Technology and Investment

Vol.06 No.01(2015), Article ID:53824,23 pages

10.4236/ti.2015.61003

Foreign Ownership, Employment and Wages in Brazil: Evidence from Acquisitions, Divestments and Job Movers

Pedro S. Martins1,2,3, Luiz A. Esteves4,5,6

1Queen Mary University of London, London, UK

2CEG-IST, Lisbon, Portugal

3IZA, Bonn, Germany

4Federal University of Paraná, Curitiba, Brazil

5CADE/MJ, Brasília, Brazil

6CNPq, Brasília, Brazil

Email: p.martins@qmul.ac.uk, luiz.esteves@cade.gov.br

Copyright © 2015 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 18 January 2015; accepted 2 February 2015; published 5 February 2015

ABSTRACT

How much do developing countries benefit from foreign investment? We contribute to this question by comparing the employment and wage practices of foreign and domestic firms in Brazil, using detailed matched firm-worker panel data. In order to control for unobserved worker differences, we examine both foreign acquisitions and divestments and worker mobility, including the joint estimation of firm and worker fixed effects. We find that changes in ownership do not tend to affect wages significantly, a result that holds both at the worker- and firm-levels. However, divestments are related to large job cuts, unlike acquisitions. On the other hand, movers from foreign to domestic firms take larger wage cuts than movers from domestic to foreign firms. Moreover, on average, the fixed effects of foreign firms are considerably larger than those of domestic firms, while worker selection effects are relatively small.

Keywords:

Foreign Direct Investment, Ownership Changes, Worker Mobility

1. Introduction

How much do developing countries benefit from foreign investment? This is a question with important implications in terms of how globalization is perceived across the world. In fact, the popular assessment of the international benefits of globalization is perhaps still influenced by the view that multinationals operate “sweatshops” in developing countries. However, a considerable body of academic work indicates that foreign firms pay higher wages than domestic firms in several developing countries ( [1] - [3] , etc.).

In this paper, we study the case of Brazil, a large developing country which has so far not been examined in the literature about foreign-firm wage differentials. Brazil is also an interesting country to study due to the richness of its data, including a detailed matched employer-employee panel data set that we use here. The quality of the data allows us to make a contribution to the literature (which in most cases uses firm-level data, at least when considering developing countries) also on a methodological level. Specifically, we seek to address the unobserved heterogeneity problem that workers in foreign and domestic firms may be different along dimensions not quantified in the data [4] .

In order to provide a robust contribution to our understanding of the foreign-firm wage premium in developing countries, our paper pursues four different but complementary approaches. First, we examine the evolution of wages as firms change ownership type (domestic or foreign), considering not only the case of acquisitions, when domestic firms become foreign-owned (as in [5] [6] , etc.), but also divestments, when foreign firms are sold to domestic investors. In our view, divestments can be as informative as acquisitions. Moreover, divestments are also interesting in their own right, particularly if one believes that “footloose” multinationals are an important fact of life in a globalised world.

Our second approach involves conducting our analysis not only at the firm-level but also at the worker level [7] -[10] . By considering the two levels of analysis, we are able to understand if any changes in firm-level wages that may be observed following acquisition or divestment are due to compositional differences in the workforce. Indeed, even a large set of firm-level human capital controls may not appropriately pick up workforce differences across different owners.

At this point, it is important to clarify the methodological differences between firm-level and worker-level regressions. The firm-level regressions uses “mean-values-variables”, for example, the average wage paid by the firm, the average age and tenure of their workers, etc. The firm-level mobility regressions capture changes in the ownership of the firms. The worker-level regressions use individual worker information, for example, the wage received by a particular worker, his age, tenure, etc. In terms of mobility, in the worker-level regressions we are no longer interested in the effects of the change of ownership of a firm, but the effects of worker mobility who migrated from a domestic firm to a foreign one, or vice versa. Although the specifications of the worker-level and firm-level regressions look similar, the interpretation of their results is completely different, as will be discussed throughout the article.

Third, in order to address such compositional issues in more detail, we also study how job and worker flows evolve as firms change ownership, not only immediately after (i.e. in the first year under new ownership) but also over time. In fact, this aspect strikes us as an important oversight in most of the research about the foreign- firm wage premium, as wages tend to be studied in isolation from employment levels, although the two variables are presumably strongly related.

Finally, we also address the unobserved heterogeneity problem mentioned above by following the same workers as they move across different domestic and foreign firms (Martins 2008). This topic has received attention recently, although the focus has been on FDI spillovers embodied in workers that move from foreign to domestic firms [11] - [13] , rather than on wage differentials between the two types of firms. Moreover, we are amongst the first to estimate jointly worker and firm fixed effects [14] in the international economics literature. Again, this type of analysis is only possible with matched employer-employee panel data as the one we use here, so that one can follow workers over time, at different employers.

To the best of our knowledge, this is one of only two papers that consider both acquisitions and worker mobility while also studying changes from domestic to foreign firms and vice versa. The other paper employing a similar approach is [9] , which considers the case of Germany. However, as far as we know, our paper is the first to examine foreign-firm wage differentials in a developing country using matched employer-employee panel data. As mentioned above, we also pay particular attention to employment flows and to the contrast between the firm- and the worker-levels of analysis, unlike most of the literature.

In our results, based on a matched sample of about 1350 manufacturing-sector firms, observed from 1995 to 1999, and a total of about 3.3 million worker-years, we find that both acquisitions and divestments do not tend to affect wages significantly. However, although this result holds simultaneously at the firm and the worker- levels, divestments are related to large job cuts, while acquisitions are not followed by significant employment differences. Moreover, movers from foreign to domestic firms take larger wage cuts than movers from domestic to foreign firms (and the latter in many cases see their pay increase or at least not decrease). Finally, when estimating worker and firm fixed effects simultaneously, we find that the fixed effects of foreign firms are on average considerably larger than those of domestic firms. On the other hand, the differences in the worker fixed effects are minor.

The structure of the paper is as follows: Section 2 introduces the data; Sections 3 and 4 describe the firm- and worker-level analysis, respectively; and Section 5 discusses the results.

2. Data

The main data set used in this paper is RAIS (“Relacao Anual de Informacoes Sociais”, Annual Social Data Report), a Census of all firms and all their formal-sector employees in Brazil conducted by the Ministry of Labour. The data include detailed information about each employee (wages, hours worked, education, age, tenure, gender, worker nationality, etc.) and each firm (industry, region, size, establishment type, etc.) in each year, plus a unique identifier for each employee, each establishment and each firm.1

Although RAIS is particularly rich, it does not include information on (foreign) firm ownership. In order to use such information, we draw on two additional firm-level data sources that we merge in using a common firm identifier. The first data source is CCE (Foreign Capitals Census), a census conducted every five years by the Central Bank of Brazil. These data consider all firms which have at least 50% of their capital owned by foreign investors. Moreover, the census collects detailed information about the foreign ownership structure of firms based in Brazil, including additional data such as exports, imports, location, activity sector, number of employees. We use the information from the 1995 census in order to classify each firm in our sample as domestic or foreign in that first year of our analysis.

The second additional firm-level data source we use is the information compiled by [16] about firms that changed their foreign/domestic nature after 1995. In order to obtain this information, [16] examined a third data set, PIA (Yearly Manufacturing Survey), which is conducted across all firms in the manufacturing sector with at least 30 employees plus a sample of firms with between 5 and 30 employees. PIA includes data about changes in firm ownership in each firm. Based on this information, [16] establishes if and in which year firms change their domestic/foreign status between 1995 and 2000.

