Technology and Investment, 2013, 4, 244-254 Published Online November 2013 (http://www.scirp.org/journal/ti) http://dx.doi.org/10.4236/ti.2013.44029 Open Access TI The Capital Structure of Business Start-Up: Is There a Pecking Order Theory or a Reversed Pecking Order? —Evidence from the Panel Study of Entrepreneurial Dynamics Hédia Fourati, Habib Affes Faculty of Economics and Management, University of Sfax, Sfax, Tunisia Email: hedia.fourati@yahoo.fr, habib.affes@yahoo.fr Received May 12, 2013; revised June 12, 2013; accepted June 19, 2013 Copyright © 2013 Hédia Fourati, Habib Affes. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. ABSTRACT Using the Panel Study of Entrepreneurial Dynamics, we study if the problems of asymmetry and opacity of information, asset specificity, agency problem and signaling theory predict the financial structure at inception. Thus, we conduct a study in two steps. First, by analyzing the descriptive statistics, we find that novice entrepreneurs turn first to internal sources of finance. Then, they apply to external debts and finally to equity finance. We prove then the applicability of the Pecking order theory in case of entrepreneurial firms. Second, by analyzing the role of financial theory in predicting the capital structure of entrepreneurial firms we find the following results. In fact, evidence from analyzing the role of information opacity, asset specificity and signaling theory, proves that the main source of finance is equity rather than debt. In the majority of the cases, depth interviews show from studying the financial theory an inverted pecking order. Two main reasons for this pattern can be established. First, entrepreneurs consider debt as a personal liability as it re- quires to be underwritten by personal guarantees. Entrepreneurs place a self-imposed limit on the extent to which they are prepared to mortgage their assets. Second, entrepreneurs deliberately seek out equity investment as a means of ob- taining added value. This external equity which has been viewed as expensive is viewed as good value. A well chosen investor can add business skills and social capital in the form of commercial contacts and access to relevant networks. Keywords: Pecking-Order Theory; Capital Structure; Asset Specificity; Signaling Theory; Moral Hazard; Credit Rationing; Information Opacity 1. Introduction One of the most fundamental questions of enterprise re- search: “How business start-ups are financed?” In fact, theoretical principles underlying the capital structure and financing choices can be generally described in terms of static trade-off or in term of Pecking-order framework. Nevertheless, researchers have demonstrated that the Trade-off theory is not profitable for young firms, [1]. Static trade-off includes the tax benefits of leverage and bankruptcy costs, [2]. Young firms have less tax benefits which are associated with more debt use, (Day et al., 1983). The second component of the trade-off theory is the bankruptcy cost. In fact, “young firms are more fail- ure prone than older ones” [3]. Nevertheless, bankruptcy costs are insufficient for proving the negative association between risk and leverage, [4]. Entrepreneur is more con- cerned with debts than its tax benefits. Thus, researchers demonstrated that the Pecking-order theory is more suit- able for justifying the financial choice of new firm. This result is attributable to the importance of internal/external debts vs. internal/external equity for the entrepreneur, [5,6]. To the best of our knowledge little empirical vali- dation of pecking order prediction has been previously developed for a sample of business start-up, [7]. In fact, [8] used a sample of new technology based firms; the study of [5] investigates a sample of business start-up. The latter studied the problem of information opacity, asset specificity and human capital as determinants of capital structure of business start-up. The originality of this paper is in testing in more depths how the financial theories (information opacity, agency problem, transac- tion costs, signaling theory and human capital) may pre- dict the capital structure. As our knowledge we find oth- ers research doing so but for a sample of SME not for business start-up, [9].  H. FOURATI, H. AFFES 245 By the present research, we aim to study in one hand the possible application of the Pecking order Theory and in another hand the role of financial theory in predicting the capital structure of entrepreneurial firms. The organi- zation of this paper is as follows: Section 2 is the study of the applicability of the pecking order theory; Section 3 is a summary of the role of financial theory in explaining the capital structure, Section 4 introduces the model con- struction, including selection of variables, data resources, model formulation as well as the estimation method and results and Section 5 draws conclusions and results. 2. Related Literatures The literature introduced two opposite frameworks rele- vant to the financing hierarchy of business start-ups: a standard POT, following the spirit of Myers and Majluf, (1984) and a reversed POT where external equity is pre- ferred over external debt. Recent theoretical work has shown this pecking order is reversed where investors have supe- rior knowledge about the commercialization process of an entrepreneur’s invention, and/or add value to the entre- preneur’s project, [10]. However, the empirical works test- ing these theories have one substantial limit, [11]. In fact, the capital structure is investigated by descriptive statis- tics relevant to the amount of different financing sources. Comparing the magnitude of each source, a financial hi- erarchy can be verified. This approach prevents us from understanding the capital structure dynamics and determi- nants. Therefore we maintain to contribute with a more robust, explicit and comparative testing of the pecking or- der theory on the one hand by investigating the descrip- tive statistics and on the other hand by studying the role of financial theory in justifying the financial structure of start-up activities. We aim to respond to the following ques- tion: Is there a Pecking order theory or a reversed Pecking order of the capital structure of business start-ups? 3. The Pecking Order Theory in Case of Entrepreneurial Firm’s In fact, the Table 1 presents the different options of fi- Table 1. Different sources of fun ding, $ value and percen tage of firms . Means Source of funding N1 % 2 Value3 By the entrepreneur 886 73%12291.02 Personal savings By others owners 330 27.2%85390.37 Internal equity Of the entrepreneur 558 46%12,686 Others sources by the entrepreneur 5 0.4%48.33 Others sources by others owners 7 0.6%3241 Personal debt to the new business 68 5.6 85,796 Personal debt Other personal loans to the new business in the first year that must be paid back 49 4% 46,636 Personal debt from relatives and family 159 13.1%2857.49 Personal debts of others owners from their family 40 3.3%3033 Personal debts of others owners from colleagues and employers 18 1.5%369 Personal debts from colleagues and employers 57 4.7%1478.77 Debts of the activity from the entrepreneur 369 30.4%12296.85 Debts of the activity from others owners 149 12.3%296605.94 Debts from others 12 1% 246 Personal debts from relatives in the first year 5 0.4%566 Personal credit for employees who do not share the ownership of the business during the first year 1 0.1%9 Internal debt Debts of other individuals in the first year 15 1.2%38,585 Total debts - 589449.77 Total of internal finance - 602135.77 Venture capitalist 1 - 203 Credit card of the entrepreneur 122 10%775.00 Credit card of others owners 28 2.3%1164.14 Bank debt by the entrepreneur 97 8% 3744.29 Bank debt by others owner 43 3.5 10296.51 Asset backed loan like a second mortgage or car loan by the entrepreneur 49 4% 1778.58 asset backed loan like a second mortgage or car loan by others owners 22 1.8 38980.73 Leasing 13 1.1%8212.4 Bank line of credit, credit to finance working capital 13 1.1%2941.18 Debt from supplier 13 1.2%871 Credit card of the activity 17 1.4%1444 Bank debt of the new activity 11 0.9%14,250 Bank loans by SBA guarantee 24 0.2%2637 Asset backed loan 121 10%95,215 Others loans 5 0.4%2123 External debts Others debts 1141 94%41794.31 Total external financing 225226.83 Total external debts 225023.83 Total 828386$ 1This is the number of companies that adopt this modality of financing; 2Is the percentage of firms whose value financing modality is greater than zero; 3This is the average value in $. Open Access TI  H. FOURATI, H. AFFES 246 nance to entrepreneurial firms; their average value and the percentage of firms that use each modality. Table 1 produces a set of thirty-three sources of fund- ing that may be adopted by new entrepreneurs in the USA. 46% of the newly created firms have some equity stake. The average of this contribution is in the order of 12,686$. In fact, 73% of entrepreneurs contribute to fi- nancing the activity by their personal savings and its av- erage value is about 12,291$ against 27% as a contribu- tion in personal savings by other owners whose average contribution is about 85,390$. Thus, the personal debt has a minimal role. In fact, one quarter of the companies adopt this type of financing. The majority of personal debt adopted by entrepreneurs is in the form of bank credit card. The average contribution of this type of fund- ing is about 775$. 