Paper Menu >>

Journal Menu >>

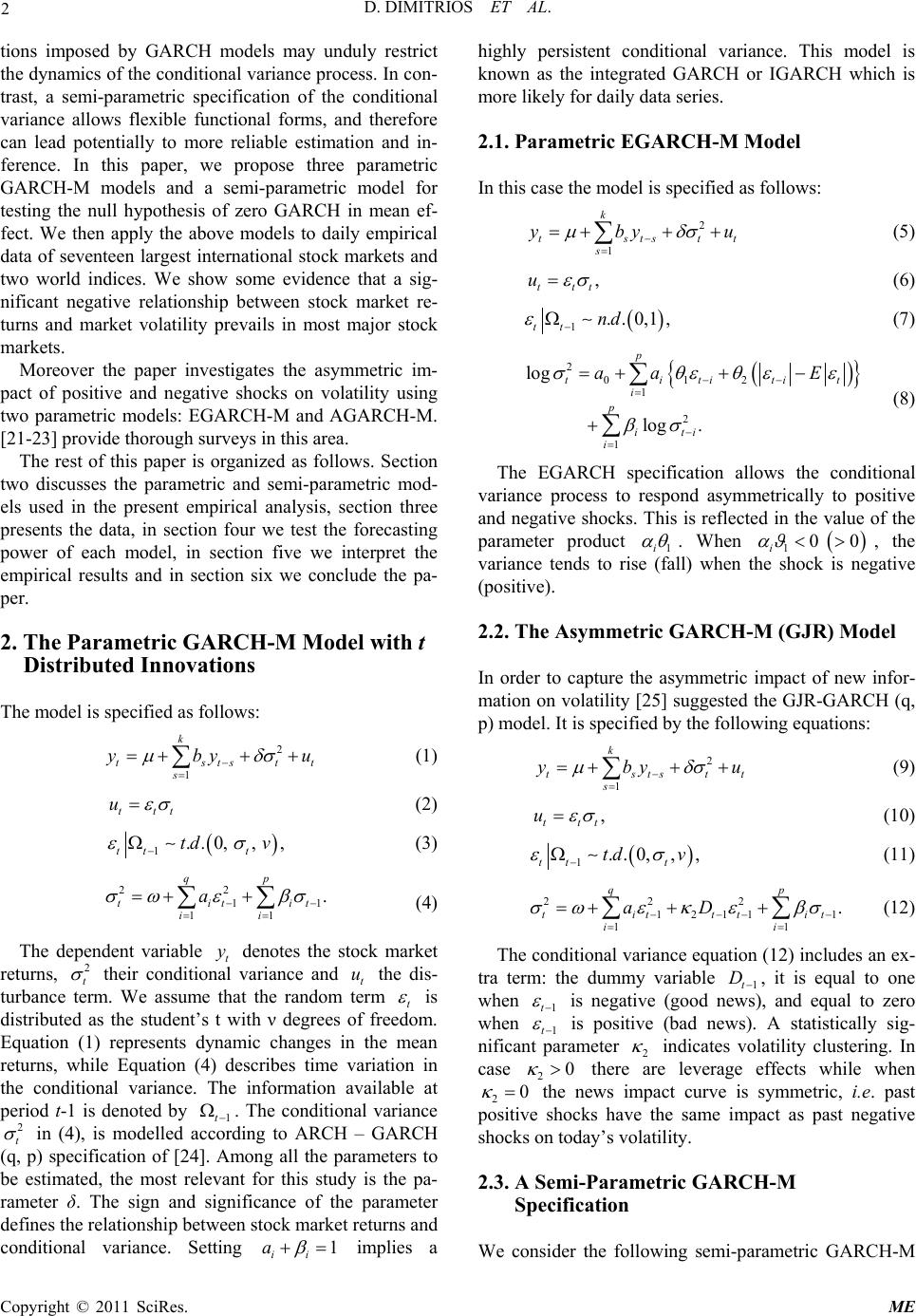

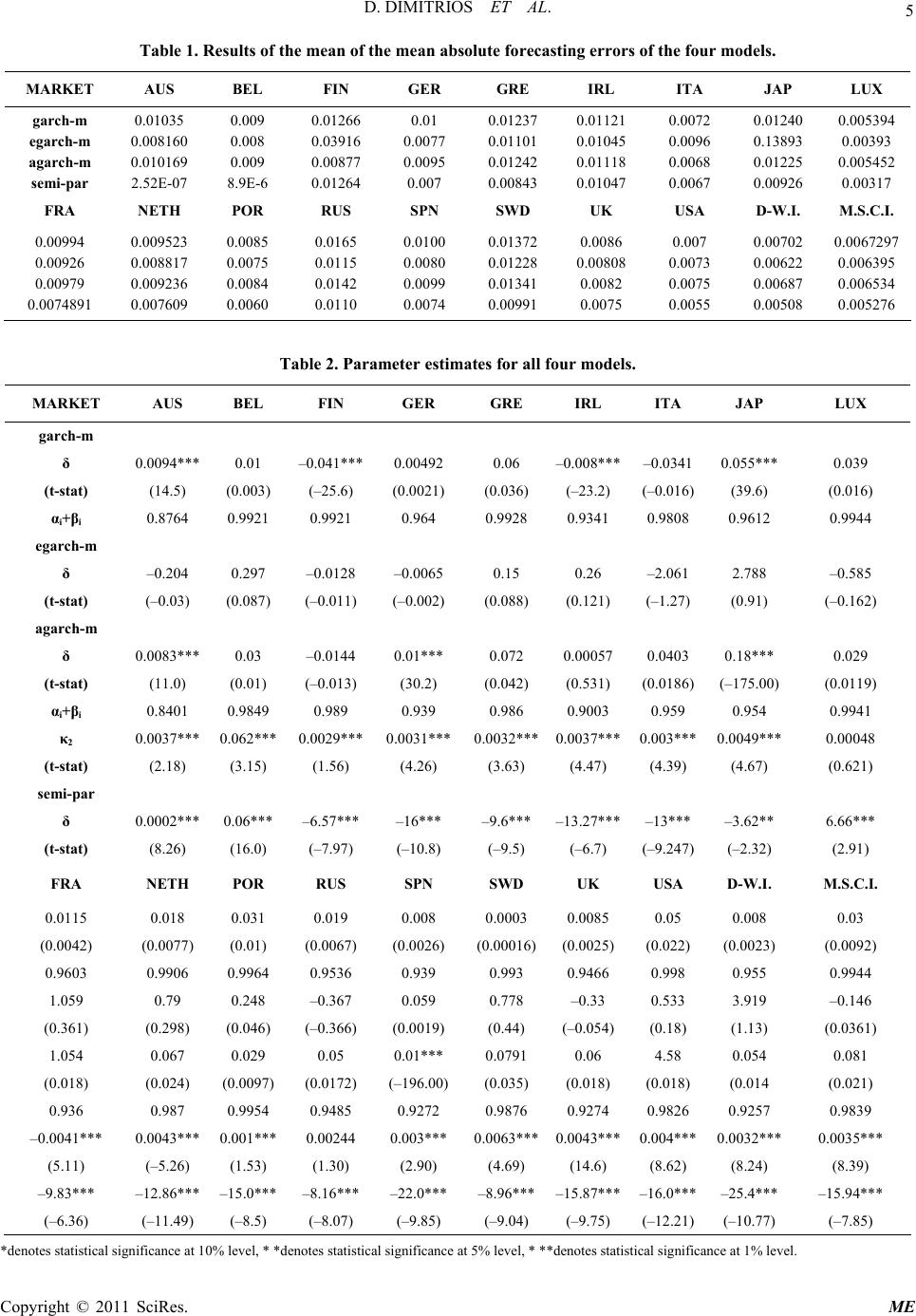

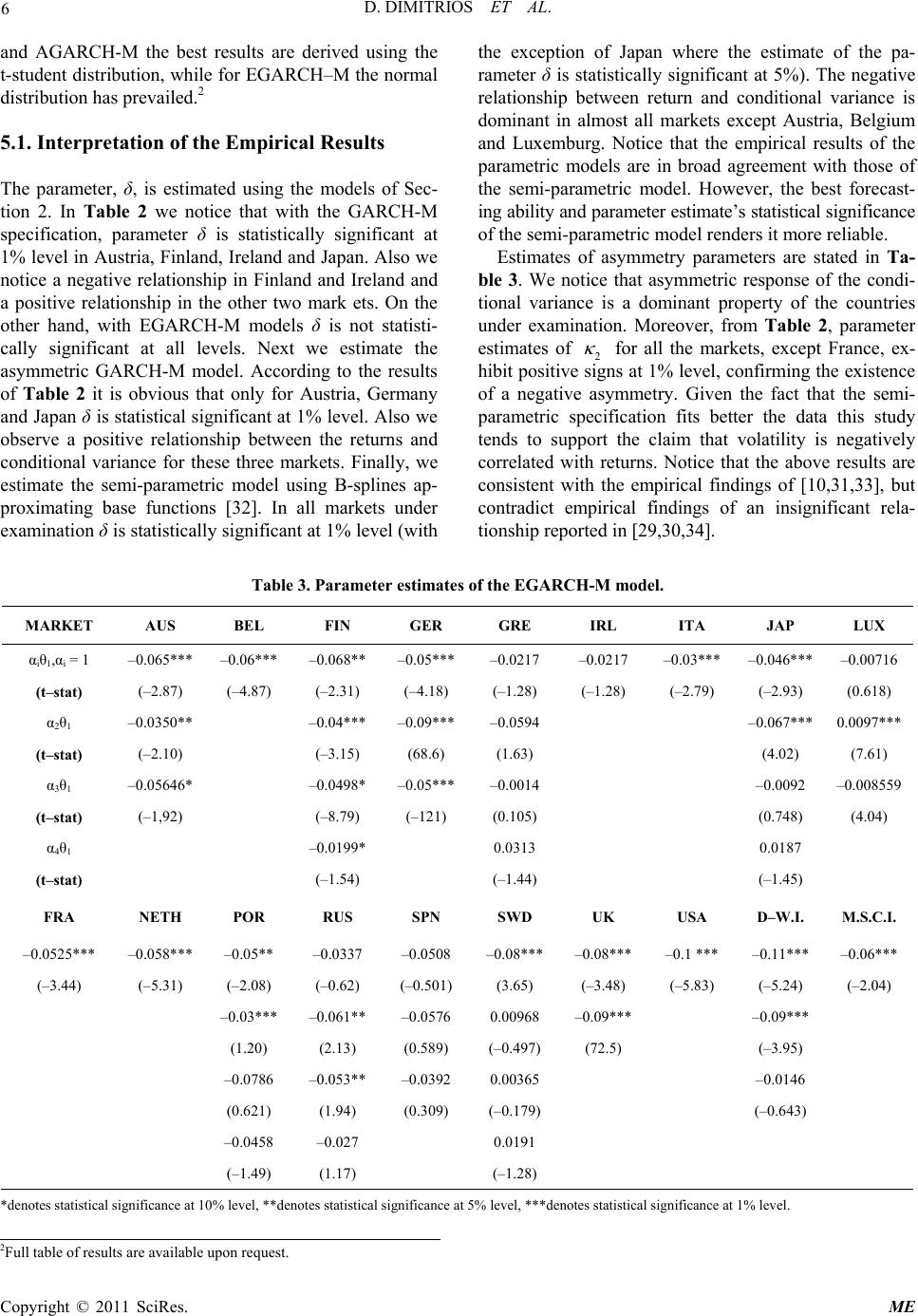

Modern Economy, 2011, 2, 1-8 doi:10.4236/me.2011.21001 Published Online February 2011 (http://www.SciRP.org/journal/me) Copyright © 2011 SciRes. ME The Relationship between Stock Returns and Volatility in the Seventeen Largest International Stock Markets: A Semi-Parametric Approach Dimitrios Dimitriou, Theodore Simos Department of Economics, University of Ioannina, Ioannina, Greece E-mail: tsimos@cc.uoi.gr Received November 4, 2010; revised December 5, 2010; accepted January 1, 2011 Abstract We empirically investigate the relationship between expected stock returns and volatility in the twelve EMU countries as well as five major out of EMU international stock markets. The sample period starts from De- cember 1992 until December 2007 i.e. up to the recent financial crisis. Empirical results in the literature are mixed with regard to the sign and significance of the mean – variance tradeoff. Based on parametric GARCH in mean models we find a weak relationship between expected returns and volatility for most of the markets. However, using a flexible semi-parametric specification for the conditional variance, we unravel significant evidence of a negative relationship in almost all markets. Furthermore, we investigate a related issue, the asymmetric reaction of volatility to positive and negative shocks in stock returns confirming a negative asymmetry in almost all markets. Keywords: Risk-Return Tradeoff, International Stock Markets, Semi-Parametric Specification of Conditional Variance 1. Introduction An important topic in asset valuation research is the tradeoff between volatility and return (typically log price changes). The theoretical asset pricing models [1-5] link returns of an asset to its own variance or to the covari- ance between the returns of stock and market portfolio. However, whether such a relationship is positive or negative has been controversial. As summarized in [6], most asset-pricing models [1-4] suggest a positive trade- off for expected returns and volatility. On the other hand, there are many empirical studies that confirm a negative relationship between returns and volatility: [7-10]. Ref- erence [11] indicates that there is a strong positive rela- tionship between risk and excess return while [12,13] as well as [9] found negative relationship in a variety of USA market indices. Reference by [14] using data from the S&P index, find a negative relationship between un- expected volatility and excess returns. Similar are the findings of [15] which use a two regime model. Accord- ing to [14] argue that the observed negative relationship provides indirect evidence of a positive relationship be- tween expected risk premium and exante volatility. In other words, if expected risk premiums are positively related to predictable volatility, then a positive unex- pected change in volatility increases future expected risk premiums and lowers current stock prices. [16] also points to a positive relationship between risk and return for USA monthly and daily returns over the period 1926-1988. [17,18] in various assets of USA market find a negative relationship before 1990. [19] reports no sig- nificant relationship in USA stock market at the same period. Also, [20] suggests that the relationship between risk and return may be time varying. These conflicting empirical results in the literature warrant further exami- nation using different and probably more appropriate econometric techniques. In this work we utilize a flexible functional form to model conditional variance. We favour this approach, given that estimation