Open Journal of Social Sciences

Vol.04 No.02(2016), Article ID:63596,10 pages

10.4236/jss.2016.42011

Impact Study of Central Bank Communication to Money Market Benchmark Interest Rate

Liping Zhou, Haishan Wu

School of economics, Jinan University, Guangzhou, China

Copyright © 2016 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 14 January 2016; accepted 17 February 2016; published 22 February 2016

ABSTRACT

In the past two decades, central bank communication as a new type of monetary policy tool has continually received attention from central banks. With the gradual advance of the market-led interest rate process, most central banks establish policy operation framework which can effectively guide and regulate the market interest rate. This article is based on the implementation of China’s monetary policy tools framework, using EGARCH model to empirically study the impact of central bank communication as a new monetary policy tool to benchmark money market rates. The result indicates: the influence of central bank communication to SHIBOR is significant, the direction of impact is in accordance with the direction of monetary policy intentions; verbal communication is more remarkable than written communication in affecting the SHIBOR; increasing the central bank of communication can dampen short-term interest rate fluctuations and can play a positive role in the financial markets.

Keywords:

Central Bank Communication, SHIBOR, EGARCH Model

1. Introduction

Monetary policy regulation function has always been the responsibilities which the central bank should fulfill, but important changes took place in the performance. In the 1970s, Lucas [1] , Sargent and Wallace [2] have raised a revolutionary power in rational expectations. Central bankers believed that any expectations of monetary policy had no effect on real variables in the actual operation of monetary policy. Only surprise policy was the most effective. However, with the development of theory and practice, people come to realize the importance of the central bank communication in improving monetary policy effectiveness. Royal Bank of New Zealand in 1989 and Bank of England in 1992 came into forced openness and transparency of monetary policy, the Swedish central bank as a pioneer followed in 1993, the federal reserve released the target interest rate decisions to the public for the first time, central banks’ monetary policy operation style also gradually changed from the mysterious to transparent and open. Major performance is that central banks continue to strengthen the communication with financial market and the public.

Xie Jiebin [3] defined the central bank communication as the process that the central banks disclosed monetary policy goals, monetary policy strategy, economic forecasts and future monetary policy intentions and other relevant information to the relevant subject, and sought the transmitted information which was recognized by the market. Along with the central bank communication rising importance in the operation of monetary policy, the central bank communication are more and more concerned by scholars. At present, foreign literature studies of central bank communication mainly focus on four aspects: the impact of the central bank communication to monetary policy from theoretical analysis; the study of the central bank communication’s practice of monetary policy from empirical perspective; monetary policy committee structure and the central bank communication strategy choice; how to choose the central bank communication “degree”.

In recent years, China’s central bank also complied with the international trend to strengthen the central bank communication. Our central bank has done a lot of work in monetary policy information disclosure and communication: for example, the regular release of monetary policy implementation report, the press conference, etc. But China’s monetary policy operation strategy and financial market developed degree compared with the developed economies are quite different, special studies of the central bank communication effect in China are not only necessary but also important for improving the monetary policy operation strategy and the policy effectiveness.

Compared with western developed countries, the central bank communication in China started later. And related researches are later than western scholars. As a result, most of the studies are based on the basis of western scholars study. Xie Jiebin [3] , Cheng Junli [4] , Xu Yaping [5] , Liu Bei and Hu Haiou [6] , Sean Lee and Li Zhongfei [7] , Ji Zhibin and Zhou Xianping [8] , etc. early got into the central bank communication area. From the central bank communication’s impact on financial markets and expectations of perspective, Li Yunfeng [9] chose “China’s monetary policy implementation report” as a sample, compared central bank communication to macroeconomic variables model in the prediction of the official interest rate differences, and found that Central bank communication improved the explanatory power of official interest rates decision. Ji ZhiBin and Song Qinghua [10] used data from October 2006 to June 2011 in our country, investigated the effect of central bank communication to short-term financial market. Conclusion shows that the influence of China’s central bank communication to short-term rates and exchange rate was significant. Zhang Qiang and Hu Rongshang [11] took the stock market as an example. They used the classic macroeconomic models to analyze the impact of central bank communication to financial asset prices and found that the central bank communication could reduce the volatility of stock prices. It is advantageous to the stability of financial asset prices. Zhang Qiang and Hu Rongshang [12] empirically researched the different period of the central bank communication of all kinds of market interest rates and term spreads and credit spreads with EGARCH model. Pan Zaijian [13] used the method of undetermined coefficients to derive interest rate decision equation based on the new Keynesian macroeconomic models. And then it discussed the inner mechanism and channels of the central bank communication guiding interest rate expectations.

