Paper Menu >>

Journal Menu >>

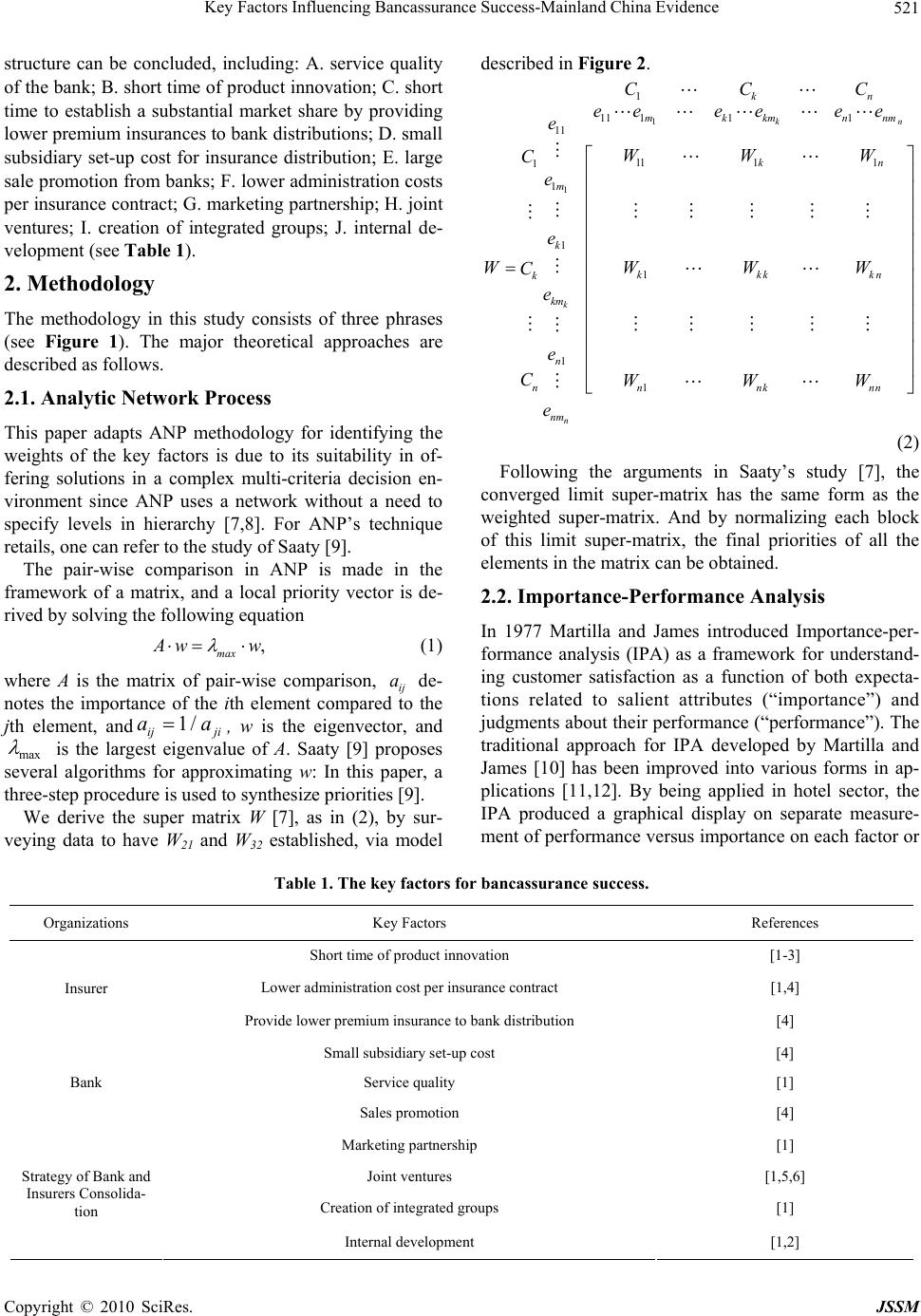

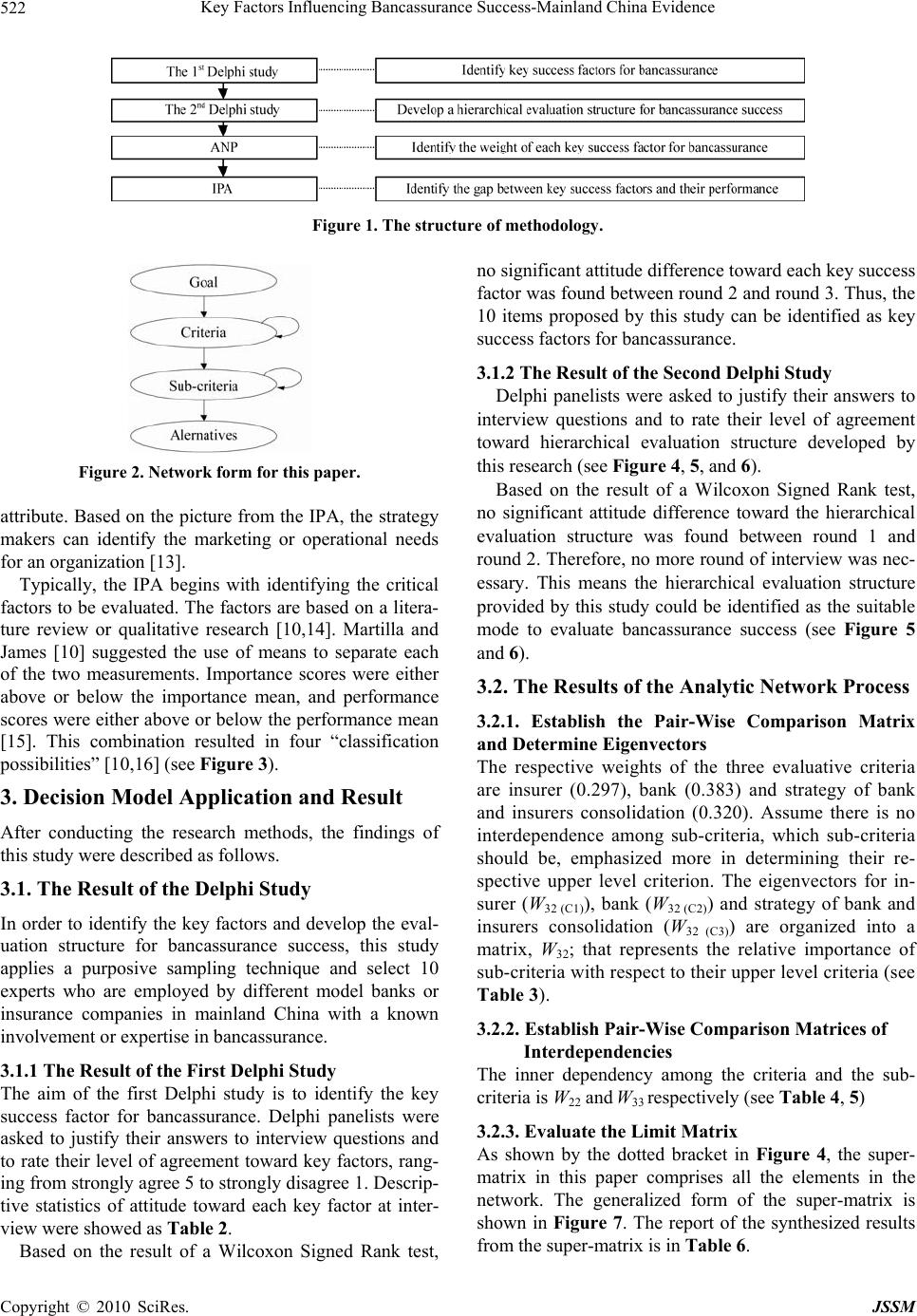

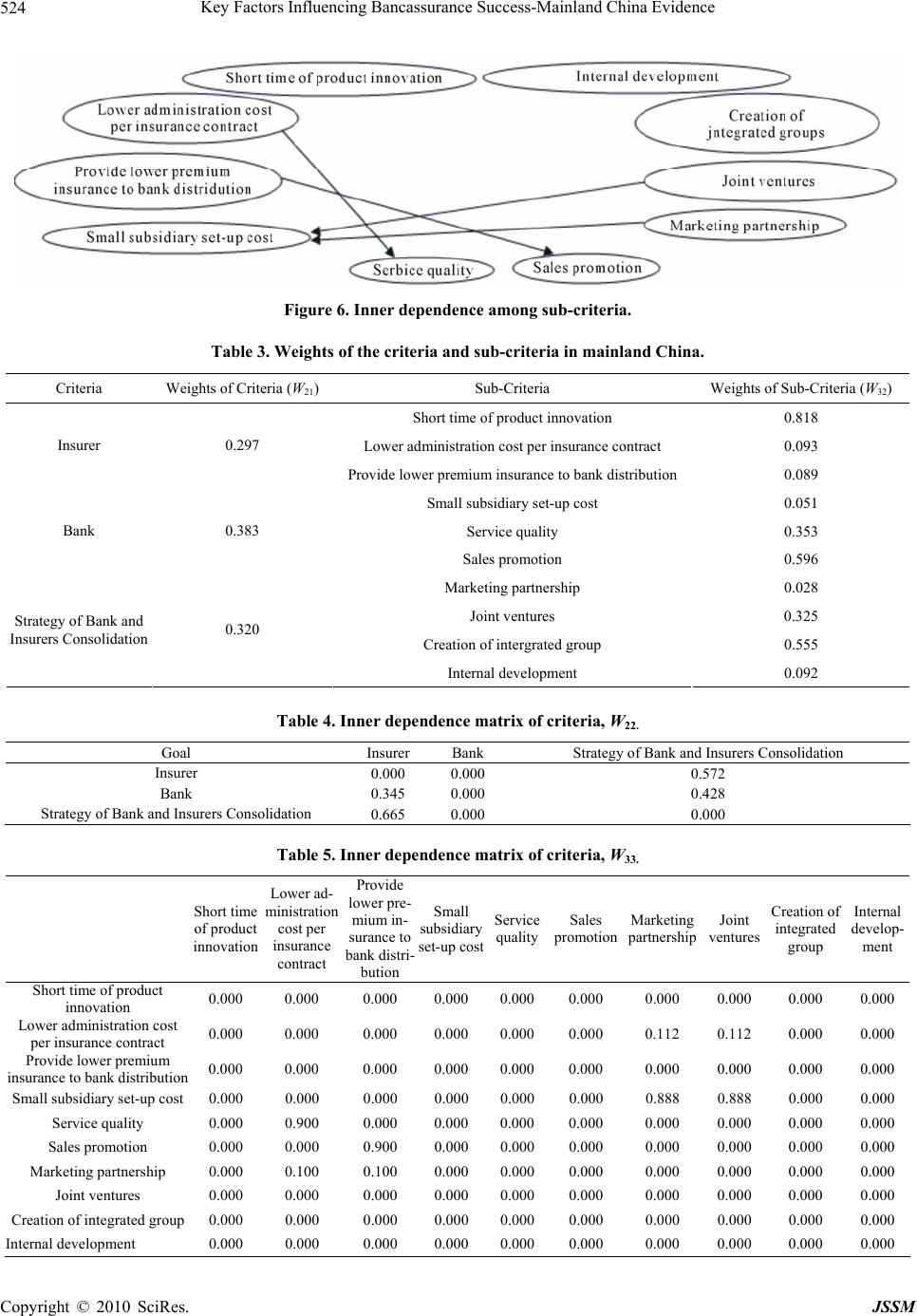

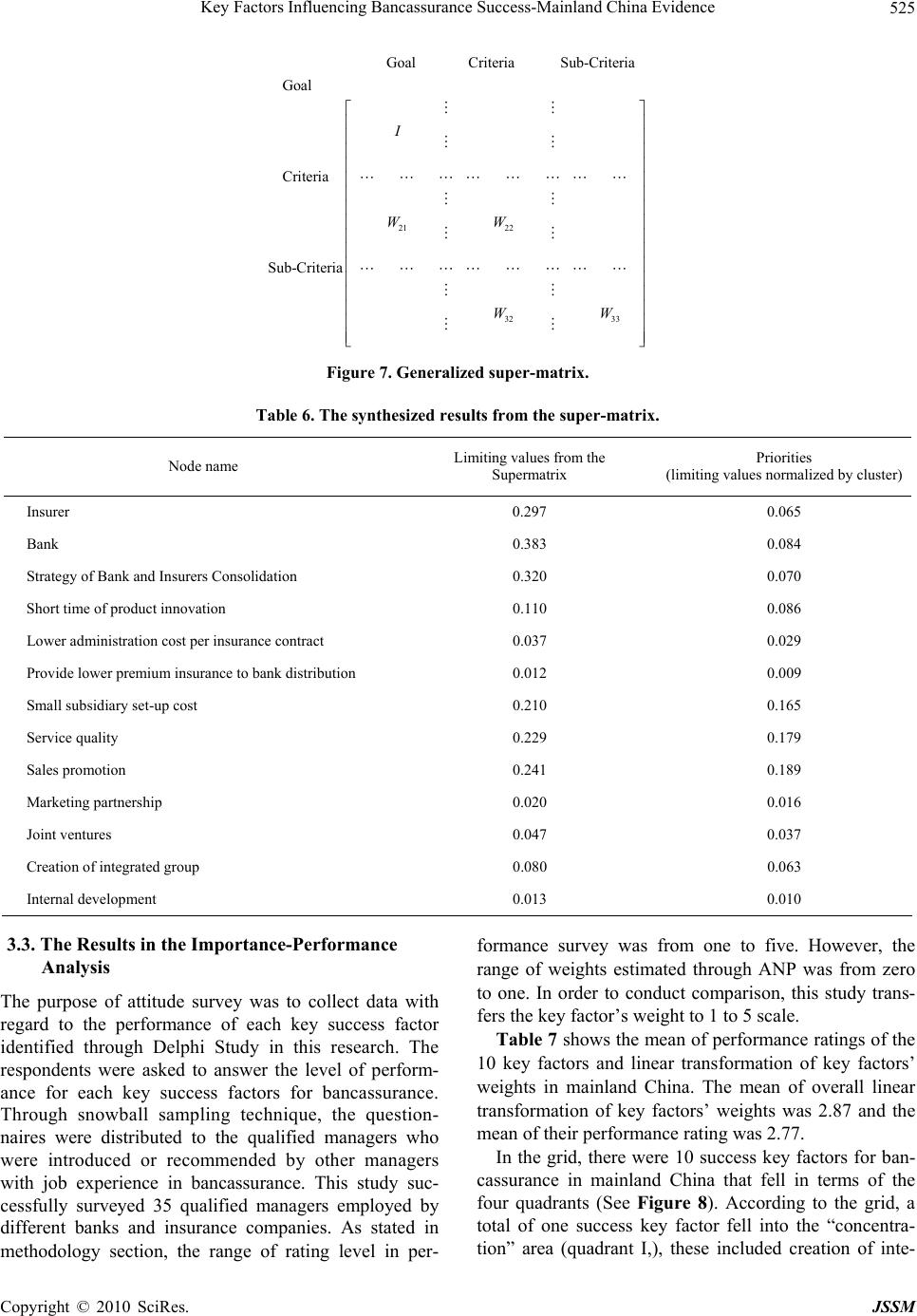

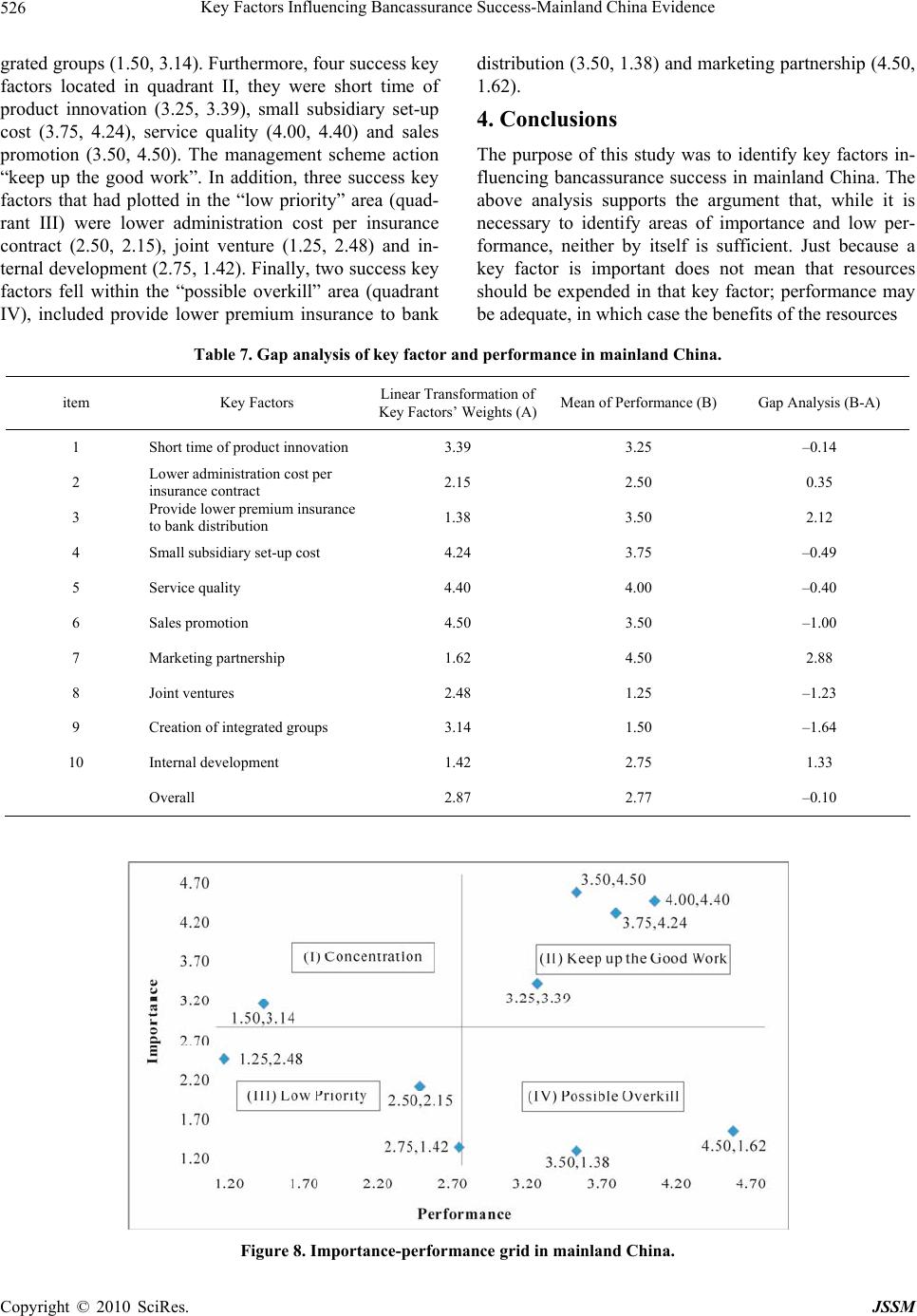

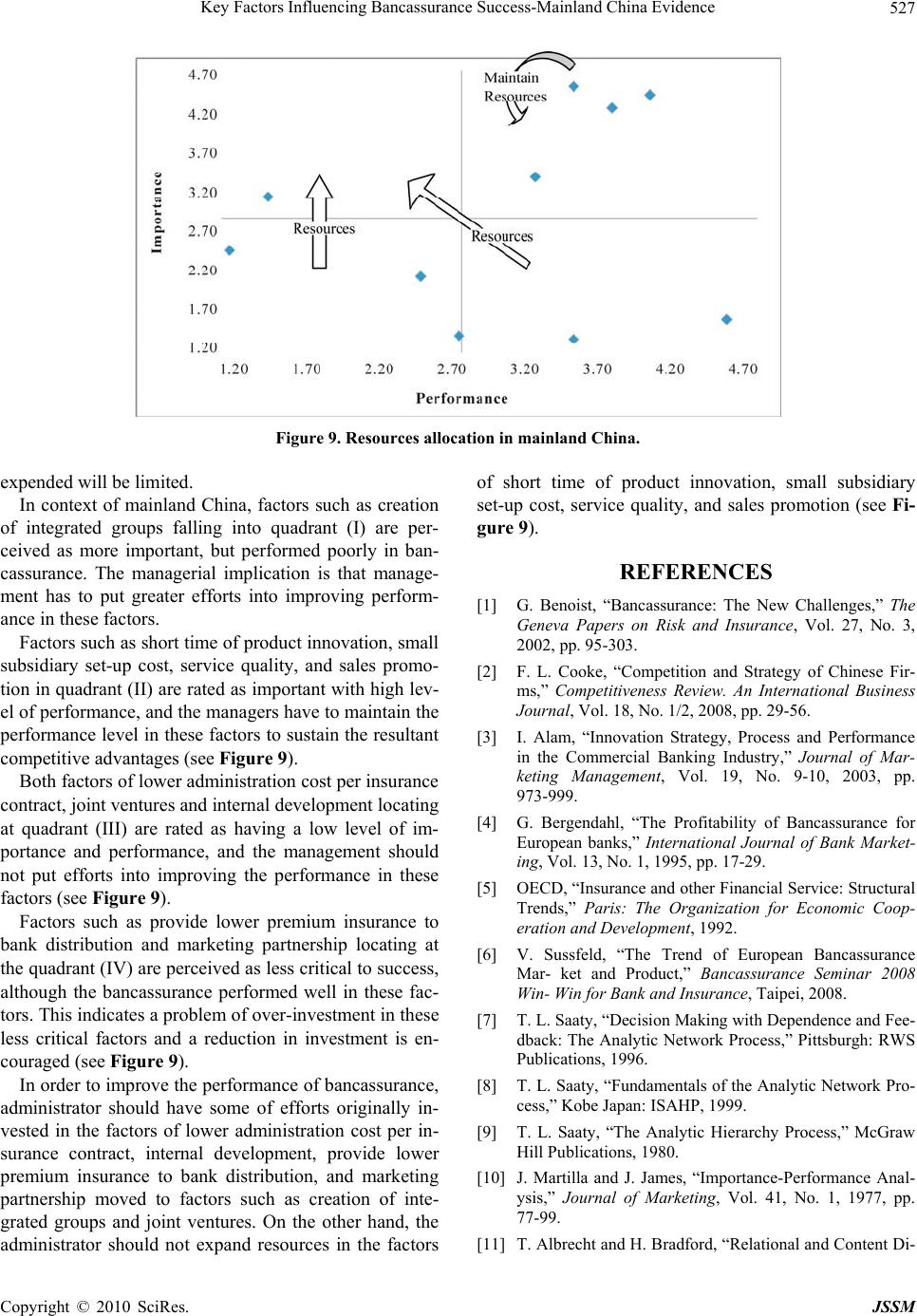

J. Service Science & Management, 2010, 3, 520-528 doi:10.4236/jssm.2010.34059 Published Online December 2010 (http://www.SciRP.org/journal/jssm) Copyright © 2010 SciRes. JSSM Key Factors Influencing Bancassurance Success -Mainland China Evidence Chiang Ku Fan1, Yu Hsuang Lee2 1Department of Risk Management and Insurance, Shih Chien University, Taipei,Taiwan, China; 2Department and Graduate Institu- tion of Business Administration, Shih Chien University, Taipei, Taiwan, China. Email: ckfan@ms41.hinet.net Received August 14th, 2010; revised October 5th, 2010; accepted November 10th, 2010. ABSTRACT The aims of this paper are 1) search for the key factors of bancassurance operation in mainland China; 2) explore the weight of each key success factor; 3) identify performance gaps typically measured as performance min us key success factors. This study besides reviewin g literatures and interviewing with exp erts, also adopts the modified Delphi Method and the Analytical Network Process (ANP) to construct a framework of key success factors of bancassurance. Then, the Importance Performance Analysis (IPA) is applied to identify the performance of each key success factor for bancas- surance. The finding offers the decision-maker fo r the revision of the bancassurance strategy that had been inappropri- ate. In other words, the strateg y maker can identify the weakness and strength o f their bancassurance strategy, and al- locate their resource accordingly as well. Keywords: Bancassurance, Analytical Network Process, Delphi Study, Key Factor, Importance Performance Analysis 1. Introduction Bancassurance becomes the most popular insurance sell- ing channel in mainland China. According to the statisti- cal reported by China Insurance Regulatory Commission, the premium income from bancassurance increased from RMB 127.8 billion to 339.9 billion during 2006 to 2008. Bancassurance has accounted for 45.6% of total first year life insurance premium income in 2008 compare to 31.0% in 2006. In this context, competition in the bancassurance in- dustry is at an all-time high, challenging providers to attract new customers while retain existing ones. Thus, identifying key success factors for insurers and banks improving their bancassurance strategy accordingly is not only a critical competitive differentiator but a neces- sity. Unfortunately, several theories or research lay be- hind the expansion of bancassurance. However, identify- ing and qualifying the key success factors for bancassur- ance is a complex issue and often depend on the subjec- tive assessments of managers. The strategic planners in banks or insurers, however, often lack