90% of entrepreneurs use some bank loans for financing new venture. Nevertheless, most per- sonal contribution of the entrepreneur is by their personal savings. Indeed, more than half of entrepreneurial activi- ties use this type of financing. It is mobilized through an equity stake. Internal debt is preferred to internal equity (the con- tribution of business owners). Similarly, external debt is preferred rather than external equity mobilized by ven- ture capitalists. Venture capitalists provide an average of 203$. Indeed, only 121 new companies were able to at- tract the participation of investors. Taking into account the role of insiders, the contribu- tion of the entrepreneur is mobilized by half of the sample. In addition, internal debt is a source of funding that should not be overlooked. The average contribution of this category of funding is by 326,048$. This funding takes the form of debt from family, friends, colleagues, former employers and the contribution of the entrepre- neur as a credit for the new venture. For example, 43% of start-ups adopt this type of financing to launch its busi- ness; its average contribution is about 308,908$. Thus, personal savings of the founder is a source of financing which is adopted by the majority of entrepreneurs. In fact, weight intervention funding by the founding entrepreneur is higher than that of other partners for all types of inter- nal financing. We are going now to compare the financial structure by “insiders” and “outsiders”. In fact, 12% of the entrepreneurs adopt a financing by bank loans. This contribution is about 14,041$. 6% of the entrepreneurs use a bank loan financing backed by an asset. This contribution is an average of 40,759$. Indeed, the importance of bank debt with guarantee in the launch phase is quite crucial [12]. It turns out that companies with more tangible assets have less financial constraints, [13]. For instance, Leasing, lines of credit and credit providers have a relatively the lowest percentage 1% and their av- erage values are successively: 8212$, 2941$ and 871$. Taking into account the role of indebtedness for fi- nancing new firms creation, we find that this type of fi- nancing choice is adopted with low percentages: 1%. This debt comes from bank loans, the government debt and bank loans with SBA1 guarantee. In fact, internal debt is a source of financing which is very considerable than external debt. It has a double in value. One point to admit in entrepreneurial finance is that the entrepreneur lacks access to formal capital market. The table above reflects the terms of the applicability of entrepreneurial finance in terms of financial choices. The newly created firms have an average capital of about 828,386$. Half of it comes from internal debt and the quarter from external debt. The majority of funds come from external bank loans backed by asset and from credit cards. If we relate the total credit card of the entrepreneur to the credit card company, we find that it is the seventh. This result con- firms that the majority of funding comes from the entre- preneur. On this way, we can suggest some “Pecking Order” which describes the capital structure of business start-up. If we treat the equity contribution and personal debt as internal funds, we find that many companies consider their internal funds, fewer companies relate to debt and less to venture capitalists. This confirms the message which is transmitted by Myers and Majluf, (1984) about the “Peck- ing Order”. Some authors introduced the need to revise the POT, since they found evidence that both retained earnings and external equity are quite unusual means of financing for new firms; debt also seems to be disre- garded compared to internal funds [14]. Literature has recently introduced a revised version of the POT, where external equity is preferred over external debt in the case of innovative firms [15]. According to his study the pecking order theory in the case of innovative firms is reversed as follows: 1) Insider Capital, informal private equity and easy-term financing (seed); 2) Venture capital financing (start-up); 3) Self financing, banks and or busi- ness credit (early growth); 4) Direct issue of bonds and public equity (sustained growth). Is there a Pecking order theory or a reversed Pecking order if we consider a more dynamic approach that ana- lyzes the role of information opacity, asset specificity and signaling theory in predicting the capital structure of start-up? 4. The Financial Theory as a Determinant of the Capital Structure of Business Start-Up We study the role of information opacity, agency prob- 1The Small Business Administration (SBA) is a United States govern- ment agency that provides support to entrepreneurs and small busi- nesses. SBA loans are made through banks, credit unions and other lenders who partner with the SBA. The SBA provides a govern- ment-backed guarantee on part of the loan, Wikipédia, 2012. Open Access TI  H. FOURATI, H. AFFES 247 lems, signaling theory and transaction costs in defining the existence of a POT or a reversed POT for business start-up. 4.1. Information Opacity and Capital Structure of Entrepreneurial Firms Previous studies demonstrated that new firms have no historical and no reputational effects. Thus, business is informationally opaque. This informational problem makes the external financing not available at start-up phase, [16]. Under this problem, a Pecking order will take place. Firstly, personal savings, secondly short-term debt, then long-term debt, and ultimately and the least preferred is the role of external investors, [17]. Given the difficulty in obtaining external financing, entrepreneurs rely heavily on internal funds, [18]. Under the condition of informa- tion opacity, after internal funds, the firm must resort to bank borrowings then to equity contributions. Indeed, a relationship of debt is based on “soft” information gener- ated by the banking experience with the lender and by a continuous contact bank-owner by providing some fi- nancial services, [19], p. 645. Some studies have demon- strated the importance of the relationship of debt in grant- ing loans to small businesses, Hanley and Crook, (2005). Due to this informational problem, internal financing is the primary source of funding followed by external debt and ultimately a limited amount of external equity. The following hypotheses regarding the problem of informa- tion opacity are proposed: H1: information opacity is positively correlated with the probability of using internal funds in financing new venture creation; H2: Information opacity is negatively associated with the probability of using bank debts in financing new ven- ture; H3: Information opacity is negatively associated with the probability of financing the new venture by external equity; Nevertheless, information problem may create some agency problems. In the following section, we analyze the role of moral hazard problem and credit rationing in justifying some financial choice of the entrepreneurial firms. 