Overall, the sample of foreign research in central bank communication is mainly dominated by developed countries, and less related to the emerging economies. At present, the domestic scholars who study the impact of the central bank communication on the financial market are very few based on the actual implementation of the framework of China’s monetary policy to make a detailed analysis of the impact of the monetary market benchmark interest rate. Therefore, this article is based on the implementation framework of China’s monetary policy, using EGARCH model to empirically study the effect of central bank communication to SHIBOR.

2. Analysis of the Influencing Factors of the Benchmark Interest Rate of Money Market

To establish a short-term benchmark interest rate based on commercial credit, basing on the formation mechanism of the benchmark interest rate of international financial market from London, Tokyo, Hong Kong and Singapore etc. SHIBOR formally launched in January 4, 2007 after a year of exploration, brewing and 3 months of trial operation [14] . SHIBOR, as the benchmark interest rate of the money market, is the core of the interest rate system in China, is the leverage of other interest rate and financial product price, and it is the basis of macroeconomic regulation and control of the central bank’s financial indicators. The Central bank through monetary policy to adjust the benchmark interest rate, and the pricing of financial products based on the benchmark interest rate, to formulate a scientific basis of interest rates have an important effect on introduction of financial derivatives and pricing and promotion on marketization of interest rate.

Research on the situation of Chinese money market and SHIBOR operation shows that SHIBOR has the basic characteristics of the currency market benchmark interest rates [15] . SHIBOR trend more clearly reflects the implementation effect of macro-control policies when the correlation with other interest rate in money market is also constantly improving, and the further important role of SHIBOR shows in the monetary policy transmission channel [16] . SHIBOR becomes the benchmark interest rate in China’s currency market gradually established; it reflects the comprehensive consideration of the factors such as the cost of capital, the supply and demand of market funds and the expectation of monetary policy etc. SHIBOR has a strong deep influence on the money market and provides a benchmark for the pricing of financial markets, is playing an important role in the internal and external pricing of commercial banks. In improving the Conduction mechanism of monetary policy, a necessary condition that The people’s Bank of China influences the SHIBOR through the policy that means, which makes the SHIBOR accords with the purpose of monetary policy, makes SHIBOR becomes China’s benchmark interest rate.

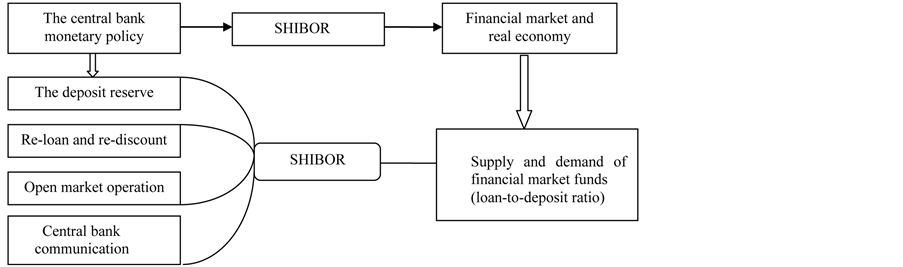

In the last dozen years, The people’s Bank of China mainly use the open market operation and the adjustment of the statutory reserve ratio and other quantitative monetary policy means, influencing the wholesale market together with the central bank communication pre control or fine tuning control, affecting the commercial bank deposit and loan interest rates, and then the macroscopic level control of China’s economy. Under the framework of the existing monetary policy in China, the influencing factors of SHIBOR also the influencing factors of commercial bank borrowing and lending behavior is similar to the conduction effect of the U.S. federal funds rate. It can be summarized in Figure 1 as follow.