When creating our data set, we decided to consider only (manufacturing sector) firms with at least 100 employees in 1995. While the firm size threshold is originally designed to meet our computational constraints, in fact such threshold is not particularly binding. As most foreign firms in Brazil and elsewhere employ 100 or more workers, a rigorous “like-for-like” comparison of domestic and foreign firms would in fact require disregarding smaller firms. Furthermore, in order to ensure we draw on a homogeneous group of firms, we conducted a propensity score matching analysis [17] to remove from our sample those firms that displayed ‘non-compa- rable’ observable characteristics in 1995.

Specifically, we adopted a “nearest-neighbour” matching method, so that each foreign firm was matched to its most “similar” domestic counterpart (in terms of their characteristics in 1995, as indicated by the propensity score). In the construction of this propensity score, we used a large set of covariates, including three-digit industry dummies, state dummies, and quadratics in firm size and the level of exports and in the averages of worker age, gender, schooling and tenure. Moreover, we also imposed a “common support” condition, so that foreign firms which could not be matched (because their propensity score was “too” different―more than 0.01 different―from the propensity score of the “closest” domestic firm) were dropped from the data.2 Finally, after selecting the matched firms in 1995, a total 678 foreign firms and 669 domestic firms, we finally match in their data for 1996 to 1999.

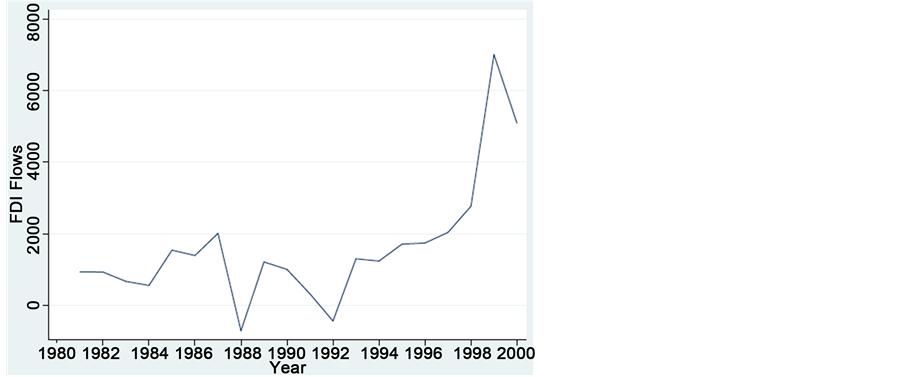

It is due to the richness of the data and/or our computational constraints that we consider in our analysis a period of not more than five years (1995 to 1999). Although this time frame is not particularly long, it is important to underline that this was a period characterized by a large number of mergers and acquisitions in Brazil [18] . As mentioned in the Introduction, such changes in firm ownership play a very important role in the identification strategy adopted here. Moreover, Brazil also followed the international trend of increasing foreign direct investment flows over the period, as can be seen in Figure 1.

As only a small number of firms exit the data, there is a total of 6337 firm-year observations. Moreover, about 8% of the firms in the data exhibit a change in foreign/domestic ownership-a total of exactly 100 changes, 51 of

Figure 1. Foreign Direct Investment in Brazil (Manufacturing), 1980- 2000. Source: [24] . Unit: Millions of US dollars.

which being acquisitions (domestic firms acquired by foreign investors) and the remaining 49 divestments. As to the time distributions of the ownership changes, while the divestments are spread out over the 1996-1999 period, the acquisitions are very strongly concentrated in 1997, which was in fact a ‘boom year’ for such forms of firm entry/expansion [18] . There are more than 1.1 million individuals, observed approximately 3.3 million times. 1.8 million of these worker-years are employed in foreign firms.

3. Firm-Level Analysis

3.1. Descriptive Statistics

Given the richness of the data, we consider a large set of firm- and worker-level variables in our analysis. Most of these variables are derived directly from the original data set, but other variables were constructed by us, based on such original variables. The latter group includes worker flow variables, which are created from the worker-level data and then merged back into the firm-level data.

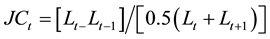

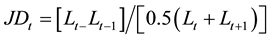

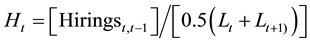

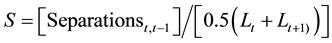

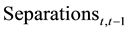

All flow variables (job and workers) are defined in the way that has become standard in the literature [19] . Each rate is constructed by dividing a given own by the average employment of the firm over the two periods

analyzed. Specifically, the job creation rate is defined as  if

if , or

, or , if

, if  in which

in which  denotes the number of workers in period t. Similarly, the job destruction rate is defined as

denotes the number of workers in period t. Similarly, the job destruction rate is defined as , if

, if , or

, or , if

, if . Moreover, the net job creation rate (NJCRt) corresponds to

. Moreover, the net job creation rate (NJCRt) corresponds to  and the job reallocation rate

and the job reallocation rate  is

is .

.

In terms of worker flows, the hiring rate is , in which

, in which  denotes the number of workers present in the firm in the period

denotes the number of workers present in the firm in the period  but not in period

but not in period

and the churning rate (CRt), a measure of “excessive turnover” [20] , is defined here as

Before conducting regression analyses, we provide some comparisons from the raw data. We compare three types of firms, the first category (Table 1) corresponding to firms that do not switch nationality, i.e. either firms that are always domestic owned (left-hand-side columns) or firms that are always foreign owned (right-hand- side columns). The second type of firms corresponds to acquisitions―domestic firms that are acquired by foreign investors (Table 2), in which the left-hand-side columns describe those firms before they undergo their change in ownership and the right-hand-side columns describe those firms after the change in ownership. Finally, the third category (Table 3) corresponds to divestments-foreign firms that are acquired by domestic investors.

Table 1. Non-acquired firms-descriptive statistics. Sample: only firms that are either always domestic or always foreign owned over the period 1995-1999.

Notes: This table describes the characteristics of firms that do not change their domestic/foreign status over the 1995-1999 period. Each firm-year carries the same weight. Schooling refers to the average schooling (measured in years) of the workforce of the firm in each year; experience is defined as Mincer experience; tenure is measured in months; “foreign worker” is a dummy taking value one for workers who are not Brazilian nationals, “firm size” is measured as the (spell-weighted) number of workers in the firm, and pay is measured in 2006 “reais”. Job creation rate and the following job and worker flow rates are defined in the standard way (see main text). “1995”, “1996”, etc., are dummy variables for each year.

Table 2. Acquisitions-descriptive statistics. Sample: firms that are initially domestic owned and are then acquired by foreign investors.

Notes: This table describes the characteristics of firms that switch from domestic to foreign status over the 1995-1999 period. The left columns describe these firms while they are domestic owned and the right columns describe these same firms when they are foreign owned. See Table 1 for description of variables and weights.

Table 3. Divestments-descriptive statistics. Sample: firms that are initially foreign owned and are then acquired by domestic investors.

Notes: This table describes the characteristics of firms that switch from foreign to domestic status over the 1995-1999 period. The left columns describe these firms while they are foreign owned and the right columns describe these same firms when they are domestic owned. See Table 1 for description of variables and weights.

