Paper Menu >>

Journal Menu >>

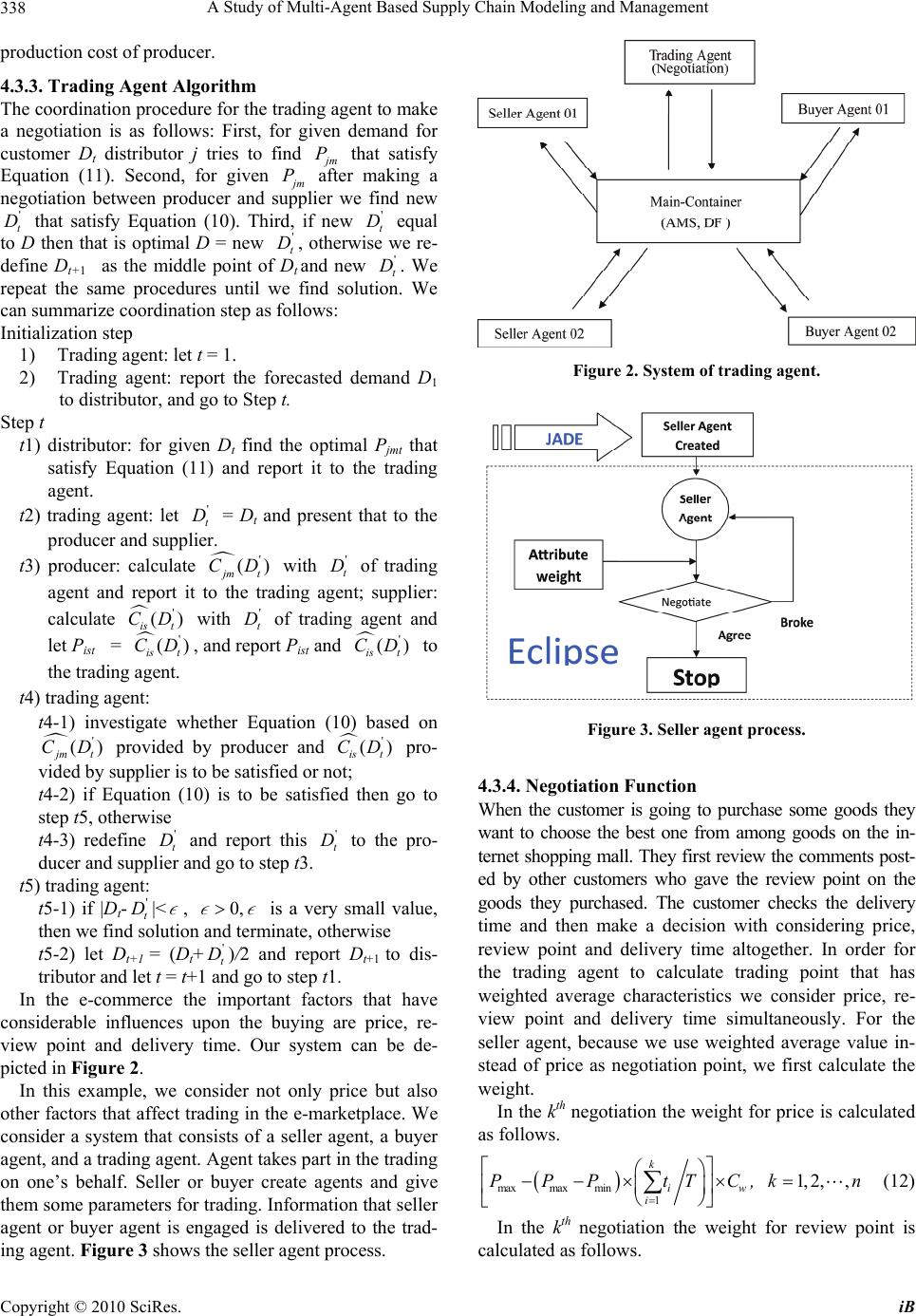

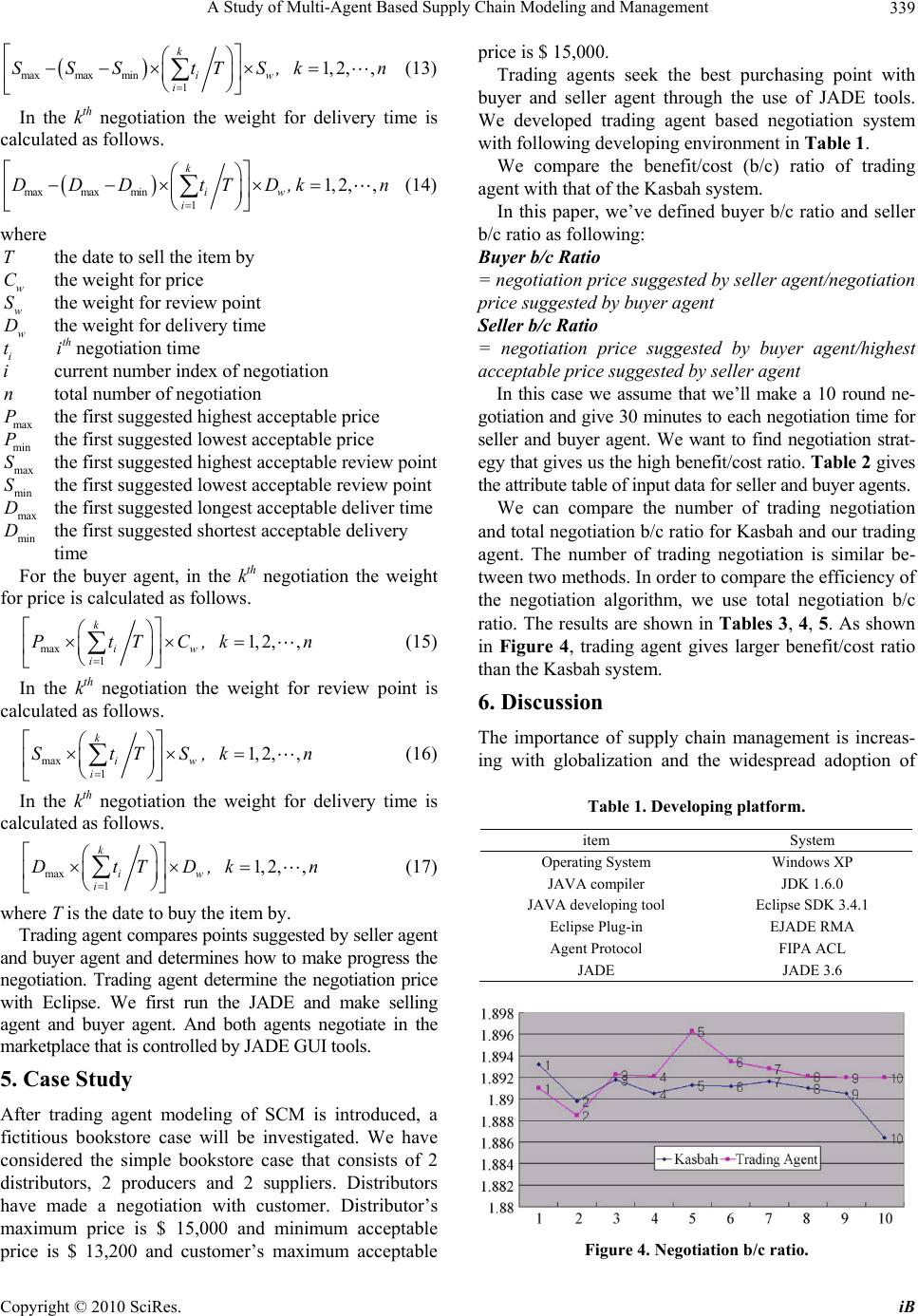

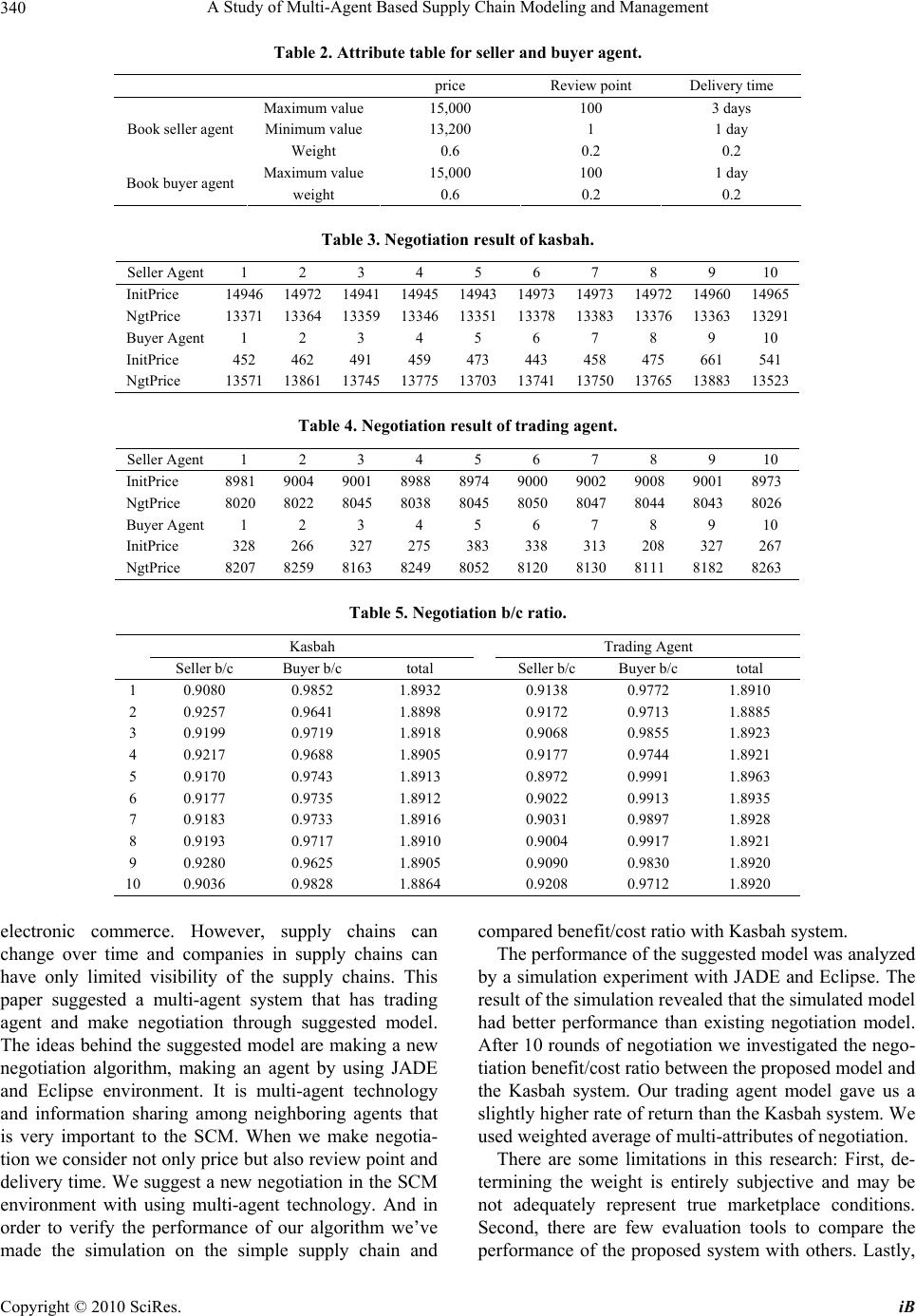

iBusiness, 2010, 2, 333-341 doi:10.4236/ib.2010.24043 Published Online December 2010 (http://www.scirp.org/journal/ib) Copyright © 2010 SciRes. iB A Study of Multi-Agent Based Supply Chain Modeling and Management WanSup Um1, Huitian Lu2, Teresa J. K. Hall2 1Gangneung-Wonju National University, Gangneung, Korea; 2South Dakota State University, Brookings, USA. E-mail: eomeom@nukw.ac.kr, huitian.lu@sdstate.edu, teresa.hall@sdstate.edu Received June 15th, 2010; revised October 13th, 2010; accepted November 20th, 2010. ABSTRACT Supply Chain Management (SCM) is a management paradigm to understand and analyze the flow of goods, services and the accompanying values reaching to the consumers followed by the processes of purchasing, production and dis- tribution with combining and connecting the whole system. Today, SCM is regarded as an essential strategic factor which has a great deal of influence on earning competitiveness in the abruptly changing global business environment. Multi-agent technology becomes the best candidate for problem solver under these circumstances. An agent performs given tasks automatically using inter-collaboration or negotiation with other agents on behalf of a human on the basis of real-time connectivity. There will be the conflict among the pursuit of the profit of all members of the SCM. In order to maximize the total profit of the SCM, negotiation among all members is necessary. In this research, we propose to find the best negotiation strategy that makes all members of the SCM satisfied in a simple SCM. We suggest a new negotiation algorithm in the SCM environment with using multi-agent technology. The ideas behind the suggested model are negotiation algorithm with a trading agent and we consider multiple factors that are price, review point and delivery time. We created agents with Java Agent Development Framework (JADE) and performed the simulation under JADE and Eclipse environment. The case study denotes that our algorithm gives a better result than the Kasbah system that is a typically well known system where users create autonomous agents that buy and sell goods on their behalf. We’ve used benefit/cost ratio as a performance measure in order to compare our system with the Kasbah system. Keywords: Supply Chain Management, Multi-Agent, Trading Agent, JADE, Eclipse 1. Introduction The supply chain is a worldwide network of suppliers, factories, warehouses, distribution centers, and retailers through which raw materials are acquired, transformed, and delivered to customers. In order to optimize per- formance of a supply chain, its functions must operate in a coordinated manner. But the dynamics of the enterprise and the market make this difficult: materials are delayed in shipment, production facilities experience downtime, workers call in sick, customers change orders or cancel, and other issues cause deviations from the plan. In the global marketplace with shortening product life cycles and fast changing trends, the need for real time supply chain coordination is vital. Information technology and information sharing make coordination possible. The major contribution of information technologies such as the Internet is to enable many companies to make contact with customers directly without time zone or distance intervention. Collaborations in supply chains cannot be- governed by any single company in a one-directional way, but need to be coordinated by autonomous partici- pation of companies. For these reasons, agent technology is regarded as one of the best candidates for supply chain management. To optimize supply chain decisions, an agent cannot by itself make a locally optimal decision rather it must determine the effect its decisions will have on other agents and coordinate with others to choose and execute an alternative that is optimal over the entire supply chain. In dealing with stochastic events, the agents must make optimal decisions based on complex global criteria that are not completely known by any one agent and may be contradictory, therefore require trade-offs. Internet tech- nologies have contributed significantly to e-commerce by increasing the mutual visibility of consumers and suppliers, and by raising the possibility that some of their trading processes may be automated. Despite these ad- vances, most procurement activities within supply chains  A Study of Multi-Agent Based Supply Chain Modeling and Management Copyright © 2010 