H. L. ZHAO ET AL.

Copyright © 2013 SciRes. OJAppS

3

According the asymptotic null distribution discussed

in last section, the p-value with the observed

is approximately that is very close

to 0, leading to the assertion that there exists a change-

point during the 270 eruptions of the Old Faithful geyser

in October 1980.

we have

when and are chosen to be constant, .

Liu and Qian (2010) suggests to use and

. Such a choice clearly satisfies. Another popu-

lar choice is , ; see Perron and

Vogelsang (1992). In p ar ticu l ar, if for ,

and where is the greatest integer

less than or equal to x, by Corollary A.3.1 of

and

4. Acknowledgements

The research is partially funded by the Fundamental Re-

search Funds for the Central Universities (No. 2011-IV-

116).

REFERENCES

3. A Real-Life Example [1] M. Csorgo and L. Horvnth, “Limit Theorem in

Change-Point Analysi,” Wiley Series in Probability and

Statistics, John Wiley & Sons: New York, 1997.

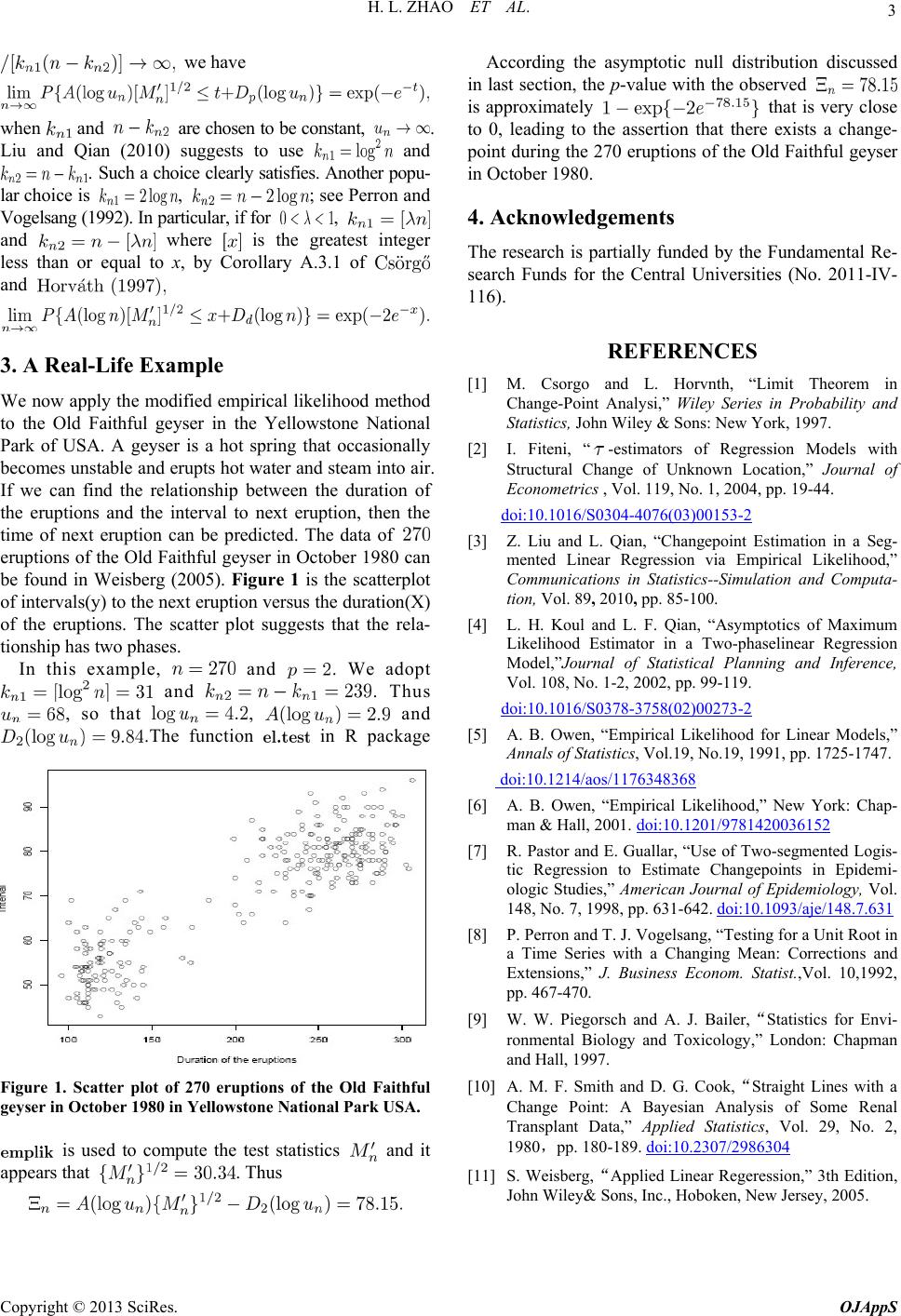

We now apply the modified empirical likelihood method

to the Old Faithful geyser in the Yellowstone National

Park of USA. A geyser is a hot spring that occasionally

becomes unstable and erupts hot water and steam into air.

If we can find the relationship between the duration of

the eruptions and the interval to next eruption, then the

time of next eruption can be predicted. The data of

eruptions of the Old Faithful geyser in October 1980 can

be found in Weisberg (2005). Figure 1 is the scatterplot

of intervals(y) to the next eruption versus the duration(X)

of the eruptions. The scatter plot suggests that the rela-

tionship has two phases.

[2] I. Fiteni, “-estimators of Regression Models with

Structural Change of Unknown Location,” Journal of

Econometrics , Vol. 119, No. 1, 2004, pp. 19-44.