4.2. Agency Problems and Capital Structure of the Entrepreneurial Firms The provision of loan by investor to the entrepreneur will create an agency relationship between the entrepreneur (the agent) and the investor, who is the principal, [20]. Agency problems are more developed in small entrepre- neurial firms than their counterparts large firms. In fact, collecting information by financial intermediary is rare and expensive, [21]. The sharing in capital with the ven- ture capitalist involves establishing a cooperative rela- tionship between the investor and the entrepreneur, [22]. *Moral hazard and capital structure of the entrepre- neurial firms Due to the inability to write complete contracts speci- fying the benefits right under any liquidation act, the entrepreneur has interest to expropriate funds after sign- ing the contract with the bank, Huyghebaert and Van De Gucht, (2007). The moral hazard problem leads therefore to a first incentive to undertake riskier projects and in- centives of underinvestment in projects with positive net present value. *Credit rationing and capital structure of the entre- preneurial firms There are two theoretical models emphasizing credit rationing, [23]. Indeed, these models are those of (Stieglitz and Weiss, 1981) and [24]. Due to the problem of credit rationing, loan applicants are generally the firms with good quality. For those who come to borrow, the bank increases the value of the debt and/or increase the matur- ity of the credit. Credit rationing affects only the decision of bank financing, and will have no effect on debt, Huy- ghebaert and Van De Gucht, (2007). This discussion leads to the following hypothesis: H4: agency problems must be negatively associated with the probability of using bank debt in financing new venture. 4.3. Asset Specificity and Capital Structure of the Entrepreneurial Firms The theory of transaction costs defined by Williamson, (1988) implies that the specific assets generate quasi- rents for business. The asset specificity is a source of competitive advantage in the market, [25]. Assets of an entrepreneurial project may be specific to it and the op- timal financial contract is one that minimizes transaction costs. The asset specificity for start-ups gives rise to two main problems. The first is related to the lowest net asset value. The second is related to the “hold-up problem” due to the specific human capital which gives rise to the opportunism problem. In business start-up, the entrepre- neur will contribute not only by his managerial skills but also contribute with his financial capital, his knowledge and his human capital, [26]. The relative importance of the intangible assets does not always allow banks to have guarantees, [27]. Such assets have high transaction-costs and do not al- low bankers to hedge against the risk of bankruptcy. Thus external investors and especially lenders may be reluctant to finance such projects. New venture that has more spe- cific assets should primarily be financed through equity and secondly through a public offering and finally by external debt, Huyghebaert and Van De Gucht, (2007). One proposed solution to this problem of “hold-up” is to Open Access TI  H. FOURATI, H. AFFES 248 grant control rights to the entity that has specific re- sources, [28]. Based on our review of the role of asset specificity in new venture financing, we propose to test the following hypothesis: H5: Asset specificity must be negatively correlated with the probability of using external debts; H6: Asset specificity must be positively associated with the probability of using internal fund for new venture financing; H7: asset specificity must be positively associated with the probability of using external equity for new venture financing. 4.4. The Signaling Theory and the Capital Structure of Entrepreneurial Firms Following the literature the contribution of the entrepre- neur in the project serves as a signal of its quality, [29]. In fact, the capital of the entrepreneur is engaged as a credit guarantees and has a signal effect, [30]. Indeed, the willingness of the lender to fund new projects is posi- tively related to the personal guarantee of the entrepre- neur especially regarding the personal funds that are in- vested, [31]. The size of the ratio of debt to guarantee exceeds the unity for 85% of small businesses in the UK, [32]. In fact, the underlying asset has different roles for the financial institution. Warranty can cover the contrac- tor to overcome the problem of moral hazard, [33]. It is a signal to the bank stating that the contractor perceives that his project will win. Similarly, the guarantee consti- tutes a solution of the problem of information asymmetry and reduces the problem of credit rationing, [34]. The underlying asset allows the renegotiation of the contract in case of financial distress, [35]. Regarding the role of the signaling theory in explaining the financial decision of entrepreneur we aim to test the following research hypothesis: H8: An increase in equity contribution of the entre- preneur and the other owners is a signal to increase the probability of financing by bank debt; H9: An increase in the entrepren e ur’s and other own- ers’ personal guarantees of the business are a signal to increase the probability of financing by bank deb. 4.5. Characteristics of the Activity and the Capital Structure of Entrepreneurial Firms *The role of size Previous studies explained the existence of a positive correlation between long-term debt and size. In fact, smaller firms employ less long-term debt due to scale effects. This positive relationship may also be accounted for by collateral effects, as the natural logarithm of total assets is commonly employed as a proxy variable for size. This finding is consistent with the view that smaller firms are heavily reliant on short-term debt. Thus firms are un- willing or unable to use long-term debt because of the relatively higher transaction costs, Mac an Bhaird, (2010). *The legal form of organization The legal form of the organization provides a specific form of financing. It is a signal that indicates credibility and formality of operations and ensures future growth as noted by Cassar, (2004). There is, then, a positive corre- lation between debt and organization in incorporation, [36]. However, the legal organization ensures more bank debt. Under this discussion the following research hy- pothesis are proposed: H10: An increase in the size of activity reduces the probability of financing the entrepreneurial projects by debts; H11: The legal form of organization in “incorpora- tion” is increase the probability of financing the entre- preneurial project by external debt and bank debt. 4.6. The Entrepreneur’s Attributes and the Capital Structure of the Entrepreneurial Firms The personal characteristics include gender, education [37] and experience. H12: The individual characteristics of an entrepreneur increase the probability of financing new venture by debts. 5. Data Our analysis uses the detailed data in the Panel Study of Entrepreneurial Dynamics (PSED). The description of the background and the sampling methodology are pre- sented by, [38]. The PSED is a longitudinal database selecting the period 2005-2010. PSED was started in 2005 with the selection of a cohort of 1214 nascent en- trepreneurs chosen from a representative sample of 31,845 adults. In the first year, a follow-up interview was com- pleted with 1214 entrepreneurs (80% of the original co- hort): 87% of the interviewed persons are “novice” en- trepreneur; 60% of them have accepted to participate to a second interview after one year. 5.1. Model and Measure of Variables *Model In our model the dependent variable is dichotomous (i.e., whether or not an individual use the mean of fi- nance in internal or external funds). Accordingly, we use the logistic regression methodology to estimate the coef- ficients. The generalized form for the response probabili- ties for the model is given in the following equation: 123 45 6 (financing ) inf opacityagencyasset specificity signalingentrepreneu attributesActivity i P Open Access TI  H. FOURATI, H. AFFES Open Access TI 249 where: financingi, is a dichotomous variable that measures if the entrepreneur adopt one of the modalities of fi- nancing in 1) the owner resource, 2) internal finance, 3) external finance, 4) bank finance and 5) the outside equity). “Information opacity”: Is a vector that explain the existence or not of certain information opacity. Agency problem: Is a vector that explains the exis- tence or not of an agency problem in moral hazard and credit rationing. Asset specificity: Is a vector that explains the exis- tence or not of an