Y.-S. HWANG, H.-G. MIN

Copyright © 2013 SciRes.

42

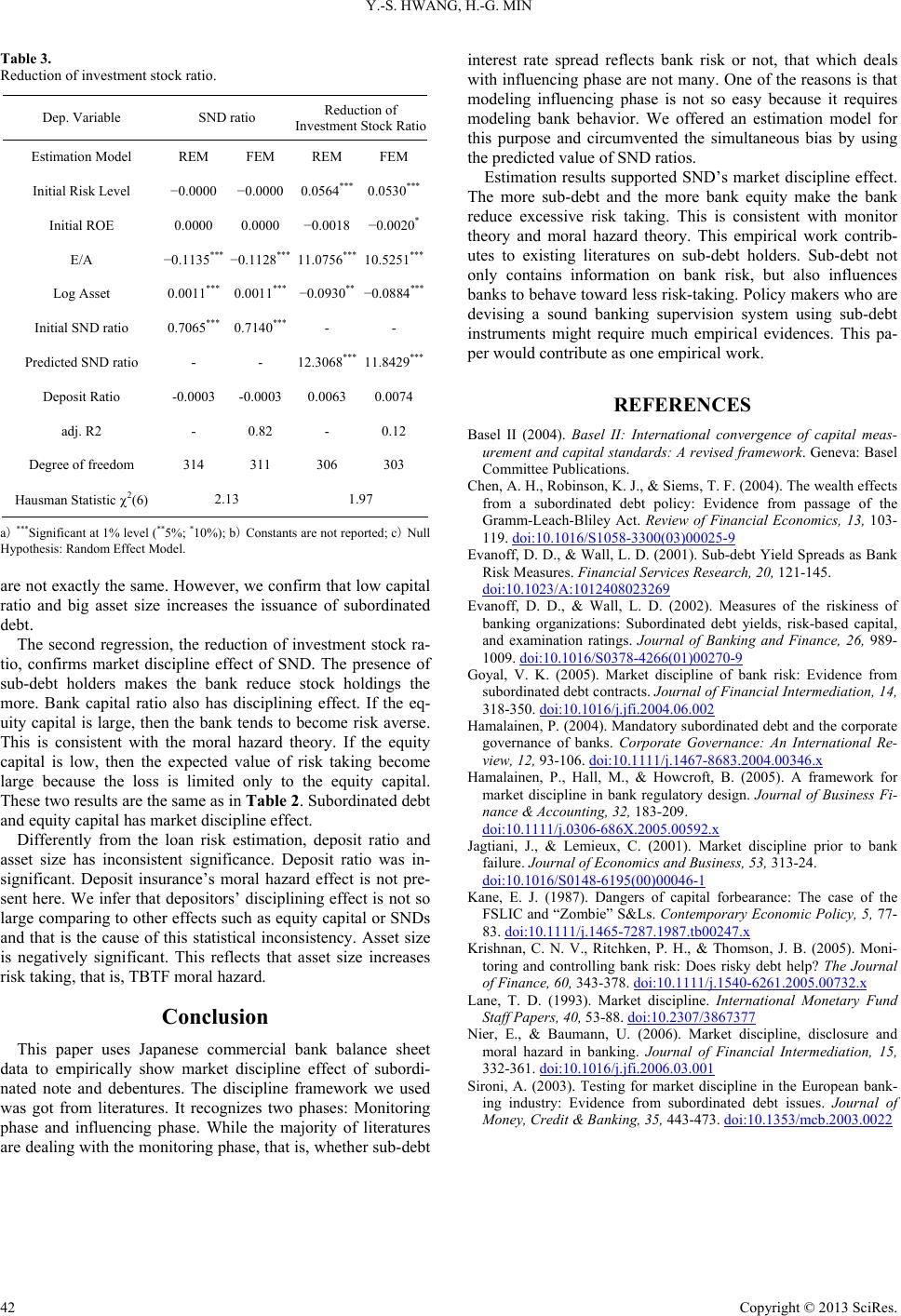

Table 3.

Reduction of investment stock ratio.

Dep. Variable SND ratio Reduction of

Investment Stock Ratio

Estimation Model REM FEM REM FEM

Initial Risk Level −0.0000 −0.0000 0.0564*** 0.0530***

Initial ROE 0.0000 0.0000 −0.0018 −0.0020*

E/A −0.1135*** −0.1128*** 11.0756*** 10.5251***

Log Asset 0.0011*** 0.0011*** −0.0930** −0.0884***

Initial SND ratio 0.7065*** 0.7140*** - -

Predicted SND ratio - - 12.3068*** 11.8429***

Deposit Ratio -0.0003 -0.0003 0.0063 0.0074

adj. R2 - 0.82 - 0.12

Degree of freedom 314 311 306 303

Hausman Statistic 2(6) 2.13 1.97

a) ***Significant at 1% level (**5%; *10%); b) Constants are not reported; c) Null

Hypothesis: Random Effect Model.

are not exactly the same. However, we confirm that low capital

ratio and big asset size increases the issuance of subordinated

debt.

