Open Journal of Business and Management

Vol. 1 No. 3 (2013) , Article ID: 38620 , 15 pages DOI:10.4236/ojbm.2013.13010

Delving into the Boardroom “Black Box”: A Research Model of “Board Learning Capability” (BLC)

Henley Business School, University of Reading, Henley-On-Thames, UK

Email: *f.m.a.morais@pgr.reading.ac.uk, n.kakabadse@henley.ac.uk

Copyright © 2013 Filipe Morais, Nada K. Kakabadse. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Received August 23, 2013; revised September 25, 2013; accepted October 4, 2013

Keywords: Corporate Boards; Chairman; Learning Challenges; Board Learning Capability; Board Effectiveness

ABSTRACT

This paper aims to shed light into boardroom processes by bringing together the literature on organization behaviour and that of boardroom process in order to form a model of boardroom learning capability. Board process is viewed as primarily a learning process whereby individual members with their knowledge, skills and external networks engage in a collective learning process that culminates in a “shared understanding” about the problems and respective solutions and increased “board social capital”. It can be argued that boards that do better at this “collective learning process” will display greater effectiveness and ultimately better firm performance. In learning organisation’s terms, one can speak of “board learning capability” (BLC). The chairman of the board has a pivotal role in facilitating and mastering the collective learning process in the boardroom. Central to our model are the interplay between the “chairman role and skill set” and the “board learning challenges”. Building on research literature that focuses on learning organisations and on boardroom processes, we propose a model of “board learning capability” (BLC), which could shed additional light on the boardroom process dynamics. In the future, an organisation could develop a “board’s learning capability” measure to complement “good governance” indices which rely heavily on structure and composition proxies, despite limited empirical evidence. Empirical testing of the model can be of value for boardroom development and for risk and reputational concern minimization by uncovering differences in “boardroom learning capability” in different governance domains.

1. Introduction

Many critics have blamed the recent corporate scandals and the 2008 financial crisis on governance and boardroom behaviour of large corporations [1-3]. One can argue whether corporate boards are able to learn effectively as the same mistakes seem to occur repeatedly. For example, according to Senge [4] one key “discipline” for a learning organisation is “systems thinking”. The fact that boards are unable to learn and to apply systems thinking within the agency framework has been questioned throughout the last decade or so. From the well known corporate scandals such as WorldCom, Arthur Andersen, Enron and Tyco for example, to the 2008 global financial crises (GFC), there are numerous examples of failure to thinking systematically. Maybe the most disastrous lack of systems thinking was the predatory lending practices in the US banking system and subsequent sub-prime crisis that ruined the lives of millions of ordinary citizens and resulted in shareholders losing billions of dollars in some cases. Another example is the sky rocketing executive compensation in the US and elsewhere that some view as a direct cause of rising income inequality [2,3,5]. These calamities have led to the rise of organised movements such as “Occupy Wall Street” in the US and “Los Indignados” in Spain [6], which protest social and economic inequality, greed, corruption and the perceived undue influence of corporations on governmentparticularly from the financial services sector. Interestingly, all governments apply systems thinking as a justification for massive bank bailouts with tax payers’ money in order to overcome the danger of systemic risk. Justification for such failures maybe found in the agency framework and its pursuit of shareholder value maximization. Some argue that agency theory [7] is too narrow and does not make sense of changing environmental conditions as it pursues only the interests of one part of the system (i.e. shareholder value maximisation) [8,9] in a closed loop system. This constrains systems thinking and thus affects board learning and effectiveness.

There are other governance frameworks that facilitate and embody systems thinking such as the stakeholder theory [10], which offers better hopes for enabling learning in the boardroom. Building on previous calls for a behavioural theory of the board [11] and on the literature focusing on learning organisations [4,12-18], this paper contends that boards are subjected to a number of “board learning challenges” which reduces their “collective learning capability” and therefore role effectiveness and ultimately, organisational performance.

The paper aims to provide a model for boardroom research that can bring additional light and perspective to the processes occurring inside the boardroom. It starts by exploring some key contributions to the study of boardroom process [11,19,20] and follows a discussion on literature focusing on learning organisations and previous attempts to apply its principles to the board [15,16]. The authors conceptualise the role of the chairman as pivotal [16,21,22] in facilitating the “collective learning process” in the boardroom, hence they discuss some key studies on NED/chairman competencies, skills and role. Building on previous calls for more adventurous, qualitative and fine grained studies of governance and boardroom process [23-25], the authors propose a research model of “board learning capability”. The paper ends with limitations, avenues for future research and a concluding section.

2. Boardroom Dynamics: Contributions to Understand the “Black-Box”

In the last decade or so the interest for boardroom process and behaviour has grown and many call for more contextual and fine-grained studies of boardroom processes [23-26]. For reference [27], structure and board composition and other similar measures are not good predictors of “good governance” and hence research should acknowledge the effect of “outward appearance, inner decisions”. Monks [28] also shares this idea. For example, a recent review of 105 studies covering 30 peer reviewed journals and 16 years’ worth of research (1990- 2006) relating to corporate boards’ variables (structure and composition) and company performance found inconsistent and inconclusive results for duality, insideroutsider ratio, board size and stability, board ownership, director rewards, shareholder activism and corporate ratings [26]. The results concluded that there is a need to broaden the board performance measures in use [26]. This is in line with [29], when they observe that despite the inconsistent results, corporate governance ratings systems are a reflection of the literature that focuses on structural aspects rather than boardroom process variables, which puts into question the system’s reliability. Yet there has been some encouraging progress to date in studying boardroom process, despite the enormous barriers that researchers encounter to gain access to “live boardrooms” [24].

References [30,31] ethnographic study of boardroom process, supported by the theory of communicative action [32,33] and conversation analysts [34], investigated how “live boards” evoked four types of “validity claims” in conjunction with four micro linguistic resources (i.e., use of personal pronouns, discourse markers, metalingual expressions and modalising terms). They concluded that the skilled way by which board members use these resources to evoke validity claims is determinant in shaping power and influence in boardroom dynamics [31]. Whilst this study is unique, it seems to describe what the organisational learning literature calls “win-lose dynamics”, whereby the more skilled use of validity claims and of linguistic resources leads one of the board members to victory at the expense of others.

A large study in the UK charity sector conducted by Cornforth [35] concluded that three process variables explain a greater variance on perceived boardroom effectiveness. Boards with “more time, skill mix and experience”, a “shared common vision of how to achieve organisational goals” and which engage in periodical reviews on “how they work together with management”, tend to perceive greater board effectiveness. Similarly, reference [20] survey and interview study with Italy’s largest manufacturing firms’ CEOs and other board members concluded that “effort norms” (the time and effort a board member is expected to put towards a task) and “use of knowledge and skills” (the group’s ability to extract individual knowledge and skills, Wageman, 1999 cited in [20]), were positively associated with effective perceived performance for all three service, monitoring and networking board tasks. In contrast, “cognitive conflict” defined as “(…) task oriented differences in judgement or issue-related disagreement among directors” (Forbes and Milliken, 1999 cited in [20]), presented no relation with service and monitoring tasks and only a weak positive relation with networking tasks [20]. Other researchers have focused on decision-making and the underlying formal boardroom routines. Reference [27] interviewed 21 executive and non executive directors of large financial and non-financial US, Canadian and British listed companies and showed the existence of three mechanisms that determine boardroom decision-making dynamics: 1) annual calendaring; decision-making protocols and 2) executive judgement. Whilst “annual calendaring” and “decision-making protocols” formally establish what board members will discuss and what requires board approval, these are “rigid” documents and include a rather limited list of decisions, leaving to management the decision of what to include in a board meeting agenda and the outcomes of unanticipated important decisions remain under management discretion [27]. Thus we see that “who should decide remains in the hands of management, not the board” [27].

Reference [36] collected information from five “live” boardroom meetings of a Swedish firm and looked at the role of emotions in boardroom dynamics from a social constructivist approach, specifically how emotions interact as “power energizers” and “status energizers” in the boardroom to fulfill the tasks of control and service. Results showed that short term negative emotions have an important role in board dynamics preventing a certain “board pattern” to evolve into “powerlessness and alienation” or have longer term emotional consequences such as distrust, hence these scholars view emotional support as an important part of the service role played by the board [36].

French [37] interesting incursion on the role of emotions in organizational change provides some insight for application to the boardroom. Drawing on the concept of “negative capability” which was first described by the poet Keats [37] as a state whereby a person “…is capable of being in uncertainties, mysteries, doubts, without any irritable reaching after fact and reason” and taken to the field of psychoanalysis by Bion [37] the author discusses the importance of “negative capability” in successful organizational change. French states:

“Negative capability indicates the capacity to live with and to tolerate ambiguity and paradox, to “remain content with half knowledge” (Ward, 1963, p. 161 cited by [37], and, therefore, to engage in a non-defensive way with change, resisting the impulse merely to react to the pressures inherent in risk-taking” [37].