objective deci- sion-making procedures and clear-defined evaluations criteria while identify the key success factors for ban- cassurance, not to mention to assess the weight and prac- tical performance of each key factor. To fill this gap, the purposes of this paper, first of all, is to search for the key success factors for bancassurance in the mainland China area. The second is to explore the weight of each key success factor. Finally, is to identify performance gaps typically measured as performance minus key success factors. The finding offers the decision-maker for the revision of the bancassurance strategy that had been inappropriate. In other words, the strategy maker can identify the weakness and strength of their bancassurance strategy, and allocate their resource accordingly as well. Summary of th e literature review with reg ard to the key factors for success with bancassurance are as followings: 1) What methods employed to identify the key factors of success were not described in the prior papers related to key factors for success with bancassurance. 2) The weight or ranking of each key factor were not defined in prior studies related to key factors for success with bancassur a nce. 3) No prior research focused on evaluating the per- formance of the key success factors for bancassurance. 4) According to the prior studies, some key success factors for bancassurance and a hierarchical evaluation  Key Factors Influencing Bancassurance Success-Mainland China Evidence521 structure can be concluded, including: A. service quality of the bank; B. short time of product innovation; C. short time to establish a substantial market share by providing lower premium insurances to bank distributions; D. small subsidiary set-up cost for insurance distribution; E. large sale promotion from banks; F. lower administration costs per insurance contract; G. marketing partnership; H. joint ventures; I. creation of integrated groups; J. internal de- velopment (see Table 1). 2. Methodology The methodology in this study consists of three phrases (see Figure 1). The major theoretical approaches are described as follows. 2.1. Analytic Network Process This paper adapts ANP methodology for identifying the weights of the key factors is due to its suitability in of- fering solutions in a complex multi-criteria decision en- vironment since ANP uses a network without a need to specify levels in hierarchy [7,8]. For ANP’s technique retails, one can refer to the study of Saaty [9]. The pair-wise comparison in ANP is made in the framework of a matrix, and a local priority vector is de- rived by solving the following equation , max A ww (1) where A is the matrix of pair-wise comparison, ij de- notes the importance of the ith element compared to the jth element, and, w is the eigenvector, and max a 1/ ij ji aa is the largest eigenvalue of A. Saaty [9] proposes several algorithms for approximating w: In this paper, a three-step procedure is used to synthesize priorities [9]. We derive the super matrix W [7], as in (2), by sur- veying data to have W21 and W32 established, via model described in Figure 2. 