Theoretical Economics Letters, 2013, 3, 202-210 http://dx.doi.org/10.4236/tel.2013.34034 Published Online August 2013 (http://www.scirp.org/journal/tel) Capacity Choice in a Private Duopoly: A Unilateral Externality Case* Yasuhiko Nakamura College of Economics, Nihon University, Tokyo, Japan Email: yasuhiko. r.nakamura@gmail.com Received May 29, 2013; revised June 29, 2013; accepted July 18, 2013 Copyright © 2013 Yasuhiko Nakamura. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. ABSTRACT This paper studies capacity choice in a quantity-setting and price-setting private duopoly with differentiated goods wherein either of two firms has a price-raising effect on the price level of the product of the opponent firm. In both quantity-setting and price-setting competition, whether the price-raising effect of the product of one firm on the price level of the other firm’s product is strong or weak strictly depends on the differences between the quantities and cap ac- ity levels of both firms. More precisely, in the quantity-setting competition, when th e price-raising effect is sufficiently strong, both firms choose under-capacity, whereas when such an effect is sufficiently weak, both firms choose over- capacity. Furthermore, in the price-setting competition, when the price-raising effect is sufficiently strong, both firms choose over-capacity, whereas when such an effect is sufficiently weak, both firms choose under-capacity. Therefore, the presence of the price-raisin g effect as the unilateral externality strikingly change s the difference between each firm’s quantity and cap acity level in the contexts of both the quantity-setting competition and the price competitio n in a private duopoly wi t h differenti a t e d go ods. Keywords: Private Duopoly; Externality; Capacity Choice 1. Introduction This paper considers the capacity choices of two profit- maximizer firms in a private duopoly with unilateral ex- ternality. More precisely, in the contexts of both quan- tity-setting competition and price-setting competition wherein one firm has a price-raising effect on the price level of the product of the opponent firm as the unilateral externality, we investigate the difference between the quantity and capacity level of each firm. We introduce the price-raising effect as the unilateral externality into each firm’s demand function à la Choi and Lu [1]. The purpose of this paper is to check the robustness of the result on the difference between each firm’s quantity and capacity level obtained in the standard private duopoly with differentiated goods against the introduction of the price-raising effect of the one firm’s product on the price level of the opponent firm’s product in the fashion of Choi and Lu [1]. In the model of this paper, following the model em- ployed in Choi and Lu [1], we consider the situation where both firms produce a homogeneous good if there does not exist the price-raising effect of the product of the one firm as the unilateral externality1. Similar to Choi and Lu [1], since only the quantity of the product of the one firm (say firm 1) has the price-raising effect on the price level of the opponent firm’s product, we refer to this effect as the unilateral externality. When the price- raising effect of firm 1’s product is sufficiently strong, its product becomes a complement to the product of the firm without the price-raising effect (say firm 0). Hence, when the price-raising of firm 1’s product as the unilateral externality is sufficiently strong, the strategic relations between the quantities/price levels and between the capacity levels as the strategic variables of both firms are changed in the context of both the quantity-setting com- petition and the price-setting competition. Cabral and Majure [2] found theoretical and empirical evidence on the asymmetry of the strategic relation in the Portuguese banking industry. More precisely, they indicated that for some banks, the number of branches of rival banks is a 1As indicated in Choi and Lu [1], although we can investigate the model such that the products of both firms can be differentiated even i there is the price-raising effect of the one firm as the unilateral exter- nality, such an assumption does not change the qualitative results ob- tained in this paper. *We are grateful for the financial support of KAKENHI (25870113). All remaining errors a re our own. C opyright © 2013 SciRes. TEL  Y. NAKAMURA 203 strategic complement, whereas for other banks, it is a strategic substitute2. By considering a standard oligopoli- stic market without unilateral externality, Bulow et al. [3] and Bulow et al. [4] found that the dominant firm in an industry can consider the products