Paper Menu >>

Journal Menu >>

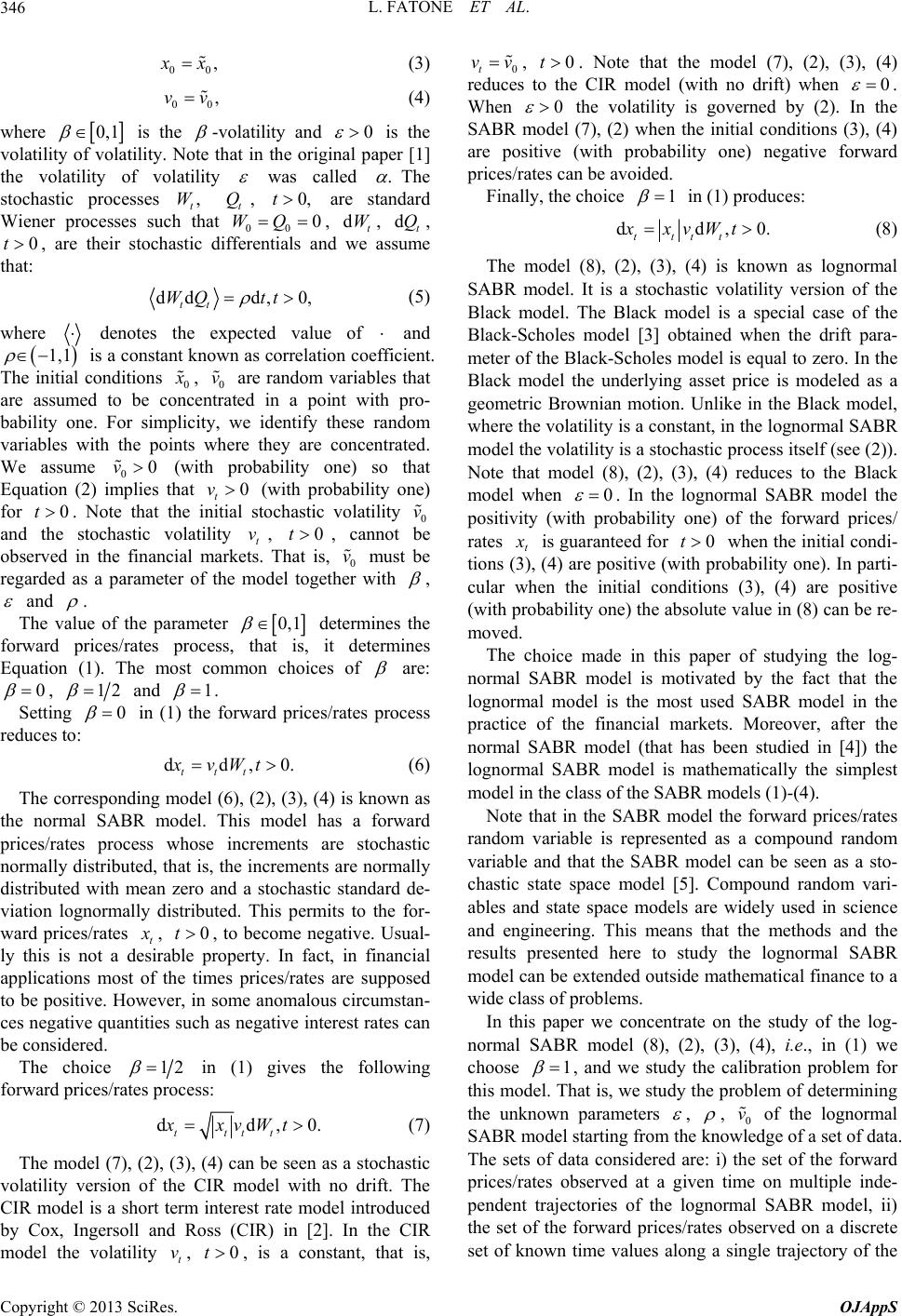

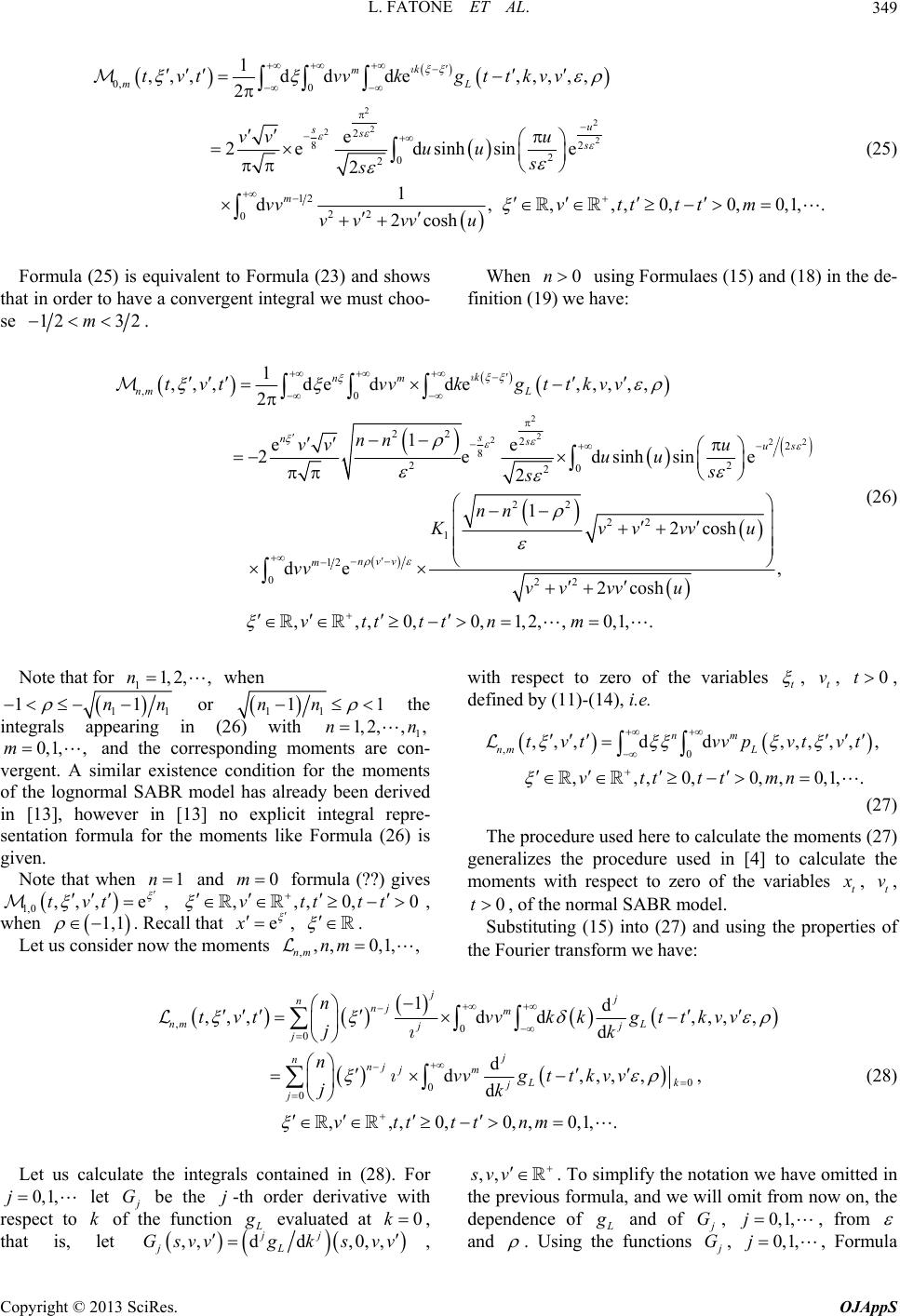

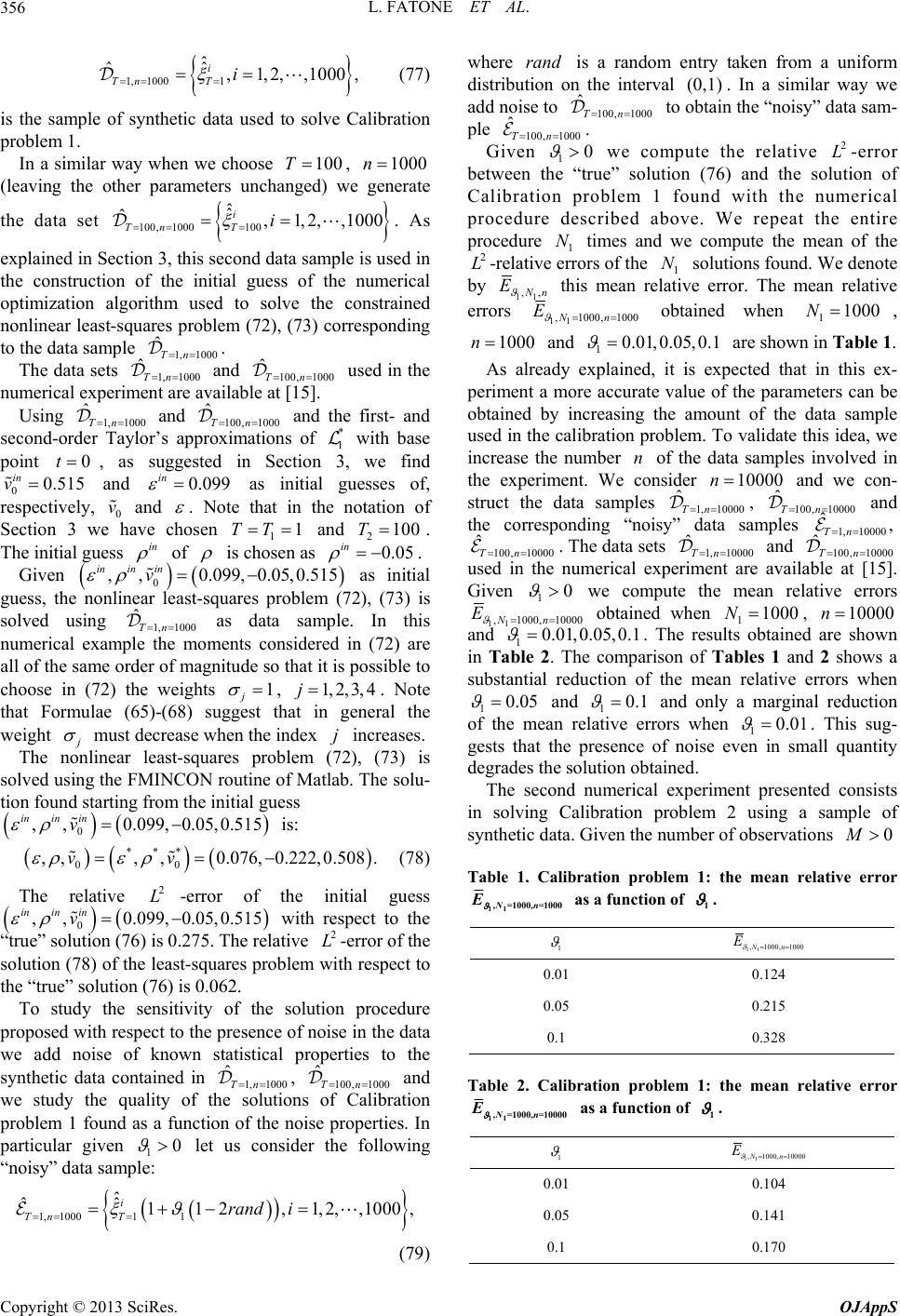

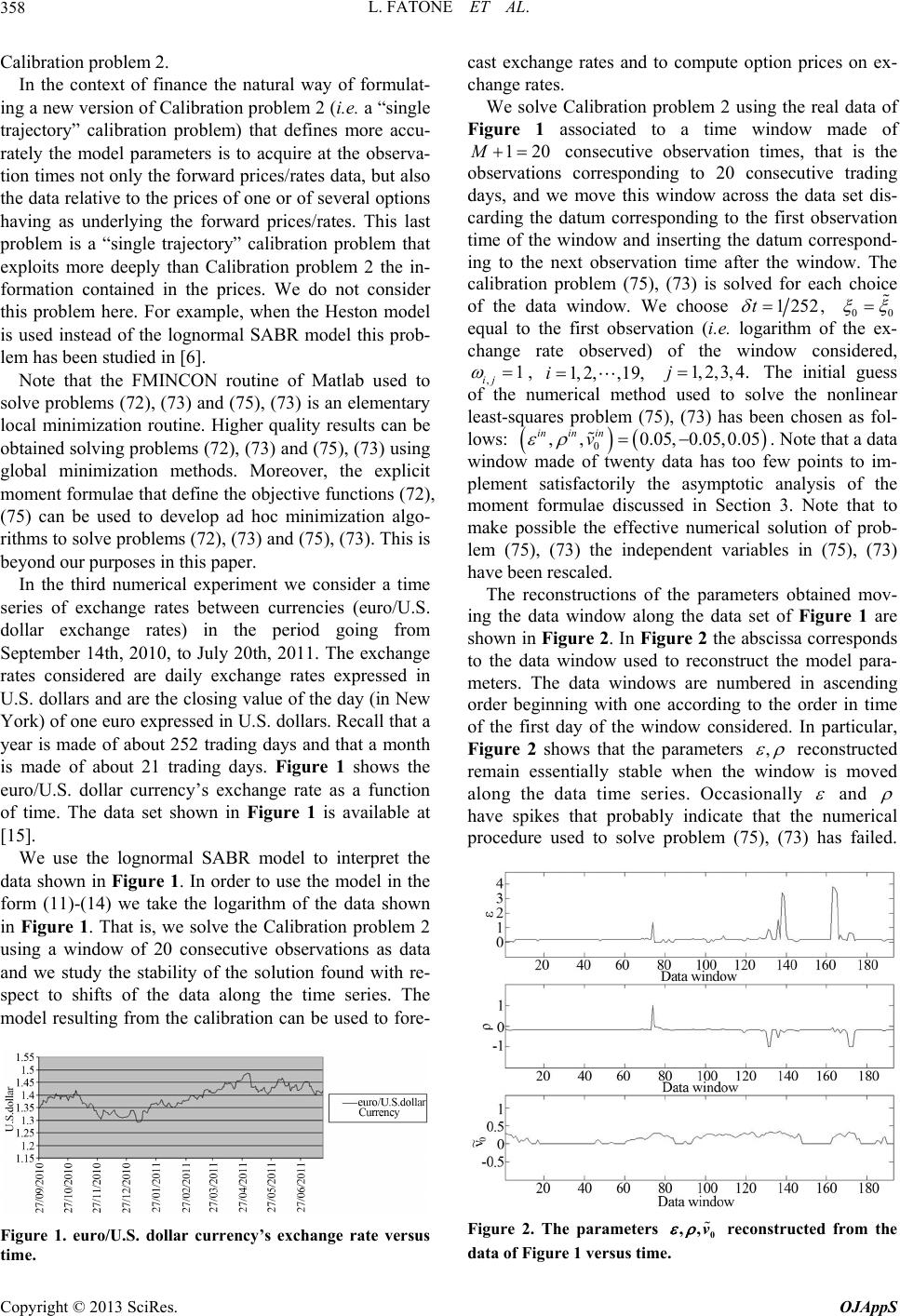

Open Journal of Applied Sciences, 2013, 3, 345-359 http://dx.doi.org/10.4236/ojapps.2013.36045 Published Online October 2013 (http://www.scirp.org/journal/ojapps) Closed Form Moment Formulae for the Lognormal SABR Model and Applications to Calibration Problems Lorella Fatone1, Francesca Mariani2, Maria Cristina Recchioni3, Francesco Zirilli4 1Dipartimento di Matematica e Informatica Università di Camerino via Madonna delle Carceri 9, Camerino, Italy 2Dipartimento di Scienze Economiche Università degli Studi di Verona Vicolo Campo_ore 2, Verona, Italy 3Dipartimento di Management Università Politecnica delle Marche Piazza Ma rtelli 8, Ancona, Italy 4Dipartimento di Matematica “G. Castelnuovo” Università di Roma “La Sapienza” Piazzale Aldo Moro 2, Roma, Italy Email: lorella.fatone@unicam.it, francesca.mariani@univr.it, m.c.recchioni@univpm.it, zirilli@mat.uniroma1.it Received August 11, 2013; revised September 17, 2013; accepted September 30, 2013 Copyright © 2013 Lorella Fatone et al. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. ABSTRACT We study two calibration problems for the lognormal SABR model using the moment method and some new formulae for the moments of the logarithm of the forward prices/rates variable. The lognormal SABR model is a special case of the SABR model [1]. The acronym “SABR” means “Stochastic- ” and comes from the original names of the model parameters (i.e., ,, ) [1]. The SABR model is a system of two stochastic differential equations widely used in mathematical finance whose independent variable is time and whose dependent variables are the forward prices/rates and the associated stochastic volatility. The lognormal SABR model corresponds to the choice 1 and depends on three quantities: the parameters , and the initial stochastic volatility. In fact the initial stochastic volatility cannot be observed and can be regarded as a parameter. A calibration problem is an inv erse problem that con sists in determine- ing the values of these three parameters starting from a set of data. We consider two differen t sets of data, that is: i) the set of the forward prices/rates observed at a given time on multiple independent trajectories of the lognormal SABR model, ii) the set of the forward prices/rates observed on a discrete set of known time values along a single trajectory of the lognormal SABR model. The calibration problems corresponding to these two sets of data are formulated as con- strained nonlinear least-squares problems and are solved numerically. The formulation of these nonlinear least-squares problems is based on some new formulae for the moments of the logarithm of the forward prices/rates. Note that in the financial markets the first set of data considered is hardly available while the second set of data is of common use and corresponds simply to the time series of the observed forward prices/rates. As a consequence the first calibration prob- lem although realistic in several contexts of science and engineering is of limited interest in finance while the second calibration problem is of practical use in finance (and elsewhere). The formulation of these calibratio n problems and the methods used to solve them are tested on synthetic and on real data. The real data studied are the data belonging to a time series of exchange rates between currencies (euro/U.S. dollar exchange rates). Keywords: SABR Model; Calibration Problems; FX Data 1. Introduction We study two calibration problems for the lognormal SABR model using the moment method and some new formulae for the moments of the logarithm of the forward prices/rates variable. The lognormal SABR model is a special case of the “Stochastic- ” model which has become known under the acronym of SABR model [1]. The SABR model is widely used in the theory and prac- tice of mathematical finance, for example, it is widely used to price in terest rates derivatives and options on cu r- rencies exchange rates. Let be a real variable that denotes time and t t x , t, be real stochastic processes that describe, res- pectively, the forward prices/rates and the associated stochastic volatility, as a function of time. The SABR model [1] assumes that the dynamics of the stochastic processes t v 0,t x , t, , is defined by the following system of stochastic differential equations: v0t dd, tttt xxvWt 0, (1) dd, ttt vvQt0, (2) with the initial cond itions: C opyright © 2013 SciRes. OJAppS  L. FATONE ET AL. 346 00 , x x (3) (4) 00 ,vv where 0,1 is the -volatility and 0 is the volatility of volatility. Note that in the original paper [1] the volatility of volatility was called . The stochastic processes W , are standard Wiener processes such that 00, , t, , are their stochastic differentials and we assume that: , t t Q0,t0 WQ dt WdQ 0t ddd, 0, tt WQ tt (5) where denotes the expected value of and is a constant known as correlation coefficient. The initial conditions 0 1,1 x , 0 are random variables that are assumed to be concentrated in a point with pro- bability one. For simplicity, we identify these random variables with the points where they are concentrated. We assume 0 (with probability one) so that Equation (2) implies that (with probability one) for . Note that the initial stochastic volatility 0 and the stochastic volatility t, , cannot be observed in the financial markets. That is, 0 must be regarded as a parameter of the model together with v t v 0v 0 v 0tv 0tv , and . The value of the parameter 0,1 determines the forward prices/rates process, that is, it determines Equation (1). The most common choices of are: 0 , 12 and 1 . Setting 0 in (1) the forward prices/rates process reduces to: . (6) dd, ttt xvWt0 The correspond ing model (6), (2), (3), (4) is known as the normal SABR model. This model has a forward prices/rates process whose increments are stochastic normally distributed, that is, the increments are normally distributed with mean zero and a stochastic standard de- viation lognormally distributed. This permits to the for- ward prices/rates t x , , to become negative. Usual- ly this is not a desirable property. In fact, in financial applications most of the times prices/rates are supposed to be positive. However, in some anomalous circumstan- ces negative quan tities such as neg ative interest rates can be cons idered. 