M.-C. KIM ET AL. 1035

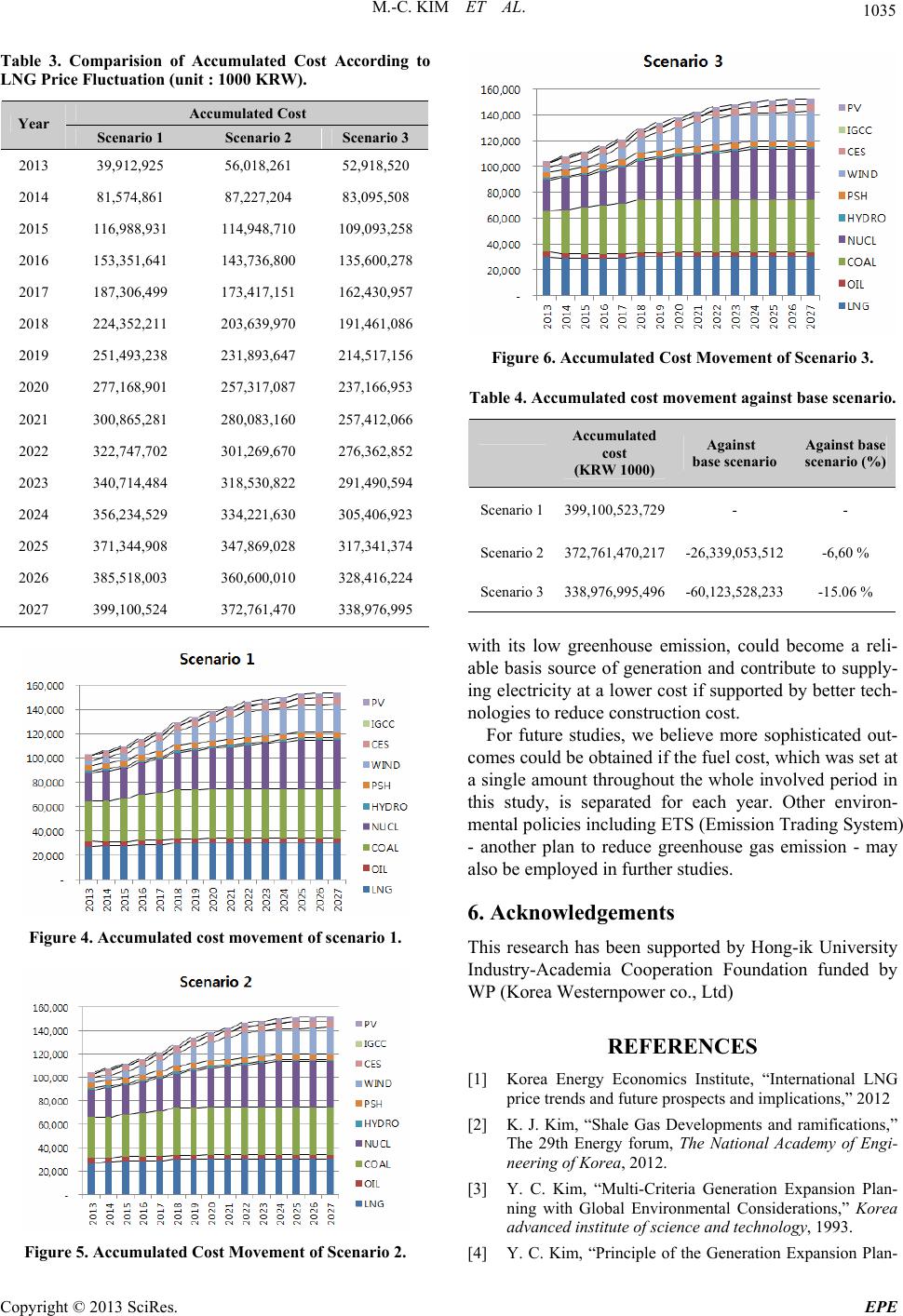

Table. Compag to 3rision of Accumulated Cost Accordin

LNG Price Fluctuation (unit : 1000 KRW).

Accumulated Cost

Year Scenario 1 Scenario 2 Scenario 3

2013 39,912,925 56,018,261 52,918,520

2014 81,574,861 87,227,204 83,095,508

2015 116,988,931 114,948,710 109,093,258

2016 153,351,641 143,736,800 135,600,278

2017 187,306,499 173,417,151 162,430,957

2018 224,352,211 203,639,970 191,461,086

2019 251,493,238 231,893,647 214,517,156

2020 277,168,901 257,317,087 237,166,953

2021 300,865,281 280,083,160 257,412,066

2022 322,747,702 301,269,670 276,362,852

2023 340,714,484 318,530,822 291,490,594

2024 356,234,529 334,221,630 305,406,923

2025 371,344,908 347,869,028 317,341,374

2026 385,518,003 360,600,010 328,416,224

2027 399,100,524 372,761,470 338,976,995

Figure 4. Accumulated cost movement of scenario 1.

Figure 6. Accumulated Cost Movement of Scenario 3.

able 4. Accumulated cost movement against base scenario. T

Accumulated Against Against base

cost

Figure 5. Accumulated Cost Movement of Scenario 2.

(KRW 1000) base scenario scenario (%)

Scenario 1399,100,523,729- -

Scenario 2372,761,470,217-26 ,339,053,512 -6,60 %

Scenario 3338,97 6,995,496- 60,123,528,233 -15.06 %

ith its low greenhouse emission, could become a reli-

isticated out-

co

6. Acknowledgements

rted by Hong-ik University

REFERENCES

[1] Korea EnergyInternational LNG

a Generation Expansion Plan-

Plan-

w

able basis source of generation and contribute to supply-

ing electricity at a lower cost if supported by better tech-

nologies to reduce construction cost.

For future studies, we believe more soph

mes could be obtained if the fuel cost, which was set at

a single amount throughout the whole involved per iod in

this study, is separated for each year. Other environ-

mental policies including ETS (Emission Trading System)

- another plan to reduce greenhouse gas emission - may

also be employed in further studies.

This research has been suppo

Industry-Academia Cooperation Foundation funded by

WP (Korea Westernpower co., Ltd)

Economics Institute, “

price trends and future prospects and implications,” 2012

[2] K. J. Kim, “Shale Gas Developments and ramifications,”

The 29th Energy forum, The National Academy of Engi-

neering of Korea, 2012.

[3] Y. C. Kim, “Multi-Criteri

ning with Global Environmental Considerations,” Korea

advanced institute of science and technology, 1993.

[4] Y. C. Kim, “Principle of the Generation Expansion

Copyright © 2013 SciRes. EPE