Y. FANG

Open Access

76

cate that regardless of the style of the stock, investors signifi-

cantly underreact to good news and overreact to bad news, but

volatilities do not present a significant asymmetric pattern.

overreaction or underreaction in the Chinese stock market.

The results of empirical tests based on daily returns indicate

that when the return at time t − 1 is conditionally positive, the

return at time t would present a significant positive first-order

autocorrelation. Moreover, when the return at time t − 1 is con-

ditionally negative, the return at time t would present a signifi-

cant negative first-order autocorrelation. From the behavioral

point of view, investors underreact to good news and overreact

to bad news.

A significant difference in autocorrelation intensity was not

observed in both longitudinal and transverse comparisons.

Tests on Market Cycle

In this section, we examine how the market cycle affects the

overreaction or underreaction of investors. The daily returns of

the Shanghai Composite Index are used. The bull market sam-

ple period is from August 7, 2006 to October 16, 2007. The

sample size is 289. In this period of 14 months, the Shanghai

Composite Index rose from 1547 points to 6992 points, or

293.69%. The bear market sample period is from June 13, 2001

to June 3, 2005. The sample size is 957. In this period of 48

months, the Shanghai Composite Index fell from 2242 points to

1014 points, or 293.69%.

We then conduct a series of robust tests on the underreaction

or overreaction of investors with regard to run length, abnor-

mality degree, time scale, size, sector, style, and market cycle.

Wald coefficients tests are used to compare the autocorrelation

intensities.

The empirical results in this paper could provide significant

reference for investors to adopt a suitable investment strategy.

