iBusiness

Vol.6 No.2(2014), Article ID:45991,8 pages DOI:10.4236/ib.2014.62006

Foreign Trade & Infrastructure: The Brazilian Small Business Reality

Isabela Lana, Renata Borges, Isabella Reis

Department of Management, Universidade Federal de Minas Gerais, Belo Horizonte, Brazil

Email: isabelalana@gmail.com, renatasg@face.ufmg.br, isabellacoutoreis@gmail.com

Copyright © 2014 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 24 February 2014; revised 22 April 2014; accepted 14 May 2014

ABSTRACT

Internationalization is a process in which organizations increase their economic activities in international markets. Specifically small business should aim internalization to become more competitive since their competitors are not only local companies but also multinational organizations. However, a medium or small size business from Brazil faces considerable challenges to internationalize such as the lack of Brazilian infrastructure. Therefore, given the importance of internationalization to the Brazilian economy and the role of small business in the global market, this study analyzes the struggles of a Brazilian small mining company through the exportation process of its main product—a high quality silica. As result, this study shows how significant can be national and international transportation costs as well as the costs related to wharfage. In fact, surprisingly, this study revealed that the costs related to national transportation are greater than the international shipment. We conclude that the main obstacle to enhance exportation in Brazil is in fact the transportation infrastructure, representing the bottleneck of Brazilian infrastructure even for small business focused on the national market.

Keywords:Exportation, Small Business, Brazilian Infrastructure, Brazilian Transportation Cost

1. Introduction

Until 1990, the Brazilian foreign policy was quite protectionist preserving the national industry over international competition [1] [2] . Only after the globalization phenomenon on late 1990s, Brazilian economy shifted from a closed market to a free market model [3] . This fact evidenced that the protectionist economic policy was preventing Brazilian growth. Indeed, at that time, Brazilian economy needed a great share of international resources to set up the competitive ability of Brazilian industry which was striving to survive over international products.

In this scenario, Brazilian government also tried to restore the national industry growth stimulating internationalization. Internationalization is a process in which organizations increase their economic activities in international markets [4] . According to Martinelli et al. [5] , organizations in order to achieve competitive advantage should consider internalization regardless of size and industry. Maia [6] adds that specifically small business should aim internalization to become more competitive since their competitors are not only local companies but also multinational organizations.

A medium or small size business from Brazil faces considerable challenges to internationalize. First, small companies have to overcome the Brazilian lack of infrastructure with high financial investments. This situation by itself compromises the small business competiveness because they are only able to spread the costs in their limited production. When compared to the amount of goods multinationals send abroad, small business goods are in general no longer competitive due to these costs. Second, but no less important, the Brazilian red tape makes the exportation process very expensive, long lasting, and even unfeasible to small companies.

Even though more than 60,000 transnational organizations are medium and small business, Brazil does not invest significantly for decades in infrastructure to enhance their exportation [6] [7] . Moreover, the Brazilian government does not appear to be concerned in developing and implementing any policy to reduce bureaucracy in order to make exportation easier.

Therefore, given the importance of internationalization to the Brazilian economy and the role of small business in the global market, this study analyzes the struggles of a Brazilian small mining company through the exportation process of its main product—a high quality silica. Hence, this research aims to indentify the challenges and possible solutions regarding the exportation of Brazilian small business products. As result, this study aims to support practitioner by discussing this case and sensitize public administrators to this specific problem.

2. Brazilian Investments, Infrastructure, and Incentives

Brazilian government and organizations are trying to increase participation in foreign trade. However, seeking internationalization to boost Brazilian economy is not in an easy task because on one hand there is this pressure for development and modernization; and on the other hand not only international market competition but also structural barriers restrain the economic growth [8] . To overcome the structural barriers it is necessary to invest heavily in logistics and physical component like roads and ports to provide services and commodities exportation.

According to the IBGE (Brazilian Institute of Geography and Statistics), in only thirty years (1970-2000), the investments in infrastructure were higher than the Brazilian Gross Domestic Product (GDP) [8] . Nonetheless, after this period Brazilian investment in infrastructure experienced the opposite situation, the reduction of investment to much lower than the GDP. As result, Brazil currently lacks of the infrastructure necessary to support their growing needs. Other countries such as China present a very different situation, which gives them a significant competitive advantage over Brazilian products [8] .