asset specificity. Signaling: Explains the owner’s contribution to col- lateralize and/or to finance the entrepreneurial project. *Measure of variables Table 2 explains the different items of the dependent and the independent variables. Information opacity is measured by a home based activity, if the entrepreneur is a serial one. Asset specificity is measured by the entre- preneurial experience, the industrial experience, the value of tangible assets and the existence of an intellectual property. Agency problems consist in credit rationing and moral hazard. The signaling theory is measured by the value of the entrepreneur’s asset and his contribution to finance the activity in equity finance. Control variables are in the entrepreneur’s attributes and the characteristics of activity. Table 2. Measure of variables of the model. Variables Labels Measures Dependent variables Internal equity PCINTERNE Dichotomous variable coded “1” if the share of capital retained by the entrepreneur exceeds or equal 50%. Internal debts DETEINTERNE Dichotomous variable coded “1” if the entrepreneur use some debts from family, friends and others personal resources. External debts DETEXTERNE Dichotomous variable coded “1” if the entrepreneur have some debts from banks, credit cards, suppliers and others external debts. Bank debts CREDIBANC Dichotomous variable coded “1” if the entrepreneur uses some bank debts for financing the new venture. Bank debt with guaranty CREDIBANGAR Dichotomous variable coded “1” if the entrepreneur uses some secured bank debts. External equity PCEXTERNE Dichotomous variable coded “1” if the entrepreneur uses some external equity. Independent variables INFORMATION OPACITY Home based RESIDENCE Dichotomous variable coded “1” if the venture is based in the home of the founder. Serial SERIAL The total numbers of the activities which are started by the owners of this venture. ASSET SPECIFICITY Entrepreneurial expérience EXPERIENCE_ENTREPREN Number of years of the entrepreneurial experience in the same industry. Industrial experience EXPERIENCEINDUS Number of years of industrial experience. Tangible LOG-TANG Value of cash available to the contractor which can be used as a collateral for obtaining credit (value of physical properties of the contractor machinery, construction). Intellectual property PREOPRIETE-INTELLECTUELLEDichotomous variable coded “1” if the entrepreneur has some intellectual property, (patents, copyrights, and trademarks). AGENCY PROBLEMS Moral hazard RISQUMORAL Dichotomous variable coded “1” if the entrepreneur responds “no” to the following question: “Are all funds deposited in a bank account in the name of the company?” Credit rationning RATIONNEMENT The percent of new venture which starts without looking for bank debts. SIGNALING THEORY Personal equity LOG-PARTICIP Value of personal contribution to the new venture. Tangible LOG-TANG Value of tangible assets. ENTREPRENEURIAL ATTRIBUTES Age AGE Age of the principal founder. Gender GENRE Dichotomous variable coded “1” if the entrepreneur is a man. Education BAC Dichotomous variable coded “1” if the entrepreneur has a level education. VENTURE CARACTERISTICS Legal form INCORPORATION Dichotomous variable coded “1” if the startup is a limited liability company, a subchapter S-corporation, a C-corporation, a general partnership, or a limited partnership company. Size TAILLE Number of employees in the start-up year.  H. FOURATI, H. AFFES 250 5.2. The Logistic Regression and the Results The econometric estimation of the logistic regression is presented in Tabl e 3 and reveals the following results for each financial problem. Since most firms are financed primarily by only one type of finance, we use discrete variables (for example, the binary 0, 1)2, when describing the financial structure for each firm. For our main as- sessment of the PSED in the financial structure, we con- sider the four-way financial sources: internal equity, in- ternal debt, external equity, and external debt, and then the six-way decomposition that focuses on the types of external debt. From Table 3 we find that in term of information opacity, serial entrepreneurs have some reputation. New activities, that are home-based and installed by a “habit- ual” entrepreneur, are more exposed to problems of in- formation opacity. For these activities, internal resources dominate the financial structure and then external debt and little equity finance. In fact, information opacity for business start-up prevents any source of external financ- ing in the form of debt or equity, [39]. Taking into account the variables that measure the in- formation opacity, the activities installed in own homes have the most information opacity. They are more likely to be financed by equity contribution. These entrepre- neurs have less than 38% chance of having a bank debt and less than 30% chance of having external equity in their capital structure. Nevertheless there is a positive correlation with internal equity. The serial entrepreneur is more likely to finance the new venture activity by in- ternal and external equity due to the availability of in- formation of the owner. We show a positive correlation between a serial entrepreneur and the probability of using internal debt. The serial entrepreneur does not attract the investors in our sample. In fact, they have 68% less chance of having some external equity. With regard to the availability of information, they are more likely to have an external debt. Table 3. Logistic regression for determinants of capital structure of business start-up. Internal equity (Model 1) Internal debt (Model 2) External debt (Model 3) Bank debt (Model 4) Secured bank loan (Model 5) External equity (Model 6) INFORMATION OPACITY Home based activity 0.041 −0.34* −0.317 −0.386* −0.22 −0.28 Serial −0.14 0.018 0.158 −0.067 −0.10 −0.68 ASSET SPECIFICITY Entrepreneurial experience −0.025 0.937 −0.015 0.227 0.282 0.337 Industrial experience 0.001 0.0034 −0.0049 −0.011 0.012 −0.013 Log (tangible asset) 0.012 0.1500*** 0.242*** 0.144*** 0.023 0.139 Intellectual property −0.175 0.210 −0.104 0.016 0.343 −0.217 AGENCY PROBLEMS Moral hazard −0.499*** −0.91*** 0.19 Credit rationning 0.174 −0.44*** 1.28 ENTREPRENEUR ATTRIBUTES Log (owner equity) 0.009 −0.059*** 0.020 0.069*** −0.0007 0.012 Age −0.007 −0.015*** −0.007 −0.005 −0.013 −0.01 Gender −0.117 0.019 0.335* −0.234 0.06 −0.468 Éducation 0.532*** −0.212 0.19 −0.049 0.208 −0.639 VENTURE CARACTERISTICS Size −0.003 0.003 −0.0002 −0.006 −0.03 −0.047 Incorporation 0.766*** −0.020 −0.102 0.356** −0.47 1.32*** C −0.596* 0.273 1.192 3.138*** −3.702* −4.95** McFadden R-squared = 4% McFadden R squared = 3.3% McFadden R-squared = 7% McFadden R-squared = 12.5% McFadden R-squared = 2% McFadden R-squared = 9% 2Empirical work on established firms often uses the share of different types of financing instead of the 0-1 binary choice. However, for the startup financial data, the 0-1 choice variable is superior because some of the shares are small while others are at such extremes that there would not be a normal distribution for the share variable. Open Access TI  H. FOURATI, H. AFFES 251 Taking into account the extent of asset specificity, an increase in asset tangibility increases the probability of having some external debt and bank debt in its financial structure. Indeed, the tangible assets are important in the eyes of creditors. The Pecking-order theory also provides the same conclusions. Indeed, a firm having more tangi- ble assets will be less sensitive to asymmetry of informa- tion. Tangible assets are less exposed to the problem of information asymmetry and lose, in case of liquidation, less value than the intangible assets. Predictions based on the information opacity are clas- sified, based on the characteristics of assets for the ma- jority of new start-ups. For this type of business, the en- trepreneur does not only have managerial expertise of the business but also produces a certain human and financial capital. This type of specific human assets cannot be trans- ferred to alternative uses due to the problem of informa- tion opacity. As noted by Sanyal and L. Mann, (2010). The activity that has the most specific asset is primarily financed by the entrepreneur’s own resources and through his participation in external capital and lastly by external debt. Other activities acquired by the entrepreneur, may be used as collateral