Paper Menu >>

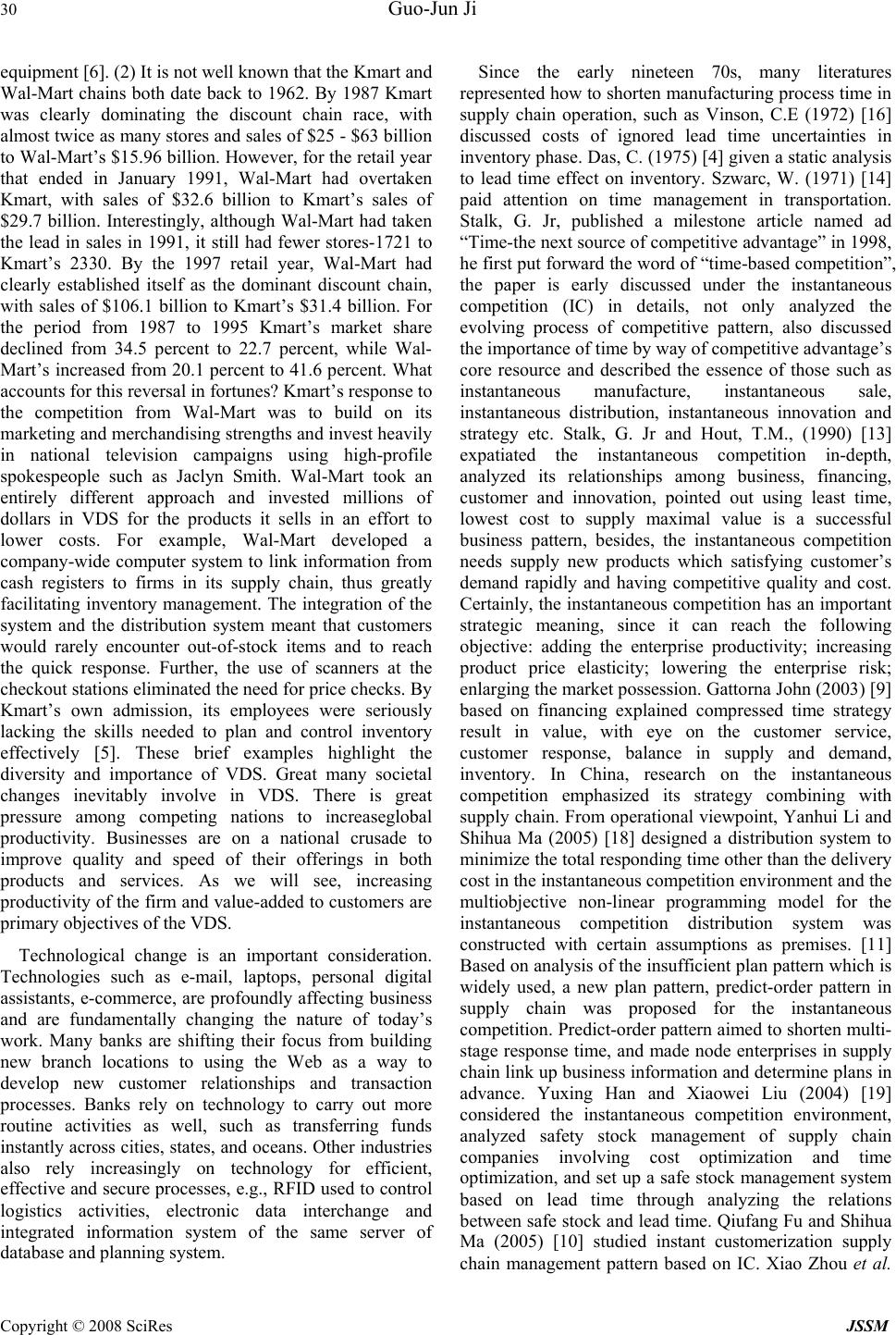

