Paper Menu >>

Journal Menu >>

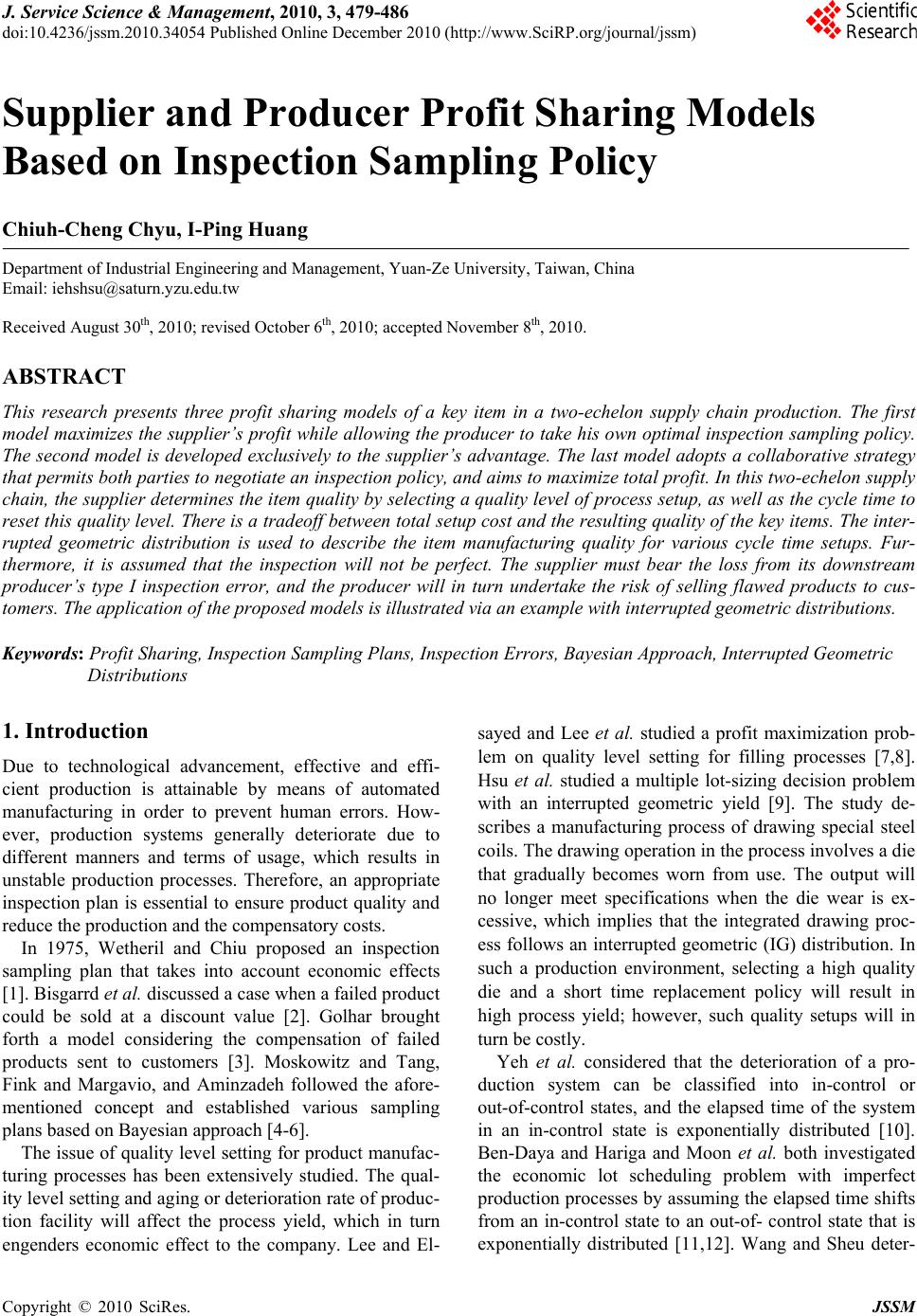

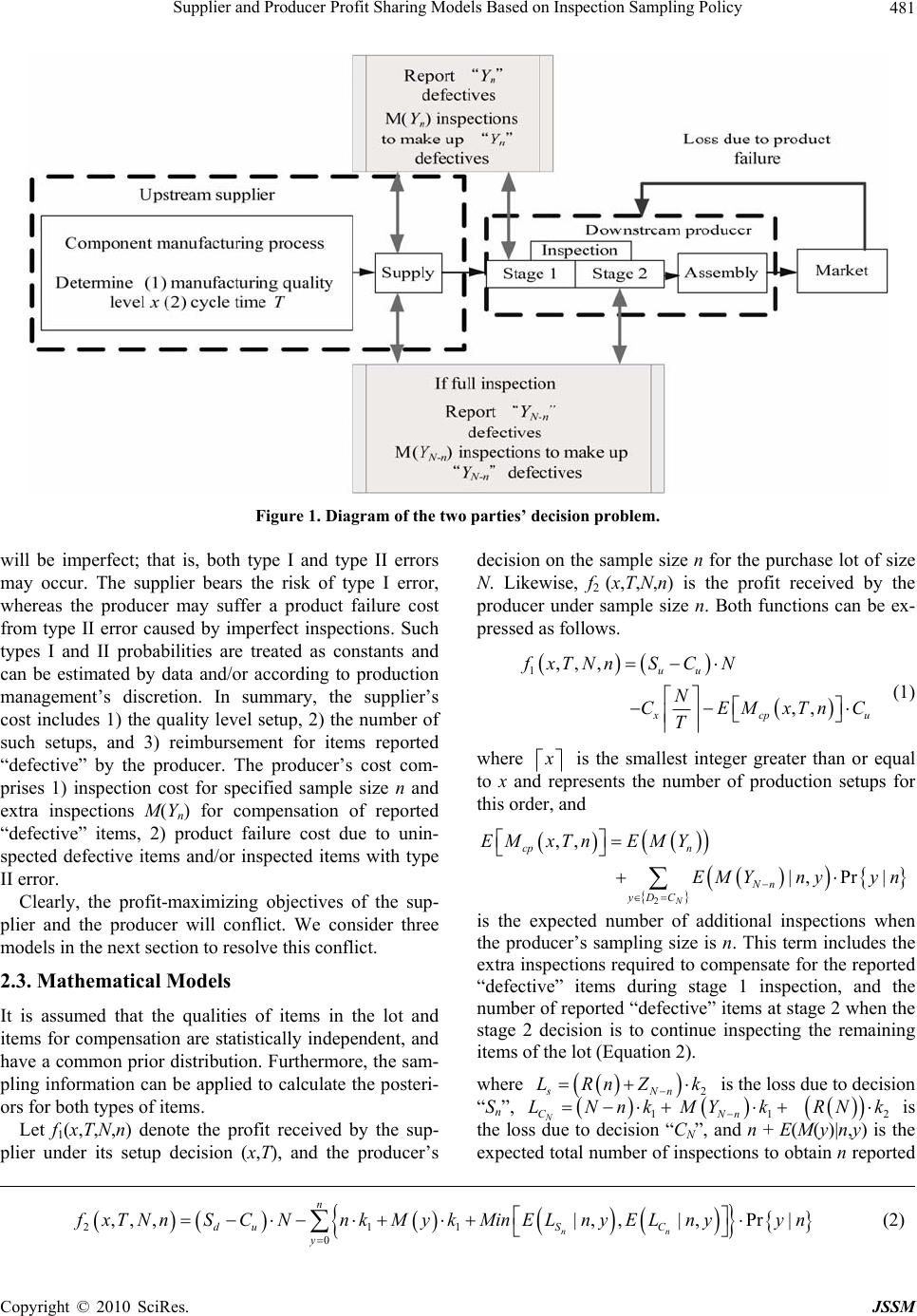

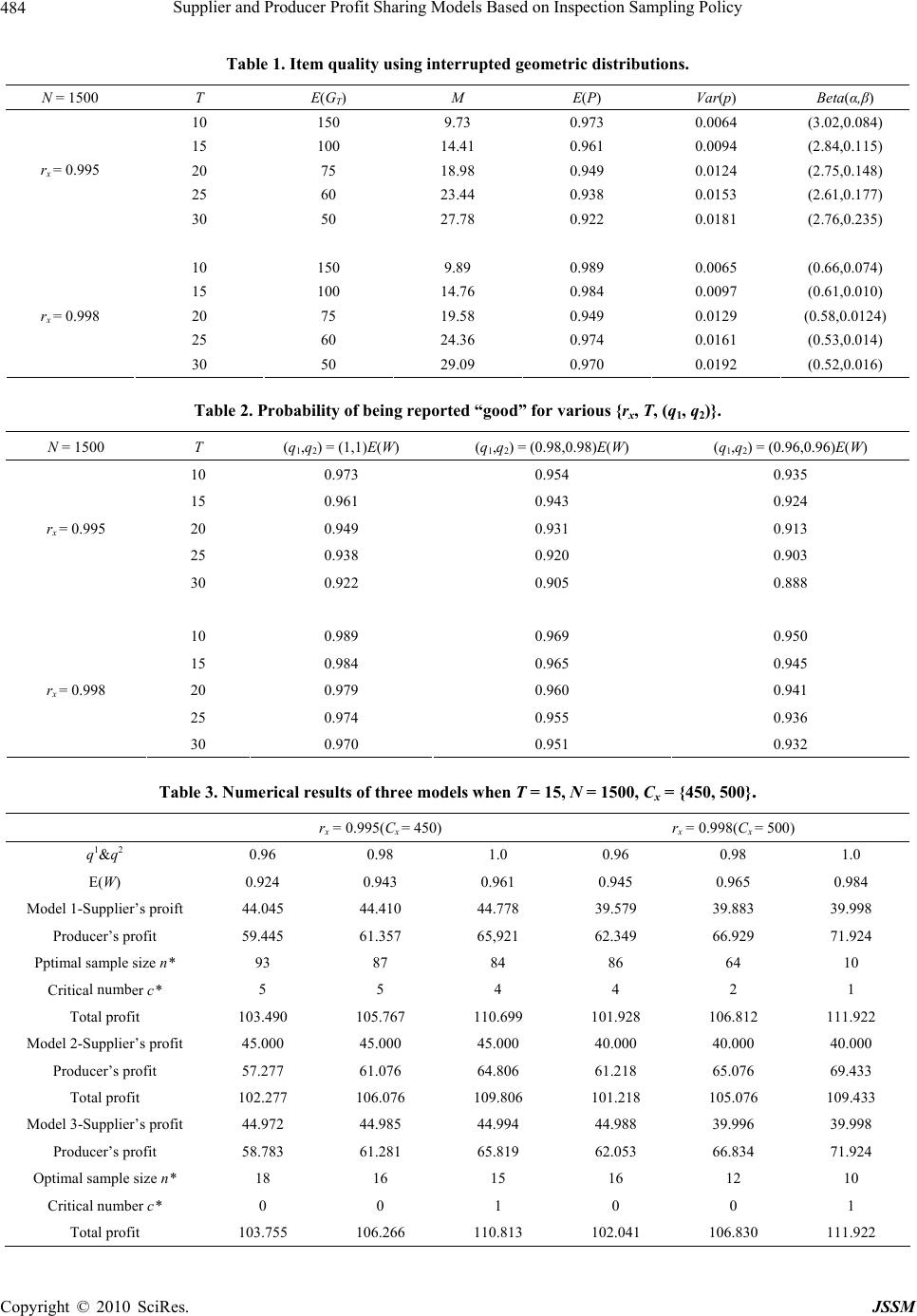

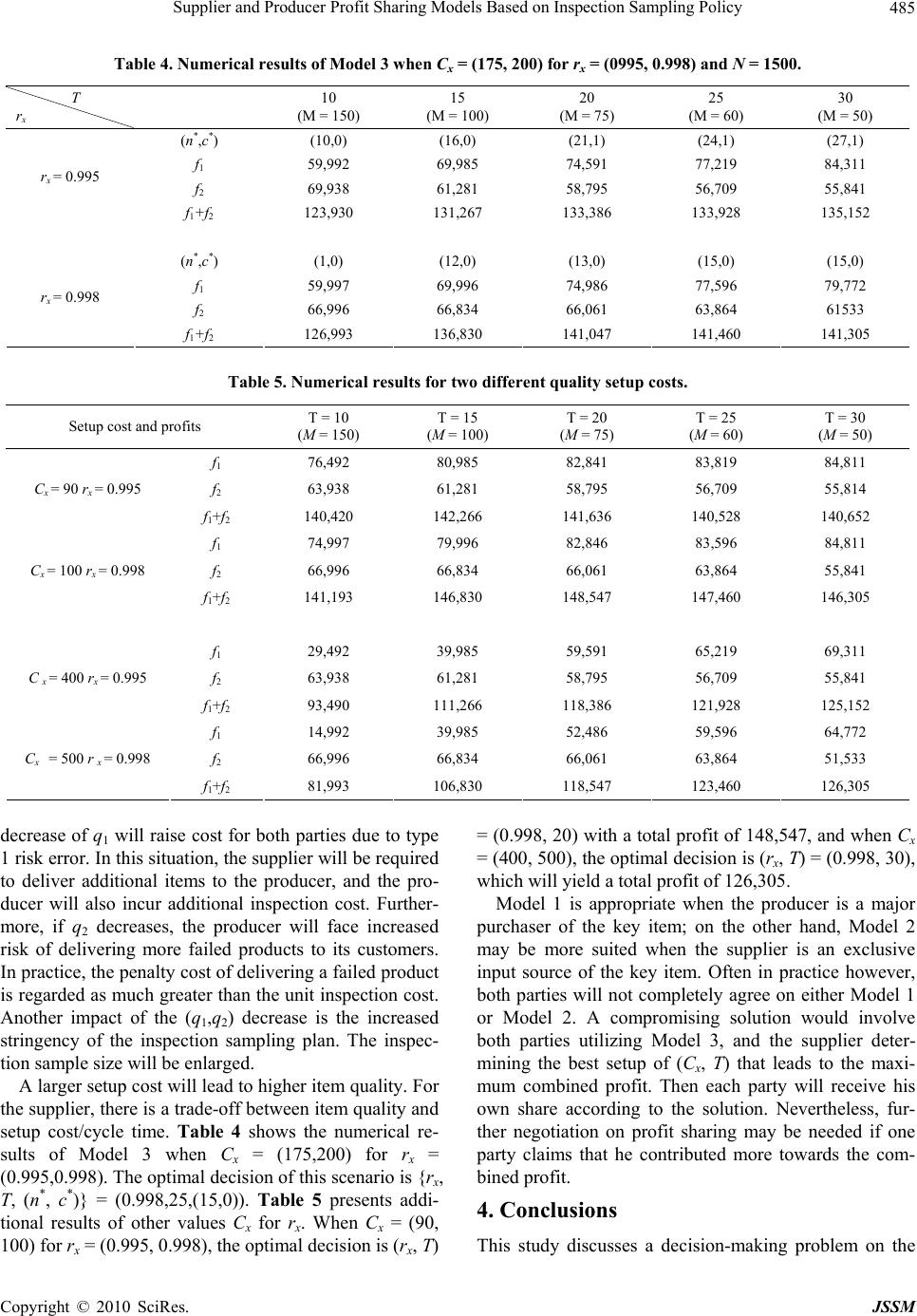

J. Service Science & Management, 2010, 3, 479-486 doi:10.4236/jssm.2010.34054 Published Online December 2010 (http://www.SciRP.org/journal/jssm) Copyright © 2010 SciRes. JSSM 479 Supplier and Producer Profit Sharing Models Based on Inspection Sampling Policy Chiuh-Cheng Chyu, I-Ping Huang Department of Industrial Engineering and Management, Yuan-Ze University, Taiwan, China Email: iehshsu@saturn.yzu.edu.tw Received August 30th, 2010; revised October 6th, 2010; accepted November 8 th, 2010. ABSTRACT This research presents three profit sharing models of a key item in a two-echelon supply chain production. The first model maximizes the supplier’s profit while allowing the producer to take his own optimal inspection sampling policy. The second model is developed exclusively to the supplier’s advantage. The last model adopts a collaborative strategy that permits both parties to negotiate an inspection policy, and aims to maximize total profit. In this two-echelon supply chain, the supplier determines the item quality by selecting a quality level of process setup, as well as the cycle time to reset this quality level. There is a tradeoff between total setup cost and the resulting quality of the key items. The inter- rupted geometric distribution is used to describe the item manufacturing quality for various cycle time setups. Fur- thermore, it is assumed that the inspection will not be perfect. The supplier must bear the loss from its downstream producer’s type I inspection error, and the producer will in turn undertake the risk of selling flawed products to cus- tomers. The application of the proposed models is illustrated via an example with interrupted geometric distributions. Keywords: Profit Sharing, Inspection Sampling Plans, Inspection Errors, Bayesian Approach, Interrupted Geometric Distributions 1. Introduction Due to technological advancement, effective and effi- cient production is attainable by means of automated manufacturing in order to prevent human errors. How- ever, production systems generally deteriorate due to different manners and terms of usage, which results in unstable production processes. Therefore, an appropriate inspection plan is essential to ensure product quality and reduce the production and the compensatory costs. In 1975, Wetheril and Chiu proposed an inspection sampling plan that takes into account economic effects [1]. Bisgarrd et al. discussed a case when a failed product could be sold at a discount value [2]. Golhar brought forth a model considering the compensation of failed products sent to customers [3]. Moskowitz and Tang, Fink and Margavio, and Aminzadeh followed the afore- mentioned concept and established various sampling plans based on Bayesian approach [4-6]. The issue of quality level setting for product manufac- turing processes has been extensively studied. The qual- ity level setting and aging or deterioration rate of pro duc- tion facility will affect the process yield, which in turn engenders economic effect to the company. Lee and El- sayed and Lee et al. studied a profit maximization prob- lem on quality level setting for filling processes [7,8]. Hsu et al. studied a multiple lot-sizing decision problem with an interrupted geometric yield [9]. The study de- scribes a manufacturing process of drawing special steel coils. The drawing op eration in the process involves a die that gradually becomes worn from use. The output will no longer meet specifications when the die wear is ex- cessive, which implies that the integrated