Journal of Mathematical Finance

Vol.06 No.01(2016), Article ID:63372,6 pages

10.4236/jmf.2016.61003

Transfer Policies with Discontinuous Lorenz Curves

Johan Fellman

Hanken School of Economics, Helsinki, Finland

Copyright © 2016 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 28 June 2015; accepted 2 February 2016; published 5 February 2016

ABSTRACT

In earlier papers, classes of transfer policies have been studied and maximal and minimal Lorenz curves  obtained. In addition, there are policies belonging to the class with given Gini indices or passing through given points in the

obtained. In addition, there are policies belonging to the class with given Gini indices or passing through given points in the  plane. In general, a transformation

plane. In general, a transformation  describing a realistic transfer policy has to be continuous. In this paper the results are generalized and the class of transfer policies

describing a realistic transfer policy has to be continuous. In this paper the results are generalized and the class of transfer policies  is modified so that the members may be discontinuous. If there is an optimal policy which Lorenz dominates all policies in the class, it must be continuous. The necessary and sufficient conditions under which a given differentiable Lorenz curve

is modified so that the members may be discontinuous. If there is an optimal policy which Lorenz dominates all policies in the class, it must be continuous. The necessary and sufficient conditions under which a given differentiable Lorenz curve  can be generated by a member of a given class of transfer policies are obtained. These conditions are equivalent to the condition that the transformed variable

can be generated by a member of a given class of transfer policies are obtained. These conditions are equivalent to the condition that the transformed variable  stochastically dominates the initial variable X. The theory presented is obviously applicable in connection with other income redistributive studies such that the discontinuity can be assumed. If the problem is reductions in taxation, then the reduction for a taxpayer can be considered as a new benefit. The class of transfer policies can also be used for comparisons between different transfer-raising situations.

stochastically dominates the initial variable X. The theory presented is obviously applicable in connection with other income redistributive studies such that the discontinuity can be assumed. If the problem is reductions in taxation, then the reduction for a taxpayer can be considered as a new benefit. The class of transfer policies can also be used for comparisons between different transfer-raising situations.

Keywords:

Lorenz Dominance, Stochastic Dominance, Tax Policy, Transfer Policy

1. Introduction

Lorenz curves were initially introduced for comparison and analysis of income distributions in a country in different times or in different countries in the same era. Later it has been widely applied in different contexts. Especially, classes of transfer and tax policies have been studied and maximal and minimal Lorenz curves  obtained. In addition, there are policies with given Gini indices or passing through given points in the

obtained. In addition, there are policies with given Gini indices or passing through given points in the  plane. Furthermore, the conditions (stochastic dominance) for attainable Lorenz curves have been obtained ([1] , [2] ). These findings have been found under the assumption that the transformation is continuous. In this paper we generalize the results for discontinuous transformations.

plane. Furthermore, the conditions (stochastic dominance) for attainable Lorenz curves have been obtained ([1] , [2] ). These findings have been found under the assumption that the transformation is continuous. In this paper we generalize the results for discontinuous transformations.

2. Notations

We use similar notations as in my previous papers. Let the income be X with the distribution function ,

,

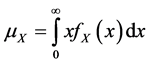

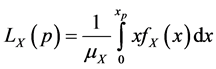

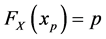

density function , mean

, mean , and Lorenz curve

, and Lorenz curve . The basic formulae are

. The basic formulae are  and

and , where

, where .

.

We introduce the transformation

tax or post-transfer income. The mean and the Lorenz curve for the variable Y are

A general theorem concerning Lorenz dominance ( [3] [4] ) is:

Theorem 1. Let X be an arbitrary non-negative, random variable with the distribution

1)

2)

3)

3. Results

Classes of transfer policies. The class of transfer policies

H:

where

H*:

where

If an optimal policy exists which Lorenz dominates all policies in H*, then according to Theorem 1, it must be continuous because

Figure 1. A sketch of a transformation

Consequently, although class (2), also contains discontinuous policies in comparison with initial class H, the policy

being optimal among all continuous policies, is still optimal, having the Lorenz curve

The inferior Lorenz curve can be obtained from the sequence [7]

These policies give no benefits to the poorest sector of the population (

inferior Lorenz curve. If we define

and monotone increasing:

where

Assume that

Figure 2. A sketch of the function

The Lorenz curve is inferior because we can prove [8] .