Again, the left-hand-side columns describe those firms before they undergo their change in ownership and the right-hand-side columns describe those firms after the change in ownership. In all tables, the very last column displays the p-value of the test of the equality of the means of each variable across the two subsamples.

Each table describes average worker characteristics of each firm-year, in which all firm-years are weighted equally, regardless of firm size. Besides the standard human capital variables (schooling, experience, gender, tenure), and real wages and real wage growth, we also present information about the workers’ nationality (Brazilian or non-Brazilian). Finally, we also include descriptive statistics about job and worker flows and year dummy variables.

First, when comparing always-domestic and always-foreign firms (Table 1), we find that, amongst other differences, the latter group exhibits more educated workers, a greater percentage of foreign workers (1.8% against 0.6%), larger firms and higher log wages (2.61 against 2.05). Job and worker flows are also different, as foreign firms exhibit less job destruction (and more net job creation), and also less worker reallocation and churning.3

Table 2 compares firms before and after they are acquired (i.e. before and after they move from domestic to foreign ownership). We find that average education increases, that the female share falls considerably, while firm size falls only marginally (and not significantly). Job reallocation increases while churning falls but not significantly.

Finally, Table 3 compares the same firms, before and after they are divested (i.e. before and after they move from foreign to domestic ownership). We find that, again, the female share falls considerably and so does the firm size (from 230 to 97 workers), while the remaining variables generally do not change in a significant way, the main exception being job reallocation that almost doubles.

Overall, our findings from the descriptive statistics suggest that acquisitions and divestments are different processes, not only in terms of the before-after changes in firm and worker characteristics but also in terms of the type of firms subject to each type of change of ownership (i.e. when comparing the left columns of Table 2 and Table 3). For instance, divested firms tend to be much smaller, to pay lower wages and to have workers with lower levels of tenure when compared to acquired firms. The divested firms also exhibit more worker turnover, more job destruction and less net job creation even before they are divested. With respect to before- after changes in firm characteristics, divestments seem to involve much higher job cuts but higher increases in pay when compared to acquisitions.

In the next section, we extend these comparisons to a regression framework.

3.2. Results

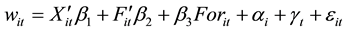

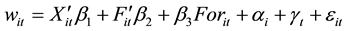

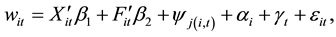

Our empirical analysis involves the estimation of wage, size and job and worker flow equations, firstly using data aggregated at the firm level. In the case of wages, the equation we consider, based on equation (12) and the discussion in Appendix C, is:

in which

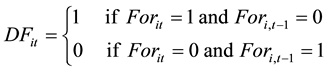

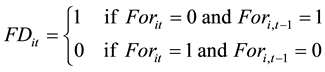

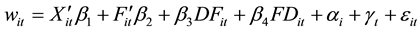

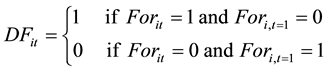

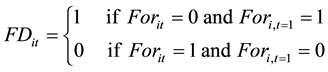

We also decompose the wage differential between acquisitions and divestments. In fact, there are no ‘a priori’ reasons for the effect of such changes in ownership to be symmetric, i.e. for the effects of divestments to be equal to minus the effect of acquisitions. We carry out this decomposition by considering the following wage equation:

in which all variables take the same meaning as in Equation (1),

and

β3 and β4 are the parameters of interest, indicating the average change in wages for firms that undergo acquisitions or divestments, respectively.

Table 4 presents the results for each one of the two specifications. Columns 1-4 consider different versions of equation 1 while columns 5-8 consider different versions of Equation (2). The OLS results corroborate the standard finding that foreign firms pay higher wages, the premium ranging from more than 50%, when only firm-level control variables are included, to more than 25%, when worker-level control variables are also included.4 However, once the specification includes firm fixed effects (i.e. once the identification of the foreign firm difference is based on acquisitions and divestments), we find that there are no significant wage differences between the two types of firms.

Moreover, we also find that, when disentangling the wage differences between acquisitions and divestments, there are no significant differences between the two types of ownership change. This result is robust to controlling for worker characteristics (column 6) and to restricting the sample to the last year before ownership change

Table 4. Firm wage equations.

Notes: Dependent variable: Log average real hourly wage. All columns include firm-level controls (size, industry dummies and state dummies) and year dummies. Even columns includes worker-level controls (average of the following characteristics of workers: schooling, experience and its square, tenure and its square; and the share of female workers and of foreign workers). “Foreign firm” is a dummy taking value one if the firm-year is foreign owned (and value zero otherwise). “D-to-F switcher” is a dummy taking value one if the firm was domestic owned in the previous period(s) and is foreign owned in the current period(s) (and value zero otherwise). “F-to-D switcher” is a dummy taking value one if the firm was foreign owned in the previous period(s) and is domestic owned in the current period(s) (and value zero otherwise). All firm-years used in all specifications, except in the final two columns (only firms that switch ownership, domestic or foreign, are observed, and only in the last period before changing and in the first period after changing). All firm-years receive the same weight. Robust standard errors. Significance levels: *: 0.10; **: 0.05; ***: 0.01.

and the first year after that (columns 7 and 8). While there is evidence of a significant wage decrease following an acquisition, the lack of precision of the coefficient for divestments rules out the rejection of the equality of the two effects. It is also interesting to notice that changes in some worker characteristics are very significant in predicting wage changes: for instance, increases in the percentage of foreign workers tend to be associated with (particularly large) increases in wages, while increases in the percentage of female workers tend to be associated with declines in wages.

For the remaining dependent variables that we analyze in Tables 5-9 (firm size, job creation, job destruction, job reallocation, worker reallocation and churning), we consider exactly the same specifications as for wages, except that we do not include the measure of firm size in the list of regressors. In the case of firm size (Table 5), we find, as suggested by the analysis of the descriptive statistics, that foreign firms are bigger. This result also holds after controlling for firm fixed effects. Actually, it even increases once controlling for firm fixed effects, which is consistent with the fact that our sample is matched in 1995 characteristics, including size. Moreover, once we separate the foreign firm dummy into the “D-to-F switcher” and the “F-to-D switcher” dummies, we obtain evidence that most of the effect is driven from the downsizing of firms that undergo divestment, as there is no effect from firms that are acquired.

The results for net job creation rates (Table 6) are similar to those for firm size: Foreign firms are shown to exhibit higher net job creation rates and most of the effect comes from the lower rates exhibited by “F-to-D switchers”, not from higher rates for “D-to-F switchers”. However, the difference is not significant in two speci- fications, although the point estimates are still consistent with the remaining results.5 Overall, the robustness of the results across Table 5 and Table 6 is important as it addresses, at least in part, the possibility that firms undergoing divestment are already cutting their job levels before the process of change of ownership begins. In

Table 5. Firm size equations.

Notes: Dependent variable: Log firm size (number of workers in each year, weighted by length of spell of each individual). All columns include firm-level controls (industry dummies and state dummies) and year dummies. Even columns includes worker-level controls (average of the following characteristics of workers: schooling, experience and its square, tenure and its square; and the share of female workers and of foreign workers). “Foreign firm” is a dummy taking value one if the firm-year is foreign owned (and value zero otherwise). “D-to-F switcher” is a dummy taking value one if the firm was domestic owned in the previous period(s) and is foreign owned in the current period(s) (and value zero otherwise). “F-to-D switcher” is a dummy taking value one if the firm was foreign owned in the previous period(s) and is domestic owned in the current period(s) (and value zero otherwise). All firm-years used in all specifications, except in the final two columns (only firms that switch ownership, domestic or foreign, are observed, and only in the last period before changing and in the first period after changing). All firm-years receive the same weight. Robust standard errors. Significance levels: *: 0.10; **: 0.05; ***: 0.01.