SciRes. iB 334 are still based on static long-term contracts and relation- ships. In many cases, such contracts are detrimental be- cause they fail to handle the dynamic nature of these environments. To rectify this, we believe agent-based solutions are needed. This research suggests a multi-agent system for distributed and collaborative supply chain management. Multi-agent technology has many beneficial features for autonomous, collaborative, and intelligent systems in distributed environments, which makes it one of the best candidates for complex supply chain management. A new negotiation algorithm for SCM system with a trad- ing agent is proposed to make the most appropriate deci- sion using multiple attributes for buyer demand. We cre- ated agents with Java Agent Development Framework (JADE) and performed the simulation with JADE and Eclipse environments. The results indicate the simulated environment had a higher rate of return than a traditional negotiated exchange. To date, however, the use of agents within e-com- merce has generally focused on simple auctions. But the supply chain domain typically requires handling a much more complex setting where decisions must be made in the presence of greater degrees of uncertainty. To this end, the International Trading Agents Competition for Supply Chain Management (TAC SCM) represents an ideal envi- ronment in which to test the autonomous agents. The remainder of the paper is organized as follows: Section 2 describes a review of the literature; Section 3 presents the framework for agent development; Section 4 suggests the modeling of the problem under study; Sec- tion 5 provides a case study; and finally, Section 6 con- cludes this paper and outlines the areas of future work. 2. Literature Review In supply chain management, improving the efficiency of the overall supply chain is of key interest. Because of market globalization and the advancement of e-com- merce the importance of supply chain network is in- creasing [1]. It is very difficult for different companies in supply chains to share information. A supply chain can produce products for multiple markets. Also, an individ- ual company is likely to have only limited visibility of the supply chain structure, which makes it difficult to make future demand estimations, because the pattern of demand propagation through the supply chain depends on the capabilities and strategies of companies along the path from the markets to the company. These problems are further amplified if the supply chain changes over time dynamically. As a result of these problems, individual companies are likely to make inaccurate demand estimations and the supply chain can suffer from the well-known Bullwhip effect [2]. The Bullwhip effect refers to the problem where the fluctua- tions of productions and inventory levels are amplified in the upstream parts of supply chains than in the down- stream parts. The bullwhip effect was first observed by Forrester [2], and has been studied further by Lee et al. [3]. One of the solutions proposed to deal with the bull- whip effect is to have information sharing across the companies in the supply chain. There are unique characteristics required for informa- tion systems that support supply chain management. First, they should be able to support distributed collaboration among companies. Second, a single company cannot govern collaborations in supply chains in a one-direc- tional way, but need to be coordinated by autonomous participation of companies. Third, they need a high level of intelligence for planning, scheduling, and change ad- aptation. For these reasons, agent technology is regarded as one of the best candidates for supply chain manage- ment [4]. Since the mid 1990s, the agent concept has emerged in the literature relevant to computer applications. Agents may have many other properties. Agents can exhibit au- tonomy, social ability and responsiveness, in addition to adaptability, mobility, and rationality [5]. Studies on agent-based supply chain management can be classified into three categories. The first type of research is con- cerned with the coordination aspect. In this type of re- search, various types of companies and their capabilities are modeled into individual agents and their interactions are designed for efficient collaboration [6]. The second type of research focuses on simulation of supply chains using agent-based models. This type of research tries to discover the performance of agent-based supply chain architectures under various strategies and constraints [7]. The third type of research studies