for financing new activities. The value of the intellectual property is less certain and brings low net asset value. We believe that a start-up with high hu- man capital is primarily funded by internal resources and specifically by internal equity. In fact, many tangible assets increase the probability of having some internal debt by 15%, and increase the probability of having a bank debt by 14%. Nevertheless, increasing the probabil- ity of having some intellectual property reduces the prob- ability of having an external debt by 10%. The intellec- tual property reduces the probability of being financed by external funding sources. It decreases the probability of financing by bank debt. High industrial experience (as a component of specific human capital) increases the probability of using the in- ternal equity in financing venture activities. This effect is negative and insignificant for using external debt. The influence of industry knowledge increases the secured bank loan. Nevertheless, an increase in the knowledge of the activity mobilized by the entrepreneurial experience decreases the probability of having a debt in its external structure. This negative correlation between the entre- preneurial experience and external debt can be attributed to a loser entrepreneurial experience. The latter generates negative information about the reputational capital of the entrepreneur. Nevertheless, it appears that the past entrepreneurial experience helps to attract the external investors. In term of agency problem, credit rationing is nega- tively associated with bank debt. We notice that an in- crease in credit rationing decreases the use of bank debt by 44%. We find also the existence of a positive correla- tion between credit rationing and bank loans. This result confirms those of Huyghebaert and Van De Gucht, (2007). The latter showed that bank increases the maturity of the debt when credit rationing occurs to reduce the problem of adverse selection. Moral hazard is negatively associ- ated with external debt and bank debt. The existence of moral hazard problem reduces the use of external debt by 50% and the use of bank debt by 93%. The owner’s characteristics are a determinant of the capital structure and the financial characteristics of the new activities. Age, education and gender produce a sig- nal on the quality of the human capital. Better human capital is associated with a viable business. Therefore ac- cess to debt as noted by Storey, (1994) is more important for this type of business. An increase in equity by the owner is a signal to outsiders by providing an increase in external debt, especially bank debt. This increase is in order of 7%. Taking into account the variable log-tangi- ble as a signal for personal guarantees, the latter is posi- tively associated with bank loans which are secured or unsecured. The newly founded activities by older entre- preneur are less financed by internal, external and bank debt. Many educated entrepreneurs are 20% more likely to be funded by bank debt and secured external debt. Contrary to the results of Sanyal and L. Mann, they are 50% more likely to be financed by internal or external equity contributions. This is associated with the condi- tion that they have sufficient financial knowledge to be aware of the sources of bank financing and government, [40]. Venture activities founded by men are 35% more likely to be financed by external debt. Characteristics of the activity are quite crucial to de- fine the financial structure of the business. Banks per- ceive corporation serve as a signal that describes the credibility and indicates the future growth opportunities. For example there is a positive correlation between debt and the legal form. It suggests that it leads to more bank debt. The legal form is positively and significantly asso- ciated with bank loan. Indeed, the legal organization in- creased 36% chance of using bank debt. It constitutes a signal and attracts the external investors. It increases the probability of using external finance and by 76% the prob- ability of using internal funds. Taking into account the three funding scenarios flow, external debt and equity contribution to various external and financial problems of opacity information, asset speci- ficity in agency problems and the role of signaling theory, we test the possible existence of a Pecking-order or a reversed Pecking order for justifying the financial struc- ture of new entrepreneurial projects. We take into con- sideration the sign of association and the existence of a more or less elastic coefficient. Taking into account the problem of opacity information, the entrepreneur has Open Access TI  H. FOURATI, H. AFFES 252 more probability of being financed by personal saving, then by external equity and less chance of being financed by external debt. Indeed in term of opacity of informa- tion, we retain reversed version of the Pecking-Order. And we retain the following classification: internal funds, external equity and external debt. In terms of asset speci- ficity, from all items, we also prove the existence of a reversed Pecking-order. Taking into account the role of signaling theory, in term of personal contribution to the venture activity and the role of tangible assets, external debts are more preferred to external equity for financing new venture creations and we prove the Pecking order theory. 6. Conclusion Our study is conducted on the PSED database. We are interested in studying the decisive weight of the financial problems in information opacity, asset specificity, agency problems and signaling theory in the decision of the capi- tal structure of the new entrepreneurial projects. From a logistic regression of binary variables that defined the sixth funding scenarios of finance, we have drawn the following conclusions. New entrepreneurial activities are more likely to have some external debt in their capital structures if they have more tangible assets that serve as collateral and if they have a legal form in incorporation. Due to the lowest value of human capital, the entrepre- neurial activities in more human capital are less likely to have some external debt and more likely to be financed by internal finance. Home based activities are more likely to be financed by internal equity contributions, less by external debt and attracting less outside investors. More educated entrepreneurs contract more external debt and attract more investors. In fact, external debts bring some transaction costs. Then we studied the applicability of the POT in a context of entrepreneurial firms. We conduct two different studies. The first study is interested in some descriptive statistics of different means of finance. Then, we conclude the applicability of Pecking order theory in defining the capital structure of entrepreneurial firms. The second study is more analytic and parts from study- ing the role of financial theory in defining the capital structure of entrepreneurial firms. Thus, we conclude from the logistic regression the existence of a reversed Peck- ing order defining the capital structure of business start- up except of signaling theory. The introduction of exter- nal equity into a start-up business can be seen by an owner as a dilution of control, [41]. Our results corre- spond to a response to the critics of Cassar, (2004) the studies of the capital structure of the entrepreneurial pro- jects. The first method has the limit of time of using the different modalities of finance. In fact, some methods of financing are used by entrepreneur. Nevertheless, others modalities are incurred in the name of the business and after one year of the inception. Then, we explain this result by the problem of responses bias for some means of fi- nance and especially in terms of the role of the external equity. In this paper, the sample of entrepreneurs has the limit of collecting external equity and non responses bias. This limit does not allow us treating the entire roles and issues associated with the Pecking order theory. The study conducted on the same sample leads to conclude that novice and more rich American entrepreneurs face more financial constraints, [42]. It would, therefore, be useful to chart the experience of entrepreneurs who face finan- cial constraints. In their search for finance did they fol- low the sequence suggested by either the POH or of the reversed