of fringe firms as strategic complements, whereas the fringe firms can con- sider the output level of the dominant firm as strategic substitutes. In addition, Tombak [5] considered a two- stage game in which one firm regards its rival’s second- stage strategic variable as a strategic complement where- as the other firm regards its rival’s second-stage strategic variable as a strategic substitu te3. In contrast to the works in this field including Choi and Lu [1], in this paper, we elaborate on the influences of the price-raising effect that the dominant firm has on not only the strategic variables in the market but also the additional strategies (the cap acity levels) of the dominant firm and the fringe firm, that is, whether the over- capacity or under-capacity is achieved in both firms4. In this paper, we show that when the price-raising effect of the one firm’s product on the price level of the other firm’s product is sufficiently strong, in the quan- tity-setting competition, both firms choose under-capa- city, while in the price-setting competition, both firms choose over-capacity. These results sharply contrast with those obtained in th e standard quantity-setting and price- setting competitions with differentiated goods and with- out the price-raising effect5. As described above, the strength of the price-raising effect of firm 1’s product changes the strategic relation between the strategic va- riables of both firms, i.e., their quantities/price levels and capacity levels. More precisely, when the price-raising effect of the product of firm 1 is sufficiently strong (weak), in the quantity-setting competition, the strategic relation of firm 0’s quantity with firm 1’s quantity is a strategic complement (substitute) in firm 0’s reaction function in the q uantity-setting stag e6. On the other hand, in the price-setting competition, when the price-raising effect of the product of firm 1 is sufficiently strong (weak), the strategic relation of firm 0’s price level with firm 1’s price level is a strategic substitute (co mplement) in firm 0’s reaction function in the price-setting stage7. Furthermore, in the contexts of both quantity-setting competition and price-setting compe-tition, the influence of firm 1’s capacity level on firm 0’s quantity/price level is changed when the price-raising effect is sufficiently strong. Thus, when the price-raising effect is sufficiently strong, the changes of the strategic relations between the strategic variables yield changes of the signs of the dif- ferences between the quantities and capacity levels of both firms in the context of both quan tity-setting compe- tition and the price-setting competition. The remainder of this paper is organized as follows. In Section 2, we formulate a private duopolistic model with the prise-raising effect of the one firm’s product as the unilateral externality and with the capacity choices of both firms that will be investigated throughout th is paper. In Section 3, from the viewpoints of quantity-setting competition and the price-setting competition, we con- sider the differences between the quantities and capacity levels of both firms using the model built in Section 2. Section 4 concludes with several remarks. The market outcomes including each firm’s equilibrium price level and profit are relegated to the appendix. 2. Model Following Choi and Lu [1], we formulate an asymmetric duopolistic model with unilateral externality wherein both firms determine not only their quantities/pr ice levels but also their capacity levels. The products are perfect substitutes if the unilateral externality does not exist. When the unilateral externality is introduced, the quan- tity of firm 1’s products can have an price-raising effect on the price level of firm 0’s products. On the basis of Choi and Lu [1], we call the effect such that the output level of firm 1 can raise firm 0’s price level the “uni- lateral externality”. The inverse demand functions of firms 0 and 1 are given as follows: 2The findings obtained in Cabral and Majure [2] are explained by the following two facts: i) the geographic differences (urban or rural areas) of the expansion patterns of incumbents (public banks) and entrants (private banks) and ii) the degree of customer honesty (in general, rural customers are more honest than urban customers) . 3More precisely, Tombak [5] investigated the situation where only the dominant firm decid e s t h e in v e s tment for R&D in the first stage. 