how virtual supply chains can be organized flexibly by multi-agent systems [8]. For example, research by Chen et al. [8] showed how virtual supply chains can be formed by solving distributed constraint satisfaction problems by agents. Multi-agent technology has many beneficial features for autonomous, collaborative, and intelligent systems in dis- tributed environments, which makes it one of the best can- didates for complex supply chain management [7]. Recent research literature acknowledges intelligent agents as the most appropriate technology for trading and auctioning in electronic markets [9]. A software agent is viewed as an encapsulated computer system that is capable of flexible autonomous action in that environment in order to meet its design objective [10]. In automated negotiations, the agents prepare bids and evaluate offers in order to obtain the maximum return for the parties they represent [11]. Such automated negotiation leads to dynamic pricing which en- sures that goods and services are allocated to the entity that  A Study of Multi-Agent Based Supply Chain Modeling and Management Copyright © 2010 SciRes. iB 335 values them most highly [12]. Optimal control deals with the problem of finding a control law for a given system such that a certain optimality criterion is achieved. A con- trol problem includes a cost functional that is a function of system state and control variables. 3. Agent Development Framework 3.1. Agent Since the mid 1990s, the agent concept is increasingly emerging in study relevant to computer applications. Agents may have goals and an ability to plan based on their goals. They may be able to execute actions based on their goal-directed plans, monitor their environment to determine the effects of their actions, analyze the extent to which their actions brought about the desired changes in the environment, and replan their actions when neces- sary to reach their goals. Agents may have many other properties. Agents can exhibit social ability, responsive- ness in addition to adaptability, mobility, and rationality [5]. Furthermore, agents may have both high-level and low-level reasoning capabilities [13] and the actions that result from these capabilities may be influenced by in- tentions and beliefs. Also, agents provide a modular or object-oriented modeling framework from the point of system development’s view. In recent years, a new software architecture for man- aging the supply chain at the tactical and operational levels has emerged. It views the supply chain as com- posed of a set of intelligent software agents, each re- sponsible for one or more activities in the supply chain and each interacting with other agents in planning and executing their responsibilities. In order to carry out their common project such as the supply chain planning in a decentralized supply chain environment, agents are de- signed to undertake several different tasks by means of cooperation or negotiation among themselves. 3.2. Multi-Agent System (MAS) The dynamics of the supply chain makes coordinated be- havior an important factor in its integration. To optimize supply chain decisions, an agent cannot just make a locally optimal decision by itself, but must determine the effect of its decisions on other agents and coordinate with others to choose and execute an alternative that is optimal over the entire supply chain. The problem is exacerbated by the stochastic events generated by the flow of new objects into the supply chain. These include modifications to customer orders at the customer’s request, resource unavailability from suppliers, and machine breakdown all drive the sys- tem away from any existing predictive schedule. Agents operate within organizations where humans must be rec- ognized as privileged members. This requires knowledge of organization roles and respecting the obligations and authority incurred by the roles. Recent works on the dynamics of industrial systems and supply chains have attempted to describe the net- works of relationship that characterize contemporary businesses’ trading situations and internal functional structures. In modeling these relations, research has in- creasingly turned to frameworks derived from multi- agent system (MAS). The concept of agents and of MASs emerged from a number of research disciplines including artificial intelligence, systems design and analysis using object-oriented methodology and human interfaces. Agents send and receive messages concerning their current situations to agents in other related or same sys- tem, and display evolutionary behavior in response to changes. Within the MAS, different types of agents have different degrees of problem solving capabilities within different problem domains. MAS architectures vary ac- cording to the complexity of problem domains, i.e., in number of agents, system design, and the number of va- riables determining agents’ decision making behavior. Effective coordination mechanisms regulating agents’ interaction are particularly needed in these circumstances. There are many multi-agent development tools. 