via a parametric GARCH-M model is prone to model misspecifications. Consistent estima- tion of a GARCH-M model requires that the full model is correctly specified [21]. Indeed, the problem that in- ferences drawn on the basis of GARCH-M models may be susceptible to model misspecification is well known to applied researchers. [18] argues that parameter restric-  D. DIMITRIOS ET AL. Copyright © 2011 SciRes. ME 2 tions imposed by GARCH models may unduly restrict the dynamics of the conditional variance process. In con- trast, a semi-parametric specification of the conditional variance allows flexible functional forms, and therefore can lead potentially to more reliable estimation and in- ference. In this paper, we propose three parametric GARCH-M models and a semi-parametric model for testing the null hypothesis of zero GARCH in mean ef- fect. We then apply the above models to daily empirical data of seventeen largest international stock markets and two world indices. We show some evidence that a sig- nificant negative relationship between stock market re- turns and market volatility prevails in most major stock markets. Moreover the paper investigates the asymmetric im- pact of positive and negative shocks on volatility using two parametric models: EGARCH-M and AGARCH-M. [21-23] provide thorough surveys in this area. The rest of this paper is organized as follows. Section two discusses the parametric and semi-parametric mod- els used in the present empirical analysis, section three presents the data, in section four we test the forecasting power of each model, in section five we interpret the empirical results and in section six we conclude the pa- per. 2. The Parametric GARCH-M Model with t Distributed Innovations The model is specified as follows: 2 1 k tststt s y by u (1) ttt u (2) 1..0, , , tt t td v (3) 22 11 11 . qp titit ii a (4) The dependent variable t y denotes the stock market returns, 2 t their conditional variance and t u the dis- turbance term. We assume that the random term t is distributed as the student’s t with ν degrees of freedom. Equation (1) represents dynamic changes in the mean returns, while Equation (4) describes time variation in the conditional variance. The information available at period t-1 is denoted by 1t . The conditional variance 2 t in (4), is modelled according to ARCH – GARCH (q, p) specification of [24]. Among all the parameters to be estimated, the most relevant for this study is the pa- rameter δ. The sign and significance of the parameter defines the relationship between stock market returns and conditional variance. Setting 1 ii a implies a highly persistent conditional variance. This model is known as the integrated GARCH or ΙGARCH which is more likely for daily data series. 2.1. Parametric ΕGARCH-M Model In this case the model is specified as follows: 2 1 k tststt s y by u (5) , ttt u (6) 1..0,1, tt nd (7) 2 012 1 2 1 log log. p ti titit i p iti i aa E (8) The EGARCH specification allows the conditional variance process to respond asymmetrically to positive and negative shocks. This is reflected in the value of the parameter product 1i . When 10 0 i , the variance tends to rise (fall) when the shock is negative (positive). 2.2. The Asymmetric GARCH-M (GJR) Model In order to capture the asymmetric impact of new infor- mation on volatility [25] suggested the GJR-GARCH (q, p) model. It is specified by the following equations: 2 1 k tststt s y by u (9) , ttt u (10) 1..0, , , tt t td v (11) 222 1211 1 11 . qp titttit ii aD (12) The conditional variance equation (12) includes an ex- tra term: the dummy variable 1t D, it is equal to one when 1t is negative (good news), and equal to zero when 1t is positive (bad news). A statistically sig- nificant parameter 2 indicates volatility clustering. In case 20 there are leverage effects while when 20 the news impact curve is symmetric, i.e. past positive shocks have the same impact as past negative shocks on today’s volatility. 