pecking order? REFERENCES [1] C. Mac an Bhaird, “The Modigliani-Miller Proposition after Fifty Years and Its Relation to Entrepreneurial Fi- nance,” Strategic Change, Vol. 19, No. 1-2, 2010, pp. 9- 28. http://dx.doi.org/10.1002/jsc.855 [2] S. C. Myers and N. Majluf, “Corporate Financing and Investment Decisions When Firms Have Information That Investors Do Not Have,” Journal of Financial Economics, Vol. 13, No. 2, 1984, pp. 187-221. http://dx.doi.org/10.1016/0304-405X(84)90023-0 [3] R. Cressy, “Why Do Most Firms Die Young?” Small Business Economics, Vol. 26, No. 2, 2006, pp. 103-116. http://dx.doi.org/10.1007/s11187-004-7813-9 [4] P. Poutziouris and F. Chittenden and N. Michaelas, “The Financial Development of Smaller Private and Public (SMEs),” Wo rking Paper 378, Manchester Business School, Manchester, 1999. [5] P. Sanyal and L. M. Catherine, “The Financial Structure of Startup Firms: The Role of Assets, Information, and Entrepreneur Characteristics,” Federal Reserve Bank of Boston, Working Paper 10-17, 2010. [6] J. Rédis, “Finance Entrepreneuriale le Créateur d’Entre- prise et les Investisseurs en Capital,” Préface de Hughes Franc, Edition de Boek, 2009. [7] S. Paul and G. Whittam and J. B. Johnston, “The Opera- tion of the Informal Venture Capital Market in Scotland,” Venture Capital, Vol. 5, No. 4, 2003, pp. 313-335. http://dx.doi.org/10.1080/1369106032000141931 [8] L. Cassia and T. Minola, “Pecking Order Theory Extesion and the Role of Human Capital in New Technology Based Firms. Evidence from the Kauffman Firm Survey,” Paper Presented at the European Institute for Advanced Studies in Management (EIASM) RENT XXIV—Research in Entrepreneurship and Small Business, Maastricht, 18- 19 November 2010. [9] A. Newan and S. Gunessee and B. Hilton, “Applicability of Financial Theories of Capital Structure to the Chinese Cultural Context: A Study of Private Owned SMEs’,” In- ternational Small Business Journal, Vol. 27, 2012, pp. 470-495. [10] M. Garmaise, “Informed Investors and the Financing of Open Access TI  H. FOURATI, H. AFFES 253 Entrepreneurial Projects,” University of Chicago, Work- ing Paper, 2001. [11] G. Cassar, “The Financing of Business Start-Up,” Journal of Business Venturing, Vol. 19, No. 2, 2004, pp. 261-283. http://dx.doi.org/10.1016/S0883-9026(03)00029-6 [12] A. Hanley and J. Crook, “The Role of Private Knowledge in Reducing the Information Wedge: A Research Note,” Journal of Business Finance & Accounting, Vol. 32, No. 1-2, 2005, pp. 415-433. http://dx.doi.org/10.1111/j.0306-686X.2005.00599.x [13] M. Campello and R. J. Graham and R. C. Harvey, “The Real Effects of Financial Constraints: Evidence from a Financial Crisis,” Journal of Financial Economics, Vol. 97, No. 3, 2008, pp. 470-487. [14] A. Atherton, “Rational Actors, Knowledgeable Agents: Extending Pecking Order Considerations of New Venture Financing to Incorporate Founder Experience, Knowledge and Networks,” International Small Business Journal, Vol. 27, No. 4, 2009, pp. 470-495. http://dx.doi.org/10.1177/0266242609334969 [15] L. Sau, “New Pecking Order Financing for Innovative Firms: An Overwiew,” Working Paper, Department of Economics, Università di Torino, 2007. [16] A. Paulson and R. Townsend, “Entrepreneurship and Fi- nancial Constraints in Thailand,” Journal of Corporate Finance, Vol. 10, No. 2, 2004, pp. 229-262. http://dx.doi.org/10.1016/S0929-1199(03)00056-7 [17] A. D. Cosh and A. Hughes, “Size, Financial Structure and Profitability: UK Companies in the 1980S’,” In: A. Hughes and D. Storey, Eds., Finance and the Small Firm, Routledge, London, 1994. [18] N. Huyghebaert and L. M. Van de Gucht, “The Determi- nants of Financial Structure: New Insights from Business Start-Ups,” European Financial Management, Vol. 13, No. 1, 2007, pp. 101-133. http://dx.doi.org/10.1111/j.1468-036X.2006.00287.x [19] A. N. Berger and G. F. Udell, “Small Business and Debt Finance,” International Handbook Series on Entrepre- neurship, Vol. 1, 1998, pp. 299-328. [20] M. Cherif, “Asymétrie d’Information et Financement des PME Innovantes par le Capital Risque,” Revue d’Eco- nomie Financière, Vol. 54, No. 54, 1999, pp. 163-178. [21] T. Baas and M. Schrooten, “Relationship Banking and SMEs: A Theoretical Analysis,” Small Business Econo- mics, Vol. 27, No. 2-3, 2006, pp. 127-137. http://dx.doi.org/10.1007/s11187-006-0018-7 [22] M. Falconer, G. Reid and N. Terry, “Post Investment De- mand for Accounting Information by Venture Capitalist,” Managerial Finance, Vol. 20, 1994, pp. 186-196. [23] S. Parker, “The Economics of Entrepreneurship: What We Know and What We Don’t Know,” Foundations and Trends, in Entrepreneurship, Vol. 1, No. 1, 2005, pp. 1- 54. http://dx.doi.org/10.1561/0300000001 [24] O. E. Williamson, “Corporate Finance and Corporate Go- vernance,” Journal of Finance, Vol. 43, No. 3, 1988, pp. 567-591. http://dx.doi.org/10.1111/j.1540-6261.1988.tb04592.x [25] R. D. Ireland and M. A. Hitt and D. G. Sirmon, “A Model of Strategic Entrepreneurship: The Construct and Its Di- mensions,” Journal of Management, Vol. 29, No. 6, 2003, pp. 963-989. [26] D. B. Audretsch and E. E. Lehmann and L. A. Plummer, “Agency and Governance in Strategic Entrepreneurship,” Entrepreneurship Theory and Practice, Vol. 33, No. 1, 2009, pp. 150-166. [27] J. Jacquin, “Les Jeunes Entreprises Innovantes: Une Pri- orité pour la Croissance,” Rapport du Commissariat Gén- éral au Plan, La Documentation Française, 2003. [28] O. Hart and J. A. Moore, “A Theory of Debt Based on the Inalienability of Human Capital,” The Quarterly Journal of Economics, Vol. 109, No. 4, 1995, pp. 841-879. http://dx.doi.org/10.2307/2118350 [29] H. Leland and D. Pyle, “Informational Asymmetries, Fin- ancial Structure, and Financial Intermediation,” The Jour- nal of Finance, Vol. 32, No. 2, 1977, pp. 371-387. http://dx.doi.org/10.2307/2326770 [30] A. W. Boot and A. V. Thakor and G. F. Udell, “Secured Lending and Default Risk: Equilibrium Analysis, Policy Implications and Empirical Results,” Economic Journal, Vol. 101, No. 406, 1991, pp. 458-472. [31] B. F. Blumberg and W. A. Letterie, “Business Starters and Credit Rationing,” Small Business Economics, Vol. 30, No. 2, 2008, pp. 187-200. http://dx.doi.org/10.1007/s11187-006-9030-1 [32] J. Black and D. De Meza and D. Jeffreys, “House Prices, the Supply of Collateral and the Enterprise Economy,” The Economic Journal, Vol. 106, No. 434, 1996, pp. 60- 75. http://dx.doi.org/10.2307/2234931 [33] J. Bartholdy and C. Mateus, “Financing of SME’s: An Asset Side Story,” Société Universitaire Européenne de Recherches Financiéres, Palais du Luxembourg, Paris, 2008. [34] D. J. Storey, “Understanding the Small Business Sector,” Routledge, New York, 1994. [35] G. Gorton and J. Kahn, “The Design of Bank Loan Con- tracts,” The Review of Financial Studies, Vol. 13, No. 2, 2000, pp. 331-364. http://dx.doi.org/10.1093/rfs/13.2.331 [36] S. Coleman and R. Cohn, “Small Firms’ Use of Financial Leverage: Evidence from the 1993 National Survey of Small Business Finances,” Journal of Business and En- trepreneurship, Vol. 12, No. 3, 2000, pp. 87-103. [37] R. Cressy, “Are Business Start-Ups Debt-Rationed?” Eco- nomic Journal, Royal Economic Society, Vol. 106, No. 438, 1996, pp. 1253-1270. [38] P. Reynolds, “Informal and Early Formal Financial Sup- port in the Business Creation Process: Exploration with PSED II Data Set,” Journal of Small Business Manage- ment, Vol. 49, No. 1, 2011, pp. 27-54. http://dx.doi.org/10.1111/j.1540-627X.2010.00313.x [39] G. Guidici and S. Paleari, “The Provision of Finance to Innovation: A Survey Conducted among Italian Technol- ogy-Based Small Firms,” Small Business Economics, Vol. 14, No. 1, 2000, pp. 37-53. http://dx.doi.org/10.1023/A:1008187416389 [40] T. Bates, “Entrepreneur Human Capital Inputs and Small Business Longevity,” The Review of Economics and Sta- Open Access TI  H. FOURATI, H. AFFES Open Access TI 254 tistics, Vol. 72, No. 4, 1990, pp. 551-559. http://dx.doi.org/10.2307/2109594 [41] S. Paul and G. Whittam and J. Wyper, “The Pecking Or- der Hypothesis: Does It Apply to Start-Up Firms?” Jour- nal of Small Business and Enterprise Development, Vol. 14, No. 1, 2007, pp. 8-21. http://dx.doi.org/10.1108/14626000710727854 [42] H. Fourati and H. Affes, “Financial Constraints, Human and Social Capital, and Risk-Taking Attitude in the Foundation of New Firms,” Strategic Change: Briefings in Entrepreneurial Finance, Vol. 20, No. 5-6, 2011, pp. 219-232.