0t The choice 12 in (1) gives the following forward prices/rates process: dd, tttt xxvWt0. model the volatility , is a constant, that is, (7) The model (7), (2), (3), (4) can be seen as a stochastic volatility version of the CIR model with no drift. The CIR model is a short term interest rate model introduced by Cox, Ingersoll and Ross (CIR) in [2]. In the CIR 0t vv t v, 0t , 0t. Note atmodel (7), (2), (3), (4) CIR model (with no drift) when 0 th the reduces to the . When 0 the volatility is governed by (2). I SABR l (7), (2) when the initial conditions (3), (4) are positive (with probability one) negative forward prices/rates can be avoided. Finally, the choice 1 n the mode in (1) produces: dd,0.xxvWt tttt (8) (8), (2), (3), (4) is knowThe m SA odel n as lognormal BR model. It is a stochastic volatility version of the Black model. The Black model is a special case of the Black-Scholes model [3] obtained when the drift para- meter of the Black-Scholes model is equal to zero. In the Black model the underlying asset price is modeled as a geometric Brownian motion. Unlike in the Black model, where the volatility is a constant, in the lognormal SABR model the volatility is a stochastic process itself (see (2)). Note that model (8), (2), (3), (4) reduces to the Black model when 0 . In the lognormal SABR model the positivity (witbability one) of the forward prices/ rates t x is guaranteed for 0t when the initial condi- tions (3, (4) are po sitive (wobability o ne). In parti- cular when the initial conditions (3), (4) are positive (with probability one) the ab solute value in (8 ) can be re- moved. The c h hoice m pro )ith pr ade in this paper of studying t ic entrate on the study of t he log- es/rates he log- no ran no rmal SABR model is motivated by the fact that the lognormal model is the most used SABR model in the practice of the financial markets. Moreover, after the normal SABR model (that has been studied in [4]) the lognormal SABR model is mathematically the simplest model in the class of the SABR models (1)-(4). Note that in the SABR model the forward pr dom variable is represented as a compound random variable and that the SABR model can be seen as a sto- chastic state space model [5]. Compound random vari- ables and state space models are widely used in science and engineering. This means that the methods and the results presented here to study the lognormal SABR model can be extended outside mathematical finance to a wide class of problems. In this paper we conc rmal SABR model (8), (2), (3), (4), i.e., in (1) we choose 1 , and we study the calibration problem for this modat is, we study the problem of determining the unknown parameters el. Th , , 0 v of the lognormal SABR model starting from the owldge of a set of data. The sets of data considered are: i) the set of the forward prices/rates observed at a given time on multiple inde- pendent trajectories of the lognormal SABR model, ii) the set of the forward prices/rates observed on a discrete set of known time values along a single trajectory of the kn e Copyright © 2013 SciRes. OJAppS  L. FATONE ET AL. 347 lognormal SABR model. The formulation of the cali- bration problems corresponding to these two sets of data is based on some new closed form formulae for the mo- ments of the logarithm of the forward prices/rates vari- able. Using these formulae the calibration problems con- sidered are formulated as constrained nonlinear least- squares problems. The moments formulae are deduced extending to the lognormal SABR model a method in- troduced in [4] in the study of the normal SABR model. Note that the data set used in the first calibratio n prob- le proach to study the calibration prob- le least-squares pr hat, extending the results presented in [4], it is po significance levels in th is paper. of the moments of the lo f the Lognormal SABR Model oments of the es of the lognormal m, that is, a data sample made of observations at a given time on multiple trajectories, is hardly available in the financial markets. In fact, in the financial markets usually it is not possible to repeat the “experiment” as done routinely in contexts where observations are made in experiments carried out in a laboratory. This implies that the first calibration problem although realistic in se- veral fields of science and engineering has limited appli- cations in finance. Instead, the second calibration prob- lem is of practical use in finance since single trajectory data samples are easily available in the financial markets and can be identified with time series of observed for- ward prices/rates. An alternative ap m for the lognormal SABR model correspo nding to the single trajectory data sample consists in extending the method proposed in [6,7] to study a similar calibration problem for the Heston model and for some of its varia- tions. This method is based on the idea of maximizing a likelihood function. However, the use of closed form moment formulae (see Formulae (65)-(68)) rather than the use of a likelihood function involving the transition probability density fun ction of the differential model and the solution of a kind of Kushner equation (see [6,7]) gives to the method based on the moment formulae pre- sented here a substantial computational advantage in comparison to the method suggested in [6], [7]. A similar statement holds when the method presented here is com- pared to methods where averages of quantities implicitly defined by the differential model (such as the moments) are computed using statistical simulation . The numerical solution of the nonlinear oblems that translate the calibration problems consider- ed can greatly benefit from the availability of a good ini- tial guess to initialize the optimization algorithm. In Sec- tion 3 we discuss briefly how to exploit the first moment formula obtained in Section 2 to build the initial guesses needed. Note t ssible to define ad hoc statistical tests that can be used to associate a statistical significance level to the parame- ter values obtained as solution of the calibration prob- lems. We do not consider statistical tests and statistical The remainder of the paper is organized as follows. In Section 2, new formulae for some garithm of the forward prices/rates variable of the log- normal SABR model are derived. In Section 3, the cali- bration problems for the lognormal SABR model corre- sponding to the two data sets discussed previously are formulated as constrained nonlinear least-squares prob- lems. Finally, in Section 4 we solve numerically the cali- bration problems presented in Section 3 and we discuss the results obtained in numerical experiments on synthe- tic and on real data. The real data studied are time series of euro/U.S. dollar exchange rates. 