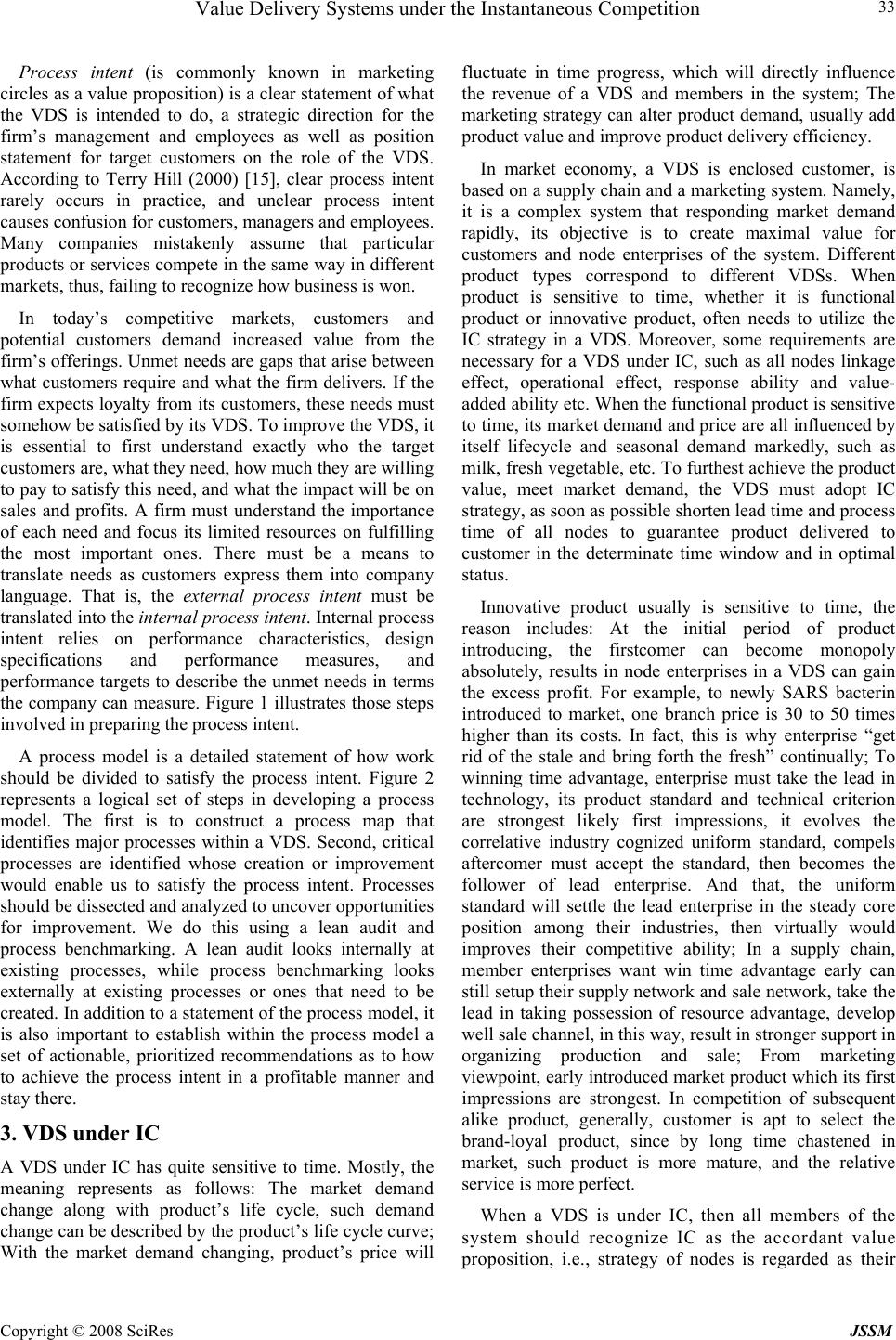