1 11 11 11 1 1 1 1 1 k n kn m k kkk k km n n nm e WWW Ce e WWW C e e C e 1 1 11 111 1 kn mkkmnn kn nnk C eeee ee W WWW m nn kn CC (2) Following the arguments in Saaty’s study [7], the converged limit super-matrix has the same form as the weighted super-matrix. And by normalizing each block of this limit super-matrix, the final priorities of all the elements in the matrix can be obtained. 2.2. Importance-Performance Analysis In 1977 Martilla and James introduced Importance-per- formance analysis (IPA) as a framework for understand- ing customer satisfaction as a function of both expecta- tions related to salient attributes (“importance”) and judgments about their performance (“performance”). The traditional approach for IPA developed by Martilla and James [10] has been improved into various forms in ap- plications [11,12]. By being applied in hotel sector, the IPA produced a graphical display on separate measure- ment of performance versus importance on each factor or Table 1. The key factors for bancassurance success. Organizations Key Factors References Short time of product innovation [1-3] Lower administration cost per insurance contract [1,4] Insurer Provide lower premium insurance to bank distribution [4] Small subsidiary set-up cost [4] Service quality [1] Bank Sales promotion [4] Marketing partnership [1] Joint ventures [1,5,6] Creation of integrated groups [1] Strategy of Bank and Insurers Consolida- tion Internal development [1,2] Copyright © 2010 SciRes. JSSM  Key Factors Influencing Bancassurance Success-Mainland China Evidence 522 Figure 1. The structure of methodology. Figure 2. Network form for this paper. attribute. Based on the picture from the IPA, the strategy makers can identify the marketing or operational needs for an organization [13]. Typically, the IPA begins with identifying the critical factors to be evaluated. The factor s are based on a litera- ture review or qualitative research [10,14]. Martilla and James [10] suggested the use of means to separate each of the two measurements. Importance scores were either above or below the importance mean, and performance scores were either ab ove or below the performance mean [15]. This combination resulted in four “classification possibilities” [10,16] (see Figure 3). 3. Decision Model Application and Result After conducting the research methods, the findings of this study were described as fo llows. 3.1. The Result of the Delphi Study In order to identify the key factors and develop the eval- uation structure for bancassurance success, this study applies a purposive sampling technique and select 10 experts who are employed by different model banks or insurance companies in mainland China with a known involvement or expertise in bancassurance. 