2. Formulae for the Moments o Let us deduce closed form formulae for the m logarithm of forward prices/rat SABR model. Let us consider the model given by: dd,0, tttt xxvWt (9) dd, ttt vvQt0, (10) with ositive initial conditions (3) assumption (5). That is, we assume p, (4) and the 0x (with 0 probability one) and 00v (with probability one), so that Equations (9), (10) imply 0 t x (witability one), and 0 t v (withbility one) for 0t. Let h prob proba ln tt x , 0t, belogarithm of the forward prtes. Using the variables t the ices/ra , t e storeEquations (9), (10) and the initial conditions (3), (4) are rewritten as foow v, 0t, th ll s: chastic diffential 2 1 ddd,0, 2 tttt vtvWt (11) 0,dd, ttt vvQt (12) 00 0 ln , x (13) Starting from the expression transition robability density fun pr 00 .vv (14) obtained in [8] for the pction of the stochastic ocesses t , t v, 0t, we deduce explicit formulae (eventually involving integrals) for the moments with respect to zero of t , t v, 0t, and of t x , t v, 0t. In particular, we derive closed form formulae (that do not involve integrals) f the momenw rt to zero of t ore first fivts ithespec , 0t. In [8], using the backward Kolmogorov Equation associated to (11), (12), the following formula for the transition probability density function L p of the sto- chastic processes , tt v , 0t, implicitly defined by (11)-(14) has been obtained: Copyright © 2013 SciRes. OJAppS  L. FATONE ET AL. 348 ,,,,, 1 L pvtvt de , ,,, ,, 2 ,, ,,,0,0, kL kg ttkvv vv tttt (15) where is the imaginary unit and we have t , t t vv, , , t vv ,0 tt , 0tt . In (15), when 0 we must choose 0 t , 0 vv n. The functio L g is gi ven by: 2 0 , e de sinh, ,,,,0, 1,1, k vvv 2 8 2 2 ,, ,,e vv s Lv gskv K kvKkv skvv (16) where the function K of denotes the second type modi- fied Bessel functionorder (see [9] p. 5). Finally, 2k , ,k is defined as 22 2 1 kk k 2 2 i,.k (17) The function L g can be rewritten as follows [8]: 2 222 22 22 22 2 81 ,,,,ee k Lv gskvv vv 22 2 0 2 1 2c osh2 22 0 , ed sinhsine 2 de ee, ,,,,0,1,1. vv s sus vv k vv kyv vvvuvv yy u uus s y sk vv (18) Formulae (15), (16) or (15), (18) give L p ilit as a two dimensional integral of an explicitly known integrand. Note that in (15) the transition probaby density function L p is written using the variables ln tt x , t v, 0t. It is easy to obtain a formula analogous to formula (15) for the transition probabil ritten in the original variables t ity density function w x , t v, 0t. Formulae (15), (16) and (15), (18) are representation formulae for L p that hold when . These 1,1 for- mulae have been obtained in [8]. Previously when 0 for L pnly series expanwers of osions in po with base point 0 were known (see, for example, ] and t references therein). Let us begin deg some formulae for the moments ,nm , ,0,1,,nm with respect to zer [10,11he rivin o of the vari- ables t x , t v, 0t, of the lognor mal SABR model (9), 3), ( ,,,,ded,,,,, , nm nm tvtvvpvtvt (10), (4), namely, 0 ,, ,0,0,,0,1, L vt tttmn 0n . (19) We distinguish two cases, that is: the case and the case When 0n. 0n we have: , 0, 0 ,,,d d,,,, mL tvtvvp vtv 0 , ,,,,, d,0,,,,, ,,,0,0,0,1, m L mL t k ttkvv vvgttvv vttttm 0 de d km kvvg (20) where is the Dirac’s delta. From (18) we have: 2 2 0 2 0 2 32 cosh 22 00 d,0,,,, 2 ddeee, ,,0,1,1,0,1,. mL vv yy myu vv vvgsv v s s vv y sv m (21) Using formula (29) on pa ge 1 46 of [12] we have: 2 22 22 8e ed sinhsine ssus vu uu 12 32 22 12 0dee2 , ,,,vy vv yy vv vvvK y and this implies that: (22) 2 2 2 22 2 8 0, 2 2 2 0 cosh 12 0 2e ,,,e 2 d sinhsine d()e, ,,,0, 0,0,1,. s ms m us yu m v tvt s u uus yK y vtt tt m ( From Formula (24) on page 197 of [12] it follows that: 23) cosh 1/2 0 sinh 2 de , sinh yu u yK yu u . (2 on page 92 of [12] we can conclude 4) From Formulaes (23) and (24) and using formula (37) that 0,0 ,,, 1tvt ,, 0,vttt 0 t , , and that ,tv 0,1 ,,tv , , ,, 0,0tttt v . Note that the moments 0, ,2,3,, mm diverge. In fact, when 0n integrating (20) first with respect to k when k , and then with respect to when we have: , Copyright © 2013 SciRes. OJAppS  L. FATONE ET AL. Copyright © 2013 SciRes. OJAppS 349 22 2 22 0, 2 82 2 0 2 12 22 0 e e 2ed sinhsine 2 1 d,,,,0,0,0,1,. 2cosh m u sss m tk g vv u uus s vvvt tttm vv vvu (25) Formula (25) is equivalent to Formula (23) and shows at in order to have a convergent integral we must choo- 0 1 ,,,d dd,,,,, 2 k m vt vv ttkvv L When using Formulaes (15) and (18) in the de- finition (19) we have: 0n th se 12 32m . 2 2 222 ,0 22 22 8 22 0 2 22 22 1 12 0 1 ,,,de dde,,,,, 2 1 ee 2ed sinhsine 2 12cosh de k nm nm L s nsus nvv m tvtvvk gttkvv nn vv u uus s nn Kvvvv vv u 22 , 2cosh ,,,0,0,1,2,,0,1,. vv vvu vttttnm (26) Note that for when with respect to zero of the variables t 11,2,,n 11 11nn or 11 11nn the integrals appearing in th n and the conding mothe moments logno (26) wi 1 1, 2,,,n ments are 0,1,,m rrespocon- vergent. A similar existence condition for of thermal SABR model has already been derived in [13], however in [13] no explicit integral repre- sentation formula for the moments like Formula (26) is given. Note that when 1n and 0m formula (??) gives 1,0 ,,, etvt , ,,,0,0vtttt , wh , defined by (11)-(14), i.e. . t v, 0t, ,,,,dd nm nm tvtvvp 0,,,,,, ,,,0,0,,0,1, Lvtvt vttttmn (2) The procedure used here to calculate the moments (27) generalizes the procedure used in [4] to calculate m 7 the oments with respect to zero of the variables t x , t v, 0t, of the normal SABR model. Substituting (15) into (27) and using the propeiesf ourier transform we have: en 1,1 . Recall that ex , . Let us consider now the mo,,0,1, ,nm ments rt o the F ,nm ,0 0 0 0 0 1d d d,, j m vv kkgttk,,,, , d d d,,,,, d ,,,0,0,,0,1,. nnj nm L jj j j nnjjm Lk j j n tvt vv jk nvvgttkv v jk vttttnm j (28) Let us calculate the integrals contained in (28). For let 0,1,j j G be the-th order derivative with j respect to k of the function L g evaluated at 0k , that is, let ,,d d,0,, jj jL Gsvvgks vv , ,,svv the previ. To simplify the notation we have omitted in ous formula, and we will omit from now on, the dependence of L g and of j G0,1,j, fro, m and . Using the functions j G, 0,1,j, Formula  L. FATONE ET AL. 350 (28) can be . We restrict our attention to rewritten as follows: , 0 0 ,,, d,, nm nnjj j tvt nvv G j (29) , ,,,0,0,,0,1, m jttv v vttttmn ,0 ,,, ntvt , , ,v 3 in th n , 1n ,0, 0,ttt tn e solution of the ca ,2,3,4 . The choice 0,1,. In fact, in libration problems of considering Section we will use 0m ,0 in lems isthe due to moments used to solve theob arkets the variable t calibration pr financial m the fact that in the x , 0t, and, as a consequence, the variable t , 0, can beserved, while the variable t v0, cannot be observed. That is, the moments ,nm , 0,1,n, 0m, cannot be easily estimated from eata, while the moments ,0n , 0,1,n, c timated immediately from observed data. Let us define *,0 ,, ,,, ,, nn nnjj sv tvt nDsv t obs rved be es ob d , t an 0 ,, ,0,1, j jj sttvn . (30) where 0 0 0d ,d,, d,,,,,,0,1,, d jj j Lk j DsvvGsvv vgskvv sv j k (31) and 0 d ,,d,,,, d ,, ,0,1,. j jL j Dskv vgskvv k skv j (32) We have 0 00 ,,, dd,,, , d ,,0,1,. jj k j L j k DsvDskv vgskv v k sv j (33) The functions j D, tial value 0,1,j problem , can be deter solving the inis deduced belo function mined by w. The L g (see [8] is the solution of the following initial value problem): 2 22 0,, ,,, ,. L gkvvvvk vv (35) Equation (34) is the Fourier transform of the b Kolmogorov equation of th e lognor mal SABR model and the parameter ackward k gate variable in the Fourie that appears in (34) is the con- ju r transform of the variable . Integrating both sides of (34), (35) with respect to v when v we have: 2 22 222 00 0 0 2 22 DD D k vvDkv 22 ,, ,, 2 2 2 2 22 1 L LL L L g gg k vvgkv s v v kv g skv (34) 20 1,, ,, 2 v v s kv D skv (36) 00,,1,,.Dkvkv (37) When 0k , Equations (36), (37) reduce to: 2 22 00 2,,, 2 DD vskv sv , (38) 00, 1,.Dv v (39) Equations (36)-(39) define initial value problems satis- fied by and by, respectively. Recall tha is given in (33). It is easy see t 0 D lation between hat 0 D and t the re- 0 D0 D to Dsv 0,1 , this ,sv solutio , n usis ing a la a solution of (38), (39). Let us obtain procedure that ter will be extended to deduce explicit formulae for the functions j D when 0. Defining Lj 0, and0 L through the relations: 00 ,Dsv,L vvs , , ,sv ln v , v (i.e. ev , ) and 00 ,,Ls Lsv , ,s , problem (38), (39) can be rewritten as follows: 2 s ) 22 00 0 2,,, 28 LL Ls (40 2 00,e.L (41) , The solution of (40), (41) is given by: 2 00 ,d,e,,, (42) Lss s whre e 22 22 8 01 ,ee, s s ss 2,. 