Journal of Service Science and Management

Vol.08 No.06(2015), Article ID:61254,8 pages

10.4236/jssm.2015.86082

An Explanation for China’s Economic Growth: Expenditure on R&D Promotes Economic Growth

―Based on China’s Provincial Panel Data of 1997-2013

Huachun Wang, Dingchang Wu*

School of Government, Beijing Normal University, Beijing, China

Copyright © 2015 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

Received 7 July 2015; accepted 10 August 2015; published 19 November 2015

ABSTRACT

There are so many reasons to explain the China’s economic growth. This paper tries to give a different perspective. This study examines the relationship between expenditure on R&D from government and enterprise and economic growth by using China’s provincial panel data of 1997-2013 with a multiple linear regression. The study finds that there is a strong and positive correlation between expenditure on R&D and economic growth. Moreover, the study has a new finding. Compared to enterprise R&D strong correlation, the correlation between government R&D expenditure and the economic growth is nearly zero. One possibility is that government R&D expenditure is more directed toward basic research, which does not directly promote economic growth. The finding does not imply that government R&D expenditure is not a necessary component for economic growth. Both enterprise and government R&D expenditure are important for economic growth.

Keywords:

Government R&D Expenditure, Enterprise R&D Expenditure, Innovation Growth, Regression Analysis, Economic Growth

1. Introduction

In 2012 the rate of China’s GDP growth was 7.7%, which fell below 8% for the first time since 2000. It means that the economy is slowing down. The rate of GDP growth in the first quarter of 2015 fell to 7 percent, because the demographic dividend was disappearing, and the cost of labor, energy and raw material was rising. The way of technological advances is changing―the profits coming from imitation technology and learning techniques are reducing, so that imitate technology is no longer a competitive advantage in the future. At the same time independent research and innovation become increasingly important. In this context, the government proposes to build a national innovation system, in order to change the traditional way of economic development to the way of innovation-driven economic development. Scholars from different countries and regions generally believe that research activities could promote economic development, which means increasing R&D investment has become a common requirement and a necessary thing in the countries and regions. The problem is what the interaction between public and private sectors R&D expenditure and economic growth is and why this happens. This article will try to explain it.

At present, almost none of scholars use the Chinese provincial R&D expenditure panel data to study the relationship between the R&D expenditure and economic growth. This article attempts to do this. The article will use Chinese 1997-2013 year’s provincial data to study the relationship between the R&D expenditure from public sector and private sector and economic growth. Particularly, how public sector and private sector’s R&D expenditure affect economic growth and what it is. After that, according to the research, we hope to provide some advice to improve R&D expenditure used efficiency and provide some evidence to support the truth―innova- tion from enterprises by R&D investment is the one of the mainly explanations for China’s economic growth.

2. Previous Studies

2.1. Studies on Relationship between the R&D Expenditure and Economic Growth out of China

The contribution of technological progress to economic growth had been demonstrated by many economists in earlier. Such as Schumpeter put forward that technical progress was an important driver of economic growth. Solow’s study [1] had examined this view and provided empirical support. That was most of the contribution, which could not be explained by the accumulation of capital and labor, could be explained by the technological progress. After that, many scholars studied the relationship between technological progress and economic growth using empirical methods. Sylwester [2] took 20 OECD countries as sample for analysis, and used multiple regression models to study the relationship between the R&D expenditure and economic growth. The study result was that there was no significant evidence between them in the 20 countries of OECD. However there would be strong significant correlation between the R&D expenditure and economic growth if we put the United States, Japan, Germany, France, Britain, Italy, and Canada as sample. Sylwester considered there might be two explanations, one was that R&D investment in the developed countries was more important because the economic growth of these countries mainly came from the scientific and technological progress and development; Another explanation was that these countries whose service sector accounted for more than half of the country, R&D investment in the service sector’s role was not clear. Madden and Savage took OECD countries and some Asian countries as the research sample, Kuo and Yang [3] analyzed the Chinese provincial panel data, Bronzini and Piselli [4] investigated the Italian data. They all found the positive correlation between R&D expenditure and economic growth. In addition, some researchers also found that the effect of the R&D expenditure in science and technology was cumulative and delayed so that it would not promote economic development immediately.