drawing proc- ess follows an interrupted geometric (IG) distribution. In such a production environment, selecting a high quality die and a short time replacement policy will result in high process yield; however, such quality setups will in turn be costly. Yeh et al. considered that the deterioration of a pro- duction system can be classified into in-control or out-of-control states, and the elapsed time of the system in an in-control state is exponentially distributed [10]. Ben-Daya and Hariga and Moon et al. both investigated the economic lot scheduling problem with imperfect production processes by assuming the elapsed time shifts from an in-control state to an out-of- control state that is exponentially distributed [11,12]. Wang and Sheu deter-  Supplier and Producer Profit Sharing Models Based on Inspection Sampling Policy 480 mined the optimal lot size with an assumption that the deteriorating production system has a geometric survival distribution under a free-repair warranty policy [13]. Wang obtained the optimal lot size by assuming the dete- riorating productio n process has an increasing failur e rate with a general shift distribution [14]. Other studies as- sumed that the number of conforming items in the im- perfect production process has the following distributions: discrete uniform [15], binomial [16], and interrupted geometric [17-19]. This research presents three profit sharing models of a product involving a key item in a two-echelon supply chain process. The upstream supplier determines the quality level and cycle time setting of the key item pro- duction, while the downstream producer can select its own inspection sampling plan. It is assu med that the item manufacturing quality meets the interrupted geometric distribution, and inspection errors may occur. Bayesian approach is used to solve the two-echelon benefit prob- lem by incorporating into the models the following fac- tors: the supplier’s item quality information, the pro- ducer’s sampling information, inspection and product failure costs, and inspection accuracy. Finally, an exam- ple is provided to illustrate the features and applications of the models. The remainder of the paper is organized as follows: Section 2 defines the problem and describes the model; Section 3 presents numerical results of two examples; Section 4 concludes this study. 2. Problem and Models In this section, notations used throughout the paper are first introduced. The problem then is illustrated in Sub-Section 2.2 via a diagram. Finally, three profit shar- ing models and a sampling inspection plan are detailed in subsequent sections. 2.1. Notations x: a process quality level setting, x X. X: set of possible quality level settings. T: cycle time for resetting the process quality lev e l. : set of all choices for cycle time T. Su: selling price per item by supplier. Cu: manufacturing cost per item by supplier. Cx: setup cost for process quality level x. N: quantity ordered by producer. Sd: selling price per item by producer. D1: producer’s stage 1 decision for sample size n. q1: probability of no type I error, a constant. q2: probability of no type II error, a constant. P: process yield or probability that an item is good; a random variable. W: probability of an item being reported “good” dur- ing inspection. Yn: number of reported “defective” items at stage 1; y is the realization. ZN-n: number of defective items in the remainder of lot. YN-n: total number of reported “defective” items in the remainder of the lot after full inspectio n. k1: inspection cost per item. k2: penalty cost of a failed product sold to customers. M(y): number of inspections to compensate y reported as “defective” to producer. R(n): number