3.1.1 The Result of the First Delphi Study The aim of the first Delphi study is to identify the key success factor for bancassurance. Delphi panelists were asked to justify their answers to interview questions and to rate their level of agreement toward key factors, rang- ing from strongly agree 5 to strongly disagree 1. Descrip- tive statistics of attitude toward each key factor at inter- view were showed as Table 2. Based on the result of a Wilcoxon Signed Rank test, no significant attitude difference toward each key success factor was found betw een round 2 and ro und 3. Thu s, th e 10 items proposed by this study can be identified as key success factors for bancassurance. 3.1.2 The Result of the Second Delphi Study Delphi panelists were asked to justify their answers to interview questions and to rate their level of agreement toward hierarchical evaluation structure developed by this research (see Figure 4, 5, and 6). Based on the result of a Wilcoxon Signed Rank test, no significant attitude difference toward the hierarchical evaluation structure was found between round 1 and round 2. Th erefore, no mor e round of interv iew was nec- essary. This means the hierarchical evaluation structure provided by this study could be identified as the suitable mode to evaluate bancassurance success (see Figure 5 and 6). 3.2. The Results of the Analytic Network Process 3.2.1. Establish the Pair-Wise Comparison Matrix and Determine Eigenvectors The respective weights of the three evaluative criteria are insurer (0.297), bank (0.383) and strategy of bank and insurers consolidation (0.320). Assume there is no interdependence among sub-criteria, which sub-criteria should be, emphasized more in determining their re- spective upper level criterion. The eigenvectors for in- surer (W32 (C1)), bank (W32 (C2)) and strategy of bank and insurers consolidation (W32 (C3)) are organized into a matrix, W32; that represents the relative importance of sub-criteria with respect to their upper level criteria (see Table 3). 3.2.2. Establish Pair-Wise Comparison Matrices of Interdependencies The inner dependency among the criteria and the sub- criteria is W22 and W33 respectively (see Table 4, 5) 3.2.3. Evaluate the Limit Matrix As shown by the dotted bracket in Figure 4, the super- matrix in this paper comprises all the elements in the network. The generalized form of the super-matrix is shown in Figure 7. The report of the synthesized results rom the super-matrix is in Table 6. f Copyright © 2010 SciRes. JSSM  Key Factors Influencing Bancassurance Success-Mainland China Evidence523 Table 2. Descriptive statistics of attitude toward each key factor at interview round 2 and round 3. Attitude toward Key factors SA A UD D SD Key factors R2R3R2 R3R2 R3 R2 R3 R2R3 Short time of product innovation 8 9 2 1 0 0 0 0 0 0 Lower administration cost per insurance contract 7 8 2 2 1 0 0 0 0 0 Provide lower premium insurance to b a n k d