2s (43) ntegral (42) when The i 212qj and 0j can be computed using the formula 2 222 0 418 82 ee e , ,,. sq sq sq ) d,e e e q qsq s (44 It follows that the solution of problem (40), (41) 0 L Copyright © 2013 SciRes. OJAppS  L. FATONE ET AL. Copyright © 2013 SciRes. OJAppS 351 is given by: ,,,,,1, jj DsvvLsvsvj 2,, (51) 22 28 82 0,eee e, , ss Ls s . (45) From (45) it follows that and considering the change of variable ln v , v , define the following functions ,, , jj j Lsv LseLs , , s , 1, 2,j. 00 ln ,,l v DsvvLs v (46) 2 n e1,,.vsv Let us derive the initial value problems th sa It is easy to see that (47), (48) imply that the function , is the solution of the following initial value problem: 1 L at are tisfied by the functions 0 ,,, jj DsvDskvk 2 22 0 2 11 1 2 32 0 e 28 1e, , 2 LL D L s Dsv , (52) , erentiating times with (34), (35) and sutin ,s respect to ,v 1, 2,j. Diffj bstituk problemg 0k in the resulting equation 1j the s, we have that when function 1,Dsv , ,sv , satisfies the following initial value problem: 10, 0,,L (53) 2 222 1 0 2,, , 22 DD vDsv sv 1 v (47) 10, 0,,Dvv (48) and when 2,3,j thtion ,Dsv , ,,sv satisfies the where 00 ,,e1Ds Ds , , s . Moreover, from (49), (50) it follows that the functions j L , 2,3, ,j satisfy the initial value problems: e func following ine problem: 2 22 32 2 2 1 232 1 1e 282 ee 2 ,,2,3,, jj , j j jj LL j Lj D s Dj jD sv j (54) j itial valu 2 22 22 2 1 22 1 =1 22 , jj j 2 ,, 2,3,, jj DD j vjvD svD jvD (49) (50) Let us assume that jv v sv j 0,0,,2,3, , j Lj (55) where ,, jj Ds Ds 0,0,,2,3, . j Dv vj e, , s , 2,3,j . The solution of (52)-(55) can be written as follows: 0 0 32232 1 ,dd , 1ee,e,, 22 ,,1,2,, s j j Ls s jj jDD D sj (56) where we have defin ed 21 (, ) jj j 1,0Ds , s , . Let us give the explicit expressio ns of ,,ln,, jj DsvvLsv sv *00 ,, , jtv ,t when 1,2, , and of . Recall that 3, 4j ,=Dsv ,l jj vLs n ,v and that , ,sv j1,2,, 0,1Dsv , we have: ,.sv Using Formulae (44), (56) 22 ,e 1e,,, ss vsv (57) 2 11 2 Dsv 2 22 2 22 2 2 23 2 56 46 1e 1e ,e1e 23 1e 1e,,, 256 s s s ss s Ds v vsv 2 3 3 2e 1e s s vv (58)  L. FATONE ET AL. 352 22 22 2 2 22 2 34 23 356 326 3 456 6 1e1e1e 1e1e ,6 e18e 2318 1018 1e 1e 3e 56 ss ss ss ss s vv Dsv v 2 s 222 2 10 es 2 22 2 2 5479 10 691415 15 1e 1e 1e 1 3e 60421015 11e1e1e e3 4907030 sss s sss s v v ,, ,sv (59) and finally , 4123 ,,,,,,D svI svIsvIsvsv 1 I , 2 I and 3 I (60) where are the fol lowing function s: 2 222 222 2 2 2 2 45 26 36 1 547910 310 54 10 1e ,4e 1e91e 5 1e 1e 11e 42 s e 4e4 5755 1e 4e s ss s sss s s s v Isv v v 22 22222 2 910 65 9121415 215 72 1e1e 4 10155 1e 1e1e1e1e 2e3532 70 18841415 e ss sssss s v v 22 22 26152021 11e1e1e1e 9,,, 630 225700105 ss ss ssv (61) 22 22 2 2 22 2 45 56 7910 610 2 6914 15 1e1e1e1e 1e ,6e6 e 56 21915 31e1e e 10 27 ss ss ss s s vv Isv v 2 s 2 15 1e ,, , 79 ss sv (62) and 22 2 2 22 22 2 57910 10 3 6912 1415 215 1e 1e 1e ,12 e351830 1e 1e1e1e 2e 9 45 127015 ss s s ss ss s v Isv v 222 2 2222 2 691415 15 711 1518202 21 1e 1e1e 6e 270 7090 1e 1e1e1e1e e33 2 770 150126100 sss s sss s s v v 2 2222 2 1 81322 2728 28 105 11e1e1e1e e, 20819 1986384 s ssss s vsv ,. (63) Copyright © 2013 SciRes. OJAppS  L. FATONE ET AL. 353 Recall that s tt , 0 . From (30), (46), (57)-(60), choosing 0t , 0 vv we have that s t of t and threspect to zero e first five moments with , t , are (64) , (65) , (66) 6 (68) The momentsdepend on the pa- rameters of the logd el given by: * 000 0000 ,,, 1,,,,tv Dtvtv * 100 00010 00 ,,,, , ,, tvDtvDtv tv *2 200000010 01 020 00 ,,, 2, 3, , ,,, tv DtvDtv Dtv Dtv tv *3 2 300 000010 02 0 ,,,3, 3, tv DtvDtv Dtv 3 0 00 ,, ,, , Dtv tv ( 7) *4 4 400 000010 2 020030 400 0 ,,, 4, 6,4, ,,, , tv DtvDtv Dtv Dtv Dtv tv * ** * . 1 , nor 2 , ma 3 , l SABR m 4 o , , s on0 v and on the time depe t. In particular, * 1 Lnd , 0 v and , while on t* 2 , * 3, * 4 depend , 0, v and t. T mo me ohent * 0 does not dependn , 0 v , , t ems for new lve alo- for in and fo and th go m ca r the l o are e cal fo course as re an nnot cali ogno rm the mme m closed formun the fnext ibratiod pr us rmuleast all the remadefi o d that, as al Sectiorm formulae of t l 8oe nc be rm nts of t mo orm n ae can inin nm o use pr re in d i al SABR he lo me ul obl be g m incr vo n nt fo the m gnorm rm ae used ems di ded omen lved. stud odel. F ul in t ced ts Note y h scusse of o al SABR ae anno e (at l ,nm brat ulaes (6 ced sect evio in ne i i on 5) odel are in ons t usly prin n ( ,nm ready sai probl -(68 the o s . An ple) 27) be ) o d Section 1 u ci d i. Of come , mease the formulae for n 1, closed foobservable quantities implicitly defined by (9), (10), (3), (4) such as (65)-(68) are very useful to build computationally efficien me- thods to solve calibration problems. In [4], Formuaeanalogous to (65)-(6) fr th mo- ments of the forward prices/rates variable of the normal SABR model (6), (2), (3), (4) are derived and used to solve calibration problems. 3. Two Calibration Problems for the Lognormal SABR Model Let us study the calibration problems of the lognormal SABR model (11)-(14) annoued in Section 1. Recall that the parameters , , e unknowns and are th that we want to determine these parameters starting from the knowledge of a set of data. We consider the sets of data specified previously. The corresponding calibration problems are formulated using the closed form Formulaes (65)-(68) for the moments of the logarithm of the for- ward prices/rates variable and are solved numerically. Let us begin formulating the first calibration problem. Let be given. We consider multiple traj f the lognormal SABR model (11), (12) as- soitial conditions (13), (14) assigned at time 0 v 0T ectories o ciated to the in 0t independent . The set of data of the first calibration prob- leme set of the logarithms of the forward prices/ d at time is th rates observetT in this set of trajectories. In particular, letting be a positive integer, we consider independenpies n t co ni T , of variable 1,2,,,in the rando T m solution at time tT of (11)-(14). For 1,2,,in let ˆi T be a realization of i T . The set: 1ˆ,1,2,,, i Tin (69) is the data sample used in the following calibration pr the data set defined in (69), recues of the paraers oblem: Calibration problem 1: multiple trajectories calibra- tion problem. Given 0T, 0n and 1 metonstruct the val , e and 0 v of the lognormal SABR model (11)-(14 To solve this calibration problem we com ). pare th theoretical values of the four moments * j , 1,2, 3,4,j given by (65)-(68) with the estimates of these moments obtained from the sample 1 of the observed data. It is easy to see that the random variables: 1 1 ,, 1,2,3,4, nj i jT i nT j n (70) are unbiased estimators of, respectively, * j , 1, 2,3, 4j . For 1,2,3,4j let us consider the realization ˆ,, jnT in the