The pace of the economic growth of Brazil is directly related to the volume of investments the country makes in infrastructure. As a comparison, other emerging countries invest more than 30% of their GDP in infrastructure such as China (45%), India (35%), and South Korea (33%). Meanwhile, Brazilian investment rate range poorly 18% of its GDP. It should also be noted that from the 18% of investments, only 2.1% represents investments in infrastructure [9] .

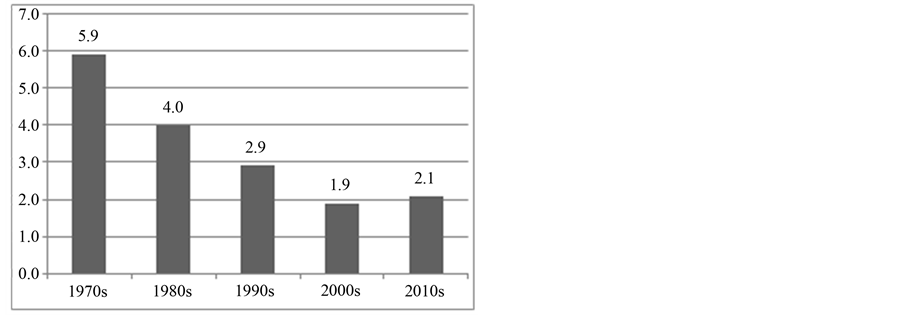

As cited before, in the 1970s, investments in infrastructure were larger than today. The Brazilian GDP in the 1970s to the 1980s increased an average rate of 8.5 percent minimum despite the world oil crisis. In 2012 and 2013 Brazilian GDP scored poorly around 0.9%. Figure 1 shows the amount of Brazilian GDP invested in infrastructure in percentage since 1970s.

Investments in infrastructure decreased in Brazil for two main reasons. First, the uncontrolled situation of the inflation in the 1980s along with the continuous unsuccessful attempts of economic stabilization prevented any kind of investment in production to prosper. Moreover, extremely high inflation leads investors to leave their money in the financial maelstrom than in the industry. Just to illustrate, Brazilian inflation reached its peak in 1993 achieving 2447.15% from December 1992 to December 1993. The second reason is related to the government fiscal policy. Facing a rapid growth in the public expenditure, the government was forced to increase the tax burden in order to reduce the public deficit. This measure was largely criticized since it did not achieve the expected result [9] .

Figure 1. GDP invested in infrastructure (%).

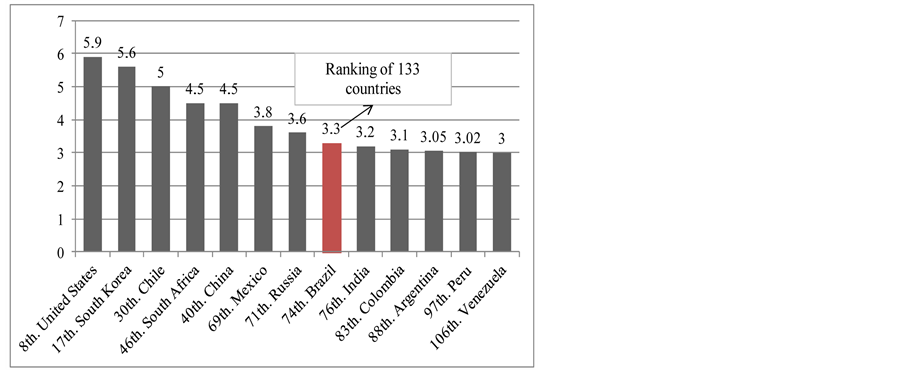

In the following years, investments in infrastructure increased slightly with private investments. Yet, public investments accounted for the major part. However, this increase was not enough to enhance the country competitiveness. Figure 2 shows the countries quality and competitiveness ranking in infrastructure in 2012.

Even between the Latin American countries like Mexico and Chile, Brazil falls behind, occupying the 74th position among 133 countries.

In the same ranking, it is possible to analyze the infrastructure quality for each segment. Brazil reached its best position in electricity supply (65th position) and its worse position in port infrastructure (127th position). The country also obtained the 86th position in railroad infrastructure, followed by the 89th place in air transportation infrastructure, and finally the 106th position in road infrastructure.