It is argued that “negative capability” development is essential for board directors as they need to cope with the challenges of “information asymmetry” arising from the agency framework along with an ever growing complex external environment that increases ambiguity, paradox and contrast which generates turmoil of emotions. Hence the need for a container of emotions in the boardroom which the literature suggests lies with the role of the chairperson [31,38,39]. Thus, “negative capability” implies the ability to learn, to hold and contain other’s emotions, to “digest them on behalf of the whole system” (or group) until a new understanding is formed which “may facilitate a change of mind or heart in self or colleagues, and hence encourage learning in the wider system” [37]. When “negative capability” is insufficiently developed people tend to “rush into action”, to what is called “dispersal” behavior [37]. Hence, “negative capability” maybe viewed as a condition for learning and in turn enhancing boardroom effectiveness.

Reference [19] developed an interesting framework of board effectiveness based on the concept of intellectual capital. They propose a holistic model where inputs (organisation type, history, strategy, constitution and legislative and societal framework) are transformed by the board process in outputs such as increased board effectiveness (both individual and as a group) and ultimately, organisational performance. They conceptualise the board process as a “transformation process” whereby an individual director’s human (knowledge and expertise), social (relevant social relationships and board ties) and cultural (values, norms and rules of dominant group) capital interacts with the board’s structural (processes, procedures and roles, committees) and social capital (i.e., climate and relationship CEO-chairperson), shaping boardroom dynamics. It is argued that the model can serve as a roadmap for diagnosing and solving problems at the board level; however, the model appears to deliver little in regards to the actual key board mechanisms through which boardroom dynamics work [19].

Drawing on a large sample of US companies’ board outside directors, [40] investigated the effect of “pluralistic ignorance” (i.e., defined as the extent to which board members underestimate the degree to which others share their concerns, or the hesitancy of board members to voice minority opinions) on the firm’s persistence to pursue strategy which induces firm performance. The emergent evidence indicates that when board members receive negative information about the company’s performance and the viability of its strategy, they will not express their concerns unless other board members do so. Voicing minority opinions has been found to be subject to a number of social sanctions. Hence “pluralistic ignorance” leads to silence in the boardroom, and that silence is frequently interpreted as a sign of agreement with the current strategy [40]. The results show that outside directors of firms exhibiting low performance have a general tendency to underestimate each other’s concerns about the viability of the strategy (hence persisting in failing strategies) and that the propensity towards “pluralistic ignorance” is mediated by weak friendship ties amongst outside directors (or social cohesion) and demographic heterogeneity. It is proposed that increasing pluralistic ignorance awareness in boards and taking steps toward increasing homogeneity and social ties amongst outside directors will improve board effectiveness [40]. Pluralistic ignorance may therefore be viewed as impeding collective learning and inhibiting genuine shared understanding in the boardroom.

Reference [11] provides an interesting contribution to a future behavioural theory of the board and corporate governance. Building on the behavioural theory of the firm, and related concepts of bounded rationality, satisficing behaviour, routinisation of heuristic decisionmaking practices, and political bargaining [41] they argue that the main behavioural dimension that characterises the board is the “limited ability of organisational actors to gather and process information”, conceptualising boards not only or not just as solvers of conflicts of interests, but primarily as “problem-solving institutions that reduce complexity, create accountability and facilitate cooperation and coordination between stakeholders” [11]. They do not view the firm as a nexus of contracts between the principal and the agents, where the board’s primary responsibility is to exert control over management and align their interests via extrinsic rewards, but as “a nexus of coalitions of stakeholders with different interests” where the primary role of the board is to enable cooperation and coordination by “engaging in collective processes of organised information and knowledge gathering” [11]. The authors identify six major research streams that address the behavioural study of boards and corporate governance in terms of 1) structure; 2) interactions and 3) decisions. They then address each of these aspects in terms of internal relationships or external relationships [11].

A recent large study on the selection processes of members of the supervisory board of Germany’s 80 largest industrial firms found that a “minimum amount of cohesion inside the boardroom is necessary to make use of existing individual knowledge, skills and abilities and to foster human capital within boards”. Depending on who is involved in the selection process, the boards more or less achieve cohesion [42]. One can argue, however, that the chairman’s ability to manage boardroom diversity, dynamics and processes and not as an a priori, static exercise of selection, can better determine board cohesion.

A 2013 study on two tier boards in the Netherlands found three core challenges that non-executive directors’ (NEDs) board members face from management [43]. The first challenge was the ability of NEDs to ask management critical questions which defensive management behaviours, a non-questioning board culture, and lack of director abilities, group support and in-depth information trigger. The second challenge related to “information asymmetries” and this is enhanced by inadequacies on the quantity, scope and timing of information and on the organisational capabilities to collect the right information. Finally, the third challenge relates to “board-management relationships” which board difficulties in “balancing formal responsibilities with personal relationships”, the lack of openness in the relationships and the (low) quality of executive and non-executive directors trigger [43].

A common theme in the literature is how boardroom process transforms a director’s individual knowledge, skills, expertise and networks (human, social and cultural capital) into effective role performance. A second common aspect is that researchers have been considering the boardroom process primarily as a decision-making process whereby role effectiveness is dependent on the quality of decision-making. This is then dependent on a number of variables that distort the optimal decision. Next, we will turn attention to the literature which focuses on learning organisations in our attempt to show its relation with boardroom processes.

3. Learning Organisations and Organisational Learning

We can trace literature focusing on learning organisations back to 1963 where March and various colleagues on The Behavioural Theory of the Firm discussed among other aspects, the importance of learning for organisations [41]. Despite numerous conceptual works on learning organisations and organisational learning to date [12,13,16,17,44-46], there is no consensus yet as to the distinction between “learning organisation” and “organisational learning” nor has a unique model or theory emerged [47]. This is despite strategists and academics acknowledging the role of learning faster than competitors as a source of competitive advantage [45,48]. One of the most difficult and debated questions is the relationship between individual and organisational learning and whether an organisation can learn [49].

According to Antonacopoulo [49], there are four contrasting positions in literature. The first rejects the idea that organisations have human qualities such as the ability to learn [50]. A second strand defends the idea that organisations can not only learn, but that this is a key competitive advantage [4,12,18,45]; Others, however, are unsure of whether organisational learning exists and whether there is such a thing as a learning organisation, but recognise some of the arguments of other branches of learning organisations [51,52]. A fourth and last position views organisational learning as a social process affected by contextual factors such as structure, information systems and control procedures, which then influence the way individuals learn [46,53,54].

References [12] and [55] and its central concepts— Learning Theory and Action Theory—were fundamental for the development of the study of learning in organisations. The learning theory poses that there are two types of learning. The “single loop learning” implies changes in superficial routines normally via changes in behaviour and procedures. The “double loop learning” implies changes in more fundamental values and organisational plans that are on the basis of the creation of more superficial routines. These concepts were deeply influenced by Cyert and March’s ideas [41] when trying to answer the question of whether learning occurred through gradual or sudden change. The Action Theory has introduced the idea of “espoused theory” versus “theory-in-use” as a way to explain the difficulties of companies to engage in “double loop” learning [56]. Espoused theory argues that executives often use defense mechanisms for ideas and information that are likely to challenge the status quo and corresponding supporting values, by separating the ideas that they say they defend from the values one can infer from their actions [13,57,58].

Numerous authors view learning as a process of continuous interaction with the environment whereby the organisation must start by studying the environmental forces and the impact they may have in the organisation [59,60] and devise different responses to changing environmental conditions [61] by using different types of learning processes to create knowledge. Following this line of research, others [62] speak of “absorptive capacity” as the ability to recognise, assimilate and apply new knowledge to a commercial purpose among its constituents and “learning-by-reflection” whereby through internal self-reflexive learning practices, individuals and groups make implicit and tacit knowledge more explicit for themselves and for others [62,63].

Reference [64] discusses the learning organisation under three perspectives: the normative, evolutionist and capability perspectives. The normative view contends that leaders should create the essential conditions for collective learning to take place by removing organisational learning barriers [4,14,18,65]. The evolutionist perspective views organisational learning as a process that evolves with organisational age, growth, management development and technology and where development provides the context for learning to continue to evolve [66,67]. The capability perspective [68,69] contends that all organisations develop their own learning processes; hence, the question is not whether how organisations become learning organisations or if learning takes place in the organisation. Instead, what is important is to study the learning processes—how, where and what is learned. In this sense there is not one best way of learning—but all types of learning are valid and specific to each organisation [64].

Can Boards Learn?

According to [56], scholars have studied the field of organisational learning from various perspectives: sociotechnical systems, organisational strategy, production, economic development, systems dynamics, human resources and organisational culture. Surprisingly, learning organisations principles and practices have had little or no attention from corporate governance and boardroom studies.