of defectives due to type II error for n reported “good” items. D2: producer’s stage 2 decision on the re mainder of th e lot after observing the sampling outcome; it con tains two alternatives: stop inspection (Sn) and continue to inspect the remaining all (CN). M(YN-n): number of inspections to obtain YN-n reported “good” items. Mcp(x,T,n): number of items to compensate producer under supplier’s setup (x,T) and producer’s sampling size n. 2.2. Problem Description Consider a decision problem arising in a two-echelon production process, where the upstream level (or supplier) manufactures a key item and the downstream level (or producer) assembles a product involving this key item. The supplier can select the item production process with a high quality level setup and short cycle time for reset- ting, but the corresponding total setup cost will be large. On the other hand, if the supplier selects a low quality level with large cycle time, the total setup cost is lo w, but the risk of returned defective items will be high. Fur- thermore, for both cases the item quality can be im- proved if the supplier selects a smaller cycle time of re- setting the produc tion process. The problem assu mes that the producer bears all inspection cost under its sampling plan, and the supplier undertakes the compensation cost of the returned items. Figure 1 portrays the problem. When the supplier re- ceives a demand request, he schedules the production process and determines the initial qu ality setup level “x”, as well as the cycle time “T” to reset the process. A higher initial quality level setup will incur a higher cost, and such will be the same for a shorter cycle time. On the other hand, the downstream producer can take a two-stage rectifying inspection before sending items to its assembly line. Stage 1 determines the sample size, whereas stage 2 chooses between continuing and stop- ping the remaining items in the lot after the sampling utcome is observed. It is assumed that the inspection o Copyright © 2010 SciRes. JSSM  Supplier and Producer Profit Sharing Models Based on Inspection Sampling Policy Copyright © 2010 SciRes. JSSM 481 Figure 1. Diagram of the two parties’ decision problem. decision on the sample size n for the purchase lot of size N. Likewise, f2 (x,T,N,n) is the profit received by the producer under sample size n. Both functions can be ex- pressed as follows. will be imperfect; that is, both type I and type II errors may occur. The supplier bears the risk of type I error, whereas the producer may suffer a product failure cost from type II error caused by imperfect inspections. Such types I and II probabilities are treated as constants and can be estimated by data and/or according to production management’s discretion. In summary, the supplier’s cost includes 1) the quality level setup, 2) the number of such setups, and 3) reimbursement for items reported “defective” by the producer. The producer’s cost com- prises 1) inspection cost for specified sample size n and extra inspections M(Yn) for compensation of reported “defective” items, 2) product failure cost due to unin- spected defective items and/or inspected items with type II error. 1,, , ,, uu x cp u fxTNnS CN N CEMxTn T C (1) where x is the smallest integer greater than or equal to x and represents the number of production setups for this order, and 2 ,, |,Pr | N cp n Nn yDC EM xTnEMY EMY nyyn is the expected number of additional inspections when the producer’s sampling size is n. This term includes the extra inspections required to compensate for the reported “defective” items during stage 1 inspection, and the number of r eported “d efective” items at stage 2 wh en the stage 2 decision is to continue inspecting the remaining items of the lot (Equ a tion 2). Clearly, the profit-maximizing objectives of the sup- plier and the producer will conflict. We consider three models in the next section to resolve this conflict. 