American Journal of Industrial and Business Management

Vol.4 No.4(2014), Article ID:44557,10 pages DOI:10.4236/ajibm.2014.44027

Multicriteria Analysis for Improving the Innovation Capability in Small and Medium Enterprises in Emerging Countries

Juan Sepúlveda, Elizardo Vasquez

1Industrial Engineering Department, University of Santiago, Santiago, Chile

Email: juan.sepulveda@usach.cl

Copyright © 2014 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 26 February 2014; revised 26 March 2014; accepted 2 April 2014

ABSTRACT

In this paper we describe an analytical model to determine the innovation capability of a small and medium enterprise (SME) as the first step towards the continuous improvement of performance in such a dimension of an organization. The model first assesses organizational variables and classifies companies by using the Flowsort™ multicriteria method. As second step, the classification module categorizes SMEs into four classes of companies: passive, reactive, proactive, proactive. From this sorting and the subsequent analysis of the variables measured by the survey, it is determined the set of best management practices for innovation that the company needs to implement in order to increase their level of performance. The application of the model to nine companies in Chile is shown along with numerical results. Evaluations show that the classification is consistent with expert judgment and that effectively identifies those areas that contribute most to the increase of the innovation capability in the SMEs.

Keywords

Innovation Management, Multicriteria Analysis, Benchmarking, Industrial Development

1. Introduction

In many countries, research organizations are devoted to the phenomenon of innovation and they have given courses of action to be followed by the companies in their regions in order to reach profitable and competitive innovation levels. Monitoring of management processes in organizations which are characterized by outstanding levels of innovation, particularly in tangible products, combined with the observation of best business practices, has shown to be a convenient task to fulfill since global innovation does play a key role in the growth and advance of nations. Today, experts agree that the widening gap between developed and emerging countries is not due to differences in capital investments, but to their development in the area of technological innovation. This paper aims to provide a tool for augmenting innovation in emerging countries.

This work began with an adaptation of a measurement tool for national application [1] preceded by the original research of Boly [2] in a group of French SMEs, where a number of 13 selected management practices based on survey data were found to be positively correlated with the good performance in traditional innovation output variables, such as patents of new developments. Progressively, several other works [3] [4] and national applications [5] have been designed to quantify, synthesize and to incorporate new practices, thus giving origin to the work reported in this article. In this work, special attention is given to other studies seeking to establish patterns of innovative companies as measured through surveys. We compare and integrate other three methodologies in order to detect similarities and rescue the positive aspects to be added to an inventory of good practices of innovation. The common denominator in all four methodologies (three former studies and the present one) is the compliance to the indications and suggestions proposed by the OCDE in the collection and analysis of data on business innovation, indications that are published in the “Oslo Manual” [6] . The new measurement tool was applied in 2011 to nine companies in order to conduct an exploratory study and allow their classification according to the innovation performance level.

2. Theoretical Background of the Multicriteria Analysis of the Innovation Dynamics

The assessment of the innovation capability of a SME based on the performance analysis of various business management areas or dimensions that are known to have a positive impact in enhancing innovation, is the starting point for performing further studies about what practices are more effective out of a set of possible ways for improving innovation capability. The approach followed in this work identifies enterprise innovation profiles by using multicriteria decision making (MCDM) models. The criteria are related to the most significant factors that explain the innovation capability in an organization. Based on [2] , in [4] thirteen management practices that are most used by innovative enterprises are listed; these practices include aspects or dimension such as: product design planning, innovation project follow up, strategic level involvement, portfolio management, team control and feedback, infrastructure, competence-based management, incentives and support, collective learning, knowledge management, technological surveillance and business intelligence, networking, and worker’s participation in innovative ideas. These practices can be assessed by quantitative and qualitative variables and incorporated in a measurement instrument. However, the practices and their intensity need adaptation to the local o regional context due to differences in organizational culture and characteristics of the national system of innovation.