In the mining industry context, products are transported mostly by trucks and ships. Brazilian companies that want to send their products abroad face one of the highest costs regarding port charges. Although the port charges in Brazil reached their lowest levels in 10 years, it is still 82% greater than the ports of Rotterdam, Hamburg, and Antwerp. In 2013, the average cost of handling containers in Brazilian ports is 200 dollars, 166% greater than the Asian ports. Besides the high costs, the Brazilian National Confederation of Transport (NCT) draws attention to other difficulties export companies will experience. The NCT categorized as “too severe” first the excessive taxation, followed by the poor in land access, the high costs with hand labor in the port, and the excessive bureaucracy [10] .

Regarding the transportation by road, the NCT highlights major problems companies face sending their products by truck. The first one is the frequency of urban area trespassing, followed by the traffic jam of loaded trucks, the dangerous conditions of the roads in general, and lack of safety due to robbery [10] .

Exports Incentives for Small Business

Brazilian government stimulates small business to export in a sort of ways. The Drawback system, for example, is a program of BNDES (National Bank for Economic and Social Development) which suspend or eliminate the importation taxes of raw materials that are used produce goods ultimately for exportation [11] . This mechanism aids exports because reducing the manufacturing costs of products that are designed for foreign trade helps them to become more competitive. Moreover, after 2002, the BNDES launched a system of financing specifically targeting companies that want to internationalize by providing support on projects of international investments [12] .

Another incentive is the reduction of tax burden to the export operations. It means that, the extensive Brazilian taxation does not apply to products focused on exportations. The list of taxations also include: IPI (Tax on Industrialized Products), ICMS (Tax on Circulation of Goods and Services, PIS (Social Integration Program), COFINS (Contribution to Social Security Financing), and IOF (Tax of Financial Operations), see Garcia and Scaramelli [13] for further information.

Despite the financial incentives for small business to export, the bottleneck of exportation—the infrastructure—remains without a solution. The high costs with transportation inside the country, that is, the costs to carry the product from the company to the port or airport are extremely high, inhibiting exportation. As result, the

Figure 2. Infrastructure global competitiveness index in 2012.

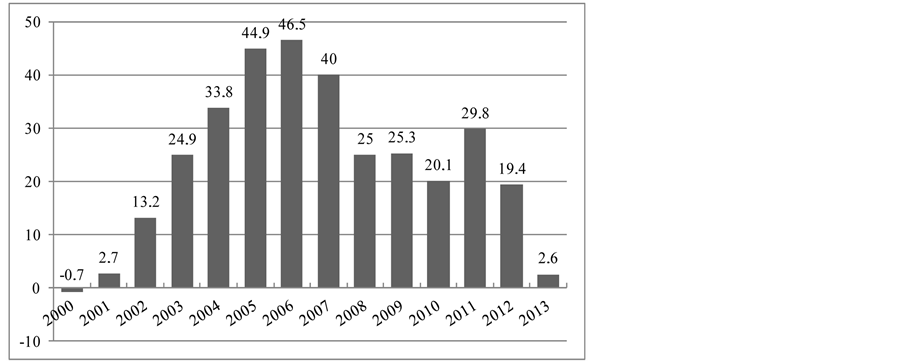

Brazilian balance of trade reached in 2013 its worse balance in 13 years. In 2013, Brazil exported 242,178 billion dollars against 139,617 billion dollars of importation, leaving a positive balance of 2561 billion dollars. Figure 3 shows the evolution of the Brazilian balance of trade in the last 13 years.

Commodities represented 46.7% of Brazilian exportation in 2013, while manufactured and semi-manufactured products represented 51% (12.6% semi-manufactured and 38.4% manufactured). Iron ore, soybean, corn, chicken meat, and beef cattle are the major commodities exported. The manufactured and semi-manufactured products Brazil exports most are steel, iron ore derivatives, raw sugar, automobiles, cellulose, and so forth. The country exports more to Europe (19.7%), China (19.0%), and United States (10.3%).

3. The Mining Company Case

Sand is a material which usually has a particle size between 0.5 and 0.1 mm and results from the breakdown of rocks [14] . Silica sand is a kind of sand that has a high content of silica (SiO2) in the form of quartz [15] . When it has a high level of purity, it means that it is silica. Silica has great demand because its applicability reaches several segments, such as: manufacture of glass and paints; foundry industry (molds), earthenware, refractory, mortar, installation of synthetic grass; fiber; laser (sand courts, playgrounds, decoration), and others [16] .