2.3. Mathematical Models It is assumed that the qualities of items in the lot and items for compensation are statistically independent, and have a common prior distribution. Furthermore, the sam- pling information can be applied to calculate the posteri- ors for both type s of items. where 2sN LRnZk n is the loss due to decision “Sn”, 1 N C LNnk 1Nn M Yk 2 RN k Let f1(x,T,N,n) denote the profit received by the sup- plier under its setup decision (x,T), and the producer’s is the lo to decision “CN”, and n + E(M(y)|n,y) is the expected total number of in spections to obtain n reported ss due 211 0 ,, ,|,,|,Pr| nn n duS C y f xTNnSCNnkMyk MinELnyELnyyn (2)  Supplier and Producer Profit Sharing Models Based on Inspection Sampling Policy 482 “good” items given the sampling result (n,y). The pro- ducer’s optimal sample size n* is the number satisfying quation (3). Clearly, f2(x,T,N,n*) is the expected tio tempts to m E maximum profit that the producer can obtain under quality level setup (x,T). Model 1: Producer’s profit maximiz ation In this model, the producer’s profit maximization is a constraint (Equation 4) of the supplier’s profit optimiza- n problem. In other words, the supplier at aximize its profit by selecting a quality setup (x,T) given that the producer has optimized its own expected profit under (x,T). * 11 ,,, M aximizefx TNn , xXT * 212 ,,,,,, for 0 f xTNnfxTNnnN (4) Model 2: Supplier’s profit maximization The supplier’s profit is maximized when the ducer’s sampling size n is 0; in such a case there w no Model 3: Collaborative strategy for total profit maximization pro- ill be compensation to the producer. 1 ,,,0aximizefxTNn , xXT (5) M , , 12 ,,,, M aximizefx TNnfxTN n , , 0 x XTn N (6) This model permits both parties to negotiate the in- spection sampling policy to be execuy the pro- ducer. This collaborative strategy will m ted b yield the maxi- um total profit as the profit conflict between both sides is minimized. For any quality setup (x,T) and requested quantity N, the following results hold: 1) For Models 1 and 3: (1.a) ** 12 ,,,,,, f xTNnfxTNn ** 112 ,,,,,, 1 f xTNnfxTNn, where n* is the optimal sample size for Model 3. The reason is th izes the combined profit f1 , whereas * 1 n optimizes f2 w at the sample ithin 0 n siz N e n* optim + f2 w ithin 0 n N. (1.b) * 2 ,,, f xTNn * 21 ,,, f xTNn, * 1 ,,, f xTNn * 11 ,,, f xTNn and * 1 ,,, f xTNn 11 ,* , , f xT ,N n ** 2 , 21 ,, ,, f xTT N ls 2 a N nfxn. ** 12 ,, ,,, , f xTNnfxTNn 2) For Modend 3: (2.a) 12 ,, ,0,, ,0TNnfxTNnfx (2.b) * 1,, , f xTNn 1,, ,0fxTN , * ,, , 2 f xTNn ,, ,0TN ad 2 fx n * 2 ,,, f xTNn , ,0N 1,fxT 22 , ,0, * ,, , f xTNNf xTn. 2.4. Computation Formulae The probability that an item is reported as “good” (in- cluding type II error) is as follows: 1 1 1 0 11 pqp dppwWE 02dppq (7) where p conform is the prior probability density function of an iteming to quality specification. In our study, p is assum as “d f y ed to be Beta ( , ). The probability o reported efective” items for n samples is: 1 0 Pr |1y ny n ynwwp dp y Other calculations are shown below. 