From the theoretical point of view, given a set of criteria or dimensions and a set of choices or course of actions, the problem is to classify or sort a company into one of those possible categories based on the values obtained for the evaluation criteria.

The classes or categories of SMEs can be: “Passive”, “Reactive”, “Preactive” and “Proactive” by following the characterization of their innovation strategies as given by several authors [3] [7] . By Passive SME we mean a company with little or none innovation activity, by Reactive one that acts only as a response to a serious threat, by Preactive, one that shows some innovative performance, and by Proactive a leading company with a recognized performance in innovation.

Since sorting a company in a class is different from establishing a multicriteria ranking, we use an overclassification tool. A relatively new method for doing this, is FlowSort™ [8] which is utilized for assigning actions (choices) to a set of completely ordered categories; these categories are defined either by limiting profiles or by central profiles (named “centroids”). In what follows, limiting profiles will be used since they adapt better to the problem under study. The assignment of an action to a category is based on the relative position of this action with respect to the defined reference profiles in terms or incoming or outgoing net flows of the Promethee MCDM model. In Flowsort, the set A of n actions (enterprises in our application case) to be sorted, are evaluated on q criteria Gj (j = 1...q) to be maximized.

The categories C are delimited by two boundaries and they are ordered as C1 > … > Ch > Cl > … > Ck, where Ch > Ck, with h < l, which denotes that Ch is preferred to Cl. Let R = {ri ..., rK+1} be the set of limiting profiles. Thus, a category Ch is defined by an upper and lower profile, denoted as rh and rh+1 respectively. At the same time, rh is the lower profile of Ch−1 and rh+1 is the upper profile of Ch+1. Let π(x,y) be the preference of action x over an action y, as in the Promethee method. Thus, on the basis of these preferences, positive, negative and net flows of each action x in R are computed by equations (1)-(3). Where R = R ∪ {ai} is the extended set of profiles, regardless limiting or central profiles. That is, the flows are averaged over the cardinality of set R . The rules for assigning actions ai to a category Ch are given by equations (4) and (5) when using limiting profiles. If contradiction arises between (4) and (5) then net flow is used to make final decision.

(1)

(1)

(2)

(2)

(3)

(3)

(4)

(4)

(5)

(5)

Seen as a process, once a SME has been sorted into a category, an intervention program can be put in place as to coach the innovation. A concrete experience is developed in the following section.

3. Supporting Innovative Processes in SMEs

A first model to measure the innovation management practices at industrial SMEs was designed and first tested in three companies [5] and later expanded to nine new case studies. In general, the results have shown that less than 25% of the SMEs classified in the preactive and proactive classes, or 75% were passive or reactive. Also, that the sorting tool gave an outcome consistent with an expert panel’s opinion in all of the cases. From the evaluation of the case studies and the comparisons with other methodologies for assessing the innovation performance that are being applied in Chile we decided to include two additional criteria regarding the organizational culture (Dimension N°1 in Table 1) and the ability to manage returns on the investment (ROI) in innovation (Dimension N°8 in Table 1). A new multicriteria survey was developed by integrating criteria from three other models being used in Chile and from the literature. The common denominator of all models is compliance with the indications proposed by the OECD for gathering and analyzing data on enterprising innovation [6] . The models used as a basis were:

Model 1: INE (National Institute of Statistics) “6th Survey of Innovation and 3rd of R&D Expenditures and Personnel, year 2009”, developed by the Department of Projects on Economic Statistics of INE;

Model 2: InnoScore Tool developed by the Fraunhofer IAO Institute, Germany, in 2009 [9] ;

Model 3: “Ranking of Innovative Companies in Chile, 2010”, developed by Most Innovative Companies Chile, in alliance with the IESE Business School of the University of Navarra, Spain.

The four methodologies integrated in this study are focused on the “subject”, i.e. the company, and the classification is into four categories: 1) passive, 2) reactive, 3) preactive, 4) proactive. Each category can be considered a fuzzy set to which the company as subject belongs, according to multiple criteria measured by variables that can be qualitative, through a Likert scale, or else quantitative.

