Paper Menu >>

Journal Menu >>

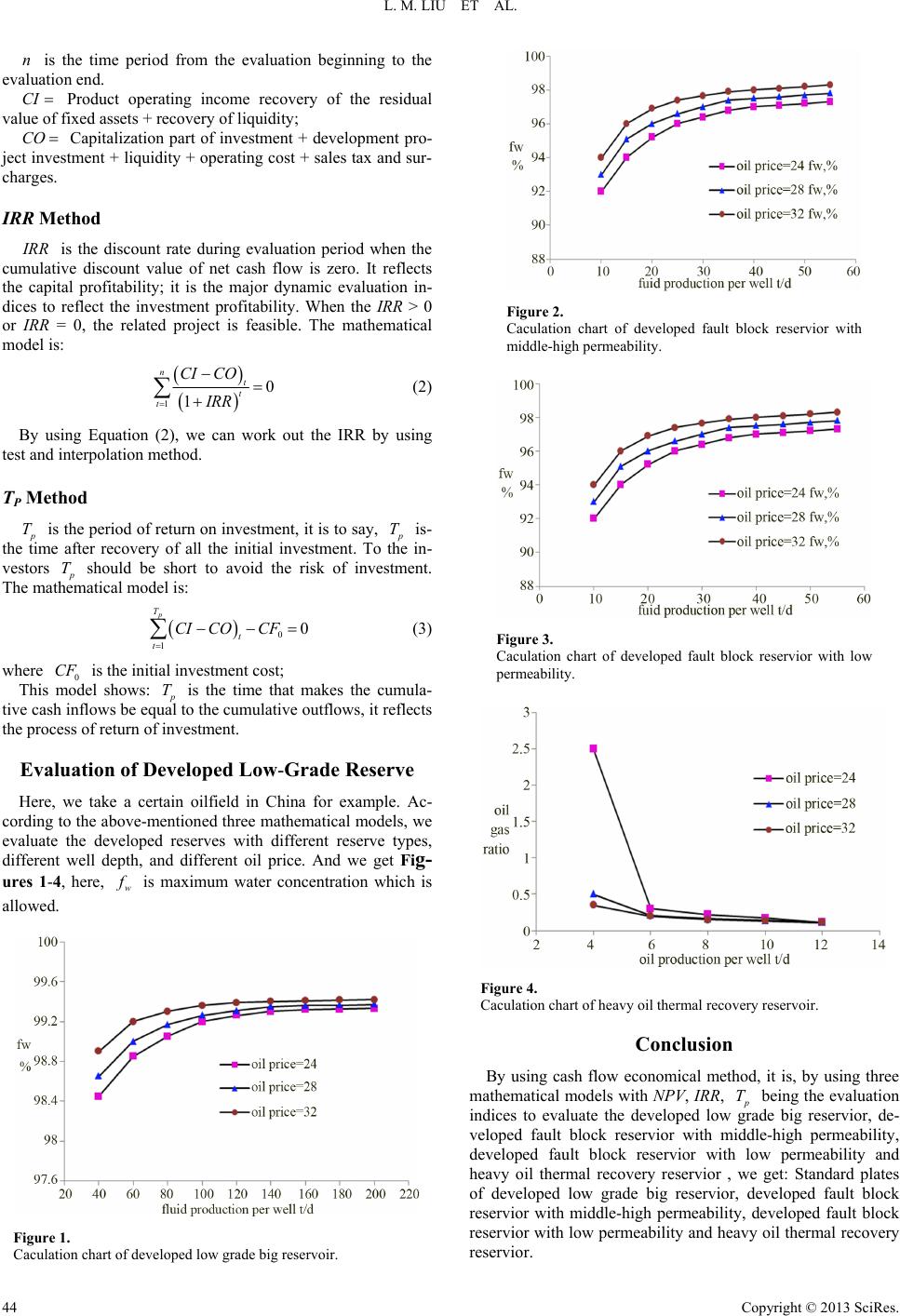

Journal of Financial Risk Management 2013. Vol.2, No.2, 43-45 Published Online June 2013 in SciRes (http://www.scirp.org/journal/jfrm) http://dx.doi.org/10.4236/jfrm.2013.22007 Copyright © 2013 SciRes. 43 Evaluation of Developed Low-Grade Reservoir by Cash Flow Economic Evaluation Method Liming Liu1, Youming Xiong1, Songlin Zhang2,3, Lixue Ch en2, Haohan Li u 2,3 1School of Petroleum Engineering, Southwest P et roleum University, Ch e n gd u , China 2School of Computer Science, Sou thwes t Pet roleum University, Chengdu, China 3Department of Computer Engineering, Sich ua n C ollege of Architectural Technology, Deyang, China Email: liulimi ng_swpu@163.com, songlin_zhang@yeah.net Received March 5th, 2013; rev ised Ap ril 6th, 2013; accepted April 14th, 2013 Copyright © 2013 Liming Liu et al. This is an open access article distributed under the Creative Commons At- tribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. There is no united method to evaluate developed low-grade reservoir. Cash flow economic evaluation method is widely used in China and other countries. Cash flow method contains three different economic evaluation methods, they are VP, IRR and investment recovery period methods. In this paper, we evaluate a developed low-permeability sandstone reservoir and a developed middle-high permeability complex fault block sandstone reservoir with the cash flow economic evaluation method. We get the evaluation standard charts of the developed low grade big reservior, developed fault block reservior with mid- dle-high permeability, developed fault block reservior with low permeability and heavy oil thermal re- covery reservior. This new cash flow method lays theoretical foundations for evaluation of developed low-grade reservoir and other kinds of reservoirs. Keywords: Cash Flow; Developed; Low-Grade Reservoir; NPV; IRR; Investment Recovery Period Introduction It is difficult to forecast some parameters based on the cash flow economic method without proper mathematical models. In China, many related experts proposed some methods, such as minimum economic reserve method (Li & Luo, 1999), million ton capacity investment method (Li & Wu, 2006) and movable oil price method (Zhong & Ye, 2009) to facilitate the operation. For example, the minimum economic reserve method is to use the physical properties of oil reservoirs, such as permeability and oil viscosity, reservoir depth, reserves abundance and pos- sible economical factors to model related mathematical models and to calculate the minimum economical reserve. If the evalu- ation reserve is larger than the minimum economical re- serve, we can draw a conclusion: There is no value for devel- opment of this kind of reserve. The geological institute of Shengli oil- field proposed the movable oil price method after years of prac- tical experience (Chen & Tian, 2009; Chen, Hu, & Wang, 2011). This method is based on the theory that the oil price in development project can not be the present real oil price. This method is to determine