After confirming significant correlation between R&D investment and economic growth, some researchers began to study the rate of return of R&D expenditure coming from different sectors. Most people concluded that compared with the effect of promoting economic growth enterprise R&D expenditure in science and technology made, government made small. It mainly due to the greater spillover effects of government investment in science and technology, and the long time achievements and lag effects with the government R&D expenditure focusing in mostly basic research. Griliches [5] found that, rate of return on investment to science and technology of the private sector was more than the public sector’, however the public sector R&D expenditure would produce driving effects and would generate additional productivity and indirect effect. Some studies had found government R&D expenditure to economic growth did not bring immediate results, but most national and regional governments still paid enough attention to science and technology investment, because of the lag and spillover effects of the government R&D expenditure. Salter and Martin [6] and Inekwe [7] found that, after World War II the United States federal government R&D expenditure showed a substantial long term growth, while in 1820th the United States economic growth began to stabilize and did not show a dramatic growth phenomenon. The two results did not seem to match. At the same time economic growth did not show a downward trend, they believed that a large number of government R&D expenditure had played an important role in maintaining the long-term stable growth of the US economy.

Some scholars had found that some studies showed no correlation or even negative correlation between government R&D expenditure and economic growth. Park [8] took 10 OECD countries as sample, on one hand his studies found there was negative correlation between government R&D expenditure and economic growth, on the other hand there was spillover effects that government R&D expenditure had an impact on private R&D expenditure among different countries. Because of this, Government R&D expenditure might have indirect, positive impact on productivity. Nadiri [9] used an empirical model to analyze the data of the United States, France, Germany, Japan and Britain, he found there was a significant correlation between R&D expenditure and outputs and productivity. Considering the spillover effects, the return of private sector R&D is generally 20% - 30%, while the total returns of R&D approaching 50%. Griliches and Mairesse [10] found the contribution of R&D expenditure to manufacturing was 7% in the United States, and Griffith et al. [11] found it was 1.2% - 2.9% in UK.

2.2. Studies on Relationship between the R&D Expenditure and Economic Growth in China

The researches in China were mainly focusing on using time series regression model to study the relationship between the R&D expenditure and economic growth. The general conclusion was that R&D expenditure promoted economic growth. Enha Hu [12] , testing the Chinese 1983-2006 year’s data released by Bureau of Statistics of China, found the significant correlation between the R&D expenditure and economic efficiency. Not only could R&D expenditure promote current economic growth, but also was there a 2-year lag effects. Kai Wang [13] , taking 1978-2008 year’s time series data as sample and using a variety of methods to exam the relations between Chinese financial R&D expenditure and economic growth, found that the financial R&D expenditure promoted economic growth, and there was “the time lag effects” and “marginal effects recede” phenomenon. Yun Zhu [14] , using the way of co-integration to exam 1978-2005 year’s fiscal data, found that R&D expenditure and economic growth interacted with each other and promoted each other. Bonai Fan [15] , examining 50-year fiscal data from 1953 to 2002 found there was a causal relationship between R&D expenditure and economic growth, and the contribution rate of R&D expenditure to economic growth is 17.6%. In addition, Fangyuan Lu [16] and other scholars, using provincial data to study the effect of the provincial R&D expenditure to economic efficiency, found that there were regional differences.

Current researches out of China focused on the following aspects. The first was that what the relationship was between the R&D expenditure and economic growth and the conclusion was the R&D expenditure promoted economic growth. The second was that whether there were spillover effects about the R&D expenditure and how much it was because of coming from different sources―public sectors and private sectors. The result was the spillover effects of public sectors R&D expenditure were more significant. The third was that whether there were different effects about the R&D expenditure to economic growth between developed and developing countries and regions. The results showed the influence of R&D expenditure to the economy was more significant in high-income countries, particularly those developed countries in the field of science and technology. The fourth was the relationship between R&D expenditure from different sources and economic growth. The general conclusion was that there was a significant positive correlation between them. Chinese scholars had conducted a similar study and reached similar conclusions. First, China’s R&D expenditure promoted economic growth by analyzing time series data of China. Second, Chinese scholars studied the promotion effect of China Financial R&D expenditure to economic growth, due to the time lag effects and the cumulative effects, they found promoting is less significant. Finally, Chinese scholars using provincial panel data to study the effect of provincial R&D expenditure found that there were regional differences.