The Survey

The aim of the comparative study was to obtain a synthesis of key areas in which the evaluated methodologies agree mostly, yielding a total of eight key dimensions or areas as shown in Table 1. First Model (2010) denotes our former survey and Second Model (2012) the one presented here. The 2012 survey includes a total of 20 questions all of them using a five-level Likert scale. In the survey, Level 1 means No presence of the aspect being considered or Total disagreement with the practice, whereas Level 5 means Absolute presence of the aspect being considered or Total agreement with/execution of the practice.

4. Model Application

The improved survey was placed on Internet by using a public domain survey manager: a number of 25 SMEs in

Table 1. Comparison of evaluated dimensions in different methodologies of innovation surveys.

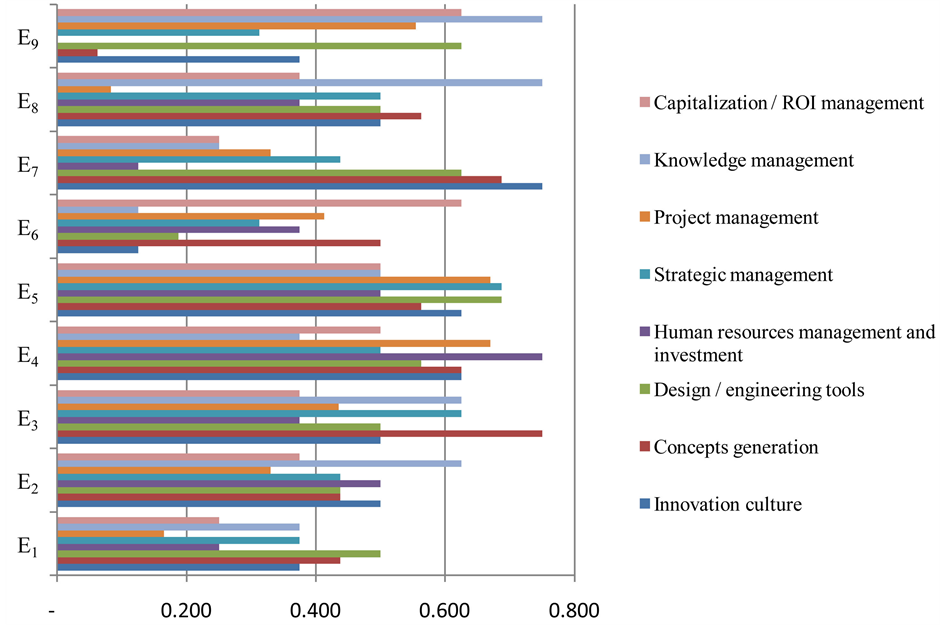

different areas of business were invited during the months of November and December 2011. Nine of them were completed and evaluated in the field. Table 2 and Figure 1 show a summary of the weighted average score (boldfaced the best criteria for each company) by using the Likert scale of five levels (one to five score). Table 3 shows the final results obtained by using the Formulas (1) through (5) of the FlowSort™ method. Table 4 shows the SMEs business sectors.

The scores in Table 2 were obtained from the questions concerning the dimensions listed in Table 5. For each dimension, there were from two up to four statements for which the interviewed company’s officer had to provide his/her agreement ranging from 1 (total disagreement) to 5 (total agreement). Furthermore, we mapped the answers in the scale 1 to 5 on the [0,1] normalized interval in steps of 0.25 points. That is, Level 1 maps onto 0.00, Level 2 onto 0.25, Level 3 onto 0.50, Level 4 onto 0.75, and Level 5 onto 1.00. Recall that in the Likert scale a value 1 means “very much in disagreement”, 2 “in disagreement”, 3 “neutral”, 4 “in agreement”, 5 “very much in agreement”.