a decision-making oil price according to the trend of the international oil price and other factors. For example, the decision-making oil price is 35$/bbl before Chi- nese fifteen policy, the decision-making oil price is 18$/bbl during the Chinese fifteen policy. If the profit rate of invest- ment is less than 0.12, then we think this reserve is im- proper for development. Million ton capacity investment me- thod is similar to the movable oil price method. It is to deter- mine the investment per million ton capacity according to the plans de- sign, indices forecast and cost and investment forecast. If the investment is larger than the inner ruled investment, then we think this reserve is improper for development. Besides, some exports think that it is more feasible for margin reserve evalua- tion by combing the evaluation foundation, evaluation unit, evaluation parameter and evaluation method (Zhang & Xie, 1999; Zhao & Yu, 2011; Guo, 2011; Luo & He, 2012). Here, we will introduce the cash flow economical method with three kind of mathematical models to evaluate developed low-grade reservoir and other kinds of reservoir Cash Flow Economical Method Cash flow economical method (Xu, Xie, & Zhang, 2011) is to use the following three mathematical models to evaluate different reserves. The evaluation indices are net present value (NPV), Internal Rate of Return (IRR) and the payback period ( p T). NPV Method NPV is the sum of present value after discount of future net cash flow according to the discount rate. From the point view of investment decisions, it is profitable when the net present value is bigger then 0. The calculation formula is: 11 nt t t CI CO NPV i (1) where N PV is net present value; CI i and are cash inflows and outflows of certain year; CO is the discount rate; t is the evaluation year during the evaluation period;  L. M. LIU ET AL. n is the time period from the evaluation beginning to the evaluation end. CI Product operating income recovery of the residual value of fixed assets + re covery of liquidity; CO Capitalization part of investment + development pro- ject investment + liquidity + operating cost + sales tax and sur- charges. IRR Method IRR is the discount rate during evaluation period when the cumulative discount value of net cash flow is zero. It reflects the capital profitability; it is the major dynamic evaluation in- dices to reflect the investment profitability. When the IRR > 0 or IRR = 0, the related project is feasible. The mathematical model is: 1 0 1 nt t t CI CO IRR (2) By using Equation (2), we can work out the IRR by using test and interpolation method. TP Method p T is the period of return on investment, it is to say, p T is- the time after recovery of all the initial investment. To the in- vestors p T should be short to avoid the risk of investment. The mathematical model is: 0 1 0 p T t t CI COCF (3) where is the initial inves tment cost; 0 This model shows: CF p T is the time that makes the cumula- tive cash inflows be equal to the cumulative outflows, it reflects the process of return of investment. Evaluation