Table 6. Net job creation equations.

Notes: Dependent variable: Net job creation rate (defined as in the text: the change in firm size divided by the average firm size, if positive, zero otherwise). All columns include firm-level controls (industry dummies and state dummies) and year dummies. Even columns includes worker-level controls (average of the following characteristics of workers: schooling, experience and its square, tenure and its square; and the share of female workers and of foreign workers). “Foreign firm” is a dummy taking value one if the firm-year is foreign owned (and value zero otherwise). “D-to-F switcher” is a dummy taking value one if the firm was domestic owned in the previous period(s) and is foreign owned in the current period(s) (and value zero otherwise). “F-to-D switcher” is a dummy taking value one if the firm was foreign owned in the previous period(s) and is domestic owned in the current period(s) (and value zero otherwise). All firm-years used in all specifications, except in the final two columns (only firms that switch ownership, domestic or foreign, are observed, and only in the last period before changing and in the first period after changing). All firm-years receive the same weight. Robust standard errors. Significance levels: *: 0.10; **: 0.05; ***: 0.01.

Table 7. Job destruction equations.

Notes: Dependent variable: Job destruction rate (defined as in the text: the absolute value of the change in firm size divided by the average firm size, if change is negative, zero otherwise). All columns include firm-level controls (industry dummies and state dummies) and year dummies. Even columns includes worker-level controls (average of the following characteristics of workers: schooling, experience and its square, tenure and its square; and the share of female workers and of foreign workers). “Foreign firm” is a dummy taking value one if the firm-year is foreign owned (and value zero otherwise). “D-to-F switcher” is a dummy taking value one if the firm was domestic owned in the previous period(s) and is foreign owned in the current period(s) (and value zero otherwise). “F-to-D switcher” is a dummy taking value one if the firm was foreign owned in the previous period(s) and is domestic owned in the current period(s) (and value zero otherwise). All firm-years used in all specifications, except in the final two columns (only firms that switch ownership, domestic or foreign, are observed, and only in the last period before changing and in the first period after changing). All firm-years receive the same weight. Robust standard errors. Significance levels: *: 0.10; **: 0.05; ***: 0.01.

Table 8. Job reallocation equations.

Notes: Dependent variable: Job reallocation rate (defined as in the text: the sum of job creation and job destruction divided by the average firm size). All columns include firm-level controls (industry dummies and state dummies) and year dummies. Even columns includes worker-level controls (average of the following characteristics of workers: schooling, experience and its square, tenure and its square; and the share of female workers and of foreign workers). “Foreign firm” is a dummy taking value one if the firm-year is foreign owned (and value zero otherwise). “D-to-F switcher” is a dummy taking value one if the firm was domestic owned in the previous period(s) and is foreign owned in the current period(s) (and value zero otherwise). “F-to-D switcher” is a dummy taking value one if the firm was foreign owned in the previous period(s) and is domestic owned in the current period(s) (and value zero otherwise). All firm-years used in all specifications, except in the final two columns (only firms that switch ownership, domestic or foreign, are observed, and only in the last period before changing and in the first period after changing). All firm-years receive the same weight. Robust standard errors. Significance levels: *: 0.10; **: 0.05; ***: 0.01.

Table 9. Worker reallocation equations.

Notes: Dependent variable: Worker reallocation rate (defined as in the text: the sum of hirings and separations divided by the average firm size). All columns include firm-level controls (industry dummies and state dummies) and year dummies. Even columns include worker-level controls (average of the following characteristics of workers: schooling, experience and its square, tenure and its square; and the share of female workers and of foreign workers). “Foreign firm” is a dummy taking value one if the firm-year is foreign owned (and value zero otherwise). “D-to-F switcher” is a dummy taking value one if the firm was domestic owned in the previous period(s) and is foreign owned in the current period(s) (and value zero otherwise). “F-to-D switcher” is a dummy taking value one if the firm was foreign owned in the previous period(s) and is domestic owned in the current period(s) (and value zero otherwise). All firm-years used in all specifications, except in the final two columns (only firms that switch ownership, domestic or foreign, are observed, and only in the last period before changing and in the first period after changing). All firm-years receive the same weight. Robust standard errors. Significance levels: *: 0.10; **: 0.05; ***: 0.01.

such a case, net job creation would already be negative just before divestment, leading to smaller and/or insignificant estimates, which we do not find in these results.

Given that job creation is very small across the firms in our sample, our results about this variable (not reported) are almost always insignificant or indicating very small differences across the two types of firms (slightly larger for foreign firms, but only in specifications without firm fixed effects). Unsurprisingly, Table 7, which presents estimates for job destruction, indicates similar results as the net job creation rate, although of the opposite sign. We find that foreign firms exhibit less job destruction than domestic firms although the differences are in some cases insignificant.

Consistent with the previous tables, we find that job reallocation (the sum of job creation and job destruction) is significantly lower in foreign firms, while “F-to-D” switchers are the main drivers of such effect (Table 8). A similar result is found when addressing worker reallocation (the sum of worker hirings and worker separations―see Table 9).6

4. Worker-Level Analysis

Here we address the unobserved heterogeneity problem by following the same workers as they move across different domestic and foreign firms. Again, this is only possible using matched employer-employee panel data, so that one can trace workers over time and focus, for instance, on those who change employers.

4.1. Descriptive Statistics

We consider five types of workers: stayers, “movers” through acquisitions, “movers” through divestments, movers from domestic to foreign firms and, finally, movers from foreign to domestic firms. In each table and for each type of mover we present descriptive statistics about the worker and the worker’s firm before and after the movement (left and right columns, respectively). In the case of stayers, we present descriptive statistics separately for stayers in domestic and foreign firms.

Table 10 refers to the latter cases, which also correspond to the largest category in our data. We find more than 0.8 million workers-year that stay in the same domestic firms between 1995 and 1999 and more than 1.2 million workers-year that stay in the same foreign firms over the same period. According to the table, some of the most important differences are related to tenure (higher for workers in foreign firms), nationality (twice as many foreign workers in foreign firms, in proportional terms), firm size, pay and pay growth (all bigger in foreign firms). The net job creation rate and the worker reallocation rate are also higher in foreign firms. (Given the large size of the data, all differences are statistically significant at any conventional levels.) When considering instead workers that stay in firms that are subject to acquisition (Table 11), we find that tenure tends to increase while the percentage of female workers and the size of the firm fall. (Bear in mind that, although these workers are the same in the two periods, their distribution is not necessarily the same: the changes in their observable characteristics are related to differences in terms of how many times each workers appears before and after the change in his/her status.) Moreover, pay and pay growth increase while net job creation also increases.

Table 12 considers divestments. An important difference between the periods before and after the change in ownership is probably the decrease in firm size, from an average of 182 workers in foreign firms to an average of 134 when in domestic firms. We also find that pay and pay growth increase, although only the latter significantly.