3. Empirical Analysis

3.1. Some Instructions

In China the R&D expenditure mainly comes from government funds, enterprise funds and other funds. Government funds are from government Finance, including budgetary expenditure and other extra-budgetary expenditure for science and technology research activities. Enterprise funds are mainly from enterprise for science and technology research activities and are used by enterprise R&D departments, research institutes and university’s R&D. The rest of the R&D expenditure is other R&D expenditure1.

Government R&D expenditure and enterprise R&D expenditure are two main R&D expenditure, so we will focus on studying how both of them affect China’s economic growth. We think the role on scientific and technological activities that the government plays is explained by government R&D expenditure, while enterprise role explained by enterprise R&D expenditure. If we analyze the different roles, we will understand what role they play and how they play the role. Based on the above we can get some Conclusions and make some suggestions. Now we propose the following hypothesis and we will use Chinese provincial panel data to examine the hypothesis.

3.2. Constructing a Hypothesis

The hypothesis is that scientific and technological research activities can be transformed into productivity, thus contributing to economic growth. Whether the private sector R&D expenditure or public sector R&D expenditure, they have both contributed to economic growth. Compared with government R&D expenditure, enterprise R&D expenditure has more significant effects.

3.3. The Explanation for the Sample Data

We use 1997-2013 year’s China’s 31 provinces panel data as sample, so the number of sample is 527 (31 provinces × 17 years). They are gdp for GDP, grde for government R&D expenditure, erde for enterprise R&D expenditure, orde for other R&D expenditure, employment for number of employees, fdi for FDI. The unite of gdp, grde, erde, orde is 100 million RMB. The unite of fdi is 100 million dollars. The unite of employment is 10,000. The data comes from “China Statistical Yearbook of Science and Technology”, “China Statistical Yearbook” and other files released by the government. Since there is no standard statistical classification before 1997, we only use 1997-2013 data (Table 1). Considering the multi-col-linearity and auto-correlation, we use panel data. In order to get the objective and accurate results, we conduct a stationary test and logarithms of the data.

3.4. Panel Data Stationary Test

Panel data contains time-series and cross-sectional data at the same time. If the data is not stable, it may cause spurious regression affecting the final result. It is necessary to carry out data stationary test. We use Im, Pesaran and Shin W-stat, ADF-Fisher Chi-square and PP-Fisher Chi-square to test the data. As shown in Table 2, after we use 1st difference, the variables all pass the stationary test.

3.5. Constructing the Multiple Regression Model Equation

3.5.1. Model Explains

Our target is to tell the relationship between R&D expenditure and economic growth, and which of them plays a greater role on the regional economic growth. So we define every province’s GDP to be the dependent variable, while government R&D expenditure and enterprise R&D expenditure to be the independent variable. The control variable contains other R&D expenditure, fdi and employment.

Table 1. The description of the main variables.

Table 2. The results of panel data stability test.

Note: *indicates at the 10% level statistical tests significant, **at the 5%, ***at 1%.

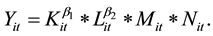

Consistent with previous empirical researches, this article assumes that the production function on the regional economy is similar to the Cobb-Douglas production function. At the same time, we assume that economic growth is endogenous type. So the model is:

(1)

(1)

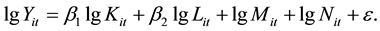

We transfer it in logarithmic form.

(2)

(2)

The equation is set as follows:

(3)

(3)

Yit represents the i province’s t year’s GDP. Kit, Lit represent the independent variables. Mit represents the control variables. According to most studies, Mit contain FDI and number of employees. Mit represents some factors that do not change with time and is the unique characteristics (for example, natural environmental features). Nit represents changes in science and technology policy. ε represents the error term.