This study focuses on the case of Silicaminas Extraction of Minerals and Trade Products Inc. It is a small company which main business is to extract and trade silica sand with 99.69% purity. Due to its high quality product, the foreign trade has been constantly requesting the company to send abroad the silica. However, as many small businesses in Brazil, exportation is difficult because of the transportation costs that might end up derailing the exportation of the product at competitive prices.

An Angolan organization ordered 70 tons of silica from the Silicaminas Inc. Silicaminas warned the Angolan organization that the exportation process could make silica cost even 10 times more than its price in the national market. The Angolan organization thus authorized the transaction starting up a whole new process in Silicaminas Inc. The Brazilian company had no idea how to send its product abroad. Hence, this study aimed to follow Silicaminas in this new effort by indentifying and analyzing the logistics, infrastructures, and cost involved in the exportation process of a Brazilian small business product.

The first step Silicaminas took was to contact trading companies to understand the exportation process and costs. The national price of the 70 tons of silica, which was ordered by the Angolan organization, is US$ 893.621. From this value the company has to deduct cost related to national trade and add costs related to exportation. The distribution cost in the domestic market, which represents the amount of US$106.38 for 70 tons of silica, is the first item deducted from the final price. This amount is spent exclusively with truckage around the southeast region, where the company’s clients are located.

Another deducted cost accounts for the national taxes. As explained before, there are taxes benefits to exported products, such as zero taxes on industrialized product (IPI), zero taxes regarding the circulation of goods and service (ICMS), exclusion of the charges related to social security (COFINS) and social integration pro-

Figure 3. Brazilian balance of trade in billion dollars.

grams (PIS), and absence of the financial operation tax (IOF). Since Silicaminas is a small business, it opted by collecting taxes through the SIMPLES program. SIMPLES is the Brazilian acronym for integrated system of tax and contributions payments for micro and small businesses. In this simplified taxation system a unique aliquot includes most of the federal taxes (IPI, CONFINS, and PIS). The company pays for 70 tons of silica 7% of taxes in the SIMPLES program, which represents US$62.35.

Still in the deduction section, the seller’s commission was subtracted (US$ 8.94) because the deal was made by the company CEO. Thus, the total amount of deductions for 70 ton of silica that is not intended for the national market is US$ 177.67 leaving a total of US$ 715.95 to be added to the exportation costs. Table 1 shows all the deductions.

On the other hand, the exportation expenses include the packaging—a specific container for exportation— which refers to 70 big bags bearing 1000 kilograms each. The big bags are loaded in silos inside the mining. However, the sewing of each bag is made manually, leading to a handling expense. An outsourced company will transport the 70 big bags of silica from Silicaminas to the nearest port. All the transportation has to be made in the very same containers that are going to be sent overseas. Hence, before initiating the loading, the outsourced company responsible for transportation has to bring the three containers from the port. In sum, the national transportation adds to the expenses an amount of US$ 4902.12 including tolls.

In order to send abroad goods under US$ 50000.00 overall, the company might chose to make the customs clearance using the Siscomex system. The Siscomex is an integrated system developed by the Brazilian government to control, keep record, and monitor foreign trade. The international transportation will be done by ship taking near 30 days to go from Rio de Janeiro to the port of Angola. This is the cheapest way to send this quantity and type of product overseas [13] .

The costs described as ISPS-TSC (Terminal Security Charge-International Ship and Port Facility Security) relates to insurance for the product shipped abroad. The Fee BL (Bill of Lading) corresponds to an important port document of the process of exporting, this is the bill that proves the company lading the goods. The Bill of Lading (Knowledge of Lading or Certificate) is a document accepted by banks as a guarantee that the goods were actually shipped abroad. That’s because this document is issued in English by the carrier only when the goods are actually on board [11] [17] [18] .

The foremanship consists of port expenses such as transportation and storage operations regarding the use of the port facilities [19] . According Chinelato, Cruz and Ziviani [20] , Brazilian port expenses are considered as one of the highest of the world, a factor that end up in a negative impact on profit margins and competitiveness of exported products. There are also expensed with exchange rate to pay international bills. Finally, “other port expenses” includes the port seal made when the product is boarded and the pre-shipment inspection (IPE)—required by Angolan authorities. The IPE encompasses activities of verification of the quality, quantity, price (including exchange rates and financial terms), and customs classification of goods ready to be exported. The IPE is mandatory for all goods listed in Decree n.˚ 41/06 of 17 July, regardless of their value. In order to take the IPE survey, the company must issue Verification Certificates (ADV), a document issued by the company that

Table 1. The cost of exportation.