Whilst we argue that boards include all the necessary characteristics for learning to occur, we also contend that boards are not very good at it due to a number of underlying board learning challenges. For [56], there are a number of characteristics for a collectivity to become organisational:

“Collectivities become organizational when they meet three constitutional capabilities: 1) to make collective decisions (so that groups of individuals can say “we” about themselves; 2) to delegate authority for actions to an individual in the name of the collectivity and; 3) to say who is and who is not a member of the collectivity” [56].

He continues arguing that:

“Under these conditions, it makes conceptual sense to say that individuals can act on behalf of the organization. It also makes conceptual sense to say that on behalf of the organization individuals can take learning processes (organizational inquiry) that can, in turn, yield outcomes as reflected in changes in organizational theories of action and the artifacts that encode them” [56].

Following along the same line of reasoning, we argue that it also makes conceptual sense to study boards as a unit of learning, perhaps the most important within the organisational setting.

More than two decades ago, Argyris [70] observed that “people at leadership positions are not very good at learning”, something that according to Garratt [16] is still true some 20 years later. It is argued [70] that people tend to become defensive when faced with the question of “what their role is in solving organisational problems”. He purports that people need to think critically about how their own behaviour contributes to organisational goals. Others recognise that the first starting point for building a “learning company” would be to “work with the board of directors”, and that the boards should “live out” through their own actions and learning. They should themselves become masters of the learning company [17]. However, there is pressure for organisational leaders to be “competent at all times”, which stops them from asking questions that would enhance their individual and collective learning, with impact on decision-making [17]. In this way, it is necessary to identify those “hard and soft aspects” that block learning in the boardroom.

4. “Learning Challenges” of the Board

The normative approach seems to suggest that organisational leaders are primarily collective learning enablers [4,15-18].

Departing from the normative perspective of learning organisations literature whereby the role of leaders is to create the conditions for organisational learning to occur by removing a number of barriers to learning, we contend that organisational leaders have at best focused in removing these from their organisations, but often failed in looking in their own “backyard”, that is, how boardroom learning was occurring and being managed, so as to arrive at real consensus [70], shared vision [4], shared understanding [17] or “idea generalisation” [18].

There are a number of challenges that impede effective learning. Some call it “dysfunctional patterns of organisational behaviour” [41,71], others “defensive routines” [72,73], “conditions for error” [56], “learning barriers” [4] and “learning disabilities” [18]. These factors tend to reduce productive learning and organisational effectiveness.

For Argyris [56], these are “counter-productive group dynamics” and include “win-lose dynamics”, “non-addivity”, “conformity” and “group thinking”. The so called “theories-in-use” govern individuals’ behaviour with the objective of remaining in unilateral control, maximising “wining” and minimising “losing”, suppressing negative feelings and being as rational as possible so as to evaluate whether their behaviour worked as intended. These four basic values exist for individuals to “avoid embarrassment or threat, feeling vulnerable or incompetent” [70].

Argyris states:

“(…) the simple act of encouraging more open inquiry is often attacked by others as “intimidating”. Those who do the attacking deal with their feelings about possibly being wrong by blaming the more open individual for arousing these feelings and upsetting them. Needless to say, such a master program inevitably short-circuits learning. And for a number of reasons unique to their psychology, well-educated professionals are especially susceptible to this” [70].

According to Argyris [56] practitioners adhering to certain microeconomic principles and the firm’s behavioural theory have produced information noise that hinders the ability to learn.

It is argued that economic theories, such as the agency theory, assume an amount of information gathering and processing that is beyond human capacity, whereby the ability of the board to monitor management is limited. Moreover, by assuming a top-down perspective, those at the top “seek to win, not to learn” and hence those in the next level “protect themselves by providing as valid information as they can while still protecting themselves” [56].

Executives view organisational routines as “monumental barriers to valid economic information” [58]. Jensen and Meckling [7] purport that because humans have a finite capacity to process large amounts of information, they have less ability to reach optimal decisions which lead to satisficing behaviour [74] which helps them make the best available decision [56]. However, according to Argyris [56], we need to interpret “satisficing behaviour” in conjunction with “organisational routines” and that the willingness of decision-makers to satisfice depends on their ability to recognise and overcome such routines.

Reference [56] contends that Behavioural Theory of the Firm concepts such as satisficing, partial resolution of conflict and problemistic search [41] all exist as a consequence of “organisational defensive routines”. Therefore, it derives from here that in order to reduce information noise and maximise valid economic information, it is necessary to eliminate organisational defensive routines so that organisational learning can occur and decision-making can improve. Argyris [56] also argues that the Behavioural Theory of the Firm views the organisation as seeking to identify problems (problemistic search) rather than problem solvers seeking to find solutions.

Reference [56] suggests that by identifying and removing “organisational defensive routines”, board members could reduce information noise so that learning could occur effectively and they could reach real consensus. Argyris reports how a CEO behaved in a real company study:

“(…) in the guise of being “diplomatic” he would pretend that a consensus about the problem existed, when in fact none existed” [56].

Reference [17] views conflict as something positive, whereby companies should learn out of dialectic generated by conflicts and use conflicts as a mean of “testing old ideas and generating new ones”. Furthermore, they contend that the stage of organisational development determines the amount of conflict and its nature (constructive versus destructive). The authors observe:

“(…) the level of conflict is high in “adolescence”, when shared understanding is low, and decreases with age. However, as the learning company reached a certain stage of maturity it can tolerate and cope with more conflict where differences are appropriately surfaced and worked on (…)” [17].

Senge [4] speaks of “personal mastery”, “mental models”, “shared vision” and “team learning” as further conditions of organisational learning. These four conditions, together with systems thinking, are interrelated and learning cannot occur effectively if one of them is missing or poorly developed.

For example, mental models refer to personal (or collective) “deeply engrained assumptions” that “influence the way we understand the world and how we take action”; whereas, personal mastery is the commitment to clarify our vision of the world through continuous learning and scrutiny [4]. Mental models normally generate inconsistencies between the “theories-in-use” and the “expressed theories” [4]. These then appear to be conditions for building a (genuine) “shared vision” which is a process that “fosters learning through which the future is projected and commitment is generated rather than compliance” [4]. The last condition for effective learning is “team learning” or “dialogue”. Dialogue is different from discussion. Whilst dialogue is aimed at reaching insights and solutions not reachable by individuals alone, discussion is more a way where an individual tries to see his/her own vision of the world to prevail, or as Senge puts it, discussion is a “winner takes all competition” [4]. This is in line with Argyris’ [70] idea of “win or lose dynamics”. The promotion of “dialogues” instead of “discussion” harnesses the potential for collaborative learning. Senge explains: “(…) in dialogue people actually feel as if they are building something, a new deeper understanding” [4]. He continues arguing that directors individually need to be accustomed to dialogue and not discussion and that “the presence of a skilled facilitator is of the utmost importance” [4]. Prominent authors studying boardroom effectiveness have called for the return of the chairman as the key to promote dialogue and an environment of collective learning so as to achieve a shared understanding [22].

Interestingly, many authors from different branches of governance and boardroom literature have referred to similar distortive aspects of boardroom effectiveness. For example, [1] and [2], referring to inordinate power of CEOs in the US, speak of “underlying structural effects” and “social and psychological constraints” that impede the boards to pose real questions and to challenge dominant “mental models”, “visions” and where dialogue gives way to discussion, conformity or passivity.

Reference [18] defines learning capability in a systemic perspective which both the internal and external environment influence with an impact on organisational performance. They define organisational learning as the ability to generate and generalise ideas with impact. In order to do this, organisations need to identify and overcome a number of “learning disabilities”. The authors identify seven different “learning disabilities”: 1) blindness; 2) superficiality; 3) unity; 4) hierarchy; 5) marasmus/paralysis; 6) superstition and 7) poor diffusion [18].

Garratt [14-16] was one of the first to apply the learning organisations principles to the functioning of the board as result of his own extensive experience as a consultant and less as a result of academic activity. He argued that boards move from “high understanding-high inclusion” to “low understanding-low-inclusion”. This can produce four types of boards: 1) the professional board (seen as the best); 2) the unitary board; 3) the country club board and 4) the passive board (which is seen as the dominant type of board), whereby board members have a low understanding on how to carry out their roles, but have high inclusion in the board affairs.