4. Multi-Agent Modeling with Trading Agent 4.1. Java Agent Development Framework (JADE) JADE is a software framework fully implemented in Java language. It simplifies the implementation of mul- ti-agent systems through a middle-ware that complies with the Foundation for Intelligent Physical Agents (FI- PA) specifications and through a set of graphical tools that supports the debugging and deployment phases. The agent platform can be distributed across machines that not even need to share the same OS and the configura- tion can be controlled via a remote graphical user inter- face (GUI). The configuration can be even changed at run-time by moving agents from one machine to another one, as and when required. Eclipse is an open source community, whose projects are focused on building an open development platform comprised of extensible frameworks, tools and runtimes for building, deploying and managing software across the lifecycle. Eclipse is a software development platform helping the software de- veloper to rapidly build new JAVA applications: Eclipse is a JAVA-based developing platform and service set that makes developing environment with plug-in com- ponents easier. 4.2. Negotiation System Kasbah is a Web-based system where users create auto- nomous agents that buy and sell goods on their behalf where the original idea was to reinvent the classified ads.  A Study of Multi-Agent Based Supply Chain Modeling and Management Copyright © 2010 SciRes. iB 336 We observed that there are many sites on the Web that post adv. These classified ad sites all provide tools to help the user find adv. of interest. Certainly, such tools are useful yet they only assist with one step in the mul- ti-step process of buying and selling that of finding ads which match what one is looking for. The idea behind Kasbah is to help users with the other step in the process, the negotiations between buyer and seller, by providing agents which can autonomously negotiate and make the best possible deal on the user’s behalf. Kasbah is avail- able through a Web site where users go to buy and sell things. They do this by creating buying and selling agents, which then interact in the marketplace, thus, Kasbah is a multi-agent system. The marketplace is designed to handle any type of agent that supports the appropriate protocol, though the current prototype only has a single kind of relatively simple buying and selling agents. It is these agents that will be described in the remainder of the paper. The agents themselves are not tremendously smart. They do not use any AI or Machine Learning techniques, which usually exist in current agent developer. Despite the growth in the number of online auction sites, there is still a need for a more dynamic, personalized bidding experi- ence. Existing bidding and auction sites overemphasize bid price as the sole parameter determining the match of a buyer and a seller. We believe that for dynamic pricing systems to truly benefit the buyer and seller, the negotia- tion interaction needs to extend further than a simplistic exchange of bid and ask prices. On-line auction systems, such as eBay, Amazon Auctions, and Priceline’s airline bidding system violate several principles we believe are necessary for a bidding system to benefit both the buyer and the seller. These principles are: 1) offers should be evaluated and selected on multiple criteria, not just price; 2) the nego- tiation should be a non-binding arrangement, allowing the buyer to make multiple bids on multiple offers, in- creasing the chance of a successful match; and, 3) sellers should have the tools to evaluate bids based on complex criteria, not just immediate revenue. 