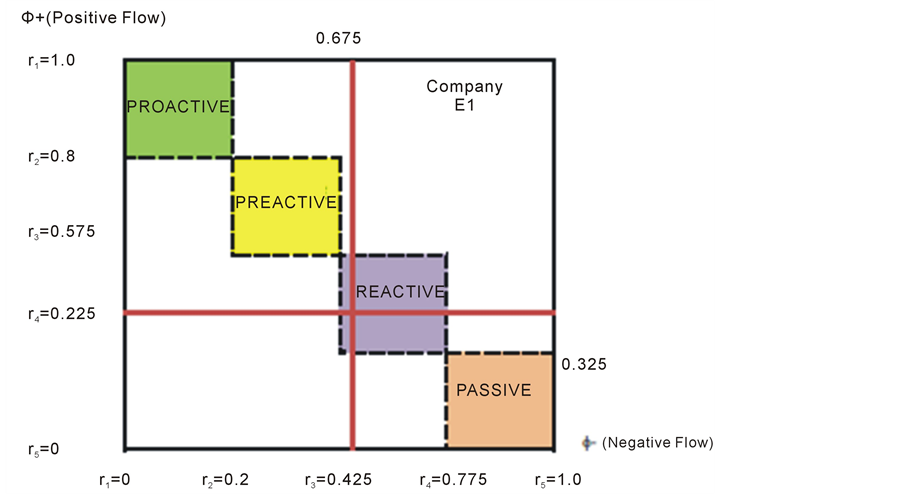

Thus, the scores in Table 2 are of qualitative nature; nonetheless the sorting method treats them as numerical scores. For example, the value 0.375 in E1-G1 (Innovation Culture) in Table 2 is the result of two questions (see row 1 in Table 5), one answered with level 3 and the other answered with level 2, each with same weight, so that 0.375 = 0.5 ⋅ 0.50 + 0.5 ⋅ 0.25. Likewise, for each of the eight criteria, the inner questions and criteria were given equal weights, but these weights of criteria and questions may be modified in other application. Due to the normalization in the scores, the limiting profiles r1 = 1.00; r2 = 0.75; r3 = 0.5; r4 = 0.25; r5 = 0.0 were equally applied to the eight criteria Gi (i = 1 ... 8). In addition, the π function used in equations (1) and (2) was a step-function, that is if x > y (x preferred to y) then π = 1 otherwise π = 0.

Figure 2 shows the example of the Company 1 and its sorting into the category Reactive according to the positive and negative flow mapping, as stated by Formulas (4) and (5).

A Service Platform

Classifying an enterprise into a category, let this be Passive (little or none innovation activity), Reactive (acts only as a response to a serious threat), Preactive (shows some innovative performance), Proactive (complies remarkably with all of the best practices) is an important mean but not the end proper. It provides the base for developing a service of measuring and benchmarking in the first place. More important, however, is providing advice to the enterprise in the specific ways the company leaders and workers can improve the performance. This gives place to a second type of service which is the change management process. This is an ongoing project at our university in the Industrial Engineering Lab, which by means of web-based information services, university workshops, student cooperative work, among other initiatives, seeks to help SMEs to continuously improve their innovation capability by enhancing the innovation management practices. Section 5 gives a summarized overview of the practices and what is measured in the survey.

5. Synthesis of Innovation Best Practices

Best practices are a coherent set of documented actions or procedures that on previous occasions have provided verifiable good or better results ; their peculiarity is that if applied again in a context as close as possible to the original, the results will be equally positive. The following recommendations and process models, deliver ways of

Table 2. Summary of the weighted average scores for the nine enterprises.

Table 3. Classification of the enterprises into categories.

conducting business areas to an environment of continuous innovation. The sections are exactly the same which includes the method of assessing the level of innovation, which measures the extent to which these recommendations are addressed successfully in the enterprise.

5.1. Innovation Culture

The organization tolerates failure and encourage failing as early as possible to avoid rising costs when developing

Table 4. Surveyed companies and their lines of business.