We now consider the case of workers that move between firms. Table 13 presents descriptive statistics for workers that move from a domestic to a foreign firm. As expected, there is a significantly larger percentage of workers that are new hires. (However, not all are new hires, as we keep following these workers after they move.) Pay and pay growth increases significantly. Comparing firm-level job and worker flow rates, we find that movers from domestic to foreign firms tend to become employed in firms with higher job (gross and net) creation rates and worker reallocation.

Finally, we consider the case of workers that move from a foreign to a domestic firm (Table 14). Unlike in the previous case, pay and pay growth tend to fall. Comparing firm-level job and worker flow rates, we find that, amongst other results, movers from domestic to foreign firms tend to become employed in firms with low job (gross and net) creation rates.

Table 10. Worker-level descriptive statistics: Only workers that always stay in firms that are either always domestic or always foreign owned over the period 1995-1999.

Notes: This table describes the characteristics of workers that do not change their affiliation between domestic or foreign firms over the 1995-1999 period. However, workers may move between firms, provided they are in the same “sector”. Schooling is measured in years; experience defined as Mincer experience; tenure measured in months; “foreign worker” is a dummy taking value one for workers who are not Brazilian nationals, ‘firm size’ is measured in terms of the number of workers in the firm in 31 December of the year, “dismissal without cause” is a dummy variable taking value one if the worker was fired without cause from his/her previous job, “new hire” is a dummy taking value one if the worker is in the first year in the current firm, “reemployed” is a dummy taking value one if the worker left and then returned to the current firm, pay is measured in 2006 “reais”, “foreign firm” is a dummy taking value one for firms owned at least at 50% by foreign investors. Job creation rate and the following job and worker flow rates are defined in the standard way (see main text). “1995”, “1996”, etc., are dummy variables for each year.

Table 11. Worker-level descriptive statistics: Only workers that stay in firms that are initially domestic owned and are then acquired by foreign investors.

Notes: This table describes the characteristics of workers that change their affiliation from domestic to foreign firms over the 1995-1999 period because their firms are acquired and they stay in that firm. Schooling is measured in years; experience defined as Mincer experience; tenure measured in months; “foreign worker” is a dummy taking value one for workers who are not Brazilian nationals, “firm size” is measured in terms of the number of workers in the firm in 31 December of the year, “dismissal without cause” is a dummy variable taking value one if the worker was fired without cause from his/her previous job, “new hire” is a dummy taking value one if the worker is in the first year in the current firm, “reemployed” is a dummy taking value one if the worker left and then returned to the current firm, pay is measured in 2006 “reais”, “foreign firm” is a dummy taking value one for firms owned at least at 50% by foreign investors. Job creation rate and the following job and worker flow rates are defined in the standard way (see main text). “1995”, “1996”, etc., are dummy variables for each year.

Table 12. Worker-level descriptive statistics: Only workers that stay in firms that are initially foreign owned and are then acquired by domestic investors.

Notes: This table describes the characteristics of workers that change their affiliation from foreign to domestic firms over the 1995-1999 period because their firms are acquired and they stay in that firm. Schooling is measured in years; experience defined as Mincer experience; tenure measured in months; “foreign worker” is a dummy taking value one for workers who are not Brazilian nationals, “firm size” is measured in terms of the number of workers in the firm in 31 December of the year, “dismissal without cause” is a dummy variable taking value one if the worker was fired without cause from his/her previous job, “new hire” is a dummy taking value one if the worker is in the first year in the current firm, “reemployed” is a dummy taking value one if the worker left and then returned to the current firm, pay is measured in 2006 “reais”, “foreign firm” is a dummy taking value one for firms owned at least at 50% by foreign investors. Job creation rate and the following job and worker flow rates are defined in the standard way (see main text). “1995”, “1996”, etc., are dummy variables for each year.

Table 13. Worker-level descriptive statistics: Only workers that stay in firms that are initially foreign owned and are then acquired by domestic investors.

Notes: This table describes the characteristics of workers that change their affiliation from domestic to foreign firms over the 1995-1999 period because they move between firms. Schooling is measured in years; experience defined as Mincer experience; tenure measured in months; “foreign worker” is a dummy taking value one for workers who are not Brazilian nationals, “firm size” is measured in terms of the number of workers in the firm in 31 December of the year, “dismissal without cause” is a dummy variable taking value one if the worker was fired without cause from his/her previous job, “new hire” is a dummy taking value one if the worker is in the first year in the current firm, “reemployed” is a dummy taking value one if the worker left and then returned to the current firm, pay is measured in 2006 “reais”, “foreign firm” is a dummy taking value one for firms owned at least at 50% by foreign investors. Job creation rate and the following job and worker flow rates are defined in the standard way (see main text). “1995”, “1996”, etc., are dummy variables for each year.

Table 14. Worker-level descriptive statistics: Workers that move from foreign to domestic firms.

Notes: This table describes the characteristics of workers that change their affiliation from foreign to domestic firms over the 1995-1999 period because they move between firms. Schooling is measured in years; experience defined as Mincer experience; tenure measured in months; “foreign worker” is a dummy taking value one for workers who are not Brazilian nationals, “firm size” is measured in terms of the number of workers in the firm in 31 December of the year, “dismissal without cause” is a dummy variable taking value one if the worker was fired without cause from his/her previous job, “new hire” is a dummy taking value one if the worker is in the first year in the current firm, “reemployed” is a dummy taking value one if the worker left and then returned to the current firm, pay is measured in 2006 “reais”, “foreign firm” is a dummy taking value one for firms owned at least at 50% by foreign investors. Job creation rate and the following job and worker flow rates are defined in the standard way (see main text). “1995”, “1996”, etc., are dummy variables for each year.

4.2. Regression Results

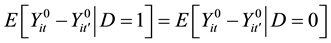

We now estimate wage equations using data at the worker level. The wage equation we consider here is:

in which

Table 15 presents the results of equation 5 without firm-level controls7 and Table 16 presents the same

Table 15. Worker-level wage equations.

Notes: Dependent variable: log real hourly wage. Worker-level controls are schooling, experience and its square, tenure and its square, a female dummy variable and a foreign worker (non-Brazilian) dummy variable. All columns except (1) include worker fixed effects. “Foreign firm” is a dummy taking value one if the firm-year is foreign owned (and value zero otherwise). “D-to-F mover” is a dummy taking value one if the worker was employed in a domestic firm in the previous periods and is employed in a foreign owned firm in the current period (and value zero otherwise). “F-to-D mover” is a dummy taking value one if the worker was employed in a foreign firm in the previous periods and is employed in a domestic owned firm in the current period (and value zero otherwise). All specifications include year dummies. Robust standard errors, clustered at the firm level. Significance levels: *: 0.10; **: 0.05; ***: 0.01.

Table 16. Worker-level wage equations, including firm-level controls.

Notes: Dependent variable: log real hourly wage. Worker-level controls are schooling, experience and its square, tenure and its square, a female dummy variable and a foreign worker (non-Brazilian) dummy variable. All columns except (1) include worker fixed effects. “Foreign firm” is a dummy taking value one if the firm-year is foreign owned (and value zero otherwise). “D-to-F mover” is a dummy taking value one if the worker was employed in a domestic firm in the previous periods and is employed in a foreign owned firm in the current period (and value zero otherwise). “F-to-D mover” is a dummy taking value one if the worker was employed in a foreign firm in the previous periods and is employed in a domestic owned firm in the current period (and value zero otherwise). All specifications include year dummies. Robust standard errors, clustered at the firm level. Significance levels: *: 0.10; **: 0.05; ***: 0.01.

results including firm-level controls

Moreover, when decomposing such premium in the wage difference driven by acquisitions or divestments and the wage difference driven by worker mobility, we find that the wage difference in the first case is virtually zero while the difference from mobility is about 4% (columns 3 and 4). These differences hold when using only observations from the period immediately before or immediately after the change in firm status (columns 5 and 6). Moreover, all results are robust to controlling for firm characteristics (Table 16), except that the OLS result is now significant.