4By taking into account the managerial delegation in the fashion o Fershtman and Judd [6], Sklivas [7], and Vickers [8], although Choi and Lu [1] investigated the multi-stage game where the delegation arameters of both the firms as well as their quantities/price levels are determined, their main focus was to derive the result on the equilibrium timing of setting th e quantities of both firms obtained in the endogenous timing game (the consequent order of the game). We consider how the setting of the strategic variable for the firm without the price-raising effect except for its strategic variable in the market is influenced by the setting of the strategic variables for the firm with the price-raising effect as the unilateral externality. 5In the appendix, we give the results on the differences in the quantities and capacity levels between both firms in the standard quantity-setting and price-setting competitions with differentiated goods and without the rice-raising effect. More precisely, in a standard quantity-setting com- etition, both firms always choose ove -capacity irrespective of the degree of product differentiation, whereas in a standard price-setting competition, both firms choose under-capacity irrespective of the de- gree of product differentiation. 0011 01 1,, respectively,paq qpaqq where i and i denote firm ’s price level and out- put level, respectively, and parameter p qi measures the 6In firm 1’s reaction function in the quantity-setting competition, the strategic relation of firm 1’s quantity with firm 0’s quantity is a strate- gic substitute irrespective of the strength of the price-raising effect o firm 1. 7In firm 1’s reaction function in the price-setting competition, the strategic relation of firm 1’s price level with firm 0’s price level is a strategic complement irrespective of the strength of price-raising effect of firm 1. Copyright © 2013 SciRes. TEL  Y. NAKAMURA 204 degree of the price-raising effect as the unilateral exter- nality, . Note that denotes the demand para- meter and 8. indicates that the price-raising effect of firm 1’s output level is rela- tively strong whereas indicates that the price- raising effect of firm 1’s output level is relatively weak. Futhermore, implies that firm 1’s product becomes a complement to firm 0’s product whereas implies that firm 1’s product becomes a substitute for firm 0’s product. 0,1i 1 a 0,1 i 0,1 1,2 1,2 , ii Cqx 1,2 0, Both firms adopt identical technologies represented by the cost function , where i is the capacity level of firm , . Following Vives [9], Ogawa [10], Bárcena-Ruiz and Garzón [11], Tomaru et al. [12], Nakamura and Saito [13], Nakamura and Saito [14], and Nakamura [15], we assume that the cost function is given by iii , . This cost function implies that if each firm’s output level equals its capacity level, ii , the long-run average cost is minimized. The profit of firm is given by . i , iii Cqx pqCq 0,1i mq q qx ,xi 2 x 0,1 0,1i i iiiiii We investigate the game with the following orders of each firm’s moves: In the first stage, firms 0 and 1 simultaneously set their capacity levels. In the second stage, after both firms observe their capacity levels, they engage in either quantity-setting competition or price- setting competition with each other. 3. Equilibrium Analysis 3.1. Quantity Competition We first solve the quantity-setting game by backward induction from the second stage to obtain the subgame perfect Nash equilibrium. In the second stage, firm maximizes its profit i with respect to i, i q 0,1i. The best response functions of firms 0 and 1 in the second stage are given as follows: 01 qq 01 ;,xx a 1 0 2qx 14,q m (1) 10 qq q 1 q q 1 ;x a 0 q1 x24.m (2) From Equations (1) and (2), when , 0 is decreasing in 1, whereas when , is in- creasing in . For any , 1 is de- creasing in 0. Thus, the strategic relation of the quan- tity of firm 0 with the quantity of firm 1 strictly depends on the value of 0,1 1,2 0 q 1,2q q 10, ; that is, when , the quantity of firm 0 is a strategic substitute for the quantity of firm 1, whereas when , the quantity of firm 0 is a strategic complement to the quantity of firm 1. On the other hand, the strategic relation of the quantity of firm 1 is a strategic substitute for the quantity of firm 0 irrespective of 0,1 1,2 0,1 1,2 . Furthermore, we obtain the following equilibrium quantities of firms 0 and 1 as the functions of their capa- city levels in the Nash equilibrium in the quantity-setting stage: 011 822 15 xxxa 0 33 , m q (3) 0 32 . 15 amx x 1 1 8 q (4) In the first stage, firms 0 and 1 realize that the choices of their capacity levels influence their quantity deter- mined in the second stage. Provided Equations (3) and (4), respectively, firms 0 and 1 simultaneously and in- dependently set their cap acity levels with respect to their profits. Thus, by solving the first-order conditions of the profits of firms 0 an d 1 , we o btain 1 16 213 97 30 xa 01 2 3, m xx (5) 0 2 16 332 97 30 amx 10 , xx (6) yielding 2 023 123 18 , 5 3. 