data sample 1 , of the random variable , jnT, that is: 1 1ˆ ˆ,,1,2,3,4. nj i jT i nT j n (71) The unknown parameters , , 0 v of the normal SABR model can be determined as solutions of the fol- lowing constrained nonlinr least-squares problem: 0 4*00 ,, 1 ˆ min,,, jj j vj Tv nT 72) sbject to the const ea ( uraints: 2, 0 0, 11,0,v (73) where j , 1,2,3,4,j are non negative weights that will be chosen in Section 4. Copyright © 2013 SciRes. OJAppS  L. FATONE ET AL. 354 Note that roughly speaking when increases the “q n uality” of the moments ˆ,, jnT 1,2,3,4,j estimated from the data samp mer to lve sib rained no n values the m construct good initial guesses of problem (72), (73) we take a closer look to the explicit expression of Formulae (65)-(68). In particular, we consider the (fula (65)) when be su withder appr le increases and this should ake easisoatisfactorily the Calration prob- lem 1. The numerical experience shows that the const nlinear least-squares problem (72), (73) has many local minimizers with similar objective functio. This means that the solution of problem (72), (73) is sensitive to the choice of the initial guess of inimization procedure used to solve it. To the moment asymptotic expansion of the moment * 1 orm 0. Let ch that 12 0TT, we approximate the first- and the send-order Taylor's expansions e point t 2t * 1 oximation o 12 ,TT of bas * 1 when co The first-or 0. f 1 tT 0 v is us . Th ed to obtain th e seconde initial g appr uess fo oximation or th 1 e param * wheneter 2 tT -order f is used to obtain the initial guess for the parameter . To build an initial guess of the parameter it is necessary to use higher-order moments. We prefer to exploit the fact that 11 nt formul lution of p and th r at th akes co lem (72) e av i ailab mput , (73). Th com al gu ility o onally is m putationa f the exp very eans that, wh l cost, it is for the param licit en eter mome the soae m ob ati esses efficient necessary, at an affordable possible to use multiple init . The defined in (69) used in Calibra- tion problem 1 to formulate problem (72), (73) must be co data sample 1 mpleted with the auxiliary data 1 ˆi T , 2 ˆi T , 1, 2,,,in (observed at tim e 1 tTand2 tT ) needed to build the initial guess of the minimization procedure used to solve problem (72), (73). For sim- plicity, it is possible to choose or as it is do 1 TT 2 TT ne in the numerical example discussed in Section 4. In this case, the data contained in (69) are used both to formulate the nonlinear least-squares problem (see (72), (73)) and to obtain the initial guess for 0 v (when 1 TT) or, the initial guess for (when 2 TT). This set of data is realistic in several contexts of science and engineering where, for example, the obser- vations are obtained in experiments done in a laboratory. In fact, repeated experiments are a routine work in a laboratory. However, most of the times this is not re- alistic for observations made in the financial markets where usually it is not possible to repeat the “experi- ment”. That is, in the financial markets repeated obser- vations at a given time 0t of independent realizations of the forward prices/rates random variable t are usually not available. This is a serious concern which implies that the Calibration pm 1 is of limited in- terest in finance. The second calibration problem for the lognormal SABR model (11) -(14) overcomes this difficulty. In fact, ample considered in the second calibration problem is the set of the logarithms of the forward pri- ces/rates observed on a discrete set of known time values along a single trajectory of the lognormal SABR model. This data sample is easily available in the financial mar- ts. roble the data s ke It can be identified with a time series of the log- arird thms of the forwaprices/rates observed in the finan- cial market. Going into details, let M be a positive inert 01 teg and le ,, , M tt t be 1 M discrete timues sut 1, ii tt e valch tha 1,2,,,iM and 00t. Recall that the times i t, 0,1, ,iM , are known. The data of the second calibration problem are arith the for- ward prices/rates observed at the times 01 ,, , . the logms of M tt t For 1, 2,,iM let us denote by ˆi the logarithm of the forward prices/rates observed at time i tt along one trajectory of the stochastic process ,0. tt T set: he 2ˆ,1,2,, , iiM (74) is the data sample used in the following calibration problem: Calibration problem 2: single trajectory calibration problem. Given 0M, 1 M discrete time values 01 ,, , , M tt t such that 1, ii tt 1,2,,,iM and 00,t and given the data set defined in (74), determine the values of the parameters 2 , and 0 v of the lognormal SABR model (11)-(14). The Calibration problem 2 can be formulated as the following constrained nonlinear least-sq uares problem: 0 2 4* ,00 ,, 11 ˆ min( ,,), Mj ijjii vij tv (75) subject to the constraints (73). The constants ,ij , 1, 2,,,iM 1, 2, 3, 4,j in (75) are non negative weights that will be chosen in Section 4. Note that when M increases the “quality” of the terms ˆ j i , 1, 2,,,iM 1, 2, 3,4,j does not increase, it is only the number of addenda of (75) that increases. For this reason we expect Calibration problem 2 to be more di pro The numl exp shows t the behavioe con qres problem r the num optimization or ent form in Section 2. In particular, we use the first- and the fficult than Calibration blem 1. ericaerience with problem (75), (73) hatur of thstrained nonlinear least-sua (75), (73) is similar to the behaviour of problem (72), (73). This implies that the availability of a good initial guess foerical algorithm used to solve (75), (73) is very helpful to obtain a satisfactory solu tion. Inder to build this initial guess we exploit the momulae deriv ed Copyright © 2013 SciRes. OJAppS  L. FATONE ET AL. 355 second-order Taylor’s approximations of with base point . From the first- of th (i.e. ng thervations * 1 (see (65)) order Taylor's 0t e traject approximation at 0t of * 1 evaluated at the beginning ˆory usie obs i with i small, that is 1,2,,10i in the numerical example of s Sectioess of econd n 4) -or we obtain Tay the in lor's itial gu0 om the der approximation at 0tv . Fr ated at the esing servations ˆi of the * 1 obevalu (i.e.nd of te trajecthory u with i close to M , that is 91,92, ,100i in the numerical examp oection we obtain the initial guess of lef S4) . Sometimes also the first-order Taylor’s approximation of * 1 d dt with base point is used to construct the initial g num imization algorithm used to solv at 0t erical opt 1 uess of the e (75), (73). In this last case the first-order Taylor’s approximation at 0t of * is used to obtain the initial guess of the parameter 0 v and the first-order Taylor’s approximation 0 of t* 1 d d is used to obtain the initial guf the parameter tess o . These approximations are evaluated at the beginning of the trajectory. As explained more in detail in Section 4, in financial applications a priori information about is available. That is, due to the financial meaning of the variables, we must expect 0 . In Section 4 we exploit this information to choose an initial guess for the parameter . 