Source: Authors.

conducted the Pre-Shipment Inspection. The final expenses with all the exportation process is US$ 12.799.15. See Table 1 for detailed expenses.

After indentifying the deductions and expenses, the company adds to the price its markup which is 10% (US$ 1351.51) of 70 tons of silica. Summing up, the Angolan company will pay for 70 tons of silica from Silicaminas a total amount of US$ 14866.61 while a buyer from Brazil pays for the very same products US$ 893.62, almost 17 times less.

The final Cost, Insurance, and Freight (CFI) price is 0.2124 USD per kilogram. This CFI price does not compromise the Brazilian-Angolan deal because, according to the Angolan company, most of silica sand is imported from Egypt and Saudi Arabia. In fact, the Brazilian price is quite competitive due to the high quality of the product because its international competitors have a CIF price of 0.02 per∙kg. In fact, Egypt and Saudi Arabia sell their product in the local market for USD 0.05 per kilogram while Silicaminas sell it for USD 0.0128. At the end, the FOB Brazilian price (free on board) compensates the exportation expenses.

The final price of silica from Brazil is slightly higher than the other countries. However, this difference is compensated by the purity of the product that is the differential. Moreover, it should also be pointed out that the Silicaminas works with a profit margin of 10%. This fact gives extra room for negotiation, keeping its price even more competitive towards the competitors.

4. Conclusions

The impact infrastructure has on exportation, specifically for small business is widely known [21] . Moreover, the costs and services with transportation represent the bottleneck of Brazilian infrastructure even for small business focused on the national market [22] . This study shows how significant can be national and international transportation as well as the costs related to wharfage. In fact, surprisingly, this study revealed that the costs related to national transportation (32.9% of the final cost) are greater than the international shipment (30.0%).

The main obstacle to enhance exportation in Brazil is in fact the transportation infrastructure. Only between 2002 and 2007, the international demand for Brazilian products doubled representing almost 160 billion dollars [9] . However, at the same period, investments in infrastructure were limited to 142 billion dollars approximately. The consequence of this policy is exemplified in the problems agricultural exportation faces at the end of every harvest with trucks getting in long lines in the Brazilian ports to ship its products. Some of them waited until 16 days to ship soybeans to China, which lead the Chinese companies to cancel the contract. According to the dockworker union, the losses in Santos port due to the long lined reached 115 million dollars. See the Globo [23] news for details.

OECD [24] emphasizes that the more countries invest in infrastructure higher they are in the ranking of global competitiveness. In this sense, to achieve sustainable economic growth the government needs to support business in general to be competitive in the international market by investing in infrastructure. Specifically small business relies heavily on the country’s infrastructure to determine the products prices. This study shows that high quality products with low internal value can still remain competitive in the international market due to the high costs of national transportation.

To public administrators this study draws attention to the consequences of the poor Brazilian infrastructure to small business. Practitioners can learn from this case and try to overcome the national transportation costs by developing effective strategies and partnerships or even though pushing the government to prioritize the Brazilian infrastructure agenda.

References

- Lafer, C.A. (2001) Identidade Internacional do Brasil e a Política Externa Brasileira: passado, presente e futuro. Perspectiva, São Paulo.

- CERVO, A.L. (2008) Inserção Internacional: formação dos conceitos brasileiros. Saraiva, São Paulo.

- Menezes, N.B. (2012) A Política Governamental Brasileira de Incentivo à Internacionalização de Empresas 1997 a 2005 in Seminário Brasileiro de Estudos Estratégicos Internacionais (SEBREEI), Porto Alegre.

- Gereffi, G. and Memedovic, O. (2003) The Global Apparel Value Chain: What Prospects for Upgrading by Developing Countries? United Nations Industrial Development Organization, Vienna.

- Martinelli, D.P., Ventura, C.A.A. and Machado, J.R. (2004) Negociação Internacional. Atlas, São Paulo.

- Maia, J.M. (1997) Economia Internacional e Comércio Exterior. 3rd Edition, Atlas, São Paulo.

- Sauvant, K.P. (2007) O Investimento Direto Estrangeiro dos BRIC no Exterior. In: Almeida, A., Ed., A Internacionalização de Empresas Brasileiras. Elsevier, Rio de Janeiro, 37-77.