In the upstream side of the SHIBOR transmission chain is the impact of central bank’s macroscopic monetary policy. The main impact factors include the central bank’s deposit reserve ratio, the re-loan and re-discount, the open market operation and the central bank communication.

1) The deposit reserve ratio

Deposit reserve policy is kind of system refers to the central bank adjusts the deposit reserve ratio of commercial banks deposit, by changing the money multiplier to control the credit expansion of financial institutions and the supply of the social money indirectly, so as to affect the national economic activities. The central bank affects the scale of the available funds of commercial banks by adjusting the deposit reserve ratio, thereby affecting the market liquidity, and then affecting the level of SHIBOR interest rates.

2) Re-loan and re-discount

The ways in which commercial banks borrow money include the central bank’s loan window, the inter-bank lending market, the buy-back market, and the foreign banks. While the central bank’s re-loan and re-discount rate affect the choice of commercial banks to borrow funds from the inter-bank lending market. Commercial banks generally choose to borrow money from the inter-bank lending market when the re-loan and re-discount rate of re discount rate is high, rising the inter-bank lending. So the re-loan and re-discount rate and the inter-

Figure 1. Factor affecting the level of SHIBOR interest rates.

bank interest rates are positively correlated.

In recent years, however, the financial macro-control mode is gradually transformed from direct control to indirect regulation. The structure and investment also had important changes when the re-loan accounted for the proportion of the base currency gradually decreased and the structure. New re-loan is mainly used to promote the adjustment of credit structure, which guide and expand the county and the agricultural credit delivery, the changes of re-discount rate can only affect the commercial banks that are required and are eligible for re discount. And then through the excess reserves of these commercial banks affect the rate of interest rates. Because of the limited access to re-discount funds of commercial banks, its impact on the inter-bank interest rates is limited. In this paper, we don’t regard it as the SHIBOR influence factor to study and analysis.

3) Open market operations

The people’s Bank of China established the primary dealer system in open market operations since 1998, which at present includes a total of 40 commercial banks. As one of the central bank’s monetary policy, the conduction effect of open market operation is softer and more directly than the other two. First of all, through open market policy the people’s Bank of China can achieve the purpose expanding and contracting of credit at any scale in a timely and appropriate amount and regulating the amount of money supply, and is more flexible than adjustment of legal deposit reserve ratio. Secondly, the open market policy can take the initiative at any time rather than passively waiting. At last, the central bank can adjust the operation constantly according to financial market information, producing a continuous effect and the society will not make a violent response easily, while the other two policies will do. Based on the advantages of the above several aspects, open market operation is the main monetary policy tool to regulate market liquidity for central bank in most developed countries. Net money is selected as a proxy variable for open market operations in this paper.

4) Central bank communication

The central bank is one of the important participants in financial markets, the monetary policy information communication behavior mainly through the signal channels and cooperative channels affect the interest rate changes. Signal channel refers to the central bank transmit information to financial markets and create information; Coordinated channel refers to the central bank through communication to reduce the information of market participants and the desired heterogeneous, it encourage interest rates to reflect economic fundamentals more realistic. The concentrated effect embody in signal channels as follows: on the one hand, when central banks give information to financial markets, market participants according to the received information update their information set, and adjust the investment decisions. This will lead to financial market funds flowing in or out, and then result in interest rates uncertainty. On the other hand, central banks disclose information of monetary policy will guide the market participant to correct their expectations of future short-term interest rate movements, and then drive long-term interest rate change. The concentrated effect embody in cooperative channels as follows: on the one hand, central banks disclose information of monetary policy can lower the information acquisition cost for market participants, speed up their learning process, reduce the prediction error and behavioral bias. And then promote interest rate to convergence the equilibrium interest rate (Xie Jiebin, 2009) [3] . On the other hand, the central bank through communication to make information known for market participants. This will help to alleviate the degree of information asymmetry between different market participants, especially when market participants’ private information less than the central bank’s message. Market participants’ information structure will tend to be more homogeneous state. And thus reduce market participants overreact or under-react for exogenous shock result of heterogeneous information.