The second regression, the reduction of investment stock ra-

tio, confirms market discipline effect of SND. The presence of

sub-debt holders makes the bank reduce stock holdings the

more. Bank capital ratio also has disciplining effect. If the eq-

uity capital is large, then the bank tends to become risk averse.

This is consistent with the moral hazard theory. If the equity

capital is low, then the expected value of risk taking become

large because the loss is limited only to the equity capital.

These two results are the same as in Table 2. Subordinated debt

and equity capital has market discipline effect.

Differently from the loan risk estimation, deposit ratio and

asset size has inconsistent significance. Deposit ratio was in-

significant. Deposit insurance’s moral hazard effect is not pre-

sent here. We infer that depositors’ disciplining effect is not so

large comparing to other effects such as equity capital or SNDs

and that is the cause of this statistical inconsistency. Asset size

is negatively significant. This reflects that asset size increases

risk taking, that is, TBTF moral hazard.

Conclusion

This paper uses Japanese commercial bank balance sheet

data to empirically show market discipline effect of subordi-

nated note and debentures. The discipline framework we used

was got from literatures. It recognizes two phases: Monitoring

phase and influencing phase. While the majority of literatures

are dealing with the monitoring phase, that is, whether sub-debt

interest rate spread reflects bank risk or not, that which deals

with influencing phase are not many. One of the reasons is that

modeling influencing phase is not so easy because it requires

modeling bank behavior. We offered an estimation model for

this purpose and circumvented the simultaneous bias by using

the predicted value of SND ratios.

Estimation results supported SND’s market discipline effect.

The more sub-debt and the more bank equity make the bank

reduce excessive risk taking. This is consistent with monitor

theory and moral hazard theory. This empirical work contrib-

utes to existing literatures on sub-debt holders. Sub-debt not

only contains information on bank risk, but also influences

banks to behave toward less risk-taking. Policy makers who are

devising a sound banking supervision system using sub-debt

instruments might require much empirical evidences. This pa-

per would contribute as one empirical work.

REFERENCES

Basel II (2004). Basel II: International convergence of capital meas-

urement and capital standards: A revised framework. Geneva: Basel

Committee Publications.

Chen, A. H., Robinson, K. J., & Siems, T. F. (2004). The wealth effects

from a subordinated debt policy: Evidence from passage of the

Gramm-Leach-Bliley Act. Review of Financial Economics, 13, 103-

119. doi:10.1016/S1058-3300(03)00025-9

Evanoff, D. D., & Wall, L. D. (2001). Sub-debt Yield Spreads as Bank

Risk Measures. Financial Services Research, 20 , 121-145.

doi:10.1023/A:1012408023269

Evanoff, D. D., & Wall, L. D. (2002). Measures of the riskiness of

banking organizations: Subordinated debt yields, risk-based capital,

and examination ratings. Journal of Banking and Finance, 26, 989-

1009. doi:10.1016/S0378-4266(01)00270-9

Goyal, V. K. (2005). Market discipline of bank risk: Evidence from

subordinated debt contracts. Journal of Financial Intermediation, 14,

318-350. doi:10.1016/j.jfi.2004.06.002

Hamalainen, P. (2004). Mandatory subordinated debt and the corporate

governance of banks. Corporate Governance: An International Re-

view, 12, 93-106. doi:10.1111/j.1467-8683.2004.00346.x

Hamalainen, P., Hall, M., & Howcroft, B. (2005). A framework for

market discipline in bank regulatory design. Journal of Business Fi-

nance & Accounting, 32, 183-209.

doi:10.1111/j.0306-686X.2005.00592.x

Jagtiani, J., & Lemieux, C. (2001). Market discipline prior to bank

failure. Journal of Ec o n o mi c s a n d Business, 53, 313-24.

doi:10.1016/S0148-6195(00)00046-1

Kane, E. J. (1987). Dangers of capital forbearance: The case of the

FSLIC and “Zombie” S&Ls. Contemporary Economic Policy, 5, 77-

83. doi:10.1111/j.1465-7287.1987.tb00247.x

Krishnan, C. N. V., Ritchken, P. H., & Thomson, J. B. (2005). Moni-

toring and controlling bank risk: Does risky debt help? The Journal

of Finance, 60, 343-378. doi:10.1111/j.1540-6261.2005.00732.x

Lane, T. D. (1993). Market discipline. International Monetary Fund

Staff Papers, 40, 53-88. doi:10.2307/3867377

Nier, E., & Baumann, U. (2006). Market discipline, disclosure and

moral hazard in banking. Journal of Financial Intermediation, 15,

332-361. doi:10.1016/j.jfi.2006.03.001

Sironi, A. (2003). Testing for market discipline in the European bank-

ing industry: Evidence from subordinated debt issues. Journal of

Money, Credit & Banking, 35, 443-473. doi:10.1353/mcb.2003.0022