2.3. A Semi-Parametric GARCH-M Specification We consider the following semi-parametric GARCH-M  D. DIMITRIOS ET AL. Copyright © 2011 SciRes. ME 3 model 2 011 , tttttt y aayuxau (13) where t y is the stock market returns, 2 1 1, , ttt xy , 01 ,, 'aaa is a vector of parameters to be estimated, 2 1 var ttt y is the conditional on 1t variance of t y, 1t is the information set available up to time t – 1. The error term is a martingale difference process, i.e., 10 tt Eu . We are interested in testing the null hypothesis of 0:0H versus 1:0H . The null hypothesis implies that the conditional variance 2 t does not affect the returns t y. We first examine a simple semi-parametric GARCH model of the form 22 11 , ttt mu (14) where the functional form of m is not necessary specified parametrically. In case 2 11tt mua u the model is reduced to the standard GARCH(1,1) speci- fication. Under the null 0:0H using (13), we ob- tain 11012tt t uyaay . Then, we can generalize (14) as follows 22 1121 var, , tttt tt yIgy y (15) where 1210121 , tttt t gyymyaay mu Expression (15) allows the conditional variance to de- pend on lagged values of t y. Denoting 112 , ttt zyy and substituting (15) recursively yields 22 12 3 1 tt tt d td g zgzgz gz (16) Given that 0 < γ < 1, we may approximate (16) by a finite lag model of length d: 22 12 3 1 tt tt d td g zgzgz gz (17) Equation (17) is a restricted additive model with the restriction that the different additive functions g are proportional to each other. The model allows lagged ts y being included at the right-hand side of (17). [26], in a similar framework, suggests a kernel-based method to estimate the model. Although Equation (17) is only a two-dimensional non-parametric model, it can be diffi- cult to estimate by the popular kernel method, especially when d is large. Moreover, when d is large, the kernel method can give quite unreliable estimates due to its failure to impose the additive model structure. In this work we opt to estimate (17) by the non-parametric se- ries method. The advantage of using a series method is that the additive proportional model structure is imposed directly and the estimation is performed in one step. To this end, let 0 ii y denote a series-based func- tion that can be used to approximate any univariate func- tion my. We can use a linear combination of the product base function to approximate 12 , tt gy y , ''1 0'0 00 001001 10 101011 001 1 .. , qq iiit sits ii tstsqts qts tstsqtsqts q qtsts qqqt sqt s iea yy ay yay y ayya yy ay y ay ys 1,, .d After re-arranging terms, the approximating function is of the form: 21 00001 1 1 00 1 1 1 1010 1 1 1 111 1 1 001 1 1 ds ttsts s ds qtsqts s ds ts ts s ds qtsqts s ds qqtsts s s qqqt sqt s ayy ayy ayy ayy ayy ayy 1 1 . d s (18) There are 2 11q parameters, namely γ and ,0,, ij aij q. Note that the number of parameters in model (18) does not depend on the number of lags in- cluded in the model. For example, if q is fixed, then the number of parameters is also fixed. Therefore, we can let d as T (with0dT). Asymptotically, it allows an infinite lag structure without the curse of di- mensionality problem (since q is independent of d). The estimation procedure is as follows: Under 0:0H we obtain 011ttt yaay u . Define 0tt y ya 11t ay , then 22 1ttt Ey and 2, ttt y v (19) where 2 10 tt Ey . Using the series approximation of 2 t in (18) we substitute out 2 t in (19), and re- placing 0 a and 1 a by the least squares estimators of 0 a and 1 a, we can estimate the parameters γ and ij a’s using nonlinear least squares methods. Alternatively, one can estimate ij a, 0,1, ,i, j =q, by least squares, re- gressing 2 t y ( 2 t y) on the series approximating base functions, and searching over the grid 0, 1 for op- timizing values. In order to ensure that the above pro-  D. DIMITRIOS ET AL. Copyright © 2011 SciRes. ME 4 cedure leads to a consistent estimate of the g func- tion, we need to let q and 0qT as T. The condition q ensures that the asymptotic bias goes to zero. For example, if one uses power series as the base function, then it is well known that the approxima- tion error of using a q-th order polynomial goes to zero as q. The condition 0qT ensures that the estimation variance goes to zero as sample increases. See [27,28] for more details on the rate of convergence of series estimation. Let 2 t denote the resulting nonparametric series es- timator of 2 t . Replacing 2 t by 2 t in Equation (13), we get 2 011 , tttt yaay (20) where 2 2t tt t u . We then estimate the pa- rameters vector 01 ,, 'aaa by least squares. Equa- tion (20) contains a non-parametrically generated re- gressor 2 t . Let 01 ˆ ,, 'aaa denote the resulting estimator. If one estimate the conditional variance ignor- ing the additive structure of 2 t , then can use the results of [30] and obtain the asymptotic distribution of a from: 0,na aN (21) where is the asymptotic covariance matrix. Based on the least squares estimation of (18), the non-parametric estimator 2 t , is consistent under the null hypothesis of 0:0H . Next, we discuss the selection of the number of lags d and the order of series approximation q, in finite sample applications. For a fixed value of q, the number of pa- rameters to be estimated is fixed and does not depend on d. In particular, choosing a large value of d does not lead to over fitting because the number of parameters that need to be estimated does not vary as d increases. Therefore, it makes sense to select the value of q that minimizes the AKAIKE information criteria. 3. Description of the Data To estimate the models we use daily US-dollar denomi- nated returns1 on stock indices of seventeen countries: the twelve stock markets of the European Monetary Un- ion, Italy (ITA), Greece (GRE), Germany (GER), France (FRA), Finland (FIN), Belgium (BEL), Austria (AUS), Ireland (IRL), Netherlands (NETH), Luxemburg (LUX), Spain (SPN), Portugal (POR), as well as the United States of America (USA), the United Kingdom (UK), Japan (JAP), Sweden (SWD) and Russia (RUS). We also include two world stock-indices: the international index of DataStream’s stock-exchange markets (D-W.I.) (this includes stocks from the most developed markets world- wide and it remains through many years one of the most recognized indices in the world) and the M.S.C.I (Mor- gan Stanley Capital International) world index, which is a stock index of the international market. The last index includes stocks from 23 developed markets. It is com- puted since 1969 and has been a common evaluation index of the international stock-markets. The data set starts from 4th December of 1992 and end up at 5th December of 2007, comprising 3.914 observa- tions. The source is the DataStream database. Daily re- turns of each country are calculated using the first loga- rithmic differences of general indices that include divi- dends. 