At the downstream side of the SHIBOR transmission chain is connected with a huge financial market, the main factor is the financial market funds supply and demand situation. Level of SHIBOR quotation reflects the quotation bank’s funds demand pressure in a certain extent as well as the financial markets’ funds demand pressure. The pressure of demand for funds can financial institutions deposit ratio of the index expression, the greater the ratio of ratio of the ending balance of the loan and deposit, the more strong demand for funds in the whole society it Indicated, and it is bound to promote the level of interest rates.

3. Model Building and Data Selection

3.1. Model Building

Generally speaking, compared with the normal distribution, the distribution of time series data in the financial markets show the characteristics of biased, peak, thick tail. It may have a heteroscedasticity in regression error. With the characteristics of the data fitting, using some type of ARCH model can better show the heteroscedasticity in regression equation than the standard regression model of Variance equal. The estimated results are more effective.

Learn from Nelson [17] study, we have chosen to use EGARCH (an Exponential GARCH) model to study the central bank communication’s impact on the asset price returns and volatility. Because it not only can modify skewness, leptokurtic and asset price volatility changes over time, but also don’t need applying the nonnegative restrictions to the right side coefficient in the variance equation. This model is widely used in the central bank communication in the literature [18] [19] .

From the point of view of financial markets, the central bank communication may have two aspects influence. One is the impact to the levels of asset prices; the second is the impact to the degree of asset price volatility. To test the communication’s effects on these two aspects, we need to separately include the communication variables into the average equation and variance equation. Average equation can reflect the communication effect of asset price gains. And the variance equation can reflect communication effect of asset price volatility.

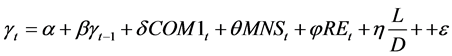

We first establish EGARCH (1, 1) model of the mean equation:

(1)

(1)

In Formula (1),  represents the interest rate at time t;

represents the interest rate at time t;  is constant;

is constant;  represents the interest rate at time t − 1 (considering the dependent variable is non-stationary);

represents the interest rate at time t − 1 (considering the dependent variable is non-stationary);  represents the central bank communication variables;

represents the central bank communication variables;  represents currency net;

represents currency net;  represents large deposit financial institutions reserve requirements; L/D represents financial institution sloan-to-deposit ratio; as random residual items represents other factors that affect interest rates, obeys a normal distribution with mean 0 and variance. The purpose of joining all these control variables is to guarantee the mean equation coefficient depicting the effect of central bank communication alone.

represents large deposit financial institutions reserve requirements; L/D represents financial institution sloan-to-deposit ratio; as random residual items represents other factors that affect interest rates, obeys a normal distribution with mean 0 and variance. The purpose of joining all these control variables is to guarantee the mean equation coefficient depicting the effect of central bank communication alone.

Because we need to test the central bank communication effect of asset price fluctuations, we also need to communicate as the virtual variable to join the EGARCH (1, 1) model in the variance equation. Assuming that equation (1) of the error term under the information set of t − 1 time obey mean 0 and variance of the normal distribution. The variance equation can be expressed as:

(2)

(2)

In Formula (2),  represents virtual variable for communication, with communication happened in 1, otherwise 0; there is no communication variable obtained by the assignment method, because we use the variance equation mainly studying the effect of communication on asset price volatility. Don’t need to reflect the direction of monetary policy, and to distinguish the directional communication intentions.

represents virtual variable for communication, with communication happened in 1, otherwise 0; there is no communication variable obtained by the assignment method, because we use the variance equation mainly studying the effect of communication on asset price volatility. Don’t need to reflect the direction of monetary policy, and to distinguish the directional communication intentions.

3.2. Specifications of Variables and Data Sources

The template is used to format your paper and style the text. All margins, column widths, line spaces, and text fonts are prescribed; please do not alter them. You may note peculiarities. For example, the head margin in this template measures proportionately more than is customary. This measurement and others are deliberate, using specifications that anticipate your paper as one part of the entire journals, and not as an independent document. Please do not revise any of the current designations.