1 0 1 |, |,EM ynyypnydp w , whe by re Bayes’ theorem we obtain 1 |, Pr{ | y pn yyn } y ny nwwp 12 012 11 |, |, 11 pq ERnnynpny dp pqpq |,1 |, Nn E ZnyNnE P ny |,1 |, Nn EYnyNnEW ny 1 0 |, |,EWnywp nydp 1 |, |, Nn EMYnyNn Eny w At stage 2, decision “S” is better than “CN” when n |, |, nn SC E LnyE Lny. After algebraic opera- tions, the inequality is converted to |, ,|,Pr nn SC 11 0|, | n y 0nN M innkEMyn ykMinn ELn yELn yy (3) Copyright © 2010 SciRes. JSSM  Supplier and Producer Profit Sharing Models Based on Inspection Sampling Policy483 2 12 1 2 11 1(|,) |, 11 1|, Pq EP nyEny PqP qk k Eny W ( If there exists an integer c 0 such that for all y > c decision CN is better than Sn, the integer c will be referred to as the critical number of sample size n. 2. y item engen- erty:ctive item is produced, all items follow- T 8) 5. Process Quality Level Setup and Cycle Time Resetting In the problem, it is assumed that the ke dered in the production process has the following prop- once a defe ing the first defective one will also be defective. Inter- rupted geometric (IG) distribution meets the item quality for such a production environment. A short time re- placement policy of production equipment (resetting) will result in a high process yield; however, the item quality enhancement will be costly when the lot size is large. For IG, let rx represent the yield of the first item with respect to x quality level setup. Thus, the probability o f t non-defective items under cycle time T will be Pr{G = t} = t(1 ) x x rr , t = 0, 2,…, T-1; Pr{ GT = T} = Pr{ GT T} = T x r. Here we assume that each item takes one unit of time to produce. The ae and variance of yield for cycle time T are as lows: verag fol 1 // 1 T EG T T r (9) T rr 2 21 2 // 1/ 1 1 TT TT T Var GTVar GT rTr rT r r 2 rT For a lot size , the process will perfo setups to pro. Let be the number of conf unde tim yield (10) NMT duce N items orming items rm M 1,,M TT GG r M setups with cycle e T. The expected will be the same as (9), but the variance becomes 121 2 (...)/ ()/ M TT TT VarGGGTMVar GTM (11) Suppose that the supplier only provides the produce with information on the mean and variance of the key item’s quality; if the producer selects Beta ( , ) a pri an r s the or distribution for the output yield, the parameters d can be estimated by 1/ T EP EGT and (12) 12 2 /1 T VarPVar GTM (13) 3. Illustrative Example The profit sharing models are illustrat ple with the following parameters: k1 = 12, k2 = 150, Cu = 120, N = 1500, Su = 180, Sd = 230, two possibilities of process quality setups: X = {rx | 0.995, 0998}, the set of resetting cycle times: = {T | 10, 15, 20, 25, 30}, ty levels: one of whic and the other two are with etheless receive m creases as true yield E(P), q1, and q2 decrease. The ed through an exam- and h is three cases of inspection quali error-free (q1,q2) = (1.0, 1.0), minor errors: (q1, q2) = (0.98, 0.98) and (0.96, 0.96). As aforementioned, the producer will obtain the mean and variance of the yield regarding the lot of size N. The pro- ducer adopts a Beta prior distribution to represent the lot quality and for sampling inspection. Table 1 presents the information on yield, E(P) and Var(P), which are derived from Equations (9), (10) and (11). This information will in turn be used to estimate the p arameters ( , ) of Beta prior according to Equations (12) and (13). The results indicate that a shorter cycle time T leads to a higher item quality and smaller var iance. The resulting Bet a prior will then be incorporated with (q1,q2) to calculate “reported good” probability E(W) using equation (7). Table 2 displays the probabilities of “reported good” for all possible combina- tions of {rx, T, (q1,q2)}. The higher the value of (q1,q2), the larger the probability of “report ed good”. Table 3 show s the numerical results of the three mod - els when T = 15 and N = 1500 with three different (q1, q2) values. The calculation uses the following quality setup costs: Cx = 450 for rx = 0.995, and Cx = 500 for rx = 0998. Generally, when there are inspection errors, reported defective probability 1-E(W) increases as the