for Hypothesis H1.

In terms of the interaction between competitive position and employee wage, we find that the firms’ competitive position is positively associated with worker’s pay. In columns 3, the coefficients (t-values) of PCM is 0.122 (3.79). The result show that under the same conditions, the higher the competitive position of the listed companies in the industry, the higher the staff salary. Further by introducing the product market competition variables into the model, the symbol and significance of PCM remain unchanged. Thus, the findings in columns 3 - 5 provide consistent support for Hypothesis H2.

5. Robustness Checks

As robustness checks, we conduct two additional sets of tests. First, we use the LNwage2 as the employee wages’ proxy variable. We can see from Table 3 the coefficients (t-values) of HHI, NUM and PCM are −0.246 (−1.96), 0.122 (3.47), 0.129 (3.97) in columns 1 - 3. Obviously, the sign and significance of HHI, NUM and PCM remain unchanged. These findings suggest that our result have certain robustness.

Industry competition and enterprise competitive position are two aspects of the research of the economic behavior of micro enterprises. If the enterprise’s competitive position is different, the product market competition effect on the enterprises’ decision-making behavior should be different. Therefore, we examine the impact of product market competition on employee compensation when the competitive position of enterprises is not the same. We grouped the PCM according to the median, greater than the median for the high corporate competitive group, lower than the median for the low corporate competitive group. Table 3 shows the regression results in columns (4) and (5), we find that HHI for LNwage is insignificant in low firm competitive position group, whereas HHI for LNwage is significant at the 1% level in high firm competitive position group.

6. Conclusions

As an important external governance mechanism, market competition has an important influence on the strategic decision of enterprises. However, there are few studies on competition in the current accounting literature,

Table 2. Regression results.

*Statistically significant at the 10% level. **Statistically significant at the 5% level. ***Statistically significant at the 1% level.

especially in China. In addition to being the control variables, most of the accounting literature has not been systematically studied the impact of competition on the corporate. Besides, although the staff is also the creator of enterprise value, but previous research on pay is mainly concentrated in the executive, and rarely studies the wages of employees. In this paper, we use the Chinese listed companies to examine the impact of competition on the wages of employees.

We use data on Shanghai and Shenzhen A-share listed companies from 2002 to 2014. Our empirical evidence shows that product market competition has a significant positive effect on employee wage. When the market competition is intense, the enterprise in order to recruit more excellent staff to cope with the market competition pressure, is more willing to pay more wages. At the same time, we in the robustness tests also found that, when the enterprise competitive position is high, the effect is more significant. This is mainly because of the low competitive position of enterprises generally face bad operating conditions and poor performance, so they will

Table 3. Robustness checks.

*Statistically significant at the 10% level. **Statistically significant at the 5% level. ***Statistically significant at the 1% level.

not pay more wages to the employees. In sum, this paper provides evidence of the impact of competition on employee wages.

Cite this paper

Li Yang, (2016) Product Market Competition, Competitive Position and Employee Wage. Journal of Human Resource and Sustainability Studies,04,176-182. doi: 10.4236/jhrss.2016.43019

References

- 1. Nickell, S.J. (1996) Competition and Corporate Performance. Journal of Political Economy, 104, 724-746. http://dx.doi.org/10.1086/262040

- 2. Hart, O.D. (1983) The Market Mechanism as an Incentive Scheme. The Bell Journal of Economics, 14, 366-382. http://dx.doi.org/10.2307/3003639

- 3. Karuna, C. (2007) Industry Product Market Competition and Managerial Incentives. Journal of Accounting and Economics, 43, 275-297. http://dx.doi.org/10.1016/j.jacceco.2007.02.004

- 4. Giroud, X. and Mueller, H.M. (2011) Corporate Governance, Product Market Competition, and Equity Prices. The Journal of Finance, 66, 563-600. http://dx.doi.org/10.1111/j.1540-6261.2010.01642.x

- 5. Peress, J. (2010) Product Market Competition, Insider Trading, and Stock Market Efficiency. The Journal of Finance, 65, 1-43. http://dx.doi.org/10.1111/j.1540-6261.2009.01522.x

- 6. Berk, J.B., Stanton, R. and Zechner, J. (2010) Human Capital, Bankruptcy, and Capital Structure. The Journal of Finance, 65, 891-926. http://dx.doi.org/10.1111/j.1540-6261.2010.01556.x

- 7. Zeng, Q.S. and Chen, X.Y. (2006) State Stockholder, Excessive Employment and Labor Cost. Economic Research Journal, 5, 74-86.

- 8. Chen, D., Fan, C., Shen, Y. and Zhou, Y. (2010) Employee Incentive, Wage Rigidity and Firm Performance: Empirical Evidences from Chinese Unlisted SOEs. Economic Research Journal, 7, 116-129.

- 9. Xia, N. and Dong, Y. (2014). Executive Compensation, Employee Compensation and Corporate Growth—Based on Listed SMEs in China Empirical Data. Accounting Research, 9, 89-95.

- 10. Xing, L.Q. and Chen, H.W. (2013) Product Market Competition, Competitive Position and Audit Fees. Auditing Research, 3, 50-58.