Modern Economy

Vol.07 No.02(2016), Article ID:63433,6 pages

10.4236/me.2016.72014

India’s Tea Price Analysis Based on ARMA Model

Hong Liu1, Shuang Shao2

1College of Economics, Jinan University, Guangzhou, China

2College of Economics & Management, South China Agricultural University, Guangzhou, China

Copyright © 2016 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 15 January 2016; accepted 13 February 2016; published 16 February 2016

ABSTRACT

In this paper, the ARMA model is used to analyze the sample of India’s weekly tea auction price in the year 2013 to 2014. First, the data were tested for stability, autocorrelation and partial correlation test, and the ARMA (1, 1) model was established. Then, the parameters of the model are determined, and the residuals are tested by white noise. The test results are satisfactory and meet the forecast requirements. Finally, we use the model to predict the tea price of the last week in 2014 and the tea price of the first two weeks in 2015, and the prediction error is small. Therefore, this paper suggests that a mature tea auction market should be established in China which is a big exporter of tea production, and we should set an early warning mechanism for the price of tea, and use the price information to guide the production of tea cultivation and sales activities.

Keywords:

ARMA Model, Forecast Analysis, Price Mechanism, Tea Price

1. Introduction

India, which is the largest country in South Asia and located in the northern hemisphere, is one of the world’s largest exporters of tea. From 1840s to the present, India’s tea cultivation has more than 170 years of history. It has made great achievements in the area of tea cultivation, production and processing technology, sales, government management and guidance. There are 28 states in India, and 16 of them are tea growing areas. The main tea growing area includes Assam, West Bengal, Tamil Nadu and Kerala. In 2013, India’s tea planting area was larger than 564 thousand hectares, and the output was about 1209 thousand tons. There are two main tea growing areas in India. The most important part is the North India, which has 457 thousand hectares planting zone and the yield is 965 thousand tons, and the South India’s is 106 thousand hectares and 243 thousand tons (Data source: The Tea Board of India). In 2013, India exported 219 thousand tons tea to Russia, Britain, the United States, Pakistan, Iran, Bangladesh, the United Arab Emirates and other countries.

Tea price, as an important regulator of economic operation of the tea market, is not only an important regulation mechanism for the interests of buyers and operators in the tea market, but also an important regulation mechanism of supply and demand balance in the tea market. At the same time, the price, to a certain extent, also reflects the competitiveness of products. So, we can study and forecast the price of tea, and use the market information to guide the production of tea. However, India, as an important tea producing country in the world, has a great influence on the price of the tea market in the world, and the tea auction market in India is mature. It is of great significance for China and the world to research on the price of the tea in India.

2. Literature Review and Model Selection

2.1. Literature Review

There are a lot of research on auction transaction and price of tea. Auction transaction mode can not only allocate resources, but also reduce transaction costs effectively, and it could be used to improve transaction efficiency and reduce the risk of producers [1] . Besides, it has become one of the main ways to deal with agricultural products in developed countries [2] . Auction, as an information intermediary mode, can be used to design a price discovery mechanism to minimize the market inefficiency effects, which may be by the incentive compatible and play effective price discovery mechanism [3] . In terms of study on tea price, Vickner and Davies (2002) [4] use vector error correction model to study the price relationship between the six brand red tea and the herbal tea. The empirical results show that the price of the products in the domestic market of the large tea producers in the United States is not unrelated. In order to explore whether the process that investigate the price of red tea is effective, Dharmasena and Bessler (2004) [5] use the time series method and VAR model to analyze the tea price of the world’s major tea producer. The domestic scholars on the price of tea mainly concentrated in the prices of China’s tea trade and its influence factors [6] , the factors that influence the tea’s export prices [7] and price structure, the forming mechanism and other aspects [8] [9] .

We can provide the decision-making basis for the tea production operators and market policy makers, help them better grasp the laws of market fluctuations and improve the economic efficiency of tea production if we forecast the price of tea effectively. Domestic and foreign scholars mainly use the time series quantitative measurement methods to investigate and forecast the price of agricultural products. These studies mainly analyze the factors affecting the price of agricultural products and the construction of prediction model. The factors that influence the price fluctuation of agricultural product not only include the relationship between supply and demand which is the most direct factor, but also include the money supply, international price fluctuation, agricultural products trade policy, related testing methods and standards, inflation, fluctuations in the prices of raw materials, agricultural policy and institutional reforms, and the changes in the price of complements and substitutes. The existing literature on tea research is mainly focused on competitiveness, international trade and the formation and influence factors of price, but less paper is involved in the study of tea auction price. Due to the role of the market mechanism, the price fluctuations of agricultural products have a certain rule. In the aspect of the theory and method of forecasting economic time series, there are some classical, such as exponential smoothing method, growth curve and so on. These methods are quite accurate in predicting the long-term trend of economic operation, but the effect in predicting short-term fluctuation is not ideal. Auto regressive moving average model (ARMA model) is of high accuracy in the short-term trend of economic operation because of both the dependence of economic phenomena on time series and the interference of random fluctuation are considered. In this paper, we use the ARMA, combined with the historical data of agricultural product price index, to establish the model, and use the model to predict the future short-term trend of agricultural prices and put forward the corresponding recommendations on the basis of this.