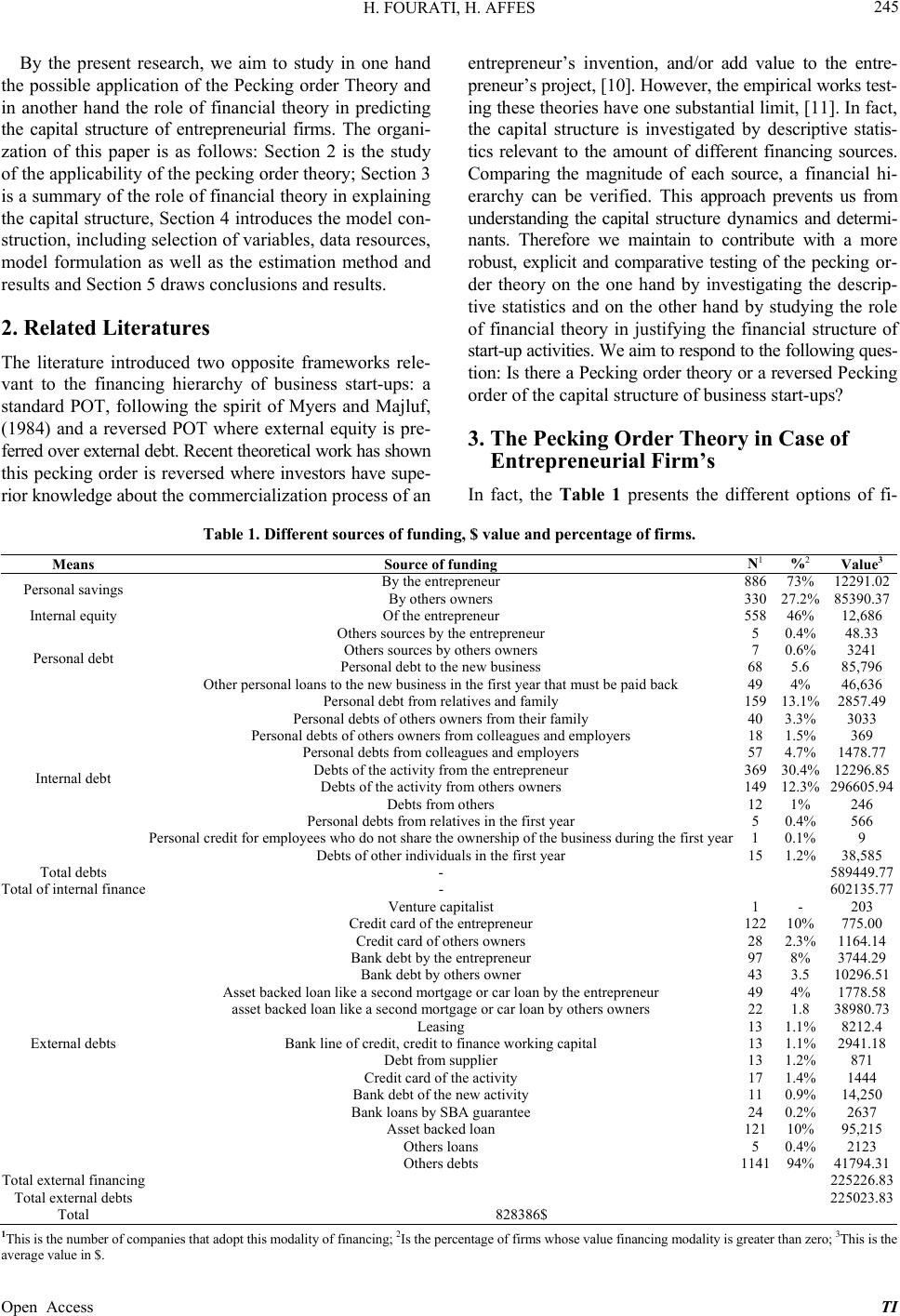

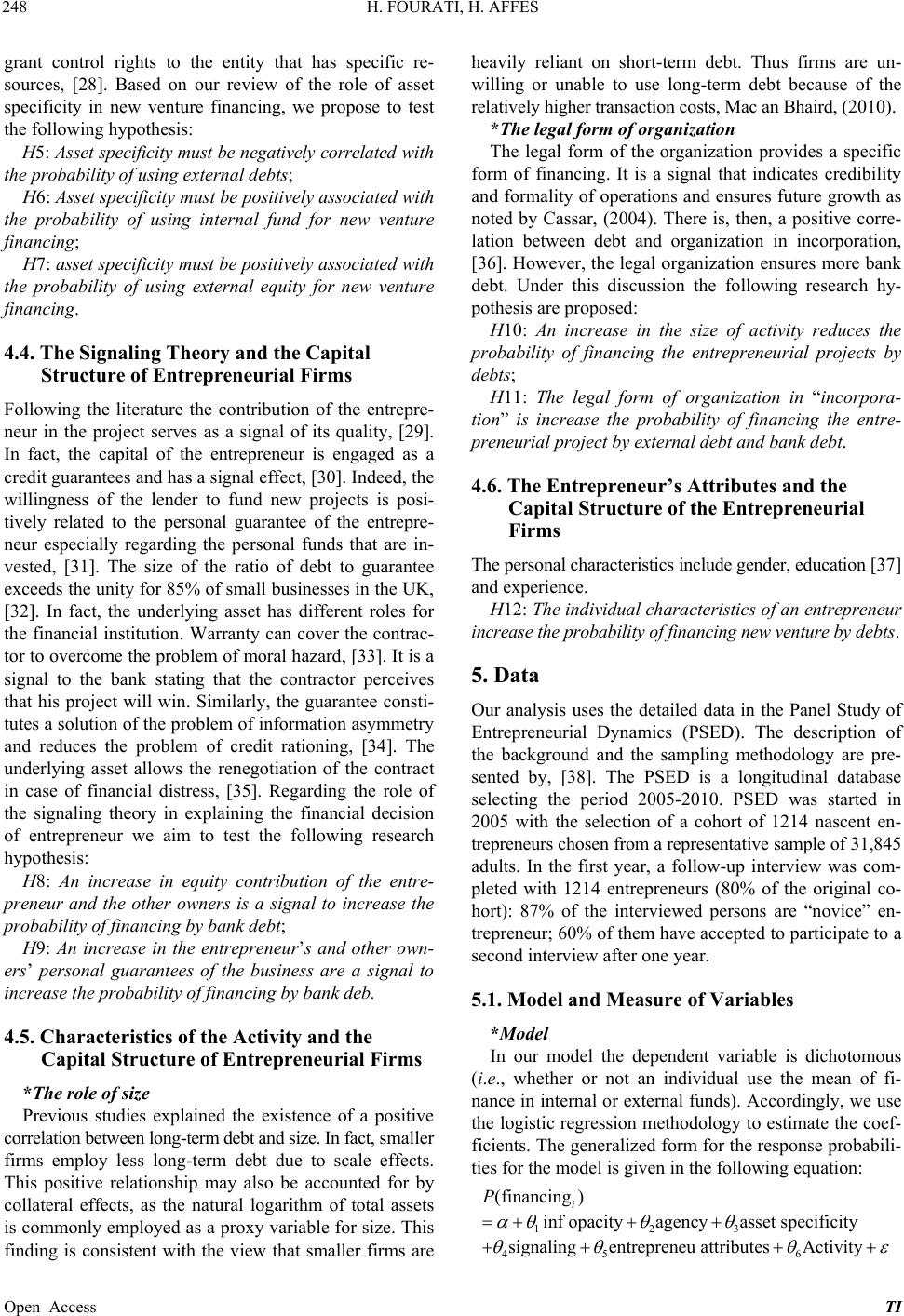