4. Some Numerical Experiments In this section we discuss three numerical experiments. In the first numerical experiment we solve the Calibra- tion problem 1 using synthetic data. In the second and third numerical experiments we solve the Calibration problem 2 using, ctively, synthetic and real data. The real data studied the da belonging to a time series of exchange rates between currencies (euro/U.S. llar excange rates). The numerical experiments presented in this section can be “interpreted” as follows. As already said, the numical experiment can be seen as a “physical experi- ment” done in the context of a scientific laboratory where make repeated observations of the same quantity. This type of experimen usually is based on a respe are ta do h first er it is possible to tgno l ha al m the no more accurate value of the parameters can be obtained increasing the numerousness of the data sample used in ibn probl eriman b pring and to hedge y important to eters. In some setting of the first numerical ex “physical model” (i.e. in this case the lormal SABR model) where the parameters of the modeve a precise physiceaning (i.e. they are masses, charges, ...). In these circumstances the main scope of a calibration problem (such as Calibration problem 1) is to determine umerical values of these parameters in the best pos- sible way. Nte that in this kind of experiments usually a the calratioem. The second and third numerical expents ce seen as experiments in finance or in a different context where it is not possible to make re- peated observations of the same quantity. Note that in mathematical finance the model and its parameters are mainly an auxiliary tool. In fact, the model is simply an instrument to interpret the data or to forecast future data. In the practice of the financial markets the calibrated financial models (such as the calibrated logno rmal SABR model) are used to do option’sic portfolios. In these contexts it is not reall know the exact values of the model param sense even the existence of “exact” values for the model parameters can be debated. In mathematical finance the key fact is to show that the calibrated model is able to interpret the observations, that is, for example, to show the consistency of the option prices computed using the calibrated model with the option prices observed in the market. Let us describe the periment. Let 0T be given and n, m be positive integers. Let tTm be the time increment and i tit , 0,1,, ,im be a discrete set of equispaced time values. Let m tT , m tT vv be the solutions of (11)-(14) at time tT . The n independent realizations ˆi T , 1,2,,,in of the random variable T used as data in Calibration problem 1 are ap- proximated integrating numerically n times (in cor- respondence of different realizations of the Wiener processes) the lognormal SABR model (11)-(14) in the time interval 0,T using the explicit Euler method (see [14]). In the numerical example we choose 1T, 100m , 1000n , 0.1 , 0.2 , 00 1 and 00 0.5vv . The parameters 0 ,,0.1,0.2,0.5 ,v (76) are the “true” values of the unknowns of the calibration problem considered (i.e. they are the values of the unknowns used to generate the data). We reconstruct these unknown parameters solving Calibration prob lem 1 using as data sample the set of the logarithms of the forward prices/rates observed at time 1tT in 1000n independent trajectories of the lognormal SABR model (11)-(14) (with the parameter values given in (76) and 00 1 ). These trajectories are ap- proximated integrating numerically using the explicit Euler method the model (11)-(14). In particular, when 1000n let us denote by 1 ˆ ˆ, i T 1, 2,,,in the approximations of 1 ˆ,1,2,,, i Tin obtained at time 1tT integrating with the explicit Euler method 1000n independent trajectories of the model (11)-(14) (with the parameter values given in (76) and 00 1 ). The set: Copyright © 2013 SciRes. OJAppS  L. FATONE ET AL. 356 1,10001,1,2,,1000, i TnT i (77) is the sample oftic data used to solve Calibration problem 1. In a similar way when we choose 100T, 1000n ˆ ˆˆ synthe (leaving the other parats unchanged) we generate the data set 100, 1000100 ˆ,1,2, ,1000 i TnTi . As explained in Section 3, this second datasample is used in the construction of the initial guess of the numerical optimization algorithm used to solve the constrained nonlinear leasres problem (72), (73) corresponding to the data samˆ meer t-squa ple ed in th numerical Using and the first- and second-oor’s ap point ugg io ˆ ˆ 1, 1000Tn . The data sets 1,1000 ˆTn and 100, ˆTn use experiare avai 1, 1000 ˆn and 100, ˆT 1000 lable at [15]. ment T rder Tayl 0, as s 1000n proximations o ested in Sectf 1 with base n 3, we find * t 00.515 in v and 0.099 in as initial guesses of, respectively, 0 v and . Note that in the notation of Section 3 we have chosen 11TT and 2100T . The initial guess in of is chosen as 0.05 in . Given 0 ,,0.099,0.05,0.515 inin in v as initial guess, the nonlinear least-squares problem ) is sing 1, 1000 ˆTn as data sample. In this numerical example the moments considered in (72) are all of the same orgnitude so that it is possible to choose in (72) the weights 1 j (7 der of ma 2), (73 solved u , 1, 2,3, 4j. Note that Formulae (65)-(68) suggest that in general the weight j must decrease whenses. The nonlinear lelem (72), (73) is ing the FMINCON routine of Matlab. Th e solu- d starting from the initial guess the index j ast-squares prob increa solved us tion foun (78) The relative -error of the initial guess 0 ,,0.099, 0.05,0.515 inin in v is: ** 00 ,,,,0.076,0.222,0.508 .vv * 2 L ) is 0 e -error of the so lem wit he sensitivity of the solution procedure respect to the presence of noise in the 0 ,,0.099, 0.05,0.515 inin in v with respect to the “true” soluti2 on (76.275. The relativL lution (78) of the least-squares probh respect to the “true” solution (76) is 0.062. To study t proposed with data we add noise of known statistical properties to the synthetic data contained in 1, 1000 ˆTn , 100, 1000 ˆTn and we study the quality of the solutions of Calibration problem 1 found as a function of the noise properties. In particular given 10 ple: wing “n distribu interval let considuser the follo oisy” data sam ˆ ˆˆ2 i 1,1001 11 ,1,2,,1000, Tn i (79) where is a random entry taken from a uniform on the1) . In a similar way we add noise to 100, 1000 to obtain the “noisy” data sam- ple 100, 1000 ˆTn . Given 10 0 1 Trand rand tion (0, ˆTn comute the relatiwepve -error bee” solution (76) and the ibed ab 2 L tween solution of Calibration problem 1 found with the numerical procedure descove. We repeat the entire procedure 1 N times and we compute the mean of the 2 L-relative errors of the 1 N solutions found. We denote by the “tru r 11 ,, N n E this mean relative erroelative errors r. The mean r 11 ,1000, 1000Nn E obtained when 11000N , 1000n 1 and 0.01,0.05,0.1 are show in Table 1. n As already explained, it is expected that in this ex- periment a more accurate value of the parameters can be obtained by increasing the amount of the validat data sample used in the calibration problem. Toe this idea, we increase the number of the data samples invo the experiment. Wensider and we con- st the correspondingi n co ple “no lved in 10000n 00 ata d ruct the data sams 1,10 0 ˆTn , 100, 10000 ˆTn and samples 1,10000 ˆ, Tn 100, 10000 ˆTn . The data sets 1, 10000 ˆTn an100, 10000 ˆTn used in the numerical experiment are available at [15]. Given 0 sy” d 1 we compute the mean relative errors 11 ,1000, 10000Nn obtained when 11000N, 10000nE and 10.01,0.05,0.1 . The results obtained are shown in Table 2. The comparison of Tables 1 and 2 shows a substantial reduction of thehen 10.05 mean relative errors w and 10.1 and only a marginal reduction of the mean relative errors when 10.01 . This sug- gests that the presof noise even in small quantity degrades the solution ence obtained. The second numerical experiment presented consists in solving Calibration problem 2 using a sample of synthetic data. Given the number of observations 0M Table 1. Calibration problem 1: the mean relative error Nn E 11 ,=1000,=1000 as a function of 1. 