- Pereira, B.L.C. (2006) Economia Brasileira na Encruzilhada. Editora FGV, Rio de Janeiro.

- Lanzana, A. and Lopes, L.M. (2011) Desafios da Infraestrutura e Expansão dos Investimentos: 2011/2014. Fundação Instituto de Pesquisas Econômicas (FIPE), 372, 28-37.

- Confederação Nacional de Transportes (CNT) (2012) Pesquisa CNT de Transporte Marítimo.

- Luz, R. (2012) Comércio Internacional e Legislação: atualizada até a IN RFB n° 1.266/2012. 5th Edition, Elsevier, Rio de Janeiro.

- Alem, A. and Cavalcanti, C.E. (2005) O BNDES e o Apoio à Internacionalização das Empresas Brasileiras: algumas Reflexões. Revista do BNDES, Rio de Janeiro, 12, 43-76.

- Garcia, A.V. and Scaramelli, J.M.M. (2006) Exportação: seus caminhos e incentivos in I Congresso Unisalesiano de Desenvolvimento Regional—Sebrae. Set.

- Davis, L.L. and Tepordei, V.V. (1985) Sand and Gravel. In: Mineral Facts and Problems. Edition Bureau of Mines, Bulletin 675, United States Department of the Interior.

- British Geological Survey (BGS) (2013) Mineral Planning Factsheet. Silica Sand, 9p. www.mineralsuk.com

- Ferreira, G.C. (1997) Avaliação da Evolução dos Mercados Produtores e Consumidor de Areia Industrial no Estado de São Paulo. Revista Geociências, São Paulo, 16.

- MRE—BRASIL. (2004) Ministério das Relações Exteriores. Divisão de Programas de Promoção Comercial. Exportação Passo-a-passo. MRE, Brasília.

- Castro, J.A. (2007) Exportação: aspectos práticos e operacionais. 7th Edition, Aduaneiras, São Paulo.

- Morini, C., Simões, R.C.F. and Dainez, V.I. (2012) Administração de Mercado Exterior. IESDE, Curitiba (Inteligência Educacional e Sistemas de Ensino).

- Chinelato, F.B., Cruz, D.B.F. and Ziviani, F. (2011) Made in Brasil: o impacto da infraestrutura da logística brasileira nas operações de comércio exterior. Revista Administração em Diálogo (RAD), 13, 44-55.

- Limao, N. and Venables, A.J. (2001) Infrastructure, Geographical Disadvantage, Transport Costs and Trade. The World Bank Economic Review, 15, 451-479. http://dx.doi.org/10.1093/wber/15.3.451

- Martínez-Zarzoso, I., Menéndez, L.G. and Suárez-Burguet, C. (2003) The Impact of Transport Costs on International Trade: The Case of Spanish Ceramic Exports. Maritime Economics & Logistics, 5, 179-198. http://dx.doi.org/10.1057/palgrave.mel.9100069

- GLOBO. China Cancela Compra de Soja do Brasil por Causa do Atraso na Entrega—Março de 2013. http://g1.globo.com/jornal-nacional/noticia/2013/03/china-cancela-compra-de-soja-do-brasil-por-causa-do-atraso-na-entrega.html

- GLOBO. Fila de Caminhões no Porto de Santos Bate Recorde e Prejudica Exportações—Maio de 2013. http://g1.globo.com/bom-dia-brasil/noticia/2013/03/fila-de-caminhoes-no-porto-de-santos-bate-recorde-e-prejudica-exportacoes.html

- GLOBO. Navios Esperam até 16 Dias para Atracar em Porto do País, diz MDIC—Ministério do Desenvolvimento, Indústria e Comércio Exterior—Março de 2013. http://g1.globo.com/economia/noticia/2013/03/navios-esperam-ate-16-dias-para-atracar-em-porto-do-pais-diz-mdic.html

- GLOBO. Prejuízo com Filas no Porto de Santos Chega a R$ 115 milhões, diz sindicato—Março de 2013. http://g1.globo.com/sp/santos-regiao/noticia/2013/03/congestionamentos-causam-prejuizo-de-r-115-milhoes-no-porto-de-santos.html

- Organisation for Economic Co-Operation and Development (OECD) (2011) Strategic Transport Infrastructure Needs to 2030. OECD, Franc.

NOTES

1The exchange rate adopted in this study is the average rate of 2013, which is US$1.00 = R$2.35.