1) Central bank communication

There are a variety of central bank communication ways. Present studies are all on the basis of such information: monetary policy implementation report, monetary policy committee meeting resolution, and press release after monetary policy committee meetings, monetary policy committee member said in an interview or delivered a keynote speech. Then they carry on the quantitative analysis. Take example by Jansen & de Haan [20] method, in this paper, the central bank of communication can be divided into two categories, written communication and oral communication. Refer to the research methods from Zhang Jiang and Hu Rongshang [12] , collecting monetary policy implementation report, central bank quarterly meeting information and Zhou Xiaochuan’s speech as the central bank communication event. Identify each quarter monetary policy implementation report and the central bank quarterly meeting information in the official website of the people’s bank of China as written communication event. Through input in Baidu news headlines Zhou Xiaochuan + monetary policy, interest rates and other monetary policy related words to search and select governor Zhou’s view on monetary policy orientation, the economic situation and other information directly related to monetary policy, such information are identified as verbal communication event. In the mean equation, According to the speech we use the content analysis method to quantify the central bank of communication (COM): contractionary monetary policy assign 1, neutral monetary policy assign 0, and easing monetary policy assign 1.

2) Money market benchmark interest rate

In this paper, different deadline rates are further chosen to fully reflect the monetary market benchmark interest rate response to the central bank of communication. Interest rates include 1 month, 3 months, 6 months, 9 months and 12 months of SHIBOR in detail, respectively represented for Shibor_1m, Shibor_3m, Shibor_6m, Shibor_9m and Shibor_1y. The data are from WIND database. These data are done based on interval of sample time during November 2, 2006 to December 26, 2014 under the limitation of availability and quality.

3) Control variable

Under the framework of monetary policy in our country, in order to eliminate the influence of other related factors on the currency market benchmark interest rate as much as possible. Finally we choose large deposit financial institutions reserve requirements, open market operations (currency net drop), financial institutions loan-to-deposit ratio as control variables. In order to study the central bank of communication’s impact on monetary market benchmark interest rate better. Currency net and large deposit financial institutions reserve requirements are from the WIND database. Financial institutions loan-to-deposit ratio is calculating the ratio of the balance of loans in financial institutions and deposit balance by its definition. The loan and deposit balance comes from local and foreign financial institutions credit balance sheet in the people’s bank of China official website.

3.3. Data Description

First of all, analyze the basic characteristics of SHIBOR. Requirement of building a financial market time series data is stable. This paper examines stationarity of all variable interest rates using ADF unit root test. Table 1 showed the results as follows, all variables under 10% significance level cannot refuse to contain a unit root. But the first order difference sequence under the significance level of 1% refused to the null hypothesis contains a unit root. This means that all variables for integrated of order 1, that is the I (1) sequence. We further statistical analysis interest rate variables found that each variable’s skewnesss is not zero, and kurtosis is not for 3. This means that the distribution of the variables present the characteristics of biased, peak, thick tail. The relevant variables connot obey the normal distribution, and it may be with heteroscedasticity in regression error.

Next, ADF test the rest of variables except for SHIBOR can be seen that the central bank communication, currency net on the time series is stationary. Large deposit financial institutions reserve requirements and financial institutionsloan-to-deposit ratio are not smooth, but time series after the first-order difference are stationary. Table 2 illustrates that skewnesss is not zero, and kurtosis is not 3 for the rest of variables except for SHIBOR. This means that the distribution of the variables present the characteristics of biased, peak, thick tail. These variables do not obey the normal distribution. Because the EGARCH model not only can correct skewness, leptokurtic and asset price volatility changes over time, but also don’t need a nonnegative restriction on the right end

Table 1. Robustness test and descriptive statistics of SHIBOR.

Table 2. Robustness test and descriptive statistics of other variables.

coefficient in the variance equation. This paper chooses the most commonly used EGARCH (1, 1) model.

In the end, we analyze China’s central bank communication times. The results are shown in Table 3. In general, there are 197 times in the central bank communication in the sample interval. Among them, 67 times to tighten monetary policy intention, neutral monetary policy intent with 74, easing monetary policy intentions have 56 times.

4. An Empirical Analysis of the Central Bank Communication Practice

4.1. Analysis on the Overall Effect of Central Bank Communication to SHIBOR

According to Formula (1) and (2), we estimate each coefficient of the mean equation and the variance equation. Only the coefficient of central bank communication and control variables are given in order to save space, as shown in Table 4. The estimated results are done ARCH-LM test, there is no ARCH effect found in residual sequence and the result is a smooth. This model can be accepted.