Table 5. Evaluated dimensions.

new concepts. Top and senior managers communicate as many employees as possible that failure risks are part of the corporate strategy, so that employees live in an environment where providing new ideas is always desired by the organization, even if the results are not the expected ones. Moreover, there is fluent communication between hierarchical levels through posters, newsletters, easy access to managers or bosses concerning new ideas, the stimuli for seeking participation, and organizational meetings. The meetings involve ideally the whole organization in an environment without existence of levels of command, so that everyone can talk as equals, remembering that the sense of the meeting is to convey new ideas and discuss the existing ones; the meeting ends with summaries of the ideas discussed. In terms of communicating the objectives of the organization, this includes poster publication of mission, vision and values, or by the web and internal bulletins, allowing employees to meet the mission statements continuously so they end up being internalized. This ensures that the ideas emerge keeping in mind the intentions of the company.

5.2. Concept Creation and Generation

Organizations hold frequent meetings to promote creativity. They set in the short and medium-term, programs of mandatory meetings within the business activities where everyone may propose changes to the company (at least once every six months). The sessions are arranged within working hours to ensure full participation and consist of

Figure 1. Plot of the weighted average scores for the nine enterprises.

Figure 2. Graphical view of the sorting of Company 1.

a talk by a senior officer who recalls the company goals for focusing the employees´ proposals. Use of brainstorming techniques is common in such meetings. Proactive companies also include the customers in the generation of ideas. They collect and analyze suggestions and criticisms by using point-of-sale mailboxes, e-mail or websites. Customers or their representatives attend the creative meetings to jointly work new ideas and projects. The company studies and tracks the use the customer gives to the product or the offered service. In the case of custom products they visit the customer facilities to know their reality. They present prototypes of new products/services to a group of clients to collect opinions before market launch. A common practice is also including suppliers in the generation of ideas by consulting them on a regular basis about new inputs (materials, parts, equipment, technologies, etc.) that can generate new business opportunities for the company. Usually, suppliers are invited to get involved early in the development of new projects by practicing concurrent engineering methodology.

5.3. Design Tools and Activities

Innovative companies have a team responsible for the innovation process. They have created an area where the main task of its members is the search for new projects. People should be sought for this work within the company in order to ensure that they are aware of the needs, objectives and capabilities of the organization. The main aspect to look at this area is the ease of communication with all other areas of the company, including top positions. Companies strengthen efforts to collect ideas by keeping an updated program of creative sessions, attached to the suggestions of practice 5.2 above. The information collected is sorted and stored by the computer, in order to rescue what is essential to start a new project. There should be design support methodologies, such as documentation with the company’s own regulations and the recommended standards that new products must meet. This will be a test protocol which should also include quality standards to which the company adheres. Depending on the characteristics of the business, the company must have appropriate design tools, namely, leading computer programs, in order to maintain some complexity in the design, in addition to the advantages of more advanced programs. It is essential that professionals are trained for using design software and tools (CAD, virtual reality, rapid prototyping, and decision support). Use of ICTs to collect the information and guarantee access to it within the company is also a key point. This may be accomplished by enabling a virtual space (e.g., a database), which in a small business may be just a computer exclusively for this type of use. The stored information is entered and managed exclusively by the innovation area or by the specific projects, but access to such information should be wider, so that it can be used for the birth of new ideas or in ongoing projects. Since information is a fundamental part of the wealth of the company, it is essential to keep it closely guarded.