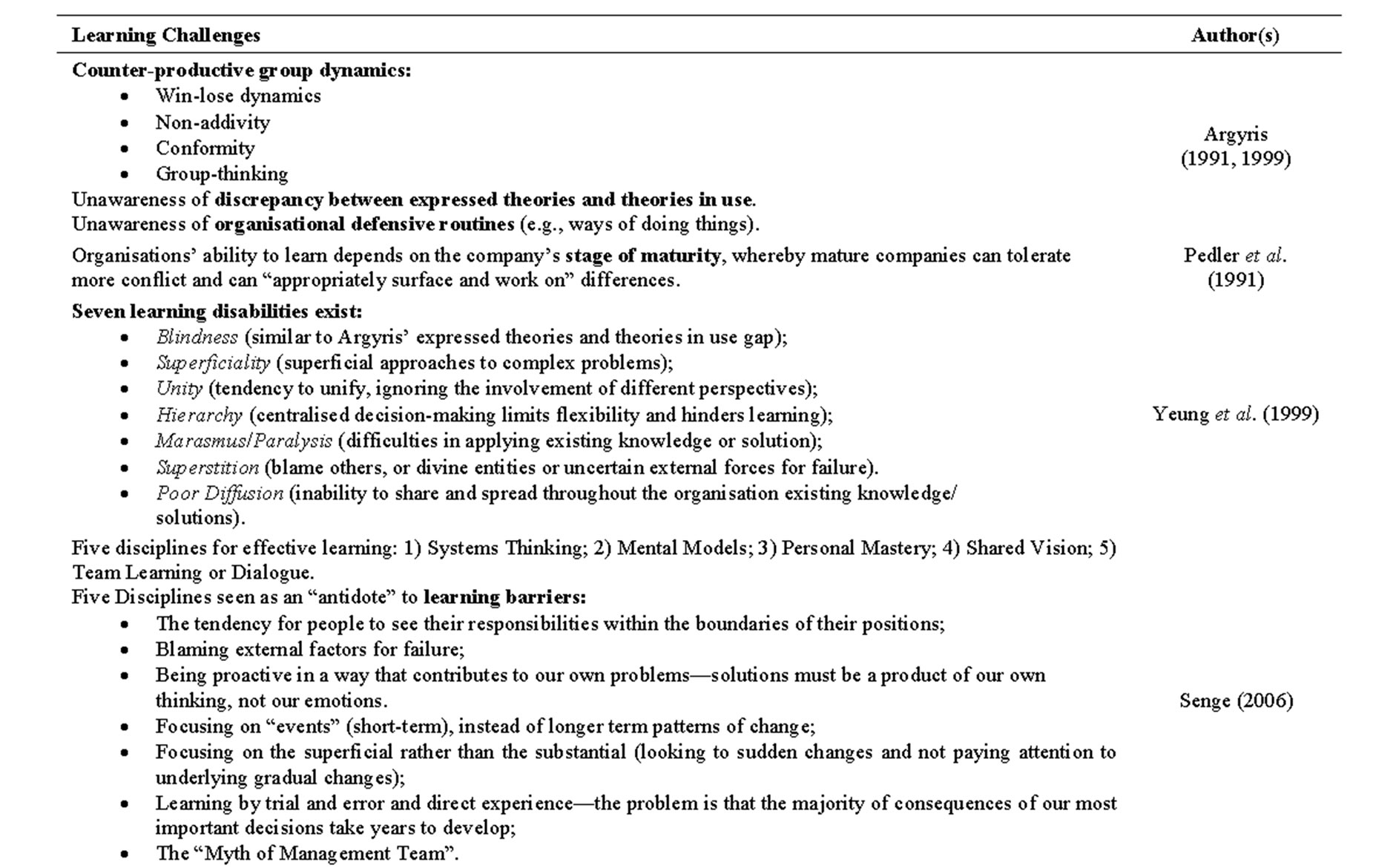

It is argued that two sets of “blockages to becoming a learning board” exist. The first set is called “unawareness of impending corporate collapse” [16] and comprises six common blockages to learning: 1) one-man rule; 2) a non participating board; 3) an unbalanced top team; 4) a lack of management depth; 5) a weak finance function and 6) a combined role of chairman and chief executive officer. The second set of learning blockages is based on Irving Janis’ work on group thinking and includes factors “allowing group thinking to foster” [16] such as 1) illusion of vulnerability; 2) collective efforts to rationalise; 3) unquestioning belief in the board’s inherent morality; 4) stereotyped views of rivals and enemies; 5) director pressure on dissident board members; 6) self-censorship or deviations from group consensus; 7) a shared illusion of unanimity and 8) the emergence of self-appointed “mind guards”. Table 1 below highlights some of the most influential authors’ findings on barriers to organisational/board learning.

According to this stream of literature, removing a number of learning challenges so as to facilitate collective learning and arriving at “shared understanding” of organisational problems and solutions at any point in time would enhance a board’s learning capability. Hence, the presence and frequency of such learning challenges would form a part in determining a “board’s learning capability”.

5. The Chairman as Facilitator of Board Learning

Researchers have increasingly acknowledged the importance of context in understanding individual and boardroom performance during the last decade. The “formative context” within which a board and its members operate is likely to vary substantially and each have their own specific “peculiarities” [25,75,76] The complexity of an organisational “formative context” (e.g. institutional arrangements, cultural values, ethnic tastes, training, background and cognitive frames that shape the daily routines of individuals, ideology and objectives, relational proximity/interactivity), and the plethora of variables that can react with them, suggests that it is unlikely that organisations could or should view boardroom performance in isolation.

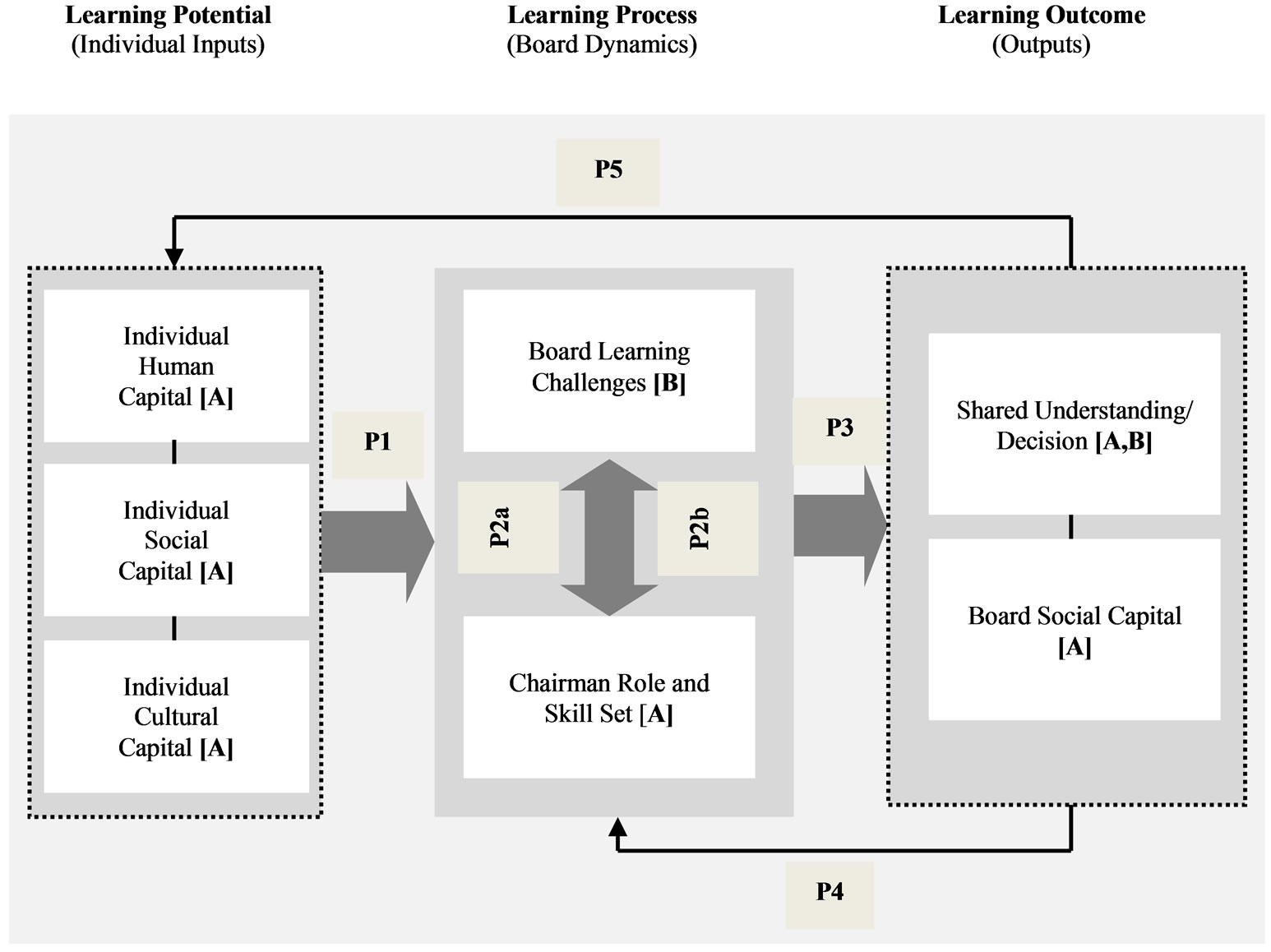

Although the board duties include the expectations of a fiduciary duty by all Officers and Directors [77] some interpret this as a Non-Executive Director’s (NED’s) duty, and from that position the corporation imposes it. The corporation assumes that the NEDs will demonstrate the underlying conduct, which includes imposing duties on officers and managers including legal, due care, good faith and risk-taking [77]. In addition, the NED’s role, depending on the board, may involve wide-ranging duties and responsibilities. The companies’ corporate governance structures may allow the NED, to act as a chairperson or as a board member who is also a member of a committee (e.g. nominations, remuneration, audit, risk or other committees concerned with environmental, safety and ethical issues). Thus, NEDs increasingly need to have (and learn) distinctive capabilities. A growing number of studies have identified skills and competen

Table 1. Challenges to organisational/board learning.

cies necessary for board directors and produced a normative model of effective NED.