Acknowledgments

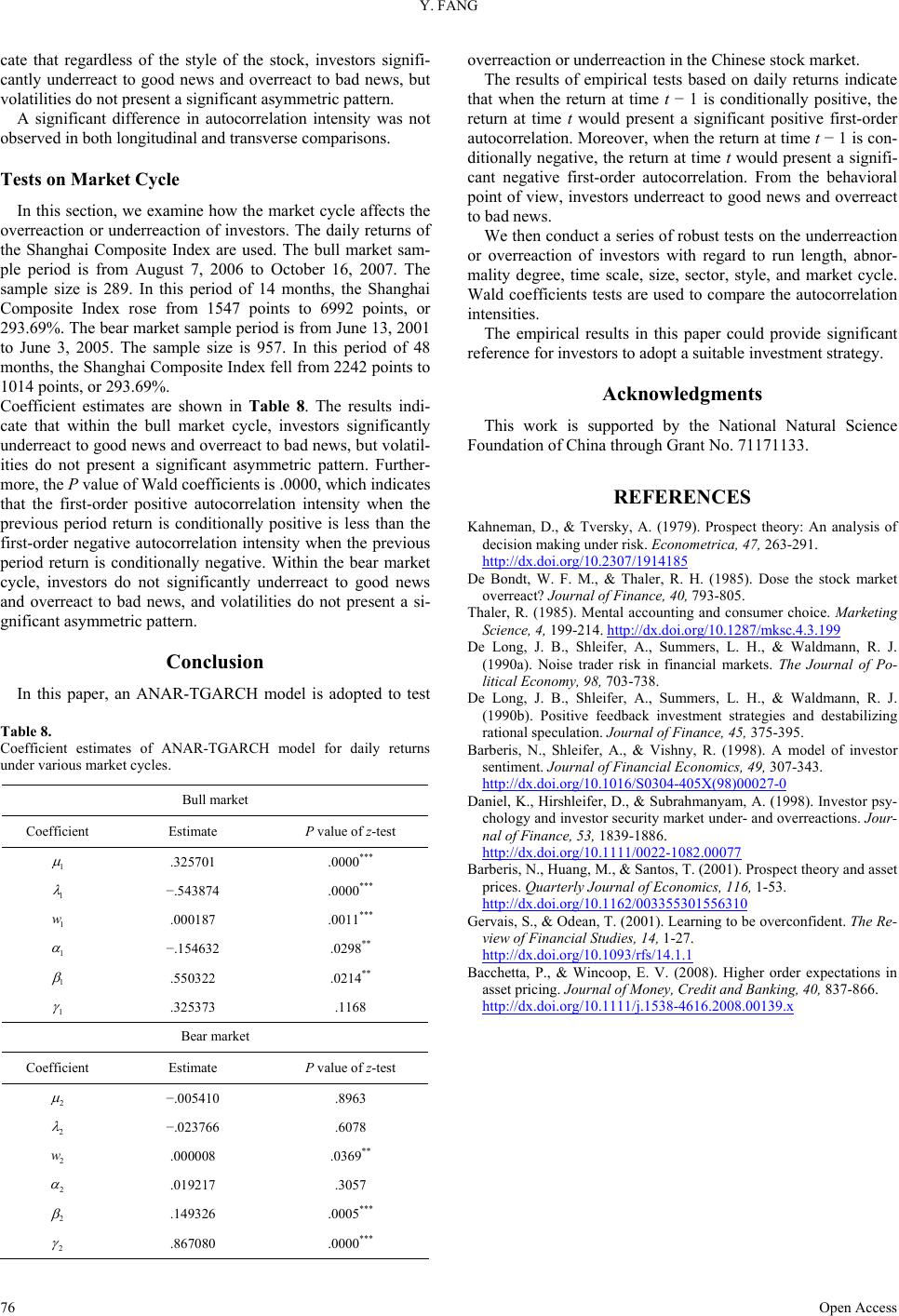

Coefficient estimates are shown in Table 8. The results indi-

cate that within the bull market cycle, investors significantly

underreact to good news and overreact to bad news, but volatil-

ities do not present a significant asymmetric pattern. Further-

more, the P value of Wald coefficients is .0000, which indicates

that the first-order positive autocorrelation intensity when the

previous period return is conditionally positive is less than the

first-order negative autocorrelation intensity when the previous

period return is conditionally negative. Within the bear market

cycle, investors do not significantly underreact to good news

and overreact to bad news, and volatilities do not present a si-

gnificant asymmetric pattern.

This work is supported by the National Natural Science

Foundation of China through Grant No. 71171133.

REFERENCES

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of

decision making under risk. Econometrica, 47, 263-291.

http://dx.doi.org/10.2307/1914185

De Bondt, W. F. M., & Thaler, R. H. (1985). Dose the stock market

overreact? Journal of Finance, 40, 793-805.

Thaler, R. (1985). Mental accounting and consumer choice. Marketing

Science, 4, 199-214. http://dx.doi.org/10.1287/mksc.4.3.199

De Long, J. B., Shleifer, A., Summers, L. H., & Waldmann, R. J.

(1990a). Noise trader risk in financial markets. The Journal of Po-

litical Economy, 98, 703-738.

Conclusion

In this paper, an ANAR-TGARCH model is adopted to test De Long, J. B., Shleifer, A., Summers, L. H., & Waldmann, R. J.

(1990b). Positive feedback investment strategies and destabilizing

rational speculation. Journal of Finance, 45, 375-395.

Table 8.

Coefficient estimates of ANAR-TGARCH model for daily returns

under various market cycles.

Bull market

Coefficient Estimate P value of z-test

1

.325701 .0000***

1

−.543874 .0000***

1

w .000187 .0011***

1

−.154632 .0298**

1

.550322 .0214**

1

.325373 .1168

Bear market

Coefficient Estimate P value of z-test

2

−.005410 .8963

2

−.023766 .6078

2

w .000008 .0369**

2

.019217 .3057

2

.149326 .0005***

2

.867080 .0000***

Barberis, N., Shleifer, A., & Vishny, R. (1998). A model of investor

sentiment. Journal of Financial Economics, 49, 307-343.

http://dx.doi.org/10.1016/S0304-405X(98)00027-0

Daniel, K., Hirshleifer, D., & Subrahmanyam, A. (1998). Investor psy-

chology and investor security market under- and overreactions. Jour-

nal of Finance, 53, 1839-1886.

http://dx.doi.org/10.1111/0022-1082.00077

Barberis, N., Huang, M., & Santos, T. (2001). Prospect theory and asset

prices. Quarterly Journal of Economics, 116, 1-53.

http://dx.doi.org/10.1162/003355301556310

Gervais, S., & Odean, T. (2001). Learning to be overconfident. The Re-

view of Financial Studies, 14, 1-27.

http://dx.doi.org/10.1093/rfs/14.1.1

Bacchetta, P., & Wincoop, E. V. (2008). Higher order expectations in

asset pricing. Journal of Money , Credit and Banking, 40, 837-866.

http://dx.doi.org/10.1111/j.1538-4616.2008.00139.x