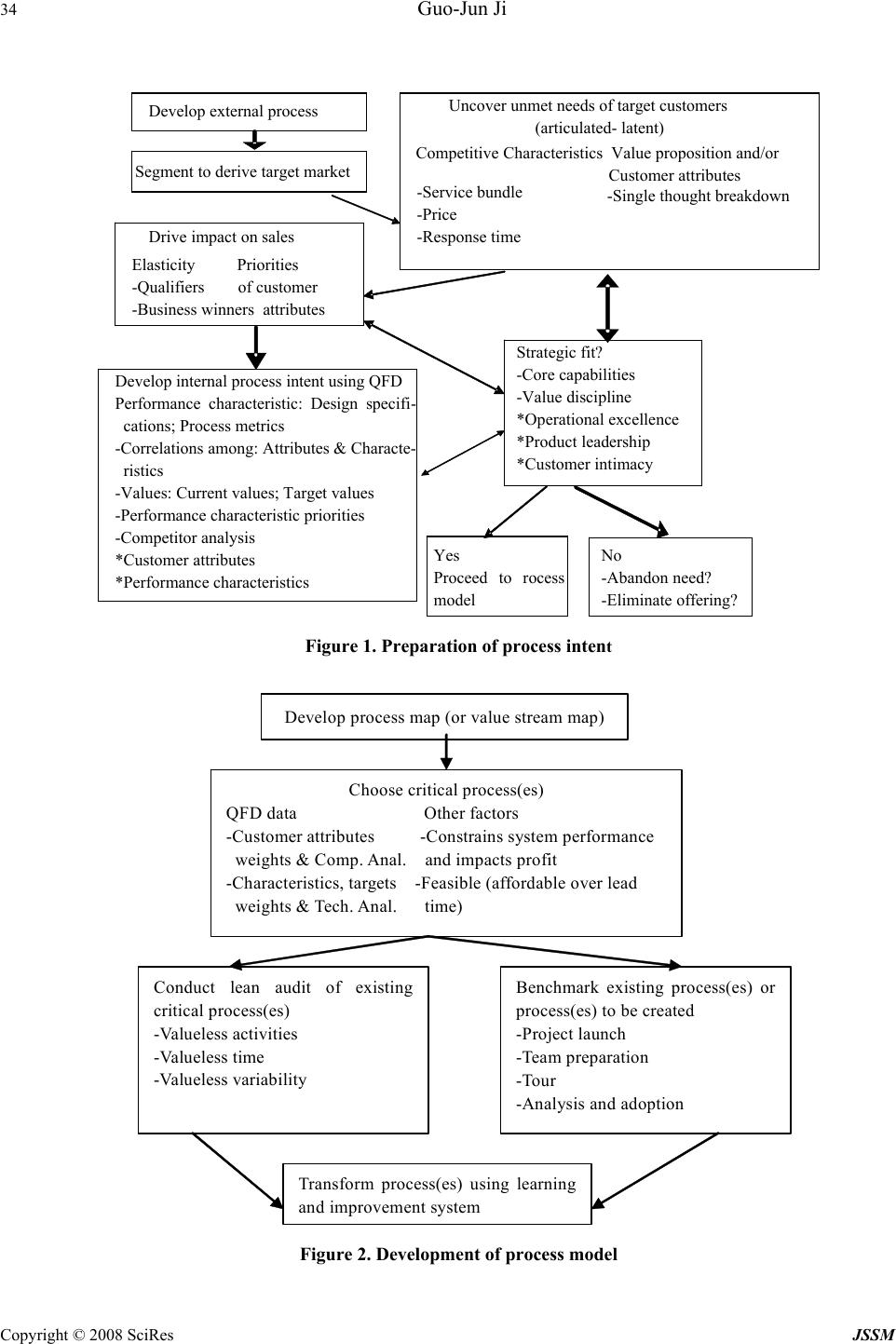