2.2. Model Introduction

Auto regressive moving average model (ARMA model) is an important method for the study of time series, and it is composed of the self-regression model (AR model) and sliding average model (MA model). ARMA model is a model for the analysis of stationary and non-pure random sequences, so when we get a set of data, we first test the stability of a set of data. In the aspect of data stability test, we mainly see the sequence diagram of the data sequence and unit root test. Differential operations can be performed when the original data is not a smooth sequence, so that useful information can be extracted from the sequence. Then we test whether the sequence data is purely random, that is, whether there is a significant correlation between the data sequence. To determine the order number of ARMA model is to determine the parameters’ (p and q) value, which is, using the nature of the sample autocorrelation coefficient and the partial autocorrelation coefficient map and selecting the appropriate ARMA model to fit the observed value sequence. Specific expressions are as follows:

(1)

(1)

3. Sample Data and Analysis

The data source of this article is the Indian tea committee. In this paper, we select the tea’s auction price which the committee disclosure weekly, and the time span is 2013-2014.

3.1. Time Series Stationarity Test

We can only use stationary series to set an ARMA model, so before constructing the model, it is necessary to carry out a sequence of unit root test.

We take logarithm for auction price p and get a new sequence {p1}. There should be no significant time trend in Figure 1, so test regression equation does not include the time trend, at the same time, sequence deviates from the value of zero, so we should consider constant term when test the regression equation.

From Table 1, the DF statistic is −3.977 < −3.509, so we can decline the original hypothesis that “there is a

Figure 1. The trend chart of sequence {p1}.

Table 1. DF test.

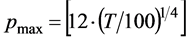

unit root” on the 1% significance level. In order to avoid possible autocorrelation of the disturbance in the DF test, this article will do higher-order ADF test for sequence {p1}. According to Schwert’s method (1989), the maximum lag order number is , and we calculate the maximum delay order number is 12. From top to low, we do ADF test one by one, until the final first-order lag items through the inspection. After inspection at the time of lag 11 order through the test, at this point, the t statistic is −2.928, under the level of 5%, smaller than the critical value −2.890. So we can refuse the original hypothesis that “there is a unit root”, and at the same time, McKinnon approximate p value is 0.0422, consistent with this conclusion, so we can think {p1} is smooth sequence.

, and we calculate the maximum delay order number is 12. From top to low, we do ADF test one by one, until the final first-order lag items through the inspection. After inspection at the time of lag 11 order through the test, at this point, the t statistic is −2.928, under the level of 5%, smaller than the critical value −2.890. So we can refuse the original hypothesis that “there is a unit root”, and at the same time, McKinnon approximate p value is 0.0422, consistent with this conclusion, so we can think {p1} is smooth sequence.

3.2. ARMA Model Identification

We use Stata 11.0 software to calculate (10 order) autocorrelation and partial correlation for sequence {p1}. As shown in Figure 2 and Figure 3:

Figure 2. Autocorrelation chart.

Figure 3. Partial correlation chart.

Through Figure 2 and Figure 3, as you can see, the autocorrelation chart is beyond 95% confidence interval after the lag 5 order, and partial autocorrelation figure is within the 95% confidence interval after the lag 2 order. This has the characteristics of ARMA model. Besides, we calculate the average of sequence {p1} is 4.82, the standard deviation is 0.11, and we can’t refuse the assumption that the mean is 0, therefore it is suitable to set up ARMA model.

According to the rule of information, we set up ARMA model and make a definite order step by step for the sequence {p1}. At the same time, we find that AR (3), AR (4) and AR (5) can’t pass through the statistical significance test in the process of inspection. So, in this paper, we test the four groups of model AR (1) MA (1), AR (1) MA (2), AR (2) MA (2) and AR (2) MA (1). The specific test result is just as in Table 2.

Combined with the data in Table 2, according to the rule of information, the ARMA (1, 1) model has the minimum AIC and BIC, so we choose the ARMA (1, 1) model. Let Y = p1, specific expression is as follows:

(2)

(2)

And we conduct fit test or white noise inspection of the residual sequence for ARMA (1, 1) model. Using the autocorrelation analysis diagram (Figure 4),we can get that autocorrelation of residual sequence and 0 have no significant difference, and all the autocorrelation coefficient within the confidence interval can be judged to be white noise sequence. Therefore, we can make use of ARMA (1, 1) model to forecast.

3.3. Prediction and Evaluation

Through the above analysis, we have obtained the ARMA model of India tea auction price in this paper. The purpose of this paper is to build an ARMA model to predict the price of India tea auction. So, we utilize the model established above, and use Stata 11.0 software to forecast India tea auction price in the last week of 2014 and the first two weeks of 2015. Its real price and predict price are shown in Table 3.