From the point of the mean equation, the central bank communication impact on SHIBOR is positively significant. Positive-going central bank communication indicates that central bank communication intention have a tightening of monetary policy in the future. Considering the communication plays a role by influencing the market expected, and expected changes will be quickly reflected in the financial markets. So the effect of positive communication signal to the market expected makes interest rates rise, empirical results and theoretical analysis are consistent in this paper. That illustrate the impact of central bank communication to financial markets is the same as the desired direction. From the variance equation, central bank communication has a negative impact on each period interest rate. It suggests that the increase of central bank communication can reduce interest rate fluctuations. But in the significance level, only coefficient of SHIBOR_1w, SHIBOR_3m, SHIBOR_ 6m, SHIBOR_1y is significant under 10% level. The ability of central bank disclosure information is weak, it needs to be strengthened.

4.2. Differences of SHIBOR Reactions to Different Communication Style

The central bank communication is divided into written communication and oral communication. Because two kinds of communication channels transmit signals in different ways, the effects on the market interest rates are likely to produce differences. This paper will give written communication and oral communication to Formula (1) and (2), specific results are shown in Table 5.

From the point of the mean equation, affect from written communication to each period interest rate is negative. Among them only for SHIBOR_1w, SHIBOR_1m, SHIBOR_3m’s influence is significant. This shows that written communication cannot well to guide the public expected. Reason may be that China’s monetary policy committee is not a decision-making body, only is to provide one kind of monetary policy consulting or advice. Monetary policy implementation report and the monetary policy committee meeting referred to in the most information about monetary policy have less effect on the market. It is hard to understand the central bank’s monetary policy intentions public. The influence of oral communication to each period rates are positive, overall effect analysis is consistent with communication. This suggests that the central bank communication function mainly through verbal communication. The effect of verbal communication to SHIBOR_1w, SHIBOR_1y is significant. The reason may be that the flexibility of verbal communication is strong. Central Bank Governor’s words not only represent the opinions of the monetary policy committee, but also reflect the intention of monetary policy. That makes the market and the public can better forecast movements in interest rates. From the variance

Table 3. The number of central bank communication statistics.

Table 4. The influence of central bank communication to SHIBOR.

Note: P-value is shown in brackets, ***, **,* represent in 1%, 5% and 10% significance level. The same below.

Table 5. The influence of different central bank communication channels to SHIBOR.

equation, the influence of written communication and oral communication to each period SHIBOR is indiscriminate and negative. It suggests that the increase of central bank communication can reduce interest rate fluctuations, for the financial market stability it play a positive role.

5. Conclusions and Recommendations

With the development of financial sector reform and the deepening of market interest rates change process, market benchmark interest rate as financial markets’ reference is one of the most important financial infrastructures in interest rate marketization. This paper studies the influence of the central bank communication to SHIBOR based on the influence of monetary policy tools to market benchmark interest rate with EGARCH model. To understand the interest rate transmission mechanism and effect of monetary policy has the vital significance. Empirical study indicates that central bank communication is indeed able to deliver an effective signal to the financial markets. Interest rates can make consistent response with the central bank’s policy intentions while it can reduce the rate of interest rate fluctuations. Verbal communication is better than written communication.

In fact, there are many factors which can affect the interest rate. Except China’s monetary policy tools and central bank communication, the economic policy, economic situation, and the commercial bank’s own behavior have an effect on market benchmark interest rate. There are both expected factors and not expected factors; we need to plan as a whole to consider the impact of these factors in the later research. The central bank of communication’s influence on the market benchmark interest rate is more and more obvious, but many central banks still need to improve communication. In order to fully play the role of central bank communication in monetary policy operation, our country still needs to further accelerate the process of interest rate marketization in the future, improve the mechanism of communication mechanism and interest rates and strengthen the market interest rate response to monetary policy operation. To create the basic conditions of the central bank communication, such as speeding up to promote the institutionalization of the central bank communication, flexible use central bank communication strategies and skills, etc. Then People’s Bank of China can smooth conduction of central bank communication and improve prospective and effectiveness of monetary policy in our country.