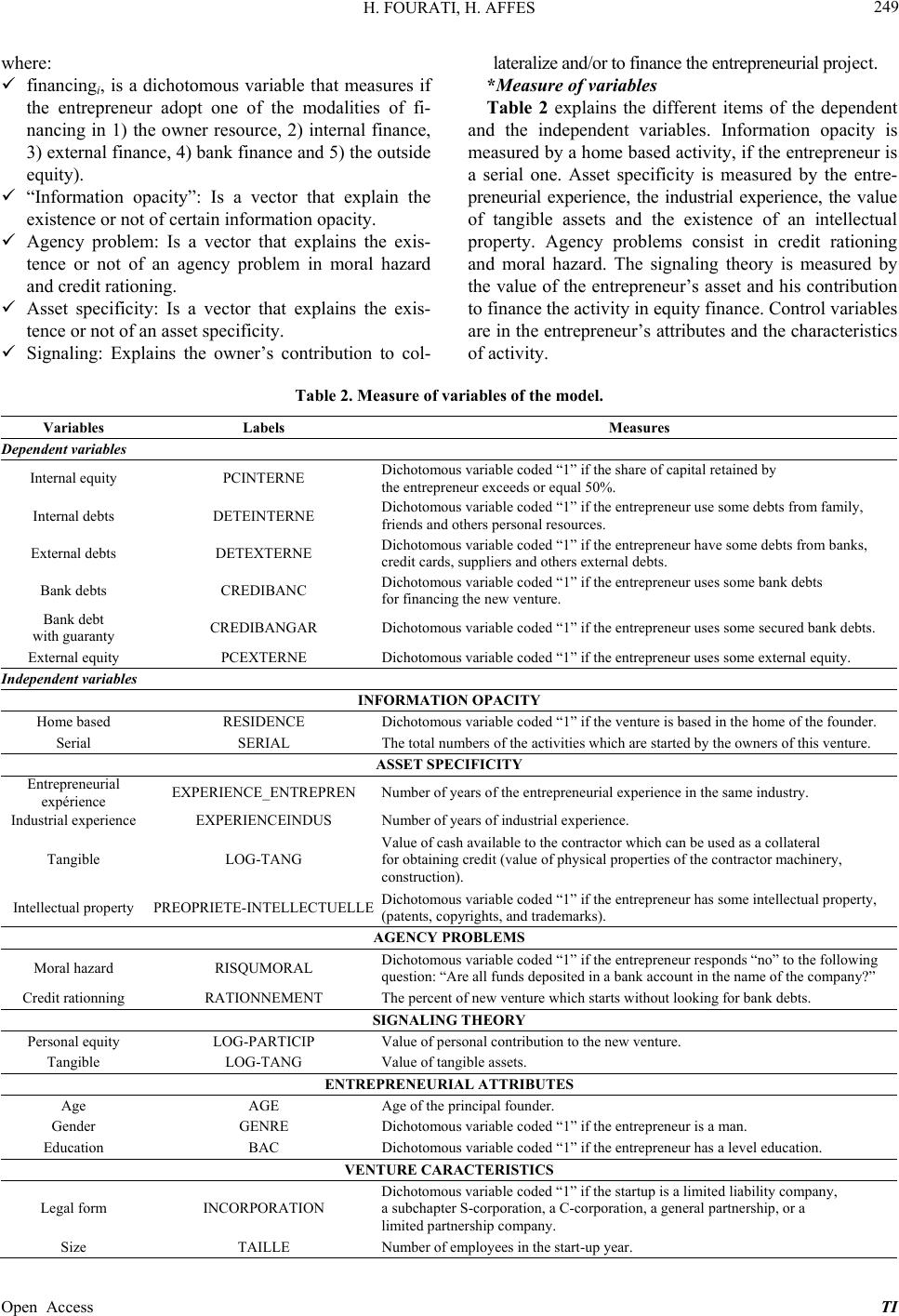

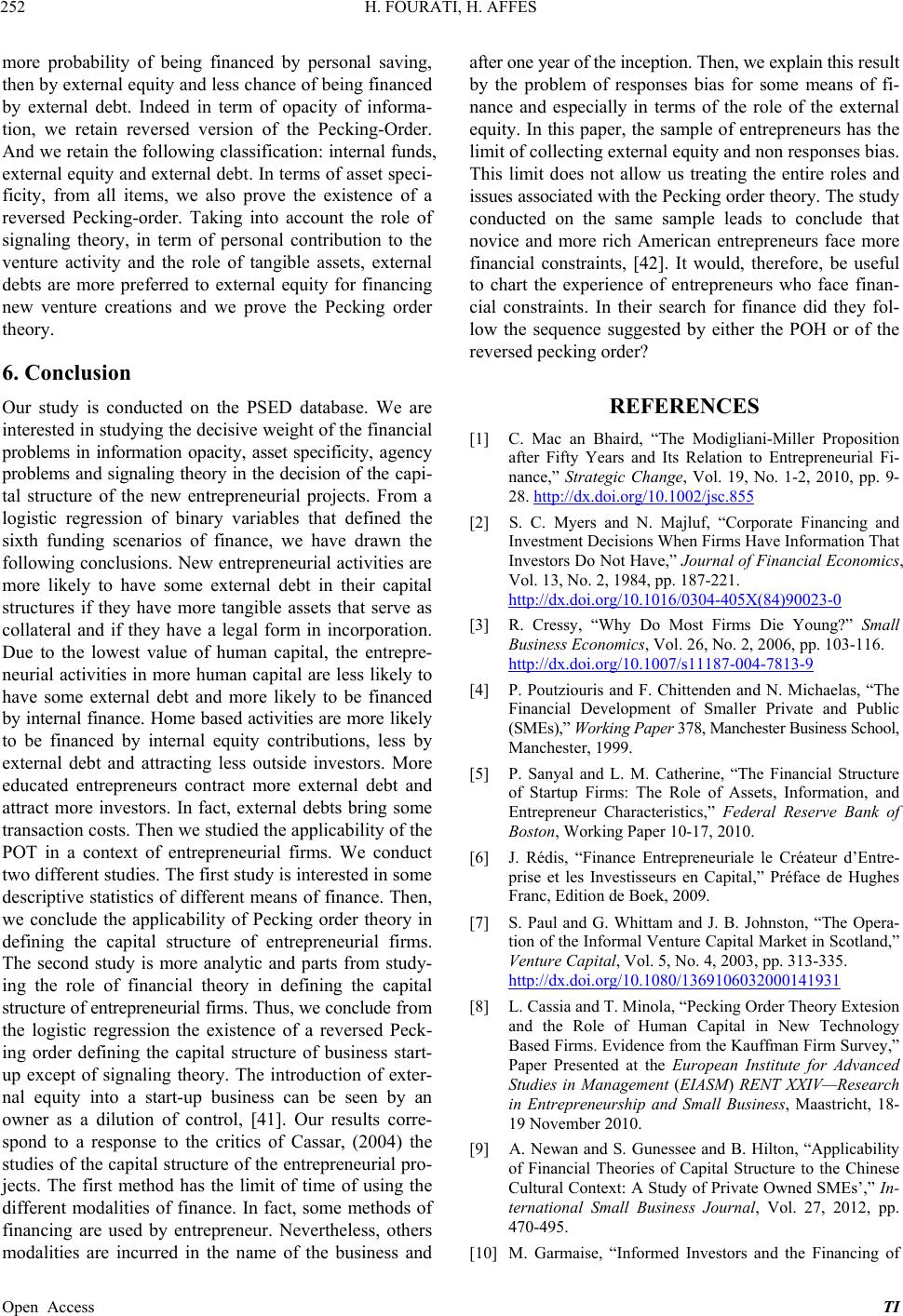

|