5.4. Human Resources Management

Most innovative companies have continuous knowledge of the personnel's training level, such as courses and specific skills of the employees. Each training action must be recorded in a database for the ease of recovery. The company makes a list of the main skills or types of training that it needs; based on these, it develops tests for measuring the competences with particular emphasis on identifying gaps in knowledge that may lead to processing errors or accidents. If a very low level of knowledge is detected some operator training program is essential; or the employee can be put to work with a better evaluated worker, explaining him/her the reason. Best performers in innovation award their employees to stimulate them in the contribution to innovation. Awards are massively published to recognize employees who actively participate in brainstorming sessions or the innovation projects being considered. In the budget, in periods varying from one company to another, monetary resources may be allocated to fund the delivery of cash bonds or the purchasing of items or services for prizes to the most successful ideas. It should be emphasized that in the medium term it is expected that the contribution of ideas are born not only in search of prizes, but from a rooted culture of innovation.

5.5. Strategy

Innovative firms place innovation as one of the pillars of their competitive strategy, by assigning resources, and defining KPI (key performance indicators) for measuring their achievements. They develop a strategic plan, which includes an analysis of market, financial and technological capabilities. Based on the results, they set goals for the amounts of investment in innovation and the generation of new ideas. Innovation seen as a strategic factor allows employees to align with the creation of new ideas. Regarding networking for enhancing innovation capability, companies work jointly with competent R&D institutions and/or developers. For instance, they post R&D and innovation opportunities to university students (thesists), taking advantage of lower costs but rewarding the student’s professional work to maintain their motivation. Companies search the needs of R&D centers for applied research and closely monitor the studies made at these centers to capture new knowledge. They develop market research, surveys and focused marketing efforts to reveal trends or emerging needs in order to identify what aspects to enhance in existing services or products and eventually discover new business opportunities based on needs where there is yet an unclear competition. The application of surveys can reveal customer dissatisfaction or opportunities for value-adding add-ons to existing products.

5.6. Project Management

Innovative companies practice objectiveness in the project selection process. They have a team of professionals specializing in project evaluation, or a trained workforce, whose skills deliver confidence to the organization that the selection process will be objective and professional. The methodology can be accessible in search of greater transparency and motivated employees by previously knowing the outweighing aspects when their ideas are evaluated. The companies also invest in adequate planning of the innovation project and follow rigorously the execution of the projects. They have project supervisors with established standards in place so that accountability may be demanded to managers when abnormal events occur without preference or subjectivity. The responsible for the monitoring of projects in conjunction with the project manager must document progressive learning and relevant aspects in order to enrich the knowledge of activities, which can be consulted in future projects. Best performers also strengthen the resources for innovation projects. They define an innovation budget in the overall budget to avoid excessive bureaucracy in obtaining resources for short or unexpected projects. Investment limits are established and justified according to the company’s strategy, thus improving transparency for other areas of the business.

5.7. Knowledge Management and Intellectual Property

Innovative companies strengthen and plan the personnel training. They create files or presentations on new processes or equipment that is used in projects, so they can be addressed later by employees who have not participated in those projects that generated the knowledge. If the acquisition of new equipment is accompanied by training, attendees are evaluated and the best qualified rescued to subsequently transmit the knowledge to other employees through simplified training. Learning about new machinery or processes is measured on the employees. Another aspect deals with the protection of intellectual property. A company must inquire about the rules of intellectual property protection. If the company does not have a lawyer or specialist in charge, it seeks to define protection policies. Once such policies are defined (its thoroughness varies according to the philosophy and purposes of the organization) the company ensures that all staff is aware of these. They massively inform through meetings or brainstorming sessions, on the importance of not disclosing information about the company projects that could be misused by competitors or other companies. Depending on the characteristics of the innovation, the company may need to hire specialists for the administrations of patents and the subsequent technology negotiations.