value of (q1,q2) decreases. The producer will non aximum profit in Model 1 as its risk of delivering de- fective products to customers is minimized. However, the supplier will receive minimum benefit if he complies with Model 1. In contrast, the supplier’s profit will be maximized in Model 2, since he has no obligation for any defective items sent to the producer. Here, the producer’s interest is reduced to the minimum. In Model 3, the benefits of both parties are between Models 1 and 2, but their combined profit is the highest. In the case of T = 15 and N = 1500, the optimal decisions (rx,n*,c*) are (0.995,18,0), (0.998,12,0), (0.998,10, 1) for (q1,q2) = (0.96,0.96), (0.98,0.98) and (1.0,1.0), respectively. It appears that for any model, the profit of either party de- Copyright © 2010 SciRes. JSSM  Supplier and Producer Profit Sharing Models Based on Inspection Sampling Policy 484 Table 1. Item quality using intepte d ge ometr i c distr i butions. N = 1500 T E(GT) M E(P) Var(p) Beta(α,β) rru 10 150 90.973 0.0064 (3.02,0.084) .73 15 100 14 20 rx = 0.995 .41 0.961 0.0094 (2.84,0.115) 0124 (2.75,0.148) 25 60 23.44 0.938 0.0153 (2.61,0.177) 2 ( rx = 0.998 30 50 29. 0.970 0.0192 (0.52,0.016) 75 18.98 0.949 0. 30 50 7.780.922 0.0181 2.76,0.235) 10 150 9.89 0.989 0.0065 (0.66,0.074) 15 100 14.76 0.984 0.0097 (0.61,0.010) 20 75 19.58 0.949 0.0129 (0.58,0.0124) 25 60 24.36 0.974 0.0161 (0.53,0.014) 09 ble 2. Probabf being reported “good” for v {rx, T, (q1, N = 1500 (q1,q21,1)E(W) 1,q2) = (0.98,W) ) = (0.96, Taility oarious q2)}. T ) = ((q0.98)E((q1,q20.96)E(W) 10 0.973 0.954 0.935 15 0.961 0.943 0.924 0.913 rx = 0.995 25 0.974 0.955 0.936 rx = 0.998 20 0.949 0.931 25 0.938 0.920 0.903 30 0.922 0.905 0.888 10 0.989 0.969 0.950 15 0.984 0.965 0.945 20 0.979 0.960 0.941 30 0.970 0.951 0.932 Tab Numerical res three models when T = 15, = 1500, Cx = {450, 500}. 5(Cx = 450) r x = 0.998(Cx = le 3.ults ofN rx = 0.99 500) q1&q2 0.96 0.98 1.0 0.96 0.98 1.0 E(W) 0.924 0.943 0.961 0.945 0.965 0.984 Model 1-Supplier’s pr39.998 Produces profit 59.445 65,921 62.349 71.924 Pptimal size n* Criticaer c* Mo 5 6 6 6 6 6 1077 106 106 108 106 103 Modelofit Op Cri c* oift 44.045 44.410 44.778 39.579 39.883 r’61.357 66.929 sample 93 87 84 86 64 10 l numb5 5 4 4 2 1 Total profit 103.490 105.767 110.699 101.928 106.812 111.922 del 2-Supplier’s profit 45.000 45.000 45.000 40.000 40.000 40.000 Producer’s profit 7.2771.0764.8061.2185.0769.433 Total profit 2.26.079.801.215.079.43 3-Supplier’s pr44.972 44.985 44.994 44.988 39.996 39.998 Producer’s profit 58.783 61.281 65.819 62.053 66.834 71.924 timal sample size n* 18 16 15 16 12 10 tical number 0 0 1 0 0 1 Total profit 103.755 106.266 110.813 102.041 106.830 111.922 Copyright © 2010 SciRes. JSSM  Supplier and Producer Profit Sharing Models Based on Inspection Sampling Policy485 . Numericlts of Moen Cx = (175, 200) for rx , 0.998) a1500. rx 10 (M = 150) 15 (M = 100)20 (M = 7525 (M = (M = 50) Table 4al resudel 3 wh= (0995nd N = T ) 60) 30 (n*,c*) (10,0) (16,0(21,() 1) 24,1) (27,1) f1 59,992 69,985 74,591 77,219 f 69,938 61,281 58,795 56,709 55, 84,311 2841 rx = 0.995 f1 2 x +f 123,930 131,267 133,386 133,928 135,152 (n* *) ,c(1,0) (12,0) (13,0) (15,0) (15,0) f1 f 59,997 69,996 74,986 77,596 79,772 2 66, f1+f2 996 126,993 66,834 136,830 66,061 141,047 63,864 141,460 61533 141,305 r= 0.998 Table 5. Nu results foifferent quetup costs. Setup cost and profi mericalr two dality s ts T = 10 (M = 150) T = 15 (M = 100) T = 20 (M = 75) T = 25 (M = 60) T = 30 (M = 50) f1 76,492 80,985 82,841 83,819 84,811 f26,709 55,814 Cx = 90 rx = 0.995 f1+f2 140,142,141, f1 Cx = 100 rx = 0.998 f f1 14,992 39,5 52,486 59,596 64,772 Cx = 500 r x = 0.998 f 63,938 61,281 58,795 5 