5 q q x x 16 13 559 4194 16 13 559 4194 am am Note that superscript is used to represent the subgame perfect Nash equilibrium market outcomes in the quantity-setting competition. Then, the equilibrium quantities of firms 0 and 1 are given as follows: q 2 023 123 1513 18, 559 41945 1513 3. 559 41945 q q am q am q Therefore, from easy calculations, we obtain the following equilibrium result on the differences between the quantities and capacity levels of firms 0 and 1: 2 00 23 11 23 11318, 559 41945 1133. 559 41945 qq qq am qx am qx Proposition 1 In the quantity-setting competition, when the price-raising effect of firm 1’s product on the price level of firm 0’s product is sufficiently strong, i.e., 1,2 , both firms 0 and 1 choose under-capacity. In contrast, in the quantity-setting competitio n, when such a price-raising effect of firm 1’s product is sufficiently 8Similar to Choi and Lu [1], we omit the case of 1 since firm 0’s rice level is independent of firm 1’ s output level; this is a trivial case. Copyright © 2013 SciRes. TEL  Y. NAKAMURA 205 weak, i.e., , both firms 0 and 1 choose over- capacity. 0,1 ,0,ij 0,1 i Proposition 1 indicates that whether either of the two firms has a price-raising effect on the price level of the product of its opponent firm strictly determines the differences between the quantities and capacity levels of both firms. More precisely, when the price-raising effect of the one firm’s product on the price level of the product of its opponent firm is sufficiently strong, both firms choose under-capacity, whereas when such an effect is sufficiently weak, both choose over-capacity. This result is strikingly different from that obtained in the standard quantity-setting competition with differentiated goods9. In the standard private duopolistic competition without the price-raising effect, since firm i pays attention to its market share in order to increase its profit, it attempts to decrease the quantity of its opponent firm j n order to increase its market share by increasing its capacity level when the relation between their output levels is sub- stitutable, . In addition, in the case wherein the relation between the products of both firms is complementary, firm i has an incentive to increase its market share by decreasing the quantity of its opponent firm j by decreasing its own capacity, and thus, this behavior of decreasing firm ’s capacity also decreases firm j’s capacity since their capacity levels are strategic complements in the first stage, . Although the capacity levels of both firms tend to be low, their quantities are lower than their capacity levels since their capacity levels are positively associated with their own quantities. Thus, irrespectiv e of whether the relation of the goods produced by both firms are substitutable or complementary, in a standard quantity-setting duopoly without the price-raising effect, they choose over- capacity. 1;i j i ,0,1; i jij In the quantity-setting competition wherein the one firm has the price-raising effect of its product on the price level of the product of the other firm, if such an effect is sufficiently weak, i.e., , the intuition behind the result that both firms 0 and 1 choose over- capacity is similar to that given in the standard quantity- setting competition with substitutable goods and without the price-raising effect10. From Equations (3) and (4), when , both firms 0 and 1 have incentive to decrease the quantities of their respective op ponent firms through increasing their own capacity in order to expand their respective market share, implying that both firms choose over-capacity. On the other hand, when the price-raising effect of firm 1’s product is sufficiently strong, i.e., 0,1 1,2 , we obtain the result that the diffe- rences between the quan tities and capacity lev els of firms 0 and 1 are positive, which is strikingly different from the results obtained for i) the quantity-setting com- petition without the price-raising effect and ii) the case wherein such a price-raising effect is sufficiently weak, i.e., 10, . The intuition behind this result is as follows: from Equation (3), firm 1 which has the price- raising effect has an incentive to decrease firm 0’s quan- tity by decreasing its own capacity, and consequently, firm 1 chooses under-capacity. On the other hand, from Equation (4), firm 0, which does not have the price- raising effect has an incentive to decrease firm 1’s quan- tity by increasing its own capacity, similar to the case where 0,1 . However, taking Equations (5) and (6) into account, firm 0’s capacity tends not to become so high when 1,2 . Therefore, since the quantity of firm 1 does not become so low because of the relatively low capacity of firm 0, from Equation (1), the quantity of firm 0 is higher relative to its capacity when 1,2 i 0, 1 . Consequently, firm 0 also chooses under-capacity. We emphasize that the strength of the price-raising effect and the change of the relation of the goods produced by firms 0 and 1 on the basis of such an effect determine the difference between the quantity and capacity of each firm in the quantity-setting competition with the price-raising effect as the unilateral effect. 