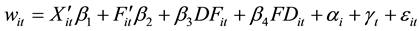

As before, in the firm-level analysis, we are also interested in decomposing the foreign firm effect into changes from domestic to foreign and vice versa. In order to do this, we now estimate new individual-level wage equations as follows:

in which all variables are defined in the same way as in Equation (5), while

and

Table 17 presents the results of Equation (6) without firm-level controls. The results indicate that foreign- to-domestic mobility is generally associated to wage cuts. On the other hand, domestic-to-foreign mobility is either associated to wage gains (column 6) or wage cuts that are smaller than those of foreign-to-domestic movers. These findings are corroborated when including firm-level controls (Table 18).

Unlike before, the overall difference between foreign and domestic firms is driven by both stayers and movers: movers that switch from a foreign to a domestic firm take a significant pay cut of about 9%, while the wage difference for switchers from domestic to foreign firms is about 7% (columns 3 and 4). When considering only workers-year observed immediately before or after the change in firm type, the coefficients either are not significant or only domestic-to-foreign movers increase their pay. All these results are generally robust to the inclusion of firm-level controls―see Table 18.

4.3. Firm and Worker Fixed Effects

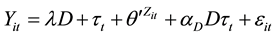

Finally, we estimate wage equations including simultaneously worker and firm fixed effects [4] :

in which all variables are defined as before and

As it is well known in the literature, the estimation of these models relies on workers that move between firms, a process which we have documented in some detail in this section. In practical terms, we pursue the methods discussed in [14] and the routine developed in [21] .8 These methods involve the identification in the data of a

Table 17. Worker-level wage equations, by mobility type.

Notes: Dependent variable: log real hourly wage. Worker-level controls are schooling, experience and its square, tenure and its square, a female dummy variable and a foreign worker (non-Brazilian) dummy variable. All columns except (1) include worker fixed effects. “Foreign firm” is a dummy taking value one if the firm-year is foreign owned (and value zero otherwise). “D-to-F mover” is a dummy taking value one if the worker was employed in a domestic firm in the previous periods and is employed in a foreign owned firm in the current period (and value zero otherwise). “F-to-D mover” is a dummy taking value one if the worker was employed in a foreign firm in the previous periods and is employed in a domestic owned firm in the current period (and value zero otherwise). All specifications include year dummies. Robust standard errors, clustered at the firm level. Significance levels: *: 0.10; **: 0.05; ***: 0.01.

Table 18. Worker-level wage equations, by mobility type, with firm-level controls.

Notes: Dependent variable: log real hourly wage. Worker-level controls are schooling, experience and its square, tenure and its square, a female dummy variable and a foreign worker (non-Brazilian) dummy variable. All columns except (1) include worker fixed effects. “Foreign firm” is a dummy taking value one if the firm-year is foreign owned (and value zero otherwise). “D-to-F mover” is a dummy taking value one if the worker was employed in a domestic firm in the previous periods and is employed in a foreign owned firm in the current period (and value zero otherwise). “F-to-D mover” is a dummy taking value one if the worker was employed in a foreign firm in the previous periods and is employed in a domestic owned firm in the current period (and value zero otherwise). All specifications include year dummies. Robust standard errors, clustered at the firm level. Significance levels: *: 0.10; **: 0.05; ***: 0.01.

(large) group of workers and their firms amongst whom there are connections via worker mobility. In our case, this first group accounts for about 95% of the entire data. Under the assumption that mobility is exogenous (and normalizing worker fixed effects so that their sum is equal to zero), one can then estimate the two sets of fixed effects.

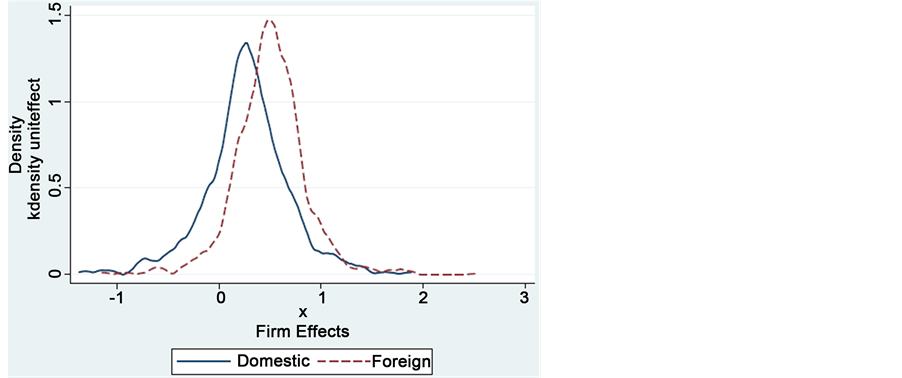

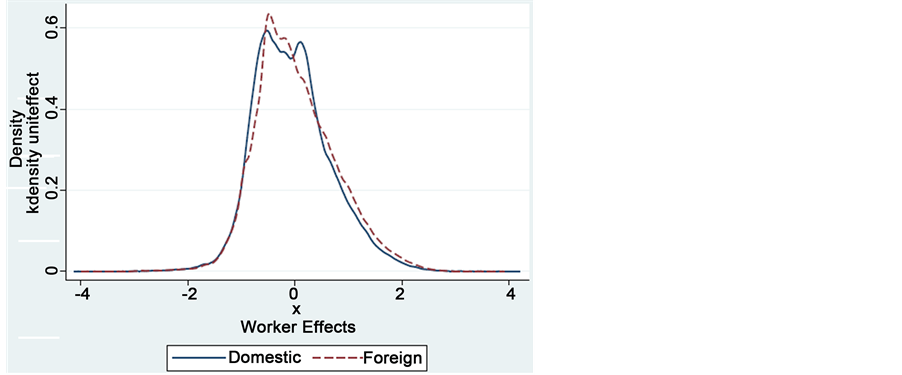

Our results indicate a considerable degree of dispersion across either worker or firms-see Figure 2 and Figure 3. However, the average firm effect for domestic firms is 0.274 while the same number for foreign firms is 0.499 (these averages are computed by considering all firms-year in which a firm is either domestic or foreign owned; the standard deviations of these firm fixed effects are, respectively, 0.411 and 0.346). Indeed, Figure 2 indicates that the distribution of foreign firms fixed effects corresponds approximately to a rightward translation of the equivalent distribution for domestic firms. On the other hand, we find that the average worker effect when the worker is employed by a domestic firm is −0.040 while the average worker effect when the worker is employed by a foreign firm is −0.027 (similarly to the previous case, these worker averages are computed by considering all workers-year in which a worker is employed in either a domestic or a foreign firm; the standard deviations of these worker fixed effects are, respectively, 0.706 and 0.740).