1 11 ,1000, 1000Nn E 0.01 0.124 0.05 0.215 0.1 0.328 Table 2. Calibration problem 1: the mean relative error N 11 , =10 n00, =1 E0000 as a function of 1 1 . 11 ,1000, 10000Nn E 0.01 0.104 0.05 0.141 0.1 0.170 Copyright © 2013 SciRes. OJAppS  L. FATONE ET AL. 357 and a time increment 0t , let , i tit 0,1, ,,iM be a discrete set otion times. Let ˆ ˆi f observa be the approximat of ,1,2,,, i tiM ion of a realization obtained integrating with tt d one trajectolognor model (11)-(14). Let us choose 100,M 1,t he explici ofmal SABR Euler methory the 0.1, 0.2, That is, we wan 00 1 and 00 0.5.vv t to reconstruct th p (76) by solving Calibration problem 2 using as data sample the set of the logarithms of the forward prices/ rates observed at time ,1,2,,100, i ti M along one trajectory of the lognormal SABR model. The set 2ˆ ˆˆ,1,2,,100, ii (80) e unknownarameters is the sample of synthetic data used to solve Calibration problem 2. The data set 2 ˆ used in the numerical xperiment is available at [15]. eProceeding as discussed in Section 3 using the data set ˆ , the least-squares fit of the first-order Taylor’s n of * with b 2 appr at t of seco point in oximatio ase point evaluated ves itial guess set fit of th e ap with base d at gives 1 0, gi ata lor's uate itial gu 0t as in ares * 1 , i, 0 v nd 1,2 ,1i . Using the d -or ay tval 0.114 , 00.533 in v 2 ˆ, the least-squ oximation i t, 91i of pr ess der T of 0 e,92,100, as in . To obtain an initial guess of tharae pmeter we take a e prices go do ploiting this dvantag unde wn th e of th rstand e vo fact and the fact e “a in the latility priori” information that in finance the correlation be- tween forward prices/rates and stochastic volatility is ve. In fact, as it is easy to us fina goe that ually n nc s u egati ial markets wh p and i 11 en ceversa. th Exv the initial guess in of that we solution of data thbservations choose is in g from th0.5 . e in Startin itial guess 0 ,,0.114, 0.5,0.533 inin v that uses as ˆ, i in the Calibration problem 2e o ˆ 20,30i non FMINCON routin corresponding to the central part , ,80, of 2 ˆ is obtained solving the linear least-squares problem (75), (73) using the e of Matlab. Note that in (75) we prefer to use only a subset of the observations of the data sample 2 ˆ (i.e. 20,30,,80,i of the avoid the presence of too many addenda in the objective function (75). In the numerical computation the weights ,ij a subset of data trajectory) to , 20,30,,80,i 1, 2, 3,4,j are chosen such that the addenda of (e order of magnitude. Using 2 ˆ as data and 75) are of 0 ,,0.114, 0.5,0.533 inin in v solution of problem (75), (73) found t h as i is: e sam nitial guess the e i *** 00 ,,,,0.019,0.168,0.472 .vv (81) The relative 2 L-error of thnitial guess 3 “tr solu 76 s point out thta of su rate ta obss. ow sensitivity ora ed 0 ,,0.114, 0.5,0.53 inin in v with respect to the Calib eves stu ue” solution (76) is 0.551. The relative 2 L-error of the tion (81) of the least-squares problem with respect to the “true” solution () is 0.167. Let uat the daration problem 2 are pposed to be prices/s observed in the financial markets, that is, these data are not affecteby noise as the daerved in physicHdy the f the solution of Calibtion problem 2 found with the numerical procure proposed with respect to the presence of noise in the data. We add noise to the synthetic data contained in 2 ˆ and we study the quality of the solution of Calibration problems 2 found as a function of the noise properties. In particular given 20 d r, let u let us consider the following “noisy” data sam- ple: 1,100 22 ˆ11 2 , irand i where rand is a random entry taken from a uniform distribution on the interval ,1 . Given 20 ˆ 0 ˆ2,,, (82) we compute the relative 2 L-error be- tween the “true” solution (76) and the solution of Cali- bration problem 2 found with the numerical procedure described above. The entire procedure is repeated 2 N times and the mean of the -relative errors of the 2 N solutions found is calculated. Let 2 L 22 , N E be this mean relative error. The mean relative errors 22 , 1000N E ob- tained when 1000N2 and 0.01,0.05,0.1 2 are shown in Table 3. Table 3 shows mean relative errors greater than the corresponding meaelative errors of the first numerical experiment. The calibration problem studied in the second experiment is more difficult than th n r problem studied in the first one quantity of the data and abov qu ng deduced from the data sample 2 ˆ e calibration . This is due e all to the quality o es problem ed a in, to the f the antities enteri in the nonlinear least-squar when compared, for example, to the quantity of data contain in the data sample 1,1000 ˆTn and 100, 1000 ˆTn . That is, there are 100 data in 2 ˆ and 2000 ˆ dat 1, 1000 ˆTn 100, 1000Tn and the moments estimated from the data contained in 1, 1000 ˆTn , 100, 1000 ˆTn using formula (71) are of high quality due to the average over a sample of 1000=n observations. There is no a similar effect in Table 3. Calibration problem 2: the mean relative error N E 22 ,=1000 as a function of 2. 1 22 ,1000N E 0.01 0.239 0.05 0.265 0.1 0.369 Copyright © 2013 SciRes. OJAppS  L. FATONE ET AL. 358 Calibration problem 2. In the context of finance the natural way of f w veeth a n reor exhn the Heston m e lognodel this p ho ur purposis paper. der a tim series of enge raten the p rates con .S. dollars and are the closing value of the day (in New year is m tring days and that a month is made of about 21 trading days. Figure 1 shows the euro/U.S. dollar currency’s exchange rate as a function of time. Town in Figu s available at [15]. We use lognormal SABR mo interpret the data show Figure 1. In order to umodel in the he logarithm of the data shown ormulat- ing a nersion of Calibration problem 2 (i.e. a “single trajectory” calibration problm) that defines more accu- rat model ely theparameters is to acquire at e observa- tion times not only the forward prices/rates data, but also the data relative to the prices of one or of several options having as underlying the forward prices/rates. This last problem is a “single trajectory” calibration problem tht exploits more deeply than Calibratio problem 2 the