J.-Y. YANG

514

addition, Kwon, Park and Chang [2] report that deriva-

tives trading volumes are positively associated with AR.

This suggests that derivative trading would improve the

AR.

Jalivand [3] documents that the integrated level of

company size, efficiency of business, and financial ac-

tivities of a company are the major determinants of de-

rivatives traders, for non-financial institutions in Canada.

In a study of the listed companies in Nordic economies,

Brunzell, Hansson, and Liljeblom [4] find that most

firms trade derivatives for the purpose of hedging, but

more than a majority of firms were seeking returns in

addition to hedging. Ahmed, Kilic, and Lobo [5] study

the effects of SFAS 133, the financial accounting stan-

dard for derivatives, on the risk relevance of accounting

measures of derivative exposures.

This paper is organized as follows. Section 2 discusses

the research method. Section 3 provides the results. Sec-

tion 4 concludes.

2. Models and Data

2.1. Empirical Models

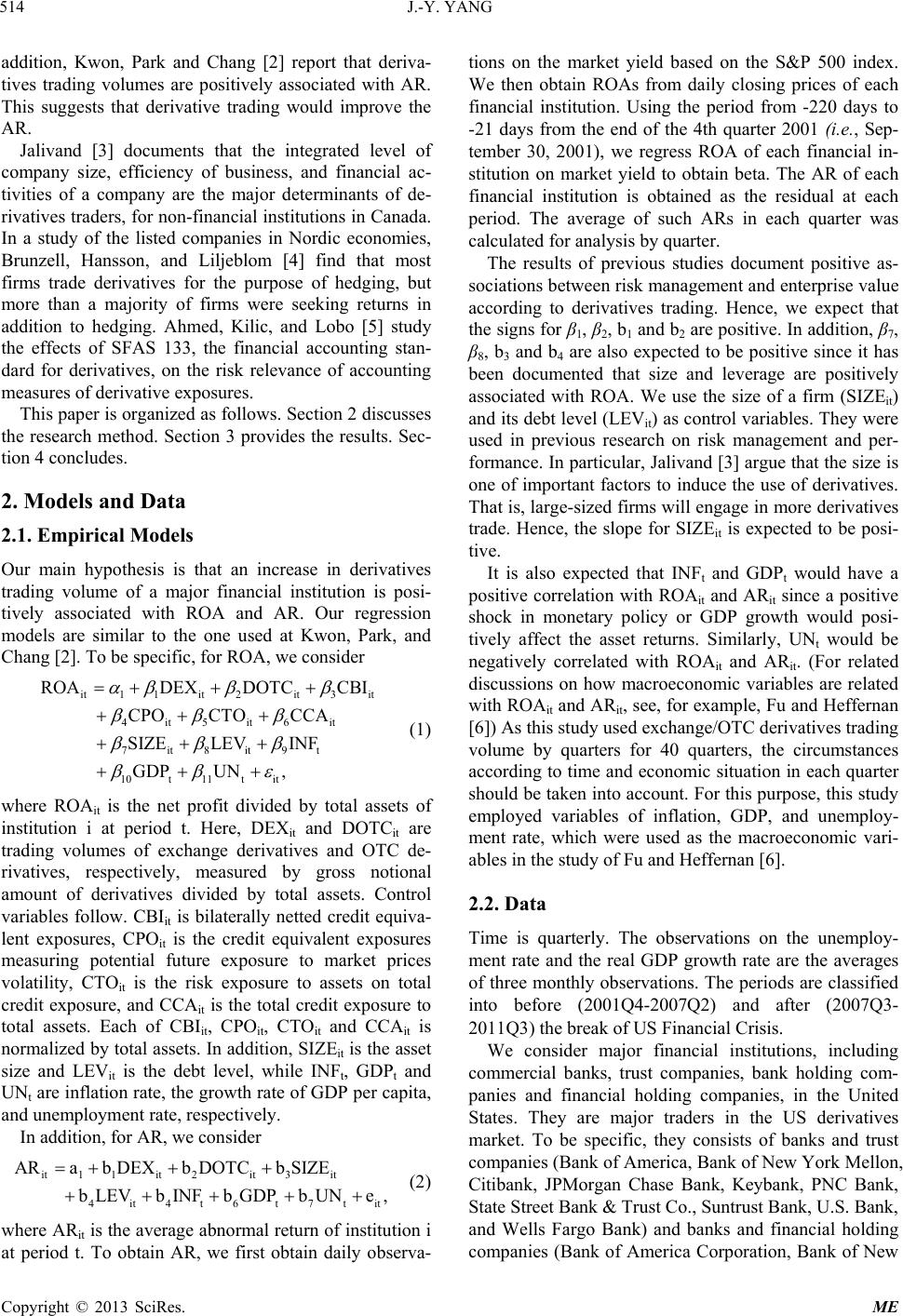

Our main hypothesis is that an increase in derivatives

trading volume of a major financial institution is posi-

tively associated with ROA and AR. Our regression

models are similar to the one used at Kwon, Park, and

Chang [2]. To be specific, for ROA, we consider

it1 1it2it3it

4it5it6 it

7it8it9t

10t11 t it

ROADEXDOTC CBI

CPO CTO CCA

SIZELEV INF

GDPUN ,

(1)

where ROAit is the net profit divided by total assets of

institution i at period t. Here, DEXit and DOTCit are

trading volumes of exchange derivatives and OTC de-

rivatives, respectively, measured by gross notional

amount of derivatives divided by total assets. Control

variables follow. CBIit is bilaterally netted credit equiva-

lent exposures, CPOit is the credit equivalent exposures

measuring potential future exposure to market prices

volatility, CTOit is the risk exposure to assets on total

credit exposure, and CCAit is the total credit exposure to

total assets. Each of CBIit, CPOit, CTOit and CCAit is

normalized by total assets. In addition, SIZEit is the asset

size and LEVit is the debt level, while INFt, GDPt and

UNt are inflation rate, the growth rate of GDP per capita,

and unemployment rate, respectively.

In addition, for AR, we consider

it1 1it2it3it

4 it4t6t7tit

ARab DEXbDOTCb SIZE

LEVb INFb GDPbUNe,

(2)

where ARit is the average abnormal return of institution i

at period t. To obtain AR, we first obtain daily observa-

tions on the market yield based on the S&P 500 index.

We then obtain ROAs from daily closing prices of each

financial institution. Using the period from -220 days to