4.3. Mathematical Modeling with Trading Agent 4.3.1. Design Element and Notation We propose multi-agent modeling for a SCM system using adaptive trading agent to make the most appropri- ate decision using multi attribute for demand of buyer. We had created agents with JADE and performed the simulation under JADE and Eclipse environments. Communication among agents is performed by a set of messages that follow predefined protocols. In our model, FIPA’s two protocols, Query and Request, were used to model the conversations among agents. Each supply chain entities exhibit a tendency to have independent authority with conflicting requirement, and may possess local information relevant to its interests. In order to maximize the total profit of the SCM, negotiation among all members is necessary. In this research, we want to find the best negotiation strategy that makes all members of the SCM satisfy in the simple SCM. But the interest of supplier, producer and distributor is not in keeping with, there will be the conflict among the pursuit of the profit of all members of the SCM. All supply chain entities pursue their own profit. The objective function for supply chain is to maximize the total profit of the self-interested supply chain entities. So the trading agent performs a negotiation among supply chain entities. We consider a simple supply chain that only consists of suppliers, producers, distributors, and customers. We assume that we restrict our research scope to coordination of the unit price that producer paid to supplier, the unit price that distributor paid to producer, and trading quantities. We assume that the demand of end products is determined by the price that the distribu- tor has set up. And we assume that trading agent tries to communicate and adjust to supply chain entities. We want to maximize the total profit of a simple supply chain. Distributor is supplied with finished products by producer and sells end products to the customer. Pro- ducer is supplied with parts by supplier and makes a fin- ished product. Supplier makes parts and supplies the producer with parts. The process of a simple supply chain is depicted as Figure 1. where the total profit of supplier is , producer j m , and distributor kd D the demand for customer or production quantities x the number of supplier y the number of producer z the number of distributor is P the unit price that producer paid to supplier i, i = 1,2,…,x j m P the unit price that distributor paid to producer j, j = 1,2,…,y kd P the unit price that customer paid to distributor k, k = 1,2,…,z is C the unit production cost of supplier i, i = 1,2,…,x j m C the unit production cost of producer j, j = 1,2,…,y kd C the unit delivery cost of distributor k, k = 1,2,…,z i, j, k the indices for supplier, producer, and distributor respectively 4.3.2. Mathematical Modeling In our model we assume that 1) Each entity in supply chain makes decision inde- pendently but they are ready to negotiate in order to op- timize all supply chain;  A Study of Multi-Agent Based Supply Chain Modeling and Management Copyright © 2010 SciRes. iB 337 Figure 1. The process of a simple supply chain. 2) Distributors have exclusive selling rights in the sup- ply chain; 3) The price and demand are determined by negotia- tion between distributor and customer, and 4) After negotiation between distributor and customer, the demand for producer and supplier is determined as constant D. In SCM modeling study, we look for max from the supply chain. The total profit of the supply chain is the sum of the profit of distributor, producer, and supplier. 111 y zx kdjm is kji Maximize (1) subject to 11 1 ,, () y zz kdkd jmkdkd kj k DP PP DDP 11 y z kdkd jmjm kj CDDP PDDP (2) Distributor is supplied with finished products by pro- ducer and sells end products to the customer. The profit of distributor is total price that customer paid to dis- tributor minus both total delivery cost and total price paid to producer. 111 11 ,, yyy xx jmjm isjmjmis jij ji DPPPDCD DPD (3) Producer is supplied with parts by supplier and makes a finished product. The profit of producer is total price that distributor paid to producer minus both total produc- tion cost and total price paid to supplier. 111 , xxx is isisis iii DPPDCD D (4) Supplier makes parts and supplies the producer with parts. The profit of supplier is total price that producer paid to supplier minus total production cost. In order to maximize supplier’s profit, the optimality condition is found as follows, 111 ,0 xx ii x is isisis i dDPdDPdCDDdD let 1 x i i issDd CDDCdD the condition for optimization is 1 1 xx is isis i i Pd CDDdDCD (5) The same procedure to maximize producer’s profit, 11 1 ,, yy x j mjmis jm ji j dDPPdDP 11 0 yx jm is ji dCDDdD P (6) Let 1 dC y jm jm j CD DDdD the condition for optimization is 11 yx j mjmis ji CD PP (7) The same procedure for distributor, 11 1 ,, y zz kdkd jmkd kj k dD PPdDdPDDdD 11 0 yy jm jm jj dCDDdD P (8) let 1 dP z kd kd k RD DDdD the condition for optimization