Overall, the results provide strong support of more generous wage policies offered by foreign firms, as the average fixed effect of the latter is approximately 0.22 log points higher than the average firm fixed effect of domestic firms. On the other hand, the results suggest that worker selection issues across domestic and foreign firms are also relevant but of less importance, as their difference is only 0.067 log points, or less than one fourth

Figure 2. Distribution of firm effects. Source: Authors’ calculations.

Figure 3. Distribution of worker effects. Source: Authors’ calculations.

of the average difference documented from the firm fixed effects. However, a caveat to be considered in this analysis is that there is considerable dispersion in the firm fixed effects, implying that many foreign firms do pay lower wages than similar domestic firms.

5. Discussion

How much do developing countries benefit from foreign investment? We contribute to this question by comparing the employment and wage practices of foreign and domestic firms in Brazil, using detailed matched firm- worker panel data. In order to control for unobserved worker differences, we examine not only acquisitions (when foreign investors acquire domestic firms) but also divestments (when domestic investors acquire foreign firms). Moreover, we also consider the wage implications of worker mobility, from foreign to domestic firms and vice versa. Throughout our analyses we also pay particular attention to employment levels at the different types of firms and to the differences between the firm- and worker-levels.

We find that both types of acquisitions (domestic to foreign or vice versa) do not tend to affect wages significantly, a result consistent with the literature [7] - [9] . However, although this wage result holds both at the firm- and the worker-levels, divestments tend to lead to large job cuts, unlike acquisitions. In other words, divestments appear to involve much more job reallocation that acquisitions.

One possible implication of this result is that, in general, the comparability of acquisition and the divestment wage results may need to be considered carefully. For instance, the wage changes of stayers involved in acquisitions may be more “representative” than the wage changes of workers involved in divestments. This would be the case if the new owners following a divestment tend to offer lower pay to a greater share of their workforce, prompting a larger number of workers to leave, when compared to the case of foreign acquisitions. A complementary interpretation involves the reassignment of workers in divested firms to other firms of the same holding group of the new owner.

We also find that, while movers from foreign to domestic firms typically take (large) wage cuts when they move, movers from domestic to foreign firms tend to either take lower wage cuts or to maintain or even to increase their pay ([23] presents similar evidence using Portuguese matched data). Of course, this process of worker mobility may be subject to selection issues. In any case, the fact that workers that leave domestic firms and become employed by foreign investors receive lower wage decreases or even wage increases supports the view that foreign firms offer more generous wage policies.

Moreover, such findings are reinforced by our novel estimates of worker and firm fixed effects. Although this analysis indicated considerable dispersion of both types of fixed effects―an interesting finding that merits further research―, the fixed effects of foreign firms are, on average, considerably higher than those of domestic firms. On top of that, our results also suggest that worker selection issues are not particularly important, as the difference of the average worker fixed effects across domestic and foreign firms are relatively small.

From a methodological point of view, the findings in our paper underline the importance of considering employment issues when studying changes in ownership, particularly when one wants to address wage differentials. We also present evidence that the related theme of worker mobility can be particularly illuminating from the point of view of the assessment of the role of foreign firms in labour markets. From the point of view of the debate of the effects of globalization, our results suggest that foreign firms play a positive role in the labour market of Brazil and, perhaps, other developing countries.

Finally, our results support the hypothesis that the employment and compensation practices differ considerably between domestic and foreign firms in Brazil. The evidence presented throughout the article, 1) evidence of higher job destruction rates when the firm ownership changes nationality from domestic to foreign; and 2) evidence of higher wage reductions when a worker migrates from a foreign firm to national one-point to the fact that, under similar conditions, foreign firms are relatively less prone to implement staff and wages cuts. So, it is possible to infer that foreign firms would contribute to reduce employment instability in Brazil.

Acknowledgements

We thank Alex Hijzen, Francis Kramarz, Robert Lipsey, Robert Lensink, Eduardo P. Ribeiro, Fredrik Sjöholm, Jan Svejnar, Eric Strobl, Katherine Terrell, Richard Upward and conference/workshop participants at the Universities of Nottingham, Michigan, and Ghent, at Central European University (CAED), and at IPEA (Brasilia) for their feedback. We also thank IPEA, Gustavo Costa and Fernando Freitas for logistical and computational support and Martins gratefully acknowledges the British Academy (research grant SG-44044). The data used in this paper are confidential but the authors’ access is not exclusive.

References

- Aitken, B., Harrison, A. and Lipsey, R. (1996) Wages and Foreign Ownership: A Comparative Study of Mexico, Venezuela, and the United States. Journal of International Economics, 40, 345-371. http://dx.doi.org/10.1016/0022-1996(95)01410-1

- Velde, D. and Morrisey, O. (2003) Do Workers in Africa Get a Wage Premium If Employed in Firms Owned by Foreigners? Journal of African Economies, 12, 41-73. http://dx.doi.org/10.1093/jae/12.1.41

- Lipsey, R. and Sjoholm, F. (2004) Foreign Direct Investment, Education, and Wages in Indonesian Manufacturing. Journal of Development Economics, 73, 415-422. http://dx.doi.org/10.1016/j.jdeveco.2002.12.004

- Abowd, J., Kramarz, F. and Margolis, D. (1999) High Wage Workers and High Wage Firms. Econometrica, 67, 251- 333. http://dx.doi.org/10.1111/1468-0262.00020

- Conyon, M., Girma, S., Thompsom, S. and Wright, P. (2002) The Productivity and Wage Effects of Foreign Acquisition in the United Kingdom. Journal of Industrial Economics, 50, 85-102. http://dx.doi.org/10.1111/1467-6451.00169

- Lipsey, R. and Sjoholm, F. (2006) Foreign Firms and Indonesian Manufacturing Wages: An Analysis with Panel Data. Economic Development and Cultural Change, 55, 201-221. http://dx.doi.org/10.1086/505723

- Martins, P.S. (2004) Do Foreign Firms Really Pay Higher Wages? Evidence from Different Estimators. IZA Discussion Paper, Bonn, 1388.

- Heyman, F., Sjoholm, F. and Tingvall, P.G. (2007) Is There Really a Foreign Ownership Wage Premium? Evidence from Matched Employer-Employee Data. Journal of International Economics, 73, 355-376. http://dx.doi.org/10.1016/j.jinteco.2007.04.003

- Andrews, M., Bellman, L., Schank, T. and Upward, R. (2007) The Takeover and Selection Effects of Foreign Ownership in Germany: An Analysis Using Linked Worker-Firm Data. GEP University of Nottingham Research Paper, Nottingham.

- Earle, J. and Telegdy, A. (2007) Ownership and Wages: Estimating Public-Private and Foreign-Domestic Differentials Using LEED from Hungary, 1986-2003. NBER Working Paper, Cambridge, MA, 12997.

- Martins, P.S. (2006) Inter-Firm Worker Mobility, Wages, and Foreign Direct Investment Spillovers. Mimeo, Queen Mary University of London.

- Poole, J. (2007) Multinational Spillovers through Worker Turnover. Mimeo, University of California, Santa Cruz.

- Balsvik, R. (2008) Is Mobility of Labour a Channel for Spillovers from Multinationals to Local Domestic Firms? Mimeo, Norwegian School of Economics and Business Administration, Bergen.

- Abowd, J., Creecy, R. and Kramarz, F. (2002) Computing Person and Firm Effects Using Linked Longitudinal Employer-Employee Data. Mimeo, Cornell University Working Paper, Ithaca.