3.2. Price Competition We next solve the price-setting game by backward induction from the second stage to obtain the subgame perfect Nash equilibrium. In the second stage, firm maximizes its profit with respect to i, . The best-response functions of firms 0 and 1 in the second stage are given as follows: pi 2 10 22 21 pmx 2 , a 0 p (7) 001 2 . p x 1 p2 21 pm (8) From Equations (7) and (8), when , 0 is increasing in , whereas when , 0 is de- creasing in . For any , 1 is increasing in 0. Thus, the strategic relation of the price level of firm 0 with the price level of firm 1 strictly depends on the value of 0,1 1,2 p 1,2 p p 1 p 1 p p 0, 1 ; that is, when 10, , the strategic relation of the price level of firm 0 is a strategic complement to the price level of firm 1, whereas when 1,2 , the strategic relation of the price level of firm 0 is a strategic substitute for the price level of firm 1. On 9This results on the differences between the quantities and capacity levels of firms 0 and 1, which are obtained in the standard quantity- setting competition with differentiated goods and without the price- raising effect, are given in the appendix. More concretely, in both cases wherein firms 0 and 1 produce substitutable goods or complementary goods, it was shown that they both always choose over-capacity. 10As described in the setting of this model, we recall that the fact that the price-raising effect is sufficiently weak implies that the products firms 0 and 1 are substitutable. Copyright © 2013 SciRes. TEL  Y. NAKAMURA Copyright © 2013 SciRes. TEL 206 Furthermore, we obtain the following price levels of firms 0 and 1 as the functions of th e capacity lev els in th e Nash equilibrium in the price-setting stage. the other hand, the strategic relation of the price level of firm 1 is a strategic complement to the price level of firm 0 irrespective of . 0,1 1,2 22 010112 2 444224223, 87 xxxxx ma 0 p (9) 2 10 2 2432212 . 87 am xx 1 p (10) In the first stage, firms 0 and 1 realize that the choices of their capacity levels influence their price levels in the second stage. Provided Equations (9) and (10), re- spectively, firms 0 and 1 set their capacity levels with re- spect to their profits. Thus, by solving the first-order conditions of the profits of firms 0 and 1 in the first stage, we obtain 1 01 234 43 4111, 28 523710 xam xx (11) 20 10 234 234222 , 28 523710 xa m xx (12) yielding 2 23 41 360 231 am 23 0456 6178 , 80 2647513 p x 2345 123 212344 360 231 456 3299. 80 26475 13 pam x Note that superscript p represents the subgame perfect Nash equilibrium market outcomes in the price-setting competition. Then, the equilibrium quantities of firms 0 and 1 are given as follow s: 22 0 3 456 276 , 80 2647513 p q 23 287 360 231 am 22 1 3 456 46 5 80 2647513 pam q 23 87 360 231 Therefore, from easy calculations, we obtain the following equilibrium result on the differences between the quantities and capacity levels of firms 0 and 1: 00 2 23 211 360 231 456 225 , 80 2647513 pp qx am 11 23 23 12 360 231 456 465 . 80 2647513 pp qx am Proposition 2 In the price-setting competition, when the price-raising effect of firm 1’s product on the price level of firm 0’s product is sufficiently strong, i.e., 1,2 , both firms 0 and 1 choose over-capacity. In contrast, when such a price-raising effect of firm 1’s product is sufficiently weak, i.e., , both firms 0 and 1 choose under-capacity. 0,1 Similar to the quantity-setting competition with the price-raising effect of the product of firm 1, Proposotion 2 indicates that the differences between the quantities and capacity levels of firms 0 and 1 strictly depend on the strength of the price-raising effect o f firm 1’s product on the price level of firm 0’s product. More concretely, it is shown that when the price-raising effect of firm 1’s product is sufficiently strong, the differences between the quantities and capacity levels of firms 0 and 1 are ne- gative, whereas when su ch an effect is sufficiently weak, the differences between their quantities and capacity levels are positive11. In the price-setting competition with the price-raising