of Developed Low-Grade Reserve Here, we take a certain oilfield in China for example. Ac- cording to the above-mentioned three mathematical models, we evaluate the developed reserves with different reserve types, different well depth, and different oil price. And we get Fig- ures 1-4, here, w f is maximum water concentration which is allowed. Figure 1. Caculation chart of developed low grade big reservoir . Figure 2. Caculation chart of developed fault block reservior with middle-high permeability. Figure 3. Caculation chart of developed fault block reservior with low permeability. Figure 4. Caculation chart of heavy oil thermal recovery reservoir. Conclusion By using cash flow economical method, it is, by using three mathematical models with NPV, IRR, p T being the evaluation indices to evaluate the developed low grade big reservior, de- veloped fault block reservior with middle-high permeability, developed fault block reservior with low permeability and heavy oil thermal recovery reservior , we get: Standard plates of developed low grade big reservior, developed fault block reservior with middle-high permeability, developed fault block reservior with low permeability and heavy oil thermal recovery reservior. Copyright © 2013 SciRes. 44  L. M. LIU ET AL. Copyright © 2013 SciRes. 45 REFERENCES Chen, G. C., & Tian, X. P. (2009). Disteribution of turbidite reservoir and its significance in reserve assessment. Marine Geology Frontiers, 27, 8-13. Chen, H., Hu, Z. G., & Wang, Y. C. (2011). Application of material balance equation in evaluation of water drive gas reserve. Nei Jiang Science and Technology, 5, 136-137. Guo, X. P. (2011). Evaluation of dynamic reserves in Jingbian Gas. Liaoning Chemical Industry, 40, 1101-1106. Li, H., Meng, X.-J., & Sun, G.-H. (2000). A study on the evaluation method of the economic recoverable reserves of low permeable. Oil Fields Petroleum Geology & Oilfield Development in Daqing, 19, 31-33. Li, J. C., & Luo, H. L. (1999). A new method of reserve’s economic evaluation: Minimum economic reserve method. Tuha Oil & Gas, 1, 27-29. Li, X. P., & Wu, A. P. (2006). Decision-making oil price adaptive to the economical evaluation of oilfield development project. Journal of Oil and Gas Technology, 28, 156-157 . Luo, Y., He, P. et al. (2012) Tang Yun research on the parameters for the development potential evaluation of low permeability reservoir. Reservior Evaluation and Development, 2, 24-27. Xu, D.-S., Xie, X.-J., & Zhang, A. (2011). Study on beneficial evalua- tion and optimal model of developed low-grade reservoir. Journal of Southwest Petroleum University (Science & Technology Edition), 33, 168-171. Zhang, W. M., & Xie, P. H. (1999). Evaluation criterion of marginal reserves and DBD in marginal reserves. Oil & Gas Geology, 20, 302-304. Zhao, P. F., & Yu, J. (2011). Methods for shale gas resources assess- ment. Marine Geology Frontiers, 27, 57-63. Zhong, Y. S., & Ye, Z. J. (2009). Economic assessment of relations between investment in oilfield productivity construction and daily single-well output. Sino-Global Energy, 14, 52-56. |