i s t ribution6 7 3 3 1 0 0 0 0 0 Small subsidiary set-up cost 7 8 2 2 1 0 0 0 0 0 Service quality 7 9 3 1 0 0 0 0 0 0 Sales promotion 8 9 2 1 0 0 0 0 0 0 Marketing partnership 8 8 2 2 0 0 0 0 0 0 Joint ventures 6 7 3 3 1 0 0 0 0 0 Creation of integrated groups 7 8 2 2 1 0 0 0 0 0 Internal development 8 9 2 1 0 0 0 0 0 0 *Five Attitudes toward Key Success Factors: Strongly Agree (SA), Agree (A) Undecided (UD), Disagree (D), and Strongly Disagree (SD). Figure 3. IPA concept map. Figure 4. Evaluation structure of key factors. Figure 5. Inner dependence among criteria. Copyright © 2010 SciRes. JSSM  Key Factors Influencing Bancassurance Success-Mainland China Evidence 524 Figure 6. Inner dependence among sub-criteria. Table 3. Weights of the criteria and sub-criteria in mainland China. Criteria Weights of Criteria (W21) Sub-Criteria Weights of Sub-Criteria (W32) Short time of product innovation 0.818 Lower administration cost per insurance contract 0.093 Insurer 0.297 Provide lower pr emium insuranc e to bank distribution0.089 Small subsidiary set-up cost 0.051 Service quality 0.353 Bank 0.383 Sales promotion 0.596 Marketing partnership 0.028 Joint ventures 0.325 Creation of intergrated group 0.555 Strategy of Bank and Insurers C onsolidation 0.320 Internal development 0.092 Table 4. Inner dependenc e matrix of criteria, W22. Goal Insurer Bank Strategy of Bank and Insurers Cons o lidation Insurer 0.000 0.000 0.572 Bank 0.345 0.000 0.428 Strategy of Bank and Insurers Cons o lidation 0.665 0.000 0.000 Table 5. Inner dependenc e matrix of criteria, W33. Short time of product innovation Lower ad- ministration cost per insurance contract Provide lower pre- mium in- surance to bank distri- bution Small subsidiary set-up cost Service quality Sales promotion Marketing partnership Joint ventures Creation of integrated group Internal develop- ment Short time of product innovation 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 Lower administration cost per insurance contract 0.000 0.000 0.000 0.000 0.000 0.000 0.112 0.112 0.000 0.000 Provide lower premium insurance to bank distribution 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 Small subsidiary set- u p cos t 0.000 0.00 0 0.000 0.000 0. 000 0.000 0.888 0.888 0.000 0.000 Service quality 0.000 0.900 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 Sales promotion 0.000 0.000 0.900 0.000 0.000 0.000 0.000 0.000 0.000 0.000 Marketing partnership 0.000 0.100 0.100 0.000 0.000 0.000 0.000 0.000 0.000 0.000 Joint ventures 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 Creation of integrated group 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 Internal development 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 Copyright © 2010 SciRes. JSSM  Key Factors Influencing Bancassurance Success-Mainland China Evidence Copyright © 2010 SciRes. JSSM 525 21 22 32 33 Goal Criteria Sub-Criteria Goal Criteria Sub-Criteria I WW WW Figure 