420 74,997 266 79,996 636 140, 82,846 528 140, 83,596 652 84,811 f2 66,996 66,834 66,061 63,864 55,841 1+f2141,193 146,830 148,547 147,460 146,305 f1 29,492 39,985 59,591 65,219 69,311 f2 63,938 61,281 58,795 56,709 55,841 C x = 400 rx = 0.995 f1+f2 93,490 111,266 118,386 121,928 125,152 98 f2 66,996 66,834 66,061 63,864 51,533 1+f281,993 106,830 118,547 123,460 126,305 decrease of q1 will raise coboth pue to typ 1 risk ation the supplier e required to dms to the produd the pro- ducer will also incur additional inspectrther ore, if q decreases, the producer will face increased n of this scenario is {r, T, (0.998, 2 a total pr148,547, en Cx 400, 500)ptimal decisio( rx, T) = , 30), ich will yielotal profit ,305. Model 1opriate w produceajor purchaser of the key item; on the other hand, Model 2 rtheless, fur- th st for arties de = error. In this situ eliver additional ite,will b cer, an ion cost. Fu- m2 risk of delivering more failed products to its customers. In practice, the penalty cost of deliv ering a failed product is regarded as much greater than the unit inspection co st. Another impact of the (q1,q2) decrease is the increased stringency of the inspection sampling plan. The inspec- tion sample size will be enlarged. A larger setup cost will lead to higher item quality. For the supplier, there is a trade-off between item quality and setup cost/cycle time. Table 4 shows the numerical re- sults of Model 3 when Cx = (175,200) for rx = (0.995,0.998). The optimal decisiox (n*, c*)} = (0.998,25,(15,0)). Table 5 presents addi- tional results of other values Cx for rx. When Cx = (90, 100) for rx = (0.995, 0.998), the optimal decision is (rx, T) may be more suited when the supplier is an exclusive input source of the key item. Often in practice however, both parties will not completely agree on either Model 1 or Model 2. A compromising solution would involve both parties utilizing Model 3, and the supplier deter- mining the best setup of (Cx, T) that leads to the maxi- mum combined profit. Then each party will receive his own share according to the solution. Neve 0) withofit of and wh = ( wh , the o d a tn is of 126(0.998 is apprhen ther is a m er negotiation on profit sharing may be needed if one party claims that he contributed more towards the com- bined profit. 4. Conclusions This study discusses a decision-making problem on the Copyright © 2010 SciRes. JSSM  Supplier and Producer Profit Sharing Models Based on Inspection Sampling Policy 486 profit sharing of a key item in a two-echelon supply chain process. The upstream supplier determines the quality level, as well as the reset cycle time, during the manufacturing process. However, the producer aims to minimize his risk by selecting and implementing an op- timal inspection decision. Since the two parties have conflicting interests, three profit sharing models are pro- e conflict. Model 1 allows the sk to the minimum level, wh r and L. Pallesen, “Economic anufactured Product,” ntents for a Canning Problem,” Journal of Quality Technology Vol. 19, No. 2 tion in Statistics – The- Engineering, Vol. 57, No. 3, 2009, pp. 699- 120, No. pp. 875-881. . 6, 2002, pp. 620-629. and S. M. Guu, “The Multiple Lot Sizing ang, “The Finite Multiple Lot posed to resolve th ducer to reduce his ripro- ereas [9] H. M. Hsu, T. S. Su, M. -C. Wu and L. -C. Huang, “Mul- tiple Lot-Sizing Decisions with an Interrupted Geometric Yield and Variable Production Time,” Computers and Industrial Model 2 will work solely to the supplier’s favor. Model 1 will be useful if the producer’s penalty cost of product failure is high. On the other hand, Model 2 is more ap- plicable if the supplier provides high quality key items, or is the dominant source of the key item. These two models tend to be more one-sided, situation-based solu- tions that lopsidedly favor either the supplier or producer. Model 3 may be the most practical and compromising one, as it requires both parties to work together in ob- taining the largest sum of profits, and prevents an unrea- sonably large gap between their individual profits. This collaborative manufactur ing strategy can ensure that both parties receive acceptable returns and maintain long-term business cooperation. 