is found as 1 y kd kdjm j RD CDP (9) Trading agent try to coordinate their different views and lead to optimal negotiation. So the negotiation of trading agent depends on following optimality conditions. The optimal condition for supply chain must satisfy the optimal condition for distributor, producer and supplier simultaneously. We’ve found the condition for optimiza- tion from Equations (5), (7), and (9) 1 y jm jmis j PCDCD (10) 1 y jm kdkd j PRDCD (11) These equations are interpreted to mean that optimal conditions will be obtained if sum of the marginal pro- duction cost of producer and the marginal production cost of supplier equal to the unit production cost of pro- ducer or the difference between marginal profit of dis- tributor and marginal cost of distributor equal to the unit  A Study of Multi-Agent Based Supply Chain Modeling and Management Copyright © 2010 SciRes. iB 338 production cost of producer. 4.3.3. Trading Agent Algorithm The coordination procedure for the trading agent to make a negotiation is as follows: First, for given demand for customer Dt distributor j tries to find j m P that satisfy Equation (11). Second, for given j m P after making a negotiation between producer and supplier we find new ' t D that satisfy Equation (10). Third, if new ' t D equal to D then that is optimal D = new ' t D, otherwise we re- define Dt+1 as the middle point of Dt and new ' t D. We repeat the same procedures until we find solution. We can summarize coordination step as follows: Initialization step 1) Trading agent: let t = 1. 2) Trading agent: report the forecasted demand D1 to distributor, and go to Step t. Step t t1) distributor: for given Dt find the optimal Pjmt that satisfy Equation (11) and report it to the trading agent. t2) trading agent: let ' t D = Dt and present that to the producer and supplier. t3) producer: calculate ' () j mt CD with ' t D of trading agent and report it to the trading agent; supplier: calculate ' () is t CD with ' t D of trading agent and let Pist = ' () is t CD, and report Pist and ' () is t CD to the trading agent. t4) trading agent: t4-1) investigate whether Equation (10) based on ' () j mt CD provided by producer and ' () is t CD pro- vided by supplier is to be satisfied or not; t4-2) if Equation (10) is to be satisfied then go to step t5, otherwise t4-3) redefine ' t D and report this ' t D to the pro- ducer and supplier and go to step t3. t5) trading agent: t5-1) if |Dt-' t D|< , 0, is a very small value, then we find solution and terminate, otherwise t5-2) let Dt+1 = (Dt+' t D)/2 and report Dt+1 to dis- tributor and let t = t+1 and go to step t1. In the e-commerce the important factors that have considerable influences upon the buying are price, re- view point and delivery time. Our system can be de- picted in Figure 2. In this example, we consider not only price but also other factors that affect trading in the e-marketplace. We consider a system that consists of a seller agent, a buyer agent, and a trading agent. Agent takes part in the trading on one’s behalf. Seller or buyer create agents and give them some parameters for trading. Information that seller agent or buyer agent is engaged is delivered to the trad- ing agent. Figure 3 shows the seller agent process. Figure 2. System of trading agent. Figure 3. Seller agent process. 4.3.4. Negotiation Function When the customer is going to purchase some goods they want to choose the best one from among goods on the in- ternet shopping mall. They first review the comments post- ed by other customers who gave the review point on the goods they purchased. The customer checks the delivery time and then make a decision with considering price, review point and delivery time altogether. In order for the trading agent to calculate trading point that has weighted average characteristics we consider price, re- view point and delivery time simultaneously. For the seller agent, because we use weighted average value in- stead of price as negotiation point, we first calculate the weight. In the kth negotiation the weight for price is calculated as follows. maxmax min 1 k iw i P PP tTC , 1, 2,,kn (12) In the kth negotiation the weight for review point is calculated as follows.  