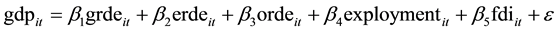

In summary, the specific equation is:

(4)

(4)

among them, gdp is for GDP, grde for government R&D expenditure, erde for enterprise R&D expenditure, orde for other R&D expenditure, employment for number of employees, fdi for FDI.

3.5.2. Regression Analysis of Data

We use the mixed effects model, fixed effects model and random effects model to do regression with the provincial panel data. The results are shown in Table 3. Regression results show that all of the models are very significant. Detailed explanation shown in Table 3.

3.5.3. Optimal Regression Model Selection

When the fixed effects model selected, F test show fixed effects model is better than mixed OLS model. In order to ensure the accuracy of model selection, this paper does the Redundancy test for fixed effects model and mixed effects model, and examine whether the random effects is significant. Redundancy test can help us to select the better one from fixed effects model and mixed effects model. By Hausman test we can select the better one from fixed effects model and random effects model. After trying these tests, in Table 4, we know the fixed effects model is the best choice.

Table 3. Regression results.

Note: ***Indicates P < 0.01, **Indicates P < 0.05, *Indicates P < 0.1; standard errors in parentheses.

Table 4. Test result.

3.5.4. The Regression Analysis Result

The regression equation is as follows:

(5)

(5)

There are two main independences, which are government R&D expenditure and enterprise R&D expenditure. The coefficient of enterprise R&D expenditure is 2.016544. It means that there is a positive relationship between enterprise R&D expenditure and GDP. Increasing 1 unit investment of enterprise R&D expenditure for science and technology, GDP will raise 2.016544 units. However GDP cannot to be good explained by government R&D expenditure, because the coefficient of government R&D expenditure is 0.1049901. It means every unit investment of Government R&D expenditure will bring 0.1049901 unit increase of GDP. The Control variables containing FDI, other R&D expenditure and number of employees are positive correlated with GDP.

Under the fixed effect model, the independent variables―government R&D expenditure and enterprise R&D expenditure both pass the 1% significance level test. That means dependent variable can be good explained by the independent variable. The model fits better.

4. Conclusions and Policy Recommendations

After we use fixed effects model to analyze 1997-2013 year’s China’s 31 provinces government panel data. We find that there is a positive correlation between enterprise and government R&D expenditure and GDP, although enterprise R&D expenditure is high positive and government R&D expenditure is nearly non-correlation. R&D expenditure from various sources doesn’t have the same effect on GDP. This is similar with Park’s study [8] .

These conclusions do not negate the government R&D expenditure contribution to economic growth. It can be explained by the following considerations: first, government R&D expenditure and enterprise R&D expenditure have different investment areas. The goal of enterprise is to pursuit more profits, so they usually invest in the kind of areas where researches transformation is short-term, large output, and high efficiency. We call them Applied Scientific Research. However, the government considers more about social long-term development strategy and public welfare. Their investment mainly focuses on basic research which needs large initial investment and is lower economic value in short-term but has an important role in social long-term development. As government funds will support basic research on mathematics, physics and other fields of universities and other institutions. Second, according to researches by scholars around the world, R&D expenditure has certain cumulative effects and time-lag effects, especially for government funds to basic research. The process from research into productivity is not in time. There is deviation when we do the regression analysis between government R&D expenditure and GDP. Third, given the spillover effects of government R&D expenditure in public research activities, its role on economic growth may be underestimated.

Compared with government R&D expenditure, enterprise R&D expenditure plays a more important direct role on economic growth. This is consistent with the mainstream viewpoint of China’s, which is now proposed by the government “Let the market play a decisive role”. This also provides innovative ideas for science and technology development. Innovation-driven economy is mainly relying on technological innovation of enterprises. Enterprises are not only the main body of the market economy, but also the main body of scientific and technological innovation. They know needs and supplies of the market. They invest in science and technology. They transform researches into productivity and products. They create profits and promote economic growth. At the same time, government’s contribution to the scientific and technological innovation cannot be ignored. Government R&D expenditure should play the leading role of public capital to scientific and technological innovation, in order to complete changing the traditional economic development mode to innovative economic development mode. Government and enterprise as two wheels of a car, in scientific and technological innovation, should play comparative advantages, cooperate with each other and have a win-win relationship.