7. Generalized super-matrix. Table 6. The synthesized results from the super -matr ix. Node name Limiting values from the Supermatrix Priorities (limi ting values normalized by cluster) Insurer 0.297 0.065 Bank 0.383 0.084 Strategy of Bank and Insurers Consolidation 0.320 0.070 Short time of product innovation 0.110 0.086 Lower administration cost per in surance contract 0.037 0.029 Provide lower premium insurance to bank distribution 0.012 0.009 Small su bsidiary set- up cost 0.210 0.165 Service quality 0.229 0.179 Sales prom otion 0.241 0.189 Marketing partnership 0.020 0.016 Joint venture s 0.047 0.037 Creation of i ntegrated group 0.080 0.063 Internal development 0.013 0.010 3.3. The Results in the Importance-Performance Analysis The purpose of attitude survey was to collect data with regard to the performance of each key success factor identified through Delphi Study in this research. The respondents were asked to answer the level of perform- ance for each key success factors for bancassurance. Through snowball sampling technique, the question- naires were distributed to the qualified managers who were introduced or recommended by other managers with job experience in bancassurance. This study suc- cessfully surveyed 35 qualified managers employed by different banks and insurance companies. As stated in methodology section, the range of rating level in per- formance survey was from one to five. However, the range of weights estimated through ANP was from zero to one. In order to conduct comparison, this study trans- fers the key factor’s weight to 1 to 5 scale. Table 7 shows the mean of performance ratings of the 10 key factors and linear transformation of key factors’ weights in mainland China. The mean of overall linear transformation of key factors’ weights was 2.87 and the mean of their performance rating was 2.77. In the grid, there were 10 success key factors for ban- cassurance in mainland China that fell in terms of the four quadrants (See Figure 8). According to the grid, a total of one success key factor fell into the “concentra- tion” area (quadrant I,), these included creation of inte-  Key Factors Influencing Bancassurance Success-Mainland China Evidence 526 grated groups (1 .50, 3.14). Fur ther more, four success key factors located in quadrant II, they were short time of product innovation (3.25, 3.39), small subsidiary set-up cost (3.75, 4.24), service quality (4.00, 4.40) and sales promotion (3.50, 4.50). The management scheme action “keep up the good work”. In addition, three success key factors that had plotted in the “low priority” area (quad- rant III) were lower administration cost per insurance contract (2.50, 2.15), joint venture (1.25, 2.48) and in- ternal development (2.75, 1.42). Finally, two success key factors fell within the “possible overkill” area (quadrant IV), included provide lower premium insurance to bank distribution ( 3.50, 1.38) and mark eting partnership ( 4.50, 1.62). 