A Study of Multi-Agent Based Supply Chain Modeling and Management Copyright © 2010 SciRes. iB 339 maxmax min 1 k iw i SSS tTS , 1, 2,,kn (13) In the kth negotiation the weight for delivery time is calculated as follows. maxmax min 1 k iw i DDD tTD ,1, 2,,kn (14) where T the date to sell the item by w C the weight for price w S the weight for review point w D the weight for delivery time i t th inegotiation time i current number index of negotiation n total number of negotiation max P the first suggested highest acceptable price min P the first suggested lowest acceptable price max S the first suggested highest acceptable review point min S the first suggested lowest acceptable review point max D the first suggested longest acceptable deliver time min D the first suggested shortest acceptable delivery time For the buyer agent, in the kth negotiation the weight for price is calculated as follows. max 1 k iw i PtTC , 1, 2,,kn (15) In the kth negotiation the weight for review point is calculated as follows. max 1 k iw i StTS , 1, 2,,kn (16) In the kth negotiation the weight for delivery time is calculated as follows. max 1 k iw i DtTD , 1, 2,,kn (17) where T is the date to buy the item by. Trading agent compares points suggested by seller agent and buyer agent and determines how to make progress the negotiation. Trading agent determine the negotiation price with Eclipse. We first run the JADE and make selling agent and buyer agent. And both agents negotiate in the marketplace that is controlled by JADE GUI tools. 5. Case Study After trading agent modeling of SCM is introduced, a fictitious bookstore case will be investigated. We have considered the simple bookstore case that consists of 2 distributors, 2 producers and 2 suppliers. Distributors have made a negotiation with customer. Distributor’s maximum price is $ 15,000 and minimum acceptable price is $ 13,200 and customer’s maximum acceptable price is $ 15,000. Trading agents seek the best purchasing point with buyer and seller agent through the use of JADE tools. We developed trading agent based negotiation system with following developing environment in Table 1. We compare the benefit/cost (b/c) ratio of trading agent with that of the Kasbah system. In this paper, we’ve defined buyer b/c ratio and seller b/c ratio as following: Buyer b/c Ratio = negotiation price suggested by seller agent/negotiation price suggested by buyer agent Seller b/c Ratio = negotiation price suggested by buyer agent/highest acceptable price suggested by seller agent In this case we assume that we’ll make a 10 round ne- gotiation and give 30 minutes to each negotiation time for seller and buyer agent. We want to find negotiation strat- egy that gives us the high benefit/cost ratio. Table 2 gives the attribute table of input data for seller and buyer agents. We can compare the number of trading negotiation and total negotiation b/c ratio for Kasbah and our trading agent. The number of trading negotiation is similar be- tween two methods. In order to compare the efficiency of the negotiation algorithm, we use total negotiation b/c ratio. The results are shown in Tables 3, 4, 5. As shown in Figure 4, trading agent gives larger benefit/cost ratio than the Kasbah system. 6. Discussion The importance of supply chain management is increas- ing with globalization and the widespread adoption of Table 1. Developing platform. item System Operating System Windows XP JAVA compiler JDK 1.6.0 JAVA developing tool Eclipse SDK 3.4.1 Eclipse Plug-in EJADE RMA Agent Protocol FIPA ACL JADE JADE 3.6 Figure 4. Negotiation b/c ratio.  A Study of Multi-Agent Based Supply Chain Modeling and Management Copyright © 2010 SciRes. iB 340 Table 2. Attribute table for seller and buyer agent. price Review point Delivery time Maximum value 15,000 100 3 days Minimum value 13,200 1 1 day Book seller agent Weight 0.6 0.2 0.2 Maximum value 15,000 100 1 day Book buyer agentweight 0.6 0.2 0.2 Table 3. Negotiation result of kasbah. Seller Agent 1 2 3 4 5 6 7 8 9 10 InitPrice 14946 14972 14941 14945 14943 14973 1497314972 14960 14965 NgtPrice 13371 13364 13359 1334613351 13378 13383 13376 13363 13291 Buyer Agent 1 2 3 4 5 6 7 8 9 10 InitPrice 452 462 491 459 473 443 458 475 661 541 NgtPrice 13571 13861 13745 1377513703 13741 13750 13765 13883 13523 Table 4. Negotiation result of trading agent. Seller Agent 1 2 3 4 5 6 7 8 9 10 InitPrice 8981 9004 9001 8988 8974 9000 9002 9008 9001 8973 NgtPrice 8020 8022 8045 8038 8045 8050 8047 8044 8043 8026 Buyer Agent 1 2 3 4 5 6 7 8 9 10 InitPrice 328 266 327 275 383 338 313 208 327 267 NgtPrice 8207 8259 8163 8249 8052 8120 8130 8111 8182 8263 Table 5. Negotiation b/c ratio. Kasbah Trading Agent Seller b/c Buyer b/c total Seller b/c Buyer b/c total 1 0.9080 0.9852 1.8932 0.9138 0.9772 1.8910 2 0.9257 0.9641 1.8898 0.9172 0.9713 1.8885 3 0.9199 0.9719 1.8918 0.9068 0.9855 1.8923 4 0.9217 0.9688 1.8905 0.9177 0.9744 1.8921 5 0.9170 0.9743 1.8913 0.8972 0.9991 1.8963 6 0.9177 0.9735 1.8912 