4. Forecasting Power of the Models In this section we empirically investigate the four models, stated in Section 2, in terms of their forecasting ability. The test statistic is the mean absolute error (MAE) which is a measurement of the co-cumulative forecasting error of the model. In our analysis the MAE is calculated from the monthly sub-samples of observations. Therefore, we are able to obtain a MAE figure for each month. The results are presented on Table 1. We notice that the best forecasting model is the semi-parametric. In almost all markets the average MAE of the semi-parametric model is smaller of that of the parametric models. The second best forecasting model is EGARCH except of Japan and Italy where the GARCH-M and AGARCH- M models provide a smaller MAE. Moreover, the models GARCH-M and AGARCH-M have a similar forecasting ability with AGARCH-M being slightly ahead. Based on the results reported in Table 1 we conclude that forecasting ability of the semi-parametric model is broadly superior. 5. Empirical Results Notice that the conditional variance of the returns for each market is calculated using the stock returns instead of the excess stock returns. The excess return of a stock is defined as the difference between return and the risk-free rate that is dominant in the market. [6,18,29,30] agree that using returns is broadly equivalent with excess returns. In the present study for the estimation of the conditional variance we use returns computed by log price differences. For the three models: GARCH-M, EGARCH-M, and AGARCH-M, we decide the appro- priate distribution and number of lags p and q based on the AKAIKE criterion. So, for the models GARCH-M 1As suggested by [31], calculating the returns in U.S. dollars eliminates the local inflation.  D. DIMITRIOS ET AL. Copyright © 2011 SciRes. ME 5 Table 1. Results of the mean of the mean absolute forecasting errors of the four models. MARKET AUS BEL FIN GER GRE IRL ITA JAP LUX garch-m egarch-m agarch-m semi-par 0.01035 0.008160 0.010169 2.52E-07 0.009 0.008 0.009 8.9E-6 0.01266 0.03916 0.00877 0.01264 0.01 0.0077 0.0095 0.007 0.01237 0.01101 0.01242 0.00843 0.01121 0.01045 0.01118 0.01047 0.0072 0.0096 0.0068 0.0067 0.01240 0.13893 0.01225 0.00926 0.005394 0.00393 0.005452 0.00317 FRA NETH POR RUS SPN SWD UK USA D-W.I. M.S.C.I. 0.00994 0.00926 0.00979 0.0074891 0.009523 0.008817 0.009236 0.007609 0.0085 0.0075 0.0084 0.0060 0.0165 0.0115 0.0142 0.0110 0.0100 0.0080 0.0099 0.0074 0.01372 0.01228 0.01341 0.00991 0.0086 0.00808 0.0082 0.0075 0.007 0.0073 0.0075 0.0055 0.00702 0.00622 0.00687 0.00508 0.0067297 0.006395 0.006534 0.005276 Table 2. Parameter estimates for all four models. MARKET AUS BEL FIN GER GRE IRL ITA JAP LUX garch-m δ 0.0094*** 0.01 –0.041***0.00492 0.06 –0.008***–0.0341 0.055*** 0.039 (t-stat) (14.5) (0.003) (–25.6) (0.0021) (0.036) (–23.2) (–0.016) (39.6) (0.016) αi+βi 0.8764 0.9921 0.9921 0.964 0.9928 0.9341 0.9808 0.9612 0.9944 egarch-m δ –0.204 0.297 –0.0128 –0.0065 0.15 0.26 –2.061 2.788 –0.585 (t-stat) (–0.03) (0.087) (–0.011) (–0.002) (0.088) (0.121) (–1.27) (0.91) (–0.162) agarch-m δ 0.0083*** 0.03 –0.0144 0.01*** 0.072 0.00057 0.0403 0.18*** 0.029 (t-stat) (11.0) (0.01) (–0.013) (30.2) (0.042) (0.531) (0.0186) (–175.00) (0.0119) αi+βi 0.8401 0.9849 0.989 0.939 0.986 0.9003 0.959 0.954 0.9941 κ2 0.0037*** 0.062*** 0.0029***0.0031***0.0032***0.0037***0.003*** 0.0049*** 0.00048 (t-stat) (2.18) (3.15) (1.56) (4.26) (3.63) (4.47) (4.39) (4.67) (0.621) semi-par δ 0.0002*** 0.06*** –6.57***–16*** –9.6*** –13.27***–13*** –3.62** 6.66*** (t-stat) (8.26) (16.0) (–7.97) (–10.8) (–9.5) (–6.7) (–9.247) (–2.32) (2.91) FRA NETH POR RUS SPN SWD UK USA D-W.I. M.S.C.I. 0.0115 0.018 0.031 0.019 0.008 0.0003 0.0085 0.05 0.008 0.03 (0.0042) (0.0077) (0.01) (0.0067) (0.0026) (0.00016)(0.0025)(0.022) (0.0023) (0.0092) 0.9603 0.9906 0.9964 0.9536 0.939 0.993 0.9466 0.998 0.955 0.9944 1.059 0.79 0.248 –0.367 0.059 0.778 –0.33 0.533 3.919 –0.146 (0.361) (0.298) (0.046) (–0.366) (0.0019) (0.44) (–0.054)(0.18) (1.13) (0.0361) 1.054 0.067 0.029 0.05 0.01*** 0.0791 0.06 4.58 0.054 0.081 (0.018) (0.024) (0.0097) (0.0172) (–196.00) (0.035) (0.018) (0.018) (0.014 (0.021) 0.936 0.987 0.9954 0.9485 0.9272 0.9876 0.9274 0.9826 0.9257 0.9839 –0.0041*** 0.0043*** 0.001*** 0.00244 0.003*** 0.0063***0.0043***0.004*** 0.0032*** 0.0035*** (5.11) (–5.26) (1.53) (1.30) (2.90) (4.69) (14.6) (8.62) (8.24) (8.39) –9.83*** –12.86*** –15.0*** –8.16***–22.0*** –8.96***–15.87***–16.0*** –25.4*** –15.94*** (–6.36) (–11.49) (–8.5) (–8.07) (–9.85) (–9.04) (–9.75) (–12.21) (–10.77) (–7.85) *denotes statistical significance at 10% level, * *denotes statistical significance at 5% level, * **denotes statistical significance at 1% level.  D. DIMITRIOS ET AL. Copyright © 2011 SciRes. ME 6 and AGARCH-M the best results are derived using the t-student distribution, while for EGARCH–M the normal distribution has prevailed.2 5.1. Interpretation of the Empirical Results The parameter, δ, is estimated using the models of Sec- tion 2. In Table 2 we notice that with the GARCH-M specification, parameter δ is statistically significant at 1% level in Austria, Finland, Ireland and Japan. Also we notice a negative relationship in Finland and Ireland and a positive relationship in the other two mark ets. On the other hand, with EGARCH-M models δ is not statisti- cally significant at all levels. Next we estimate the asymmetric GARCH-M model. According to the results of Table 2 it is obvious that only for Austria, Germany and Japan δ is statistical significant at 1% level. Also we observe a positive relationship between the returns and conditional variance for these three markets. Finally, we estimate the semi-parametric model using B-splines ap- proximating base functions [32]. In all markets under examination δ is statistically significant at 1% level (with the exception of Japan where the estimate of the pa- rameter δ is statistically significant at 5%). The negative relationship between return and conditional variance is dominant in almost all markets except Austria, Belgium and Luxemburg. Notice that the empirical results of the parametric models are in broad agreement with those of the semi-parametric model. However, the best forecast- ing ability and parameter estimate’s statistical significance of the semi-parametric model renders it more reliable. Estimates of asymmetry parameters are stated in Ta- ble 3. We notice that asymmetric response of the condi- tional variance is a dominant property of the countries under examination. Moreover, from Table 2, parameter estimates of 2 for all the markets, except France, ex- hibit positive signs at 1% level, confirming the existence of a negative asymmetry. Given the fact that the semi- parametric specification fits better the data this study tends to support the claim that volatility is negatively correlated with returns. Notice that the above results are consistent with the empirical findings of [10,31,33], but contradict empirical findings of an insignificant rela- tionship reported in [29,30,34]. Table 3. Parameter estimates of the EGARCH-M model. MARKET AUS BEL FIN GER GRE IRL ITA JAP LUX αiθ1,αi = 1 –0.065*** –0.06*** –0.068** –0.05*** –0.0217 –0.0217 –0.03*** –0.046*** –0.00716 (t–stat) (–2.87) (–4.87) (–2.31) (–4.18) (–1.28) (–1.28) (–2.79) (–2.93) (0.618) α2θ1 –0.0350** –0.04*** –0.09*** –0.0594 –0.067*** 0.0097*** (t–stat) (–2.10) (–3.15) (68.6) (1.63) (4.02) (7.61) α3θ1 –0.05646* –0.0498* –0.05*** –0.0014 –0.0092 –0.008559 (t–stat) (–1,92) (–8.79) (–121) (0.105) (0.748) (4.04) α4θ1 –0.0199* 0.0313 0.0187 (t–stat) (–1.54) (–1.44) (–1.45) FRA NETH POR RUS SPN SWD UK USA D–W.I. M.S.C.I. –0.0525*** –0.058*** –0.05** –0.0337 –0.0508 –0.08*** –0.08*** –0.1 *** –0.11*** –0.06*** (–3.44) (–5.31) (–2.08) (–0.62) (–0.501) (3.65) (–3.48) (–5.83) (–5.24) (–2.04) –0.03*** –0.061** –0.0576 0.00968 –0.09*** –0.09*** (1.20) (2.13) (0.589) (–0.497) (72.5) (–3.95) –0.0786 –0.053** –0.0392 0.00365 –0.0146 (0.621) (1.94) (0.309) (–0.179) (–0.643) –0.0458 –0.027 0.0191 (–1.49) (1.17) (–1.28) *denotes statistical significance at 10% level, **denotes statistical significance at 5% level, ***denotes statistical significance at 1% level. 