doi:10.1016/S0304-4076(03)00153-2

[3] Z. Liu and L. Qian, “Changepoint Estimation in a Seg-

mented Linear Regression via Empirical Likelihood,”

Communications in Statistics--Simulation and Computa-

tion, Vol. 89, 2010, pp. 85-100.

[4] L. H. Koul and L. F. Qian, “Asymptotics of Maximum

Likelihood Estimator in a Two-phaselinear Regression

Model,”Journal of Statistical Planning and Inference,

Vol. 108, No. 1-2, 2002, pp. 99-119.

doi:10.1016/S0378-3758(02)00273-2

In this example, and . We adopt

and . Thus

, so that , and

.The function in R package [5] A. B. Owen, “Empirical Likelihood for Linear Models,”

Annals of Statistics, Vol.19, No.19, 1991, pp. 1725-1747.

doi:10.1214/aos/1176348368

[6] A. B. Owen, “Empirical Likelihood,” New York: Chap-

man & Hall, 2001. doi:10.1201/9781420036152

[7] R. Pastor and E. Guallar, “Use of Two-segmented Logis-

tic Regression to Estimate Changepoints in Epidemi-

ologic Studies,” American Journal of Epidemiology, Vol.

148, No. 7, 1998, pp. 631-642. doi:10.1093/aje/148.7.631

[8] P. Perron and T. J. Vogelsang, “Testing for a Unit Root in

a Time Series with a Changing Mean: Corrections and

Extensions,” J. Business Econom. Statist.,Vol. 10,1992,

pp. 467-470.

[9] W. W. Piegorsch and A. J. Bailer,“Statistics for Envi-

ronmental Biology and Toxicology,” London: Chapman

and Hall, 1997.

[10] A. M. F. Smith and D. G. Cook,“Straight Lines with a

Change Point: A Bayesian Analysis of Some Renal

Transplant Data,” Applied Statistics, Vol. 29, No. 2,

1980,pp. 180-189. doi:10.2307/2986304

Figure 1. Scatter plot of 270 eruptions of the Old Faithful

geyser in October 1980 in Yellowstone National Park USA.

is used to compute the test statistics and it

appears that . Thus [11] S. Weisberg,“Applied Linear Regeression,” 3th Edition,

John Wiley& Sons, Inc., Hoboken, New Jersey, 2005.