The NED’s role is complex and dynamic, consisting of many potencies or aspects that may reveal themselves through role occupants’ interaction with other board members within the critical context [75]. The dynamic interaction between the board members comprises the intensely rich and often dramatic inner life of boards and its individual members. However, this dynamic relationship between a role occupant’s potential capabilities and manifested behaviour in relation to prescribed normative doctrines of board effectiveness are poorly understood. The relationship between board members and in particular, their relationship with Chairperson (or in the US context, Chairperson/CEO) is pivotal for the whole system of corporate governance and boardroom effectiveness [78-80]. This relationship within effective boards is a dynamic flow of give-and-take synergies, where the Chairperson’s capability to handle the synergy and the power influx of individual members (including the CEO) harmonises them and then passes them back to each individual and the board as whole is crucial. This interactive and highly dynamic capability of synergy harmonisation is the processes of “unification of the board” and is a secret to, as well as a sacred quality of board effectiveness [21,22]. Although individuals outside of the board do not recognise easily this sacred quality, if a board does not attain it, it manifests itself as a “split board” and the majority or all stakeholders often experience a consequent decline in the share price [21]. Because this unique board quality is idiosyncratic to each board and reveals itself only through board members interaction, they do not lend themselves easily to the studies from the proxy measures.

Studies on NED/Chairman Characteristics have as a consequence been rather few and the list of skills and competencies necessary for fulfilling their roles varies across studies. Studies arrive at lists of competencies and skills for the NED/Chairmen that are more or less specific and more or less comprehensive, according to the source—normative (Cadbury, 1992), consultancy-based [39,81] or academic studies, and the former depend on interview-based [22,38,75,82], questionnaire-based [83, 84], ethnographic [30] or conceptual [85] methods to collect data.

Taylor [86] argues that board members must possess due diligence abilities, strong industry and board experience and corporate intangibles such as values, integrity, reputation and relationship skills to ensure that effective governance occurs. Despite the regulators and press increasingly emphasising boardroom members’ fiduciary duties, the qualitative study of NEDs’ role contribution reveals that they need to understand due diligence skills as only one set of tools, which they do not need to display all the time and that more importantly, they need to have the conversation they value whilst equally they need to appreciate the needs and values of others in the boardroom [38]. Although, due diligence and rigour remain a priority, NEDs increasingly need to interact on a higher level and philosophically debate where passion, excitement and hope are the driving dynamics in the boardroom rather than just business metrics [38]. This then requires self-awareness and reflexive interfacing skills based on a democratic dialogue and where there is no room for rigidity, defiance or getting ones’ own way [87].

An extensive interview based qualitative study with chairmen world-wide was undertaken by Kakabadse and Kakabadse [22]. The study concluded that world class chairmen need to master six disciplines in order to lead for boardroom effectiveness: 1) delineating boundaries (between chairman/CEO roles, distinct of board and management roles); 2) Sense making (concerning the mission, vision and values in the boardroom and the organization); 3) interrogating the argument (questioning policy and strategy); 4) influencing outcomes; 5) living the values (based on trust and integrity and paying attention to the imbalances between espoused values and practiced values) and; 6) developing the board (which includes board evaluation, selection, development, coaching, etc.) [22].

More recently, researchers [88] interviewed company secretaries from some 39 large companies of the BEL20 and BEL mid (33 of which had separate chairman and CEO roles) using an interview protocol and the Decision Making Grid introduced by Hal et al. (1964) in order to enquire into (prevalent) board leadership styles. Chairmen were identified as exhibiting a highly heterogeneous leadership style which impacted on the quality of the decisions made on and the group’s commitment to those decisions. It is suggested that the chairman should be able to transform the boardroom into an effective collective decision-making body, by removing “negative group dynamics” [88]. It is concluded that the use of particular board leadership styles calls for specific personal competencies and attributes of the chairman that go beyond the structural aspects of board leadership, and that include creativity, criticality, preparedness and commitment [88]. The study concludes with a plea for the use of the “pluralistic theoretical lenses” so as to be able to explain the behavioural dimensions of chairman leadership [88].

6. Proposed Model of Board Learning Capability (BLC)

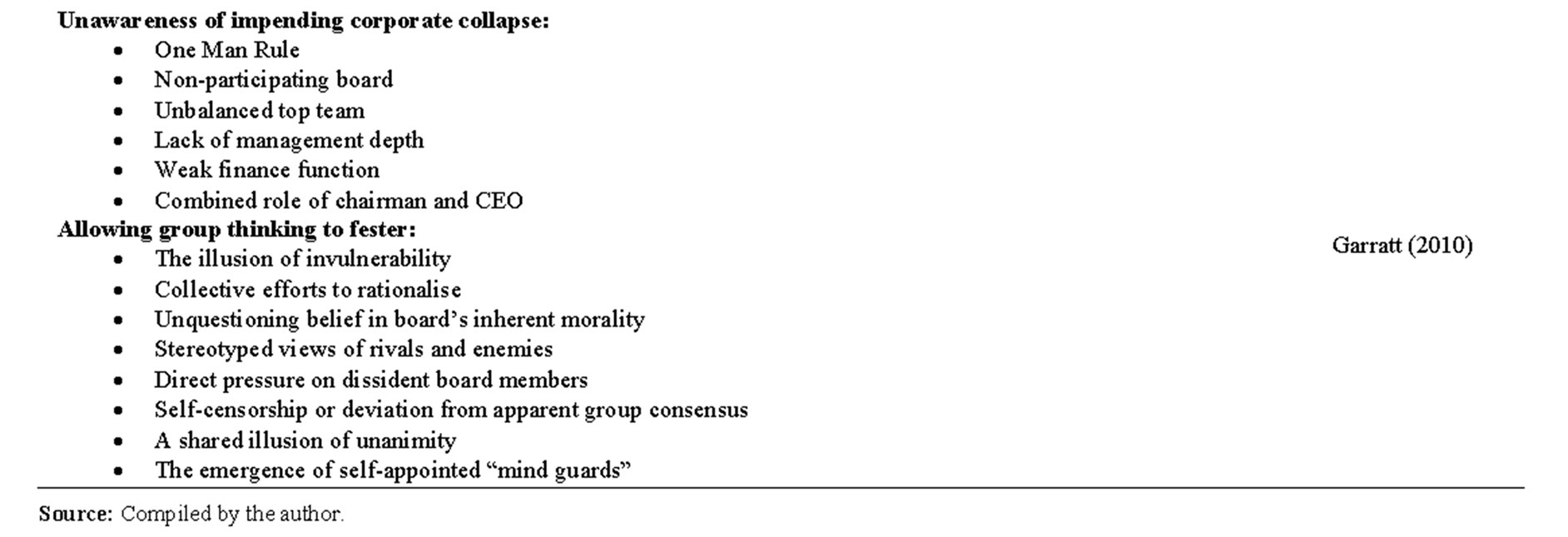

The literature seeking to identify what is the “ideal” profile of the chairman/NED often places the chairman at the heart of the board. He/she is responsible for creating an atmosphere for real learning and a truly systematic and shared understanding of the company’s problems and possible solutions, typically by encouraging dialogue and asking penetrating questions. This pivotal role awarded to the chairman is, of course, only possible in dual firms (i.e., the literature views non-duality as an impediment to effective board learning). Hence, we advocate that companies with a combined role of chairman-CEO have a diminished learning capability. For dual firms, the ability of the chairman to act as a “collective learning enabler” by indentifying and overcoming “learning challenges” will determine the ability of the board to transform individual inputs (human, social and cultural capital) into collective learning (i.e., shared understanding and decision and improved “board collective social capital”). Figure 1 presents the proposed model of Board Learning Capability (BLC).