0.9022 0.9913 1.8935 7 0.9183 0.9733 1.8916 0.9031 0.9897 1.8928 8 0.9193 0.9717 1.8910 0.9004 0.9917 1.8921 9 0.9280 0.9625 1.8905 0.9090 0.9830 1.8920 10 0.9036 0.9828 1.8864 0.9208 0.9712 1.8920 electronic commerce. However, supply chains can change over time and companies in supply chains can have only limited visibility of the supply chains. This paper suggested a multi-agent system that has trading agent and make negotiation through suggested model. The ideas behind the suggested model are making a new negotiation algorithm, making an agent by using JADE and Eclipse environment. It is multi-agent technology and information sharing among neighboring agents that is very important to the SCM. When we make negotia- tion we consider not only price but also review point and delivery time. We suggest a new negotiation in the SCM environment with using multi-agent technology. And in order to verify the performance of our algorithm we’ve made the simulation on the simple supply chain and compared benefit/cost ratio with Kasbah system. The performance of the suggested model was analyzed by a simulation experiment with JADE and Eclipse. The result of the simulation revealed that the simulated model had better performance than existing negotiation model. After 10 rounds of negotiation we investigated the nego- tiation benefit/cost ratio between the proposed model and the Kasbah system. Our trading agent model gave us a slightly higher rate of return than the Kasbah system. We used weighted average of multi-attributes of negotiation. There are some limitations in this research: First, de- termining the weight is entirely subjective and may be not adequately represent true marketplace conditions. Second, there are few evaluation tools to compare the performance of the proposed system with others. Lastly,  A Study of Multi-Agent Based Supply Chain Modeling and Management Copyright © 2010 SciRes. iB 341 the simulation was limited to a single simple system. However, we believe this model and system simulation have provided an alternative application of agent-based trading that shows potential for future research on mul- ti-agent trading environments. 7. Acknowledgements This paper is the work supported by the research fund of 2009 long-term oversea visiting scholar program from Gangneung-Wonju National University, Korea. REFERENCES [1] M. E. Nissen, “Agent-Based Supply Chain Dis-Interme- diation vs. Re-Intermediation: Economic and Techno- logical Perspectives,” Intelligent Systems in Accounting, Finance, & Management, Vol. 9, No. 4, 2000, pp. 237- 256. [2] J. W. Forrester, “Industrial Dynamics,” MIT Press, Cam- bridge, 1961. [3] H. L. Lee, P. Padmanabhan and S. Whang, “Information Distortion in a Supply Chain: the Bullwhip Effect,” Management Science, Vol. 43, No. 4, 1997, pp. 546-558. [4] M. E. Nissen, “Agent-Based Supply Chain Integration,” Information Technology & Management, Vol. 2, No. 3, 2001, pp. 289-312. [5] N. R. Jennings and M. Wooldridge, “Applying Agent Technology,” Applied Artificial Intelligence, Vol. 9, 1995, pp. 357-369. [6] M. S. Fox, M. Barbuceanu and R. Teigen, “Agent-Ori- ented Supply-Chain Management,” Flexible Manufac- turing Systems, Vol. 12, No. 2, 2000, pp. 165-188. [7] J. M. Swaminathan, “Modeling Supply Chain Dynamics: A Multiagent Approach,” Decision Sciences, Vol. 29, No. 3, 1997, pp. 607-632. [8] Y. Chen, Y. Peng, Y. Labrou, S. Cost, B. Chu, J. Yao, R. Sun and B. Willhelm, “A Negotiation-Based Multi-Agent System for Supply Chain Management,” Workshop on Agents for Electronic Commerce and Managing the In- ternet-Enabled Supply Chain, Seattle, 1999, pp. 15-20. [9] M. He, H. F, Leung and N. R. Jennings, “A Fuzzy Logic Based Bidding Strategy for Autonomous Agents in Con- tinuous Double Auctions,” IEEE Transactions on Know- ledge and Data Engineering, Vol. 15, No. 6, 2003, pp. 1345-1363. [10] Y. Yuan, T. P. Liang and J. J. Zhang, “Using Agent Technology to Support Supply Chain Management: Po- tentials and Challenges,” Michael G. DeGroote School of Business Working Paper Series, 2001, p. 453. [11] N. R. Jennings, “An Agent-Based Approach for Building Complex Software Systems,” Communications of the ACM, Vol. 44, No. 4, 2001, pp. 35-41. [12] R. H. Guttman, A. G. Moukas and P. Maes, “Agent-Me- diated Electronic Commerce: A Survey,” Knowledge En- gineering Review, Vol. 13, No. 2, 1998, pp. 147-159. [13] P. Davidsson, E. Astor and B. Ekdahl, “A Framework for Autonomous Agents Based on the Concept of Anticipatory Systems,” In: Proceedings of Cybernetics and Systems, World Scientific, Singapore, Vol. 2, 1994, pp. 1427-1434. |