effect, when such an effect is sufficiently weak, i.e., 0,1 from Equations (9) and (10), both firms 0 and 1 attempt to decrease the quantity of their respective opponent firm by decreasing their capacity in order to expand their own market share. Thus, when 0,1 , both firms 0 and 1 choose under-capacity, which is the same result as that obtained in the standard price-setting competition with differentiated goods and without the 11These results on the differences between the quantities and capacity levels of firms 0 and 1, which are obtained in the standard price-setting competition with differentiated goods and without the price-raising effect, are given in the appendix. More concretely, in both cases wherein firms 0 and 1 produce substitutable goods or complementary goods with each other, it is shown that they always choose under- capacity together.  Y. NAKAMURA 207 price-raising effect12. In contrast, the intuition behind the result that both firms 0 and 1 choose over-capacity in the price-setting competition when is given as follows: from Equation (9), firm 1 which has the price-raising effect attempts to increase firm 0’s price level by setting its capacity level high in order to decrease the quantity of firm 0, implying that it chooses over-capacity. Further- more, similar to the case wherein , from Equ- ation (10), firm 0 tends to decrease its own capacity level in order to decrease firm 1’s quantity by increasing the price level of firm 1 when as well. However, taking Equations (11) and (12) into account, firm 0’s capacity level tends not to become low when 1,2 0,1 2 1, 1,2 . Therefore, since the price level of firm 1 does not be- come so high because of the relatively high capacity level of firm 0, from Equation (7), the price of firm 0 becomes relatively high, Consequently, since the quan- tity of firm 0 becomes low, firm 0 also chooses over- capacity when . 1,2 For both the quantity-setting competition with the price-raising effect and the pr ice-setting co mp etition with the price-raising effect, we find that the choices of the quantity/price level and the capacity level for the firm with the price-raising effect influences not only th e selec- tion of the quantity/price level for its opponent firm in the market, but also the selection of the capacity level fo r its opponent firm. These choices change the differences between the quantities and capacity levels of the two firm. 4. Conclusions This paper investigated the differences between the out- put and capacity levels in a private duopoly composed of two profit-maximizer firms in both quantity-setting co m- petition and price-setting competition, particularly when one firm has the price-raising effect on the price level of the product of its opponent firm as the unilateral exter- nality. In both the standard quantity-setting competition and price-setting competition with differentiated goods and without the price-raising effect, the differences be- tween the quantity and capacity levels of the two firms do not depend on the relation between their products, that is, whether they are substitutable or complementary. More precisely, in the standard quantity-setting competi- tion with differentiated goods, bo th firms 0 and 1 always choose over-capacity, whereas in the standard price- setting competition with differentiated goods, they al- ways choose under-capacity. In contrast, in the private duopoly with the price-raising effect of th e produ ct of th e one firm, the differences between the quantities and capacity levels of both firms strictly depend on the strength of such an effect in not only the quantity-setting competition but also the price-setting competition. In particular, when the price-raising effect is sufficiently strong, both firms choose under-capacity in the quantity- setting competition whereas they both choose over-capa- city in the price-setting competition. In the model of this paper, in the quantity-setting and price-setting com- petitions when the price-raising effect of the one firm is sufficiently strong, the product of the firm with such an effect is a complement to the product of the firm without such an effect, while the product of the firm without such an effect is always a substitute for the product of th e firm with such an effect. Thus, the change of the strategic relation between the quantities/price levels and capacity levels of both firms along with the change of the relation of the product of the firm that has the price-raising effect as the unilateral externality with the product of the firm without such an effect (i.e., substitutable or comple- mentary) strikingly influences the differences between their quantities and capacity levels even if their strategic variables ( or ) are fixed in the market. The above findings comprise the most important contribution of this paper. q p Finally, we mention an issue to be addressed in the future. Throughout this paper, we explored the diffe- rences between the quantity and capacity level of each firm by adopting the private duopolistic model with the unilateral externality à la Choi and Lu [1]. However, we did not consider the impact of the separation between ownership and management, which was investigated in Choi and Lu [1], on the differen ce between the quantities and capacity levels of the firms13. Future research must deal with the above problems. 