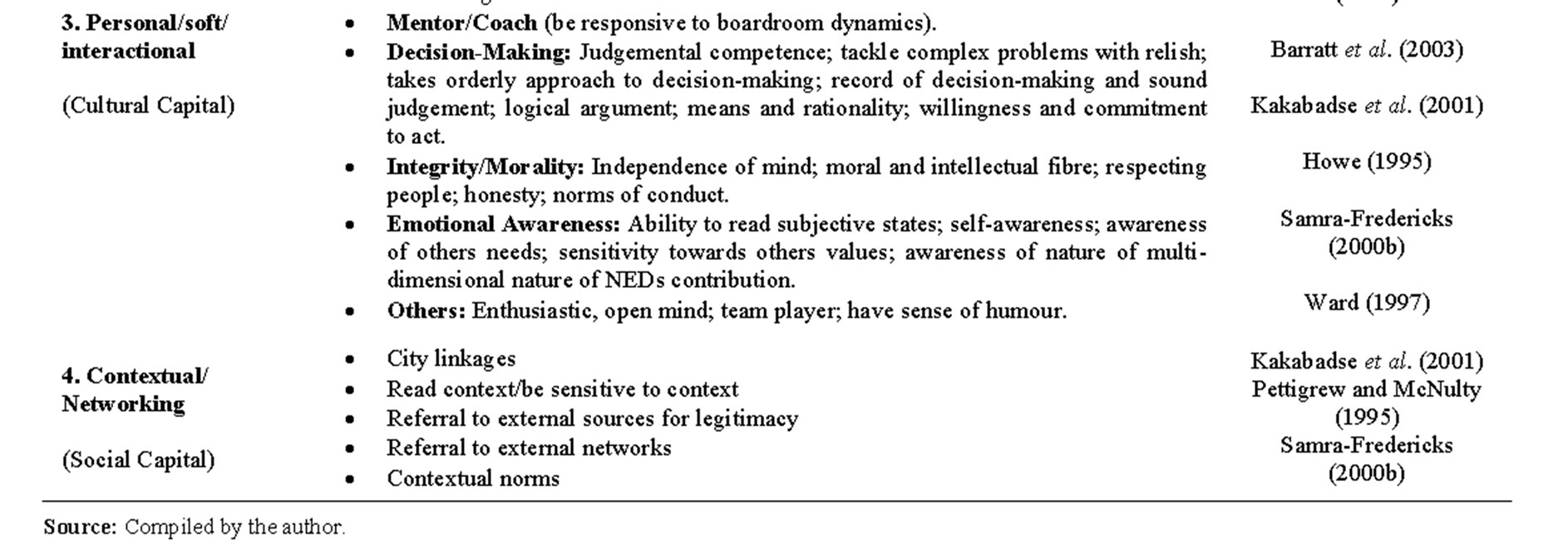

Reference [19] framework for board effectiveness supported on the concept of “intellectual capital” and the literature on Chairman/NED role competencies and skills [7,22,31,38,39,75,85,88,89] give support to the model’s

Figure 1. Board learning capability (BLC) model.

inputs of individual human, social and cultural capital [A] and to the component of “chairman role and skills set” and of “board social capital” [A] (see Table 2). We draw the “board learning challenges” [B] (see Table 1) from the literature on learning organisations [4,16-18,56,70] of which there is little record of research in the context of boards, despite some suggestions that we could apply earlier concepts of the Behavioural Theory of the Firm to boardroom dynamics [11]. Finally, literature focusing on learning organisations [4,16,17], but also literature on Chairman/NED’s role and skills [75] suggest that we can view “learning output” or the board process output primarily as a shared understanding or shared vision about a particular board issue. Hence, we argue that “shared understanding/decision” is an output of the collective learning process [A, B].

The model rests on a number of propositions (P), which we can empirically test:

P1—High/Low levels of individual board members human, social and cultural capital positively/negatively influence the interplay between the chairman’s role and skills and the board’s learning challenges. The ability of the chairman with his/her skills, knowledge and experience to identify and resolve existing board learning challenges on a particular issue will be influenced by the levels of individual human, social and cultural capital. For example, a board with members who exhibit a high and diverse human, social and cultural capital will eventually introduce much more diversity of ideas into the board and probably will not face the learning challenge of “unity” [18], but may be more prone to face challenges of “win-lose dynamics” [56], thus posing different challenges to and requiring different skills from the chairman.

P2a—The chairman’s “role and skills set” influences the ability of the board to overcome learning challenges. The chairman role and skill set is pivotal for the correct functioning of the board so as to arrive at a shared understanding and decision on a particular organisational issue [21,22,79.80]. One can argue that the chairman’s ability (through his/her skills and experience) to identify and overcome prevalent “board learning challenges” determines the board’s ability to overcome such challenges. We can view the chairman as a “collective learning enabler”.

P2b—Prevalent “board learning challenges” shape and influence the “chairman’s role and skill set”. There is an interplay between the “board learning challenges” displayed by the board for a particular issue and the chairman’s “role and skill set”. As we noted before [21,22,38,75], the chairman role is a dynamic one, where different skills are necessary for different issues and at different moments. The “prevalent board learning challenges” for a given issue and at a given point in time will

Table 2. Chairman/NED competences (that facilitate learning at the boardroom).

require different skills and behaviours from the chairman.

P3—The interplay between the “board learning challenges” and “chairman role and skill set” determines levels of “shared understanding/decisions” and of “board collective social capital”. The outcome of the interplay between the chairman’s “role and skill set” and the “board learning challenges” for any particular issue is a “shared understanding/decision” and increases “board social capital”. As the chairman overcomes learning challenges it starts to form a true “shared understanding/decision” about a particular issue. If board members reach a “shared understanding/decision”, board social capital also increases with it. For example, a board with a poor record or difficulties in achieving a true “shared understanding/decision” will have a poor “board social capital” which in turn will make it more difficult to arrive at a “shared understanding/decision”. It is a reinforcing cycle.

P4—The level of “shared understanding and decision” reinforce individual board members’ human, social and cultural capital. The board’s level of “shared understanding and decision” reinforces its human, social and cultural capital. Board members that often experience “shared understanding and decision” through a process of “collective learning” facilitated by the chairman’s “role and skill set” enrich their human capital (expertise and knowledge), their social capital (internal and external relationships) and, of course, cultural capital (their shared values and principles).

P5—Improved “board social capital” reinforces the chairman role and skills. Improved “board social capital” will legitimise further (and improve) the way the chairman conducts the board as other board members will see it as effective. The chairman itself will also refine is role and skill set as he/she perceives it to be effective.

7. Challenges, Future Research and Possible Contributions

The first limitation of the model is that is only applicable to non-dual firms, having limited applicability in firms with a combined chairman and CEO role. It follows that our model implicitly assumes that non-dual firms have better “board learning capability” than dual firms. Second, the study of the interplay between the “chairman’s role and skill set” and “board learning challenges”, lends itself to the use of more qualitative and ethnographic methods of research which implies access to “live boards”, something that can be extremely difficult and time consuming. Third, there is a need to test the model and streamline it. It would be interesting to understand whether there is a particular set of “learning challenges” more prevalent or more important, and if certain chairman skills are more helpful in enabling board collective learning. The literature also seems to suggest that shareholder models of governance (i.e., those resting on agency framework) face more difficulties in learning capability; hence, it could be interesting to test the model for shareholder and stakeholder cases to compare and contrast.

Finally, the testing of the model could provide a nonstructural measure of corporate governance, contributing to resolve problems arising from the fact that corporate governance indices rely heavily on structural and composition measures, despite the inconsistent empirical evidence.

8. Conclusions

The extant literature on corporate governance and boardroom dynamics largely ignored the learning processes occurring in the boardroom and the elements that contribute for their effectiveness. Literature focusing on learning organisations, on the other hand, has produced a number of models and identified a number of learning challenges, but scholars have conducted little empirical research on whether these learning challenges also apply to the board, to what extent they influence board effectiveness and how board members can overcome them. There is room for improved dialogue between boardroom process research and learning organisations theory in explaining boardroom dynamics and effectiveness.

Our proposed model tries to enrich the research on boardroom dynamics by taking a “collective learning” perspective to the boardroom, whereby the chairman assumes a central role in managing the flow of individual human, social and cultural capital and the learning challenges so as a to arrive at “shared understanding/decision” and improved “board social capital”. We hope that organisations can test the model in the future should opportunities arise and that such a test will help the board derive a learning capability measure to complement “good governance indices”.

REFERENCES

- L. A. Bebchuck and J. M. Fried, “Pay without Performance: Overview of the Issues,” Discussion Paper No. 528, Harvard Law School, John M. Olin Center for Law, Economics and Business, 2006.

- T. Clarke, “A Critique of the Anglo-American Model of Corporate Governance,” Comparative Research in Law & Political Economy, Research Paper 15, Vol. 5, No. 3, 2009, pp. 1-30.

- T. Clarke, “Out of Control? The Impact of CEO Power and Reward on Economic Relationships and Inequality, Paper Presented at European Academy of Management (EURAM),” Rome, 2010, pp. 1-37.

- P. M. Senge, “The Fifth Discipline: The Art and Practice of the Learning Organization,” 2nd Edition, Random House, London, 2006.