2Full table of results are available upon request.  D. DIMITRIOS ET AL. Copyright © 2011 SciRes. ME 7 6. Conclusions In this paper we empirically investigated the relationship between expected returns and conditional variance in twelve stock markets of the European Union as well as five large stock markets and two world indices. Most asset pricing models [1-4] predict a positive risk- return tradeoff. In order to investigate this, both parametric and semi-parametric estimation methods of the conditional variance have been applied to daily data from the above markets. Based on the semi-parametric specification, we find a statistically significant negative relationship of the risk-return tradeoff in most markets. There are only three exceptions: Austria, Belgium and Luxemburg. Further- more, we find significant evidence of a negative asym- metry in almost all markets confirming the previous em- pirical findings. 7. Acknowledgements We wish to thank an anonymous referee of this Journal for his/her useful comments, which improved the paper. The usual disclaimer applies. 8. References [1] W. F. Sharpe, “Capital Asset Prices: A Theory of Market Equilibrium under Conditions of Market Risk,” Journal of Finance, Vol. 19, No. 3, September 1964, pp. 425-442. doi:10.2307/2977928 [2] J. Linter, “The Valuation of Risky Assets and the Selec- tion of Risky Investments in Stock Portfolios and Capital Budgets,” Review of Economics and Statistics, Vol. 47, No. 1, February 1965, pp. 13-37. doi:10.2307/1924119 [3] J. Mossin, “Equilibrium in a Capital Asset Market,” Eco- nometrica, Vol. 34, No. 4, October 1966, pp. 768-783. doi:10.2307/1910098 [4] R. C. Merton, “An Intertemporal Capital Asset Pricing Model,” Econometrica, Vol. 41, No. 5, September 1973, pp. 867-887. doi:10.2307/1913811 [5] R. C. Merton, “On Estimating the Expected Return on the Market: An Exploratory Investigation,” Journal of Fi- nancial Economics, Vol. 8, No. 4, 1980, pp. 323-361. doi:10.1016/0304-405X(80)90007-0 [6] R. T. Baillie and R. P. DeGennaro, “Stock Returns and Volatility,” Journa1 of Financia1 and Quantitative Ana- 1ysis, Vol. 5, No. 2, June 1990, pp. 203-214. [7] F. B1ack, “Studies of Stock Price Volatility Changes,” Proceedings of the 1976 Meeting of Business and Eco- nomics Statistics Section of the American Statistical As- sociation, Vol. 27, 1976, pp. 399-418. [8] J. Cox and S. Ross, “The Valuation of Options for Alter- native Stochastic Process,” Journa1 of Financia1 Eco- nomics, Vol. 3, No.1-2, 1976, pp. 145-166. [9] G. Bakaert and G. Wu, “Asymmetric Volatility and Risk In Equity Markets,” Review of Financial Studies, Vol. 13, No. 1, 2000, pp. 1-42. doi:10.1093/rfs/13.1.1 [10] R. Whitelaw, “Stock Market Risk and Return: An Em- pirical Equilibrium Approach,” Review of Financial Studies, Vol. 13, No. 3, 2000, pp. 521-547. doi:10.1093/rfs/13.3.521 [11] R. Pindyck, “Risk, Inflation and the Stock Market,” American Economic Review, Vol. 74, 1984, pp. 335-351. [12] R.J. Shiller, “Do Prices Move too Much to be Justified by Subsequent Changes in Dividends,” American Economic Review, Vol. 71, No. 3, June 1981, pp. 421-436. [13] J. Poterba and L. Summers, “The Persistence of Volatility and Stock Market Fluctuations,” American Economic Re- view, Vol. 76, No. 5, 1986, pp. 1142-1151. [14] K. R. French, G. W. Schwert and R. F. Stambaugh, “Ex- pected Stock Returns and Volatility,” Journal of Finan- cial