12In the standard price-setting duopoly with differentiated goods,when the goods produced by both firms are substitutable, since each firm’s capacity is negatively associated with the opponent firm’s price level, each attempts to decrease the quantity of its opponent firm by increas- ing its opponent firm’s price level by decreasing its own capacity level in order to increase its own market share, and hence, each firm’s quan- tity is relatively higher than its capacity level. Thus, bo th firms choose under-capacity. On the other hand,when the relation between the roducts of the firms is complementary, each firm has an incentive to increase its opponent firm’s price level by increasing its capacity level in order to increase its market share, and thus, such capacity-increasing behavior also increases its opponent firm’s capacity since the capacity levels of both firms are strategic complements in the first stage. Al- though the capacity levels of both firms tend to become high,thei quantities are higher than their capacity levels since their capacity lev- els are negatively associated with their own price levels. Thus,whether the relation of the goods produced by both firms is substitutable or complementary, in a standard price-setting duopoly without the rice-raising effect, they choose under-capacity. 13Several types of strategic delegation, along with the separation be- tween ownership and management, are presented as the objective func- tions of managers on the basis of the manager’s bonus. For instances, Jansen et al. [16] introduced the weighted sum of the firm’s profit and its market share as the objective function of its manager, and Miller and Pazgal [17] and Miller and Pazgal [18] considered the weighted sum o the firm’s profit and (the sum of) t h e pr of i t (s) of its opponent f i r m(s). Copyright © 2013 SciRes. TEL  Y. NAKAMURA Copyright © 2013 SciRes. TEL 208 REFERENCES [1] K. Choi and Y. Lu, “A Note on Endogenous Timing with Strategic Delegation: Unilateral Externality Case,” Bulle- tin of Economic Research, Vol. 64, No. 2, 1983, pp. 253- 264. doi:10.1111/j.1467-8586.2011.00392.x [2] L. Cabral and W. R. Majure, “An Empirical Analysis of Bank Branching: Portugal 1989-1991,” In: D. Neven and L.-H. Roller, Eds., The Empirical Analysis of Industrial Organization, CEPR, London, 1994. [3] J. I. Bulow, J. D. Geanakoplos and P. D. Klemperer, “Holding Idle Capacity to Deter Entry,” Economic Jour- nal, Vol. 95, No. 377, 1985, pp. 178-182. doi:10.2307/2233477 [4] J. I. Bulow, J. D. Geanakoplos and P. D. Klemperer, “Multimarket Oligopoly: Strategic Substitutes and Com- plements,” Journal of Political Economy, Vol. 93, No. 3, 1985, pp. 488-511. doi:10.1086/261312 [5] M. M. Tombak, “Strategic Asymmetry,” Journal of Eco- nomic Behavior & Organization, Vol. 61, No. 3, 2006, pp. 339-350. doi:10.1016/j.jebo.2004.11.014 [6] C. Fershtman and K. Judd, “Equilibrium Incentives in Oligopoly,” American Economic Review, Vol. 77, No. 5, 1987, pp. 927-940. [7] S. D. Sklivas, “The Strategic Choice of Management Incentives,” RAND Journal of Economics, Vol. 18, No. 3, 1987, pp. 452-458. doi:10.2307/2555609 [8] J. Vickers, “Delegation and the Theory of the Firm,” Economic Journal, Vol. 95, No. 380a, 1985, pp. 138-147. doi:10.2307/2232877 [9] X. Vives, “Commitment, Flexibility, and Market Out- comes,” International Journal of Industrial Organization, Vol. 4, No. 2, 1986, pp. 217-229. doi:10.1016/0167-7187(86)90032-9 [10] H. Ogawa, “Capacity Choice in the Mixed Duopoly with Product Differentiation,” Economics Bulletin, Vol. 12, No. 8, 2006, pp. 1-6. [11] J. C. Bárcena-Ruiz and M. B. Garzón, “Capacity Choice in a Mixed Duopoly under Price Competition,” Econom- ics Bulletin, Vol. 12, No. 26, 2007, pp. 1-7. [12] Y. Tomaru, Y. Nakamura and M. Saito, “Capacity Choice in a Mixed Duopoly with Managerial Delegation,” Eco- nomics Bulletin, Vol. 29, No. 3, 2009, pp. 1904-1924. [13] Y. Nakamura and M. Saito, “Capacity Choice in a Price- Setting Mixed Duopoly: The Relative Performance Ap- proach,” Modern Economy, Vol. 