in- formation contained in the prices. We donot consider this problem he. Fample, weodel is used instead of thormal SABR mrob- lem has been studied in [6]. Note that the FMINCON routine of Matlab used to solve problems (72), (73) and (75) , (73) is an elementary local minimization routine. Higher quality results can be obtained solving problems (72), (73) and (75), (73) using global minimization methods. Moreover, the explicit moment formulae that define the objective functions (72), (75) can be used to develop adc minimization algo- rithms to solve problems (72), (73) and (75) , (73). Th is is beyond oes in th In the third numerical experiment we consie xchange rates between currencies (euro/U.S. dollar exchas) ieriod going from September 14th, 2010, to July 20th, 2011. The exchange sidered are daily exchange rates expressed in U York) of one euro expressed in U.S. dollars. Recall that a ade of about 252ad he data set shre 1 i thedel to n inse the form (11)-(14) we take t in Figure 1. That is, we solve the Calibration problem 2 using a window of 20 consecutive observations as data and we study the stability of the solution found with re- spect to shifts of the data along the time series. The model resulting from the calibration can be used to fore- Figure 1. euro/U.S. dollar currency’s exchange rate versus time. cast exchange rates and to compute option prices on ex- change rates. We solve Calibration problem 2 using the real data of Figure 1 associated to a time window made of 120M consecutive observation times, that is the observations corresponding to 20 consecutive trading days, and we move this window across the data set dis- carding the datum corresponding to the first observation time of the window and inserting the datum correspond- ing to the next observation time after the window. The calibration problem (75), (73) is solved for each choice of the data window. We choose 1252,t 00 equal to the first observation (i.e. logarithm of the ex- change rate observed) of the window considered, ,1 ij , 1,2, ,19,i 1, 2,3, 4.j The initial guess of the numerical method used to solve the nonlinear least-squares problem (75), (73) has been chosen as fol- lows: 0 ,,0.05,0.05,0.05 ininin v . Note that a data window made of twenty data has too few points to im- plement satisfactorily the asymptotic analysis of the moment formulae discussed in Section 3. Note that to make possible the effective numerical solution of prob- lem (75), (73) the independent variables in (75), (73) have been rescaled. The reconstructions of the parameters obtained mov- ing the data window along the data set of Figure 1 are shown in Figure 2. In Figure 2 the abscissa corresponds to the data window used to reconstruct the model para- meters. The data windows are numbered in ascending order beginning with one according to the order in time of the first day of the window considered. In particular, Figure 2 shows that the parameters , reconstructed remain essentially stable when the ndow is moved along the data time series. Occasiwi onally and have spikes that probably indicate that the numerical procedure used to solve problem (75), (73) has failed. . rs v ,, Figure 2The paramete0onstructed from the data of Figure 1 versus time. rec Copyright © 2013 SciRes. OJAppS  L. FATONE ET AL. Copyright © 2013 SciRes. OJAppS 359 is moved along the data time s The parameter reconstructed changes when the windoweries. This is cor- rect since 0 v is the stochastic volatility of the first day of the window and in a stochastic volatility model (such as the lognormal SABR model) there is no reason to ex- pect this value to be constant. The fact that the values of the parameters 0 ,, ,v 0 v obtained calibrating the lognormal SABR mod re least ti REFERENCES [1] P. S. Hagan, D. Kumar, A. S. Lesniewski and D. E. Wood- ward, “Managing Smile Risk,” Wilmott Magazine, 2002 pp. 84-108. http://www.wilmott.com/pdfs/021118_smile.pdf [2] J. C. Cox, J. E. Ingersoll and S. A. Ross, “A Theory of the Term Structure of Interest Rates,” Econometrica, Vol. 53, No. 2, 1985, pp. 385-407. [3] F. Black and M. Scholes, “c,” Journal of Political Econo- my, Vol. 81, No. 3, 1973, pp. 637-659. [4] L. Fatone, F. Mariani, M. C. Recchioni and F. Zirilli “The Use of Statistical Tests to Calibrate the Normal SABR Model,” Journal of Inverse and Ill-Posed Prob- lems, Vol. 21, No. 1, 2013, pp. 59-84. http://www.econ.univpm.it/recchioni/finance/w15 [5] S. Mergner, “Application of State Space Models in Fi- ag Göt 22. http://www.econ.univpm.it/pacelli/mariani/finance/w1. [7] L. Fatone, F.ioni and F. Zirilli, al of Inverse and Ill-Posed Problems, Vol. SABR and Multiscale SABR [6] F. Mariani, G. Pacelli and F. Zirilli, “Maximum Likeli- hood Estimation of the Heston Stochastic Volatility Mo- del Using Asset and Option Prices: An Application of Nonlinear Filtering Theory,” Optimization Letters, Vol. 2, No. 2, 2008, pp. 177-2 Mariani, M. C. Recch “Maximum Likelihood Estimation of the Parameters of a System of Stochastic Differential Equations That Models the Returns of the Index of Some Classes of Hedge Funds,” Journ 15, No. 5, 2007, pp. 329-362. el on the al data shown in Figure 1 through the “moving win- dow” procedure are “stable” (see Figure 2) supports the idea that the lognormal SABR model is able to interpret the data considered. In fact, this stability property sug- gests that the relation between the data and the parame- ters of the lognormal SABR model established solving problem (75), (73) is not an artefact of the numerical methods used to solve the nonlinear -squares prob- lem. In particular, the stability shown guarantees th at the lognormal SABR model provides “stable” opon prices and hedging strategies. http://www.econ.univpm.it/ recchioni/finance/w5 [8] L. Fatone, F. Mariani, M. C. Recchioni and F. Zirilli, “Some Explicitly Solvable Models: Option Pricing and Calibration,” Journal of Ma- thematical Finance, Vol. 3, No. 1, 2013, pp. 10-32. http://dx.doi.org/10.4236/jmf.2013.31002 http://www.econ.univpm.it/recchioni/finance/w14 [9] A. Erdelyi, W. Magnus, F. Oberhettinger and F. G. Trico- mi, “Higher Trascendental Functions,” McGraw-Hill Book Company, New York, 1953. [10] J. Hull and A. White, “The Pricing of Options on Assets with Stochastic Volatilities,” The Journal of Finance, Vol. 42, No. 2, 1987, pp. 281-300. http://dx.doi.org/10.1111/j.1540-6261.1987.tb02568.x [11] B. A. Surya, “Two-Dimensional Hull-White Model for Stochastic Volatility and Its Nonlinear Filtering Estima- tion,” Procedia Computer Science, Vol. 4, 2011, pp. 1431-1440. http://dx.doi.org/10.1016/j.procs.2011.04.15 , 4 , Vol. 24, No. 1, 2007, [12] A. Erdelyi, W. Magnus, F. Oberhettinger and F. G. Trico- mi, “Tables of Integral Transforms,” McGraw-Hill Book Company, New York, 1954. [13] P. L. Lions and M. Musiela, “Correlations and Bounds for Stochastic Volatility Models,” Annales de l’Institut Henri Poincaré (C) Analyse Non Linèaire pp. 1-16. , [14] P. Wilmott, “Paul Wilmott Introduces Quantitative Fi- nance,” Wiley Desktop Editions, Chichester, 2007. [15] http://www.econ.univpm.it/recchioni/finance/w16 nance,” Universitätsverltingen, Göttingen, 2004. |