However, there are so many factors that may affect economic growth, such as the educational level of employees, and administrative efficiency of provincial government. This article just studies some of them. In order to explain economic growth better, we also need to continue to increase the appropriate variables. This issue will be explored in future studies.

Cite this paper

HuachunWang,DingchangWu, (2015) An Explanation for China’s Economic Growth: Expenditure on R&D Promotes Economic Growth

—Based on China’s Provincial Panel Data of 1997-2013. Journal of Service Science and Management,08,809-816. doi: 10.4236/jssm.2015.86082

References

- 1. Robert, S. (1957) Technical Change and the Aggregate Production Function. Review of Economics and Statistics, 39, 312-320.

http://dx.doi.org/10.2307/1926047 - 2. Kevin, S. (2001) R&D and Economic Growth. Knowledge, Technology & Policy, 13, 71-84.

http://dx.doi.org/10.1007/BF02693991 - 3. Kuo, C.C. and Yang, C.H. (2008) Knowledge Capital and Spillover on Regional Economic Growth: Evidence from China. China Economic Review, 19, 594-604.

http://dx.doi.org/10.1016/j.chieco.2008.06.004 - 4. Bronzini, R. and Piselli, P. (2009) Determinants of Long Run Regional Productivity with Geographical Spillowers: The Role of R&D, Human Capital and Public Infrastructure. Regional Science and Urban Economic, 39.

- 5. Griliches, Z. (1979) Issues in Assessing the Contribution of Research and Development to Productivity Growth. Bell Journal of Economics, 10, 92-116.

http://dx.doi.org/10.2307/3003321 - 6. Salter, A.J and Martin, B.R. (2001) The Economic Benefits of Publicly Funded Basic Research: A Critical Review. Research Policy, 303, 509-532.

http://dx.doi.org/10.1016/S0048-7333(00)00091-3 - 7. John, N.I. (2014) The Contribution of R&D Expenditure to Economic Growth in Developing Economies. Social Indicators Research.

- 8. Park, W.G. (1995) International R&D Spillovers and OECD Economic Growth. Economic Inquiry, 33, 571-591.

http://dx.doi.org/10.1111/j.1465-7295.1995.tb01882.x - 9. Ishaq Nadiri, M. (1993) Economic Research Reports: Innovations and Technological Spillovers. New York University Faculty of Arts and Science Department of Economics Washington Square, New York.

http://dx.doi.org/10.3386/w4423 - 10. Griliches, Z. and Mairesse, J. (1984) Comparing Productivity Growth: An Exploration of French and U.S. Industrial Firm Data. European Economic Review, 21.

- 11. Griffith, R., Harrison, R. and Van, R.J. (2006) How Special Is the Special Relationship? Using the Impact of US R&D Spillovers on UK Firms as a Test of Technology Sourcing. American Economic Review, 96.

- 12. Enha, H., Hong, L. and Long, Z. (2006) An Empirical Analysis of Economic Effect of China’s Science and Technology Investment. Science Research Management, 4, 71-75.

- 13. Kai, W. and Zhen, P. (2010) Fiscal Expenditure for Science & Technology and Economic Growth in China: 1978-2008. Science Research Management, 1, 103-106.

- 14. Yun, Z. and Zheng, C.B. (2007) The Co-Integration Relationship of Fiscal Expenditure on Science and Technology and Economic Growth. Finance and Economics, 7, 53-59.

- 15. Fan, B.N., Jiang, L. and Luo, J.M. (2004) Research on Relationship between the Expenditure for Science & Technology and the Economic Growth. Science Research Management, 5, 104-109.

- 16. Lu, F.Y. and Jin, D.D. (2011) An Empirical Analysis on the Effect of R&D Input to Economic Growth Based on Panel Data. China Industrial Economics, 3, 149-157.

NOTES

*Corresponding author.

1The definitions of the R&D expenditure come from “China Science and Technology Statistical Yearbook.”