5. Acknowledgements This work was supported by the National Science Coun- cil in Taiwan under grant NSC 96-2628-E155-006. REFERENCES [1] G. B. Wetherill and W. K. Chiu, “A Review of Accep- tance Sampling Schemes with Emphasis on the Economic Aspect,” International Statistical Review, Vol. 43, No. 2, 1975, pp. 91-210. [2] S. Bisgaard, W. G. Hunte Selection of Quality of MTech- , [16] D. W. Pentico, “An Evaluation and Proposed Modifica- tion of the Sepehri-Silver-New Heuristic for Multiple Lot Sizing under Variable Yield,” IIE Transactions, Vol. 20, No. 4, 1988, pp. 360-363. nometrics, Vol. 26, No. 1, 1984, pp. 9-18. [3] D. Y. Golhar, “Determination of the Best Mean Co , 1987, pp. 82-84. [4] H. Moskowitz and K. Tang, “Bayesian Variables Accep- tance-Sampling Plans: Quadratic Loss Function and Step- Loss Function,” Technometrics, Vol. 34, No. 3, 1992, pp. 340-347. [5] R. L. Fink and T. M. Margavio, “Economic Models for Single Sample Acceptance Sampling Plans, No Inspec- tion, and 100 Percent Inspection,” Decision Sciences, Vol. 25, No. 4, 1994, pp. 625-653. Prob [6] M. S. Aminzadeh, “Bayesian Economic Variable Accep- tance-Sampling Plan Using Inverse Gaussian Model and Step-Loss Function,” Communica ory and Methods, Vol. 32, No. 5, 2003, pp. 961-982. [7] M. K. Lee, S. H. Hong and E. A. Elsayed, “The Optimum Target Value under Single and Two-Stage Screenings,” Journal of Quality Technology, Vol. 33, No. 4, 2001, pp. 506-514. [8] M. K. Lee and E. A. Elsayed, “Process Mean and Screening Limits for Filling Processes under Two-Stage Scr- eening Procedure,” European Journal of Operation Research, Vol. 138, No. 1, 2002, pp.118-126. 706. [10] R. H. Yeh, W. T. Ho and S.T. Tseng, “Optimal Produc- tion Run Length for Products Sold with Warranty,” European Journal of Operational Research, Vol. 3, 2000, pp. 575-582. [11] M. Ben-Daya and M. Hariga, “Economic Lot Scheduling Problem with Imperfect Production Processes,” The Jour- nal of the Operational Research Society, Vol. 51, No. 7, 2000, [12] I. Moon, B. C. Giri and K. Choi, “Economic Lot Sched- uling Problem with Imperfect Production Processes and Setup Times,” The Journal of the Operational Research Society, Vol. 53, No [13] C. H. Wang and S. H. Sheu, “Optimal Lot Sizing for Products Sold under Free-Repair Warranty,” European Journal of Operational Research, Vol. 149, No. 1, 2003, pp. 131-141. [14] C. H. Wang, “The Impact of a Free-Repair Warranty Policy on EMQ Model for Imperfect Production Sys- tems,” Computers & Operations Research, Vol. 31, No. 12, 2004, pp. 2021-2035. [15] S. Anily, “Single-Machine Lot-Sizing with Uniform Yields and Rigid Demands: Robustness of the Optimal Solution,” IIE Transactions, Vol. 27, No. 5, 1995, pp. 625-633. [17] S. Anily, A. Beja and A. Mendel, “Optimal Lot Sizes with Geometric Production Yield and Rigid Demand,” Operations Research, Vol. 50, No. 3, 2002, pp. 424-432. [18] A. X. Zhang lem with Rigid Demand and Interrupted Geometric Yield,” IEE Transactions, Vol. 30, No. 1, 1998, pp. 427- 431. [19] S. M. Guu and A. X. Zh Sizing Problem with Interrupted Geometric Yield and Holding Costs,” European Journal of Operational Res- earch, Vol. 145, No. 3, 2003, pp. 635-644. Copyright © 2010 SciRes. JSSM |