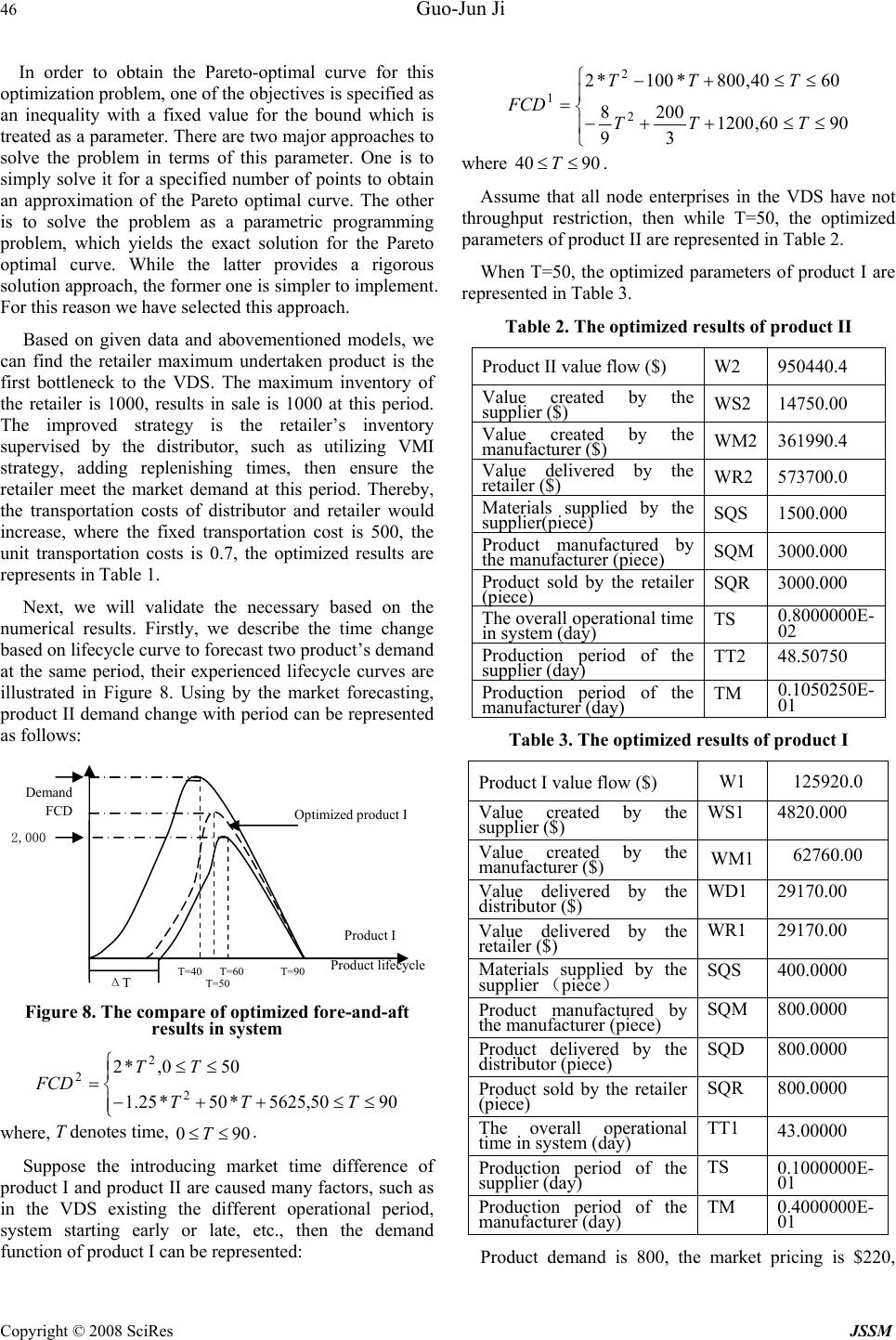

Journal Menu >>