4, No. 4, 2013, pp. 273- 280. doi:10.4236/me.2013.44031 [14] Y. Nakamura and M. Saito, “Capacity Choice in a Mixed Duopoly: The Relative Performance Approach,” Theo- retical Economics Letters, Vol. 3, No. 2, 2013, pp. 124- 133. doi:10.4236/tel.2013.32020 [15] Y. Nakamura, “Capacity Choice in a Price-Setting Mixed Duopoly with Network Effects,” Modern Economy, Vol. 4, No. 5, 2013, pp. 418-425. doi:10.4236/me.2013.45044 [16] T. Jansen, A. V. Lier and A. V. Witteloostruijn, “A Note on Strategic Delegation: The Market Share Case,” Inter- national Journal of Industrial Organization, Vol. 25, No. 3, 2007, pp. 531-539. doi:10.1016/j.ijindorg.2006.04.017 [17] N. Miller and A. Pazgal, “The Equivalence of Price and Quantity Competition with Delegation,” RAND Journal of Economics, Vol. 32, No. 2, 2001, pp. 284-301. doi:10.2307/2696410 [18] N. Miller and A. Pazgal, “Relative Performance as a Stra- tegic Commitment Mechanism,” Managerial and Deci- sion Economics, Vol. 23, No. 2, 2002, pp. 51-68. doi:10.1002/mde.1045  Y. NAKAMURA 209 Appendix Equilibrium Outcomes in a Standard Quantity-Setting Competition with Differentiated Goods In this appendix, we formulate a standard private quan- tity-setting competition with differentiated goods wherein firms 0 and 1 choose not only their ou tput levels but also their capacity levels. It is assumed that the inverse demand functions of firms 0 and 1 are 00 and 101 , respectively. Note that and denote the demand parameter and the degree of product differentiation, respectively. Moreover, similar to the setting on the cost functions of firms 0 and 1 in the main body of this paper, their cost functions are represented as i, 1 paqbq abpabqq ; iiiii xmq q 2 Cq x 0, 1i. Then, in the standard quantity-setting competition without the price- raising effect, we obtain the following equilibrium quan- tities and capacity levels of firms 0 and 1: 2 23 23 16 , 32 164 16 , 32 164 0,1. i i bam qbbb am xbbb i Note that superscrip t * is u sed to deno te the e quilibr ium market outcomes in the standard quantity-setting com- petition without the price-raising effect. Then we obtain the following equilibrium differences between the quantities an d capacity levels of firms 0 and 1: 2 23 0, 32 164 1, 00,1, 0,1. ii bam qx bbb b i Thus, we find that in the standard quantity-setting competition with differentiated goods and without the price-raising effect, firms 0 and 1 both choose over- capacity irrespective of the relation between the pro- ducts. Equilibrium Outcomes in a Standard Price-Setting Competition with Differentiated Goods Similar to the standard quantity-setting competition with- out the price-raising effect, in the price-setting com- petition without the price raising effect, we give the following equilibrium outcomes including the quantities and capacity levels of firms 0 and 1: 24 23456 24 23456 16 9, 32 162899 28 6, 321628 9 9 0,1. i i bbam qbbbbbb bbam xbbbbbb i Note that superscript ** is used to denote the equilib- rium market outcomes in the standard quantity-setting competition without the price-raising effect. Thus, we obtain the following equilibrium differences between the quantities an d capacity levels of both firms: 22 23456 30, 32 162899 1,00,1 ,0,1. ii bbam qx bbbbbb bi Thus, in the standard price-setting co mpetition without the price-raising effect, we find that both firms 0 and 1 choose under-capacity irrespective of the relation be- tween the products. Equilibrium Outcomes of Firms 0 and 1 in Quantity-Setting Competition In this subsection, we give the equilibrium following market outcomes, including the equilibrium price levels and profits of both firms 0 and 1 in the quantity-setting competition with the price-raising effect as the unilateral externality: 0 232 3 23 2195 7311169 273673 559 41945 q p ma 223 123 13 339034136, 559 41945 qam p 2 222 02 23 22 2 12 23 213189730 , 559 41945 21339730 . 559 41945 q q am am Equilibrium Outcomes of Firms 0 and 1 in Price-Setting Competition In this subsection, we give the equilibrium following market outcomes, including the equilibrium price levels and profits of both firms 0 and 1 in the price-setting competition with the price-raising effect as the unilateral externality: Copyright © 2013 SciRes. TEL  Y. NAKAMURA Copyright © 2013 SciRes. TEL 210 23456 23456 023456 6418420877 11 9284076774311, 80 2643602317513 pma p 2 23234 5 123456 4 6564 216284163383, 80 2643602317513 pam p 2 23 22 02 23456 412528 523710, 80 2643602317513 pam 34 2 2232345 12 23456 46 52880 894711. 80 2643602317513 pam

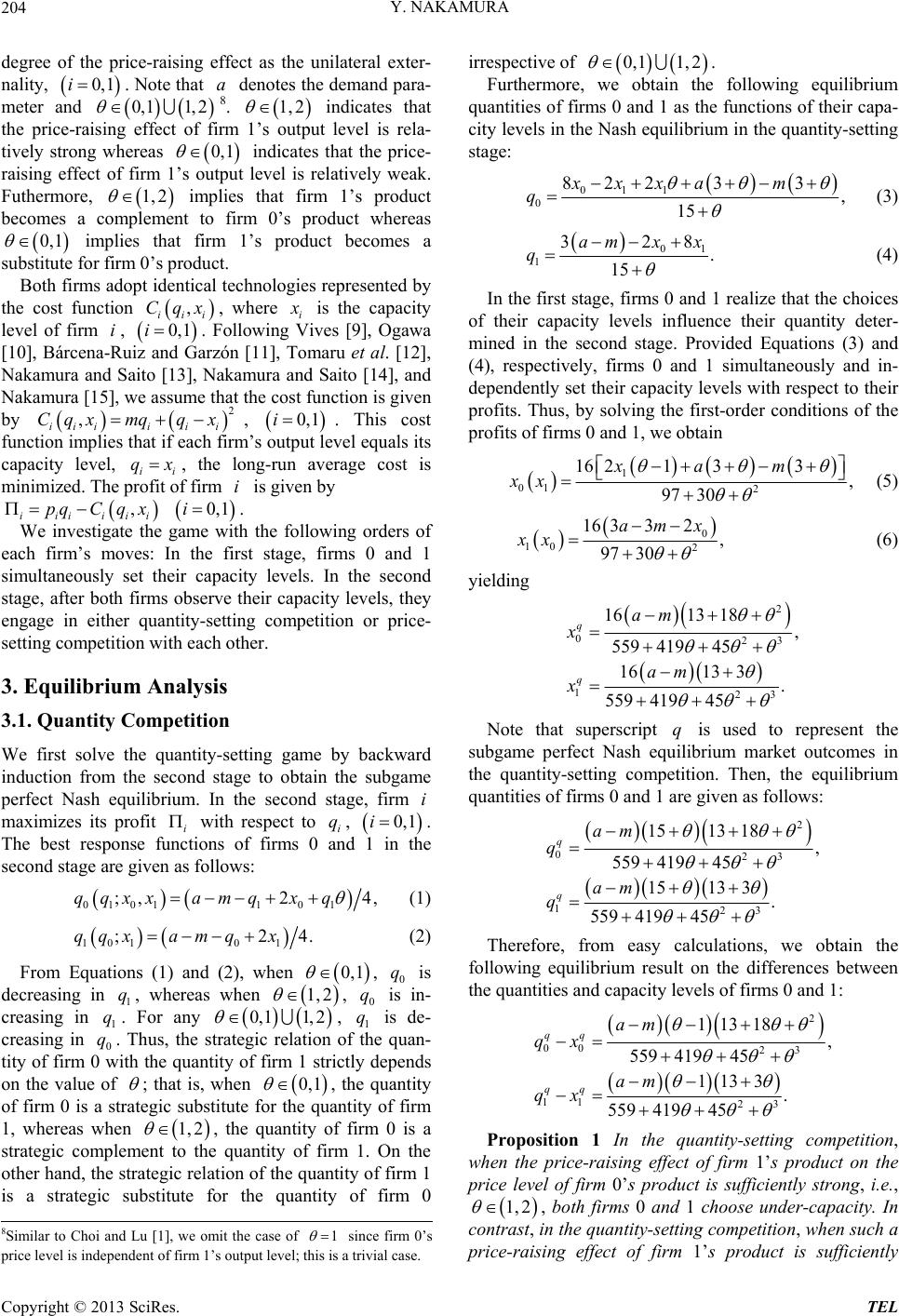

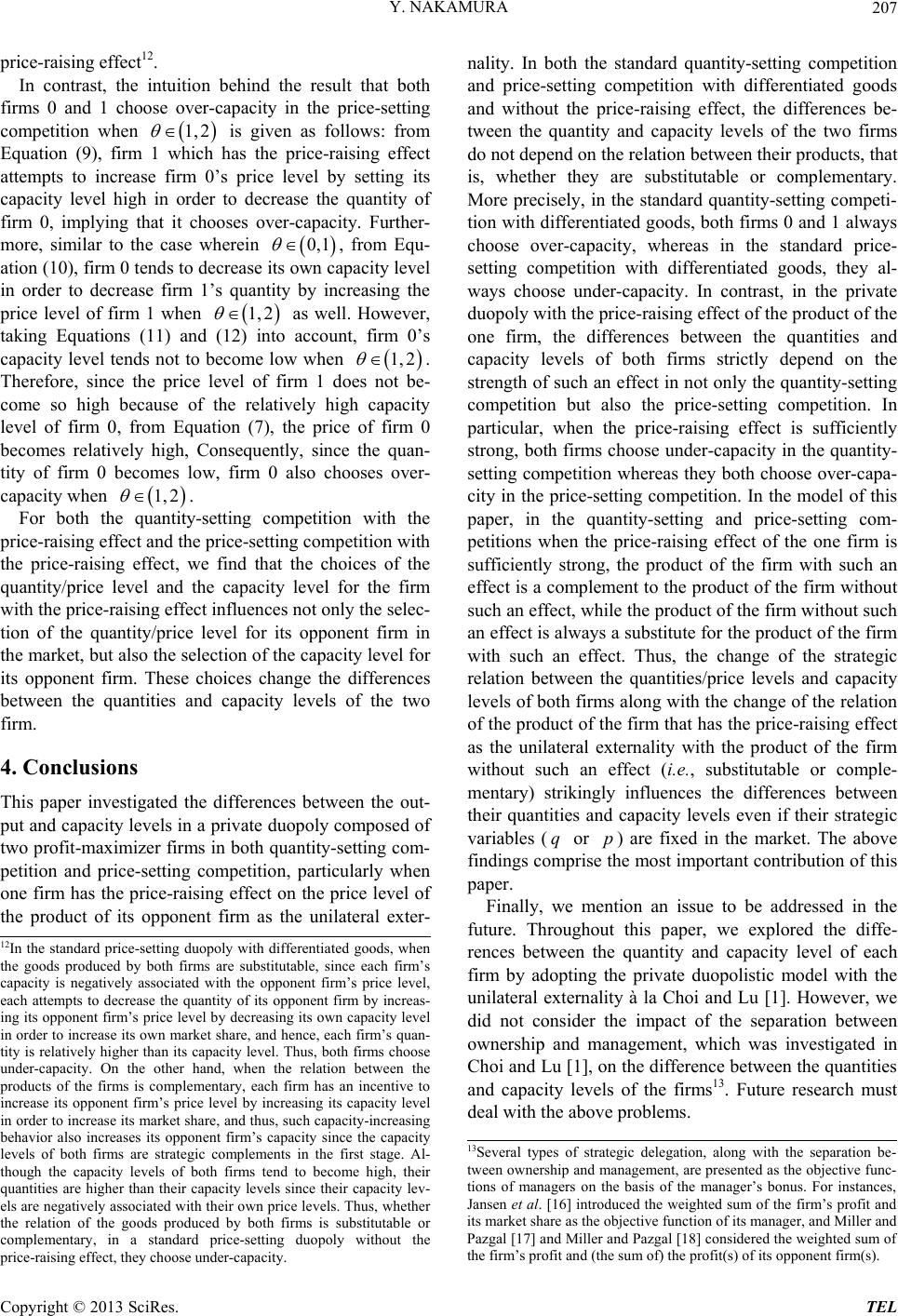

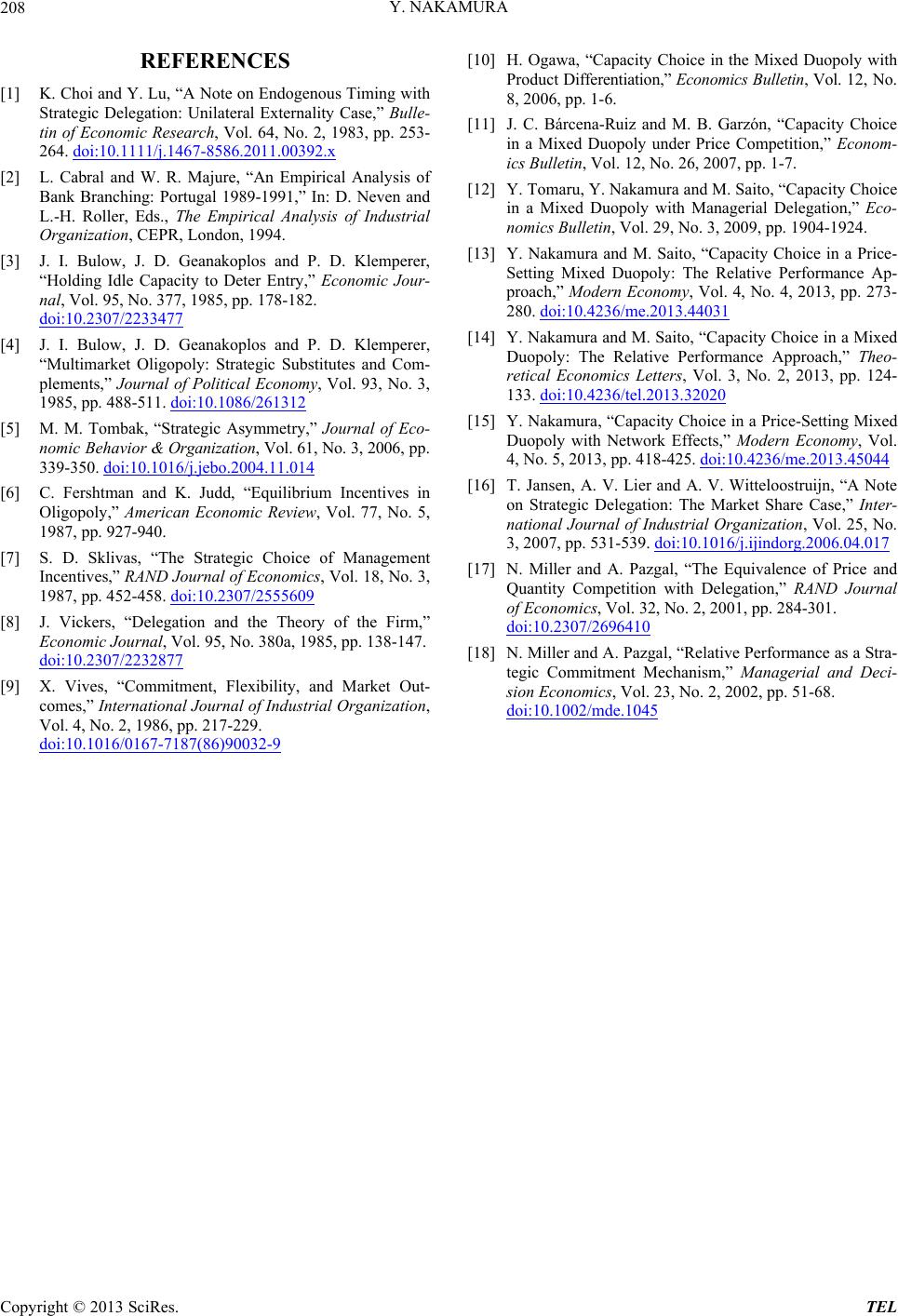

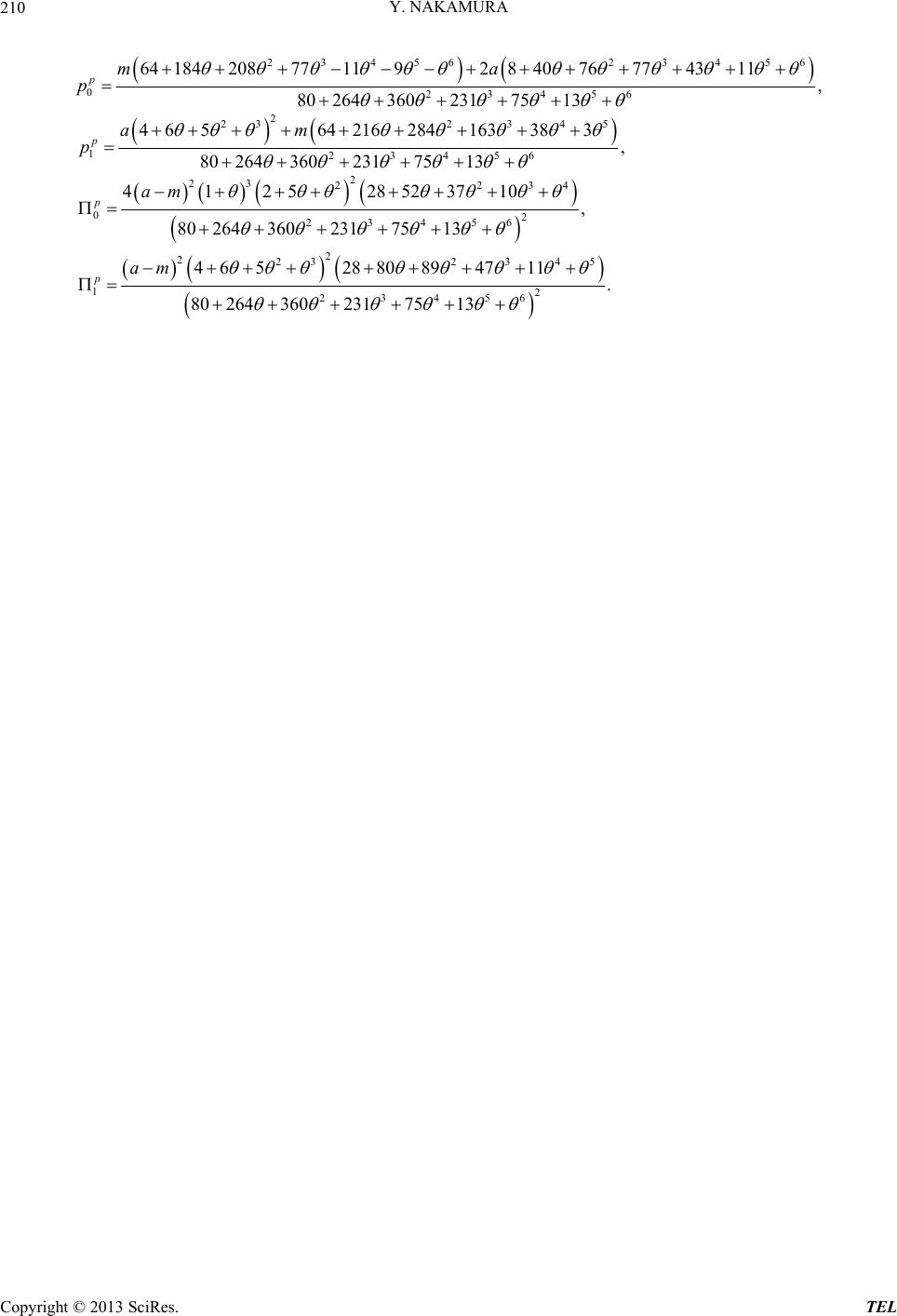

|