5.8. Capitalization and ROI Management

This aspect may apply to any type of organization but in innovative companies it becomes crucial. It concerns the thoroughness of the project evaluation. In order to reduce the risk of falling into projects that lead to losses, the company should strictly follow the evaluation and selection process, as a practice. It is advisable to discuss what happens with projects against pessimistic scenarios (e.g., the emergence of strong competition in a new product before recovering the investment, the obsolescence of the technology utilized in a project of process improvement, etc.). Companies seek to invest in process, market and organization all at the same time, besides innovating in products or services; this guarantees the company’s efficiency, savings and organizational strength to support the launch of new products or entry into new markets. The diversified investment allows the facing of failure on a given project, with the success of the other projects that can make up the losses. In case of facing a failure, the company should study the causes, document them and if necessary, propose a reformulation of the evaluation process. On the other hand, it is essential to work with an attorney or a knowledgeable professional on the subject to know when patenting ideas as to acquire patents of competitors who may threaten existing businesses. Also, the instruction to the responsible professional to seek opportunities for selling patents or licenses of the company’s creations; this will allow risk-free steady incomes.

6. Conclusion

Measuring innovation is only the initial step in the search of better performance in this management domain of an organization; it allows the diagnosis from which to choose directions for continuous improvement of the innovation capability. Hence, the need to complement existing measurement methods by proposing best innovation practices to correct the issues identified as weak in the organization. Many existing surveys on innovation collect data by consulting general aspects of the business in relation to what they consider as innovation (product, process, marketing, or organization), but they do not bring benefits to the respondents; the results are presented in statistical reports or studies of information-processing institutions. In this paper we presented the idea of assessing and incorporating Best Innovation Practices so that the participants under study become actors of the change management process by performing actions motivated by the measurement and recognition of their own capabilities. Best Practices, as models of actions and processes, can be subjective or arbitrary for the decision maker, if they are not properly justified. For supporting and ensuring the validity of these, it was essential to carry out a comparative study of four methodologies. As the theoretical foundation that builds both the survey and the collection of bestpractice methodologies, there is the international recognition of such practices, as discussed in the literature. The results of the survey’s implementation revealed that there is not a direct relationship between the size, the resources, or the type of business, with its capacity for innovation. Neither can we conclude that firms with low innovation potential share behaviors or weak areas. This clearly indicates that there is no single path or recipe for success in innovation, but it does recognize that it is possible for each company to find where the increased efforts must be focused in order to transform a specific success in a process of continuous innovation.

Acknowledgements

The authors wish to thank DICYT-U. of Santiago-Chile, Grant N° 061117SS, MECESUP 0818 and ERPI Lab U. Lorraine, France, for their support.

References

- Sepúlveda, J., Gonzalez, J., Camargo, M. and Alfaro, M. (2010) A Metrics-Based Diagnosis Tool for Enhancing Innovation Capabilities in SMEs. International Journal of Computers, Communications and Control (IJCCC), 5, 919-928.

- Boly, V. (2004) Ingénierie de l’innovation: Organisation et méthodologies des enterprises innovantes. Lavoisier, Paris, 188 p.

- Morel, L. and Camargo, M. (2006) Comparison of Multicriteria Analysis Techniques to Improve the Innovation Process Measurement. IAMOT, Beijing.

- Rejeb, H.B., Morel, L., Boly, V. and Assielou, G. (2008) Measuring Innovation Best Practices: Improvement of an Innovation Index Integrating Threshold and Synergy Effects. Technovation, 28, 838-854.

- Sepúlveda, J., Vega, C. and González, J. (2012) A Model for Measuring and Sorting the Innovation Capability of Manufacturing Enterprises: An Application in Chile. Proceedings 21st International Conference on Production Research, Stuttgart, 31 July-4 August 2012.

- (2005) Oslo Manual: Guidelines for Collecting and Interpreting Innovation Data. Third Edition, OECD/Eurostat.

- Dodgson, M., Gann, D. and Salter, A. (2008) The Management of Technological Innovation: Strategy and Practice. Oxford University Press, Oxford, 373 p.

- Nemery, P. and Lamboray, C. (2008) FlowSort: A Flow-Based Sorting Method with Limiting or Central Profiles. TOP, 16, 90-113.

- Freitag, M. and Ganz, W. (2011) InnoScore® Service: Evaluating Innovation for Product-Related Services. Annual SRII Global Conference, San José, 29 March-2 April 2011, 214-221.