-21 days from the end of the 4th quarter 2001 (i.e., Sep-

tember 30, 2001), we regress ROA of each financial in-

stitution on market yield to obtain beta. The AR of each

financial institution is obtained as the residual at each

period. The average of such ARs in each quarter was

calculated for analysis by quarter.

The results of previous studies document positive as-

sociations between risk management and enterprise value

according to derivatives trading. Hence, we expect that

the signs for β1, β2, b1 and b2 are positive. In addition, β7,

β8, b3 and b4 are also expected to be positive since it has

been documented that size and leverage are positively

associated with ROA. We use the size of a firm (SIZEit)

and its debt level (LEVit) as control variables. They were

used in previous research on risk management and per-

formance. In particular, Jalivand [3] argue that the size is

one of important factors to induce the use of derivatives.

That is, large-sized firms will engage in more derivatives

trade. Hence, the slope for SIZEit is expected to be posi-

tive.

It is also expected that INFt and GDPt would have a

positive correlation with ROAit and ARit since a positive

shock in monetary policy or GDP growth would posi-

tively affect the asset returns. Similarly, UNt would be

negatively correlated with ROAit and ARit. (For related

discussions on how macroeconomic variables are related

with ROAit and ARit, see, for example, Fu and Heffernan

[6]) As this study used exchange/OTC derivatives trading

volume by quarters for 40 quarters, the circumstances

according to time and economic situation in each quarter

should be taken into account. For this purpose, this study

employed variables of inflation, GDP, and unemploy-

ment rate, which were used as the macroeconomic vari-

ables in the study of Fu and Heffernan [6].

2.2. Data

Time is quarterly. The observations on the unemploy-

ment rate and the real GDP growth rate are the averages

of three monthly observations. The periods are classified

into before (2001Q4-2007Q2) and after (2007Q3-

2011Q3) the break of US Financial Crisis.

We consider major financial institutions, including

commercial banks, trust companies, bank holding com-

panies and financial holding companies, in the United

States. They are major traders in the US derivatives

market. To be specific, they consists of banks and trust

companies (Bank of America, Bank of New York Mellon,

Citibank, JPMorgan Chase Bank, Keybank, PNC Bank,

State Street Bank & Trust Co., Suntrust Bank, U.S. Bank,

and Wells Fargo Bank) and banks and financial holding

companies (Bank of America Corporation, Bank of New

Copyright © 2013 SciRes. ME