Theorem 2. The Lorenz curve

Proof. Consider an arbitrary, continuous or discontinuous policy

This inequality holds for all

A policy with a given Lorenz curve. In Fellman [6] we obtained necessary and sufficient conditions under which a given differentiable Lorenz curve

Now we generalise the results, for discontinuous transformations as well. We have stressed above that

One has to assume that the Lorenz curve

with the exception of a countable number of cusps. The corresponding distribution

In general, when the Lorenz curve

The crucial part of this proof is to show that

cussed in [5] and [6] . Following [6] , we obtain the transformation

has a cusp for

choose a δ > 0 so small that

Figure 3. A sketch of the Lorenz curves

Figure 4. Sketch of cumulative distribution function for X and

Now, the transformation

4. Discussion

We have studied the effects of transfer policies in this paper. In general, a transformation describing a realistic transfer policy has to be continuous. However, the theory presented is obviously applicable in connection with other income redistributive studies such that the discontinuity cannot be excluded. If the problem is reductions in taxation, then the tax reduction for a taxpayer can be considered as a new benefit [7] . The class of transfer policies H* can consequently be used for comparisons between different tax-reducing policies. If changes of transfers are of interest, then the transfer policies can also be applied in transfer-raising situations. If transfers are increased, the effect of increases on a receiver can be considered through transfer policies belonging to H*. In general, the changes may be mixtures of several different components and discontinuity cannot be excluded. The continuity assumption can be dropped and the class H* of transfer policies containing discontinuous policies satisfies the same properties as the initial class discussed in ( [5] [6] ). Analogously, tax increases and transfer reductions can be considered as new tax policies [7] . One main result is still that continuity is a necessary condition if one pursues the notion that income inequality should remain or be reduced.

Empirical applications of the optimal policies among a class of tax policies and the class of transfer policies considered here have been discussed in ( [2] [9] ), where we developed “optimal yardsticks” to gauge the effectiveness of given real tax and transfer policies in reducing inequality.

5. Conclusion

We have studied the effects of discontinuous transfer policies. The theory presented is applicable in connection with income redistributive studies such that the discontinuity cannot be excluded. A tax reduction for a taxpayer or a transfer increase on a receiver can be considered as new benefits. In general, such changes may be mixtures of different policy components and discontinuity cannot be excluded. However, one main result is still that continuity is a necessary condition if income inequality should remain or be reduced.

Acknowledgements

This work was supported in part by a grant from the Magnus Ehrnrooths Stiftelse foundation.

Cite this paper

JohanFellman, (2016) Transfer Policies with Discontinuous Lorenz Curves. Journal of Mathematical Finance,06,28-33. doi: 10.4236/jmf.2016.61003

References

- 1. Fellman, J. (2013) Properties of Non-Differentiable Tax Policies. Theoretical Economics Letters, 3, 142-145.

http://dx.doi.org/10.4236/tel.2013.33022 - 2. Fellman, J. (2014) Mathematical Analysis of Distribution and Redistribution of Income. Science Publishing Group, 166 p.

http://www.sciencepublishinggroup.com/book/B-978-1-940366-25-8.aspx - 3. Jakobsson, U. (1976) On the Measurement of the Degree of Progression. Journal of Public Economics, 5, 161-169.

http://dx.doi.org/10.1016/0047-2727(76)90066-9 - 4. Fellman, J. (2009) Discontinuous Transformations, Lorenz Curves and Transfer Policies. Social Choice and Welfare, 33, 335-342.

http://dx.doi.org/10.1007/s00355-008-0362-4 - 5. Fellman, J. (1980) Transformations and Lorenz Curve. Swedish School of Economics and Business Administration Working Paper 49, 19 p.

- 6. Fellman, J. (2003) On Lorenz Curves Generated by a Given Class of Transfer Policies. In: Höglund, R., Jäntti, M. and Rosenqvist, G., Eds., Statistics, Econometrics and Society: Essays in Honour of Leif Nordberg, Statistics Finland, Research Reports Number 239, 27-40.

- 7. Fellman, J. (2001) Mathematical Properties of Classes of Income Redistributive Policies. European Journal of Political Economy, 17, 195-209.

http://dx.doi.org/10.1016/S0176-2680(00)00035-5 - 8. Fellman, J. (1995) Intrinsic Mathematical Properties of Classes of Income Redistributive Policies. Working Papers, No. 306, Hanken School of Economics, Helsinki, 26 p.

- 9. Fellman, J., Jäntti, M. and Lambert, P.J. (1999) Optimal Tax-Transfer Systems and Redistributive Policy. Scandinavian Journal of Economics, 101, 115-126.

http://dx.doi.org/10.1111/1467-9442.00144