- A. Pryce, N. K. Kakabadse and T. Lloyd, “Income Differentials and Corporate Performance. Corporate Governance, Vol. 11, No. 5, 2011, pp. 587-600. http://dx.doi.org/10.1108/14720701111176993

- D. Rushe, “Occupy Wall Street: NYPD Attempt Media Blackout at Zuccotti Park: Journalists report Aggressive Treatment as Media Blocked from Protest Camp during Surprise,” The Guardian, 15th November 2011. http://www.guardian.co.uk/world/2011/nov/15/occupy-journalists-media-blackout

- M. C. Jensen and W. Meckling, “Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure,” Journal of Financial Economics, Vol. 3, No. 4, 1999, pp. 305-360. http://dx.doi.org/10.1016/0304-405X(76)90026-X

- J. Christopher, “Corporate Governance—A Multitheoretical Approach to Recognizing the Wider Influencing Forces Impacting on Organizations,” Critical Perspectives on Accounting, Vol. 21, No. 8, 2010, pp. 683-695. http://dx.doi.org/10.1016/j.cpa.2010.05.002

- N. Kakabadse and A. Kakabadse, “Polylogue as a Platform for Governance: Integrating People, the Planet, Profit and Prosperity,” Corporate Governance, Vol. 3, No. 1, 2003, pp. 5-38. http://dx.doi.org/10.1108/14720700310459845

- R. E. Freeman, “Strategic Management: A Stakeholder Approach,” Pitman Publishing, Boston, 1984.

- H. Van Ees, J. Gabrielson and M. Huse, “Towards a Behavioral Theory of Boards and Corporate Governance,” Corporate Governance: An International Review, Vol. 17, No. 3, 2009, pp. 307-319. http://dx.doi.org/10.1111/j.1467-8683.2009.00741.x

- C. Argyris and D. Schön, “Organizational Learning: A Theory of Action Perspective,” Addison-Wesley Publishing, Reading, 1978.

- C. Argyris and D. Schön, “Participatory Action Research and Action Compared,” American Behavioral Scientist, Vol. 32, No. 5, 1989, pp. 612-623. http://dx.doi.org/10.1177/0002764289032005008

- B. Garratt, “Creating the Learning Organization: A Guide to Leadership, Learning, and Development,” Simon & Schuster, Cambridge, 1990.

- B. Garratt, “The Learning Organization: And the Need for Directors Who Think,” Harper Collins, London, 1994.

- B. Garratt, “The Fish Rots from the Head: Developing Effective Board Directors,” 3rd edition, Profile Books Ltd., London, 2010.

- M. Pedler, J. Borgoyne and T. Boydell, “The Learning Company—A Strategy for Sustainable Development,” McGraw-Hill International, London, 1991.

- A. K. Yeung, D. Ulrich, S. W. Nason and M. A. V. Glinow, “Organizational Learning Capability—Generating and Generalizing Ideas with Impact,” Oxford University Press, New York, 1999.

- G. J. Nicholson and G. C. Kiel, “A Framework for Diagnosing Board Effectiveness,” Corporate Governance: An International Review, Vol. 12, No. 4, 2004, pp. 442-460. http://dx.doi.org/10.1111/j.1467-8683.2004.00386.x

- F. Zona and A. Zattoni, “Beyond the Black Box of Demography: Board Processes and Task Effectiveness within Italian Firms,” Corporate Governance: An International Review, Vol. 15, No. 5, 2007, pp. 852-864. http://dx.doi.org/10.1111/j.1467-8683.2007.00606.x

- A. Kakabadse and N. Kakabadse, “Essence of Leadership,” International Thomson Press, London, 1999.

- A. Kakabadse and N. Kakabadse, “Leading the Board: The Six Disciplines of World-Class Chairman,” Palgrave, London, 2008.

- T. Clarke, “Research on Corporate Governance,” Corporate Governance: An International Review, Vol. 6, No. 1, 1998, pp. 57-66.

- R. Leblanc and M. S. Schwartz, “The Black Box of Board Process: Gaining Access to a Difficult Subject,” Corporate Governance: An International Review, Vol. 15, No. 5, 2007, pp. 843-851. http://dx.doi.org/10.1111/j.1467-8683.2007.00617.x

- A. Pettigrew, “On Studying Managerial Elites,” Strategic Management Journal, Winter Special Edition, No. 13, 1992, pp. 163-182.

- D. Finegold, G. S. Benson and D. Hecht, “Corporate Boards and Company Performance: Review of Research in Light of Recent Reforms,” Corporate Governance: An International Review, Vol. 5, No. 5, 2007, pp. 865-878. http://dx.doi.org/10.1111/j.1467-8683.2007.00602.x

- M. Useem and A. Zelleke, “Oversight and Delegation in Corporate Governance: Deciding What the Board Should Decide,” Corporate Governance: An International Review, Vol. 14, No. 1, 2006, pp. 2-12. http://dx.doi.org/10.1111/j.1467-8683.2006.00479.x

- R. G. G. Monks, “Creating Value through Corporate Governance,” Corporate Governance: An International Review, Vol. 10, No. 3, 2002, pp. 116-123. http://dx.doi.org/10.1111/1467-8683.00277

- L. A. Van den Berghe and A. Levrau, “Evaluating Boards of Directors: What Constitutes a Good Corporate Board?’” Corporate Governance: An International Review, Vol. 12, No. 4, 2004, pp. 461-478. http://dx.doi.org/10.1111/j.1467-8683.2004.00387.x

- D. Samra-Fredericks, “Doing ‘Boards-in-Action’ Research —An Ethnographic Approach for the Capture and Analysis of Directors’ and Senior Managers’ Interactive Routines,” Corporate Governance: An International Review, Vol. 8, No. 3, 2000, pp. 244-257.

- D. Samra-Fredericks, “An Analysis of the Behavioural Dynamics of Corporate Governance—A Talk-Based Ethnography of a UK Manufacturing ‘Board-in-Action’,” Corporate Governance: An International Review, Vol. 8, No. 4, 2000, pp. 311-326.

- J. Habermas, “Communication and the Evolution of Society,” Beacon Press, Boston, 1979.

- J. Habermas, “The Theory of Communicative Action, Reason and the Rationalization of Society,” Vol. 1, Polity Press, Cambridge, 1984.

- H. Sacks, “Lectures on Conversation,” Vol. 1-2, Basil Blackwell, Oxford, 1992.

- C. Cornforth, “What Makes Boards Effective? An Examination of the Relationships between Board Inputs, Structures, Processes and Effectiveness in Non-Profit Organizations,” Corporate Governance: An International Review, Vol. 9, No. 3, 2001, pp. 217-227. http://dx.doi.org/10.1111/1467-8683.00249

- E. Brundin and M. Nordqvist, “Beyond Facts and Figures: The Role of Emotions in Boardroom Dynamics,” Corporate Governance: An International Review, Vol. 16, No. 4, 2008, pp. 326-341. http://dx.doi.org/10.1111/j.1467-8683.2008.00688.x

- R. French, “‘Negative Capability’: Managing the Confusing Uncertainties of Change,” Journal of Organizational Change Management, Vol. 14, No. 5, 2001, pp. 480-492. http://dx.doi.org/10.1108/EUM0000000005876

- R. Barratt, N. Kakabadse A. Kakabadse and M. Barratt, “Corporate Social Responsibility in the Boardroom: The Need for a Coherent Business Case,” The Second Colloquium of the European Academy of Business in Society Conference, Copenhagen, 19-20 September 2003, pp. 19-20.

- M. J. A. Howe, “What Can We Learn from the Lives of Geniuses,” In: J. Freeman, P. Span and H. Wagner, Eds., Actualizing Talent: A Lifelong Challenge, Cassell, London, 1995, pp. 35-73.

- J. D. Westphal and M. K. Bednar, “Pluralistic Ignorance in Corporate Boards and Firms’ Strategic Persistence in Response to Low Firm Performance,” Administrative Science Quarterly, Vol. 50, No. 2, 2005, pp. 262-298.

- R. M. Cyert and J. G. March, “A Behavioral Theory of the Firm,” Prentice-Hall, Englewood Cliffs, 1963.

- A. Walther and M. Morner, “The Human Capital of Directors Revisited: How Board Member Selection Foster the Emergence of Human Capital on Boards,” 13th Annual Conference of the European Academy of Management, Istanbul, pp. 1-31.

- P. J. Bezemer, S. Peij, L. Okruijs and G. Maassen, “Boardroom Dynamics of Two Tier Boards: How Non-Executive Directors Manage Working Relationships with Executives,” 13th Annual Conference of the European Academy of Management, Istanbul, pp. 1-26.

- V. E. Cangelosi and W.R. Dill, “Organizational Learning Observations: Toward a Theory,” Administrative Science Quarterly, Vol. 10, No. 2, 1965, pp. 175-203. http://dx.doi.org/10.2307/2391412

- C. M. Fiol and M. A. Lyles, “Organizational Learning,” The Academy of Management Review, Vol. 10, No. 4, 1985, pp. 803-813.

- H. Simon, “Bounded Rationality and Organizational Learning,” Organization Science, Vol. 2, No. 1, 1991, pp. 125- 134. http://dx.doi.org/10.1287/orsc.2.1.125

- S. R. Fisher and M. A. White, “Downsizing in a Learning Organization: Are There Hidden Costs?” The Academy of Management Review, Vol. 25, No. 1, 2000, pp. 244-251.