It can be seen from the above data, the forecast effect of the model is good, and it has a certain reference value. We can utilize ARMA model to predict the price to avoid the confusion of choose and use of main factors in the predict process, and reduce the adverse effects on the result caused by the loss of useful data. At the same time, the model requires a high stability of the data, and the deviation is large when we face big individual data

Table 2. Inspection information of the ARMA model.

Table 3. India tea auction price and forecast price.

Figure 4. Autocorrelation analysis diagram.

fluctuations (especially the economic or political changes).

4. Conclusion and Suggestion

Price, as an important means to play the role of the market, has an important role in the regulation of supply and demand. Due to the longer production period, the fluctuation of the price of agricultural products has a great influence on the agricultural producers. Agriculture is the foundation of the national economy, and agricultural products’ price stability affects the stability of the economy. As an agricultural product, tea’s price is a cyclical fluctuation, which is closely related to the cyclical fluctuation of agricultural production. The estimate of the price of tea can regulate the production and supply of tea. In this paper, we use the ARMA model to analyze the Indian tea’s auction price, and we find that the historical price information has an excellent forecast effect on Indian tea’s auction prices, and has a very good role in guiding the production activities of tea. How to improve the competitiveness of Chinese tea and agricultural products in the international market is essential to the process of agricultural modernization and the peasants’ income. Based on the conclusions above, we suggest:

(1) establishing a national and regional tea auction market. Today, the world’s leading tea production and export countries such as Kenya, India, Sri Lanka and other countries have established a mature tea auction market. The establishment of the tea auction market is convenient for both sides to obtain the required information and reduce the information asymmetry between the producer and the consumer. At the same time, it is also conducive to regulate the sale of tea and improve the quality of tea.

(2) improving the price information mechanism of tea and related products, in particular, we should set a government led tea price information release institution and release mechanism. Besides, it has the most important effect, just as India Tea Board is mainly responsible for India’s tea price disclosure. Through the establishment and improvement of the agricultural social service system, the timely publication of tea and other agricultural products supply and demand information, we can guide the tea and other agricultural products’ production and business operation, and analyze and forecast the prices of agricultural products objectively to guide the farmers, processors and consumers’ behavior.

(3) establishing a reasonable price warning mechanism of tea and related products. On the basis of perfecting the information mechanism and price monitoring system of tea price, the pricing mechanism is further constructed. Specifically, we can analyze the tea price on the basis of the tea price in the tea wholesale market, the auction market or the country’s guide price, or use the soybeans and other products’ mature futures market to set tea’s future market. We can make use of future prices to guide the spot price, and ultimately form a scientific and reasonable early warning system.

Cite this paper

HongLiu,ShuangShao, (2016) India’s Tea Price Analysis Based on ARMA Model. Modern Economy,07,118-123. doi: 10.4236/me.2016.72014

References

- 1. Jia, S.H. and Liu, Q.H. (2001) Auction Transaction and the Innovation of Trading Mode of Agricultural Products Wholesale Market in China. Chinese Rural Economy, 2, 63-67.

- 2. Li, D.S. and Zhang, G.H. (2003) Discussion on Several Technical and Economic Problems of Agricultural Products Auction Market. Journal of Agrotechnical Economics, 1, 31-35.

- 3. Dutta, S., Sarmah, S.P. and Goyal, S.K. (2010) Evolutionary Stability of Auction and Supply Chain Contracting: An Analysis Based on Disintermediation in the Indian Tea Supply Chains. European Journal of Operational Research, 207, 531-538.

http://dx.doi.org/10.1016/j.ejor.2010.04.035 - 4. Vickner, S.S. and Davies, S.P. (2002) Estimating Strategic Price Response Using Cointegration Analysis: The Case of the Domestic Black and Herbal Tea Industries. Agribusiness, 18, 131-144.

http://dx.doi.org/10.1002/agr.10012 - 5. Dharmasena, K.A.S.D.B. and Bessler, D.A. (2004) Weak-Form Efficiency vs Semi-Strong Form Efficiency in Price Discovery: An Application to International Black Tea Markets. Sri Lankan Journal of Agricultural Economics, 6, 1-24.

- 6. Su, Z.C. and Xu, Y.M. (2008) Positive Analysis on the Relation between China’s Tea Trade and the Global Tea Price. Issues in Agricultural Economy, 4, 10-14, 110.

- 7. Li, Q.G. and Li, X.Z. (2010) A Study on the Countermeasures and Influencing Factors of China’s Tea Export Price. Price: Theory & Practice, 11, 68-69.

- 8. Liang, J.F. and Liang, Z. (2008) Analysis of the Mechanism to Form Tea Price. Journal of Fujian Agriculture and Forestry University (Philosophy and Social Sciences), 11, 48-51.

- 9. Wu, Y.H., Jiang, H.C. and Xia, T. (2014) Value Composition of Tea and the Phenomenon of Price—An Analysis Based on the Theory of Labor Value. Journal of Anhui Agricultural University (Social Sciences Edition), 1, 45-48.