Economics, Vol. 19, No. 1, 1987, pp. 3-30. doi:10.1016/0304-405X(87)90026-2 [15] H. A. Shawky and A. Marathe, “Expected Stock Returns and Volatility in a Two Regime Market,” The Journal of Economics and Business, Vol. 47, No. 5, December 1995, pp. 409-422. doi:10.1016/0148-6195(95)00035-6 [16] J. Y. Campbell and L. Hentschel, “No News is Good News: An Asymmetric Model of Changing Volatility in Stock Returns,” Journal of Financial Economics, Vol. 31, No. 3, 1992, pp. 281-318. doi:10.1016/0304-405X(92)90037-X [17] E. F. Fama and W. G. Schwert, “Asset Returns and Infla- tion,” Journal of Financial Economics, Vol. 5, No. 2, 19- 77, pp. 115-146. [18] D. Nelson, “Conditional Heteroscedasticity in Asset Re- turns: A New Approach,” Econometrica, Vol. 59, No. 2, March 1991, pp. 347-370. doi:10.2307/2938260 [19] K. C. Chan, A. Karolyi and R. Stulz, “Global Financial Markets and the Risk Premium on US Equity,” Journal of Financial Economics, Vol. 32, No. 2, 1992, pp. 137-167. doi:10.1016/0304-405X(92)90016-Q [20] C. R. Harvey, “Time-Varying Conditional Covariances in Tests of Asset Pricing Models,” Journal of Financial Economics, Vol. 24, No. 2, 1989, pp. 289-317. doi:10.1016/0304-405X(89)90049-4 [21] Τ. Bollers1ev, R. Y. Chou and K. F. Kroner, “ARCH Modeling in Finance: A Review of the Theory and Em- pirical Evidence,” Journal of Econometrics, Vol. 52, No. 1-2, 1992, pp. 5-59. [22] T. Bollerslev, R. F. Engle and D. B. Nelson, “ARCH Models,” In: R. F. Engle and D. McFadden, Eds., Hand- book of Econometrics, North-Holland, Vol. 4, 1994, pp. 2959-3038. [23] H. Ludger, “All in the Family Nesting Symmetric and Asymmetric GARCH Models,” Journal of Financial Economics, Vol. 39, No. 1, September 1995, pp. 71-104. doi:10.1016/0304-405X(94)00821-H [24] Τ. Bollerslev, “Generalized Autoregressive Conditional Heteroscedasticity,” Journa1 of Econometrics, Vol. 31,  D. DIMITRIOS ET AL. Copyright © 2011 SciRes. ME 8 No. 3, 1986, pp. 307-327. [25] R. F. Eng1e and V. K. Ng, “Measuring and Testing the Impact of News on Volatility,” Journa1 of Finance, Vol. 48, No. 5, 1993, pp. 1749-1778. [26] L. Yang, “Direct Estimation in an Additive Model When the Components are Proportional,” Statistica Sinica, Vol. 12, No. 3, 2002, pp. 801 -821. [27] W. Newey, “Convergence Rates and Asymptotic Nor- mality for Series Estimators,” Journal of Econometrics, Vol. 79, No. 1, July 1997, pp. 147-168. doi:10.1016/S0304-4076(97)00011-0 [28] R. De Jong, “Convergence Rates and Asymptotic Nor- ma1ity for Series Estimators: Uniform Convergence Rates,” Jouma1 of Econometrics, Vol. 111, No 1, 2002, pp. 1-9. [29] Τ. Choudhry, “Stock Market Volatility and the Crash of 1987: Evidence from Six Emerging Markets,” Journa1 of Intemationa1 Money and Finance, Vol. 15, No. 6, 1996, pp. 969-981. [30] C. F. Lee, G. Chen and O. Rui, “Stock Returns and Vola- tility on China’s Stock Markets,” Journal of Financial Research, Vol. 24, No. 4, 2001, pp. 523-543. [31] L. R. Glosten, R. Jagannathan and D. E. Runkle, “On the Relation between the Expected Value and Volatility of Nominal Excess Return on Stocks,” Journal of Finance, Vol. 48, No. 5, 1993, pp. 1629-1658. doi:10.2307/2329067 [32] L. L. Schumaker, “Spline Functions: Basic Theory,” Wil- ey, New York, 1981. [33] Q. Li, J. Yang, C. Hsiao and Y. –J. Chang, “The Rela- tionship between Stock Returns and Volatility in Interna- tional Stock Markets,” Journal of Empirical Finance, Vol. 12, No. 5, December 2005, pp. 650-665. doi:10.1016/j.jempfin.2005.03.001 [34] P. Theodossiou and D. Lee, “Relationship between Vola- tility and Expected Returns Across International Stock Markets,” Journal of Business Finance and Accounting, Vol. 22, No. 2, March 1995, pp. 289-300. doi:10.1111/j.1468-5957.1995.tb00685.x |