- E. W. K. Tsang, “Organizational Learning and Learning Organization: A Dichotomy between Descriptive and Prescriptive Research,” Human Relations, Vol. 50, No. 1, 1997, pp. 73-89. http://dx.doi.org/10.1177/001872679705000104

- E. Antonacopoulou, “The Relationship between Individual and Organizational Learning: New Evidence from Management Practices,” Management Learning, Vol. 37, No. 4, 2006, pp. 455-473.

- D. H. Kim, “The Link between Individual and Organizational Learning,” Sloan Management Review, Vol. 35, No. 1, 1993, pp. 37-50.

- M. Schulz, “The Uncertain Relevance of Newness: Organizational Learning and Knowledge Flows,” Academy of Management Journal, Vol. 44, No.4, 2001, pp. 661- 682. http://dx.doi.org/10.2307/3069409

- K. E. Weick and K. H. Roberts, “Collective Minds in Organizations: Heedful Interrelating on Flight Decks,” Administrative Science Quarterly, Vol. 38, No. 3, 1993, pp. 357-381. http://dx.doi.org/10.2307/2393372

- B. Hedberg, “How Organizations Learn and Unlearn,” In: P. Nystrom and W. Starbuck, Eds., Handbook of Organizational Design: Adapting Organisations to Their Environment, Oxford University Press, Oxford, 1981, pp. 1-27.

- P. Pawlowski, “The Treatment of Organizational Learning in Management Science,” In: M. Dierks, A. Antal, J. Child and I. Nonaka, Eds., Handbook of Organizational Learning and Knowledge, Oxford University Press, Oxford, 2001, pp. 61-88.

- C. Argyris and D. Schön, “Theory in Practice: Increasing a Professional Effectiveness,” Jossey-Bass, San Francisco, 1974.

- C. Argyris, “On Organizational Learning,” 2nd Edition, Blackwell Publishing, Oxford, 1999.

- E. Antonacopoulou, M. Lyles, D. Simm and M. P. V. Easterby-Smith, “Constructing Contributions to Organizational Learning: Argyris and the Next Generation,” Management Learning, Vol. 35, No. 4, 2004, pp. 371- 380. http://dx.doi.org/10.1177/1350507604048268

- C. Argyris and D. Schön, “Strategy, Change and Defensive Routines,” Ballinger, Cambridge, 1985.

- D. R. Gnyawali and A. C. Stewart, “A Contingency Perspective on Organizational Learning: Integrating Environmental Context, Organizational Learning Processes, and Types of Learning,” Management Learning, Vol. 3, No. 1, 2003, pp. 63-69. http://dx.doi.org/10.1177/1350507603034001131

- [61] D. Katz and R. L. Kahan, “The Social Psychology of Organizations,” 2nd Edition, Wiley, New York, 1978.

- [62] P. Lawrence and J. Lorsch, “Organization and Environment,” Irwin, Homewood, 1967.

- [63] W. M. Cohen and D. A. Levinthal, “Absorptive Capacity: A New Perspective on Learning and Innovation,” Administrative Science Quarterly, Vol. 35, No. 1, 1990, pp. 128- 152. http://dx.doi.org/10.2307/2393553

- [64] H. Scarborough, M. Bresnen, L. F. Edelman, S. Laurent, S. Newell and J. Swan, “The Processes of Project-Based Learning: An Exploratory Study,” Management Learning, Vol. 35, No. 4, 2004, pp. 491-506. http://dx.doi.org/10.1177/1350507604048275

- [65] A. J. DiBella, “Developing Learning Organizations: A Matter of Perspective,” Academy of Management Best Paper Proceedings, pp. 287-290.

- [66] M. Pedler, T. Boydell and J. Burgoyne, “Towards the Learning Company,” Management Education and Development, Vol. 20, No. 1, 1989, pp. 1-8.

- [67] L. E. Greiner, “Evolutions and Revolution as Organizations Grow,” Harvard Business Review, Vol. 50, No. 4, 1972, pp. 37-46.

- [68] J. Kimberley, “Issues in the Creation of Organizations: Initiation, Innovation, and Institutionalization,” Academy of Management Journal, Vol. 22, No. 3, 1979, pp. 437- 457. http://dx.doi.org/10.2307/255737

- [69] C. K. Prahalad and G. Hamel, “The Core Competencies of the Corporation,” Harvard Business Review, Vol. 68, No. 3, 1990, pp. 79-91.

- [70] E. Schein, “The Corporate Culture Survival Guide,” Jossey-Bass, San Francisco, 1999.

- [71] C. Argyris, “Teaching Smart People How to Learn,” In: Hard Business Review on Knowledge Management, Harvard Business Review Press, Boston, 1991, pp. 44-64.

- [72] H. Simon, “The Sciences of the Artificial,” MIT Press, Cambridge, 1976.

- [73] T. Peters and N. Austin, “A Passage for Excellence,” Random House, New York, 1985.

- [74] T. Peters and R. H. Waterman, “In Search of Excellence,” Warner, New York, 1984.

- [75] H. A. Simon, “A Behavioral Model of Rational Choice,” Quarterly Journal of Economics, Vol. 69, No. 1, 1955, pp. 99-118. http://dx.doi.org/10.2307/1884852

- [76] A. Kakabadse, K. Ward, N. Kakabadse and C. Bowman, “Role and Contribution of Non-Executive Directors,” Corporate Governance, Vol. 1, No. 1, 2001, pp. 4-7. http://dx.doi.org/10.1108/EUM0000000005455

- [77] N. Korac-Kakabadse, A. Kakabadse and A. Kouzmin, “Board Governance and Company Performance: Any Correlations?” Corporate Governance, Vol. 1, No. 1, 2001, pp. 24-30. http://dx.doi.org/10.1108/EUM0000000005457

- [78] E. N. Veasey, “State-Federal Tension in Corporate Governance and the Professional Responsibilities,” Journal of Corporation Law, Vol. 28, No. 3, 2003, pp. 441-454.

- [79] A. P. Kakabadse, N. K. Kakabadse and R. Barratt, “Chairman and Chief Executive Officer (CEO): That Sacred and Secret Relationship,” Journal of Management Development, Vol. 25, No. 2, 2006, pp. 134-150. http://dx.doi.org/10.1108/02621710610645126

- [80] N. K. Kakabadse and A. P. Kakabadse, “Chairman of the Board: Demographics Effects on Role Pursuit,” Journal of Management Development, Vol. 26, No. 2, 2007, pp. 169-192. http://dx.doi.org/10.1108/02621710710726071

- [81] A. P. Kakabadse and N. K. Kakabadse, “The Return of the Chairman,” Business Strategy Review, Vol. 18, No. 4, 2007, pp. 62-65. http://dx.doi.org/10.1111/j.1467-8616.2007.00501.x

- [82] R. D. Ward, “21st Century Corporate Board,” John Wiley and Sons, New York, 1997.

- [83] A. M. Pettigrew and T. McNulty, “Power and Influence in and around the Boardroom,” Human Relations, Vol. 48, No. 6, 1995, pp. 845-873. http://dx.doi.org/10.1177/001872679504800802

- [84] M. Higgs and V. Dulewicz, “Top Team Processes: Does 6 + 2 = 10?” Journal of Managerial Psychology, Vol. 13, No. 1-2, 1998, pp. 47-62. http://dx.doi.org/10.1108/02683949810369129

- [85] C. Pass, “Corporate Governance and the Role of NonExecutive Directors in Large UK Companies: An Empirical Study,” Corporate Governance, Vol. 4, No. 2, 2004, pp. 52-63. http://dx.doi.org/10.1108/14720700410534976

- [86] R. P. Castanias and C. E. Helfat, “The Managerial Rents Model: Theory and Empirical Analysis,” Journal of Management, Vol. 27, No. 6, 2001, pp. 661-678. http://dx.doi.org/10.1177/014920630102700604

- [87] D. Taylor, “Facts, Myths and Monsters: Understanding the Principles of Good Governance,” The International Journal of Public Sector Management, Vol. 13, No. 2-3, 2000, pp. 108-125. http://dx.doi.org/10.1108/09513550010338755

- [88] R. Barratt and N. Korac-Kakabadse, “Creating Socially Responsive Governance: A Need for Reflexive Practitioners,” Corporate Governance, Vol. 2, No. 3, 2002, pp. 32- 36. http://dx.doi.org/10.1108/14720700210440071

- [89] A. Levrau and L. Van den Berghe, “Perspectives on the Decision-Making Style of the Board Chair,” International Journal of Disclosure and Governance, Vol. 10, No. 2, 2013, pp. 105-121. http://dx.doi.org/10.1057/jdg.2013.18

- [90] Cadbury Committee, “Report on the Financial Aspects of Corporate Governance,” Gee Publishing, London, 1992.

NOTES

*Corresponding author.