4. Conclusions The purpose of this study was to identify key factors in- fluencing bancassurance success in mainland China. The above analysis supports the argument that, while it is necessary to identify areas of importance and low per- formance, neither by itself is sufficient. Just because a key factor is important does not mean that resources should be expended in that key factor; performance may be adequate, in which case the benefits of the resources Table 7. Gap analysis of key factor and performance in mainland China. item Key Factors Linear Transformation of Key Factors’ Weights (A)Mean of Performance (B) Gap Analysis (B-A) 1 Short time of product innovation 3.39 3.25 –0.14 2 Lower administration cos t pe r insurance contract 2.15 2.50 0.35 3 Provide lower premium insurance to bank distribution 1.38 3.50 2.12 4 Small subsidiary set-up cost 4.24 3.75 –0.49 5 Service quality 4.40 4.00 –0.40 6 Sales promotion 4.50 3.50 –1.00 7 Marketing partnership 1.62 4.50 2.88 8 Joint ventures 2.48 1.25 –1.23 9 Creation of integrated gro ups 3.14 1.50 –1.64 10 Internal development 1.42 2.75 1.33 Overall 2.87 2.77 –0.10 Figure 8. Importance-performance grid in mainland China. Copyright © 2010 SciRes. JSSM  Key Factors Influencing Bancassurance Success-Mainland China Evidence527 Figure 9. Resources allocation in mainland China. expended will be limited. In context of mainland China, factors such as creation of integrated groups falling into quadrant (I) are per- ceived as more important, but performed poorly in ban- cassurance. The managerial implication is that manage- ment has to put greater efforts into improving perform- ance in these factors. Factors such as short time of product innovation, small subsidiary set-up cost, service quality, and sales promo- tion in quadrant (II) are rated as important with high lev- el of performance, and the managers have to maintain the performance level in these factors to su stain the resultant competitive advantag es (see Figure 9). Both factors of lower administration cost per insuranc e contract, joint ventures and internal development locating at quadrant (III) are rated as having a low level of im- portance and performance, and the management should not put efforts into improving the performance in these factors (see Figure 9). Factors such as provide lower premium insurance to bank distribution and marketing partnership locating at the quadrant (IV) are perceived as less critical to success, although the bancassurance performed well in these fac- tors. This indicates a problem of over-investment in these less critical factors and a reduction in investment is en- couraged (see Figure 9). In order to improve the performance of bancassurance, administrator should have some of efforts originally in- vested in the factors of lower administration cost per in- surance contract, internal development, provide lower premium insurance to bank