- Martins, P.S. and Esteves, L.A. (2006) Is There Rent Sharing in Developing Countries? Matched-Panel Evidence from Brazil. IZA Discussion Paper, Bonn, 2317.

- DeNegri, F. (2003) Desempenho comercial das empresas estrangeiras no Brasil na d´ecada de 90 [The Performance of Foreign Firms in Brazil in the 1990s]. Mimeo, Universidade Estadual de Campinas, Campinas/SP.

- Rosenbaum, P. and Rubin, D. (1983) The Central Role of the Propensity Score in Observational Studies for Causal Effects. Biometrika, 70, 41-55. http://dx.doi.org/10.1093/biomet/70.1.41

- KPMG (2001) Mergers and Acquisitions in Brazil: An Analysis of the 1990s. KPMG Corporate Finance, Sao Paulo.

- Davis, S.J., Haltiwanger, J.C. and Schuh, S. (1996) Job Creation and Destruction. MIT Press, Cambridge.

- Burgess, S., Lane, J. and Stevens, D. (2000) Job Flows, Worker Flows, and Churning. Journal of Labor Economics, 18, 473-502. http://dx.doi.org/10.1086/209967

- Ouazad, A. (2006) A2REG: Stata Module. Mimeo, Cornell University, Ithaca.

- Martins, P.S. (2008) Dispersion in Wage Premiums and Firm Performance. Economics Letters, 101, 63-65. http://dx.doi.org/10.1016/j.econlet.2008.04.006

- Martins, P.S. (2008) Foreign Ownership and Wages: Evidence from Worker Mobility. Mimeo, Queen Mary University of London.

- Muendler, M.A. (2003) Foreign Direct Investment by Sector of Industry, Brazil 1980-2000. Mimeo, University of California, San Diego.

- Ashenfelter, O. (1978) Estimating the Effect of Training Programs on Earnings. Review of Economics and Statistics, 60, 47-57. http://dx.doi.org/10.2307/1924332

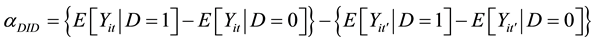

Appendix A. Identification

Let

The idea behind a difference-in-differences (DID) estimator is that we can use an untreated comparison group to identify temporal variation in the outcome that is not due to the treatment. However, in order to achieve identification of the general DID estimator we need to assume that the average outcomes for the treated and control groups would have followed parallel paths over time. This is known as the time invariance assumption

where

If assumption (10) holds, the DID estimate of the average treatment effect on the treated can be obtained by the sample analogs of

The expression above simply states that the impact of the program is given by the difference between participants and nonparticipants in the before-after difference in outcomes.

The time invariance assumption can be too stringent if the treated and control groups are not balanced in covariates that are believed to be associated with the outcome variable [25] . The DID setup can be extended to accommodate a set of covariates and this is usually done in a linear way, taking into account eligibility specific effects and time/aggregate effects.

In the following model,

where D is as before and represents the eligibility-specific intercept, τtcaptures time or aggregate effects and equals 0 for the “before” period and 1 for the “after” period, and Z is a vector of covariates included to correct for differences in observed characteristics between individuals in treatment and control groups.

This estimator controls for both differences in the Z s and for time-specific effects, but it does not impose common support on the distribution of the Z‘s across the cells defined by the D-in- D approach (namely, before and after, and treatment and control). In our case, we minimize problems of common support by drawing on a particularly homogeneous sample across domestic and foreign firms.9

Appendix B. RAIS

RAIS (“Relaca˜o Anual de Informa¸coes Sociais”, Annual Social Information Report) is an administrative report filed by all tax registered Brazilian establishments. Since the information may be used for investigation about labor legislation compliance, firms that do not comply with it do not file in RAIS. Thus, this data set can be considered a census of the formal Brazilian labor market (State-owned enterprises, public administration and non-profit organizations are also required to file the report.) Firms that do not provide accurate information will be committing an offense sanctioned by law, a threat that is likely to lead to very high standards of data quality.

RAIS covers the whole country and is carried out annually. The information is collected every year in the first quarter, referring to the previous year. Every tax registered enterprise receives a unique tax number (CNPJ). This number is composed by a specific firm part and a complement for each unit (local plant or establishment) that the firm operates.

The main variables available from the survey at the establishment level are:

• Geographic location: State, metropolitan region, county;

• Activity sector: CNAE (National Economic Activity Classification); sector Level (10 categories); activity (42 categories); sub-activity (about 560 categories);

• Establishment Size: number of workers, number of wage earners, number of owners;

• Establishment Type: Private enterprise, private foundation, State-owned enterprise, State foundation, joint public-private enterprise, non-governmental organization, government, nonprofit enterprise, notary.

At the employee level, the following information is available (although we did not obtain access to all variables listed):

• Occupation: occupation classes (CBO-Brazilian Occupation Classification system?about 350 categories); subgroup (84 categories); group (11 categories);

• Personal Characteristics: schooling (9 classes), age, gender, nationality.

• Contract Information: month of admission, month of separation, December wage rate (13th monthly salary), average yearly wage, tenure, separation cause (fired with/without fair reason, separation with/without fair reason, retiring, transfer to other units or firm), contract type (work card, civil service, isolated worker, temporary worker), contract status (in activity or paid leave, leave without paid, occupation accident, military service, ma- ternity leave, sick leave, inactive), admission type (first placement in firm, re-employment, transferred), contract hours (exclusive overtime).

As some other matched employer-employee panels, RAIS is based on worker spells, defined by an occupation-establishment-contract group in each year. In other words, if a worker changes his/her occupation or establishment or contract type in a given year, there will be one separate observation for each case.

With the establishment identification number (CNPJ) it is possible to follow all establishments that file the RAIS survey. Moreover, with the worker’s national insurance number, it is possible to follow all workers that remain in the formal sector and to match the worker’s characteristics with those of the establishment. Therefore, we can create a panel that matches workers to their establishments and follow each of them over time. It was using the firm identification numbers that we have merged the three data sets described in this appendix.

NOTES

1See Appendix D for more details on RAIS. See also [15] .

2We also checked that the balancing of the covariates across the matched foreign and domestic firms was “satisfactory”. For instance, the pseudo R2 from the estimation of the propensity score, including all variables mentioned above and using only the matched firms, falls to less than 5%. These results are available upon request.

3Part of these differences may be driven by composition issues related to differences in the number of periods the firms are present in the data, before and after the acquisition.

4These differentials are, however, relatively large when compared to other studies. This is particularly striking as these differentials are driven from a matched sample of firms and, in the specification with worker characteristics, a control for the nationality of the worker is included.

5This may be explained by the fact that considering net job creation rates (or any other job or worker flow) forces us to reduce the sample size, as such rates cannot be calculated for the first observation of each firm in the data.

6We also consider the case of churning, a measure of “excessive” worker turnover, measured by the difference between worker and job reallocation but we find no significant differences (results not reported). This can be explained by the fact that firms undergoing divestment exhibit very large job destruction rates and such job cuts and separations do not tend to involve simultaneous hirings.

7Firm-level controls include firm size and industry and region dummy variables.

8See [22] for a recent illustration of this method in a different context.

9In any case, we believe it would be worthwhile to conduct a difference-in-differences matching analysis (Martins 2004). Another approach is to take as a control group not the firms that are not acquired but those that are acquired by investors of the same nationality. In this way one could isolate the foreign effect from the change in ownership change effect. We leave these two complementary approaches for future work.