Cite this paper

LipingZhou,HaishanWu, (2016) Impact Study of Central Bank Communication to Money Market Benchmark Interest Rate. Open Journal of Social Sciences,04,69-78. doi: 10.4236/jss.2016.42011

References

- 1. Lucas Jr., R. (1972) Expectations and the Neutrality of Money. Journal of Economic Theory, 4, 103-124. http://dx.doi.org/10.1016/0022-0531(72)90142-1

- 2. Sargent, T.J. and Wallace, N. (1975) “Rational” Expectations, the Optimal Monetary Instrument, and the Optimal Money Supply Rule. Journal of Political Economy, 83, 241-254.

- 3. Xie, J.B. (2009) Central Bank Communication Theory and Practice. PhD Thesis, Xiamen University, Xiamen.

- 4. Cheng, J.L. (2010) The Monetary Policy under the Expectation of Heterogeneity: The Camera Is A Promise. International Financial Research, 3.

- 5. Xu, Y.P. (2009) Public Learning, Expectations Guiding and the Effectiveness of Monetary Policy. Financial Research, 1.

- 6. Lu, B. and Hu, H.O. (2009) Analysis of the Economic Effect of Information Communication between the Central Bank. Journal of Shanghai Jiao Tong University, 4.

- 7. Li, Y.F. and Li, Z.F. (2011) The Central Bank Communication, Macroeconomic Information and the Effectiveness of Monetary Policy. Finance and Trade, 1.

- 8. Ji, Z.B. and Zhou, X.P. (2011) The Central Bank Communication Can Be Used as a Monetary Policy Tool-Based on China’s Data “Analysis”. International Financial Research, 2.

- 9. Li, Y.F. (2011) The Central Bank’s Communication Is More Helpful in Predicting the Official Interest Rate Decision: From the “Chinese Monetary Policy Evidence”. Financial Science, 7.

- 10. Ji, Z.B. and Song, Q.H. (2012) The Financial Market Effect of Central Bank Communication—An Empirical Analysis Based on Chinese Data. Macroeconomic Research, 9.

- 11. Zhang, Q. and Hu, R.S. (2013) The Impact of the Central Bank Communication on Financial Asset Prices: The Stock Market as an Example. Finance, Trade and Economy, 8.

- 12. Zhang, J. and Hu, R.S. (2014) Research on the Influence of Central Bank Communication to the Term Structure of Interest Rates. Study of International Finance, 6.

- 13. Pan, Z.J. (2014) The Central Bank Communication and Interest Rate Expectations: Theoretical Analysis and Empirical Test. Shanghai Finance, 4.

- 14. Yi, G. (2009) Process of Interest Rates Marketization during Chinese Reform and Opening up Thirty Years. Financial Research, 1, 1-14.

- 15. Xiang, W.X. and Li, H.J. (2010) The Central Bank Benchmark Interest Rate, Open Market Operations and Indirect Monetary Control. Finance and Economics, 4.

- 16. Zhang, X.H. (2011) Overall Raise the Position of Money Market Benchmark Interest Rate for SHIBOR. Finance Research, 12, 23-25.

- 17. Nelson, D.B. (1995) Conditional Heteroskedasticity in Asset Returns: A New Approach. Econometrica: Journal of the Econometric Society, 59, 347-370. http://dx.doi.org/10.2307/2938260

- 18. Rozkrut, M., Rybiński, K., Sztaba, L. and Szwaja, R. (2007) Quest for Central Bank Communication: Does It Pay to Be “Talkative”? European Journal of Political Economy, 23, 176-206. http://dx.doi.org/10.1016/j.ejpoleco.2006.09.011

- 19. Ehrmann, M. and Fratzscher, M. (2009) Purdah—On the Rationale for Central Bank Silence around Policy Meetings. Journal of Money, Credit and Banking, 41, 517-528. http://dx.doi.org/10.1111/j.1538-4616.2009.00219.x

- 20. Jansen, D.J. and de Haan, J. (2006) Look Who’s Talking: ECB Communication during the First Years of EMU. International Journal of Finance & Economics, 11, 219-228. http://dx.doi.org/10.1002/ijfe.294