distribution, and marketing partnership moved to factors such as creation of inte- grated groups and joint ventures. On the other hand, the administrator should not expand resources in the factors of short time of product innovation, small subsidiary set-up cost, service quality, and sales promotion (see Fi- gure 9). REFERENCES [1] G. Benoist, “Bancassurance: The New Challenges,” The Geneva Papers on Risk and Insurance, Vol. 27, No. 3, 2002, pp. 95-303. [2] F. L. Cooke, “Competition and Strategy of Chinese Fir- ms,” Competitiveness Review. An International Business Journal, Vol. 18, No. 1/2, 2008, pp. 29-56. [3] I. Alam, “Innovation Strategy, Process and Performance in the Commercial Banking Industry,” Journal of Mar- keting Management, Vol. 19, No. 9-10, 2003, pp. 973-999. [4] G. Bergendahl, “The Profitability of Bancassurance for European banks,” International Journal of Bank Market- ing, Vol. 13, No. 1, 1995, pp. 17-29. [5] OECD, “Insurance and other Financial Service: Structural Trends,” Paris: The Organization for Economic Coop- eration and Development, 1992. [6] V. Sussfeld, “The Trend of European Bancassurance Mar- ket and Product,” Bancassurance Seminar 2008 Win- Win for Bank and Insurance, Taipei, 2008. [7] T. L. Saaty, “Decisi on Maki ng with Dependence and Fee- dback: The Analytic Network Process,” Pittsburgh: RWS Publications, 1996. [8] T. L. Saaty, “Fundamentals of the Analytic Network Pro- cess,” Kobe Japan: ISAHP, 1999. [9] T. L. Saaty, “The Analytic Hierarchy Process,” McGraw Hill Publications, 1980. [10] J. Martilla and J. James, “Importance-Performance Anal- ysis,” Journal of Marketing, Vol. 41, No. 1, 1977, pp. 77-99. [11] T. Albrecht and H. Bradford, “Relational and Content Di- Copyright © 2010 SciRes. JSSM  Key Factors Influencing Bancassurance Success-Mainland China Evidence 528 fferences between Elites and Outsiders in Innovation Networks,” Human Communication Research, Vol. 17, No. 4, 1991, pp. 535-546. [12] J. Crompton and N. Duray, “An Investigation of the Rela- tive Efficacy of Four Alternative Approaches to Impor- tance-Performance Analysis,” Academy of Marketing Sci- ence, Vol. 13, No. 4, 1985, pp. 69-80. [13] C. Y. Li, C. S. Wong and T. K. Luk, “The Importance and Performance of Key Success Factors of International Joint Venture Hotels in China,” The Chinese Economy, Vol. 39, No. 6, 2006, pp.83-94. [14] W. Skok, A. Kophamel and I. Richardson, “Diagnosing Information Systems Success: Importance-Performance Maps in the Health Club Industry,” Information and Management, Vol. 38, No. 7, 2001, pp. 409-419. [15] S. E. Sampson and M. J. Showalter, “The Performance- Importance Response Function: Observations and Impli- cations,” The Services Industries Journal, Vol. 19, No. 3, 1999, pp. 1-25. [16] D. Mount, “Introducing Relativity to Traditional Impor- tance-Performance Analysis,” Journal of Hospitality and Tourism Research, Vol. 21, No. 2, 1997. Copyright © 2010 SciRes. JSSM |